Supercapacitor Market by Type (Double Layer Capacitors, Pseudocapacitors, Hybrid Capacitors), Electrode Material (Carbon, Metal Oxide, Conducting Polymers, Composites), Application (Automotive, Energy, Consumer Electronics) - Global Forecast to 2027

Updated on : March 03, 2023

Global Supercapacitor market Size

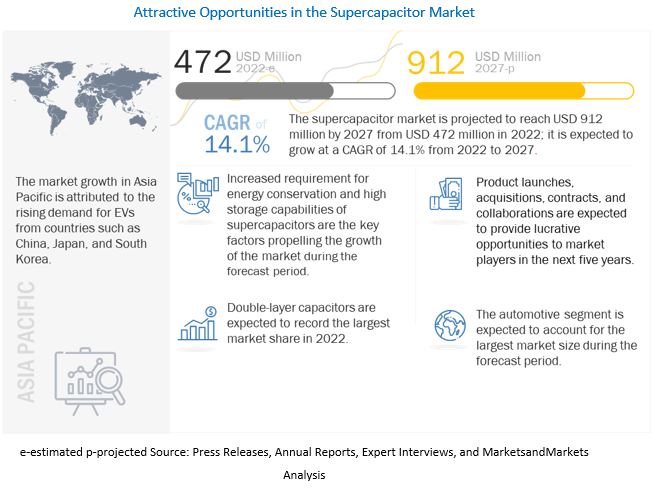

The Supercapacitor market size is projecte reach USD 912 million by 2027 from USD 520 million 2023 growing at a CAGR of 14.1% during forecat period.

Global Supercapacitor market Share

Rising requirements for energy conservation solutions and high storage capabilities especially in automotive, energy and consumer electronics applications due to accelerated use of supercapacitors for EVs/HEVs, trains and aircrafts, smart wearables, wind turbines, grid energy storage systems and rail wayside are some of the major factors propelling the growth of supercapacitor industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Rising use of supercapacitors in renewable energy generation plants

As the world is transitioning toward the sources of clean energy, there is a significant upsurge in the establishment of renewable energy power plants worldwide. The increasing demand for renewable energy solutions is driving the growth of the supercapacitor market. Supercapacitors are used in various energy storage systems, as they can offer higher power density than batteries and more energy density as compared with traditional capacitors. Supercapacitors also provide high specific capacitance and electrical stability for efficiently sustaining microgrids.

Solar and wind power plants are among the key end users of supercapacitors. These capacitors are used extensively to power microgrids for the generation of renewable energy. Solar photovoltaic (PV) panels and solar lighting are potential areas wherein supercapacitors are being used as reliable energy storage solutions. Supercapacitors are also becoming the dominant technology in large wind turbine pitch control applications, and the rise in the global uptake of renewable wind energy is expected to further fuel the growth of the supercapacitor market. Wind turbines, grid energy storage systems, and rail wayside systems increasingly use supercapacitors, thereby leading to the growth of the market worldwide.

Restraint: Limited use of supercapacitors as long term energy storage solutions

Supercapacitors are not suitable for long-term energy storage applications. The discharge rate of supercapacitors is significantly higher than lithium-ion batteries. As such, they can lose as much as 10–20% of their charge per day due to self-discharge. While batteries provide a near-constant voltage output until spent, the voltage output of supercapacitors declines linearly with their charge. This makes supercapacitors unreliable for applications that require constant energy supply for a long period of time. This causes to be a major restraining factor where long term energy storage is required especially in energy application where long term storage is essential for effective operation of microgrids.

Opportunity: Consideration of supercapacitors as a viable substitute for conventional batteries

Supercapacitors can charge and deliver energy rapidly than traditional batteries that perform the same function in a much slower manner. These capacitors equipped with electrodes and electrolytes can charge and discharge quickly over a very large number of cycles, which make them a feasible substitute for conventional batteries in a number of applications.

With environment-friendliness being a priority, there is an increased awareness among the consumers to use energy storage equipment with minimal or zero emissions. Major technology companies are speeding up their efforts to reduce greenhouse gas emissions, indicating market growth for alternative energy technologies. As supercapacitors can be recharged and recycled, they eliminate the chances of generation of any harmful toxic wastes. Hence, they can be considered as an environment-friendly substitute for traditional batteries. Currently, supercapacitors are not as developed as conventional battery-based energy storage systems are, but given the recent advancements in graphene-based supercapacitors, they can replace conventional batteries in near future.

