Security Control Room Market by Offering (Display, KVM Switch, Software, Services), Application (Public, Corporate, Industrial Safety), Vertical (Transportation, Utilities & Telecom, Defense, Healthcare), and Region - Global Forecast to 2023

The security control room market is expected to grow from USD 6.71 Billion in 2017 to USD 10.00 Billion by 2023, at a CAGR of 6.80% during the forecast period. This report provides the market size and future growth potential of the security control room market across different segments such as offering, application, vertical, and geography. The study identifies and analyzes the market dynamics such as drivers, restraints, opportunities, and challenges for the market. This report also profiles the key players operating in the market. The base year considered for the study is 2017, and the market size forecast is provided for the period between 2018 and 2023.

The prime objectives of this report can be summarized in the following points.

- To define, describe, segment, and forecast the security control room market, in terms of value, segmented on the basis of offering, application, vertical, and geography

- To forecast the market, in terms of volume, segmented on the basis of offering

- To forecast the market size, in terms of value, for various segments with respect to 4 main regionsNorth America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the overall market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the market

- To map the competitive intelligence based on company profiles, key player strategies, and key developments

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with the detailed competitive landscape for market leaders

- To analyze competitive developments such as contracts, joint ventures, mergers & acquisitions, collaborations, product launches & developments, and research and development (R&D) in the security control room market

This study involves the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this study. The research methodology followed in this report is explained below.

- Identifying various applications and industries that are using or are expected to adopt control room technology

- Analyzing each application, along with the related major companies and their system integrators and identifying the service providers for the adoption of control room technology

- Understanding the demand generated by these applications for control room technology

- Estimating the market size of control room technology for each region

- Tracking the ongoing and upcoming implementation of control room technology by various companies for each application and region to forecast the market based on these developments and other critical parameters

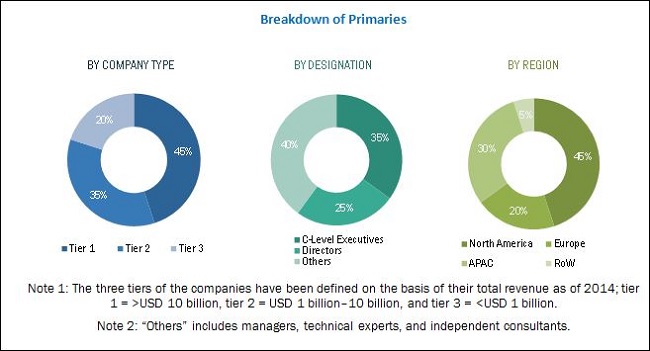

After arriving at the overall market size, the total market has been split into several segments and subsegments, which were further confirmed by the key industry experts. The figure below shows the breakdown of primaries on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The security control room ecosystem includes manufacturers and resellers such as ABB (Switzerland), Barco (Belgium), Black Box (US), Harris (US), Motorola Solutions (US), Tyler Technologies (US), Eizo Corporation (Japan), Zetron (US), TriTech Software Systems (US), Hexagon Safety & Infrastructure (US), Christie Digital Systems (US), Superion (US), Electrosonic (US), and SAIFOR Group (Spain).

Key Target Audience

- Control room technology providers

- IT service providers

- Cloud service providers

- Original equipment manufacturers (OEMs)

- System integrators and third-party vendors

- Software solution providers

- Government bodies

- Technology investors

- Enterprise data center professionals

- Research institutes and organizations

- Market research and consulting firms

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

The security control room market has been covered in detail in this report. To provide a holistic picture, the current market demand and forecasts have also been included in the report. The security control room market has been segmented as follows:

By Offering

- Displays/Video Walls

- KVM Switches

- Software

- Services

By Application

- Public Safety

- Corporate Safety

- Industrial Safety

By Vertical

- Utility & Telecom

- Transportation

- Military & Defense

- Healthcare

- Mining & Manufacturing

- Others

Geographic Analysis

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Offering Analysis:

- Detailed analysis of Displays/Video Walls, KVM Switches, Software, and Services offerings

Country-Wise Information:

- Detailed analysis of each country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Get more insight on other verticals of Semiconductor and Electronics Market Research Reports & Consulting

According to MarketsandMarkets forecast, the security control room market, in terms of value, is expected to grow from USD 7.20 Billion in 2018 to USD 10.00 Billion by 2023, at a CAGR of 6.80% between 2018 and 2023. The major drivers for the market are government initiatives, modernized policies, and regulations to increase public security and safety worldwide, as well as the increasing need to keep an eye on criminal activities and forecast natural disasters to avoid huge losses.

