Gas Insulated Switchgear Market by Installation (Indoor, Outdoor), Insulation Type (SF6, SF6 free), Voltage Rating, Configuration (Hybrid, Isolated Phase, Integrated three phase, Compact GIS), End-User and Region - Global Forecast to 2028

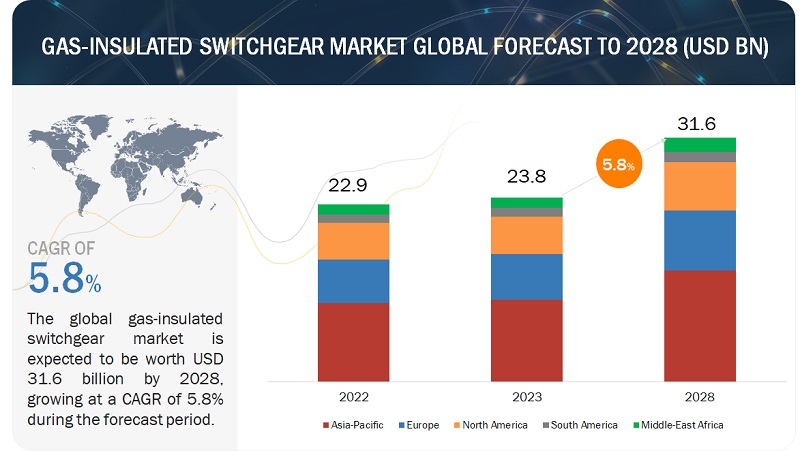

[289 Pages Report] The global gas insulated switchgear market in terms of revenue was estimated to be worth $23.8 billion in 2023 and is poised to reach $31.6 billion by 2028, growing at a CAGR of 5.8% from 2023 to 2028. The emergence of IoT technology for purposes like home and building automation has made effective energy management a paramount concern. Consequently, these developments have spurred the demand for gas-insulated switchgear to enable the monitoring and optimization of energy consumption. While the industrial sector played a pivotal role in driving this demand, the commercial, service, and residential sectors also made significant contributions to the market's expansion.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Gas Insulated Switchgear Market Dynamics

Driver: Increase in renewable energy-based capacity addition

The expansion of renewable energy is being propelled by several key factors, including sustained governmental support across more than 130 countries, ambitious net-zero commitments made by nations representing 90% of global GDP, and the increasing competitiveness of wind and solar photovoltaic (PV) technologies. China's ambitious goal of achieving carbon neutrality by 2060 has spurred the establishment of new short-term targets, such as the aim to reach 1,200 GW of combined wind and solar PV capacity by 2030. Projections indicate that renewable power growth within the European Union is set to surpass the expectations outlined in existing National Energy and Climate Plans (NECPs) for 2030, based on the trajectory of renewable capacity expansion between 2021 and 2026. Member countries are increasing auction volumes, businesses are contracting for more renewable electricity, and consumers are actively installing substantial numbers of solar panels. These collective efforts are driving a rapid transition towards renewable energy adoption, which, in turn, will have a positive impact on the global gas insulated switchgear industry as the demand for clean and sustainable energy continues to rise.

Restraints: Stringent regulations restricting SF6 gas emissions

Gas-insulated switchgear (GIS) substations contain all current-carrying components within gas-tight metal enclosures pressurized with sulfur hexafluoride (SF6) gas, serving as the insulating and arc-quenching medium. This use of pressurized SF6 gas enables the construction of more compact switchgear systems by reducing the spacing required between current-carrying elements. SF6, a dry inert gas, possesses non-flammable properties and does not naturally degrade. However, it is crucial to note that SF6 is categorized as a potent "greenhouse gas" (GHG), with a high global warming potential (GWP) within the group of chemicals known as fluorinated gases. Due to its environmental impact, stringent measures and usage restrictions have been implemented to control SF6 emissions. Regulatory bodies are increasingly scrutinizing SF6, and as regulations regarding F-gases become stricter, the gas insulated switchgears market is expected to face significant implications.

Opportunities: Investment in GIS to support growth of industrial production and renewable energy.

