Occupant Classification System (OCS) Market by Sensor (Pressure Sensor, Seat Belt Tension Sensor), Components (ACU, Sensors), Sensor Technology (Wired, Wireless), LDV Class (Economy, Mid-Size, Luxury), EV Type, and Region - Global Forecast to 2025

Occupant Classification System (OCS) Market

Occupant classification system (OCS) is a system in which the front passenger seat is equipped with occupant detection and classification sensors that prevent the front passenger airbag from deploying if the system detects a non-living object occupying the seat. OCS is also known as Seat Occupant Sensors (SOS), Occupant Detection Systems (ODS), Passenger Weight Systems (PWS), and passive occupant detection system (PODS).

Key Drivers:

- Stringent safety norms for vehicles to pass NCAP test ratings

- Increasing demand for vehicles with modern active and passive safety features

- Expansion of leading OEMs and automotive component suppliers in low-cost countries and developing economies

Key Restraints:

- Regional disparities among NCAP safety ratings

- Public acceptance of safety technology impacted by high prices

Top Players

- Aptiv (Ireland)

- ZF (Germany)

- Robert Bosch (Germany)

- Continental (Germany)

- Aisin Seiki (Japan)

- Denso Corporation (Japan)

- ON Semiconductor (US)

- IEE Sensing (Luxembourg)

- Autoliv (Sweden)

- Nidec Corporation (Japan)

- Flexpoint Sensor System (US)

Top Start-ups

- Veoneer (Sweden)

- BeBop Sensor (US)

- CTS Corporation (US)

- Flexpoint Sensor Systems – Flexpoint Sensor Systems is a developer and manufacturer of thick-film sensing technology for the automotive industry. The company was established in 1995 and is headquartered in Utah, US. The company’s innovative bend sensor technology is used in various market segments like automotive, consumer wearable, healthcare/medical, industrial, trucking, and robotics/toys. The company offers a special analog seat sensor named as bend sensor. The bend sensor plays a vital role in the deployment of smart airbag systems that can detect the presence as well as the size and positioning of the occupant. This sensor can distinguish between an infant car seat and an adult passenger and deactivate an airbag when a person weighing under 66 pounds is in the seat. The product got a positive response from global OEMs like General Motors (US), Ford (US), and Chrysler (US).

- IEE Sensing –Established in 1989 and headquartered in Contern, Luxembourg, IEE provides sensing systems for global car manufacturers. The company offers its automotive clients occupant sensing solutions such as seat belt reminder (SBR), BodySense, Driver Presence Detection (DPD), and VitaSense. Body Sense is a product that classifies vehicle occupants for smart airbag deployment. With the use of capacitive sensors in the vehicle’s passenger seat, it detects and classifies the occupants, then decides whether to deploy the airbag or not.

- BeBop Sensor –Found in 2014, BeBop Sensors is headquartered in California, US. The company is a leader in smart fabric sensor technology. BeBop uses smart fabrics to create elegant sensor solutions for OEMs. In May 2016, BeBop Sensor announced an automotive seat sensor system designed to improve occupant sensing, classification, and safety. BeBop’s smart fabric OCS takes continuous full seat pressure images, providing real-time data frames containing pressure information from the entire seat used to measure all aspects of physical contact between the occupant and the seat.

Occupant Classification System Market and Sensor Technology

- Wired Sensor –To understand real-time environment around and inside the vehicles, sensors are been used. These sensors are wired to the control module/units data transfer purpose. Similarly, in OCS, wired sensors are used. Wires are attached to one of the pressure sensors. It could be bladder or strain gauge. Wired sensors are considered sensitive, as there is a fear of cuts in wire. The cut in a wire could cause an error signal to the airbag control unit. Wired sensors have been commercialized since the introduction of OCS and still hold majority share in the market.

- Wireless Sensor –Wireless sensor are also known as smart passive sensors. These sensors eliminate the use of wire and battery for power. Recently, one of the well-known semiconductor manufacturers, ON Semiconductor, developed a smart passive sensor that can be used in an OCS. Smart passive sensors, the trademark name given by ON Semiconductor, are capable of monitoring various parameters like pressure, temperature, moisture, and proximity. ON Semiconductor pioneered this technology and other companies are also expected to innovate in the similar technology space. At the moment, wireless sensors are not commercialized for automotive applications. R&D in this space could create revenue generating opportunities for Tier II suppliers in the future.

