Insulation Products Market by Insulation Type (Thermal, Acoustic), Material Type (Mineral Wool, Polyurethane Foam, Flexible Elastomeric Foam), End Use (Building & Construction, Industrial, Transportation, Consumer) and Region - Global Forecast to 2026

Insulation Products Market

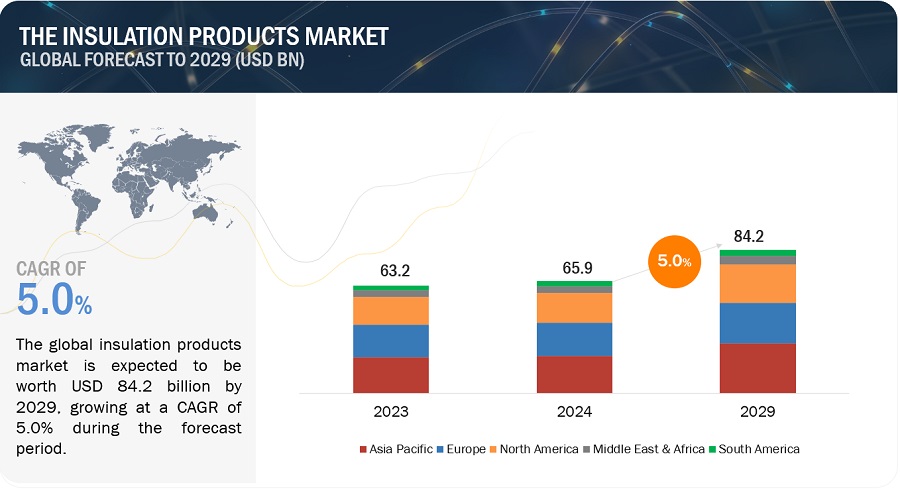

The global insulation products market was valued at USD 55.1 billion in 2021 and is projected to reach USD 71.7 billion by 2026, growing at a cagr 5.4% from 2021 to 2026. Growth in the transportation and consumer end use industries are increasing the demand for Insulation products. Increasing awareness of acoustic insulation in building & construction end use is also a key driver for the global market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Insulation products Market

The pandemic has impacted more than five billion people across the world, till April 2020. More than 100 countries were under complete or partial lockdown. Supply chain disruption and lockdown due to the pandemic have impacted the GDP of all major economies, such as Germany, the US, China, Japan, the UK, India, Italy, and France. Covid-19 pandemic led to production shutdown, lower demand from industrial sector for Insulation products during 1st and 2nd quarters of the 2020, but the industry has bounced back strongly in 2021 and is expected to achieve and exceed the pre-COVID-19 level in 2022. As a result, the demand for Insulation products is witnessing moderate growth after a decline in 2020.

The Insulation products market, by end use, was affected by COVID-19 due to restrictions on international travel, shutdown of tourism sector, halt in construction activities, and shutdown of most of the manufacturing plants. Countries like US, Germany, Italy, India, and France which always have a high demand for end use applications were severely affected by the pandemic resulting in a dip in the overall market in 2020 vs. 2019.

Insulation Products Market Dynamics

Driver: Building & Construction sector will lead the market growth during and post-COVID-19 pandemic

Over the recent past, Insulation products is gaining awareness in the building & construction sector across the globe. The trend of constructing energy efficient buildings has increased the demand for Insulation products between 2018 and 2021. Building & Construction is expected to continue to dominate the end use market with a market share of more than 35% throughout the forecast period. Increasing need of energy efficient goods and equipment, acoustic insulation in partitions and technical advancement of HVAC equipment in construction sector drives the demand for Insulation products

Large number of public transport vehicles adopting air-conditioned technology – The applications of insulation in the transportation sector include heat shields, battery insulation, fire protection, and insulation for data recorders. Fireproofing of bodywork and interiors is also a key part of vehicle safety. High-temperature insulation improves vehicle safety, supports advanced technological vehicle components, and extends the useful lifespan of vehicles.

Apart from this, COVID-19 vaccination drive is driving the growth of cold storage industry which in turn increases the demand for thermal insulation materials.

Restrain: Poorly mixed chemicals leading to health risk and ineffective insulation

One of the major concerns regarding insulation material is the emission of greenhouse gases during the manufacturing process. Polyurethane foam releases extremely harmful greenhouse gases, for instance, hydrochlorofluorocarbons (HCFC), which are significantly better than Chlorofluorocarbon (CFC) but still have an impact on the environment. The emission rates are highly monitored and standardized for PUF manufacturing. The plants are expected to do periodic checks and reduce the emission of hazardous air pollutants. In various developed countries, the use of methylene-chloride-based products is prohibited.

Challenges: Fluctuating raw material costs leading to pricing pressure on insulation manufacturers

Fluctuation in raw material prices of plastic foams is a major restraint in the growth of the Insulation products materials market. Plastic foams, such as polyurethane foams, and polystyrene foams, are crude oil-based products; and, thus, fluctuations in pricing and availability of crude oil is a major consideration in their production and use. The availability of crude oil-based products, such as polymers, and elastomers, depend on the import and production scenario of various countries. The prices of raw materials depend significantly on logistics (location of manufacturing), labor cost, trading cost, and tariffs.

