IR Spectroscopy Market by Technology (FTIR, Dispersive IR), Type (Near-infrared Spectroscopy, Mid-infrared Spectroscopy), Product Type (Benchtop Spectroscopes), End-user Industry (Healthcare & Pharmaceutical, Chemicals) - Global Forecast to 2029

Updated on : April 24, 2024

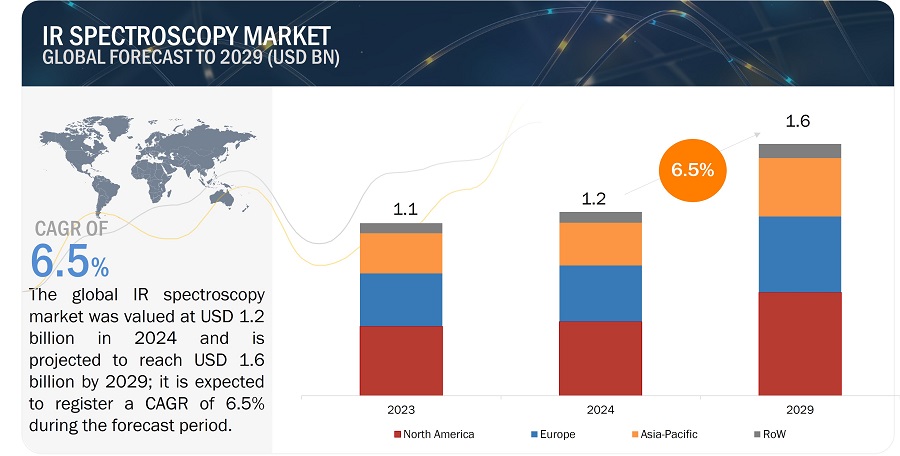

[227 Pages Report] The global IR spectroscopy market was valued at USD 1.2 billion in 2024 and is projected to reach USD 1.6 billion by 2029; it is expected to register a CAGR of 6.5% during the forecast period. Growth in the number of healthcare institutions and clinical research centers, continuous technological advancements in IR spectroscopy are among the factors driving the growth of the IR spectroscopy market.

IR Spectroscopy Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Growth in the number of healthcare institutions and clinical research centers

The growing number of healthcare institutions and clinical research centers is driving the growth of IR spectroscopy due to the increasing demand for advanced analytical techniques in the field of medicine and biomedical research. IR spectroscopy is a powerful tool for understanding the molecular landscape and chemical pathologies of various biological systems, making it a valuable asset in the diagnosis, treatment, and prevention of diseases.

As healthcare institutions and clinical research centers continue to expand, there is an increasing need for accurate and reliable analytical methods to study the complex molecular interactions that occur in biological systems. IR spectroscopy provides a non-destructive, non-invasive, and fast method for analyzing the vibrational modes of molecules, which can reveal valuable information about their structure, function, and interactions with other molecules.

Moreover, healthcare facilities translate to a larger patient pool, leading to a higher demand for efficient and accurate diagnostic tools. IR spectroscopy offers a fast, non-invasive, and reliable approach for analyzing various samples, including tissues, blood, and breath. Clinical research centers constantly seek innovative techniques to improve disease detection and monitoring. IR spectroscopy's ability to identify unique molecular fingerprints of different diseases makes it a valuable tool in their arsenal. Also, Advancements in portable and miniaturized IR spectrometers further contribute to the technology's adoption in point-of-care settings within healthcare institutions, enabling faster and more efficient analysis.

Restraint: Technical limitations of IR spectroscopy

IR spectroscopy has some technical limitations, forcing end users to shift to competitive products such as Raman or fluorescence spectroscopy. While IR spectroscopy has various applications and advantages, it also faces certain technical limitations that can act as restraints in certain situations. Here are some of the technical limitations of IR spectroscopy:

- Limited Sensitivity for Dilute Samples: IR spectroscopy may lack sensitivity, especially when dealing with dilute samples. This can be a limitation when analyzing trace amounts of a substance in a complex matrix.

- Water Absorption: Water molecules strongly absorb in the infrared region, particularly in the range of 1600-1800 cm^-1. This can be a challenge when analyzing samples containing water or in humid environments, as the water bands may overlap with the analyte's signals.