Challenge: Requirement of consistent electrical parameter optimization of supercapacitors

Supercapacitors have been used in commercial applications for about 2 decades, but they still are in their developmental stages. Presently, these capacitors can only be used for short-term high-energy applications as they have high discharge and leakage rates. They constantly require optimization of their electrical parameters to ensure their ideal performance. This makes periodic maintenance of supercapacitors a top priority.

Moreover, supercapacitors are also costly. For instance, supercapacitors used in electric vehicles cost USD 2,500 to USD 6,000 per kWh of energy storage, while lithium-ion batteries cost USD 500 to USD 1,000 per kWh. Various materials required for manufacturing supercapacitors are difficult to procure and expensive. Moreover, the manufacturers of supercapacitors find it difficult to obtain highly efficient electrodes at low costs. Thus, the high costs of materials used to develop supercapacitors increase their overall costs.

Double-layered capacitor type is expected to have the largest size of the supercapacitor market in 2022.

The double-layered capacitors segment is projected to account for the largest size of the supercapacitor market in 2022. Double-layered capacitors are being used as an alternative to conventional batteries. These capacitors work excellently in all those applications where a stable supply of energy is required over a short period of time. In consumer electronics applications such as smart wearables, computers, laptops, and foldable phones, double-layered capacitors are replacing conventional batteries. These supercapacitors are a clean source of energy as opposed to conventional batteries, and hence, a number of battery manufacturers are expanding their product portfolios in the double-layered capacitors segment.

The market for automotive application is expected to grow at a higher CAGR as well as contribute largest market share during the forecast period.

The automotive segment is projected to hold the largest size of the supercapacitor market during the forecast period. The sector is also considered as the fastest growing sector during the forecast period. The advent of electric vehicles has increased the demand for supercapacitors in the automotive sector. A number of automotive manufacturers across the world are eventually switching from battery-powered electric vehicles to supercapacitor-powered electric vehicles owing to the high scalability and broad operating temperature range offered by supercapacitors.

To know about the assumptions considered for the study, download the pdf brochure

The supercapacitor market in Asia Pacific to grow at the highest CAGR during the forecast period.

Asia Pacific is expected to be the largest contributor to supercapacitor market during the forecast period. Rapid industrialization and infrastructure developments are driving the growth of consumer electronics and automotive industries in China that is expected to increase the demand for supercapacitors in the country. China is the largest low-cost vehicle manufacturer globally and rising needs for supercapacitor for automotive vertical drives the growth of market. Additionally, there has been observed a growing number of manufacturing facilities in Japan, and South Korea that would provide opportunity for market. Thus, the manufacturing activities in the region are likely to expand to a greater extent. As a result, the region will witness huge demand for supercapacitor solutions.

Key Market Players

The supercapacitor market’s players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, partnerships, and acquisitions to strengthen their offerings in the market. The major players in supercapacitor companies are CAP-XX (Australia), Nippon Chemi-Con Corp. (Japan), Panasonic Corp. (Japan), Maxwell Technologies (South Korea), Eaton (Ireland), Cornell-Dubilier (US), and Ioxus (US) among others.

The study includes an in-depth competitive analysis of these key players in the supercapacitor market with their company profiles, recent developments, and key market strategies.

Super Capacitor Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 472 Million |

| Projected Market Size | USD 912 Million |

| CAGR (2022-2027) | 14.1% |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

On Demand Data Available |

2030 |

|

Segments covered |

|

|

Regions covered |

|

|

Companies covered |

|

| Key Market Driver | Supercapacitors in Renewable Energy Generation Plants |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Double-layered Capacitor Segment |

| Highest CAGR Segment | Hybrid Capacitor Segment |

In this report, the overall supercapacitor market has been segmented based on type, electrode material, application and region.

Supercapacitor Market By Type

- Double Layered Capacitors

- Pseudocapacitors

- Hybrid Capacitors

By Electrode Material

- Carbon

- Metal Oxide

- Conducting Polymers

- Composites

By Application

- Automotive

- Energy

- Consumer Electronics

- Industrial

- Aerospace

- Medical

Supercapacitor Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Rest of the World

- Middle East

- Africa

- South America

Recent Developments

- In February 2022, CAP-XX signed a sourcing agreement with Continental Automotive GmbH, a Tier 1 automotive supplier, to provide CAP-XX DMT220 prismatic supercaps for one of Continental’s key automotive programs.

