Management Decision Market by Offering, Vertical (BFSI, Retail & Consumer Goods, Telecom, IT & ITeS, Healthcare & Lifesciences, Manufacturing, Government, Transportation & Logistics, Energy & Utilities), Application and Region - Global Forecast to 2028

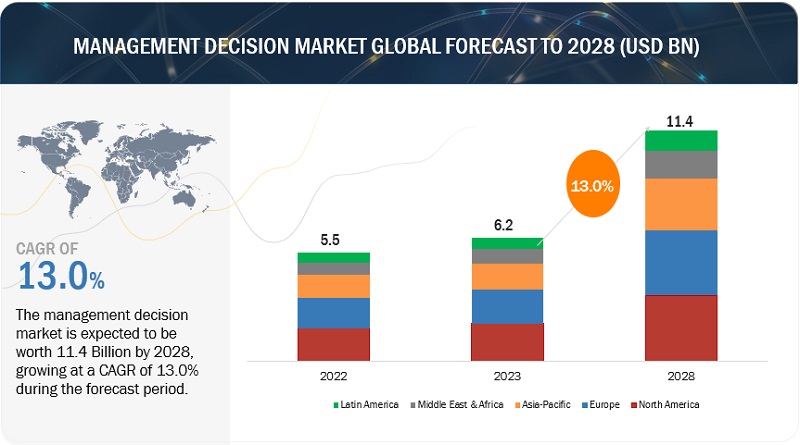

[290 Pages Report] MarketsandMarkets forecasts that the Management Decision market size is projected to grow from USD 6.2 billion in 2023 to USD 11.4 billion by 2028, at a CAGR of 13.0% during the forecast period. The rising need to enhance global presence will increase the adoption of Management Decisions. Key factors expected to drive the market’s growth are the compelling need to manage regulatory and compliance standards and the growing need for faster operational decisions and improved process efficiency. The rising customer expectations and competition among the leading market players increase the demand for cost-effective measures to enhance operational efficiencies. These factors are driving the demand for management decisions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Management Decision Market Dynamics

Driver: Increasing integration of AI to automate the decision-making process will drive market growth.

AI is transforming businesses, boosting innovation and productivity while facilitating organizational agility. It's widely implemented across industries, enhancing supply chains, transportation, education, marketing, and disaster management. AI's benefits include automation, anomaly detection, and accurate predictions, reducing manual work and improving decision-making. Organizations should strategically evaluate AI adoption to align with company goals and address ethical considerations. AI's impact on business operations is profound and continues to grow.

Restraint: Companies’ resistance to adopting modern technologies to reduce machine dependency, wrong information, and limited skills

Despite the numerous advantages of automation and cutting-edge technologies, such as time savings, decreased error rates, and cost efficiencies. Certain companies remain hesitant about integrating these advancements. This resistance often stems from apprehensions about the disruptions that new technological changes might bring to their established business environments. Consequently, some businesses confine themselves to a select group of vendors that offer familiar protocols and tools. In the present digital age, enterprises are exhibiting reluctance to adopt emerging technologies, largely due to the specialized skills and training these technologies demand.

Opportunity: Growing inclination of organizations toward decision-making with predictive analytics

There is a strong need for traditional methods to be changed, moving away from manual – arduous – planning processes to digital platforms that deliver digital transformation and build resiliency to disruption. Predictive modeling and What-If Scenario capabilities will help address this, providing insight into how different market changes and business strategies will impact the financial bottom line. This data will also offer more for operational teams and clarify how the organization achieves its overarching strategic goals.

Challenge: Lack of skilled workforce and poor management in creating user adoption process

The efficacy of technology relies heavily on the capabilities of the workforce utilizing it. The system's potential remains unrealized if employees fail to input accurate data or extract pertinent reports. This challenge is predominantly linked to training deficiencies, where numerous companies highlight the scarcity of competent candidates and proficient staff available for training. As a company embarks on a comprehensive digital transformation, the industrial landscape undergoes significant changes. Correspondingly, training initiatives must adapt to these shifts. Streamlining the complexity that has permeated company cultures within the industry will be pivotal in genuinely enhancing reliability and achieving successful digitization.

