Breast Implants Market Share, Size, Trends, Industry Analysis Report, By Shape (Anatomical and Cosmetic Surgery); By Material; By Application; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM1319

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

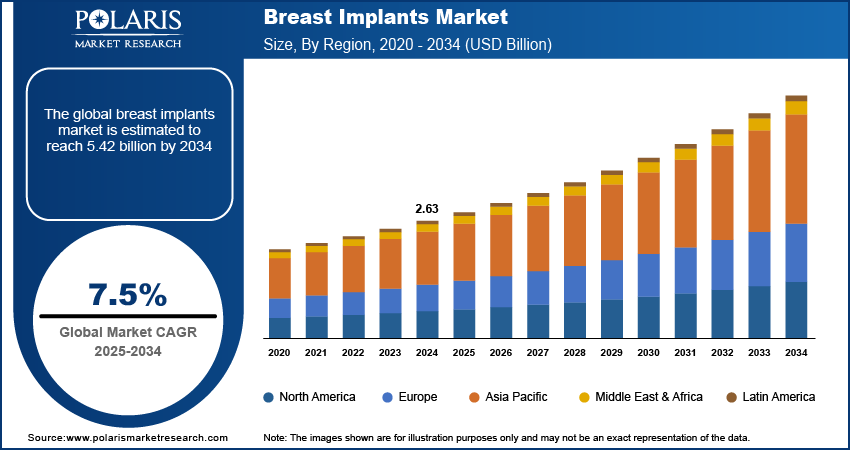

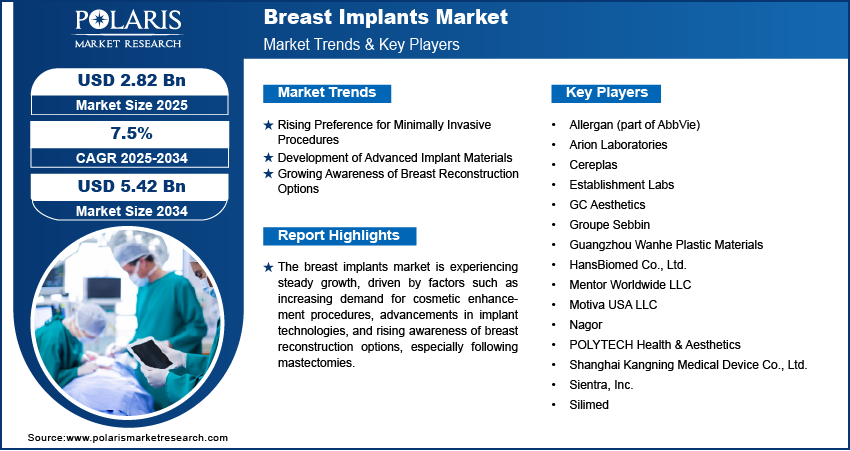

The global breast implants market was valued at USD 2.51 billion in 2023 and is expected to grow at a CAGR of 7.3% during the forecast period. The increased demand for aesthetic procedures has significantly changed breast implantation surgery. The breast implantation market's revenue is mainly driven by women who highly value improving their aesthetic attractiveness. The FDA states that women above 18 are eligible for breast augmentation procedures.

As a surgical procedure for breast enlargement, a breast implant may be done to gain back confidence for some women. For others, it’s a reconstructive procedure that’s done in response to different conditions. Breast implants can restore the breast volume that has been reduced due to various conditions, including pregnancy and weight loss. Also, it can aid in enhancing the natural volume of breasts or developing a rounded breast shape. Furthermore, it can help restore the breast after an injury or surgical removal of the breast.

Industry players in the breast implant market provide several breast implant types, including saline breast implants, silicone breast implants, gummy bear breast implants, round breast implants, smooth breast implants, and textured breast implants. Choosing the correct breast implant type needs the consideration of several factors, such as the individual’s desired breast appearance and function, skin flexibility, history of general health, and lifestyle. With the rising prevalence of breast cancer worldwide, the breast implant market is anticipated to witness steady growth over the forecast period.

Know more about this report: Request for sample pages

The silicone shells of a breast implant are either filled with sterile salt water (saline) or silicone gel. Breast implants, which are artificial things (prostheses), are surgically inserted into the breast during breast augmentation surgery, also known as mammoplasty. Women who have undergone mastectomy (breast removal due to cancer), whose breast size has reduced owing to pregnancy, aging, or weight loss, whose breasts are asymmetrical, and who wish to improve their self-esteem and body image can all benefit from breast implantation.

According to the American Society of Plastic Surgeons (ASPS), Breast augmentation is listed among the top 5 cosmetic surgeries performed in the United States. The ASPS reported that 279,143 operations involving the enlargement of this organ had been performed in the country. Because there are so many of these situations, it is anticipated that the market for breast implants will continue to expand quickly in the upcoming years.

