Orthodontic Supplies Market by Product (Removable, Fixed Braces (Bracket (Self Ligating, Lingual, Metal, Aesthetic), Ni-Ti & SS Archwire, Anchorage, Ligature (Elastomeric, Wire)), Patient (Adult, Children), End User (Hospital, Clinics) & Region - Global Forecast to 2027

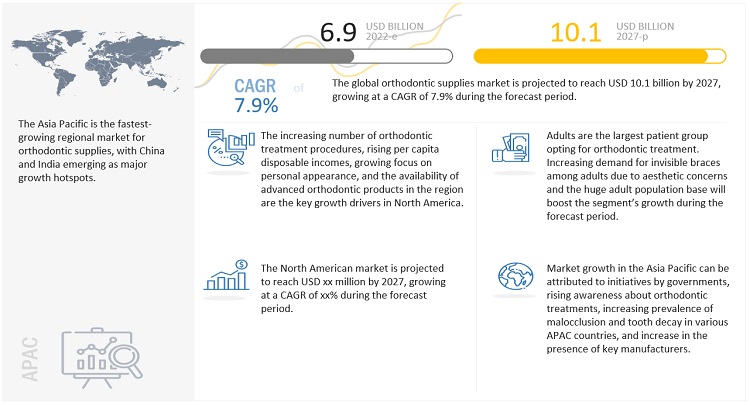

The global orthodontic supplies market in terms of revenue was estimated to be worth $6.9 billion in 2022 and is poised to reach $10.1 billion by 2027, growing at a CAGR of 7.9% from 2022 to 2027. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The orthodontic supply market is mainly driven by factors such as the growing number of patients with malocclusions, jaw diseases, tooth decay/tooth loss, and jaw pain; increasing disposable incomes and the expanding middle-class population in developing countries; increasing awareness about advanced orthodontic treatments; and ongoing research and technological advancements in orthodontic products. Also, initiatives undertaken by governments to increase awareness about orthodontic treatments are expected to drive the demand for orthodontic supplies.

On the other hand, the high costs associated with orthodontic treatments and the lack of reimbursements in various emerging countries are expected to limit the market growth to a certain extent in the coming years.

Attractive opportunities Orthodontic supplies Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Orthodontic supplies Market Dynamics

Driver: Growing number of patients with malocclusions, and jaw diseases globally.

With rapid growth in the number of people suffering from these conditions globally, the demand for orthodontic braces is expected to increase in the coming years. Crossbite, open bite, overbite, and spacing are some of the orthodontal condition in children and adolescents worldwide. Orthodontic products are used to straighten and align teeth, correct abnormal bite patterns, and close unsightly gaps. Orthodontic devices such as fixed and removable braces are widely adopted by people with malocclusions and jaw diseases. According to the article published by the Journal of Family Medicine and Primary Care in 2019, the prevalence of malocclusion among school-going children was reported in the range of 12.5% to 33.3%.

Restraint: High cost of advanced orthodontic treatments

The high cost of orthodontic products and treatments makes these treatments inaccessible to a large majority of the population in many developing countries. This limits the demand for and uptake of orthodontic treatments in developing as well as developed countries, further hampering the growth of the market.

Opportunity: Growth opportunities offered by emerging markets

Emerging countries such as China, India, Brazil are anticipated to offer huge growth opportunities to manufacturers operating in the global orthodontic supply market. Improved healthcare infrastructure, rising healthcare expenditure, and the lower orthodontic treatments cost in countries such as Brazil and Mexico increasingly focus of well-established players on undertaking strategic developments to enhance their geographical foothold in emerging countries with an aim to tap a large number of customers are anticipated to promote the growth of orthodontic supplies market in emerging nations.

The removable braces segment orthodontic supplies industry to record the highest CAGR during the forecast period, by product, in 2021

The orthodontic supplies market is driven by product innovation and growing awareness about the benefits of removable braces. Moreover, the increasing demand for invisible braces among teens and adults due to their aesthetic benefits is stimulating the growth of this market. Several leading market players are introducing invisible braces in their product portfolios or gaining a foothold and conducting various marketing activities, such as campaigns in this market, to ensure future growth.

The Adult segment accounted for the significant share of the global orthodontic supplies industry, by patient, in 2021

Adults include individuals aged 19 years and above. Adults opt for orthodontic treatments to improve their orofacial appearance, aesthetics, self-image, and self-confidence. The growth of this segment is driven by the growing number of adults seeking tooth-straightening treatments and the rising awareness about the application of clear brackets in enhancing aesthetic value, and increasing disposable incomes in various parts of the world.

The hospital and dental clinics captured for the largest share of the global orthodontic supplies industry, by end user in 2021

The rapidly growing cases of malocclusions across the globe and the rising expectations of improved dental healthcare among the expanding population worldwide play a critical role in increasing the adoption of orthodontic treatments in hospitals and dental clinics. Moreover, private investors in the dental sector have been interested in establishing chain of dental clinics and hospitals offering advanced orthodontic treatments. Also, many hospitals are promoting awareness among orthodontic surgeons about the various treatments and services available, which is further anticipated to promote the growth of this segment.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific region of the orthodontic supplies industry is expected to grow at the highest CAGR during the forecast period

The global orthodontic supplies market is segmented North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of the orthodontic supply market in 2021. This dominance can be attributed to factors such as the high per capita income in the US and Canada, growing public and private funding to support the dental industry, higher demand for orthodontic treatment among adolescents, and the presence of major orthodontic product manufacturers in North America (particularly in the US).

