Proactive Services Market by Service, Application (Network Management, Data Center Management, Cloud Management, Application Management, Device/Endpoint Management), Technology Type, Organization Size, Vertical, and Region - Global Forecast to 2022

[175 Pages Report] MarketsandMarkets expects the proactive services market to grow from $1.47 Billion in 2016 to $4.35 Billion by 2022 at a Compound Annual Growth Rate (CAGR) of 21.6% during the forecast period. The forecast period has been considered from 2017 to 2022, while 2016 is considered as the base year for estimating the market study.

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the proactive services market on the basis of segments including application, technology type, service, organization size, vertical, and region. The report provides detailed information regarding major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market. The report forecasts the market size with respect to 5 main geographic regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities in the market.

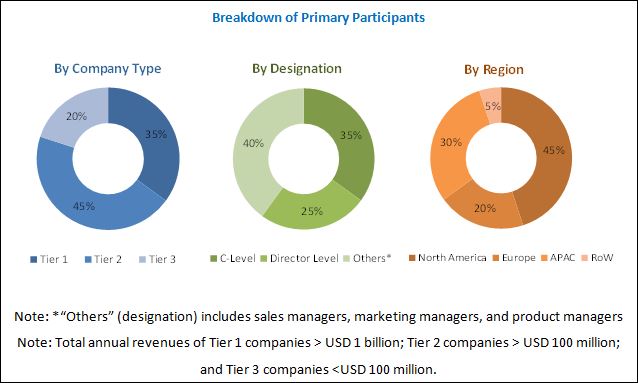

The research methodology used to estimate and forecast the proactive services market begins with the collection and analysis of data on key vendor product offerings and business strategies from secondary sources, such as OneSource Business Browser, D&B Hoovers, 10K Wizard, Bloomberg, Thomson StreetEvents, Factiva, IT service providers, technology providers, press releases and investor presentations of companies, white papers, technology journals, certified publications, articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the proactive services market from the revenue of the key market software tool providers and service providers. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives.

To know about the assumptions considered for the study, download the pdf brochure

Industry Ecosystem

The proactive services ecosystem comprises vendors, such as Cisco (US), Hewlett Packard Enterprise (US), Microsoft (US), IBM (US), Ericsson (Sweden), Juniper Networks (US), Huawei (China), Nokia Networks (Finland), Avaya (US), Fortinet (US), Symantec (US), DXC Technology (US), and McAfee (US).

Key Target Audience for Proactive Services Market

- Proactive services providers

- Managed service players

- Support service providers

- Value-added resellers

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

The research report categorizes the proactive services market to forecast the revenues and analyze the trends in each of the following submarkets:

Market By Service

- Managed Services

- Technical Support

- Design and Consulting

Market By Application

- Network Management

- Customer Experience Management

- Data Center Management

- Cloud Management

- Application Management

- Device / Endpoint Management

Proactive Services Market By Technology Type

- Big Data Analytics

- Business Intelligence

- Machine Intelligence

Market By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Proactive Services Market By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunication

- Retail

- Healthcare

- Government and Defense

- Media and Entertainment

- Others (Education and Transportation & Logistics))

Market By Region

- North America

- Europe

- MEA

- APAC

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the North American proactive services market into countries

- Further breakdown of the European market into countries

- Further breakdown of the APAC market into countries

- Further breakdown of the MEA market into countries

- Further breakdown of the Latin American market into countries

Company Information

- Detailed analysis and profiling of additional market players

The global proactive services market is expected to grow from USD 1.63 Billion in 2017 to USD 4.35 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.6% during the forecast period. Several factors such as the growing need to reduce unplanned outage and to enhance customer value proposition, and growing instances of cyber-attacks are spurring the demand for proactive services. Moreover, an increased adoption of proactive services by several industry verticals, such as telecommunications, retail, BFSI, and healthcare, is expected to boost the market growth.

In todays changing business requirements, customers are looking for innovative solutions and services to manage their IT infrastructure and prevent it from downtime and any unplanned outages. Any unplanned outages in a large IT infrastructure of an organization will lead to a significant loss. Industry participants make use of Artificial Intelligence (AI) and analytics solutions to offer proactive support to assist organizations in identifying and resolving issues before they occur.

For most organizations, IT is a significant pillar that requires cost-effective implementation of security service dynamics. However, at the same time, IT is the backbone of a modern organizations processes and the data flowing within it is highly important, further making it difficult to ignore the IT infrastructure. Maintaining an IT infrastructure, which is secured from physical as well as virtual threat, is highly expensive. Cybersecurity vendors are offering services to identify and proactively prevent cyber-attacks.