The Breast Implants Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

The COVID-19 epidemic has disrupted the world's healthcare sector. The pandemic's effects are felt strongly in the medical equipment industry, with both positive and negative outcomes. On the one hand, the demand for ventilators and PPE kits has surged. On the other hand, the demand curve for medical equipment, including implants, stents, injectables, and other items, is declining. Disruptions in the supply chain and the cancellation or delay of elective surgery are critical components of this scenario.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global rise in breast cancer prevalence is one of the critical reasons for boosting the breast implant market. The World Health Organization reports that breast cancer has surpassed lung cancer as the cancer is most often diagnosed worldwide. The World Health Organization estimates that in 2020, 2.3 million women worldwide received a breast cancer diagnosis, and 685,000 passed away. While in Asian women, the frequency of breast cancer was so high that in 2020, it represented 22.9% of all female cancer cases. In the U.S., more than 3.8 million women have had breast cancer in the past as of January 2022. Women who have completed therapy and those who are presently receiving it are included. Breast cancer accounted for 12% of all new cancer cases globally as of 2021, making it the most prevalent disease globally. These elements will likely fuel the market for breast implants shortly.

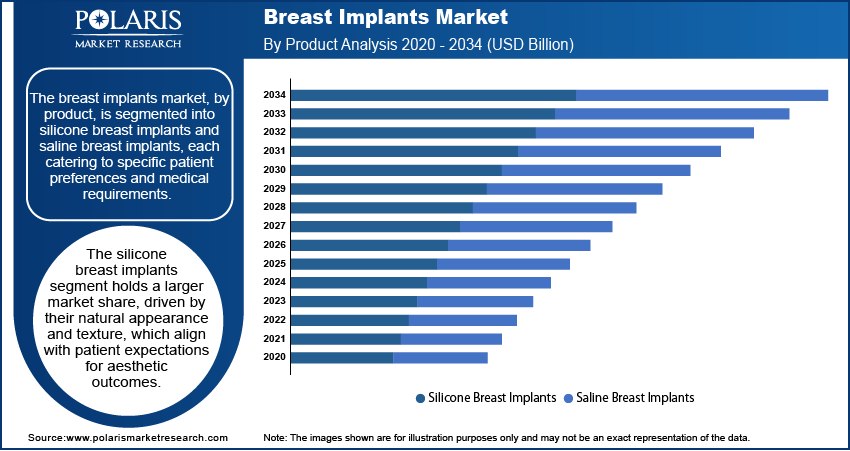

The popularity of silicone breast implants is expected to drive market expansion. The silicone gel used to create these implants closely mimics the texture of human fat, giving the breast tissue a natural-looking appearance and feel. In breast augmentation procedures, silicone implants are frequently utilized to enhance breast aesthetics while maintaining a natural appearance and feel. Therefore, the rising demand for silicone breast implants will fuel market expansion in the coming years.

Report Segmentation

The market is primarily segmented based on shape, material, application, end-use, and region.

|

By Shape |

By Material |

By Application |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Round shape segment accounted for the highest revenue share

In 2022, the highest revenue share came from implants with a round shape. They work well for breast augmentation because of their rounded form. These gadgets frequently resemble compressed spheres. As a result, there was a tremendous demand for these items, which helped the industry expand.

Round implants are symmetrical and do not cause any issues while rotating the implant. As a result, circular implants are preferred over anatomical implants by even doctors. Arion Laboratoires offers a wide variety of round breast implants. For instance, this business produces Monobloc Silicone, a spherical implant.

On the other hand, anatomically shaped gadgets are anticipated to increase considerably over the projection period because of their organic structure. This kind of implant is made to resemble a natural breast in form. Women who want to augment their breasts naturally frequently use this product.

Silicone segment held the largest market share.

In 2022, silicone implants accounted for the most significant market share. This is because these implants frequently resemble genuine breast tissue. For instance, a gummy implant gives the rebuilt breast a natural shape. Additionally, this product category has no danger of immune system diseases. Due to their soft texture, silicone implants are anticipated to maintain their supremacy during the predicted period. This characteristic reduces the possibility of developing tough scar tissue near the implantation. Gummy implants also have a reduced chance of wrinkle formation.

On the other side, a significant increase is projected for saline implants. This is because this device, after implant rupture, has fewer consequences than others. In the event of a leak, the saline is absorbed by the body without endangering the patient. Saline devices don't need any more follow-up visits with the doctor, unlike silicone ones. However, silent implant rupture is a common problem for women who have had silicone breast implantation surgery. Therefore, the FDA advises that these patients have routine MRI examinations.

Cosmetic Surgery-Application segment is anticipated to have a significant revenue share.

The expanding cosmetic industry's development brings this on to improve visual attractiveness. Breast augmentation treatments used in cosmetic surgery improve this organ's look. A well-known technique in the domain of cosmetic surgery is breast implantation. Compared to other types of implants, they feel more like actual breast tissue, which is the critical factor in which most women choose them over other forms.