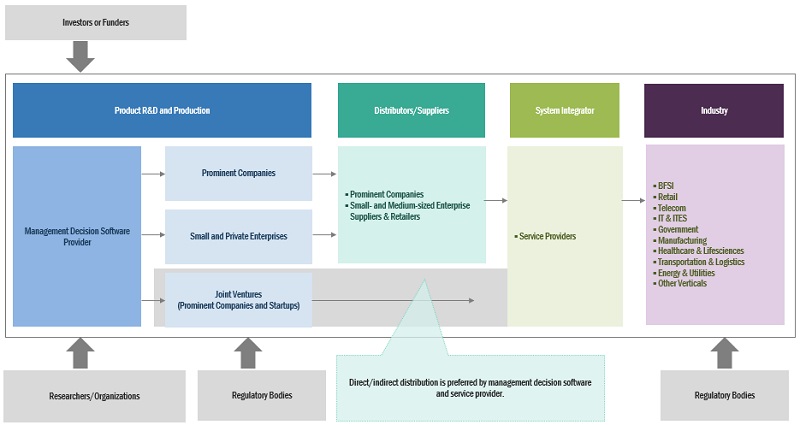

Management Decision Market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the Management Decision market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), and Experian (Ireland).

By Service, the deployment & integration segment is expected to hold the largest market size during the forecast period.

Management decision vendors offer deployment and integration services to organizations for hassle-free implementation, installation, and deployment of management decision software. System integration services help organizations plan the integration layout as per the business requirement. Management decision software needs to be integrated with the existing systems; hence, they require the right connectors and back-end integration capabilities. System integration services are gaining wide acceptance by end users globally, as they ensure that systems communicate with each other efficiently to enhance the entire production process workflow

By Vertical, the BFSI segment is expected to hold the largest market size during the forecast period.

Today’s banking organizations face the pressing challenges of digital transformation, changing regulatory requirements, increased competition, and constrained margins. Banks are compelled to fundamentally change how they operate and govern their organizations to keep up with the rapid pace of change and create efficiencies for the bank and its customers. The BFSI industry provides extensive growth opportunities for management decisions due to the globalization of financial services and the growing IT investment. Management decision software empowers financial institutions to automate the decision-making process, thereby helping them to make informed decisions.

By application, the fraud detection management segment is expected to grow with the highest CAGR during the forecast period.

Numerous companies are showing keen interest in leveraging IoT (Internet of Things) technologies within the finance sector, primarily for fraud detection, as they anticipate impressive outcomes from their implementation. This approach facilitates the collection of data related to financial transactions, enabling the monitoring of accounts for fraudulent activities, scrutiny of applications for inconsistencies, and the creation of more accurate customer spending profiles. IoT tools have the capability to seamlessly identify customers across various digital devices and channels, thereby reducing instances of fraud while facilitating legitimate transactions. By integrating IoT into banking and financial services, institutions can effectively track the location of financial crimes, identify the specific devices implicated, and proactively address these issues in a timely manner. With the rise in fraud incidents globally, the demand for management decision software is gaining traction among enterprises for fraud detection management.

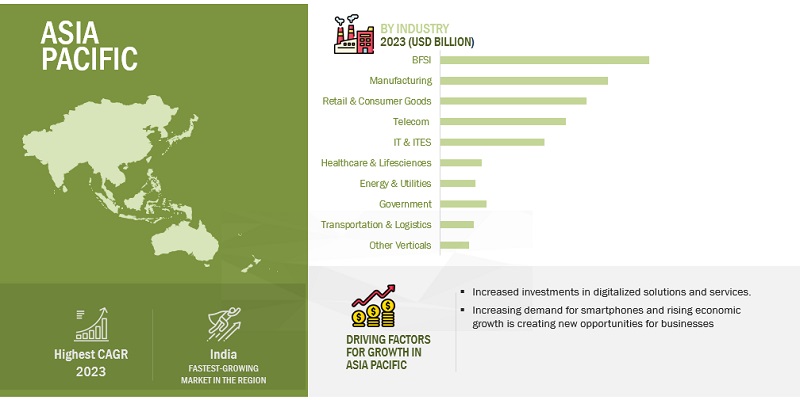

Based on region, Asia Pacific is expected to have the highest growth rate during the forecast period.

