Agricultural Surfactants Market by Type (Non-Ionic, Anionic, Cationic, Amphoteric), Application (Herbicides, Fungicides), Substrate Type, Crop Type (Cereals & Grains, Pulses & Oilseeds, Fruits & Vegetables) and Region - Global Forecast to 2028

Agricultural Surfactants Market Analysis

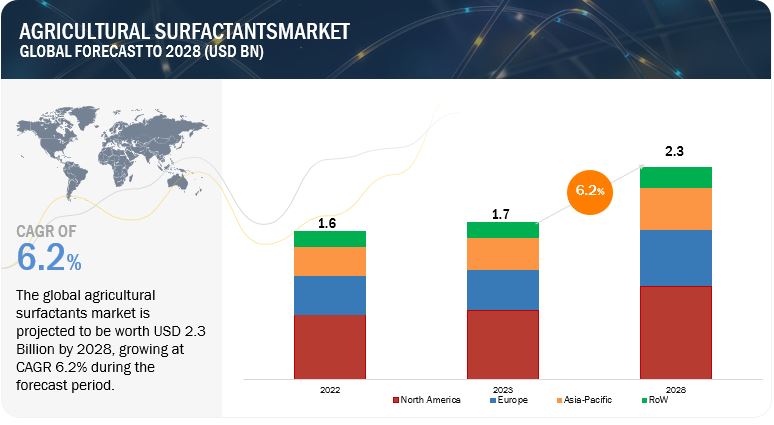

From 2023 to 2028, the global agricultural surfactants market is expected to rise at a remarkable compound annual growth rate (CAGR) of 6.2%. This rising trend is expected to boost market value from $1.7 billion in 2023 to $2.3 billion by the end of 2028.

The robust growth of the global market is intricately linked to the steady expansion of global crop production, as highlighted by the Food and Agriculture Organization of the United Nations (FAO). The increase in global crop production by 1.3% to reach 9.5 billion tonnes in 2021 underscores the intensifying need for optimizing agricultural inputs for enhanced yields. Agricultural surfactants play a pivotal role in this context, as they improve agrochemical efficiency, leading to more effective pest and weed control. This, in turn, contributes to increased crop yields and quality. Additionally, the escalating global population's demands for food necessitate higher productivity from existing agricultural land, further driving the adoption of surfactants to maximize the impact of agrochemical applications. As precision agriculture techniques become more prevalent and sustainable practices gain traction, the use of surfactants is poised to continue its upward trajectory, serving as a linchpin in meeting the world's growing food production requirements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Agricultural Surfactants Market Growth Insights

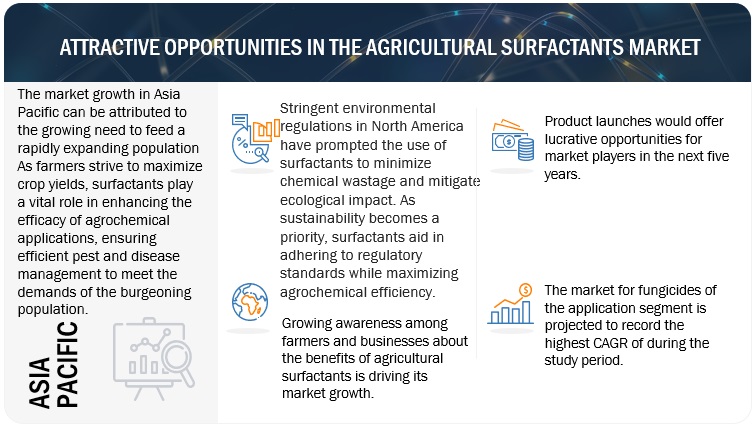

Drivers: Rise in demand for green solutions

The surge in demand for environmentally sustainable solutions is propelling substantial growth in the agricultural surfactants market. As concerns over ecological impact escalate, farmers and agribusinesses are seeking greener alternatives to conventional chemical inputs. Agricultural surfactants, with their ability to enhance the efficiency of agrochemicals and reduce chemical wastage, align perfectly with this shift towards eco-friendly practices. These surfactants enable precise and targeted application of pesticides and fertilizers, minimizing runoff and environmental contamination. The push for green solutions is driving research and development efforts toward the formulation of biodegradable and low-toxicity surfactants, further bolstering their appeal. As sustainability becomes a cornerstone of modern agriculture, the market is experiencing substantial growth due to its pivotal role in fostering environmentally responsible practices.

