Progressing Cavity Pump Market by Power Rating (Up To 50 Hp, 51–150 Hp, Above 150 Hp), Pumping Capacity, End-User (Oil & Gas, Water & Wastewater Treatment, Food & Beverage, Food Waste, Biogas, Battery Recycling) and Region - Global Forecast to 2029

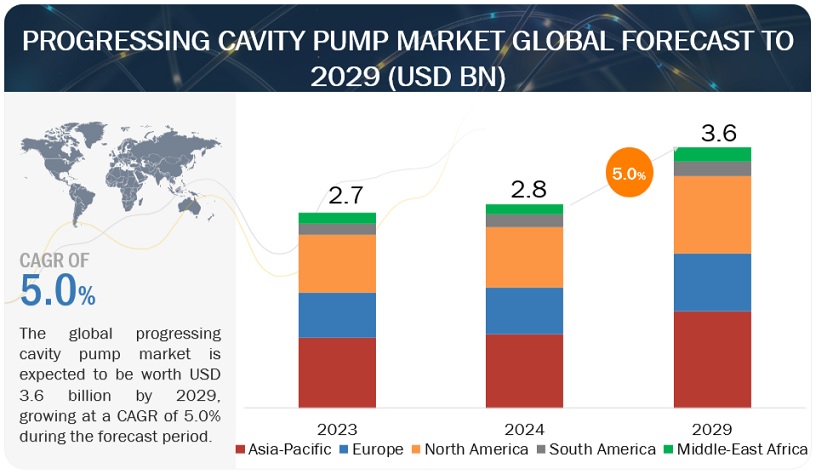

[273 Pages Report] The progressing cavity pump market is projected to witness steady growth with a compound annual growth rate (CAGR) of 5.0% throughout the forecast period, increasing from an estimated value of USD 2.8 billion in 2024 to reach USD 3.6 billion by 2029. The progressing cavity pump market is experiencing robust growth, propelled by increasing demand across diverse industries such as oil & gas, chemicals, wastewater treatment, and food & beverages. Factors driving this growth include the need for efficient fluid handling solutions, technological advancements enhancing pump performance and reliability, and rising investments in infrastructure development worldwide. Additionally, the market is benefiting from the expanding applications of progressing cavity pumps in emerging sectors such as pharmaceuticals, renewable energy, and mining. Moreover, the growing emphasis on sustainability and energy efficiency is fueling the adoption of eco-friendly pumping solutions, further stimulating market expansion. With ongoing innovation and strategic initiatives by key players, the market is poised for continued growth in the predictable future.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Progressing Cavity Pump Market Dynamics

Driver: Growing demand from the water & wastewater treatment sector.

The growing demand from the water and wastewater treatment sector stems from several interconnected factors, including urbanization, population growth, and increasingly stringent environmental regulations worldwide. As urban populations continue to expand, the need for effective and sustainable water and wastewater management becomes paramount. Stricter environmental regulations further underscore the urgency for investment in water and wastewater treatment infrastructure to mitigate pollution and safeguard public health and the environment. The UN Water report on wastewater management highlights the need for $2 trillion annual investments in wastewater treatment infrastructure by 2030 to achieve Sustainable Development Goal 6 (SDG 6) on clean water and sanitation. This presents a significant opportunity for progressing cavity pumps in wastewater treatment plants.Progressing cavity pumps are particularly well-suited for addressing the diverse challenges encountered in water and wastewater treatment processes. Their versatility and robust design make them indispensable for various critical tasks within the sector. For instance, in sludge transfer applications, where the movement of thick, viscous substances is required, progressing cavity pumps excel due to their ability to handle high viscosity fluids effectively. Similarly, in dosing chemicals for water treatment purposes, these pumps offer precise metering capabilities, ensuring accurate and consistent dosing to achieve optimal treatment outcomes. Additionally, in applications involving the metering of liquids, such as the addition of disinfectants or pH adjustment agents, progressing cavity pumps provide reliable and efficient performance.

Restraints: Balancing Initial Investment Costs and Skilled Labor Constraints.

