DDoS Protection and Mitigation Security Market by Component, Application Area (Network Security, Application Security, Endpoint Security), Deployment Mode, Organization Size, Vertical (BFSI, Healthcare, IT & Telecom) and Region - Global Forecast to 2027

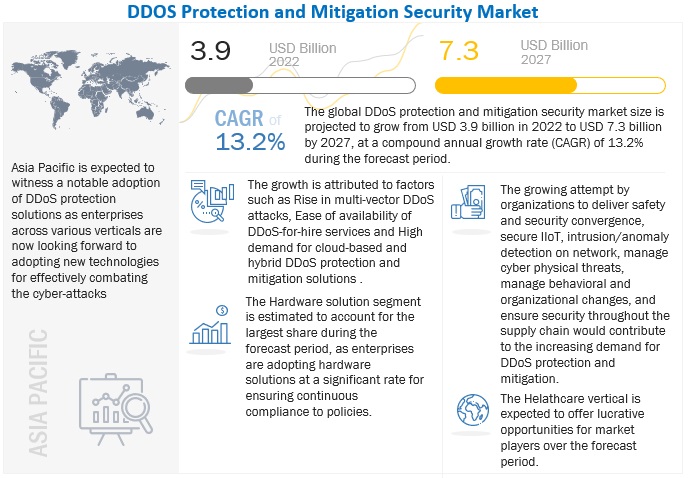

The global DDoS protection and mitigation security market size was valued at $3.9 billion in 2022 and is predicted to reach $7.3 billion by 2027, increasing at a CAGR of 13.2% from 2022 to 2027. Cloud-based DDoS protection and mitigation services can efficiently handle volumetric DDoS attacks, and layer 3 and 7 attacks. Thus, to optimize business operations and expenses, businesses are rapidly adopting cloud-based DDoS defense solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drive: Ease of availability of DDoS-for-hire services

DDoS-for-hire services are often used by DDoS attackers to induce bots on targets’ website by charging a nominal fee. DDoS stressor services include the selling of botnets, which are a group of connected devices infected by malware. The DDoS-for-hire services target Software-as-a-Service (SaaS)-based enterprises and eCommerce customers on a large scale. Attackers can launch an active attack that disrupts the functioning of the entire infrastructure, or a passive attack that monitors network and application layers’ activities. Some of the significant DDoS-for-hire services include zstress, Data Booter, Instabooter, Thunder stress, ragebooter, Netdown, Defcon, and CloudStress. These services are focused on inducing attacks by targeting DNS, Simple Network Management Protocol (SNMP), NTP, Hypertext Transfer Protocol (HTTP), Transmission Control Protocol (TCP), and User Datagram Protocol (UDP). DDoS-as-a-service aims at disrupting functioning enterprise networks and applications. This service is available at a low cost, and the payment modes include cryptocurrency and PayPal. Although the law enforcement agencies across the US and UK have seized high profile DDoS websites, hacktivists groups are continuously launching new DDoS-for-hire websites. The factors above are expected to have increased the adoption of DDoS protection and mitigation security solutions and services across enterprises.

Restraint: Easy availability of free and pirated DDoS protection and mitigation security solutions

Software piracy refers to the unauthorized copying and distribution of software or solutions. Counterfeiting of software has increased over the years, due to the availability of open-source platforms. The software piracy helps illegitimate people in making a fake software copy, which is a replica of the original software. However, it is a cybercrime that encompasses the illegal copying, sharing, and selling or installing of copyrighted software and website downloading. There are many types of software piracy; out of these, the most prevalent types include softlifting, software counterfeiting, Original Equipment Manufacturer (OEM) bundling, hard disk loading, and renting. Internet-based software piracy is one of the emerging issues in piracy. A few DDoS protection and mitigation security solutions can be downloaded at free of cost over the internet. SMEs that adopt such free solutions seldom need to pay for upgradations, customizations, and support fees. However, the presence of such solutions in the market hampers the market presence of major DDoS mitigation solutions, thereby directly hitting the profitability of DDoS solution vendors. Hence, the availability of such free solutions is expected to restrain the market growth during the forecast period.