This report covers the security control room market based on offering, application, vertical, and geography. The market for services offering is expected to grow at the highest CAGR between 2018 and 2023. The services offerings, including installation, managed services, and maintenance and support services, are an integral part of a control room and are able to work effectively in a critical working environment.

The security control room market for industrial safety applications is expected to grow at the highest CAGR between 2018 and 2023. Industrial safety applications are evolving at a high rate as these are chiefly used in manufacturing plants such as oil & gas and nuclear plants. Along with the growing industrialization worldwide, the need for industrial safety systems is increasing to protect human resources, industrial machinery, and manufacturing plants, in case any process goes beyond the allowed control margins. A control room in industrial safety plays a critical role as it has to deal with critical operations taking place in a controlled environment.

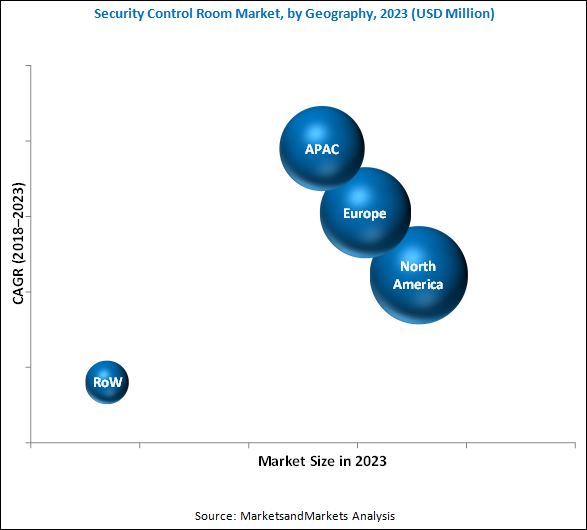

The security control room market in APAC is expected to grow at the highest CAGR between 2018 and 2023. The emerging economies such as China and India are witnessing unparalleled growth in security control room and other countries such as Taiwan, Indonesia, Singapore, and Malaysia have been exhibiting positive growth in this market. Increasing developments in the field of transportation, communication, public infrastructure, and construction are expected to create demand for public safety and control rooms.

North America is a leading region for control room technologies in terms of market share. North America has the first-mover advantage in the adoption of new technologies such as smartphones and cloud platforms. Its strong financial position also allows it to heavily invest in leading tools and technologies for effective business operations. These advantages give North American organizations a competitive market edge. Public safety agencies of all sizes in this region rely on control room solutions for managing and monitoring their dispatch units that make North America the leading market for the security control room.

The security control room market faces a few restraints such as high investment requirements for control room setup and operations. Control rooms are mainly used by the government authorities, local bodies, and military & defense industry to maintain public safety, wherein equipment comes quite expensive. In every financial year, governments spend considerable resources on the installation of public safety and security systems, such as video surveillance, biometrics systems, RMS, and CAD, to ensure public safety. Along with increasing population worldwide, the required cost for public safety and security system is also increasing, which, in turn, is restraining the growth of this market.

The major challenges for the security control room market are developing a comprehensive public safety solution, retention of technically skilled human resource for control room operations, and lack of knowledge about the implementation of an optimized CAD solution. Along with continuously evolving technologies, creating an optimized solution that monitors distributed public infrastructures across the world is a challenge. Also, control room operations are mainly time critical requiring quick response, the ability of personnel, wherein training plays a major role to make the optimum use of available resources. Hence, retention of technically skilled human resource for control room operations is another challenge for this market.