The high initial investment costs associated with progressing cavity pumps can indeed pose a significant barrier for potential buyers, particularly in industries where budgets are constrained, or capital expenditures are tightly regulated. Compared to some alternative pump technologies such as centrifugal pumps, which may have lower upfront costs, the initial purchase price of PCPs can be relatively higher due to factors such as the complexity of their design, the use of specialized materials, and the incorporation of advanced features like self-cleaning capabilities and digital monitoring systems. While the higher initial investment cost may deter some buyers, it's important to consider the total cost of ownership over the pump's lifecycle. Progressing cavity pumps often offer advantages such as longer service life, reduced maintenance requirements, and higher efficiency, which can result in lower operating costs and greater overall value for the investment. Additionally, advancements in manufacturing processes and economies of scale may lead to cost reductions over time, making PCPs more accessible to a broader range of customers. However, another challenge facing the widespread adoption of progressing cavity pumps is the availability of skilled labor for their installation, maintenance, and operation. These pumps require specialized knowledge and expertise to properly install, troubleshoot, and optimize, particularly in complex industrial environments or applications with demanding operating conditions. The shortage of skilled labor in certain regions or industries can pose a significant obstacle to the adoption of PCPs, as companies may struggle to find qualified personnel to manage their pumping systems effectively. This shortage can be exacerbated by factors such as an aging workforce, limited training and educational opportunities, and competition for talent from other sectors. To address this challenge, manufacturers and industry organizations may need to invest in training programs, certification courses, and knowledge-sharing initiatives to develop a pool of skilled professionals capable of supporting the widespread deployment of progressing cavity pumps. Collaboration between industry stakeholders, educational institutions, and government agencies can help to ensure that the necessary skills and expertise are available to meet the growing demand for PCP technology. Additionally, advancements in remote monitoring and predictive maintenance technologies can help to mitigate the impact of skill shortages by enabling more efficient troubleshooting and support processes, reducing the need for on-site expertise in some cases.

Opportunities: Adoption of Industry 4.0 technologies.

Industry 4.0 refers to the integration of digital technologies like IoT, AI, and robotics into manufacturing, creating smart factories. It optimizes processes, boosts productivity, and enables customization through data-driven decision-making and automation. The integration of progressing cavity pumps with Industry 4.0 technologies presents a significant opportunity for pump manufacturers and users alike. By leveraging advancements in the Industrial Internet of Things (IIoT) and other Industry 4.0 innovations, such as data analytics and machine learning, pump systems can be transformed into smart, interconnected assets capable of delivering enhanced performance, reliability, and efficiency. One key opportunity lies in predictive maintenance enabled by IIoT integration. By equipping progressing cavity pumps with sensors and connectivity capabilities, manufacturers can collect real-time data on various parameters such as temperature, pressure, vibration, and fluid flow rates. This data can be analyzed using advanced algorithms to detect early signs of equipment degradation or potential failures, allowing for proactive maintenance interventions before critical issues arise. Predictive maintenance not only helps to prevent costly unplanned downtime but also extends the lifespan of pump components, optimizing asset utilization and reducing overall maintenance costs.

Challenges:Competition from traditional centrifugal pumps for lower-solids content wastewater applications

In the progressive cavity pump market, competition from traditional centrifugal pumps for lower-solids content wastewater applications poses a significant challenge. Centrifugal pumps have long been favored for applications involving fluids with lower solids content due to their simplicity, efficiency, and lower initial cost compared to progressive cavity pumps. One of the main reasons for the competition from centrifugal pumps is their ability to handle fluids with lower viscosity and fewer solids effectively. In wastewater applications where the solids content is relatively low, centrifugal pumps can provide sufficient pumping capacity at a lower cost, making them a preferred choice for many users. Additionally, centrifugal pumps are often easier to install and maintain, requiring less specialized knowledge for operation and upkeep compared to progressive cavity pumps. Another factor contributing to the competition is the perception that progressive cavity pumps are better suited for handling high-viscosity or high-solids content fluids. While progressive cavity pumps excel in these applications, advancements in centrifugal pump technology have enabled them to handle a wider range of fluid viscosities and solids content, narrowing the performance gap between the two types of pumps in certain applications.