Opportunity: Need of DDoS defense solutions for 5g ecosystem

Telecommunications service providers are focusing on rolling out the state-of-the-art cellular technology, i.e., 5G services to increase the speed and responsiveness of wireless networks. There has been a continuous explosion of data traffic, due to the advent of IoT, Augmented Reality (AR), and Virtual Reality (VR) technologies; smartphones; voice applications; and audio and video content. The exponential increase in data traffic requires higher network bandwidth. 5G services are expected to provide a higher bandwidth of 1 Gbps as compared to that of 4G services. The increased bandwidth of 5G networks opens avenues for DDoS attackers to induce large DDoS attacks capable of impacting millions of mobile and IoT devices. With the rising complexities and faster networks, Internet Service Providers (ISPs) need to deploy real-time and automated DDoS protection solutions to combat with high-frequency DDoS attacks. According to A10 Network’s mobile operator survey report, 63% of the respondents believe that an advanced DDoS protection and mitigation security solution is required to protect 5G networks.

Challenge: Dearth of security skills among security professionals and lack of pre-planning among enterprises

The shortage of security skills among security professionals is a burning issue that is eminent across all the major security companies. Security teams augment the smooth functioning of DDoS solutions and services. Security professionals with excellent cybersecurity skills are required in security teams that are responsible for handling the functioning of SOCs and scrubbing centres. According to a CSIS survey conducted across eight countries in January 2019, 82% of employers reported a shortage of cybersecurity skills, and 71% stated that this gap causes direct and measurable damages to their organizations. According to (ISC)2, the global IT security skills shortage had already surpassed four million in 2019 and is expected to increase even more in the near future. These facts highlight the fact that the inability of the security teams in helping customers detect and mitigate threats may bring a bad reputation to DDoS vendors. Thus, there is a need for the DDoS vendors to upgrade their teams’ cybersecurity skills as per industry standards. This also calls for proper and improved training for security professionals to fill the gap and obtain the required expertise for identifying and analysing cyberattacks.

By application area, application security to register higher CAGR during forecast period

DDoS attacks are becoming sophisticated and complex day by day. Application layer (layer 7) attacks are launched by hacktivists or cyber terrorists using highly automated tools. Such DDoS attacks require proactive monitoring and advanced alerting to mitigate risks at an early phase. Advanced DDoS protection solutions can distinguish human traffic from bot traffic. DDoS solution providers are continuously adopting newer technologies to combat the ever-changing attacks, signatures, and patterns. The application layer deals with protocols, such as Simple Mail Transfer Protocol (SMTP), HTTP, and HTTPS, which are responsible for managing web browsers and emails, and handling requests for applications.

By deployment mode, on-premises to account for largest market share during forecast period

On-premises deployment is the traditional approach of implementing DDoS protection solutions and services across organizations. On-premises services provide organizations with full control over all the platforms, applications, systems, networks, and data. The organization’s own IT staff can handle and manage the deployed solutions. It provides local detection and mitigation of DDoS attacks, such as spoofed/non-spoofed DoS attacks, TCP (such as SYN flood and FIN flood), ICMP, UDP floods, botnets, Slowloris, application attacks etc.

By vertical, healthcare vertical to register higher CAGR during forecast period

In the current scenario, the healthcare vertical is delivering the best services by using advanced equipment and mobile devices specially designed for doctors and nurses. These devices keep the doctors connected to the patients and enable them to reach colleagues and access the huge wealth of medical data. As mobility has become an essential part of efficient and accurate care delivery, connectivity to the internet has also become a must. Moreover, certain regulatory norms, such as HIPAA, which require the healthcare providers to protect confidential patient information, are also responsible for the increasing deployment of DDoS protection and mitigation solutions in the healthcare vertical.

