Thin client Market Size, Share & Industry Growth Analysis Report by Form Factor (Standalone, With Monitor, Mobile), Application (ITS, Education, Healthcare, Government, BFSI, Industrial, Retail, and Transportation) and Region (North America, Europe, APAC, RoW) - Global Growth Driver and Industry Forecast to 2028

Updated on : April 26, 2023

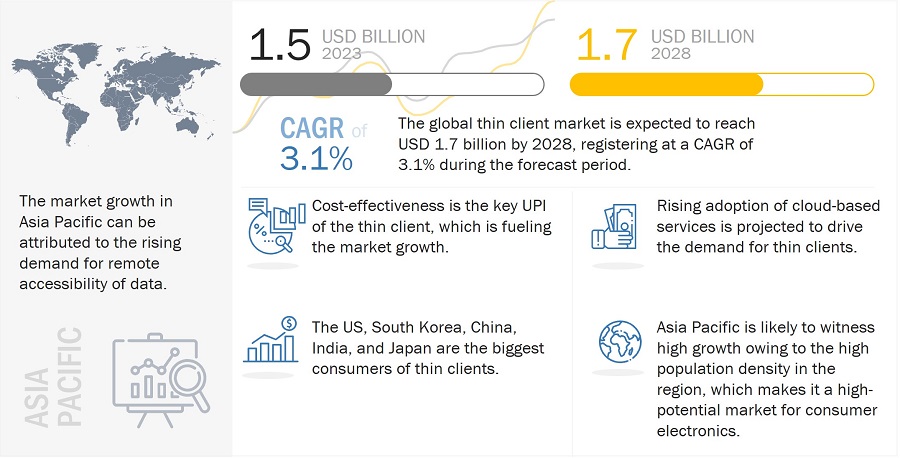

The global thin client market in terms of revenue was estimated to be worth USD 1.5 billion in 2023 and is poised to reach USD 1.7 billion by 2028, growing at a CAGR of 3.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

The thin client market trends is expected to experience steady growth in the coming years, driven by the increasing demand for cost-effective and secure computing solutions. Other factors contributing to market growth include the rise of cloud computing, the need for energy-efficient computing devices, and the growing trend towards remote work and virtualization.

Key features fueling the growth of thin clients are remote accessibility of data, centralized and easy manageability, cost-effectiveness, high security, and increased productivity. The cost reduction of thin clients is one of the major factors helping the manufacturers expand their customer reach. Additionally, consumers are looking for a system that would help them save on energy consumption, maintenance, and operational costs. Replacing traditional PCs with thin clients minimizes the cost and reduces energy consumption. Moreover, since the thin client is built with very few components, it is durable and needs nearly zero maintenance

Thin client Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising adoption of cloud-based services

Earlier, with the onset of web-based applications, multiple apps could be hosted on a shared server. However, with the increase in the number of users and the complexity of apps, shared hosting has become ineffective, pushing businesses to opt for cloud-based solutions. Cloud migration simplifies setting up applications where users can access their browsers instead of downloading them on their devices. The cloud infrastructure is bridging the gap between IT and business by improving the agility and efficiency of IT resources and delivering cloud solutions to customers at a low cost.

Many companies in the thin client market are focusing on organic or inorganic strategies toward cloud computing. For instance, Dell Technologies has collaborated with VMware, which provides computing, cloud management, networking and security, storage and availability, and other computing offerings. The company’s growth strategies partly depend on its ability to access additional technologies and sales channels through selective acquisitions and strategic investments. Also, Dell Technologies acquired Wyse, the global leader in cloud client computing. Thus, with the rising adoption of cloud-based services globally, the virtual infrastructure market is also expanding, driving the demand for thin client solutions.

Restraint: System compatibility issues and dependency on a centralized network

Though virtual infrastructure-based thin client solutions offer various technological advantages, implementing them is difficult. For instance, setting up a virtual desktop requires a highly compatible infrastructure and software configuration, and addressing these requirements could be costly, complicated, and require extensive planning. Moreover, these systems require considerable network bandwidth, as all desktops and operating environments are virtually loaded and streamed across the network. Hence, these systems’ complexity and compatibility limit their adoption.

The single most significant limitation of a thin client is its dependency on the network. While the centralization of clients brings a lot of positives, it also implies a considerable potential risk: the server that the thin clients connect to is a single point of failure. If the server goes down, all clients that connect to it will be affected. While desktop computers use the network as and when required, thin clients always use it. With network fluctuations or traffic, the thin client performance reduces.

Opportunity: Rising investments in data centers by leading corporations

As many companies are investing in their IT infrastructures, the demand for data centers is rising globally. The virtual infrastructure market is growing rapidly with the rise in investments in data centers and cloud computing to upgrade digital infrastructure. For instance, with the advent of 4G, more and more people have started shopping online, and the data collected by e-commerce businesses is tremendous and requires more storage, fueling the demand for data centers.