The proactive services market research report outlines the key trends, and market sizing and forecasting for various emerging subsegments of the market. The report also emphasizes on key global adoption trends, future growth potential submarkets, key drivers, competitive outlook, restraints, and opportunities of the proactive service market ecosystem. It also provides insights into the current and future revenues of market from 2017 to 2022 and is aimed to provide the reader with an understanding of market drivers, current and upcoming players, and the competitive landscape.

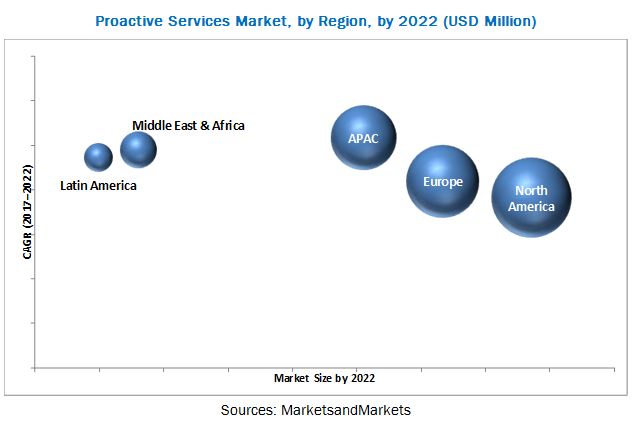

The global proactive services market has been segmented by 5 major geographic regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America to provide region-specific analyses in the report. North America is estimated to have the largest market share and is projected to continue to dominate the market during the forecast period. The adoption of proactive services is increasing in APAC and MEA, due to the rising IT spending and increasing digitalization.

Growing use of mobile devices and the popularity of the Bring-Your-Own-Device (BYOD) concept in various companies are the main factors responsible for cyber-attacks and security concerns. Proactive services provide many benefits, however organizations feel that deploying proactive services would result in the loss of control over their own IT infrastructure and hamper their privacy.

Major vendors of proactive services across the globe are Cisco (US), Hewlett Packard Enterprise (US), Microsoft (US), IBM (US), Ericsson (Sweden), Juniper Networks (US), Huawei (China), Nokia Networks (Finland), Avaya (US), Fortinet (US), Symantec (US), DXC Technology (US), and McAfee (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to further strengthen their position in the proactive services market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Proactive Services Market Size Estimation

2.3 Research Assumptions and Limitations

2.3.1 Research Assumptions

2.3.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Proactive Services Market

4.2 Market, By Vertical and Region

4.3 Market, By Organization Size

4.4 Market, By Service

4.5 Market, By Application

4.6 Market, By Technology Type

4.7 Market Potential

4.8 Life Cycle Analysis, By Region, 2017

4.9 Use Cases

5 Proactive Services Market Overview and Industry Trends (Page No. - 42)

5.1 Introduction

5.2 Innovation Spotlight

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 High Costs Incurred By Unplanned Outages

5.3.1.2 The Increasing Focus on Delivering Enhanced Customer Experience

5.3.1.3 The Growing Number of Cyber Threats

5.3.2 Restraints

5.3.2.1 Concerns Over Privacy and Security

5.3.3 Opportunities

5.3.3.1 Ai-Based Proactive Services

5.3.3.2 Partnerships and Affective Ecosystems

5.3.4 Challenges

5.3.4.1 Managing Security With Multiple Customer Touchpoints

5.3.4.2 Implementation Efforts/Costs

5.3.4.3 Lack of Qualified Talent

6 Market, By Application (Page No. - 47)

6.1 Introduction

6.2 Network Management

6.3 Data Center Management

6.4 Cloud Management

6.5 Application Management

6.6 Device/Endpoint Management

6.7 Customer Experience Management

7 Market, By Service (Page No. - 54)

7.1 Introduction

7.2 Managed Services

7.3 Technical Support

7.4 Design and Consulting

8 Proactive Services Market, By Technology Type (Page No. - 59)

8.1 Introduction

8.2 Big Data Analytics

8.3 Business Intelligence

8.4 Machine Intelligence

9 Market, By Organization Size (Page No. - 64)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Proactive Services Market, By Vertical (Page No. - 69)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Government and Defense

10.4 Healthcare

10.5 Telecommunication

10.6 Media and Entertainment

10.7 Retail

10.8 Others

11 Proactive Services Market, By Region (Page No. - 77)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 102)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Launches/New Solution Launches/New Service Launches