- In December 2021, Cornell Dubilier announced that its subsidiary, CD Snow Hill, LLC, has acquired the capacitor producing assets of NWL, Inc. possessing greater capabilities in custom high-voltage film capacitors for pulsed power and power conversion applications, the company is poised to expand its solutions for industrial, military, and medical customers.

- In October 2021, Nippon Chemi-Con has developed supercapacitor DLCAP™ modules optimal for backup power supplies in emergencies such as power losses. The products are especially for use in industrial equipment.

Frequently Asked Questions (FAQ):

What is the market size of Supercapacitor market expected in 2022?

The Supercapacitor market is expected to be valued at USD 472 million in 2022.

What is the total CAGR expected to be recorded for the Supercapacitor market during 2022-2027?

The global Supercapacitor market is expected to record a CAGR of 14.1% from 2022–2027.

Does this report include the impact of COVID-19 on the Supercapacitor market?

Yes, the report includes the impact of COVID-19 on the Supercapacitor market. It illustrates the post- COVID-19 market scenario.

Which are the top players in the Supercapacitor market?

The major vendors operating in the Supercapacitor market include CAP-X, Nippon Chemi-Con, Panasonic, Maxwell Technologies and Eaton among others.

Which major countries are considered in the North America region?

The report includes an analysis of the US, Canada, and Mexico countries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 SUPERCAPACITOR MARKET SEGMENTATION

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 SUPERCAPACITOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for estimating market size by top-down analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—SUPPLY SIDE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—SUPPLY SIDE

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for estimating market size by bottom-up analysis (demand side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 6 IMPACT ANALYSIS OF COVID-19 ON SUPERCAPACITOR MARKET

3.1 REALISTIC SCENARIO

TABLE 2 REALISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

3.2 PESSIMISTIC SCENARIO

TABLE 3 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

3.3 OPTIMISTIC SCENARIO

TABLE 4 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2022–2027 (USD MILLION)

FIGURE 7 DOUBLE-LAYER CAPACITOR SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

FIGURE 8 CARBON SEGMENT TO HOLD LARGEST MARKET SHARE IN 2022

FIGURE 9 AUTOMOTIVE SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2021

FIGURE 10 SUPERCAPACITOR MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 11 MARKET EXPECTED TO GROW AT SIGNIFICANT RATE OWING TO INCREASING DEMAND FROM AUTOMOTIVE AND CONSUMER ELECTRONICS INDUSTRIES

4.2 SUPERCAPACITOR MARKET, BY TYPE (2022–2027)

FIGURE 12 DOUBLE-LAYER SUPERCAPACITORS EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

4.3 SUPERCAPACITOR MARKET, BY APPLICATION

FIGURE 13 AUTOMOTIVE TO HOLD MAJOR SHARE OF MARKET

4.4 SUPERCAPACITOR MARKET, BY REGION

FIGURE 14 MARKET IN CANADA EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising use of supercapacitors in energy storage devices and wind power systems

5.2.1.2 Growing popularity of electric vehicles

5.2.1.3 Increasing utilization of supercapacitors in smart wearables

5.2.1.4 Outstanding ability of supercapacitors to store more energy than electrolytic capacitors

TABLE 5 COMPARISON OF SUPERCAPACITORS, CAPACITORS, AND BATTERIES

FIGURE 16 DRIVERS FOR SUPERCAPACITOR MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Unreliability of supercapacitors in long-term energy storage applications

5.2.2.2 Decline in demand for consumer electronics owing to outbreak of COVID-19

FIGURE 17 RESTRAINTS FOR MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing applications of supercapacitors in aviation sector

5.2.3.2 Elevating use of supercapacitors as replacement for conventional batteries

FIGURE 18 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 High cost and constant requirement for periodic maintenance of supercapacitors

FIGURE 19 CHALLENGES FOR MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY COMPONENT MANUFACTURERS AND SYSTEM INTEGRATORS

6 CHARGEABILITY TYPES OF SUPERCAPACITORS (Page No. - 55)

6.1 INTRODUCTION

FIGURE 21 CHARGEABILITY TYPES OF SUPERCAPACITORS

6.2 RECHARGEABLE

6.2.1 HIGH ENERGY AND POWER CHARACTERIZE RECHARGEABLE SUPERCAPACITORS

6.3 THERMALLY INDUCED SELF-CHARGING

6.3.1 CHANGES IN TEMPERATURE OF ELECTROCHEMICAL CAPACITORS LEAD TO VOLTAGE DIFFERENCE

TABLE 6 SUPERCAPACITORS: ADVANTAGES VS. DISADVANTAGES

7 SUPERCAPACITOR MARKET, BY TYPE (Page No. - 57)

7.1 INTRODUCTION

FIGURE 22 SUPERCAPACITOR MARKET, BY TYPE

FIGURE 23 DOUBLE-LAYER CAPACITORS TO DOMINATE MARKET IN 2022

TABLE 7 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 8 MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 9 SUPERCAPACITOR COMPARISON MATRIX