- Sample State and Preparation: The state of the sample (solid, liquid, or gas) can affect the quality of the IR spectrum. Solid samples may require grinding with a suitable matrix, and liquids may need proper handling to obtain reliable results.

- Instrumentation Constraints: The resolution and accuracy of IR instruments can impact the ability to resolve closely spaced peaks and accurately identify functional groups. Higher resolution instruments are typically more expensive and may require specialized expertise for operation.

- Furthermore, the identification of molecular structure in an aqueous and complex solution can be difficult with IR spectroscopy, due to which end users may opt for other competitive products for analysis. Sometimes, wavelengths of certain bandwidths are not detectable in IR spectrographic products, primarily due to specification adjustment. Such technical limitations hamper spectrographic products. Product testing using IR spectroscopy is time-consuming; hence, it becomes difficult to implement the latest technological trends in the products. The shift toward competitive products is expected to affect the IR spectroscopy market growth.

Opportunity: Rising use of NIR spectroscopy in seed quality detection

Seeds are the most basic and vital agricultural capital goods, and the quality of seeds is essential for agricultural production. Traditional nucleic acid-based and immunodiagnostic methods used for detecting seed quality are destructive, slow, and need pre-treatment. Near-Infrared (NIR) spectroscopy is known for its ability to analyze multiple components of seeds simultaneously quickly and non-destructively, such as moisture content, oil content, protein content, and more. The increased demand for seed quality assessment using spectroscopic techniques stimulates research and development in the field. Innovations and technological advancements driven by the adoption of NIR spectroscopy can lead to the development of more advanced IR spectroscopy methods, sensors, and devices, creating a positive feedback loop of improvement.

This technology allows for the selection and classification of seeds based on specific traits without altering them, opening up new avenues for quality evaluation. Additionally, NIR spectroscopy technology has been applied in testing seed constituents, vigor, disease, insect pests, moisture, starch, and more, showcasing its versatility and importance in seed quality analysis.

Challenge: High Cost of IR spectroscopy products

The high cost of infrared (IR) spectroscopy devices presents a significant challenge for the IR spectroscopy Industry. These sophisticated instruments are essential for various applications, including chemical analysis, environmental monitoring, and material characterization. However, the prohibitive expense associated with acquiring and maintaining high-quality IR spectroscopy equipment creates several obstacles for both researchers and industries.

Firstly, the substantial initial investment required to purchase advanced IR spectroscopy devices poses a financial barrier, especially for smaller research institutions, laboratories, and emerging businesses. This limits access to cutting-edge technology, hindering scientific advancements and innovation in fields that heavily rely on spectroscopic analysis.

The high cost of IR spectroscopy devices also affects market competitiveness. Industries seeking to adopt these technologies for quality control, process monitoring, or product development may face challenges in justifying the return on investment, particularly when cost-effective alternatives or competing technologies are available. This can slow down the adoption rate of IR spectroscopy in various sectors, limiting its market expansion and potential for widespread application.

IR Spectroscopy Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of IR spectroscopy systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Shimadzu Corporation (Japan); ZEISS (Germany); PerkinElmer Inc. (US); Agilent Technologies, Inc. (US); Bruker Corporation (US); ABB (Switzerland); Thermo Fisher Scientific Inc. (US); Horiba, Ltd. (Japan); Sartorius AG (Germany); Hitachi High-Tech Corporation (Japan).

By product type, portable spectroscopes is expected to grow with the highest CAGR from 2024 to 2029.

The market for portable spectroscopes is expected to grow at a CAGR of 8.9% during the forecast period. Portable spectrometers are designed to be lightweight and compact. This makes them ideal for field work, allowing researchers and professionals to take the analytical power of IR spectroscopy directly to where the samples are located. This is useful in applications like environmental monitoring, on-site material identification, or even medical analysis in remote locations. Portable spectrometers offer the advantage of mobility, allowing analysis to be performed in situ, in the field, or at point-of-care locations. This accessibility reduces the need for sample transportation and enables real-time or on-site analysis, which is particularly advantageous in applications such as environmental monitoring, food safety, pharmaceuticals, and forensic analysis

By end-user industry, biomedical research and biomaterials segment is expected to grow with the highest CAGR in 2029.