The pandemic not only led to disruption of the supply chain and lower production, but it also resulted in higher freight costs and thereby higher raw material prices. These factors affect the growth of the market for Insulation products.

Opportunities: Stringent regulations mandating use of insulation materials for energy conservation

Countries globally have acknowledged the need for a proactive approach to tackling the rising global warming issue. Energy efficiency is not a new concept, but earlier, it was not as widely accepted as it is now., Industries are developing more efficient energy-conserving insulations for applications including building insulation and automobile insulation. The goal is not only to eliminate the loss of energy but also to reduce fuel consumption. Insulation is not only used for preventing energy loss, but it also leads to increased comfort and better safety measures. Europe and North America have made amendments in their building laws to enforce the use of insulation.

Insulation Products Market Ecosystem Diagram

To know about the assumptions considered for the study, download the pdf brochure

Mineral wool segment is projected to lead the Insulation products market from 2021 to 2026

Based on material type, the mineral wool-based Insulation products segment is expected to be the largest market for Insulation products. The growth can be attributed to the rising demand from the building & construction sector for insulation products with excellent thermal insulation and sound absorption properties.

The building & construction segment is estimated to be the largest end user of Insulation products

An HVAC system in building infrastructure has become a necessity as it plays a crucial role in maintaining air quality. It circulates the air, removes harmful particles or gases from air, and regulates the temperature according to the weather. Heating and cooling are two largest energy consumers in any building. The selection of an energy-efficient HVAC system for both heating and cooling is a necessity as it regulates the flow of air, heat, and ventilation in the buildings and helps in reducing energy bills and leading to energy savings to a large extent. The increase in construction of commercial offices, data centers, warehouses, institutional buildings, and SEZs across the globe, is increasing the demand for Insulation products market.

Asia-Pacific is estimated to be the fastest-growing region of the global Insulation products market

Asia Pacific is expected to be the fastest-growing region, for Insulation products in industrial segment, with a CAGR of 5.7% during the forecast period.

Asia Pacific is the third-largest market for Insulation products. In this report, the Asia-Pacific is segmented into China, Japan, India, South Korea, and Rest of Asia Pacific. It is the fastest-growing market for Insulation products because of the emerging economies such as India and China, which are growing rapidly. This growth and development are mainly attributed to the high economic growth rate in the region, followed by heavy investments across industries, such as building & construction and automotive.

Insulation Products Market Players

Key players such as Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), Knauf Insulation (US), Huntsman Corporation (US), Armacell International S.A. (Luxembourg), Johns Manville Corporation (US), Kingspan Group (Ireland), Soprema Group (France), Cellofoam International GmbH (Germany), Recticel NV/SA (Belgium), China Jushi Co. Ltd. (China), and Rogers Corporation (US) have adopted various strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the Insulation products market.

Insulation Products Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 55.1 billion |

|

Revenue Forecast in 2026 |

USD 71.7 billion |

|

CAGR |

5.4% |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Insulation Type, Material Type, End Use, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies covered |

Covestro AG (Germany), Owens Corning Corp. (US), Rockwool International A/S (Denmark), Saint-Gobain ISOVER (France), Knauf Insulation (US), Huntsman Corporation (US), Armacell International S.A. (Luxembourg), Johns Manville Corporation (US), Kingspan Group (Ireland), Soprema Group (France), Cellofoam International GmbH (Germany), Recticel NV/SA (Belgium), China Jushi Co. Ltd. (China), and Rogers Corporation (US) are the key players in the market. |

This research report categorizes the Insulation products market based on material type, end use, and region.

By Insulation Type

- Thermal

- Acoustic & others

By Material Type

- Mineral Wool

- Fiberglass

- Stone wool

- Polyurethane Foam (PUF)

- Flexible Elastomeric Foam (FEF)

- Other Insulations

By End Use

- Building & Construction

- Industrial

- Transportation

- Consumer

By Region

- North America

- Europe

- Asia Pacific

- Rest of the world

Recent Developments

- In July 2021, Owens Corning announced the acquisition of vliepa GmbH (Germany) which specializes in the coating, printing, finishing of nonwovens, paper and film for the building materials industry. The acquisition helps Owens Corning to serve the building and construction market in the European region.

- In February 2020, Parafon, the producer of stonewool based acoustic solutions has been acquired by Rockwool International AS to become a part of its Rockfon business. By acquiring this company, Rockfon is establishing its footmarks in northern Europe and nourishing stone wool with its excellent acoustic performance in order to enhance the range of consumers and segments.

- In January 2020, Covestro AG collaborated with Recticel NV/SA to develop mattresses from end-of-life mattresses. This collaboration aims at creating a circular economy in the polyurethane foam market that is expected to help both the companies in reducing the use of raw materials to produce polyurethane foams

Frequently Asked Questions (FAQ):

What are the major drivers influencing the growth of the Insulation products market?

