Application Modernization Services Market by Service Type (Application Portfolio Assessment, Cloud application Migration, Application Re-platforming), Cloud Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

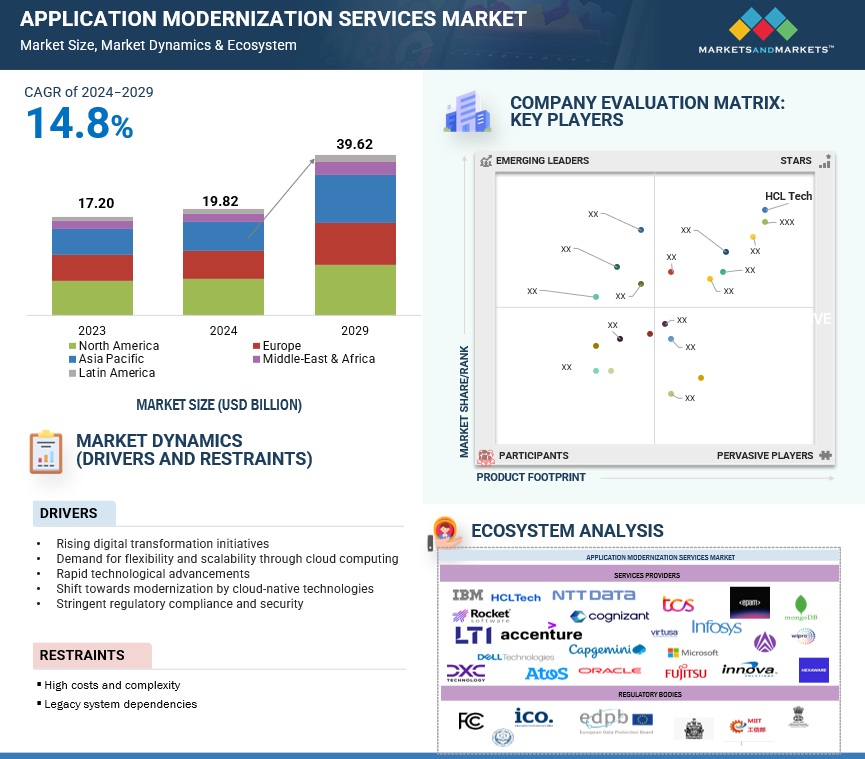

[305 Pages Report] The application modernization services market size is expected to grow from USD 15.2 billion in 2022 to USD 32.8 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 16.7% during the forecast period. Application modernization services are the process of moving legacy programs or platforms to new ones and integrating new functionality to give the organization the newest features. In order to regularly deploy application code and insulate apps from the underlying host environment, which makes them more efficient than virtual machines, modernization might also entail switching to a containerized or serverless architecture. Companies must accelerate innovation and cost-effectiveness while maintaining, or even enhancing performance and reliability. Many of these businesses continue to use out-of-date hardware and software, which raises Operation costs and puts their operations in danger. IT leaders are aware of the need to upgrade their old programs, citing decreased time to market, lower technical debt, and lower running expenses as the main motivators.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Shift toward modernization by cloud-native technologies