The biomedical research and biomaterials segment is expected to grow at a CAGR of 8.5% during the forecast period. IR light interacts with specific bonds within molecules, causing vibrations. These vibrations produce a unique spectrum, like a fingerprint, that identifies the functional groups present in a sample. This allows researchers to identify and characterize biological molecules, tissues, and biomaterials. In biomaterials research, IR spectroscopy can be used to assess the biocompatibility of a material, study its interaction with cells and tissues, and monitor its degradation over time.

By type, the Far-infrared Spectroscopy segment is expected to grow with the highest CAGR from 2024 to 2029.

The Far-infrared Spectroscopy segment is expected to witness the highest CAGR of 9.5% during the forecast period. Far infrared spectroscopy enables non-destructive and non-invasive analysis of samples. This is especially valuable in fields such as pharmaceuticals, where it is essential to analyze materials without altering their properties. It allows researchers to study samples in their native state without the need for extensive sample preparation. Far infrared spectroscopy is finding new and emerging applications in areas such as biomedical imaging, security screening, environmental monitoring, and telecommunications. These expanding application areas contribute to the growing demand for far infrared spectroscopy techniques and drive further research and development in the field.

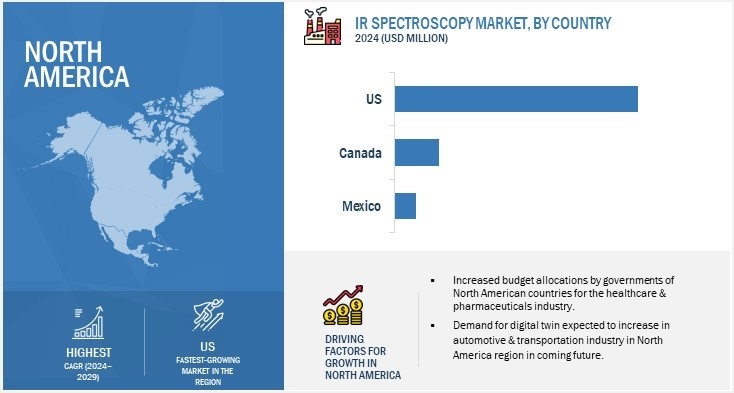

In 2029, North America is projected to hold the highest CAGR of the overall IR spectroscopy market.

IR Spectroscopy Market by Region

To know about the assumptions considered for the study, download the pdf brochure

In 2029, The IR spectroscopy market in North America is expected to grow at the highest CAGR. The North American IR spectroscopy market is experiencing significant growth due to strong demand for infrared spectroscopy products for healthcare & pharmaceuticals, chemicals, and Food & Beverages. Several companies offering infrared spectroscopy products, including PerkinElmer Inc. (US); Agilent Technologies, Inc. (US); Bruker Corporation (US); Thermo Fisher Scientific Inc. (US); have a presence in this region, which further adds to the growth of the infrared spectroscopy market in North America.

Top IR Spectroscopy Companies - Key Market Players:

Shimadzu Corporation (Japan); ZEISS (Germany); PerkinElmer Inc. (US); Agilent Technologies, Inc. (US); Bruker Corporation (US); ABB (Switzerland); Thermo Fisher Scientific Inc. (US); Horiba, Ltd. (Japan); Sartorius AG (Germany); Hitachi High-Tech Corporation (Japan) are some of the key players in the IR spectroscopy companies.

IR Spectroscopy Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 1.2 billion in 2024 |

| Projected Market Size |

USD 1.6 billion by 2029

|

| Growth Rate | 6.5% CAGR |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

Shimadzu Corporation (Japan); ZEISS (Germany); PerkinElmer Inc. (US); Agilent Technologies, Inc. (US); Bruker Corporation (US); ABB (Switzerland); Thermo Fisher Scientific Inc. (US); Horiba, Ltd. (Japan); Sartorius AG (Germany); Hitachi High-Tech Corporation (Japan) are some of the key players in the IR spectroscopy market. |

IR Spectroscopy Market Highlights

This research report categorizes the IR spectroscopy market based technology, type, product type, end-user industry, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Type |

|

|

By Product Type |

|

|

By End-user Industry |

|

|

By Region |

|

Recent Developments in IR Spectroscopy Industry :

- In December 2023, Shimadzu Corporation launched IRseries products. They are equipped with an analysis navigation program enabling novice FTIR users to obtain data easily, and a function that judges the quality of the measurement results and proposes how to obtain favorable data.