7.2 DOUBLE-LAYER CAPACITOR

7.2.1 INCREASING ADOPTION OF HYBRID ELECTRIC VEHICLES TO ACCELERATE DEMAND FOR DOUBLE-LAYER CAPACITORS

7.2.1.1 Advantages of double-layer capacitors

7.2.1.2 Disadvantages of double-layer capacitors

7.2.1.3 Applications of double-layer capacitors

TABLE 10 DOUBLE-LAYER CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 11 DOUBLE-LAYER CAPACITOR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 12 DOUBLE-LAYER CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 13 DOUBLE-LAYER CAPACITOR MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PSEUDOCAPACITOR

7.3.1 GROWING USE OF PSEUDOCAPACITORS IN HIGH-ENERGY STORAGE APPLICATIONS TO PUSH MARKET GROWTH

7.3.1.1 Advantages of pseudocapacitors

7.3.1.2 Disadvantages of pseudocapacitors

7.3.1.3 Applications of pseudocapacitors

TABLE 14 PSEUDOCAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 15 PSEUDOCAPACITOR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 16 PSEUDOCAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 PSEUDOCAPACITOR MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 HYBRID CAPACITOR

7.4.1 HIGHER EFFICIENCY OF HYBRID CAPACITORS THAN CONVENTIONAL CAPACITORS TO BOOST MARKET GROWTH

7.4.1.1 Advantages of hybrid capacitors

7.4.1.2 Disadvantages of hybrid capacitors

7.4.1.3 Applications of hybrid capacitors

TABLE 18 HYBRID CAPACITOR MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 19 HYBRID CAPACITOR MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 20 HYBRID CAPACITOR MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 HYBRID CAPACITOR MARKET, BY REGION, 2022–2027 (USD MILLION)

8 SUPERCAPACITOR MARKET, BY ELECTRODE MATERIAL (Page No. - 68)

8.1 INTRODUCTION

FIGURE 24 MARKET, BY ELECTRODE MATERIAL

FIGURE 25 CARBON SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2022 TO 2027

TABLE 22 MARKET, BY ELECTRODE MATERIAL, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY ELECTRODE MATERIAL, 2022–2027 (USD MILLION)

8.2 CARBON

8.2.1 CARBON-BASED SUPERCAPACITORS INCREASINGLY ADOPTED OWING TO THEIR SUPERIOR ELECTRICAL PROPERTIES

8.2.1.1 Activated carbon

8.2.1.2 Carbon nanotubes (CNT)

8.2.1.3 Graphene

8.2.1.4 Carbide-derived carbon (CDC)

8.2.1.5 Carbon aerogels

8.3 METAL OXIDE

8.3.1 METAL OXIDE-BASED SUPERCAPACITORS SUITABLE FOR POWER APPLICATIONS

8.3.1.1 Ruthenium oxide

8.3.1.2 Nickel oxide

8.3.1.3 Manganese oxide

8.4 CONDUCTING POLYMERS

8.4.1 CONDUCTING POLYMERS USED FOR DEVELOPING HIGH-CONDUCTIVITY PSEUDOCAPACITIVE ELECTRODES

8.4.1.1 Polyaniline (PANI)

8.4.1.2 Polypyrrole

8.4.1.3 Polyacene

8.4.1.4 Polyacetylene

8.5 COMPOSITES

8.5.1 COMPOSITES WIDELY USED AS ELECTRODE MATERIAL IN HYBRID SUPERCAPACITORS

8.5.1.1 Carbon–carbon

8.5.1.2 Carbon–metal oxide

8.5.1.3 Carbon–conducting polymers

9 SUPERCAPACITOR MARKET, BY APPLICATION (Page No. - 75)

9.1 INTRODUCTION

FIGURE 26 MARKET, BY APPLICATION

FIGURE 27 AUTOMOTIVE SEGMENT TO HOLD LARGEST SHARE OF SUPERCAPACITOR MARKET FROM 2022 TO 2027

TABLE 24 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 AUTOMOTIVE

9.2.1 GROWING ADOPTION OF SUPERCAPACITORS AS ALTERNATE ENERGY STORAGE OPTION IN EVS WILL ACCELERATE MARKET GROWTH

TABLE 26 MARKET FOR AUTOMOTIVE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 27 MARKET FOR AUTOMOTIVE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 28 SUPERCAPACITOR MARKET FOR AUTOMOTIVE, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET FOR AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

