IoT Sensors Market by Sensor Type (Pressure, Temperature, Humidity, Image, Inertial, Gyroscope, Touch), Network Technology (Wired and Wireless), Vertical (Commercial IoT and Industrial IoT) and Region - Global Forecast to 2029

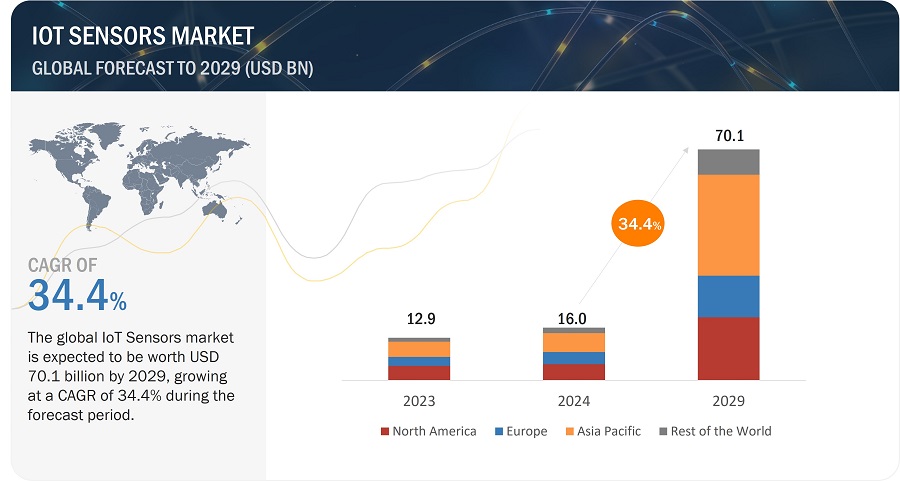

[269 Pages Report] The LoT Sensors Market is expected to grow from USD 16.0 billion in 2024 to USD 70.1 Billion by 2029; it is expected to grow at a CAGR of 34.4% during 2024 to 2029. Rising demand for connected and wearable devices are the key factors driving the growth of the IoT sensors market. The growing adoption of wearable devices, including fitness bands, smartwatches, smart glasses, EEG monitors, and pain management devices, is primarily driven by the healthcare sector.

IoT Sensors Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

IoT Sensors Market Dynamics

Driver: Higher adoption of IPv6

The Internet Protocol (IP), a more flexible, reliable, and scalable protocol than the Network Control Protocol (NCP), was introduced for routing data between networks or hosts. There are two versions of IP: IPv4 and IPv6. IPv6 is the evolutionary development of IP. It uses a 32-bit address scheme, allowing for over 4 billion addresses. With the growing number of Internet users, the number of unused IPv4 addresses is likely to be exhausted because all devices, including computers, smartphones, and gaming consoles, that connect to the internet require an IP address. Hence, IPv6 was introduced to fulfill the need for more internet addresses. IPv6 is designed to allow the internet to grow steadily in terms of the number of hosts connected and the total amount of data traffic transmitted. The adoption of IPv6 has boosted the IoT market as IPv6 utilizes 128-bit Internet addresses. It provides around 2,128 unique addresses, which are more than sufficient to fulfill the requirements of present and future communication devices.

Restraint: Data security concerns

With the emergence of new technologies, data intrusions are also increasing rapidly. IoT platforms are newly developed, and there is a lack of security standards. This is a major hindrance to the growth of the IoT sensors market because enterprise data security is paramount while developing analytics solutions for several vertical-specific applications. Moreover, many data security standards need to be followed to analyze large-scale data. Failing to adhere to these standards could result in data tampering and raise doubts about the authenticity of results generated via the analytics platform being used. In the IoT ecosystem, data is generated from machines and humans; when it comes to personal data such as patient details or financial details, security is a top priority that cannot be compromised.

Opportunity: Cross domain collaboration across businesses

IoT offers an exponential growth opportunity for organizations and businesses to adapt to technological trends and innovations. Cross-domain collaborations and new business models are of utmost importance to realize the full potential of IoT and become successful in the IoT market. For instance, in March 2015, NEXCOM International (Taiwan) developed 6 IoT applications—IoT robotics, Industry 4.0, connected cars, responsive stores, medical informatics, and security—in the industry. Opening 6 different market segments within the IoT ecosystem allowed the company to target a wide range of IoT applications.