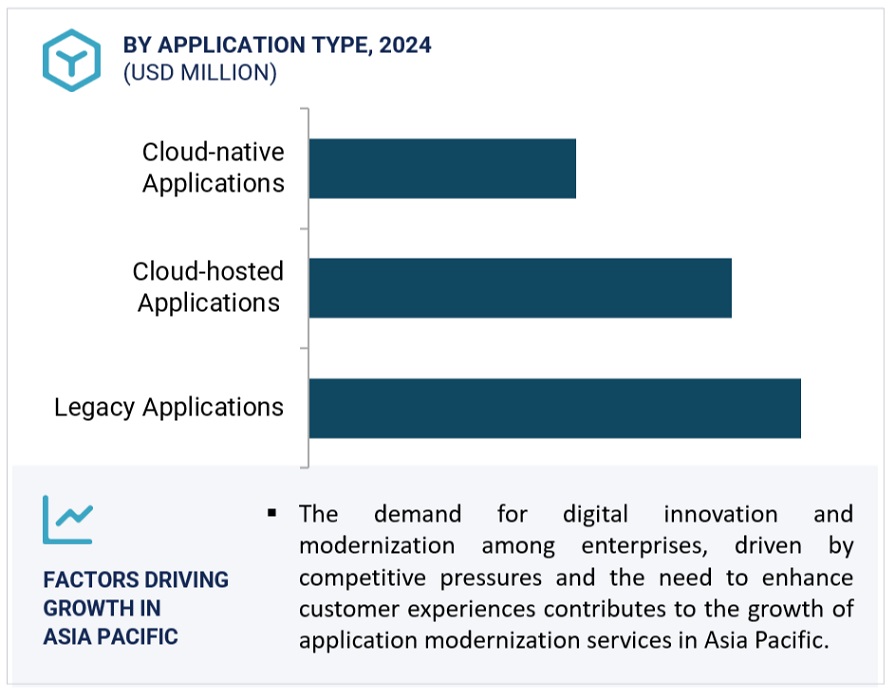

There is a sudden shift in the market during 2021 and 2022 for application modernization and migration services towards modernization that are enabled by advanced cloud-native technologies with a correspondingly lower emphasis on infrastructure-led lift-and-shift migration. At the same time, the hyper-scale cloud providers have become an integral part of customers’ migration and modernization journeys, not only by becoming important strategic partners for large enterprise customers but also by participating in dedicated go-to-market units that the large systems integrators (SIs) are forming. The market is also characterized by higher degrees of automation, including the growing importance of service delivery accelerators, quality enablers, and vertical-industry-specific assets. Modern cloud-native development techniques can often be used for the modernization of discrete portions of legacy applications; however, for many businesses, successfully collocating a legacy application on a modern platform is considered a win.

Restraint: High costs and complexities in application modernization services

Although new application features can aid companies in streamlining their operations and boosting income, organizations must first examine their return on investment (ROI) before making any decisions about their investments in application modernization. Application modernization costs are largely influenced by the features and functions of the organizations pursuing it. Organizations must make sure that the difficulties of compatibility with other legacy programs do not outweigh the advantages offered by updated applications while upgrading a few applications. It is crucial for enterprises to begin the process with an application evaluation and select the best method for application modernization based on business goals in order to take into account the costs and complexities associated with the modernization procedures. The global market for application modernization services is therefore being constrained by the rising costs and complexity of application modernization.

Opportunity: Proliferation of Kubernetes and containerization

Kubernetes adoption is increasing rapidly, making it more important to address ongoing operations and management at scale. Huge numbers of stateful applications mean that the management burden for applications is expected to grow along with the capacity needed to support them. Organizations need tools to help mitigate Kubernetes-based workloads’ complexity to prepare for ongoing operations and scalability. Several companies are implementing containerization to enhance their application’s portability and data from across computing environments. The containers help virtualize storage and other computing resources at the OS level and help developers in the logical isolation of applications. Application modernization service providers, including IBM, AWS, Alibaba Cloud, Microsoft, HPE, Dell, and Google, have added container technology in their cloud storage and cloud-native storage solutions to enable persistent storage, with which running applications can easily consume the data on demand. Thus, containers combined with DevOps and cloud storage to completely modernize application development, which is expected to create opportunities in the application modernization services market.

Challenge: Lack of IT skills among employees

The addition of additional features and functionality to apps is a component of application modernization. Although it eventually improves/simplifies the entire process, staff must learn new functionalities and adjust to new Uls in order to use all functionalities. The amount of work required to embrace modernized software can vary depending on modifications to Uls and functionality. Uls modifications may be resisted by people who are accustomed to utilizing outdated Uls and software, which is a substantial obstacle to application modernization. Many businesses struggle to modernize and incorporate new technologies within established organizational cultures. The recent pandemic has caused many firms to reevaluate how they conduct business and the idea of operating remotely as a significant business continuity option. These two factors are connected, thus businesses work to maintain a balance between them. Unless top management is convinced of the benefits of the modernization process, the traditional organizational culture may not choose to engage in it. To meet this challenge, businesses should think about organizational change management (OCM).

US to account for the largest market size during the forecast period

The geographic analysis of North America is segmented into countries, including US and Canada. A state-of-the-art IT infrastructure and readily available technical competence Due to its established end-user industries and well-established suppliers, the US holds the largest market share in North America for the adoption of application modernization, which helps to increase corporate productivity and worker efficiency. American businesses are embracing cloud-based services to take advantage of its high flexibility, scalability, and minimal maintenance expenses. Several small and large modernization service providers, including Accenture, ATOS, Capgemini, HCL, Cognizant, IBM, and TCS, are based in the US, and they are among the main forces behind the expansion of the application modernization services market in the nation. The FedRAMP is a standardized approach to security assessment, authorization, and continuous monitoring for cloud products and services that was developed by the US government. The country's highly established BFSI and healthcare industries, together with the existence of several sizable IT firms, are major factors influencing the demand for application modernization there. In the US, cloud technology adoption is reportedly very high. Due to the nation's accessibility to a highly established digital infrastructure environment, businesses can efficiently upgrade their legacy systems and boost profitability. One of the key factors propelling the nation's market for application modernization services is the urgent requirement for the modernization of numerous old federal systems.