Growing steel and aluminium industries in developing nations and Increasing awareness of acoustic insulation in building & construction end use drives the demand for Insulation products products.

What are the different type of Insulation products and how their demand varies?

Mineral wool, PUF, FEF, XPS, EPS, and Aerogel are the widely used Insulation products materials. Insulation products materials vary based on technical and physical parameters such as thermal conductivity, R-value, density, strength, and rigidity.

What are the major end use of Insulation products?

The major applications of Insulation products are building & construction, industrial, transportation, and end use.

What is the impact of COVID-19 pandemic on the Insulation products market?

The pandemic has impacted more than five billion people across the world, till April 2020. More than 100 countries were under complete or partial lockdown which severely impacted the Insulation products business globally. Supply chain disruption and lockdown due to the pandemic have impacted the GDP of all major economies, such as the Germany, US, Japan, the UK, India, Italy, and France. However, the Insulation products market is showing signs of recovery and is expected to grow at a moderate rate during the forecast period to cater to the demand.

What are the emerging trends in Insulation products manufacturers?

The insulation manufacturers are focusing on the development of new products with excellent insulation properties. For the same, the manufacturers have carried out strategic activities such as partnerships, joint ventures, and product developments to comply with the ever-changing demand from the customers and end use industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 INSULATION PRODUCTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 METHODOLOGY FOR “DEMAND-SIDE” SIZING OF INSULATION PRODUCTS MARKET

FIGURE 5 METHODOLOGY FOR “SUPPLY-SIDE” SIZING OF INSULATION PRODUCTS MARKET (1/2)

FIGURE 6 METHODOLOGY FOR “SUPPLY SIDE” SIZING OF INSULATION PRODUCTS MARKET (2/2)

2.3 DATA TRIANGULATION

FIGURE 7 INSULATION PRODUCTS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 MINERAL WOOL INSULATION PRODUCTS MARKET, BY MATERIAL TYPE

FIGURE 9 BUILDING & CONSTRUCTION TO ACCOUNT FOR LARGEST SHARE IN INSULATION PRODUCTS MARKET IN 2021

FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE IN INSULATION PRODUCTS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN INSULATION PRODUCTS MARKET

FIGURE 11 DEMAND FOR INSULATION PRODUCTS TO INCREASE IN ASIA PACIFIC DURING FORECAST PERIOD

4.2 INSULATION PRODUCTS MARKET, BY REGION

FIGURE 12 ASIA PACIFIC HELD LARGEST MARKET SIZE IN 2020

4.3 INSULATION PRODUCTS MARKET IN ASIA PACIFIC, BY MATERIAL TYPE AND COUNTRY

FIGURE 13 PUF AND CHINA ACCOUNTED FOR LARGEST SHARES OF INSULATION PRODUCTS MARKET IN ASIA PACIFIC

4.4 INSULATION PRODUCTS MARKET, BY REGION AND MATERIAL TYPE, IN 2020

FIGURE 14 MINERAL WOOL ACCOUNTED FOR LARGEST MARKET SHARE IN EUROPE

4.5 INSULATION PRODUCTS MARKET: MAJOR COUNTRIES

FIGURE 15 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN INSULATION PRODUCTS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing steel and aluminum industries in developing nations

TABLE 1 STEEL PRODUCTION, BY COUNTRY, 2020

5.2.1.2 Increasing awareness about acoustic insulation in building & construction industry

5.2.1.3 Increasing warehouse construction driving demand for quick-to-install insulation materials

5.2.2 RESTRAINTS

5.2.2.1 Toxic chemicals used as raw materials leading to health risks and ineffective insulation

5.2.2.2 Shrinking pipelines of new coal-based thermal power plants

5.2.3 OPPORTUNITIES

5.2.3.1 Various government schemes to boost manufacturing sector in Asia Pacific

5.2.3.2 Stringent regulations mandating use of insulation materials for energy conservation

5.2.4 CHALLENGES

5.2.4.1 High training costs associated with application engineers and contractors

5.2.4.2 Fluctuating raw material costs leading to pricing pressure on insulation manufacturers

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 INSULATION PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 INSULATION PRODUCTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT OF NEW ENTRANTS

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS OF INSULATION PRODUCTS MARKET

5.4.1 RAW MATERIAL SUPPLIERS

5.4.2 INSULATION PRODUCT MANUFACTURERS

5.4.3 INSULATION DISTRIBUTORS

5.4.4 INSULATION PRODUCT CONTRACTORS/CONVERTERS/CONSULTANTS

5.4.5 IMPACT OF COVID-19 ON VALUE CHAIN

5.4.5.1 Action plan against current vulnerability

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 INTRODUCTION

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

5.5.2 KEY STAKEHOLDERS IN BUYING PROCESS

TABLE 3 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USES (%)