ABB (Switzerland), Barco (Belgium), Black Box (US), Harris (US), Motorola Solutions (US), Tyler Technologies (US), Eizo Corporation (Japan), Zetron (US), TriTech Software Systems (US), Hexagon Safety & Infrastructure (US), Christie Digital Systems (US), Superion (US), Electrosonic (US), and SAIFOR Group (Spain) are the major vendors in the security control room market. These players adopted various strategies, such as product developments, mergers, partnerships, collaborations, and expansions, to cater to the needs of customers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary and Primary Research

2.1.2 Secondary Data

2.1.2.1 Secondary Sources

2.1.3 Primary Data

2.1.3.1 Key Data From Primary Sources

2.1.3.2 Key Industry Insights

2.1.3.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Market

4.2 APAC: Market, By Vertical and Country

4.3 Market, By Offering

4.4 Geographic Snapshot of the Market

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Government Initiatives, Modernized Policies, and Regulations to Increase Public Security and Safety Worldwide

5.2.1.2 Increasing Need to Keep an Eye on Criminal Activities and Natural Disasters to Avoid Huge Losses

5.2.2 Restraints

5.2.2.1 High Investment Requirements for Control Room Setup and Operations

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of Security and Surveillance Systems in Government, Transportation, and Military & Defense Applications

5.2.3.2 Advantages Offered By Internet of Things (IoT)/Connected Devices

5.2.3.3 Proliferation of Smartphones and Social Media in Communications Infrastructure for Public Safety

5.2.4 Challenges

5.2.4.1 Developing A Comprehensive Public Safety Solution

5.2.4.2 Retention of Technically Skilled Human Resource for Control Room Operations

5.2.4.3 Lack of Knowledge About Implementation of an Optimized CAD Solution

6 Security Control Room Market, By Offering (Page No. - 39)

6.1 Introduction

6.2 Displays/Video Walls

6.2.1 Display Technology

6.2.1.1 Standalone LED-Backlit LCD

6.2.1.2 Narrow Bezel LCD Video Wall

6.2.1.3 Direct-View Large-Pixel LED

6.2.1.4 Direct-View Fine-Pixel LED

6.2.1.5 Projection Cube

6.3 KVM Switches

6.4 Software

6.4.1 Call-Taking Software

6.4.2 Computer-Aided Dispatch (CAD)

6.4.3 CCTV Integration Software

6.4.4 GIS Software

6.4.5 Recording and Logging Software

6.4.6 Others

6.5 Services

6.5.1 Installation

6.5.2 Managed Services

6.5.3 Maintenance and Support

7 Security Control Room Market, By Application (Page No. - 57)

7.1 Introduction

7.2 Public Safety

7.3 Corporate Safety

7.4 Industrial Safety

8 Security Control Room Market, By Vertical (Page No. - 66)

8.1 Introduction

8.2 Utilities and Telecom

8.3 Transportation

8.4 Military & Defense

8.5 Healthcare

8.6 Mining and Manufacturing

8.7 Others

9 Security Control Room Market, By Region (Page No. - 80)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.3.4 Rest of Europe

9.4 APAC

9.4.1 China

9.4.2 Japan

9.4.3 South Korea

9.4.4 India

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.2 Africa

9.5.3 South America

10 Competitive Landscape (Page No. - 102)

10.1 Overview

10.2 Ranking of Players, 2016

10.3 Competitive Scenario

10.3.1 Product Launches

10.3.2 Agreements, Partnerships, and Contracts

10.3.3 Expansions

10.3.4 Mergers and Acquisitions

11 Company Profile (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Key Players

11.1.1 ABB

11.1.2 Barco

11.1.3 Black Box

11.1.4 Harris

11.1.5 Motorola Solutions

11.1.6 Tyler Technologies

11.1.7 Eizo Corporation

11.1.8 Zetron

11.1.9 TriTech Software Systems

11.1.10 Hexagon Safety & Infrastructure

11.1.11 Christie Digital Systems

11.1.12 Superion

11.1.13 Electrosonic

11.1.14 SAIFOR Group

11.2 Other Companies

11.2.1 Nice Systems

11.2.2 Cody Systems

11.3 Key Innovators

11.3.1 Nowforce

11.3.2 Vizexperts

11.3.3 Kaseware

11.3.4 FDM Software

11.3.5 Southern Software

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 159)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (66 Tables)

Table 1 List of Major Secondary Sources

Table 2 Primary Interviews With Experts

Table 3 Security Control Room Market, By Offering, 20152023 (USD Billion)

Table 4 Market for Displays/Video Walls, By Type, 20152023 (USD Million)