Asia Pacific is projected to register the highest growth during the forecast period owing to rising focus on aesthetics among adults and the increasing incidence/prevalence of malocclusion and tooth decay in various Asian countries, emergence of small manufacturers, geographical expansion of private dental clinics, and growing healthcare expenditure and rising collaborations among players in the region.

Align Technology (US), 3M (US), Envista Holdings Corporation (US), Institut Straumann AG (Switzerland), and Dentsply Sirona (US). Other prominent players in this market include Henry Schein (US), American Orthodontics (US), Rocky Mountain Orthodontics (US), G&H Orthodontics (US), Dentaurum (Germany), TP Orthodontics (US), Great Lakes Dental Technologies (US), DB Orthodontics (UK), Morelli Ortodontia (Brazil), Institut Straumann AG (Switzerland), Ultradent Products (US), Aditek Orthodontics (Brazil), MATT Orthodontics (US), JJ Orthodontics (India), Sino Ortho Limited (China), and JISCOP Co., Ltd. (South Korea).

Align Technology:

Align Technology is a leader in manufacturing & marketing removable braces and is one of the leading players in the global orthodontic supplies market. It expands its business by investing in resources, infrastructure, and initiatives that will drive the growth of the Invisalign treatment in its existing and new international markets. The company focuses on product development as its core business strategy to ensure growth in the market. In the last four years, the company has expanded its product offerings for patients of all age groups. The company also provides funds in the field of orthodontics and dentistry through initiatives such as the Annual Research Award Program.

Scope of the Orthodontic Supplies Industry:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$6.9 billion |

|

Projected Revenue by 2027 |

$10.1 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.9% |

|

Market Driver |

Growing number of patients with malocclusions, and jaw diseases globally. |

|

Market Opportunity |

Growth opportunities offered by emerging markets |

This research report categorizes the global orthodontic supplies market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Fixed Braces

-

Brackets, by Type

- Conventional Brackets

- Self-ligating Brackets

- Lingual Brackets

-

Brackets, by Material

- Metal/Traditional Brackets

- Ceramic/Aesthetic Brackets

-

Archwires

- Beta Titanium Archwires

- Nickel Titanium Archwires

- Stainless Steel Archwires

-

Anchorage Appliances

- Bands and Buccal Tubes

- Miniscrews

-

Ligatures

- Elastomeric Ligatures

- Wire Ligatures

-

Brackets, by Type

- Removable Braces

- Adhesives

- Accessories

By Patient

- Adults

- Children and teenagers

By End User

- Hospitals, and Dental Clinics

- E-Commerce Platforms

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoEU

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Orthodontic Supplies Industry

- In May 2022, Align Technology entered into strategic partnership with Asana, Inc. Through this strategic partnership, Align Technology will provide its Invisalign clear aligners to trained doctors in the US through the Asana Smile customizable workflow solution.

- In May 2022, Straumann acquired PlusDental to expand its footprint in the doctor-led consumer orthodontics segment across the Netherlands, Sweden, and the UK.

- In January 2021, Dentsply Sirona acquired Byte, an at-home aligner company, in with an aim to strengthen its clear aligner product portfolio.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global orthodontic supplies market?

The global orthodontic supplies market boasts a total revenue value of $10.1 billion by 2027.

What is the estimated growth rate (CAGR) of the global orthodontic supplies market?

The global orthodontic supplies market has an estimated compound annual growth rate (CAGR) of 7.9% and a revenue size in the region of $6.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities to estimate the current size of the Orthodontic supplies market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), American Association of Orthodontics (AAO), International Association of Orthodontics (IOA) were referred to identify and collect information for the orthodontic supplies market study.

Primary Research

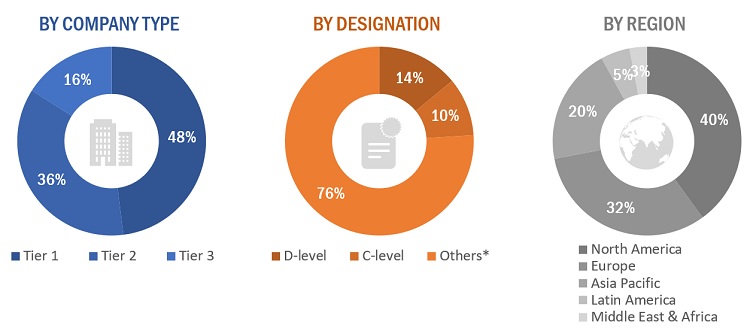

The orthodontic supplies market comprises several stakeholders such as manufacturers of fixed braces, removable braces, ligatures, orthodontic adhesive, and orthodontic clinic, dental research academic institutes, market research and consulting firms. The demand side of this market is characterized by the increasing incidence of malocclusion, growing availability of orthodontic supplies, and increased in number of players in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the orthodontic supplies market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the global Orthodontic supplies market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the global orthodontic supplies market on the basis of product, platform, mode of purchase, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key market players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global orthodontic supplies market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global Orthodontic supplies market report

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players.

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Geographic Analysis

- Further breakdown of the Rest of Europe Orthodontic supplies market into Belgium, Austria,

- Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific Orthodontic supplies market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America Orthodontic supplies market into Argentina, and Colombia, among other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Orthodontic Supplies Market