Challenge: Lack of common protocol and communication standards

It is necessary to define common protocols or communications standards to enable smart devices to communicate with each other, share data, or form an intelligent network. Interoperability and easy exchange of information between the connected devices is of utmost importance for the further growth of IoT, which would drive the demand for semiconductor chips. The current technical scenario of IoT does not provide any architectural solution or a universal standard to solve the interoperability issue. A universal standard is required in either connectivity type, data formatting, or protocol.

IoT Sensors Market Map:

Inertial sensors channel to capture the second largest market growth of the IoT sensors market during the forecast period.

An inertial sensor is a combination of the accelerometer and gyroscope functionality. These sensors are used to detect and measure acceleration, tilt, shock, vibration, rotation, and multiple degrees of freedom motions. They are used in the marine, automotive, military, aviation, wearable, consumer, medical, and automotive industries. They are useful in geoengineering, condition monitoring, and navigation.

Ethernet to have largest market size in Wired network technology during the forecast period.

Ethernet, or 802.3, is a network protocol that controls data transmission over the local area network (LAN). For the past two decades, Ethernet has had a major influence on nearly every aspect of communication systems and networking. Initially, it was used in LAN, but now it is used in most WANs too. Ethernet is cost-effective and is popular for emerging applications, such as video transport and storage area networks.

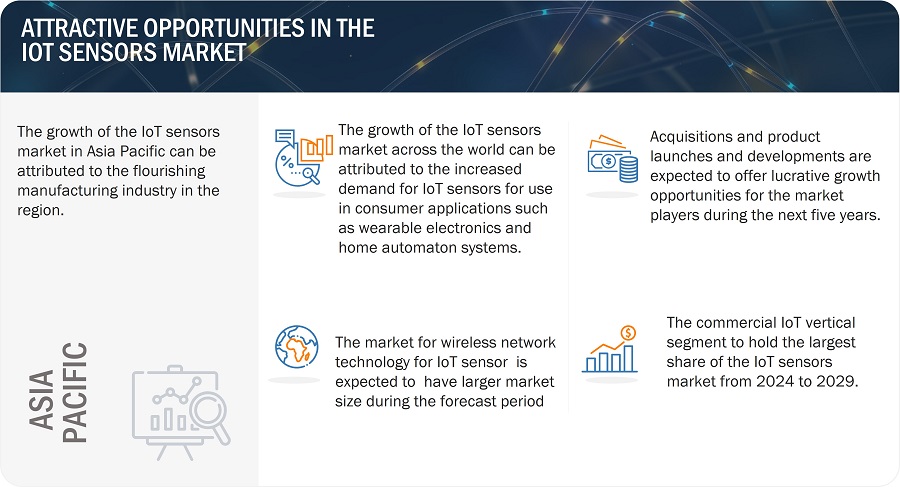

The IoT sensors market in APAC to have largest market szie during the forecast period

India, China, Japan, South Korea, and Australia are key contributors to the growth and development of the IoT sensors market in Asia Pacific. The growing penetration of the Internet across commercial and residential spaces, along with a broadening consumer base, increasing disposable income of the masses, and improving IT infrastructures are some key determinants supplementing the growth of the IoT sensors market in Asia Pacific. The surging adoption of cloud-based services and the prevailing trend of industrial automation are the key drivers fueling the growth of the IoT sensors market in China, South Korea, Japan, and India.

IoT Sensors Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the IoT sensors companies are Texas Instrument (US), TE Connectivity(Switzerland), Broadcom(US), NXP Semiconductors(Netherlands), STMicroelectronics (Switzerland), Bosch Sensortec (Germany), TDK Corporation (Japan), Infineon Technologies AG (Germany), Analog Devices(US), and Omron Corporation (Japan).

IoT Sensors Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 16.0 billion in 2024 |

|

Projected Market Size |

USD 70.1 billion by 2029 |

|

Growth Rate |

CAGR of 34.4% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Thousand/Million/Billion |

|

Segments Covered |

By Sensors Type, By Network Technology, By Vertical and By Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and the Rest of the World |

|

Companies covered |

The key players operating in the IoT sensors market are Texas Instruments (US), TE Connectivity (Switzerland), Broadcom (US), NXP Semiconductors (Netherlands), STMicroelectronics NV (Switzerland), Bosch Sensortec (Germany), TDK Corporation (Japan), Infineon Technologies (Germany), Analog Devices (US), Omron Corporation (Japan), Sensirion (Switzerland), Honeywell International (US), Siemens AG (Germany), Knowles Corporation (US), ABB Ltd. (Switzerland), Sensata Technologies (US), Emerson Electric Co. (US), Teledyne Technologies (US), SmartThings Inc. (US), Monnit Corporation (US), Murata Manufacturing Co., (Japan), Figaro Engineering Inc. (Japan), Trafag AG (Switzerland), NIDEC COPAL ELECTRONICS (Japan), and KITA SENSOR TECH. CO., LTD. (Taiwan). |