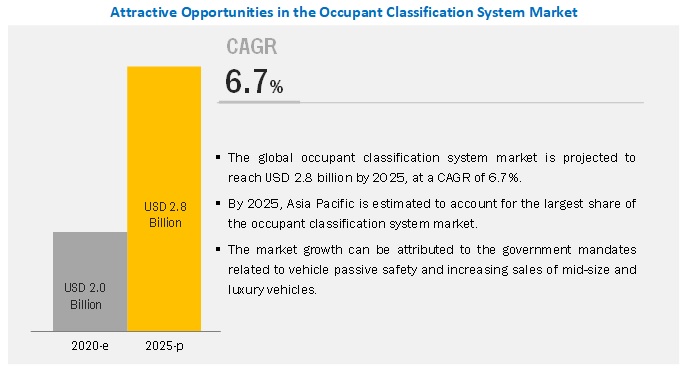

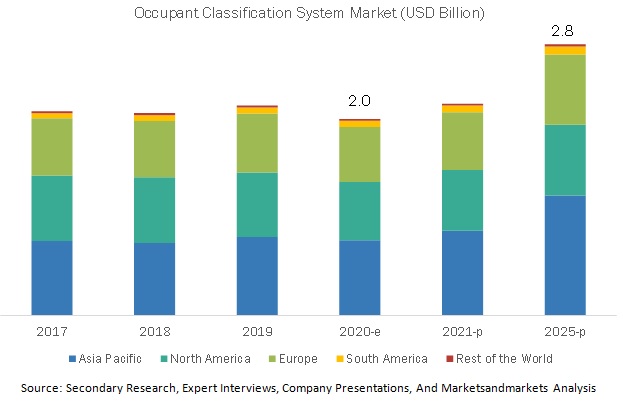

[154 Pages Report] The global occupant classification system market is projected to grow at a CAGR of 6.7% to reach USD 2.8 billion by 2025 from an estimated USD 2.0 billion in 2020. Increasing demand for safe vehicle, stringent vehicle passive safety norms to pass NCAP test ratings are the primary enabler for the growth of the occupant classification system market. However, public acceptance of safety technology impacted by high prices and regional disparities among NCAP safety ratings are restraining the growth of the occupant classification system market during the forecast period.

By sensor type: seat belt tension sensor is expected to be the largest segment in the occupant classification system market

Seat belt tension sensor and pressure sensor are among the must-have sensor in the occupant classification system. Many governments across the globe have mandated the use of airbags and seatbelts in vehicles. The average selling price associated with the seat belt tension sensor is higher than that of the pressure sensor. This is the reason for the dominance of the seat belt tension sensor segment.

By light-duty vehicle: mid-size class vehicle segment is expected to dominate the occupant classification system market

Over the past few years, mid-size vehicles are getting equipped with the popular features that are fitted in luxury vehicles. The occupant classification system is no exception to that. Many OEMs across the globe sells varieties of mid-size class vehicles. These vehicles are getting advanced with a new variant of models and new models itself. They are getting fitted with modern passive safety features like the occupant classification system. Increasing sales of mid-size class vehicles in developing is fueling the growth of this segment.

By electric vehicle type: HEV segment is expected to dominate the occupant classification system market

Hybrid electric vehicles (HEV) are the most popular electric vehicle across the globe. Before going for a fully electric vehicle, people are preferring for HEVs. European countries and Asian countries like Japan, South Korea are the biggest markets for HEVs. These vehicles are equipped with the latest technologies in the automotive. Almost every HEV on the road has an occupant classification system installed in it.

The Asia Pacific is expected to account for the largest market size during the forecast period

The Asia Pacific is a home of the world’s most populated countries like China and India. It is also a home of developed countries like Japan and South Korea. These countries are the biggest producer of vehicles across the globe. Moreover, vehicle passive safety norms in these countries are getting better and better. This is turn is fueling the market for the occupant classification system.