5.5.3 BUYING CRITERIA

FIGURE 20 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 4 KEY BUYING CRITERIA FOR TOP 3 END USES

5.6 TECHNOLOGY ANALYSIS

5.6.1 AEROGEL

5.6.1.1 SOL-GEL process

5.6.1.2 Nano compositing

5.6.1.3 Supercritical drying

5.6.1.4 STELMOR process

5.7 CASE STUDY ANALYSIS

5.7.1 PYROTEK ACOUSTIC INSULATION FOR CINEMA HALL

5.7.2 STONE WOOL INSULATION SLAB USED ACROSS SALAMANDER STREET

5.7.3 A CASE STUDY ON AEROGEL BY HELIX ENERGY SOLUTIONS GROUP

5.7.4 A CASE STUDY ON ASPEN AEROGELS CONTRACT FOR PTT LNG INSULATION

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 APPROACH

5.8.3 DOCUMENT TYPE

FIGURE 21 GRANTED PATENTS ACCOUNTED FOR 35% OF ALL PATENTS BETWEEN 2018 AND 2020

TABLE 5 PATENT ANALYSIS, 2018–2021

FIGURE 22 PATENT PUBLICATION TREND FOR INSULATION PRODUCTS, 2018–2021

5.8.4 LEGAL STATUS OF PATENTS

FIGURE 23 LEGAL STATUS OF INSULATION PRODUCTS PATENTS

FIGURE 24 INSULATION PRODUCTS PATENT JURISDICTION ANALYSIS, 2018–2021

5.8.5 TOP APPLICANTS

FIGURE 25 KNAUF INSULATION SPRL REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2018 AND 2021

TABLE 6 PATENTS BY KNAUF INSULATION SPRL, 2018–2021

TABLE 7 PATENTS BY KINGSPAN GROUP, 2018–2021

TABLE 8 PATENTS BY COVESTRO LLC, 2018–2021

TABLE 9 PATENTS BY KNAUF INSULATION, 2018–2021

TABLE 10 PATENTS BY SAINT-GOBAIN ISOVER, 2018–2021

TABLE 11 PATENTS BY JOHNS MANVILLE CORPORATION, 2018–2021

TABLE 12 PATENTS BY HUNTSMAN INTERNATIONAL LLC, 2018–2021

5.9 AVERAGE SELLING PRICE

5.9.1 AVERAGE SELLING PRICE TREND

TABLE 13 PRICE ANALYSIS OF INSULATION MATERIALS

5.10 MACROECONOMIC INDICATORS

5.10.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

TABLE 14 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

5.11 IMPACT OF COVID-19

5.11.1 INTRODUCTION

5.11.2 COVID-19 HEALTH ASSESSMENT

FIGURE 26 COUNTRY-WISE SPREAD OF COVID-19

5.11.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 27 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.11.4 IMPACT ON CONSTRUCTION INDUSTRY

5.11.5 IMPACT ON AUTOMOTIVE INDUSTRY

5.12 INSULATION PRODUCTS MARKET ECOSYSTEM

FIGURE 28 INSULATION PRODUCTS MARKET ECOSYSTEM

5.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 15 INSULATION PRODUCTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 29 REVENUE SHIFT FOR INSULATION PRODUCTS MARKET

5.15 TRADE ANALYSIS

TABLE 16 STONE WOOL IMPORT TRADE DATA FOR TOP COUNTRIES, 2017–2021 (USD)

TABLE 17 STONE WOOL EXPORT TRADE DATA FOR TOP COUNTRIES, 2017–2021 (USD)

TABLE 18 EPDM IMPORT TRADE DATA FOR TOP COUNTRIES, 2017–2021 (USD)

TABLE 19 EPDM EXPORT TRADE DATA FOR TOP COUNTRIES, 2017–2021 (USD)

5.16 TARIFF AND REGULATIONS

5.16.1 EUROPE

5.16.2 NORTH AMERICA

6 INSULATION PRODUCTS MARKET, BY INSULATION TYPE (Page No. - 83)

6.1 INTRODUCTION

FIGURE 30 THERMAL INSULATION TO REMAIN LARGER SEGMENT DURING FORECAST PERIOD

TABLE 20 INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2016–2019 (USD MILLION)

TABLE 21 INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

6.2 THERMAL INSULATION

6.2.1 RISE IN DEMAND DUE TO DEVELOPMENT OF GREEN BUILDINGS

TABLE 22 THERMAL INSULATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 THERMAL INSULATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 ACOUSTIC INSULATION

6.3.1 INCREASING DEMAND FOR ACOUSTIC INSULATION IN DEVELOPING NATIONS

TABLE 24 ACOUSTIC INSULATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 ACOUSTIC INSULATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 INSULATION PRODUCTS MARKET, BY MATERIAL TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 31 PUF EXPECTED TO GAIN MARKET SHARE DURING FORECAST PERIOD

TABLE 26 INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 27 INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

7.2 MINERAL WOOL

7.2.1 RISE IN DEMAND FOR COST-EFFECTIVE AND ENERGY-EFFICIENT BUILDINGS TO SUPPORT MARKET GROWTH

TABLE 28 MINERAL WOOL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 MINERAL WOOL MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 30 NORTH AMERICA: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 31 NORTH AMERICA: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 32 EUROPE: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 33 EUROPE: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 34 ASIA PACIFIC: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 35 ASIA PACIFIC: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 36 ROW: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 37 ROW: MINERAL WOOL MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.2.2 FIBERGLASS