IoT Sensors Market Highlights

This report categorizes the IoT sensors market based on the sensor type, Network Technology, Vertical, and region.

|

Segment |

Subsegment |

|

By Sensor Type |

|

|

By Network Technology |

|

|

By Vertical |

|

Recent Developments

- In November 2023, NXP Semiconductor collaborated with Zendar to accelerate and improve high-resolution radar solutions for autonomous driving (AD) and advanced driver assistance systems (ADAS) to complement NXP’s leading scalable radar portfolio.

- In August 2023, Texas Instruments Incorporated introduced the TMCS1123 Hall-effect current sensor with a simple design and precision for high-voltage applications. It has the industry's most robust reinforced isolation and superior accuracy throughout various temperatures and lifetimes.

- In February 2023, Bosch Sensortec announced the BMA530 and BMA580, one of the world's smallest MEMS accelerometers. BMA530 tracks activities with its step counter and is especially suitable for wearables, and BMA580 targets with voice activity detection.

- In February 2023, TE Connectivity collaborated with Preddio Technologies to monitor equipment of all sizes and to increase their efficiency through real-time data analysis. This collaboration allowed them to find solutions combining digital sensors, wireless technology, edge gateway, cloud software, and analytics.

Critical questions answered by this report:

How big is IoT Sensors Market?

The market for IoT Sensors was valued at USD 70.1 billion in 2029. Growth of Internet penetration rate are propelling the demand for IoT Sensors across different verticals during forecast period.

Are IoT Sensors in Demand?

Factors such as increasing use of sensors in IoT applications due to cost and size reduction, and technological advancement, and high adoption of IoT Sensors in industrial, and consumer vertical will further drive the demand for the sensors.

What are the various verticals of IoT sensors market?

Verticals include consumer, commercial, and industrial. The commercial vertical to showcase the highest CAGR growth during the forecast period.

What are the various sensor types available in IoT sensors?

The various sensor types are Temperature Sensor, Pressure Sensor, Humidity Sensor, Flow Sensor, Accelerometer, Magnetometer, Gyroscope, Inertial Sensor, Image Sensor, Touch Sensor, Proximity Sensor, Acoustic Sensor, Motion Sensor, Occupancy Sensor, CO2 Sensor, and Others

Who is the Leader in IoT sensors market?

Texas Instruments (US) is one of the key player in the of IoT sensors market. The company is the leading provider of IoT sensors globally, relying on its R&D capabilities and balanced product portfolio.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

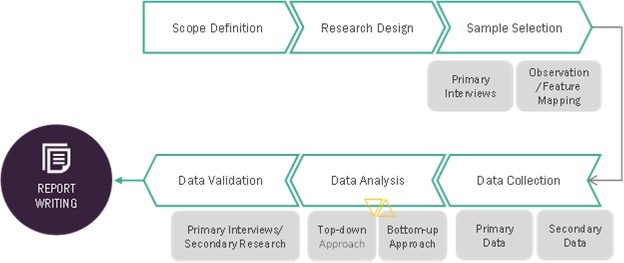

The study involved four major activities in estimating the size of the IoT sensors market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Secondary sources that were referred to for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles from recognized authors; directories; and databases. Secondary data was collected and analyzed to arrive at the overall market size, further validated by primary research.

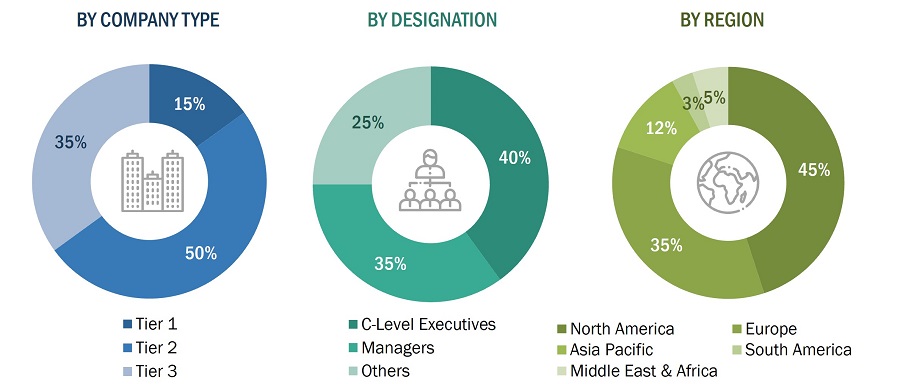

Primary Research

Extensive primary research was conducted after understanding and analyzing the IoT sensors market scenario through the secondary research process. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Asia Pacific, Europe, and RoW (including the Middle East & Africa and South America).