Key Market Players

The major occupant classification system market players include ZF (Germany), Bosch (Germany), IEE Sensing (Luxembourg), TE Connectivity (Switzerland), and Aptiv (UK), among others. These companies have secure distribution networks at a global level. Also, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are expansions and acquisitions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (‘000 units) and Value (USD) |

|

Segments covered |

Sensor, component, sensor technology, light-duty vehicle type, electric vehicle type and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, South America and Rest of the World |

|

Companies covered |

ZF (Germany), Bosch (Germany), IEE Sensing (Luxembourg), TE Connectivity (Switzerland), and Aptiv (UK). |

Based on sensor, the market has been segmented as follows:

- Pressure sensor

- Seat belt tension sensor

Based on component, the market has been segmented as follows:

- Airbag control unit

- Sensor

- Others

Based on sensor technology, the market has been segmented as follows:

- Wired

- Wireless

Based on light duty vehicle type, the market has been segmented as follows:

- Economy class

- Mid-size class

- Luxury Class

Based on electric vehicle type, the market has been segmented as follows:

- BEV

- HEV

- PHEV

- FCEV

Based on the region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Russia

- Spain

- Italy

- Turkey

- UK

- Czech Republic

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

South America

- Argentina

- Brazil

- Rest of Latin America

-

RoW

- Iran

- South Africa

- Rest of RoW

Critical Questions:

- How Tier I and Tier II are tuning airbag control units to make the best fit for the customized vehicle?

- How will the implementation of vehicle passive safety impact the overall market?

- What are the occupant classification system manufacturers doing to meet the requirement of smart airbags?

- What could be a possible development in the occupant classification system for rear-seat occupants?

- Which are the other technologies that could hamper the market for the occupant classification system?

Frequently Asked Questions (FAQ):

What is the market size of the global occupant classification system market?

The global electric bus market is projected to reach 935 thousand units by 2027 from 137 thousand units in 2019, at a CAGR of 27.2%.

Which market segment is estimated to register the maximum growth rate?

In the electric bus market, the 9–14 m bus length segment is projected to be the largest market, in terms of volume.

Which is the largest market w.r.t. occupant classification system in 2020?

Asia Pacific is the largest occupant classification system market. The region comprises of highly populated countries like India, China, and Japan. Governments in these countries are imposing vehicle passive safety which is fuelling the market for occupant classification system.

Who are the top players in the occupant classification system market?

The global electric bus market is dominated by major players such as Robert Bosch (Germany), TE Connectivity (Switzerland), Aisin Seiki (Japan), ZF (Germany), and Continental (Germany).

What are the key development in this market?

Automotive semiconductor company, ON Semiconductor recently developed the wireless sensors. They call it as a smart passive sensor. It eliminates the use of wire for connecting to the airbag control unit .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 15)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT AND MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.3 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.1.4 PRIMARY PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 25)

4 PREMIUM INSIGHTS (Page No. - 28)

5 MARKET OVERVIEW (Page No. - 31)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 IMPACT ANALYSIS : OCCUPANT CLASSIFICATION SYSTEM MARKET

6 INDUSTRY TRENDS (Page No. - 37)

7 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY SENSOR TYPE (Page No. - 38)

7.1 INTRODUCTION

7.2 PRESSURE SENSOR

17.2.1 STRAIN GAUGE

17.2.2 BLADDER

17.2.3 PRESSURE TAPE

7.3 BELT TENSION SENSOR

8 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY COMPONENT (Page No. - 43)

8.1 INTRODUCTION

8.2 AIRBAG CONTROL UNIT (ACU)

8.3 SENSORS

8.4 OTHERS

9 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY SENSOR TECHNOLOGY (Page No. - 38)

9.1 INTRODUCTION

9.2 WIRED SENSOR

9.3 WIRELESS SENSOR

10 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY LIGHT-DUTY VEHICLE TYPE (Page No. - 49)