To know about the assumptions considered for the study, download the pdf brochure

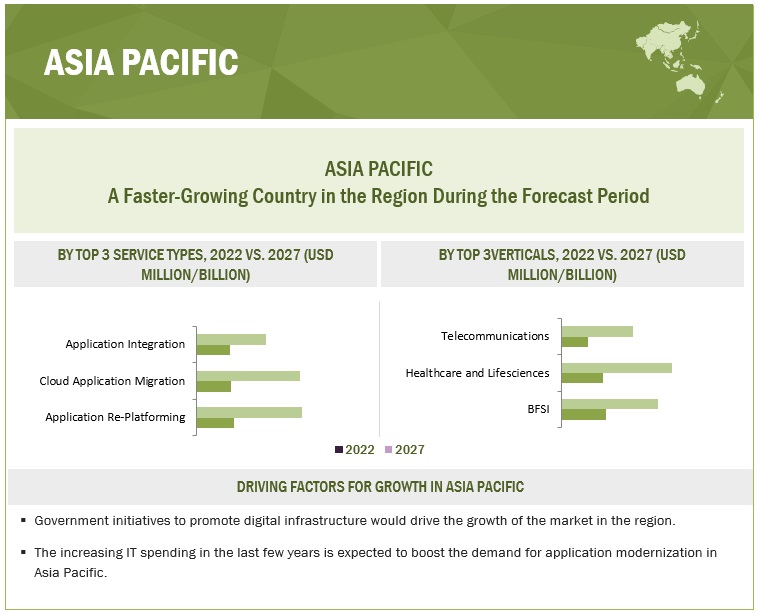

China to account for the largest market size during the forecast period

The geographic analysis of Asia Pacific is segmented into countries, including China, Japan, Australia, India, and the rest of Asia Pacific. Applications must be modernized by businesses to maintain growth and compete effectively. China's economy, which is expanding in the Asia-Pacific region, has built its foundation on the creation of cloud infrastructure services. China has one of the largest economies in the world and holds a sizeable portion of the market for application modernization services in the Asia Pacific region. The nation is swiftly adopting technology advancements, such as mobile payments and artificially intelligent virtual news broadcasts. Government programs in the nation are also intended to boost innovation and enhance technology. The nation has demonstrated a greater interest in promoting technical investments and legislative assistant in the Asia Pacific area. Traditional business models are being updated by companies in order to maintain growth and compete. Traditional business models are being updated by companies in order to maintain growth and compete. The demand for application modernization across all businesses in the country is mostly being driven by the increased adoption of new technologies such as loT, mobile, and cloud.

Key Market Players

Some of the major application modernization services market vendors are AWS (US), Microsoft (US), Google (US), Salesforce (US), Alibaba Cloud (China), Oracle (US), IBM (US), SAP (Germany), Tencent (China), Workday (US), Fujitsu (Japan), VMWare (US), Rackspace (US), HPE (US), Adobe (US), NEC (Japan), Cisco (US), Dell Technologies (US), ServiceNow (US), OVH (France), Huawei (China), Verizon (US), OrangeGroup (France), NetApp (US), dinCloud (US), Vultr (US), Megaport (Australia), AppScale (US), Zymr (US), Genesis Cloud (Germany), Ekco (Ireland), Tudip Technologies (India), ORock Technologies (US), and CloudFlex (Nigeria).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million/Billion(USD) |

|

Segments Covered |

Service Types, Cloud Deployment Modes, Organization Sizes, Verticals, and Regions |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the major application modernization services market vendors are IBM (US), Accenture (Ireland), HCL Technologies (India), Atos (France), Capgemini (France), Cognizant (US), TCS (India), Bell Integrators (US), Innova Solutions (US), Oracle (US), Microsoft (US), EPAM Systems (US), Aspire Systems (India), NTT Data (Japan), Dell Technologies (US), DXC Technology (US), Infosys (India), LTI (India), Wipro (India), Micro Focus (UK), Fujitsu (Japan), Softura (US), Hexaware Technologies (India), Virtusa (US), and MongoDB (US). |

This research report categorizes the application modernization services market based on service, organization sizes, cloud deployment modes, verticals, and regions.