Asia Pacific exhibits a notable propensity for technology adoption and is poised to achieve the highest growth rate in the Management Decision market in the coming years. The management decision market within the Asia Pacific region encompasses China, Japan, India, and other countries in the region. Asia Pacific stands as a prominent global center for digital innovation, and enterprises here have promptly recognized the advantages of utilizing cloud technology to drive their digital transformation endeavors. The need for effective management decisions is experiencing swift expansion across the Asia Pacific area. This growth can be attributed to the escalating intricacies of businesses within the region, the heightened accessibility of data, and the amplified emphasis on regulatory compliance.

Market Players:

The major players in the Management Decision market are IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the Management Decision market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Software and Service), Application (Credit Risk Management, Collection Management, Customer Experience Management, Fraud Detection Management, Pricing Optimization, and Other Applications), Vertical, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK) |

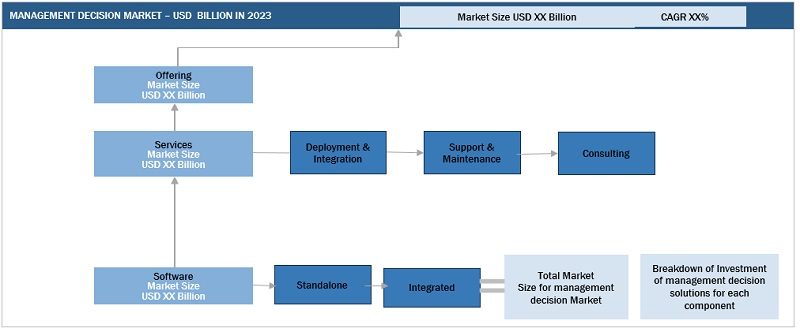

This research report categorizes the management decision market based on offering, functions, deployment model, organization size, vertical, and region.

Based on the Offering:

-

Software

- Standalone

- Integrated

-

Services

- Deployment and Integration

- Support and Maintenance

- Consulting

Based on the Application:

- Credit risk management

- Collection management

- Customer experience management

- Fraud detection management

- Pricing optimization

- Other Applications

Based on the vertical:

- BFSI

- Telecom

- IT & ITES

- Manufacturing

- Retail and Consumer Goods

- Government

- Healthcare and Life Sciences

- Energy and Utilities

- Transportation and Logistics

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2023, IBM added new features to Operational Decision Manager (ODM). The supported versions of key software components have been updated, enhancing ODM's compatibility and performance. Operational Decision Manager containers now have the RuntimeDefault seccomp profile enabled by default. This profile specifies a predefined list of system calls that can be executed within the container.

- In June 2023, FICO, a global analytic software company and recognized leader in AI decisioning platforms, and Belvo, the leading open finance data and payments platform in Latin America, announced a strategic partnership to expand credit access in Latin America. The two firms are developing an interpretable and explainable machine learning model that will provide a customer score based on consumer-permission transaction-level data aimed at increasing consumer credit access, improving banks’ risk management, and empowering lenders to create personalized financial experiences for their customers.

- In June 2023, the latest edition of the Pega Infinity™ software suite introduces new features to enhance low-code development, optimize existing processes, and deliver seamless experiences for employees and customers. These capabilities are designed to support organizations’ journey toward becoming autonomous enterprises. The software suite enables businesses to innovate rapidly, boost productivity, personalize customer interactions, and streamline operations, leading to cost reduction and decreased manual efforts. By leveraging these advancements, organizations can achieve greater efficiency and effectiveness in their operations while delivering enhanced customer experiences.

- In May 2023, FICO launched 19 major enhancements to the FICO Platform, the leading applied intelligence platform in the market, that helps clients drive critical and strategic business outcomes across their customer lifecycle.

- In February 2023, SAS Decision Manager 5.2, integrated with SAS Viya 3.4, introduced several new features and enhancements to enhance decision-making capabilities. Users can now utilize data grid variables within rules, providing greater flexibility in decision logic. Custom DS2 code files can be added and edited directly in decisions, enabling users to leverage custom code. The integration of analytic store models allows users to include them in decisions and publish them to various platforms like SAS Cloud Analytic Services, Apache Hadoop, SAS Micro Analytic Service, and Teradata.