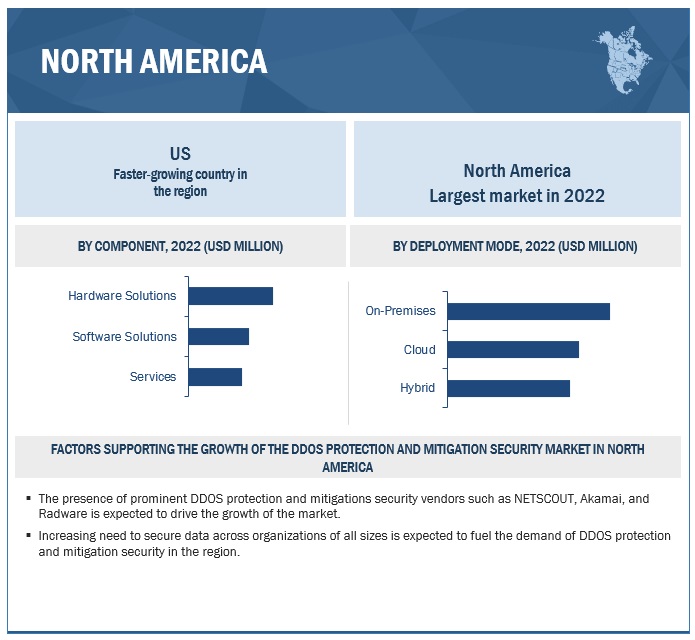

North America to account for largest market share during forecast period

North America is expected to hold the largest share of the overall DDoS protection and mitigation security market. North America leads DDoS protection and mitigation security usage, with the US and Canada at the forefront. These countries have sustainable and well-established economies, which empower them to invest strongly in R&D activities, thereby contributing to developing new technologies. According to NETSCOUT North America accounted for about 17 percent of global DDoS attacks in 1H 2022, with an average of 5,755 DDoS attacks per day when compared with the global average of 33,260 attacks per day. Despite this relatively minor increase in attack volume, it nevertheless reveals trends and anomalies that correspond to global events and attacker innovation. The broad adoption of data compliance regulations by all businesses and the quick use of cloud computing are the two main growth drivers of the North American DDoS protection and mitigation security market. Furthermore, attacks are rapidly growing and getting more sophisticated as a result of the widespread use of cloud-based applications in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The DDoS protection and mitigation security market vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in this market include NetScout (US), Akamai (US), Radware (Israel), Huawei Technology (China), Fortinet (US), Link11 (Germany), Imperva (US), Cloudflare (US), BT (England), A10 Networks (US), Fastly (US), Nexusguard (Singapore), Corero (UK), RioRey (US), PhoenixNAP (US), Allot (Israel), StrataCore (US), Sucuri (US), Verisign (US), StackPath (US), Seceon (US), Haltdos (India), DDoS-Guard (Russia), Indusface (India), Activereach (UK), and Mlytics (Singapore). The study includes an in-depth competitive analysis of these key market players along with their profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, application areas, deployment mode, organization size, vertical and region. |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

include NetScout (US), Akamai (US), Radware (Israel), Huawei Technology (China), Fortinet (US), Link11 (Germany), Imperva (US), Cloudflare (US), BT (England), A10 Networks (US), Fastly (US), Nexusguard (Singapore), Corero (UK), RioRey (US), PhoenixNAP (US), Allot (Israel), StrataCore (US), Sucuri (US), Verisign (US), StackPath (US), Seceon (US), Haltdos (India), DDoS-Guard (Russia), Indusface (India), Activereach (UK), and Mlytics (Singapore). |

This research report categorizes the DDoS protection and mitigation security market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Hardware Solutions

- Software Solutions

-

Services

-

Professional Services

- Design and Integration

- Consulting and Advisory

- Support and Maintenance

- Training and Education

- Managed Services

-

Professional Services

By Application Area:

- Network Security

- Application Security

- Database Security

- Endpoint Security

By Deployment Mode:

- On-premises

- Cloud

- Hybrid

By Organization Size:

- Small and Middle Size Enterprises

- Large Enterprises

By Vertical:

- Government and Defense

- BFSI

- Manufacturing

- Energy and Utilities

- IT and Telecommunications

- Healthcare

- Education

- Retail

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- France

- Germany

- Spain

- Italy

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- United Arab Emirates

- Kingdom of Saudi Arabia

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022, Radware acquired cloud DDoS network operator SecurityDAM for USD 30 million to accelerate the growth of its cloud security services business.