Reconstruction surgery is expected to expand significantly. Following a mastectomy, it often addresses the flaws and abnormalities of the patient's chest wall. This helps to enhance their aesthetic appeal and restore their natural appearance. After a mastectomy or any other type of organ damage from cosmetic surgery, breast implantation incorporating reconstruction surgery helps to restore symmetry. Before the implant is placed, the organ's muscles must be expanded with a tissue expander.

Hospital segment is projected to hold the most significant market share.

The hospital sector held the most significant market share in 2022 due to patients’ growing preference for plastic surgical treatment in hospitals. Additionally, more hospitals are being built in emerging areas due to rising healthcare costs.

Conversely, the cosmetology clinics market is projected to have significant expansion. This results from the growth of specialized clinics offering cosmetic operations to improve patients' aesthetics. Compared to hospitals, these clinics' surgical treatment procedures are less demanding.

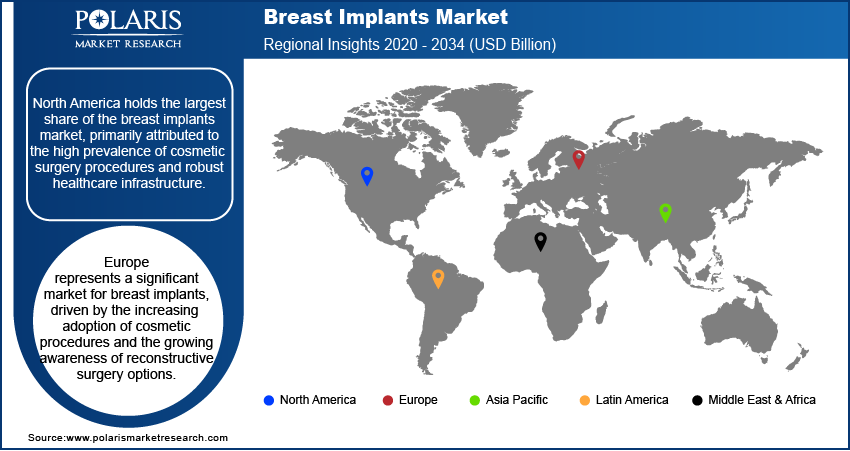

North America dominated the global market in 2022

Due to rising healthcare costs in the United States and a rise in interest in cosmetic surgery operations brought on by the improvement in the country's aesthetics, North America led the global market. Additionally, it is anticipated that the increased incidence of breast cancer in this region would aid market expansion.

However, the European market is expected to increase due to consumer preference for silicone implants, rising cosmetic product demand, and active government measures to inform the public about the many types of implants available for breast augmentation.

Competitive Insight

Some of the major players operating in the global market include GC Aesthetics, ALLERGAN, GROUPE SEBBIN SAS, Polytech Health & Aesthetics GmbH, Shanghai Kangning Medical Supplies Ltd., Establishment Labs S.A., Mentor Worldwide LLC; Sientra, Inc., Guangzhou Wanhe Plastic Materials Co., Ltd., LABORATOIRES ARION, and HANSBIOMED CO. LTD.

Recent Developments

- In October 2022, The micro-textured anatomical breast implant LUNA tx, authorized by the new European Medical Device Regulation, was given CE clearance by GC Anesthetics (MDR).

- In June 2022, The 3D bio-printed regenerative breast implant program from Coll Plant, which addresses breast reconstruction needs, announced the start of research in big animals.

Breast Implants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.69 billion |

|

Revenue forecast in 2032 |

USD 4.73 billion |

|

CAGR |

7.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Shape, By Material, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

GC Aesthetics, ALLERGAN, GROUPE SEBBIN SAS, Polytech Health & Aesthetics GmbH, Shanghai Kangning Medical Supplies Ltd., Establishment Labs S.A., Mentor Worldwide LLC; Sientra, Inc., Guangzhou Wanhe Plastic Materials Co., Ltd., LABORATOIRES ARION, and HANSBIOMED CO. LTD. |

We provide our clients the option to personalize the Explore the market dynamics of the 2024 Breast Implants Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports.

Browse Our Top Selling Reports

Battery Separators Market Size, Share 2024 Research Report

Extruded Polystyrene Market Size, Share 2024 Research Report

Healthcare Contract Research Organization Market Size, Share 2024 Research Report

FAQ's

The global breast Implants market size is expected to reach USD 4.73 billion by 2032.

Breast implants market key players are GC Aesthetics, ALLERGAN, GROUPE SEBBIN SAS, Polytech Health & Aesthetics GmbH, Shanghai Kangning Medical Supplies Ltd., Establishment Labs S.A., Mentor Worldwide LLC; Sientra, Inc., Guangzhou Wanhe Plastic Materials Co., Ltd.

North America contribute notably towards the global breast implants market.

The global breast implants market expected to grow at a CAGR of 7.3% during the forecast period.

The breast Implants market report covering key segments shape, material, application, end-use, and region.