Frequently Asked Questions (FAQ):

What is the definition of the Management Decision market?

Management decision software enables enterprises to make accurate and consistent business decisions throughout the enterprise. The software uses data analytics to control, manage, and automate business decisions, particularly operational decisions. The software is used for collection management, customer experience management, fraud detection management, pricing optimization, credit risk management, and decision automation.

What is the market size of the Management Decision market?

The Management Decision market size is projected to grow from USD 6.2 billion in 2023 to USD 11.4 billion by 2028, at a CAGR of 13.0% during the forecast period.

What are the major drivers in the Management Decision market?

The major driver of the Management Decision market is the need to improve the quality of decisions and achieve business agility with enhanced effectiveness, and the growing need for faster operational decisions and improved process efficiency. In every organization, decision-making has become increasingly intricate and multifaceted. It now encompasses broader considerations with far-reaching impacts across the entire enterprise. The traditional boundaries between strategic, tactical, and operational decisions are becoming less defined. To make effective decisions, business leaders must reevaluate what is crucial and who or what should be involved in the process.

Who are the key players operating in the Management Decision market?

The major players in the Management Decision market are The major players in the Management Decision market are IBM (US), FICO (US), SAS (US), Oracle (US), Pegasystems (US), TIBCO Software (US), Sapiens International Corporation (Israel), Experian (Ireland), Equifax (US), Actico (Germany), Parmenides (Germany), Decision Management Solutions (US), OpenRules (US), Sparkling Logic (US), Scorto (Netherland), RapidGen (UK), Progress (US), InRule (US), CRIF (Italy), Decisions (US), Enova Decisions (US), FlexRule (Australia), Rulex (US), Seon (UK), and Decisimo (UK).

What are the opportunities for new market entrants in the Management Decision market?

The rising trend of automation and intelligence decision-making creates new opportunities in the management decision market. Decision automation leverages artificial intelligence, data analytics, and predefined business rules to enable organizations to automate their decision-making processes across multiple domains. This adoption of automated decision-making yields heightened productivity and concurrently diminishes risks and errors associated with decision outcomes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

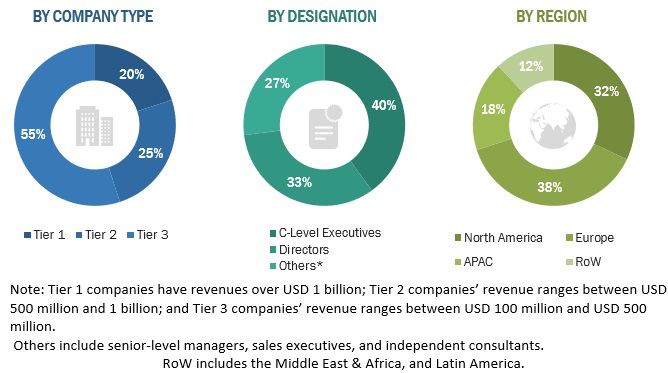

The study involved four major activities in estimating the current size of the global Management decision market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total management decision market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the management decision market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

FICO |

Senior Manager |

|

IBM |

Senior Analyst |

|

SAS |

Sales Executive |

Market Size Estimation

For making market estimates and forecasting the management decision market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global management decision market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the management decision market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Management Decision Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Management Decision Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Management decision software enables enterprises to make accurate and consistent business decisions throughout the enterprise. The software uses data analytics to control, manage, and automate business decisions, particularly operational decisions. The software is used for collection management, customer experience management, fraud detection management, pricing optimization, credit risk management, and decision automation.

Key Stakeholders

- Management Software and Service Providers

- Technology Vendors

- Telecom Providers

- System Integrators (SIs)

- Resellers

- Value-added Resellers (VARs)

- Managed Service Providers (MSPs)

- Compliance Regulatory Authorities

- Government Authorities

Report Objectives

- To determine, segment, and forecast the global Management Decision market by offering, application, vertical, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Management Decision market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Management Decision Market