- In October 2022, Akamai’s Prolexic Launches Sixth-Generation DDoS Platform Upgrade. The latest upgrade provides a strong foundation for future cybersecurity innovations, including enhanced detection and mitigation, cutting-edge deployment methodologies, expanded self-service controls, and other value-added capabilities beyond DDoS.

- In September 2021, NETSCOUT engages with NTT Communications on Threat Intelligence and DDoS Attack Resilience Research. Its focus will be to discover and mitigate large DDoS attacks and implement defense measures for application attacks.

Frequently Asked Questions (FAQ):

What is DDoS protection and mitigation security?

DDoS protection and mitigation is a set of techniques implemented across an enterprise to mitigate DDoS traffic. A Denial of Service (DoS) attack is a methodology to flood resources of victims with false requests and make them unable to serve legitimate requests. A DDoS attack is induced by a collection of devices used to target a network and application layer or induce volumetric attacks, ranging from 1 Gbps to 1 Tbps. The DDoS protection and mitigation market include solutions, such as hardware solutions, software solutions and services. The solutions are developed on algorithms that make use of Machine Learning (ML), Artificial Intelligence (AI), and big data analytics methodologies.

Which countries are considered in the North American region?

The report includes an analysis of the US and Canada in the North American region.

Which are the key drivers supporting the growth of the DDoS protection and mitigation security market?

The key drivers supporting the growth of the DDoS protection and mitigation security market include rise in multi-vector DDoS attacks, ease of availability of DDoS-for-hire services, and high demand for cloud-based and hybrid DDoS protection and mitigation solutions.

Who are the key vendors in the DDoS protection and mitigation security market?

The key vendors operating in the DDoS protection and mitigation security market include NetScout (US), Akamai (US), Radware (Israel), Huawei Technology (China), Fortinet (US), Link11 (Germany), Imperva (US), Cloudflare (US), BT (England), A10 Networks (US), Fastly (US), Nexusguard (Singapore), Corero (UK), RioRey (US), PhoenixNAP (US), Allot (Israel), StrataCore (US), Sucuri (US), Verisign (US), StackPath (US), Seceon (US), Haltdos (India), DDoS-Guard (Russia), Indusface (India), Activereach (UK), and Mlytics (Singapore).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

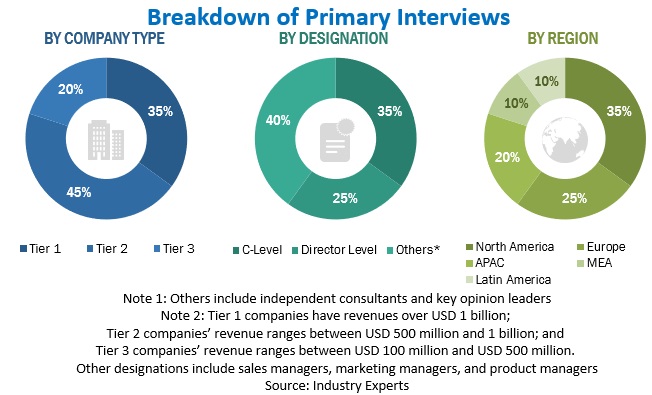

This research study involved the use of extensive secondary sources, directories, and databases, to identify and collect information useful for this technical, market-oriented, and commercial study of the DDoS protection and mitigation security market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the DDoS protection and mitigation security market.