7.2.3 STONE WOOL

7.3 POLYURETHANE FOAM (PUF)

7.3.1 INCREASING DEMAND FOR BIO-BASED PUF TO BOOST MARKET

TABLE 38 PUF MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 PUF MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: PUF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: PUF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 42 EUROPE: PUF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 EUROPE: PUF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 44 ASIA PACIFIC: PUF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 45 ASIA PACIFIC: PUF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 46 ROW: PUF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 ROW: PUF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.4 FLEXIBLE ELASTOMERIC FOAM (FEF)

7.4.1 INCREASING USAGE OF HVAC SYSTEMS TO DRIVE DEMAND FOR FEF

TABLE 48 FEF MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 FEF MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: FEF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 51 NORTH AMERICA: FEF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 52 EUROPE: FEF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 EUROPE: FEF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: FEF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 ASIA PACIFIC: FEF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 56 ROW: FEF MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 57 ROW: FEF MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.4.2 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

7.4.3 NITRILE BUTADIENE RUBBER (NBR)

7.4.4 POLYETHYLENE INSULATION (PE)

7.5 OTHERS

TABLE 58 OTHERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 OTHERS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: OTHERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: OTHERS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 62 EUROPE: OTHERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 EUROPE: OTHERS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: OTHERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: OTHERS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 66 ROW: OTHERS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 67 ROW: OTHERS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.5.1 EXTRUDED POLYSTYRENE INSULATION (XPS)

7.5.2 EXPANDED POLYSTYRENE INSULATION (EPS)

7.5.3 AEROGEL

7.5.4 OTHERS

8 INSULATION PRODUCTS MARKET, BY END-USE INDUSTRY (Page No. - 107)

8.1 INTRODUCTION

FIGURE 32 BUILDING & CONSTRUCTION TO LEAD INSULATION PRODUCTS MARKET

TABLE 68 INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 69 INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

8.2 BUILDING & CONSTRUCTION

8.2.1 RISE IN DEMAND FOR ENERGY-EFFICIENT BUILDINGS DRIVING BUILDING & CONSTRUCTION SEGMENT

TABLE 70 INSULATION PRODUCTS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 INSULATION PRODUCTS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2020–2026 (USD MILLION)

8.3 INDUSTRIAL

8.3.1 HIGH DEMAND FOR INSULATION IN PROCESS INDUSTRY PROPELLING SEGMENT GROWTH

TABLE 72 INSULATION PRODUCTS MARKET SIZE IN INDUSTRIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 INSULATION PRODUCTS MARKET SIZE IN INDUSTRIAL, BY REGION, 2020–2026 (USD MILLION)

8.3.2 REFRIGERATION

8.3.3 OIL & PETROCHEMICAL

8.3.4 FOOD PROCESSING

8.3.5 POWER GENERATION & OTHERS

8.4 TRANSPORTATION

8.4.1 INCREASING USE OF INSULATION PRODUCTS FOR HIGH-TEMPERATURE TRANSPORT EQUIPMENT

TABLE 74 INSULATION PRODUCTS MARKET SIZE IN TRANSPORTATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 INSULATION PRODUCTS MARKET SIZE IN TRANSPORTATION, BY REGION, 2020–2026 (USD MILLION)

8.4.2 AEROSPACE & DEFENSE

8.4.3 AUTOMOTIVE

8.4.4 OTHER TRANSPORTATION

8.5 CONSUMER GOODS

8.5.1 ASIA PACIFIC LED INSULATION PRODUCTS MARKET IN CONSUMER END-USE INDUSTRY IN 2020

TABLE 76 INSULATION PRODUCTS MARKET SIZE IN CONSUMER GOODS, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 INSULATION PRODUCTS MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

9 INSULATION PRODUCTS MARKET, BY REGION (Page No. - 116)

9.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC TO LEAD INSULATION PRODUCTS MARKET BETWEEN 2021 AND 2026

TABLE 78 INSULATION PRODUCTS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 INSULATION PRODUCTS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: INSULATION PRODUCTS MARKET SNAPSHOT

TABLE 80 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 81 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 83 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2016–2019 (USD MILLION)

TABLE 85 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 NORTH AMERICA: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

9.2.1 US

9.2.1.1 High demand for insulation to support market growth

TABLE 88 US: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 89 US: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Second-largest consumer of insulation products in North America

TABLE 90 CANADA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 91 CANADA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Clean energy initiative to propel market growth

TABLE 92 MEXICO: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 93 MEXICO: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3 EUROPE

FIGURE 35 EUROPE: INSULATION PRODUCTS MARKET SNAPSHOT

TABLE 94 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 95 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 96 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 97 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 98 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 99 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 100 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2016–2019 (USD MILLION)

TABLE 101 EUROPE: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

9.3.1 FRANCE

9.3.1.1 Transition to clean economy using renewable energy to boost demand for insulation products

TABLE 102 FRANCE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 103 FRANCE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3.2 RUSSIA