9.3 ENERGY

9.3.1 INCREASING INCLINATION TOWARD RENEWABLE ENERGY LIKELYTO PUSH DEMAND FOR SUPERCAPACITORS

TABLE 30 MARKET FOR ENERGY, BY TYPE, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR ENERGY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 32 MARKET FOR ENERGY, BY REGION, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR ENERGY, BY REGION, 2022–2027 (USD MILLION)

9.4 CONSUMER ELECTRONICS

9.4.1 RISING USE OF SUPERCAPACITORS IN CONSUMER ELECTRONICS TO IMPROVE OPERATING LIFE AND RUNTIME OF CONVENTIONAL BATTERIES WILL BOOST MARKET GROWTH

TABLE 34 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

9.5 INDUSTRIAL

9.5.1 INCREASING DEPLOYMENT OF SUPERCAPACITORS IN INDUSTRIAL APPLICATIONS OWING TO THEIR ABILITY TO STORE SUBSTANTIAL AMOUNT OF ENERGY FUELS MARKET GROWTH

TABLE 38 MARKET FOR INDUSTRIAL, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR INDUSTRIAL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 40 MARKET FOR INDUSTRIAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 41 MARKET FOR INDUSTRIAL, BY REGION, 2022–2027 (USD MILLION)

9.6 AEROSPACE

9.6.1 GROWING IMPLEMENTATION OF SUPERCAPACITORS IN AEROSPACE APPLICATIONS OWING TO THEIR HIGH-POWER DENSITY AND ENERGY-STORAGE CAPACITY EXPECTED TO SUPPORT MARKET GROWTH

TABLE 42 MARKET FOR AEROSPACE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR AEROSPACE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 44 MARKET FOR AEROSPACE, BY REGION, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

9.7 MEDICAL

9.7.1 RISING DEPLOYMENT OF LIGHTWEIGHT AND FLEXIBLE SUPERCAPACITORS IN MEDICAL DEVICES WILL FOSTER MARKET GROWTH

TABLE 46 SUPERCAPACITOR MARKET FOR MEDICAL, BY TYPE, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR MEDICAL, BY TYPE, 2022–2027 (USD MILLION)

TABLE 48 MARKET FOR MEDICAL, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR MEDICAL, BY REGION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 90)

10.1 INTRODUCTION

FIGURE 28 MARKET IN CANADA TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 50 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: SUPERCAPACITOR MARKET SNAPSHOT

TABLE 52 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 57 SUPERCAPACITOR MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growing demand for EVs in US to augment market growth

10.2.2 CANADA

10.2.2.1 Rising focus of Canadian government on using clean energy sources to increase requirement for supercapacitors

10.2.3 MEXICO

10.2.3.1 Ongoing advances in hybrid electric vehicles to push supercapacitor market in Mexico

10.3 EUROPE

FIGURE 30 EUROPE: SUPERCAPACITOR MARKET SNAPSHOT

TABLE 58 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 59 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 60 MARKET IN EUROPE, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 62 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 63 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Growing use of supercapacitors by German aerospace sector to drive market growth

10.3.2 UK

10.3.2.1 Considerable requirement for supercapacitors by UK healthcare industry to foster market growth

10.3.3 FRANCE

10.3.3.1 Strong focus on adoption of renewable energy sources in France to fuel need for supercapacitors

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: SUPERCAPACITOR MARKET SNAPSHOT

TABLE 64 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

TABLE 66 MARKET IN ASIA PACIFIC, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 67 MARKET IN ASIA PACIFIC, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 68 MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Consumer electronics industry expected to support market growth in China

10.4.2 JAPAN

10.4.2.1 Automotive industry major contributor to flourishing market in Japan

10.4.3 SOUTH KOREA

10.4.3.1 Thriving consumer electronics industry to boost market growth

10.4.4 REST OF ASIA PACIFIC

10.5 ROW

TABLE 70 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 71 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

TABLE 72 MARKET IN ROW, BY APPLICATION,2018–2021 (USD MILLION)