Leading cloud services providers such as AWS, Microsoft, and Google are investing heavily in opening data centers across the globe to drive digital transformation. For instance, in April 2022, Google announced a USD 9.5 billion investment in data centers and offices in the US. In March 2022, AWS announced that it would spend more than USD 2.37 billion on building and operating data centers in the UK.

With the increasing investment trend in data centers and benefits over traditional desktop systems, the demand for virtual infrastructure will fuel the adoption of thin client solutions as they are secure, cost-effective, and easily manageable.

Challenge: Creation of network traffic while managing an enormous number of devices and data

Network monitoring has become a major concern as the number of IT infrastructure elements is increasing with the rise in topological complexities. There has been exponential growth in statistical data generation due to the increased network complexity. When this data is collected and used, it does not necessarily provide useful information to the management and operation teams because of its extensive volume. Thus, it is essential to break down this massive data into chunks and use it to further increase network efficiency. The rise in the number of users and devices on each network is making managing security more challenging.

Increasing focus on upgrading traditional PCs to boost adoption of standalone thin clients segment

A standalone thin client is a general thin client that requires users to plug in peripherals, including a monitor, keyboard, and mouse. Standalone is a computer that runs from resources stored on a central server instead of a localized hard drive. Standalone thin clients connect remotely to a server-based computing environment where most applications, sensitive data, and memory are stored. They enable local printing, audio and serial device support, web browsing, and terminal emulation and combine local processing with network computing.

The thin client market for the education segment held the largest share

In this digital era, educational institutions must provide their students with the latest computing facilities. IT knowledge is essential to a student’s employability; hence they should be familiar with the best software and solutions in the industry. This means that institutions must upgrade their PCs every two to three years, in keeping with the times. Updating computers with the latest software and programs is time-consuming and difficult for institutions to stay within budget. Hence, it is easy to consider affordable and collaborative technology, such as VDI, which allows IT to create simple, secure, and centrally manageable infrastructure.

Asia Pacific accounted for the largest share of the thin client market

Asia Pacific is one of the strongest markets for thin client industry share with a major contribution from China and Japan. These nations have witnessed high digital transformation across manufacturing, retail, education, and logistics industries. Rapid industrialization in Asia and consistent growth in industrial activities in the pacific region are driving the development of the manufacturing sector in the Asia Pacific. High-tech medical device manufacturing companies are actively focusing on geographical expansion in Asia Pacific due to the growing demand for healthcare services and increasing investment in advanced healthcare infrastructure. Aerospace & Defense is a booming industry that uses commercial-grade PCs like thin clients. These solutions help consumers to operate from remote locations.

Thin client Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Thin client Companies - Key Market Players

The thin client market players have implemented various types of organic as well as inorganic growth strategies, such as new product launches and acquisitions, to strengthen their offerings in the market. The major players in the thin client companies are HP (US), Dell Technologies (US), Centerm (China), IGEL (Germany), and Fujitsu (Japan), among others. The other thin client market companies profiled in the report are NComputing (US), Samsung (South Korea), LG Electronics (South Korea), Advantech Co., Ltd. (Taiwan), Lenovo (Hong Kong), Acer (Taiwan), Intel (US), 10ZiG (US), Siemens (Germany), Chip PC (Israel), Clearcube Technology (UK), VXL Technology (UK), Stratodesk Corp (US), OnLogic (US), Clientron Corp. (Taiwan), Arista Corporation (US), Thinvent (India), Seal Technologies (India), Atrust (Taiwan) and, Praim (Italy).

Scope of the Thin Client Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.5 billion |

|

Projected Market Size |

USD 1.7 billion |

|

Growth Rate |

CAGR of 3.1% |

|

Years considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Form Factor and Application |

|

Regions covered |

North America, Europe, APAC, and the Rest of the World |

|

Companies covered |

HP (US), Dell Technologies (US), Centerm (China), IGEL (Germany), Fujitsu (Japan), NComputing (US), Samsung (South Korea), LG Electronics (South Korea), Advantech Co., Ltd. (Taiwan), Lenovo (Hong Kong), Acer (Taiwan), Intel (US), 10ZiG (US), Siemens (Germany), Chip PC (Israel), Clearcube Technology (UK), VXL Technology (UK), Stratodesk Corp (US), OnLogic (US), Clientron Corp. (Taiwan), Arista Corporation (US), Thinvent (India), Seal Technologies (India), Atrust (Taiwan) and Praim (Italy). The study includes an in-depth competitive analysis of these key players in the thin client market with their company profiles, recent developments, and key market strategies. |

Thin client Market Highlights

In this report, the overall thin client market analysis has been segmented based on form factor, application, and region.

|

Aspect |

Details |

|

By Form Factor: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In November 2022, NComputing received validation from Citrix Systems for its LEAF OS and EX500 thin client.