Restraint: Use of genetically modified seeds

The utilization of genetically modified (GM) seeds is imposing a degree of constraint on the expansion of the market. Genetically modified crops often possess intrinsic traits that provide them with enhanced resistance to pests and diseases, reducing the need for external chemical applications, including those aided by surfactants. This shift towards GM crops has led to a partial displacement of conventional crop varieties that necessitate more intensive chemical management.

As GM crops gain prominence, the demand for agrochemicals, including surfactants, may experience a relative decrease in specific markets. Moreover, the introduction of traits directly into the seed may negate the necessity for certain agrochemical applications altogether, limiting the potential applications of surfactants.

While the agricultural surfactants market remains robust due to their relevance in many contexts, the growing prevalence of GM crops alters the landscape by redefining pest and disease management practices. As a result, the market's expansion trajectory may encounter some constraints in regions or sectors where genetically modified seeds are more prevalent.

Opportunity: Production of bio-based surfactant products

The production and adoption of biobased surfactants present a significant opportunity within the agricultural surfactants market, driving its growth in a sustainable direction. Biobased surfactants, derived from renewable sources such as plant oils and microbes, align seamlessly with the increasing demand for eco-friendly solutions in agriculture. These surfactants offer distinct advantages, including higher biodegradability, lower environmental impact, and reduced toxicity compared to their synthetic counterparts.

As environmental consciousness rises, consumers, regulators, and industries alike are prioritizing sustainable practices. Biobased surfactants address this demand by providing effective agrochemical delivery while minimizing harm to ecosystems. This shift towards greener alternatives complements evolving farming practices, where precision and minimal ecological disruption are paramount.

With consumers increasingly favoring products with lower environmental footprints, the growth of biobased surfactants is driving market expansion by meeting both performance and sustainability criteria in the agricultural sector.

Challenge: Growth of environmental concerns against the usage of agrochemicals

The growth of environmental concerns is placing a significant restraint on the agricultural surfactants market. As awareness of ecological impacts intensifies, there's mounting pressure on agricultural practices to align with sustainability goals. Traditional agrochemical applications, including surfactant usage, are under scrutiny due to their potential contributions to soil and water pollution, affecting ecosystems and human health.

Regulatory bodies worldwide are imposing stricter guidelines and restrictions on agrochemical usage to mitigate environmental degradation. This has led to a shift towards more eco-friendly alternatives, challenging the conventional use of surfactants in some cases. Additionally, the perception of chemical-intensive agriculture as detrimental to ecosystems and biodiversity is influencing consumer preferences and shaping market dynamics.

As sustainable farming gains traction, the market must navigate this shift by adapting formulations, production methods, and marketing strategies to align with environmental expectations. Balancing the need for effective pest and disease management with reduced ecological impact presents a complex challenge that necessitates innovation and collaboration across the industry to address the growing concerns and ensure a sustainable future for agriculture.

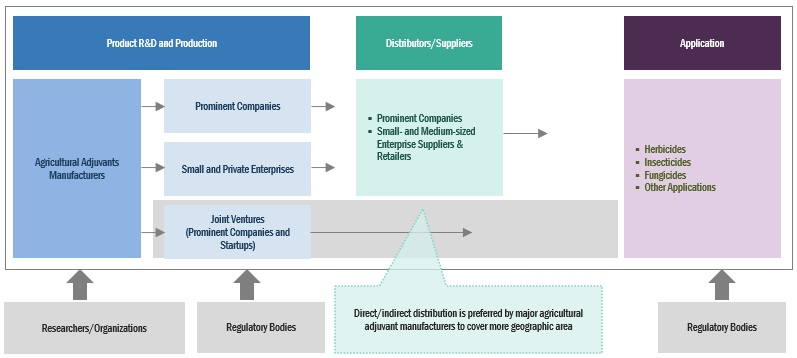

Agricultural Surfactants Market Ecosystem

Agricultural Surfactants Market by Crop Type Insights

Based on crop type, the cereals & grains segment is estimated to hold the largest market share during the forecast period of the market.