12.3.2 Business Expansions/Service Expansions/Portfolio Expansions

12.3.3 Mergers, Demergers, and Acquisitions

12.3.4 Agreements/Partnerships

13 Company Profiles (Page No. - 111)

13.1 Cisco

13.1.1 Business Overview

13.1.2 Services Offered

13.1.3 Recent Developments

13.1.4 SWOT Analysis

13.1.5 MnM View

13.1.6 Partner Network

13.2 HPE

13.2.1 Business Overview

13.2.2 Services Offered

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 MnM View

13.2.6 Partner Network

13.3 Microsoft

13.3.1 Business Overview

13.3.2 Services Offered

13.3.3 Recent Developments

13.3.4 SWOT Analysis

13.3.5 MnM View

13.3.6 Partner Network

13.4 IBM

13.4.1 Business Overview

13.4.2 Services Offered

13.4.3 Recent Developments

13.4.4 SWOT Analysis

13.4.5 MnM View

13.4.6 Partner Network

13.5 Ericsson

13.5.1 Business Overview

13.5.2 Services Offered

13.5.3 Recent Developments

13.5.4 SWOT Analysis

13.5.5 MnM View

13.5.6 Partner Network

13.6 Juniper

13.6.1 Business Overview

13.6.2 Services Offered

13.6.3 Recent Developments

13.6.4 MnM View

13.6.5 Partner Network

13.7 Huawei

13.7.1 Overview

13.7.2 Services Offered

13.7.3 Recent Developments

13.7.4 MnM View

13.7.5 Partner Network

13.8 Nokia Networks

13.8.1 Business Overview

13.8.2 Services Offered

13.8.3 Recent Developments

13.8.4 MnM View

13.9 Avaya

13.9.1 Overview

13.9.2 Services Offered

13.9.3 Recent Developments

13.9.4 MnM View

13.9.5 Partner Network

13.10 Fortinet

13.10.1 Business Overview

13.10.2 Services Offered

13.10.3 Recent Developments

13.10.4 MnM View

13.10.5 Partner Network

13.11 Symantec

13.11.1 Business Overview

13.11.2 Services Offered

13.11.3 Recent Developments

13.11.4 MnM View

13.11.5 Partner Network

13.12 Mcafee

13.12.1 Overview

13.12.2 Services Offered

13.12.3 Recent Developments

13.12.4 MnM View

13.12.5 Partner Network

13.13 DXC Technology

13.13.1 Overview

13.13.2 Services Offered

13.13.3 Recent Developments

13.13.4 MnM View

13.13.5 Partner Network

13.14 Servion

13.14.1 Overview

13.14.2 Services Offered

13.14.3 Recent Developments

13.14.4 MnM View

13.14.5 Partner Network

14 Appendix (Page No. - 165)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (60 Tables)

Table 1 United States Dollar Exchange Rate, 20142016

Table 2 Proactive Services Market Size and Growth Rate, 20152022 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Application, 20152022 (USD Million)

Table 4 Network Management: Market Size, By Region, 20152022 (USD Million)

Table 5 Data Center Management: Market Size, By Region, 20152022 (USD Million)

Table 6 Cloud Management: Market Size, By Region, 20152022 (USD Million)

Table 7 Application Management: Market Size, By Region, 20152022 (USD Million)

Table 8 Device/Endpoint Management: Market Size, By Region, 20152022 (USD Million)

Table 9 Customer Experience Management: Market Size, By Region, 20152022 (USD Million)

Table 10 Services: Proactive Services Market Size, By Type, 20152022 (USD Million)

Table 11 Managed Services: Market Size, By Region, 20152022 (USD Million)

Table 12 Technical Support: Market Size, By Region, 20152022 (USD Million)

Table 13 Design and Consulting: Market Size, By Region, 20152022 (USD Million)

Table 14 Market Size, By Technology Type, 20152022 (USD Million)

Table 15 Big Data Analytics: Market Size, By Region 20152022 (USD Million)

Table 16 Business Intelligence: Market Size, By Region, 20152022 (USD Million)

Table 17 Machine Intelligence: Market Size, By Region, 20152022 (USD Million)

Table 18 Proactive Services Market Size, By Organization Size, 20152022 (USD Million)

Table 19 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 21 Market Size, By Vertical, 20152022 (USD Million)

Table 22 Banking, Financial Services, and Insurance: Market Size, By Region, 20152022 (USD Million)