Secondary Research

The market size of the companies offering DDoS protection and mitigation security hardware, software solutions, and services globally was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of the major companies and rating companies based on their performance and quality.

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers such as DDoS white papers by Active Reach, AWS Best Practices for DDoS Resiliency, DDoS Architecture and whitepaper by F5; journals such as An Effective Mechanism To mitigate Real-Time DDoS Attacks, DDoS Attacks Prevention and Mitigation Techniques etc.; research papers such as Impact of Defending Strategy Decision on DDoS Attack, A Mechanism for Prevention of Flooding based DDoS Attack etc.; and certified publications and articles from recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from market and technology-oriented perspective – all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from DDoS protection and mitigation security solution vendors, system integrators, professional service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from the hardware, solutions, and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and installation teams of the governments/end users that use DDoS protection and mitigation security solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of DDoS protection and mitigation security solutions, which is projected to impact the overall DDoS protection and mitigation security market growth.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for the estimation of the DDoS protection and mitigation security market. The first approach involved estimating the market size by the summation of company revenues generated through the different component, application areas, deployment mode, organization size, vertical and region. The top-down and bottom-up approaches were used to estimate and validate the size of the DDoS protection and mitigation security market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players are not limited to NetScout (US), Akamai (US), Radware (Israel), Huawei Technology (China), Fortinet (US), Link11 (Germany), Imperva (US), Cloudflare (US), BT (England), and A10 Networks (US) other players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data was consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the DDoS protection and mitigation security market based on component, application areas, deployment mode, organization size, vertical and region from 2022 to 2027, and analyze various macro and microeconomic factors that affect the market growth.

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the DDoS protection and mitigation security market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the total DDoS protection and mitigation security market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the DDoS protection and mitigation security market.

- To profile key market players (top vendors and startups); provide a comparative analysis based on their business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities, in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per a company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Market Scope of Anti-DDoS Market

The Anti-DDoS market encompasses a broader range of products and services than the DDoS protection and mitigation market. It includes technologies and strategies used to prevent or mitigate DDoS attacks, such as intrusion prevention systems, firewalls, and load balancers. It also includes the use of cloud-based services and traffic scrubbing centers that can identify and filter out malicious traffic before it reaches its target.

The DDoS protection and mitigation market is a subset of the larger Anti-DDoS market, and both are important in the fight against DDoS attacks. Organizations may choose to invest in both Anti-DDoS solutions and DDoS protection and mitigation solutions to ensure comprehensive protection against DDoS attacks.

Anti-DDoS Market & Its impact on DDoS Protection and Mitigation Market

The Anti-DDoS market has grown in response to the increasing frequency and sophistication of DDoS attacks, and the need for more advanced solutions to prevent or mitigate them. This has led to the development of new technologies and services, such as cloud-based solutions and traffic scrubbing centers, that can help filter out malicious traffic and protect against DDoS attacks. As the Anti-DDoS market has expanded, it has created more options for organizations seeking to protect themselves against DDoS attacks.

At the same time, the growth of the Anti-DDoS market has also had an impact on the DDoS protection and mitigation market. The availability of more advanced Anti-DDoS solutions has led to a greater demand for more sophisticated DDoS protection and mitigation products and services. This has driven innovation in the DDoS protection and mitigation market, with new hardware and software solutions being developed to detect and mitigate DDoS attacks in real time.

In addition, the Anti-DDoS market and the DDoS protection and mitigation market are often seen as complementary, rather than competing, as both are needed to provide comprehensive protection against DDoS attacks. Many organizations will invest in both Anti-DDoS solutions and DDoS protection and mitigation solutions to ensure they are fully protected against the potential impact of DDoS attacks.

- Increasing demand for more advanced solutions: As the Anti-DDoS market continues to grow, organizations are becoming more aware of the threat posed by DDoS attacks and the importance of having effective protection in place. This is likely to drive demand for more advanced DDoS protection and mitigation solutions that can keep up with evolving threats and attacks.