Table 5 Market for Displays/Video Walls, By Type, 20152023 (Thousand Units)

Table 6 Market for Displays/Video Walls, By Application, 20152023 (USD Million)

Table 7 Market for Displays/Video Walls, By Vertical, 20152023 (USD Million)

Table 8 Market for Displays/Video Walls, By Region, 20152023 (USD Million)

Table 9 Market for KVM Switches, By Application, 20152023 (USD Million)

Table 10 Market for KVM Switches, By Vertical, 20152023 (USD Million)

Table 11 Market for KVM Switches, By Region, 20152023 (USD Million)

Table 12 Market for Software, By Type, 20152023 (USD Million)

Table 13 Market for Software, By Application, 20152023 (USD Million)

Table 14 Market for Software, By Vertical, 20152023 (USD Million)

Table 15 Market for Software, By Region, 20152023 (USD Million)

Table 16 Market for Services, By Type, 20152023 (USD Million)

Table 17 Market for Services, By Application, 20152023 (USD Million)

Table 18 Market for Services, By Vertical, 20152023 (USD Million)

Table 19 Market for Services, By Region, 20152023 (USD Million)

Table 20 Market, By Application, 20152023 (USD Billion)

Table 21 Market for Public Safety, By Offering, 20152023 (USD Million)

Table 22 Market for Public Safety, By Vertical, 20152023 (USD Million)

Table 23 Market for Public Safety, By Region, 20152023 (USD Million)

Table 24 Market for Corporate Safety, By Offering, 20152023 (USD Million)

Table 25 Market for Corporate Safety, By Vertical, 20152023 (USD Million)

Table 26 Market for Corporate Safety, By Region, 20152023 (USD Million)

Table 27 Market for Industrial Safety, By Offering, 20152023 (USD Million)

Table 28 Market for Industrial Safety, By Vertical, 20152023 (USD Million)

Table 29 Market for Industrial Safety, By Region, 20152023 (USD Million)

Table 30 Market, By Verticals, 20152023 (USD Billion)

Table 31 Market for Utilities and Telecom, By Offering, 20152023 (USD Million)

Table 32 Market for Utilities and Telecom, By Application, 20152023 (USD Million)

Table 33 Market for Utilities and Telecom, By Region, 20152023 (USD Million)

Table 34 Market for Transportation Segment, By Offering, 20152023 (USD Million)

Table 35 Market for Transportation Segment, By Application, 20152023 (USD Million)

Table 36 Market for Transportation Segment, By Region, 20152023 (USD Million)

Table 37 Market for Military & Defense, By Offering, 20152023 (USD Million)

Table 38 Market for Military & Defense, By Application, 20152023 (USD Million)

Table 39 Market for Military & Defense, By Region, 20152023 (USD Million)

Table 40 Market for Healthcare, By Offering, 20152023 (USD Million)

Table 41 Market for Healthcare, By Application, 20152023 (USD Million)

Table 42 Market for Healthcare, By Region, 20152023 (USD Million)

Table 43 Market for Mining and Manufacturing, By Offering, 20152023 (USD Million)

Table 44 Market for Mining and Manufacturing, By Application, 20152023 (USD Million)

Table 45 Market for Mining and Manufacturing, By Region, 20152023 (USD Million)

Table 46 Market for Others, By Offering, 20152023 (USD Million)

Table 47 Market for Others, By Application, 20152023 (USD Million)

Table 48 Market for Others, By Region, 20152023 (USD Million)

Table 49 Market, By Region, 20152023 (USD Billion)

Table 50 Market in North America, By Offering, 20152023 (USD Million)

Table 51 Market in North America, By Application, 20152023 (USD Million)

Table 52 Market in North America, By Vertical, 20152023 (USD Million)

Table 53 Market in North America, By Country, 20152023 (USD Million)

Table 54 Market in Europe, By Offering, 20152023 (USD Million)

Table 55 Market in Europe, By Application, 20152023 (USD Million)

Table 56 Market in Europe, By Vertical, 20152023 (USD Million)

Table 57 Market in Europe, By Country, 20152023 (USD Million)

Table 58 Market in APAC, By Offering, 20152023 (USD Million)

Table 59 Market in APAC, By Application, 20152023 (USD Million)