- In October 2022, Centerm and Kaspersky signed an MoU to Cooperate for Cyber Immune Endpoints. As a part of the cooperation, Kaspersky will provide the KasperskyOS operating system and relative cyber immune products and solutions, while Centerm will provide hardware platforms (thin clients, tablets, other hardware end-user platforms) to corporate customers.

- In August 2022, 10ZiG launched the 7500q thin client series. It features an Intel Quad Core processor with 1.10 to 2.60 GHz (Burst); 15.6” display; FHD (1920 x 1080); 16:9 panel; 8GB DDR4 2,666 MHz RAM; 2 x USB Port 2.0; 1 x USB Port 3.0; 1 x USB Port C; 1 x HDMI; 1 x SD Card Reader; offers up to 10 hours of battery life.

- In May 2022, HP launched the HP Pro mt440 G3 Mobile Thin Client for the hybrid work environment for mobile virtualization with hybrid-ready management services.

Frequently Asked Questions (FAQ):

Who are the top 5 players in the thin client market?

The major vendors operating in the industry market are HP (US), Dell Technologies (US), Centerm (China), IGEL (Germany), and Fujitsu (Japan).

What are some of the technological advancements in the market?

Thin client systems with cloud computing provide enterprises with many solutions to resolve concerns, such as cost reduction, data security, and efficient use of storage and technology. Cloud computing helps provide maximum storage with low computational costs. By enabling cloud computing technology, virtualization provides a realistic solution for resource consolidation, simplifying management. Companies can efficiently perform tasks with the help of virtual solutions and cloud productivity apps. No matter which device we use, a cloud virtual desktop (thin client) allows us to transfer work effectively and efficiently across several devices via the file system hosted in the cloud.

What are the factors driving the growth of the market?

Growing need for digitalization in the education sector and advancements in the healthcare sector.

What are their major strategies to strengthen their market presence?

The major strategies adopted by these players are product launches and contracts.

Which major countries are considered in the APAC region?

The report includes an analysis of China, Japan, India, South Korea, and the Rest of Asia Pacific.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

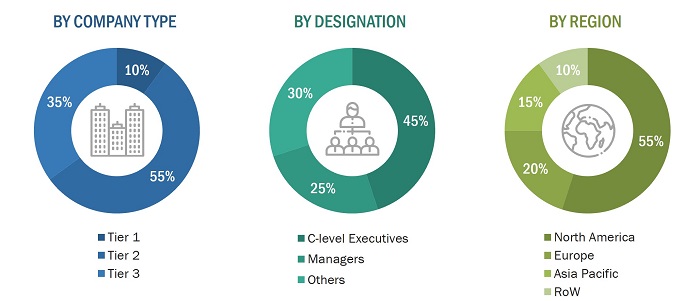

The study involves four major activities for estimating the size of the thin client market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Bottom-up approaches have been used to estimate and validate the size of the thin client market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as The Organization for Economic Co-operation and Development (OECD), Center for Security and Emerging Technology, The Japan External Trade Organization (JETRO), Semiconductor Industry Association, and SEMI have been used to identify and collect information for an extensive technical and commercial study of the thin client market.

Primary Research

Extensive primary research was conducted after understanding and analyzing the thin client market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across major regions—North America, Europe, APAC, and RoW. Approximately 30% of the primary interviews were conducted with the demand-side vendors and 70% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 85% of total primary interviews, as well as questionnaires and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The thin client market consists of form factors: Standalone, With Monitor, and Mobile. Thin client is usually employed in the following application; ITS, Education, BFSI, Industrial, Government, Healthcare, Retail, and Transportation. Top-down and bottom-up approaches have been used to estimate and validate the size of the thin client market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the thin client market, in terms of value, by form factor and application.

- To describe and forecast the thin client market, in terms of value, for four main regions – North America, Europe, APAC, and the Rest of the World.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain of the thin client market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the thin client ecosystem

- To profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze the competitive developments, such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, new product developments, and research and development (R&D), in the thin client market

Growth Opportunities for Virtual Desktop Infrastructure and Thin client desktop Market in the Future

VDI technology is closely related to thin client technology because it relies on a centralized server to provide desktop environments to multiple users. With VDI, each user is given a virtual desktop that is hosted on a central server, which they can access from any device with an internet connection. This provides greater flexibility for businesses because employees can access their desktop environment from any device, regardless of its operating system.

The combination of thin client technology and VDI has transformed the IT industry by providing businesses with a cost-effective and secure way to manage their desktop environments. It has also made it easier for businesses to manage their IT infrastructure, as they can manage multiple workstations from a central location.