9.3.2.1 Growth of industrial sector fueling demand in major end-use industries

TABLE 104 RUSSIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 105 RUSSIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3.3 GERMANY

9.3.3.1 Investments in chemical and petrochemical industry driving market

TABLE 106 GERMANY: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 107 GERMANY: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Growing investments in petrochemical industry fueling demand for insulation products

TABLE 108 ITALY: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 109 ITALY: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3.5 UK

9.3.5.1 Commercial building sector to exhibit growth

TABLE 110 UK: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 111 UK: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 112 REST OF EUROPE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 113 REST OF EUROPE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.4 ASIA PACIFIC

TABLE 114 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 117 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 119 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2016–2019 (USD MILLION)

TABLE 121 ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Rapid economic growth augmenting market growth

TABLE 122 CHINA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 123 CHINA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Development in power and energy sector to propel market

TABLE 124 JAPAN: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 125 JAPAN: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Growing urban population to drive market in commercial building sector

TABLE 126 INDIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 127 INDIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Increase in export of electronics propelling consumption of insulation products

TABLE 128 SOUTH KOREA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 129 SOUTH KOREA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 130 REST OF ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.5 REST OF WORLD (ROW)

TABLE 132 ROW: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 133 ROW: INSULATION PRODUCTS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 134 ROW: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 135 ROW: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

TABLE 136 ROW: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 137 ROW: INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 138 ROW: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2016–2019 (USD MILLION)

TABLE 139 ROW: INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

9.5.1 SAUDI ARABIA

9.5.1.1 Government energy efficiency programs driving demand for insulation products

TABLE 140 SAUDI ARABIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 141 SAUDI ARABIA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.5.2 AFRICA

9.5.2.1 Growth of construction sector fueling demand for insulation products

TABLE 142 AFRICA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 143 AFRICA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.5.3 UAE

9.5.3.1 Demand in major end-use industries boosting market growth

TABLE 144 UAE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 145 UAE: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.5.4 BRAZIL

9.5.4.1 Increasing demand for polyurethane foam to drive market

TABLE 146 BRAZIL: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 147 BRAZIL: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

9.5.5 REST OF SOUTH AMERICA, MIDDLE EAST & AFRICA (REST OF SA, MEA)

9.5.5.1 Economic growth and growing infrastructure driving end-use industries

TABLE 148 REST OF SA, MEA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2016–2019 (USD MILLION)

TABLE 149 REST OF SA, MEA: INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 150)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

FIGURE 36 INSULATION PRODUCTS MARKET EVALUATION FRAMEWORK, 2018–2022

10.3 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 150 OVERVIEW OF STRATEGIES ADOPTED BY INSULATION PRODUCTS MANUFACTURERS

10.4 MARKET SHARE ANALYSIS

10.4.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 37 RANKING OF TOP FIVE PLAYERS IN INSULATION PRODUCTS MARKET, 2020

10.4.2 MARKET SHARE OF KEY PLAYERS

TABLE 151 INSULATION PRODUCTS MARKET: DEGREE OF COMPETITION

FIGURE 38 COVESTRO AG IS LEADING INSULATION PRODUCTS MARKET

10.4.2.1 Covestro AG

10.4.2.2 Saint-Gobain ISOVER

10.4.2.3 Owens Corning

10.4.2.4 Knauf Insulation

10.4.2.5 Rockwool International A/S

FIGURE 39 REVENUE ANALYSIS OF LEADING PLAYERS

TABLE 152 REVENUE ANALYSIS OF LEADING PLAYERS (USD MILLION)

10.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 153 INSULATION PRODUCTS MARKET: MATERIAL TYPE FOOTPRINT

TABLE 154 INSULATION PRODUCTS MARKET: REGION TYPE FOOTPRINT

10.6 COMPANY EVALUATION MATRIX (TIER 1)

10.6.1 TERMINOLOGY/NOMENCLATURE

10.6.1.1 Stars

10.6.1.2 Emerging Leaders

10.6.1.3 Pervasive

10.6.1.4 Participants

FIGURE 40 COMPANY EVALUATION MATRIX FOR INSULATION PRODUCTS MARKET

10.7 START-UPS/ SMES EVALUATION MATRIX

10.7.1 TERMINOLOGY/ NOMENCLATURE

10.7.1.1 Progressive companies

10.7.1.2 Responsive companies

10.7.1.3 Dynamic companies

10.7.1.4 Starting blocks

FIGURE 41 START-UP/ SMES EVALUATION MATRIX FOR INSULATION PRODUCTS MARKET

10.8 COMPETITIVE SITUATIONS AND TRENDS

10.8.1 NEW PRODUCT LAUNCHES

TABLE 155 INSULATION PRODUCTS MARKET: NEW PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2022