- In September 2023, Sartorius AG and Repligen Corporation jointly launched an integrated bioreactor system. The Biostat STR now contains a fully compatible embedded XCell ATF hardware and software module offering predefined advanced control recipes with integrated Process Analytical Technology (PAT).

- In March 2023, Rapid Screening Research Center for Toxicology and Biomedicine (RSRCTB) at National Sun Yat-sen University (NSYSU) established the first Satellite Laboratory in Taiwan, utilizing various kinds of chemical analytical instruments manufactured by Shimadzu Corporation. The laboratory will expand the application of mass spectroscopy and Fourier transform infrared spectroscopy (FTIR).

- In January 2023, launched AIMsight. It enhances defect analysis efficiency through automation. This innovation includes features such as faster search for measurement sites, contributing to addressing societal challenges like microplastics through contaminant analysis.

- In October 2022, Agilent Technologies, Inc. launched Agilent 8700 LDIR (laser direct infrared), rapid analysis and user-friendly features to infrared spectroscopy, establishing itself as a leading method for microplastic particle analysis. The introduction of on-filter analysis represents a notable advancement in speed and throughput. Enhancing testing volumes will contribute to a better comprehension of microplastics contamination in the environment, supporting the formulation of relevant standards and regulations.

Frequently Asked Questions (FAQs):

Which are the major companies in the IR spectroscopy market? What are their major strategies to strengthen their market presence?

The major companies in the IR spectroscopy market are – Shimadzu Corporation (Japan); ZEISS (Germany); PerkinElmer Inc. (US); Agilent Technologies, Inc. (US); Bruker Corporation (US); ABB (Switzerland); Thermo Fisher Scientific Inc. (US); Horiba, Ltd. (Japan); Sartorius AG (Germany); Hitachi High-Tech Corporation (Japan) and the major strategies adopted by these players are product launches and developments.

What is the IR spectroscopy system?

IR spectroscopy system is an analytical instrument used to study the interaction of infrared radiation with matter. It works by passing infrared light through a sample and measuring the amount of light absorbed by the sample at different wavelengths. The resulting infrared spectrum is a plot of absorbance or transmittance versus wavelength.

Who are the winners in the global IR spectroscopy market?

Companies such as Shimadzu Corporation, ZEISS, Agilent Technologies, Inc., PerkinElmer Inc., and Bruker Corporation fall under the winner’s category. These companies cater to the requirements of their customers by providing IR spectroscopy systems. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the IR spectroscopy market?

Continuous technological advancements in IR spectroscopy is the driver, and rising use of NIR spectroscopy in seed quality detection is the opportunity in the IR spectroscopy market.

What are the restraints and challenges for the IR spectroscopy market?

Technical limitations of IR spectroscopy and High Cost of IR spectroscopy products are the restraints and challenges in the IR spectroscopy market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the IR spectroscopy market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering IR spectroscopy systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the IR spectroscopy market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of IR spectroscopy systems to identify key players based on their products and prevailing industry trends in the IR spectroscopy market by technology, type, product type, end-user industry, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

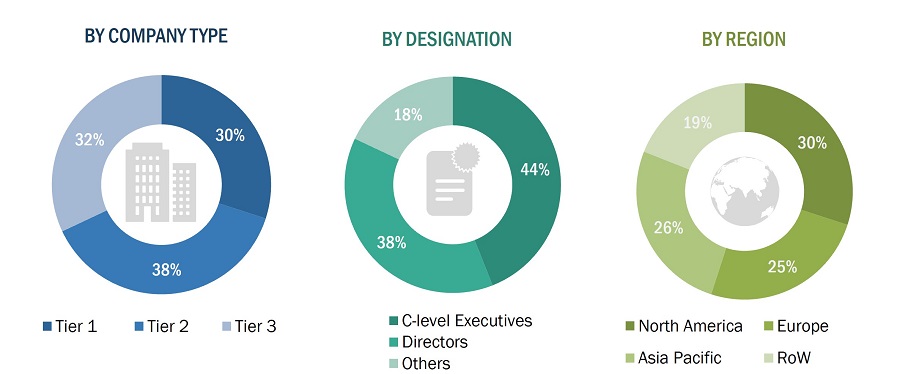

Extensive primary research has been conducted after understanding and analyzing the current scenario of the IR spectroscopy market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—North America, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