Furthermore, cost considerations play a significant role in the decision-making process for many users. Centrifugal pumps typically have lower initial purchase costs compared to progressive cavity pumps, making them a more attractive option for budget-conscious buyers, especially in applications where the benefits of progressive cavity pumps, such as better solids handling capability, are not essential. To address this challenge, manufacturers of progressive cavity pumps must emphasize the unique advantages of their products, such as superior solids handling capability, gentle pumping action, and better performance in variable flow conditions. They may also need to focus on developing more cost-effective solutions, streamlining manufacturing processes, and offering competitive pricing to remain competitive in the market.

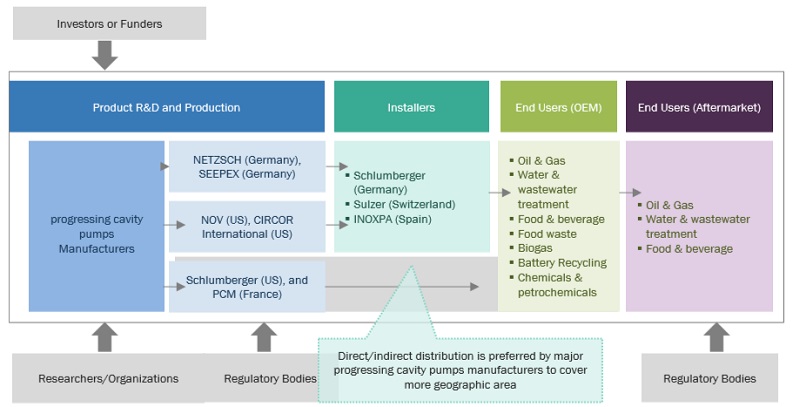

The Progressing Cavity Pump Market Ecosystem

The progressing cavity pump market is characterized by the presence of well-established, financially stable companies with significant experience in producing progressing cavity pumps and related components. These companies are well-established in the market and offer a diverse range of products. Utilizing cutting-edge technologies, they uphold vast international networks for sales and marketing. Some of the leading companies in this market are NETZSCH (Germany), SEEPEX (Germany), NOV (US), CIRCOR International (US), Schlumberger (US), and PCM (France).

Up to 50 HP segment, by power rating, to be fastest growing market from 2024 to 2029.

The up to 50 HP segment within the progressing cavity pump market is poised to emerge as the fastest-growing market from 2024 to 2029. This growth trajectory can be attributed to several factors, including the increasing adoption of compact and energy-efficient pumping solutions across various industries such as wastewater treatment, agriculture, and small-scale manufacturing. Additionally, the up to 50 HP segment caters to a wide range of applications where moderate power requirements are essential, aligning with the needs of both established industries and emerging sectors. Moreover, advancements in pump technology, coupled with a growing focus on sustainability and cost-effectiveness, are driving the demand for efficient pumping solutions within this power rating range. As a result, market players are expected to capitalize on this trend by offering innovative and reliable progressing cavity pumps tailored to the specific requirements of this segment, thereby driving its accelerated growth in the forecast period.

Water & Wastewater Treatment Segment, by end-use industry, to be the largest market from 2024 to 2029.

The Water & Wastewater Treatment segment is projected to emerge as the largest market within the progressing cavity pump industry from 2024 to 2029. This dominance can be attributed to escalating global concerns regarding water scarcity and pollution, driving significant investments in water infrastructure and treatment facilities worldwide. Progressing cavity pumps play a crucial role in various water and wastewater treatment processes, including pumping, dosing, and transferring fluids with high efficiency and reliability. Additionally, stringent environmental regulations mandating the use of advanced pumping solutions to ensure compliance further bolster the demand for progressing cavity pumps in this segment. As municipalities, industries, and governments continue to prioritize water management and sanitation, the Water & Wastewater Treatment segment is poised to sustain its leadership position in the progressing cavity pump market over the forecast period.