Table 60 Market in APAC, By Vertical, 20152023 (USD Million)

Table 61 Market in APAC, By Country, 20152023 (USD Million)

Table 62 Market in RoW, By Offering, 20152023 (USD Million)

Table 63 Market in RoW, By Application, 20152023 (USD Million)

Table 64 Market in RoW, By Vertical, 20152023 (USD Million)

Table 65 Market in RoW, By Region, 20152023 (USD Million)

Table 66 Market Ranking of the Top 5 Players in the Market, 2016

List of Figures (54 Figures)

Figure 1 Security Control Room Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Services to Dominate Market Between 2018 and 2023

Figure 6 Market for Industrial Safety Expected to Grow at Highest CAGR Between 2018 and 2023

Figure 7 Market for Utilities & Telecom Expected to Grow at Highest CAGR Between 2018 and 2023

Figure 8 North America Held the Largest Share of the Market in 2017

Figure 9 Increasing Adoption of Security and Surveillance Systems in Various Industry Verticals is Excepted to Drive the Market

Figure 10 China Held the Largest Share of the Market in APAC in 2017

Figure 11 Services Expected to Hold the Largest Size of Market Between 2018 and 2023

Figure 12 US Held the Largest Share of the Market in 2017

Figure 13 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Services Expected to Dominate the Market Between 2018 and 2023

Figure 15 Standalone LED-Backlit LCD Display Expected to Hold the Largest Size of the Market for Displays/Video Walls Between 2018 and 2023

Figure 16 Market for Displays/Video Walls in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 17 Market for KVM Switches By Public Safety Application is Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 18 North America is Expected to Hold the Largest Share of Market for Kvm Switches Between 2018 and 2023

Figure 19 CAD Expected to Dominate the Market for Software Between 2018 and 2023

Figure 20 Market for Software in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 21 Managed Services Expected to Hold the Largest Size of the Market for Services Between 2018 and 2023

Figure 22 Market for Services in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 23 Public Safety Expected to Hold the Largest Size of the SecurMarket Between 2018 and 2023

Figure 24 Market for Public Safety in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 25 Market for Corporate Safety in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 26 Market for Industrial Safety in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 27 Transportation Expected to Hold the Largest Size of the Market Between 2018 and 2023

Figure 28 Market for Utility and Telecom in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 29 Market for Transportation Segment in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 30 Market for Military & Defense in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 31 Market for Healthcare in APAC to Grow at the Highest CAGR Between 2018 and 2023

Figure 32 Market for Mining and Manufacturing in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 33 Market for Others in APAC Expected to Grow at the Highest CAGR Between 2018 and 2023

Figure 34 Market: Geographic Snapshot

Figure 35 North America: Market Snapshot

Figure 36 Transportation Expected to Hold the Largest Market Size of the Control Room Technology in North America Between 2018 and 2023

Figure 37 US Expected to Hold the Largest Market Size of the Market in North America Between 2018 and 2023

Figure 38 Europe: Market Snapshot

Figure 39 Transportation Expected to Hold the Largest Market Share of the Control Room Technology in Europe Between 2018 and 2023

Figure 40 Germany Expected to Hold the Largest Size of the Market in Europe Between 2018 and 2023

Figure 41 APAC: Market Snapshot

Figure 42 Transportation Expected to Hold the Largest Market Size of the Control Room Technology in APAC Between 2018 and 2023

Figure 43 India Expected to Grow at the Highest CAGR for the Market in APAC Between 2018 and 2023

Figure 44 Transportation Expected to Hold the Largest Size of the Control Room Technology in RoW Between 2018 and 2023

Figure 45 South America Expected to Hold the Largest Size of the Market Between 2018 and 2023

Figure 46 Product Launches: Key Strategies Adopted By the Key Players Between 2014 and 2017

Figure 47 Security Control Room Market Evaluation

Figure 48 ABB: Company Snapshot

Figure 49 Barco: Company Snapshot

Figure 50 Black Box: Company Snapshot

Figure 51 Harris: Company Snapshot

Figure 52 Motorola Solutions: Company Snapshot

Figure 53 Tyler Technologies: Company Snapshot

Figure 54 Eizo Corporation: Company Snapshot

Growth opportunities and latent adjacency in Security Control Room Market