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list key information/insights. The research methodology used to estimate the market size includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand-and supply-side. Along with this, the market has been validated using both top-down and bottom-up approaches.

IoT sensors Market Top-down Approach

Data Triangulation

After arriving at the overall market size through the process explained earlier, the total market was split into several segments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market was validated using both the top-down and bottom-up approaches.

Market Definition

IoT sensors refer to sensors used in smart applications, which require uninterrupted connectivity to carry out real-time data analytics. They require common connecting platforms for collecting and analyzing data. IoT sensors are based on the computing concept that considers every physical object to be connected to the Internet to communicate with each other. Sensors are the most important component in the IoT ecosystem. They gather required data from their surroundings and communicate it to the concerned operators. Image, temperature, pressure, ultrasonic, light, and position sensors, accelerometers, and gyroscopes are the key sensors in the IoT ecosystem.

Key Stakeholders

- Semiconductor Companies

- Embedded System Companies

- Consumer Electronics Manufacturers

- Sensor Manufacturers

- Technology Providers

- Original Equipment Manufacturers (OEMs)

- Universities and Research Organizations

- Internet Identity Management, Privacy, and Security Companies

- Machine-to-Machine (M2M), IoT, and Telecommunication Companies

- Government Bodies

Report Objectives

- To describe and forecast the size of the Internet of Things (IoT) sensors market in terms of value, based sensor type, network technology, vertical, and region

- To forecast the market size, in terms of value, for various segments in four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To forecast the size of the IoT sensors market in terms of volume

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the IoT sensors market

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

-

To analyze the opportunities in the market for various stakeholders by identifying the

high-growth segments of the IoT sensors market - To profile the key players and comprehensively analyze their market ranking and core competencies2, along with a detailed competitive landscape for the market leaders.

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments, such as product launches and developments, partnerships, collaborations, and acquisitions undertaken in the market.

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT Sensors Market

We are interested in the thermopile part of the market. Do you have any information of companies like Heimann ad Excelitas in the report?

We provide need to IoT solutions including sensor manufacturer and are interested in the predicted market demand

I am new researcher in field of IoT. I am looking for suitable sensor and free sample for investigating.

I am looking for the market that meet needs to be our market driven. Then, I want to know which kind of IoT sensor has potential market size and to match the technology what we have.

I am interested in getting some clarity around the non-SCADA, non-IoT IoT, sensor marketplace. Retrofit, crossover, and emerging light industrial. is this addressed in your report?

I would like to have an overview of this report for a task I'm conducting on Power Solutions for IoT devices, current and future trends, especially in the field of energy management.

Looking for a market share of IoT sensors especially for use in remote areas such as Mining, Energy, Agriculture etc..

We are currently building an application that entails some IoT elements and we want to better understand the IoT Sensor Market and the Global Forecast to understand what the future holds for the Africa market

As an enterprise architect, intelligent edge solutions also come under my solution port. Therefore, such market intelligence is essential for me

Hi, My company is a "start-up" in segment of IoT Sensor with focus in Temperature and Humidity Sensors and Energy Sensors. I want access to the article to better understand it market and how it will expand in next years.

Hello! I am doing some research on the sensor market. I would appreciate your time to clarify any details you shared on the report. Just a heads up that I am out of the country for travel so please contact me via email.

We are seeking to expand our portfolio of IoT solutions and would like to get a brief overview as to who are the key players in this market.

Hello! I am looking to do research on the IoT sensors market for supply chain management. This report looks very useful.

When you say 'market will USD 38 BN', please explain its scope are also. Is it include entire IoT sensor ecosystem or just devices, applications, and services? You get the drift.

We do have unbalanced sensors manufacturing in Russia. It is interesting to see where the rest of the world is going for this market.

Research in the field of ultra-low power chips for IoT sensor nodes (www.green-ic.org), with an interest to start-up a company in this space.