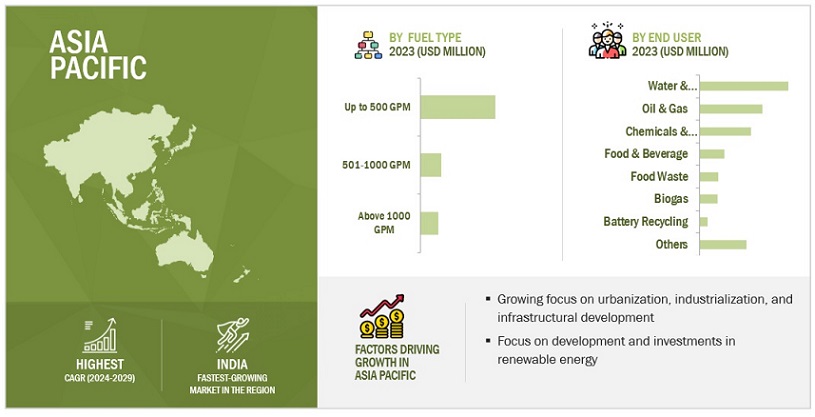

Up to 500 GPM, by pumping capacity, to have highest market share from 2024 to 2029.

In the progressing cavity pump market, the segment with pumping capacities of up to 500 gallons per minute (GPM) is anticipated to secure the highest market share between 2024 and 2029. This dominance can be attributed to several factors, including the widespread application of these pumps across various industries such as wastewater treatment, food processing, and oil & gas, where mid-range pumping capacities are often sufficient for operational needs. Additionally, technological advancements aimed at enhancing the efficiency, reliability, and versatility of pumps within this capacity range are driving their adoption among end-users. Furthermore, the increasing demand for compact, cost-effective pumping solutions in both established and emerging markets further contributes to the segment's market dominance during the forecast period.

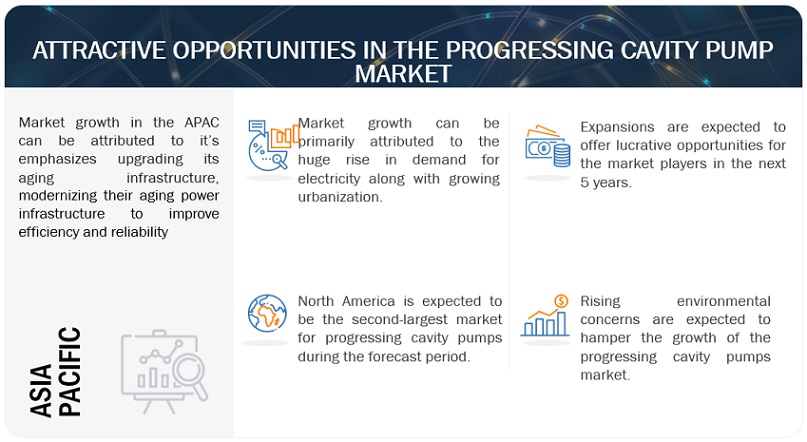

Asia Pacific to account for largest market size during forecast period.

During the forecast period, the Asia Pacific region is poised to claim the largest market size in the progressing cavity pump sector. This dominance is attributed to several factors, including rapid industrialization, infrastructure development initiatives, and increasing investments in key sectors such as oil & gas, water & wastewater treatment, and food processing. Moreover, burgeoning populations and urbanization trends in countries like China, India, and Southeast Asian nations are driving the demand for efficient fluid handling solutions, thus propelling the market forward. Additionally, favorable government policies, coupled with rising awareness regarding energy efficiency and environmental sustainability, further augment the adoption of progressing cavity pumps across various industries in the Asia Pacific region.

Key Market Players

NETZSCH (Germany), SEEPEX (Germany), NOV (US), CIRCOR International (US), Schlumberger (US), PCM (France), Xylem (US), Sulzer (Switzerland), ChampionX (US), Roto Pumps (India) .

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Power Rating, By Pumping Capacity, By End-user Industry, By Product type, By Stage type |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

NETZSCH (Germany), seepex (Germany), PCM (France), NOV Inc. (United States), Circor International (United States), ChampionX (United States), Xylem (United States), Sulzer (Switzerland), SLB (Schlumberger Limited) (United States), Wilo (Germany), Varisco (Italy), Delta PD Pumps (United Kingdom), Nova Rotors (Italy), Roto Pumps (India), Inoxpa (Spain), Shanghai GL Environmental Technology (China), Hangzhou Xinglong Pump Industry (China), Shanghai Pacific Pump Manufacturer (China), PSP Pumps (India), Tapflo (Sweden), GEA Germany GmbH (Germany), Fristam Pumps India Pvt. Ltd. (India) |

The progressing cavity pump market is classified in this research report based on power rating, pumping capacity, end-user industry, product type, stage type and region.