10.8.2 DEALS

TABLE 156 INSULATION PRODUCTS MARKET: DEALS, JANUARY 2018–JANUARY 2022

10.8.3 OTHER DEVELOPMENTS

TABLE 157 INSULATION PRODUCTS MARKET: OTHER DEVELOPMENTS, JANUARY 2018–JANUARY 2022

11 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

11.1 KEY PLAYERS

11.1.1 COVESTRO AG

TABLE 158 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 42 COVESTRO AG: COMPANY SNAPSHOT

TABLE 159 COVESTRO AG: PRODUCT LAUNCHES

TABLE 160 COVESTRO AG: DEALS

TABLE 161 COVESTRO AG: OTHER DEVELOPMENTS

11.1.2 SAINT-GOBAIN ISOVER

TABLE 162 SAINT-GOBAIN ISOVER: BUSINESS OVERVIEW

TABLE 163 SAINT-GOBAIN ISOVER: DEALS

11.1.3 OWENS CORNING

TABLE 164 OWENS CORNING: BUSINESS OVERVIEW

FIGURE 43 OWENS CORNING: COMPANY SNAPSHOT

TABLE 165 OWENS CORNING: PRODUCT LAUNCHES

TABLE 166 OWENS CORNING: DEALS

TABLE 167 OWENS CORNING: OTHER DEVELOPMENTS

11.1.4 KNAUF INSULATION

TABLE 168 KNAUF INSULATION: BUSINESS OVERVIEW

TABLE 169 KNAUF INSULATION: OTHER DEVELOPMENTS

11.1.5 ROCKWOOL INTERNATIONAL A/S

TABLE 170 ROCKWOOL INTERNATIONAL A/S: BUSINESS OVERVIEW

FIGURE 44 ROCKWOOL INTERNATIONAL A/S: COMPANY SNAPSHOT

TABLE 171 ROCKWOOL INTERNATIONAL A/S: PRODUCT LAUNCHES

TABLE 172 ROCKWOOL INTERNATIONAL A/S: DEALS

TABLE 173 ROCKWOOL INTERNATIONAL A/S: OTHER DEVELOPMENTS

11.1.6 KINGSPAN GROUP

TABLE 174 KINGSPAN GROUP: BUSINESS OVERVIEW

FIGURE 45 KINGSPAN GROUP: COMPANY SNAPSHOT

TABLE 175 KINGSPAN GROUP: DEALS

TABLE 176 KINGSPAN GROUP: OTHER DEVELOPMENTS

11.1.7 ARMACELL INTERNATIONAL S.A.

TABLE 177 ARMACELL INTERNATIONAL S.A.: BUSINESS OVERVIEW

FIGURE 46 ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

TABLE 178 ARMACELL INTERNATIONAL S.A.: PRODUCT LAUNCHES

TABLE 179 ARMACELL INTERNATIONAL S.A.: DEALS

11.1.8 HUNTSMAN CORPORATION

TABLE 180 HUNTSMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 47 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 181 HUNTSMAN CORPORATION: PRODUCT LAUNCHES