- Integration of Anti-DDoS and DDoS protection and mitigation solutions: The Anti-DDoS market and the DDoS protection and mitigation market are increasingly seen as complementary, rather than competing. As a result, we are likely to see greater integration between these two markets, with vendors offering solutions that combine both Anti-DDoS and DDoS protection and mitigation capabilities.

- Increased focus on cloud-based solutions: The Anti-DDoS market is increasingly focused on cloud-based solutions, which can provide faster and more flexible protection against DDoS attacks. This is likely to drive demand for cloud-based DDoS protection and mitigation solutions that can provide the same level of protection and flexibility.

- Consolidation of the market: As the Anti-DDoS market and the DDoS protection and mitigation market continue to evolve, we are likely to see consolidation among vendors as they seek to offer a more comprehensive set of solutions. This is likely to lead to increased competition and innovation in the market, as well as greater efficiency and cost-effectiveness for organizations seeking to protect themselves against DDoS attacks

Futuristic Growth Use-Cases of Anti-DDoS Market

- Internet of Things (IoT) Security: With the growth of the IoT, there is an increasing need to secure the devices and networks that are part of this ecosystem. The Anti-DDoS market is expected to play a key role in securing IoT devices and networks against DDoS attacks, which can disrupt the functioning of the devices and pose a significant security threat.

- 5G Networks: The rollout of 5G networks is expected to increase the risk of DDoS attacks, as it will allow attackers to launch larger and more complex attacks with greater ease. The Anti-DDoS market is expected to provide critical protection against these attacks, helping to secure the networks and the data that they carry.

- Artificial Intelligence (AI) and Machine Learning (ML): The Anti-DDoS market is expected to leverage AI and ML technologies to enhance its ability to detect and mitigate DDoS attacks in real time. By analyzing network traffic patterns and identifying anomalies, AI and ML can help Anti-DDoS solutions quickly identify and block DDoS attacks before they can cause significant damage.

- Cloud-based Security Solutions: Cloud-based Anti-DDoS solutions are expected to continue to grow in popularity, as they can provide more flexible and scalable protection against DDoS attacks. As more organizations move their operations to the cloud, the need for effective cloud-based Anti-DDoS solutions is likely to grow.

- Integrated Security Solutions: The Anti-DDoS market is expected to become more integrated with other security solutions, such as firewalls, intrusion prevention systems, and endpoint security solutions. By combining these solutions, organizations can create a more comprehensive security infrastructure that can protect against a wider range of threats, including DDoS attacks.

Top Players in Anti-DDoS Market

- Akamai Technologies

- Radware

- Imperva

- Fortinet

- F5 Networks

- Neustar

- Corero

These are just a few examples of the top players in the Anti-DDoS market. There are many other vendors in the market, and the competitive landscape is constantly evolving as new players enter the market and existing players continue to innovate and expand their offerings.

Industries Getting Impacted in the future by Anti-DDoS Market

- Financial Services: Financial institutions are a frequent target of DDoS attacks, as attackers seek to disrupt their operations and steal sensitive information. The Anti-DDoS market is expected to play a critical role in helping these institutions protect against DDoS attacks and maintain the security and integrity of their operations.

- Healthcare: The healthcare industry is increasingly reliant on digital technologies to deliver care and manage patient data. As a result, the industry is at risk of DDoS attacks that can disrupt these critical systems and compromise the security of patient data. The Anti-DDoS market is expected to help the healthcare industry to protect against these threats and ensure the continued delivery of high-quality care.

- eCommerce: Online retailers are a prime target for DDoS attacks, as attackers seek to disrupt their operations during peak shopping periods or steal sensitive customer data. The Anti-DDoS market is expected to help eCommerce businesses to protect their operations and customer data from these attacks.

- Gaming: Online gaming is a popular and growing industry, but it is also a frequent target of DDoS attacks. The Anti-DDoS market is expected to help gaming companies to protect against these attacks and maintain the performance and availability of their games.