Based on power rating, the progressing cavity pump market has been segmented as follows:

- Up to 50 HP

- 51-150 HP

- Above 150 HP

Based on pumping capacity, the market has been segmented as follows:

- Up to 500 GPM

- 501-1000 GPM

- Above 1000 GPM

Based on end-user industry, the market has been segmented as follows:

- Oil & Gas

- Water & Wastewater Treatment

- Food & Beverage

- Food Waste

- Biogas

- Battery Recycling

- Chemicals & Petrochemicals

- Others

Based on product type, the market has been segmented as follows:

- Dosing Pump

- Flanged Pump

- Hopper Pump

- Food Grade Pump (EHEDG/3A Certified)

- Food Grade Pump (Non-Certified)

- Vertical Pump

- Downhole Pump

Based on stage type, the market has been segmented as follows:

- Single Stage (90- PSI)

- Double Stage (180-PSI)

- Four Stage (360-PSI)

- Eight Stage (720- PSI)

Based on regions, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In April 2022, NOV has extended the Low Flow Metering Range Pump's availability. The pumps have a strong tolerance to harsh chemicals and are needed for either continuous or intermittent dosing. The pump is suitable for a broad range of products and applications, such as chemical injection for wastewater, chemical processing for different industries, and the pharmaceutical sector.

- In January 2022, In Brazil, NETZSCH started building the new production facility. The new facility is situated in Santa Catarina's Ribeirão Souto, close to the existing facilities in Pomerode's core region. The new plant in South America will take over the entire production of multi-screw pumps. Additionally, the plant's functioning will enable the business to increase the production of its other product lines.

- In April 2022, NOV has extended the Low Flow Metering Range Pump's availability. The pumps have a strong tolerance to harsh chemicals and are needed for either continuous or intermittent dosing. The pump is suitable for a broad range of products and applications, such as chemical injection for wastewater, chemical processing for different industries, and the pharmaceutical sector.

Frequently Asked Questions (FAQ):

What is the current size of the global progressing cavity pump market?

The global progressing cavity pump market is estimated to be USD 3.6 billion in 2029.

What are the major drivers for progressing cavity pump market?

Several factors serve as major drivers for the progressing cavity pump market. Firstly, the increasing demand for efficient fluid handling solutions across industries such as oil & gas, chemicals, and wastewater treatment is a significant driver. Secondly, technological advancements enhancing pump performance, reliability, and efficiency play a crucial role in driving market growth. Additionally, rising investments in infrastructure development projects globally contribute to the growing demand for progressing cavity pumps. Moreover, the expanding applications of progressing cavity pumps in emerging sectors such as pharmaceuticals, renewable energy, and mining further fuel market growth. Lastly, the growing emphasis on sustainability and energy efficiency encourages the adoption of eco-friendly pumping solutions, bolstering market expansion.

Which End-use Industry has the largest market share in the progressing cavity pump market?

The water & wastewater treatment end-use industry holds the largest market share in the progressing cavity pump market. This dominance is primarily driven by the increasing global focus on water conservation, stringent environmental regulations, and the growing need for efficient and reliable pumping solutions in wastewater treatment plants. Progressing cavity pumps are widely utilized in various applications within this sector, including sludge transfer, dosing, chemical metering, and handling abrasive or viscous fluids. Additionally, the rising investments in infrastructure development for water treatment facilities, particularly in emerging economies, further contribute to the market's growth within this end-use industry. As the demand for clean water continues to escalate worldwide, the water & wastewater treatment sector is expected to sustain its dominant position in the progressing cavity pump market.

Which is the largest-growing region during the forecast period in the progressing cavity pump market?

During the forecast period, the Asia Pacific region is expected to emerge as the fastest-growing region in the progressing cavity pump market. This anticipated growth is underpinned by several factors, including rapid industrialization, infrastructure development initiatives, and increasing investments in key sectors such as oil & gas, water & wastewater treatment, and food processing. Additionally, the burgeoning populations and urbanization trends in countries like China, India, and Southeast Asian nations are driving the demand for efficient fluid handling solutions, thereby fueling market expansion. Moreover, supportive government policies, coupled with a growing emphasis on energy efficiency and environmental sustainability, are further accelerating the adoption of progressing cavity pumps across various industries in the Asia Pacific region.