Cereals and grains hold the largest share of the agricultural surfactant market due to their widespread cultivation and economic significance. These staple crops encompass a vast portion of global agricultural production, serving as a fundamental source of food, feed, and industrial raw materials. According to the Food and Agriculture Organization of the United Nations (FAO), the total cereals and grains production in 2021 was 2,819 million tonnes. This is an increase of 1.6% from the total production recorded in 2020. Given their extensive leaf surfaces and expansive cultivation areas, effective pesticide coverage is essential for managing pests, diseases, and weeds. Agricultural surfactants play a pivotal role in optimizing pesticide efficiency by improving adhesion, spreading, and absorption on cereal and grain surfaces.

Furthermore, the demand for higher crop yields to feed the growing global population accentuates the importance of precision agrochemical application. Surfactants enhance the efficacy of pesticides, leading to increased yields and quality of cereals and grains. As modern farming practices evolve, the need for agrochemical optimization becomes increasingly critical, positioning cereals and grains as key beneficiaries of surfactant technology and driving their dominance in the agricultural surfactant market. The abundant availability of sugarcane bagasse, especially in regions with significant sugar production, provides a cost-effective and renewable resource for agricultural surfactants production. Additionally, utilizing bagasse can help address waste management challenges associated with its disposal, contributing to a more circular and environmentally responsible approach. By tapping into the potential of sugarcane bagasse, the agricultural surfactants market can benefit from increased feedstock availability, improved cost-efficiency, and a stronger sustainability profile, ultimately driving its growth and market adoption.

Agricultural Surfactants Market by Application Insights

Based on application, the fungicides segment is anticipated to witness the highest growth in the market.

Fungicides in the agricultural surfactants application sector are witnessing the fastest growth due to several pivotal factors. Fungal diseases pose substantial threats to crop yields and quality, necessitating effective management strategies. Agricultural surfactants significantly enhance the performance of fungicides by improving their coverage, adhesion, and penetration on plant surfaces, ensuring comprehensive protection against fungal pathogens. With shifting weather patterns and increased global trade, the risk of fungal outbreaks has surged, intensifying the demand for reliable disease management tools.

Furthermore, the environmental and regulatory push for reduced chemical usage aligns with the role of surfactants in optimizing fungicide efficiency. Their ability to aid targeted and efficient applications aligns with sustainable farming practices. As the agricultural sector prioritizes precision and eco-conscious approaches, fungicide-associated surfactants stand out as essential tools for combating fungal diseases, contributing to their rapid growth in the global market.

Agricultural Surfactants Market by Substrate Type Insights

Based on substrate type, the bio-based segment is projected to experience the highest growth during the forecast period of the market.

Biobased surfactants are poised to experience the highest growth in the market due to their alignment with two pivotal trends: sustainability and performance. As environmental concerns and regulations intensify, the demand for eco-friendly solutions in agriculture rises significantly. Biobased surfactants, derived from renewable sources, exhibit reduced environmental impact, enhanced biodegradability, and lower toxicity compared to traditional synthetic counterparts.

Moreover, the performance of biobased surfactants has been advancing, bridging the gap with synthetic alternatives. Researchers are continuously innovating to optimize their properties, ensuring compatibility with various agrochemical formulations and target crops. As modern farming practices evolve towards precision agriculture and sustainable approaches, biobased surfactants offer a strategic solution for effective pesticide delivery, reduced chemical wastage, and improved overall agrochemical performance. This dual synergy of environmental responsibility and performance enhancement positions biobased surfactants for rapid growth, making them a focal point in driving the evolution of the agricultural surfactants market.