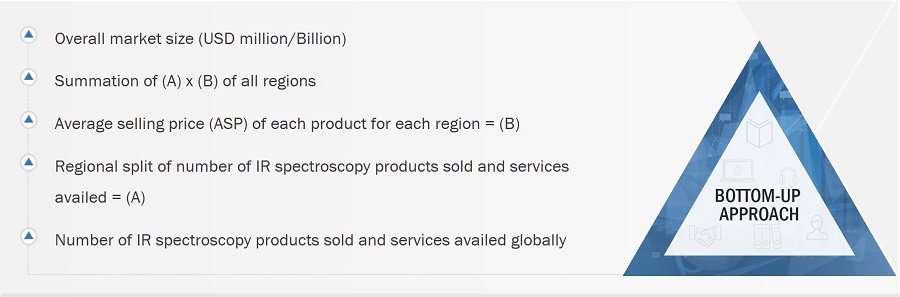

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the IR spectroscopy market.

- Identifying end-use industries wherein IR spectroscopy systems are deployed or are expected to use

- Analyzing major providers of IR spectroscopy equipment’s and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing the average selling price of IR spectroscopy systems powered by different technologies

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming developments in the market that include investments, research and development activities, product launches, contracts, collaborations, and partnerships undertaken, and forecasting the market size based on these developments

- Carrying out multiple discussions with key opinion leaders to understand the types of IR spectroscopy products, services, and software designed and developed, thereby analyzing the break-up of the scope of work carried out by the major companies in the IR spectroscopy market

- Arriving at the market estimates by analyzing the revenue generated by key companies providing IR spectroscopy products on the basis of their locations (countries) and then combining the market size for each country to get the market estimate by region

- Verifying and crosschecking the estimates at every level by discussing with key opinion leaders, including CXOs, directors, and operation managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

The top-down approach has been used to estimate and validate the total size of the IR spectroscopy market.

- Focusing on top-line investments and expenditures being made in the ecosystems of various applications

- Calculating the market size, considering revenues from major players through the cost of IR spectroscopy systems

- Segmenting each application of the IR spectroscopy system in each region and deriving the global market size based on the region

- Acquiring and analyzing information related to revenues generated by players through their crucial product offerings

- Conducting multiple on-field discussions with key opinion leaders involved in developing various IR spectroscopy solutions

- Estimating geographical splits by using secondary sources on the basis of various factors, such as the number of players in a specific country and region, types of IR spectroscopy products/solutions, and levels of services offered across several end-user industries

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the IR spectroscopy market.

Market Definition

IR spectroscopes operate in the IR region of the electromagnetic spectrum used for the study and identification of chemical compounds in a sample, which can be either be in the gaseous, liquid, or solid form. In IR spectroscopy, IR light interacts with matter to identify the composition of the materials using three ways of measurement: reflection, emission, and absorption, for quality control and other applications. IR spectroscopy is used in various verticals, such as biological research, healthcare & pharmaceuticals, and food & beverages, to study and check the quality of materials produced during the manufacturing process. The instruments used for IR spectroscopy include IR spectrometers or spectrophotometers. IR spectroscopy works in the IR spectrum, which can be further divided into near-infrared (NIR), mid-infrared (MIR), and far-infrared (FIR).

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Semiconductor wafer vendors

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs) and OEM technology solution providers

- Networking solutions providers

- Distributors and retailers

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- End users

- Technical universities

- Government/private research institutes

- Market research and consulting firms

Report Objectives

- To describe and forecast the size of the IR spectroscopy market, by type, technology, product type, end-user industry, and region, in terms of value

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To forecast the size of the IR spectroscopy market by product type, in terms of volume

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the IR spectroscopy market

- To analyze the IR spectroscopy value chain and ecosystem, along with the average selling price of IR spectroscopy systems

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies such as product launches, expansion, collaborations, acquisitions, partnerships, and expansions adopted by players in the IR spectroscopy market

- To profile key players in the IR spectroscopy market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies2

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Growth opportunities and latent adjacency in IR Spectroscopy Market