TABLE 73 MARKET IN ROW, BY APPLICATION,2022–2027 (USD MILLION)

TABLE 74 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 SUPERCAPACITOR MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Government initiatives to promote use of clean energy to create growth opportunities in South America

10.5.2 MIDDLE EAST

10.5.2.1 Increased use of microgrids based on renewable energy sources supports Middle Eastern market growth

10.5.3 AFRICA

10.5.3.1 High emphasis on clean energy to stimulate market growth in Africa

11 COMPETITIVE LANDSCAPE (Page No. - 109)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 76 OVERVIEW OF STRATEGIES DEPLOYED BY KEY SUPERCAPACITOR MANUFACTURERS

11.3 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 32 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN SUPERCAPACITOR MARKET

11.4 MARKET SHARE ANALYSIS, 2021

TABLE 77 MARKET SHARE OF TOP FIVE PLAYERS IN MARKET IN 2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 33 SUPERCAPACITOR MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPETITIVE SCENARIO

11.6.1 PRODUCT LAUNCHES

TABLE 78 PRODUCT LAUNCHES, 2019–2022

11.6.2 DEALS

TABLE 79 DEALS, 2021

11.6.3 OTHERS

TABLE 80 OTHERS, 2019–2022

12 COMPANY PROFILES (Page No. - 117)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

12.1.1 CAP-XX

TABLE 81 CAP-XX: BUSINESS OVERVIEW

FIGURE 34 CAP-XX: COMPANY SNAPSHOT

TABLE 82 CAP-XX: PRODUCTS OFFERED

TABLE 83 CAP-XX: DEALS

TABLE 84 CAP-XX: OTHERS

12.1.2 NIPPON CHEMI-CON CORPORATION

TABLE 85 NIPPON CHEMI-CON: BUSINESS OVERVIEW

FIGURE 35 NIPPON CHEMI-CON: COMPANY SNAPSHOT

TABLE 86 NIPPON CHEMI-CON: PRODUCTS OFFERED

TABLE 87 NIPPON CHEMI-CON: PRODUCT LAUNCHES

TABLE 88 NIPPON CHEMI-CON: DEALS

12.1.3 PANASONIC

TABLE 89 PANASONIC: BUSINESS OVERVIEW

FIGURE 36 PANASONIC: COMPANY SNAPSHOT

TABLE 90 PANASONIC: PRODUCTS OFFERED

TABLE 91 PANASONIC: OTHERS

12.1.4 MAXWELL TECHNOLOGIES

TABLE 92 MAXWELL TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 93 MAXWELL TECHNOLOGIES: PRODUCTS OFFERED

12.1.5 EATON

TABLE 94 EATON: BUSINESS OVERVIEW

FIGURE 37 EATON: COMPANY SNAPSHOT

TABLE 95 EATON: PRODUCTS OFFERED

TABLE 96 EATON: PRODUCT LAUNCHES

TABLE 97 EATON: DEALS

TABLE 98 EATON: OTHERS

12.1.6 CORNELL-DUBILIER

TABLE 99 CORNELL-DUBILIER: BUSINESS OVERVIEW

TABLE 100 CORNELL-DUBILIER: PRODUCTS OFFERED

TABLE 101 CORNELL-DUBILIER: PRODUCT LAUNCHES

TABLE 102 CORNELL-DUBILIER: DEALS

12.1.7 IOXUS

TABLE 103 IOXUS: BUSINESS OVERVIEW

TABLE 104 IOXUS: PRODUCTS OFFERED

12.1.8 NAWA TECHNOLOGIES

TABLE 105 NAWA TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 106 NAWA TECHNOLOGIES: PRODUCTS OFFERED

TABLE 107 NAWA TECHNOLOGIES: PRODUCT LAUNCHES

12.1.9 SKELETON TECHNOLOGIES

TABLE 108 SKELETON TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 109 SKELETON TECHNOLOGIES: PRODUCTS OFFERED

TABLE 110 SKELETON TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 111 SKELETON TECHNOLOGIES: DEALS

TABLE 112 SKELETON TECHNOLOGIES: OTHERS

12.1.10 SPEL TECHNOLOGIES

TABLE 113 SPEL TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 114 SPEL TECHNOLOGIES: PRODUCTS OFFERED

TABLE 115 SPEL TECHNOLOGIES: DEALS

TABLE 116 SPEL TECHNOLOGIES: OTHERS

12.2 OTHER PLAYERS