Which is the fastest-growing pumping capacity segment in the progressing cavity pump market during the forecast period?

The 500 GPM (Gallons Per Minute) pumping capacity segment is projected to be one of the fastest-growing segments in the progressing cavity pump market during the forecast period. This growth is driven by various factors, including increasing demand for medium-sized pumps across industries such as oil & gas, wastewater treatment, and food processing. The 500 GPM capacity offers a balance between efficiency and performance, making it suitable for a wide range of applications. Additionally, as industries strive for enhanced productivity and operational efficiency, the adoption of pumps with this capacity is expected to rise steadily, contributing to the segment's growth in the progressing cavity pump market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study embarked on a comprehensive process to ascertain the current size of the progressing cavity pump market. It commenced with an exhaustive secondary research phase, aimed at gathering data on the market, related sectors, and the broader industry landscape. Subsequently, the collected data, assumptions, and calculations underwent rigorous validation through primary research, involving consultations with industry experts spanning the entire value chain. The assessment of the overall market size was conducted through tailored analyses for each country. Following this, a meticulous examination of the market took place, with the data cross-referenced to estimate the sizes of various segments and sub-segments within the market. This two-phased approach, integrating both secondary and primary research methodologies, enhances the reliability and accuracy of the study's findings.

Secondary Research

Throughout this research study, an extensive array of secondary sources was leveraged, encompassing directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a pivotal role in acquiring crucial data necessary for conducting a comprehensive analysis of the global progressing cavity pump market. Encompassing technical, market-oriented, and commercial perspectives, these secondary sources significantly enriched the breadth and depth of the study. Additionally, supplementary secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by esteemed experts, information from industry associations, trade directories, and various database repositories. The utilization of a diverse range of secondary sources ensures a robust and well-informed foundation for the research study.

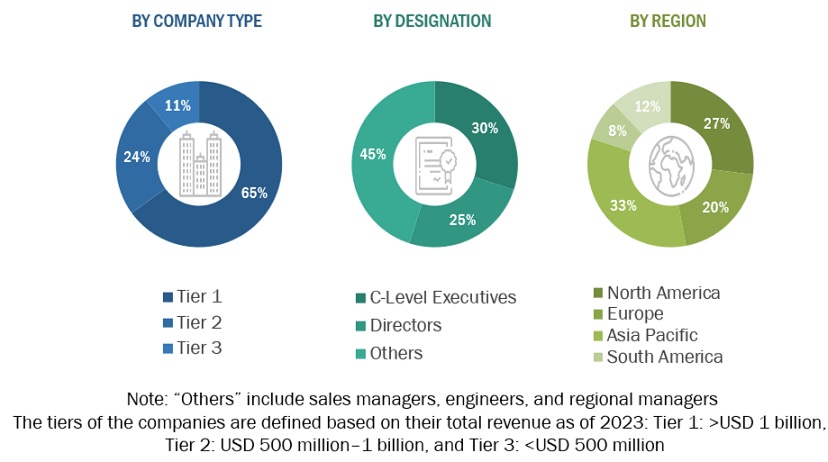

Primary Research

The progressing cavity pump market encompasses numerous stakeholders across its supply chain, including component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-users. Industrial end-users are the primary drivers of market demand, with increasing requirements from transmission and distribution utilities also contributing significantly to market growth. On the supply side, a notable trend is the heightened demand for contracts from the industrial sector, alongside a significant prevalence of mergers and acquisitions among major industry players. To attain a comprehensive understanding of the market, both qualitatively and quantitatively, a diverse array of primary sources from both the supply and demand sides were interviewed. The breakdown provided below delineates the primary respondents who played a pivotal role in offering insights for the research study.