- Government: Governments at all levels are at risk of DDoS attacks, which can disrupt critical systems and services, compromise sensitive data, and pose a threat to national security. The Anti-DDoS market is expected to help governments to protect against these threats and ensure the continued delivery of essential services.

These are just a few examples of industries that are likely to be impacted by the growth of the Anti-DDoS market. As the threat landscape continues to evolve, it is likely that other industries will also become increasingly reliant on Anti-DDoS solutions to protect against the damaging effects of DDoS attacks.

New Business Opportunities in Anti-DDoS Market

- Managed DDoS Protection Services: With the increasing complexity of DDoS attacks and the need for real-time protection, many organizations are turning to managed DDoS protection services. This represents a significant opportunity for companies that can offer comprehensive and reliable managed services that provide real-time protection against DDoS attacks.

- Cloud-Based DDoS Protection: As more organizations move their operations to the cloud, there is a growing need for cloud-based DDoS protection solutions. This presents an opportunity for companies that can offer scalable and flexible cloud-based solutions that can protect against DDoS attacks across multiple cloud environments.

- Machine Learning and AI-Based DDoS Protection: With the increasing sophistication of DDoS attacks, there is a need for advanced solutions that can detect and mitigate attacks in real time. Machine learning and AI-based solutions offer an opportunity for companies that can offer advanced detection and mitigation capabilities that are adaptive and able to keep pace with the evolving threat landscape.

- IoT DDoS Protection: With the increasing adoption of IoT devices, there is a growing need for DDoS protection solutions that can protect against attacks that leverage these devices. This presents an opportunity for companies that can offer IoT-specific DDoS protection solutions that are tailored to the unique characteristics of these devices.

- Channel Partner Programs: Many organizations are turning to channel partners to help them implement and manage DDoS protection solutions. This represents an opportunity for companies that can offer comprehensive channel partner programs that provide partners with the tools and resources they need to be successful.

Key challenges for growing Anti-DDoS business in the future Market

- Increased Attack Sophistication: As attackers become more sophisticated, it is likely that they will develop new and more complex attack techniques that can bypass traditional Anti-DDoS solutions. This could present a significant challenge for Anti-DDoS vendors, who will need to continually update and improve their solutions to stay ahead of the threat.

- Scalability: With the growing number of devices and networks that need to be protected from DDoS attacks, Anti-DDoS solutions will need to be highly scalable to handle the increasing traffic loads. This could present a challenge for Anti-DDoS vendors who will need to provide solutions that are capable of scaling up quickly and efficiently.

- Cost: DDoS protection solutions can be expensive, and many organizations may be hesitant to invest in these solutions if they believe that the risk of an attack is low. This could present a challenge for Anti-DDoS vendors, who will need to demonstrate the value of their solutions and the importance of investing in DDoS protection.

- Regulatory Compliance: As governments around the world introduce new data protection regulations, Anti-DDoS vendors will need to ensure that their solutions comply with these regulations. This could present a challenge for Anti-DDoS vendors who will need to continually update their solutions to meet changing regulatory requirements.

- Lack of Awareness: Many organizations may not fully understand the threat posed by DDoS attacks or the importance of investing in DDoS protection. This could present a challenge for Anti-DDoS vendors who will need to educate their customers on the importance of DDoS protection and the risks of not investing in these solutions.

- Competition: As the Anti-DDoS market grows, competition is likely to increase. This could present a challenge for Anti-DDoS vendors who will need to differentiate their solutions from those of their competitors and demonstrate the unique value of their offerings.

Speak to our Analyst today to know more about the "Anti-DDoS Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DDoS Protection and Mitigation Security Market

This analysis seems to solve all my queries regarding DDoS Protection and Mitigation. Very resourceful I must say! However I was wondering if you could suggest some of the best service providers for the same? I came across Mazebolt, Akamai as the best service providers. Could you suggest some more and help me out?