10.1 INTRODUCTION

10.2 LIGHT-DUTY VEHICLES (LDV)

10.2.1 ECONOMY CLASS

10.2.2 MID-SIZE CLASS

10.2.3 LUXURY CLASS

11 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY ELECTRIC VEHICLE (Page No. - 55)

11.1 INTRODUCTION

11.2 BATTERY ELECTRIC VEHICLE (BEV)

11.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

11.4 HYBRID ELECTRIC VEHICLE (HEV)

11.5 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

12 OCCUPANT CLASSIFICATION SYSTEM MARKET, BY REGION (Page No. - 61)

12.1 REGIONAL LANDSCAPE

12.2 ASIA PACIFIC

12.2.1 CHINA

12.2.2 JAPAN

12.2.3 SOUTH KOREA

12.2.4 INDIA

12.2.5 THAILAND

12.2.6 REST OF ASIA PACIFIC

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 SPAIN

12.3.4 UK

12.3.5 RUSSIA

12.3.6 TURKEY

12.3.8 REST OF EUROPE

12.4 NORTH AMERICA

12.4.1 US

12.4.2 CANADA

12.4.3 MEXICO

12.5 REST OF THE WORLD

12.5.1 BRAZIL

12.5.1 IRAN

12.5.3 OTHERS

13 COMPETITIVE LANDSCAPE (Page No. - 87)

13.1 OVERVIEW

13.2 MARKINT RANKING ANALYSIS

13.3 COMPETITIVE SITUATIONS & TRENDS

13.4 COMPETITIVE LEADERSHIP MAPPING

13.4.1 VISIONARY LEADERS

13.4.2 INNOVATORS

13.4.3 DYNAMIC DIFFERENTIATORS

13.4.4 EMERGING COMPANIES

14 COMPANY PROFILES (Page No. - 92)

(OVERVIEW, PRODUCTS OFFERED, RECENT DEVELOPMENTS, AND SWOT ANALYSIS)*

14.1 ZF

14.2 CONTINENTAL AG

14.3 AISIN SEIKI

14.4 ROBERT BOSCH

14.5 IEE SENSING

14.6 APTIV

14.7 DENSO

14.8 AUTOLIV

14.9 TE CONNECTIVITY

14.1 ON SEMICONDUCTOR

14.11 OTHER REGIONAL PLAYERS

15 INDEX (Page No. - 114)

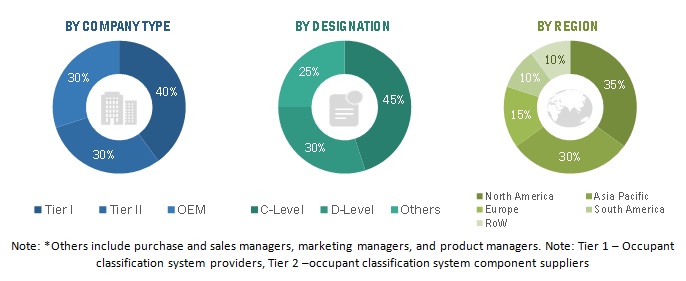

The study involved four major activities in estimating the market size for the occupant classification system. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global market. Secondary sources include company annual reports/presentations, press releases, industry association publications, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automobile Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical reports, and databases (Marklines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across four major regions-Asia Pacific, Europe, North America, Latin America and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

-

To define, segment, analyze, and forecast the market size, in terms of value (USD million) and volume (thousand units),

- By sensor (pressure sensor and seatbelt tension sensor) in terms of value (USD million)

- By component (sensors, airbag control unit, and others) in terms of volume (thousand units) and value (USD million)

- By light-duty vehicle type (economy class, mid-size class, and luxury class) in terms of volume (thousand units) and value (USD million)

- By electric vehicle type (BEV, HEV, PHEV, and FCEV) in terms of value (USD million)

- By region (Asia Pacific, Europe, North America, South America, and RoW) in terms of volume (thousand units) and value (USD million)

- To provide a detailed analysis of the numerous factors influencing the occupant classification system market (drivers, restraints, opportunities, and challenges)

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To strategically shortlist and profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the occupant classification system market

Available Customizations

- Detailed analysis of occupant classification system market, diesel engine

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Occupant Classification System (OCS) Market