Agricultural Surfactants Market by Regional Insights

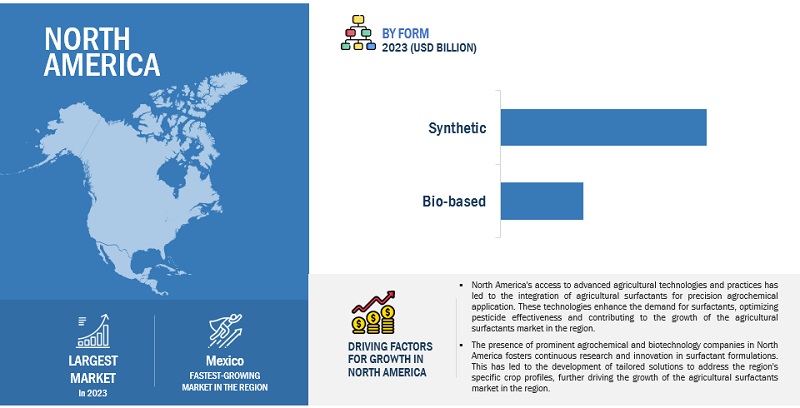

The North America market is projected to contribute the largest share of the agricultural surfactants market.

North America's dominance in the market can be attributed to a convergence of key factors. The region's advanced agricultural practices, coupled with a strong emphasis on maximizing crop yields, have driven substantial demand for surfactants that enhance the efficiency of agrochemical applications. North American farmers and agribusinesses are at the forefront of adopting cutting-edge precision agriculture techniques, necessitating precise and effective chemical application that surfactants facilitate.

Furthermore, the presence of prominent agrochemical and biotechnology companies within North America fuels research and development efforts, leading to the continuous innovation of surfactant formulations tailored to the region's diverse crop and pest profiles. Stringent environmental regulations in the region have also accelerated the adoption of surfactants to reduce chemical wastage and environmental impact.

The North American market's robust growth is further bolstered by the region's economic strength, technological advancements, and the focus on sustainable agricultural practices. The alignment of these factors positions North America as a leader in agricultural surfactant adoption, enabling it to maintain the largest market share within the global agricultural surfactants industry.

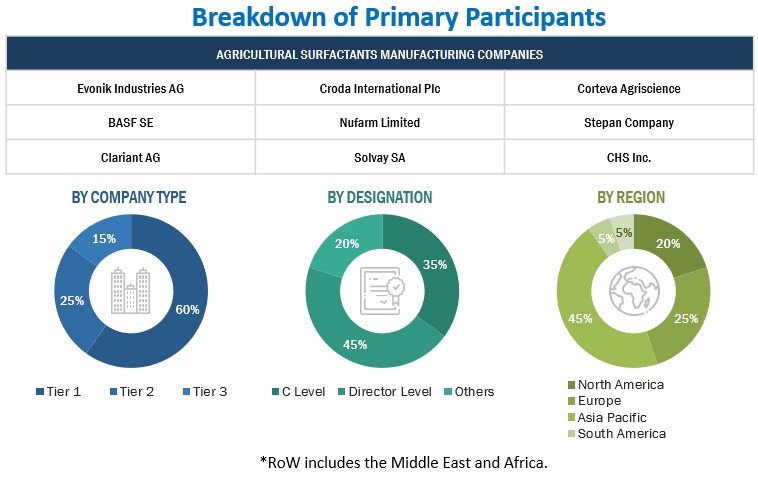

Top Companies in Agricultural Surfactants Industry

CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US)are among the key players in the global market. To increase their company's revenues and market shares, companies are focusing on launching new products, developing partnerships, and expanding their production facilities. The key strategies used by companies in the agricultural surfactants market include strategic acquisitions to gain a foothold over the extensive supply chain and new product launches as a result of extensive research and development (R&D) initiatives.