12.2.1 VINATECH

TABLE 117 VINATECH: COMPANY OVERVIEW

12.2.2 CELLERGY

TABLE 118 CELLERGY: COMPANY OVERVIEW

12.2.3 ENERG2

TABLE 119 ENERG2: COMPANY OVERVIEW

12.2.4 NANORAMIC LABORATORIES

TABLE 120 NANORAMIC LABORATORIES: COMPANY OVERVIEW

12.2.5 TARGRAY

TABLE 121 TARGRAY: COMPANY OVERVIEW

12.2.6 TOKIN

TABLE 122 TOKIN: COMPANY OVERVIEW

12.2.7 YUNASKO

TABLE 123 YUNASKO: COMPANY OVERVIEW

12.2.8 KORCHIP

TABLE 124 KORCHIP: COMPANY OVERVIEW

12.2.9 EVANS CAPACITOR COMPANY

TABLE 125 EVANS CAPACITOR COMPANY: COMPANY OVERVIEW

12.2.10 WUXI CRE NEW ENERGY TECHNOLOGY

TABLE 126 WUXI CRE NEW ENERGY TECHNOLOGY: COMPANY OVERVIEW

12.2.11 ZOXCELL

TABLE 127 ZOXCELL: COMPANY OVERVIEW

12.2.12 JINZHOU KAIMEI POWER

TABLE 128 JINZHOU KAIMEI POWER: COMPANY OVERVIEW

12.2.13 DIN ELECTRONICS

TABLE 129 DIN ELECTRONICS: COMPANY OVERVIEW

12.2.14 ELNA

TABLE 130 ELNA: COMPANY OVERVIEW

12.2.15 NICHICON

TABLE 131 NICHICON: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKET (Page No. - 171)

13.1 LITHIUM-ION BATTERY MARKET

13.2 INTRODUCTION

FIGURE 38 LITHIUM-ION BATTERY MARKET, BY TYPE

TABLE 132 LITHIUM-ION BATTERY MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 LITHIUM-ION BATTERY MARKET, BY TYPE, 2021–2030 (USD MILLION)

13.3 LITHIUM NICKEL MANGANESE COBALT OXIDE (LI-NMC)

13.3.1 HIGH ENERGY DENSITY BOOSTS DEMAND FOR NMC BATTERIES

FIGURE 39 PERFORMANCE PARAMETERS: LI-NMC BATTERIES

TABLE 134 LITHIUM NICKEL MANGANESE COBALT (LI-NMC) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 135 LITHIUM NICKEL MANGANESE COBALT (LI-NMC) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

FIGURE 40 EUROPE TO HOLD LARGEST SIZE OF LITHIUM NICKEL MANGANESE COBALT BATTERY MARKET IN 2021

TABLE 136 LITHIUM NICKEL MANGANESE COBALT (LI-NMC) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 137 LITHIUM NICKEL MANGANESE COBALT (LI-NMC) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

13.4 LITHIUM IRON PHOSPHATE (LFP)

13.4.1 EXCELLENT ELECTROCHEMICAL PERFORMANCE AND LOW RESISTANCE BOOST ADOPTION OF LFP BATTERIES

FIGURE 41 PERFORMANCE PARAMETERS: LFP BATTERIES

TABLE 138 LITHIUM IRON PHOSPHATE (LFP) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 139 LITHIUM IRON PHOSPHATE (LFP) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

TABLE 140 LITHIUM IRON PHOSPHATE (LFP) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 141 LITHIUM IRON PHOSPHATE (LFP) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

13.5 LITHIUM COBALT OXIDE (LCO)

13.5.1 LCO BATTERIES MAINLY USED IN CONSUMER ELECTRONICS

FIGURE 42 PERFORMANCE PARAMETERS: LCO BATTERIES

TABLE 142 LITHIUM COBALT OXIDE (LCO) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 143 LITHIUM COBALT OXIDE (LCO) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

TABLE 144 LITHIUM COBALT OXIDE (LCO) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 145 LITHIUM COBALT OXIDE (LCO) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

13.6 LITHIUM TITANATE OXIDE (LTO)

13.6.1 LONGER LIFE CYCLE THAN OTHER LI-ION BATTERY TYPES MAKES LTO BATTERIES SUITABLE FOR ELECTRIC VEHICLES

FIGURE 43 PERFORMANCE PARAMETERS: LTO BATTERIES

TABLE 146 LITHIUM TITANATE OXIDE (LTO) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