Table 23 Government and Defense: Market Size, By Region, 20152022 (USD Million)

Table 24 Healthcare: Proactive Services Market Size, By Region, 20152022 (USD Million)

Table 25 Telecommunication: Market Size, By Region, 20152022 (USD Million)

Table 26 Media and Entertainment: Market Size, By Region, 20152022 (USD Million)

Table 27 Retail: Market Size, By Region, 20152022 (USD Million)

Table 28 Others: Market Size, By Region, 20152022 (USD Million)

Table 29 Market Size, By Region, 20152022 (USD Million)

Table 30 North America: Market Size, By Country, 20152022 (USD Million)

Table 31 North America: Market Size, By Application, 20152022 (USD Million)

Table 32 North America: Market Size, By Service, 20152022 (USD Million)

Table 33 North America: Market Size, By Technology Type, 20152022 (USD Million)

Table 34 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 35 North America: Market Size, By Vertical, 20152022 (USD Million)

Table 36 Europe: Proactive Services Market Size, By Country, 20152022 (USD Million)

Table 37 Europe: Market Size, By Application, 20152022 (USD Million)

Table 38 Europe: Market Size, By Service, 20152022 (USD Million)

Table 39 Europe: Market Size, By Technology Type, 20152022 (USD Million)

Table 40 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 41 Europe: Market Size, By Vertical, 20152022 (USD Million)

Table 42 Asia Pacific: Market Size, By Country, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size, By Application, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Technology Type, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Vertical, 20152022 (USD Million)

Table 48 Middle East and Africa: Proactive Services Market Size, By Country, 20152022 (USD Million)

Table 49 Middle East and Africa: Market Size, By Application, 20152022 (USD Million)

Table 50 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Technology Type, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Vertical, 20152022 (USD Million)

Table 54 Latin America: Market Size, By Country, 20152022 (USD Million)

Table 55 Latin America: Market Size, By Application, 20152022 (USD Million)

Table 56 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Technology Type, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Vertical, 20152022 (USD Million)

Table 60 Market Ranking for the Proactive Services Market

List of Figures (50 Figures)

Figure 1 Proactive Services Market: Market Segmentation

Figure 2 Regional Scope

Figure 3 Market: Research Design

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Proactive Services Market: Assumptions

Figure 8 Top 3 Segments for the Market in 2017

Figure 9 North America is Estimated to Have the Largest Market Share in 2017

Figure 10 The Technical Support Segment is Expected to Offer Attractive Opportunities for the Growth of the Proactive Services Market During the Forecast Period

Figure 11 Telecommunication Vertical and North America are Estimated to Have the Largest Market Shares in 2017

Figure 12 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 13 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Device/Endpoint Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 Machine Intelligence Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Asia Pacific, and Middle East and Africa are Expected to Be the Faster Growing Regions in the Proactive Services Market

Figure 18 Key Use Cases, By Vertical

Figure 19 Use Case 1: Network Optimization in Telecom

Figure 20 Use Case 2: Data Center Management in Retail

Figure 21 Use Case 3: Cybersecurity in Banking, Financial Services, and Insurance

Figure 22 Proactive Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Device/Endpoint Management Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 24 Managed Services Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Machine Intelligence Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 27 Banking, Financial Services, and Insurance Vertical is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 28 Geographical Analysis

Figure 29 Asia Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 North America Market Snapshot: United States is Expected to Contribute the Maximum to the Market Share

Figure 31 Asia Pacific Market Snapshot

Figure 32 Key Developments By Leading Players in the Proactive Services Market During 20142017

Figure 33 Cisco: Company Snapshot

Figure 34 Cisco: SWOT Analysis

Figure 35 HPE: Company Snapshot

Figure 36 HPE: SWOT Analysis

Figure 37 Microsoft: Company Snapshot

Figure 38 Microsoft: SWOT Analysis

Figure 39 IBM: Company Snapshot

Figure 40 IBM: SWOT Analysis

Figure 41 Ericsson: Company Snapshot

Figure 42 Ericsson: SWOT Analysis

Figure 43 Juniper: Company Snapshot

Figure 44 Huawei: Company Snapshot

Figure 45 Nokia Nteworks: Company Snapshot

Figure 46 Avaya: Company Snapshot

Figure 47 Fortinet: Company Snapshot

Figure 48 Symantec: Company Snapshot

Figure 49 Mcafee: Company Snapshot

Figure 50 DXC Technology: Company Snapshot

Growth opportunities and latent adjacency in Proactive Services Market