Agricultural Surfactants Market Report Scope

|

Report Metric |

Details |

|

Agricultural Surfactants Market Estimated Size (2023) |

US $1.7 Billion |

|

Projected Market Valuation (2028) |

US $2.3 Billion |

|

Value-based CAGR (2023-2028) |

6.2% |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, By Substrate Type, By Application, By Crop Type, and By Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

Agricultural Surfactants Market Segmentation:

Market By Type

- Non-ionic

- Anionic

- Cationic

- Amphoteric

Market By Substrate Type

- Synthetic

- Bio-based

Market By Application

- Herbicides

- Fungicides

- Insecticides

- Other Applications

Market By Crop Type

- Cereals & Grains

- Pulses & Oilseeds

- Fruits & Vegetables

- Other Crop Types

Market By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Note 1 Other applications include fertilizers, biostimulants, plant regulators, and nematicides.

Note 2: Other crop types include sugarcane, plantation crops, and turf & ornamentals.

Agricultural Surfactants Market News

- In February 2022, CLARIANT (Switzerland) launched Vita, its latest innovation featuring 100% bio-based surfactants and polyethylene glycols. Tailored for natural formulations with an emphasis on achieving a robust Renewable Carbon Index (RCI), Vita enabled manufacturers to optimize bio-based carbon content in crop formulations.

- In August 2021, CHS Inc. (US) introduced Last-Chance Pro to increase herbicide uptake, translocation, and efficacy.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share of the agricultural surfactants market?

The North American region accounted for the largest share, in terms of value, of USD 0.6 billion, of the global agricultural surfactants market in 2023 and is expected to grow at a CAGR of 6.2%.

Which region is projected to account for the highest growth in the agricultural surfactants market?

Asia Pacific is projected to experience the highest growth in terms of value, with a CAGR of 7.7%.

What is the current size of the global agricultural surfactants market?

The agricultural surfactants market is estimated at USD 1.7 billion in 2023 and is projected to reach USD 2.8 billion by 2028, at a CAGR of 6.2% from 2023 to 2028.

Which are the key players in the market?

The key players in this market include CHS Inc. (US), BASF SE (Germany), Solvay (Belgium), Corteva Agriscience (US), Evonik (Germany), Croda International Plc (UK), Nufarm (Australia), CLARIANT (Switzerland), and Stepan Company (US).

What are the factors driving the agricultural surfactants market?

The agricultural surfactants market is driven by the need for enhanced agrochemical efficiency optimizing pesticide applications for improved pest and disease management. Growing awareness of environmental sustainability compels the adoption of surfactants to reduce chemical wastage and minimize ecological impact. Additionally, the rise of precision agriculture and the demand for higher crop yields further fuel the market's expansion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the extensive use of secondary sources directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural surfactants market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects.

Secondary Research

This research study of agricultural surfactants market involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect valuable information for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

In the secondary research process, sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural adjuvants market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the agricultural adjuvants market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped understand the formulation, adoption stage, functions, crop types, application, and regional trends. Stakeholders from the demand side, such as dealers, distributors, farmers, and government authorities who are using agricultural adjuvants, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of agricultural adjuvants and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

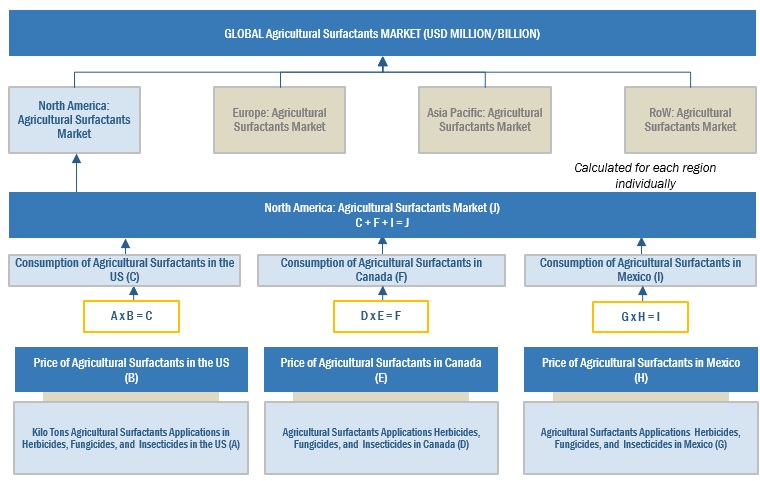

Agricultural Surfactants Market Size Estimation

The following approaches represent the overall market size estimation process employed for the purpose of this study.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