FIGURE 44 AUTOMOTIVE SEGMENT EXPECTED TO GROW AT HIGHEST CAGR IN LITHIUM TITANATE OXIDE BATTERY MARKET

TABLE 147 LITHIUM TITANATE OXIDE (LTO) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

TABLE 148 LITHIUM TITANATE OXIDE (LTO) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 149 LITHIUM TITANATE OXIDE (LTO) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

13.7 LITHIUM MANGANESE OXIDE (LMO)

13.7.1 HIGHER TEMPERATURE STABILITY FUELS DEMAND FOR LMO BATTERIES

FIGURE 45 PERFORMANCE PARAMETERS: LMO BATTERIES

TABLE 150 LITHIUM MANGANESE OXIDE (LMO) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 151 LITHIUM MANGANESE OXIDE (LMO) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

TABLE 152 LITHIUM MANGANESE OXIDE (LMO) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 153 LITHIUM MANGANESE OXIDE (LMO) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

13.8 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA)

13.8.1 HIGH ENERGY DENSITY OF NCA BATTERIES INCREASES DEMAND IN AUTOMOTIVE INDUSTRY

FIGURE 46 PERFORMANCE PARAMETERS: NCA BATTERIES

TABLE 154 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) BATTERY MARKET, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 155 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) BATTERY MARKET, BY INDUSTRY, 2021–2030 (USD MILLION)

FIGURE 47 ASIA PACIFIC TO HOLD LARGEST SIZE OF NCA BATTERY MARKET DURING FORECAST PERIOD

TABLE 156 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) BATTERY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 157 LITHIUM NICKEL COBALT ALUMINUM OXIDE (NCA) BATTERY MARKET, BY REGION, 2021–2030 (USD MILLION)

14 APPENDIX (Page No. - 187)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

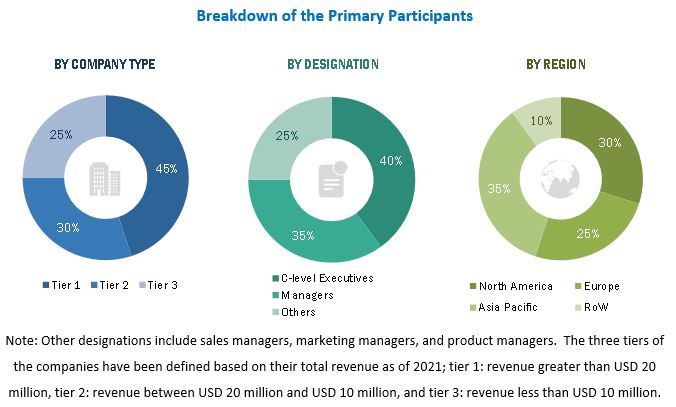

The study involves four major activities for estimating the size of the supercapacitor market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the supercapacitor market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the supercapacitor market through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, e-mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the supercapacitor market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the overall supercapacitor market based on type, electrode material, and application, in terms of value

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries, in terms of value

- To describe applications types of supercapacitors

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the supercapacitors

- To analyze the impact of COVID-19 on the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2

- To analyze competitive developments such as product launches and developments, acquisitions, collaborations, agreements, and partnerships in the supercapacitor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Supercapacitor Market

We would like to know more information on implementing graphene in the production of high-energy dense super capacitors. And related market size?

looking for a cost breakdown for supercapacitors and pricing strategies adopted by leading players.

can you provide Market Share Analysis Of Supercapacitor Market? And we would like to know methodology behind the same.

I have been working on carbon based electrode materials for supercapacitors. I would like to know global importance and upcoming trend impacting the market.

I am interested to know the units sold for each of the supercapacitor product type? For example, does the report give the percentage of the supercapacitor market or supercapacitor units sold into automated meters or electronic screwdrivers?

I would like to know the current and future market situation of supercapacitor. What all information will be available in this report?

Dose you report includes information about Energy Storage along with a upcoming technological trends in Supercapacitors? also I would like to know more about the market size for China

our company is entering into supercapacitors business. So need to know every details possible related to the APAC market.

Is report covers pricing analysis of supercapacitors? As well as after sales services? As our company is mainly into after sales service business, so we would like to know more about it.

We are interested to market Supercapacitor in European market specifically for solar panel, laptop, IPS and other uses. Do you have any information on this?

Dose this report covers the survey analysis of end users? As our company is more concerned about the end-user perspective.

Dose report contains supercapacitor price trends and the market size depending upon energy density?