TABLE 182 HUNTSMAN CORPORATION: DEALS

TABLE 183 HUNTSMAN CORPORATION: OTHER DEVELOPMENTS

11.1.9 JOHNS MANVILLE CORPORATION

TABLE 184 JOHNS MANVILLE CORPORATION: BUSINESS OVERVIEW

TABLE 185 JOHNS MANVILLE CORPORATION: PRODUCT LAUNCHES

TABLE 186 JOHNS MANVILLE CORPORATION: DEALS

TABLE 187 JOHNS MANVILLE CORPORATION: OTHER DEVELOPMENTS

11.1.10 URSA INSULATION S.A.

TABLE 188 URSA INSULATION S.A.: BUSINESS OVERVIEW

11.1.11 BASF SE

TABLE 189 BASF SE: BUSINESS OVERVIEW

FIGURE 48 BASF SE: COMPANY SNAPSHOT

TABLE 190 BASF SE: PRODUCT LAUNCH

11.1.12 CHINA JUSHI CO., LTD.

TABLE 191 CHINA JUSHI CO., LTD.: BUSINESS OVERVIEW

TABLE 192 CHINA JUSHI CO., LTD.: PRODUCT LAUNCHES

TABLE 193 CHINA JUSHI CO., LTD.: OTHER DEVELOPMENTS

11.1.13 ROGERS CORPORATION

TABLE 194 ROGERS CORPORATION: BUSINESS OVERVIEW

FIGURE 49 ROGERS CORPORATION: COMPANY SNAPSHOT

TABLE 195 ROGERS CORPORATION: PRODUCT LAUNCHES

TABLE 196 ROGERS CORPORATION: DEALS

TABLE 197 ROGERS CORPORATION: OTHER DEVELOPMENTS

11.1.14 RECTICEL NV/SA

TABLE 198 RECTICEL NV/SA: BUSINESS OVERVIEW

FIGURE 50 RECTICEL NV/SA: COMPANY SNAPSHOT

TABLE 199 RECTICEL NV/SA: DEALS

11.1.15 ASPEN AEROGELS, INC.

TABLE 200 ASPEN AEROGELS, INC.: BUSINESS OVERVIEW

FIGURE 51 ASPEN AEROGELS, INC.: COMPANY SNAPSHOT

TABLE 201 ASPEN AEROGELS, INC.: DEALS

11.2 OTHER PLAYERS

11.2.1 NANO TECH CO. LTD.

TABLE 202 NANO TECH CO. LTD.: BUSINESS OVERVIEW

11.2.2 MORGAN ADVANCED MATERIALS PLC

TABLE 203 MORGAN ADVANCED MATERIALS PLC: BUSINESS OVERVIEW

FIGURE 52 MORGAN ADVANCED MATERIALS PLC: COMPANY SNAPSHOT

11.2.3 GAF MATERIALS CORPORATION

TABLE 204 GAF MATERIALS CORPORATION: BUSINESS OVERVIEW

11.2.4 CELLOFOAM INTERNATIONAL GMBH

TABLE 205 CELLOFOAM INTERNATIONAL GMBH: BUSINESS OVERVIEW

TABLE 206 CELLOFOAM INTERNATIONAL GMBH: PRODUCT LAUNCHES

11.2.5 WINCELL

TABLE 207 WINCELL: BUSINESS OVERVIEW

11.2.6 L’ISOLANTE K’FLEX S.P.A

TABLE 208 L’ISOLANTE K-FLEX S.P.A: BUSINESS OVERVIEW

TABLE 209 L’ISOLANTE K-FLEX S.P.A: OTHER DEVELOPMENTS

11.2.7 HIRA INDUSTRIES LLC

TABLE 210 HIRA INDUSTRIES LLC: BUSINESS OVERVIEW

11.2.8 AEROFLEX COMPANY LIMITED

TABLE 211 AEROFLEX COMPANY LIMITED: BUSINESS OVERVIEW

11.2.9 SOPREMA GROUP

TABLE 212 SOPREMA GROUP: BUSINESS OVERVIEW

TABLE 213 SOPREMA GROUP: OTHER DEVELOPMENTS

11.2.10 ATLAS ROOFING CORPORATION

TABLE 214 ATLAS ROOFING CORPORATION: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 236)

12.1 INTRODUCTION

12.2 LIMITATION

12.3 ACOUSTIC INSULATION MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.4 ACOUSTIC INSULATION MARKET, BY REGION

TABLE 215 ACOUSTICS INSULATION MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 216 ACOUSTIC INSULATION MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

12.4.1 ASIA PACIFIC

12.4.1.1 By country

TABLE 217 ASIA PACIFIC: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 218 ASIA PACIFIC: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 219 ASIA PACIFIC: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 220 ASIA PACIFIC: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.2 EUROPE

12.4.2.1 By country

TABLE 221 EUROPE: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 222 EUROPE: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 223 EUROPE: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 224 EUROPE: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 NORTH AMERICA

12.4.3.1 By country

TABLE 225 NORTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 226 NORTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 227 NORTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 228 NORTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.4 MIDDLE EAST & AFRICA

12.4.4.1 By country

TABLE 229 MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 230 MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 231 MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 232 MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.5 SOUTH AMERICA

12.4.5.1 By country

TABLE 233 SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 234 SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 235 SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 236 SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

13 APPENDIX (Page No. - 246)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities for estimating the current size of the global Insulation products market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The COVID-19 pandemic impact on the demand with respect to application areas and countries were comprehended. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Insulation products market through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Insulation products market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the Insulation products market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

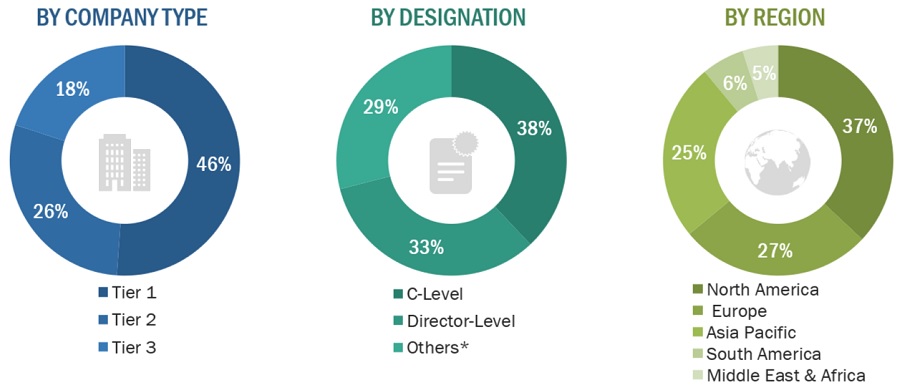

Various primary sources from both the supply and demand sides of the Insulation products market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the Insulation products industry. The primary sources from the demand side included key executives from end-use industries. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global Insulation products market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- Impact of COVID-19 pandemic was ascertained

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the Insulation products market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the Insulation products market in terms of value, based on material type, end use, and region

- To project the size of the market and its segments with respect to the regions, namely, North America, Europe, Asia Pacific, and Rest of the world

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the Insulation products market with respect to COVID-19 pandemic impact, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the Insulation products market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the Insulation products report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the Insulation products market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insulation Products Market