Top-down Approach:

- The key players in the industry and the market were identified through extensive secondary research.

- The revenues of major agricultural surfactant manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- Based on the market share analysis of key industry players from all regions, the final market size of the agricultural surfactants market has been arrived at.

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up Approach:

- Based on the share of agricultural surfactants for each application at regional and country levels, the market sizes were analyzed. Thus, with a bottom-up approach to the application at the country level, the global market for agricultural surfactants was estimated.

- Based on the demand for applications, offerings of key players, and the region-wise market share of major players, the global market for applications was estimated.

- Other factors considered include the penetration rate of agricultural surfactants, the demand for sustainable crop protection solutions, consumer awareness, functional trends, the adoption rate, patents registered, and organic & inorganic growth attempts.

- From this, market sizes for each region were derived.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural surfactants market were considered while estimating the market size.

- All parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

The following sections (bottom-up & top-down) (supply-demand) depict the overall market size estimation process employed for this study.

Agricultural Surfactants Market Data Triangulation

After arriving at the global market size from the estimation process explained above, the total market was split into various segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying a range of factors and trends from the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Agricultural Surfactants Market Definition

According to UPL, agricultural surfactants are activators that improve performance by enhancing surface contact, decreasing runoff, and improving leaf penetration. Non-ionic surfactants, anionic surfactants, and cationic surfactants are the three types of surfactants, with the first two being utilized on crops. Non-ionic surfactants lower the surface tension of water molecules, allowing droplets to cover a larger surface area of the leaf. Anionic surfactants, on the other hand, interact with water to improve foaming and spreading.

The University of Georgia states that ‘Surfactants are adjuvants that facilitate and accentuate the emulsifying, dispersing, spreading, wetting, or other surface modifying properties of liquids.’ There are different chemistries of agricultural surfactants such as Ethoxylated fatty amines (Cationic), Alkylphenol ethoxylate-based surfactants (non-ionic), Alcohol ethoxylate-based surfactants (non-ionic), and Silicone-Based Surfactants as proposed by USDA.

Stakeholders

- Manufacturers of pesticides, fertilizers, and other crop inputs

- Key manufacturers of surfactants

- Pesticide traders, distributors, and suppliers

- Raw material and intermediate traders and suppliers in the agricultural adjuvants market

- Manufacturers and suppliers related to seed treatment and the seeds industry

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

- Regulatory bodies such as

- US Food and Drug Administration (FDA)

- European Commission (EC)

- European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- United States Environmental Protection Agency (USEPA)

- Pest Management Regulatory Agency (PMRA)

- Government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Intermediary suppliers such as wholesalers and dealers

Report Objectives

Market Intelligence

- Determining and projecting the size of the agricultural surfactants market, with respect to type, application, substrate type, crop type, and region, over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for significant countries related to the market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- Impact of macro- and microeconomic factors on the market

- Shift in demand patterns across different subsegments and regions

Competitive Intelligence

- Identifying and profiling the key players in the global market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global agricultural surfactants market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Asia Pacific agricultural surfactants market into Singapore, Malaysia, Philippines, Thailand, and South Korea

- Further breakdown of the Rest of Europe's market into Netherlands, Denmark, Belgium, and Switzerland

- Further breakdown of the Rest of South America's market into Chile, Peru, and Ecuador

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Agricultural Surfactants Market

Does this report provide market numbers for Kenya?

Is market share analysis for Europe available ?