Based on the Service Type:

- Application Portfolio Assessment

- Cloud Application Migration

- Application Re-Platforming

- Application Integration

- UI Modernization

- Post-Modernization

Based on the Cloud Deployment Mode:

- Public Cloud

- Private Cloud

Based on the Organization Size:

- Large enterprises

- Small and Medium Enterprises (SMEs)

Based on the Verticals:

- BFSI

- Healthcare and Life Sciences

- Telecommunication

- IT and ITeS

- Retail and Consumer Goods

- Government and Public Sector

- Energy and Utilities

- Manufacturing

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In January 2023, the company launched Capgemini Invent, the digital innovation, design, and transformation brand of the Capgemini Group, which offers CxOs the ability to foresee and influence the direction of their companies' futures. A team of over 10,000 strategists, data scientists, product and experience designers, brand experts, and developers work in roughly 40 studios and more than 60 offices around the globe to create innovative digital services, products, experiences, and business models for sustainable growth.

- In September 2022, Innova Solutions unveiled a new vertical business strategy made up of several strategic business units (SBUs), including Healthcare, Insurance, and Life Sciences (HIL), Communications & Media, Retail, Manufacturing, and Transport (RMT), Banking and Financial Services (BFS), and Hi-Tech. The company cited a need for a wider selection of industry-specific offerings made to assist companies on their paths toward digital transformation. Innova will work with its strategic partners to expand on current tech ecosystems while it creates new products.

- In July 2022, Scalor, the Atos Accelerator, was designed to be an open innovation accelerator program for startups and SMEs. Atos announced the addition of five new startups to the program to concentrate particularly on quantum technology and digital security. As startups contribute novel solutions to Atos’ portfolio, Scaler added value for the company’s clients. In return, Atos promoted the startup’s business and international expansion by facilitating faster access to its clientele and partner network.

- In September 2021, After noticing an increase in demand from companies in the public sector and the Health Industry, Cognizant built its new delivery center in Leeds, UK and Northern Ireland to boost its client services. The action solidifies Cognizant's dedication to fostering the careers of young technologists and aligns it with the UK's Levelling-Up and North Shoring agenda.

- In February 2021, Oracle introduced the most recent enhancements to Oracle Cloud Customer Experience (CX), which can assist businesses in giving customers dynamic and unique experiences. Oracle Sales, Oracle Care, and Oracle Marketing's most recent upgrades enable businesses to shorten sales cycles, respond to customer service requests more quickly, and create rewarding loyalty programs that can increase customer lifetime value.

Frequently Asked Questions (FAQ):

How big is the Application Modernization Services Market?

What is growth rate of the Application Modernization Services Market?

What are the key trends affecting the global Application Modernization Services Market?

Who are the key players in Application Modernization Services Market?

Who will be the leading hub for Application Modernization Services Market?

What are Application Modernization Services?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

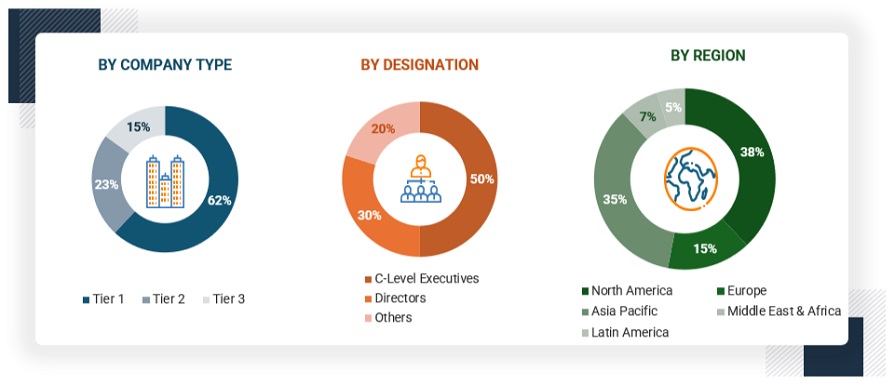

The study involved four major activities in estimating the size of the application modernization services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering application modernization services was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from application modernization services vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using application modernization services, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall application modernization services market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the application modernization services market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in BFSI, healthcare and life sciences, telecommunication, IT & ITeS, retail & consumer goods, government and public sector, energy & utilities, manufacturing, and other verticals.

Report Objectives

- To determine and forecast the global application modernization services market based on service type, cloud deployment modes, organization size, verticals, and regions from 2022 to 2027, and analyze various macro and microeconomic factors affecting the market growth.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments concerning individual growth trends, prospects, and contributions to the total market.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market's growth.

- To provide recession impact on the adoption of application modernization services adoption.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players.

- To comprehensively analyze the core competencies of the key players in the market.

- To track and analyze the competitive developments, such as product/solution launches and enhancements, business expansions, acquisitions, partnerships, and contracts and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Application Modernization Services Market

Indepth understanding of the Silverthreads Total Addressable Market.

Interested in Microsoft / Windows application modernization.

Good information. Really helpful.