To know about the assumptions considered for the study, download the pdf brochure

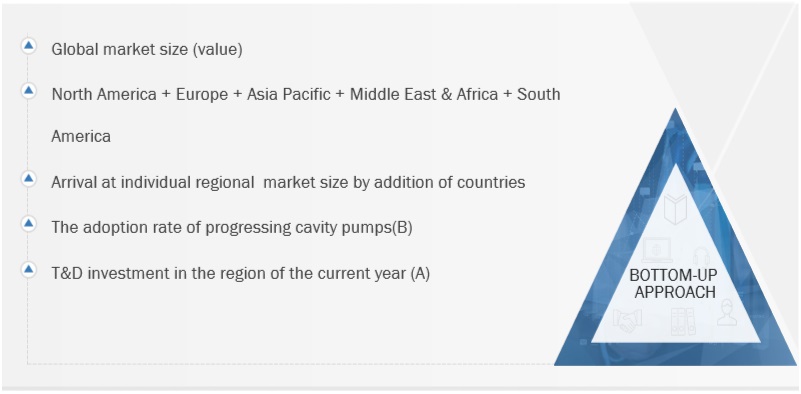

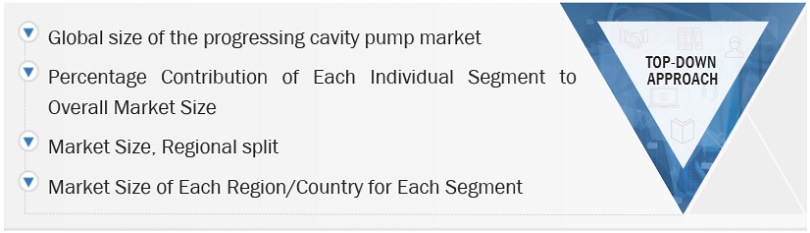

Market Size Estimation

Bottom-up & Top down methodology was used to carefully assess and validate the market size for progressive cavity pumps. The dimensions of different market subsegments were determined with rigor using this procedure. The following are the main phases of the research process.

This methodology examined regional and national production data for all varieties of progressive cavity pumps.

In-depth secondary and primary research was carried out in order to fully comprehend the worldwide market environment for different kinds of cavity pumps.

Leading authorities on the development of progressive cavity pump systems, including significant OEMs and Tier I suppliers, were questioned in several primary interviews.

Qualitative elements including market drivers, limitations, opportunities, and challenges are taken into consideration when projecting and estimating market size.

Global Progressing cavity pump Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Progressing cavity pump Market Size: Top-Down Approach

Data Triangulation

Using the previously mentioned approaches, which included segmenting the market into many segments and sub-segments, was the process of determining the total market size. Methods of data triangulation and market segmentation were used as appropriate to complete the thorough market analysis and acquire precise statistics for each market segment and subsegment. Data triangulation involved a detailed analysis of many variables and patterns from the supply and demand sides of the cavity pump industry environment.

Market Definition

The progressing cavity pump market encompasses the production, distribution, and utilization of progressing cavity pumps, a type of positive displacement pump characterized by a helical rotor rotating inside a fixed stator. These pumps are widely employed across various industries for the efficient handling of viscous, abrasive, and shear-sensitive fluids, making them indispensable in applications ranging from oil and gas extraction to water and wastewater treatment, food and beverage processing, chemicals and petrochemicals, mining, and construction. Key components of the market include manufacturers of pump components and complete systems, assemblers, service providers offering maintenance and repair services, distributors facilitating the supply chain, and end-users spanning industrial sectors with diverse fluid handling requirements. Market dynamics encompass factors such as technological advancements, regulatory landscape, industrial expansion, infrastructure development, and environmental considerations, all of which influence the demand for progressing cavity pumps and shape market trends on a global scale.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Pump manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Pump manufacturers, distributors, and suppliers

- Pump original equipment manufacturers (OEMs)

Objectives of the Study

- The progressing cavity pump market will be defined, characterised, segmented, and projected using parameters such as power rating, pumping capacity, end-user industry, product type & stage type.

- To project market sizes for the key nations in each of the following five regions: North America, South America, Europe, Asia Pacific, the Middle East, and Africa.

- To offer thorough insights into the elements influencing the industry's prospects, problems, opportunities, and constraints.

- To strategically examine each subsegment's growth trends, future potential, and overall market share.

- To assess the competitive environment for business executives and the market prospects for possible purchasers.

- To develop strategic profiles for the top businesses after carefully examining their market shares and fundamental strengths.

- To keep an eye on and assess competitive changes, including alliances, contracts for sales, the introduction of new products, contracts, joint ventures, expansions, and investments, in the cavity pump market as it develops.

- This research assesses the market for advancing cavity pumps.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Progressing Cavity Pump Market