Thin client desktops are designed to be used with thin clients, providing a remote desktop environment that can be accessed from any device with an internet connection. Thin client desktops are managed centrally, allowing businesses to easily manage and maintain their desktop environments from a central location. They also offer greater security than traditional desktops because data is stored on a central server rather than on individual devices.

How Virtual Desktop Infrastructure or Thin client desktop is going to impact the Thin client Market?

Virtual Desktop Infrastructure (VDI) and Thin Client Desktops are expected to have a significant impact on the Thin Client Market in the coming years. Both of these technologies have been gaining popularity due to their many benefits, including cost savings, improved security, and easier management.

VDI is a virtualization technology that allows multiple users to access a centralized desktop environment from anywhere with an internet connection. Thin Client Desktops, on the other hand, are desktop environments that are specifically designed to work with thin clients, allowing users to access their desktops remotely from a central server.

The increasing adoption of VDI and Thin Client Desktops is expected to drive growth in the Thin Client Market. This is because these technologies offer several benefits over traditional desktop computing, including:

Cost savings: By using thin clients or virtual desktops, businesses can reduce hardware costs, as well as maintenance and support costs.

Improved security: Thin clients and virtual desktops can provide a more secure computing environment, as data is stored on a central server rather than on individual devices.

Easier management: With thin clients or virtual desktops, IT administrators can manage and maintain desktop environments from a central location, simplifying management tasks and reducing the need for on-site IT support.

Some futuristic growth use-cases of Virtual Desktop Infrastructure market?

The Virtual Desktop Infrastructure (VDI) market is expected to see significant growth in the coming years, driven by several futuristic use-cases. Some of these use-cases include:

Remote work: The COVID-19 pandemic has accelerated the shift towards remote work, and VDI technology has played a key role in enabling this transition. As remote work becomes more common, the demand for VDI solutions is expected to grow.

Cloud adoption: With the increasing adoption of cloud computing, more businesses are looking to move their desktop environments to the cloud. VDI technology can help businesses achieve this by providing a secure and scalable solution for desktop virtualization.

Disaster recovery: VDI technology can be used as part of a disaster recovery strategy, allowing businesses to quickly and easily recover desktop environments in the event of an outage or other disaster.

IoT integration: The Internet of Things (IoT) is expected to play an increasingly important role in business operations. VDI technology can be used to provide a secure and scalable solution for managing IoT devices and applications.

Artificial Intelligence (AI) and Machine Learning (ML): As AI and ML become more integrated into business operations, VDI technology can be used to provide a secure and scalable solution for managing AI and ML workloads.

Industries That Will Be Impacted in the Future by Virtual Desktop Infrastructure

Virtual Desktop Infrastructure (VDI) is expected to have a significant impact on various industries in the future. Some of the industries that are likely to be impacted by VDI include:

Healthcare: The healthcare industry is expected to benefit from VDI technology, as it can provide a secure and scalable solution for managing patient data and electronic medical records. VDI can also help healthcare providers deliver remote consultations and telemedicine services.

Education: VDI can be used in the education sector to provide students and teachers with access to a centralized desktop environment, enabling remote learning and collaboration.

Financial services: The financial services industry is highly regulated and requires strict security measures to protect sensitive data. VDI technology can provide a secure and compliant solution for managing desktop environments in this industry.

Manufacturing: VDI technology can be used in the manufacturing industry to provide employees with access to a centralized desktop environment, enabling collaboration and remote work.

Growth Opportunities and Key Challenges for Virtual Desktop Infrastructure in the Future

Growth Opportunities:

Increasing demand for remote work solutions: The COVID-19 pandemic has accelerated the shift towards remote work, and VDI technology has played a key role in enabling this transition. As remote work becomes more common, the demand for VDI solutions is expected to grow.

Adoption of cloud computing: With the increasing adoption of cloud computing, more businesses are looking to move their desktop environments to the cloud. VDI technology can help businesses achieve this by providing a secure and scalable solution for desktop virtualization.

Need for cost-effective solutions: VDI technology can help businesses reduce costs associated with managing and maintaining desktop environments, making it an attractive option for businesses looking to reduce their IT expenses.

Increasing demand for secure solutions: As cyber threats continue to evolve, businesses are looking for secure solutions to protect their desktop environments. VDI technology can provide a secure solution by centralizing desktop management and enabling secure remote access.

Key Challenges:

Complexity: VDI technology can be complex to set up and manage, requiring specialized skills and expertise.

Infrastructure requirements: VDI technology requires a robust infrastructure to support it, including servers, storage, and networking equipment. This can be a barrier to entry for smaller businesses.

User experience: VDI technology relies on network connectivity, which can impact the user experience if the network is slow or unreliable.

Cost: While VDI technology can help businesses reduce costs in the long run, the initial setup costs can be significant, making it less accessible for smaller businesses.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thin client Market