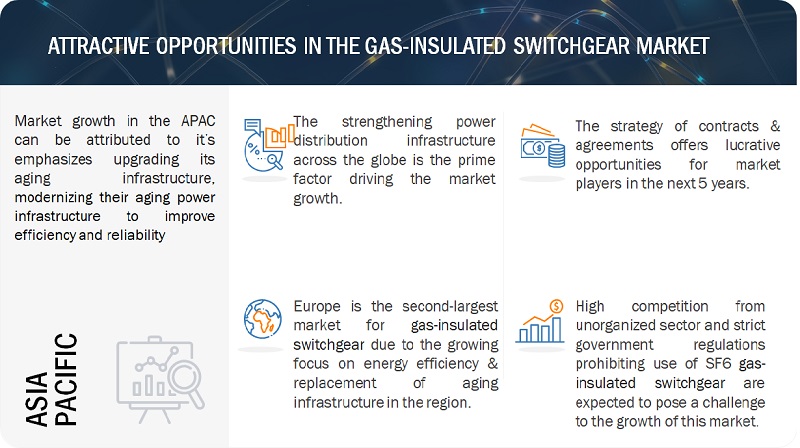

The surge in investments in industrial production related to gas-insulated switchgear (GIS) can be attributed to several compelling factors. Emerging markets, including China, India, and Brazil, are experiencing significant demand for new power infrastructure. The integration of renewable energy sources into the grid is driving the need for efficient transmission and distribution systems, while the imperative to modernize aging grids in developed nations further boosts GIS investment. Additionally, GIS is recognized as an eco-friendly technology, aligning with global sustainability efforts. Despite disruptions caused by recession, a gradual resurgence in industrial production is observed, especially in emerging economies like India and China. Various industrial projects and initiatives worldwide underscore promising prospects for GIS in ensuring power safety, regulatory compliance, and supporting industrial expansion.

Challenges: GIS is expensive compared to conventional or air-insulated switchgear

The cost of acquisition for gas-insulated switchgear (GIS) is elevated due to factors such as Capital Expenditure (CAPEX), the intricacies of the manufacturing process, and the use of expensive components like circuit breakers, transformers, and switching elements that must operate within a dielectric gas-filled enclosure. Housing all these elements within a single chamber increases equipment costs. It's important to note that SF6 gas, classified as one of the most hazardous greenhouse gases by the Intergovernmental Panel on Climate Change (IPCC), is irreplaceable in terms of its effectiveness. Consequently, the market for GIS is expected to face constraints in its growth trajectory due to the combination of high procurement costs and stringent regulations surrounding SF6 gas. Moreover, in case of internal damage, the repair costs for GIS are higher compared to air-insulated switchgear (AIS).

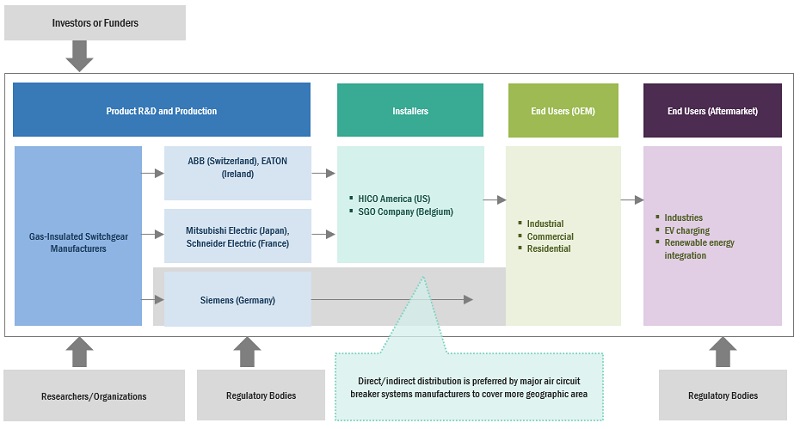

Gas-Insulated Switchgear Market Ecosystem

The market for gas-insulated switchgear (GIS) is marked by the participation of leading companies that are firmly established, financially robust, and possess substantial expertise in the production of switchgear and related components. These companies hold a significant market presence and provide a wide array of product offerings. They harness advanced technologies and maintain extensive global sales and marketing networks. Among the notable players in this market are Eaton (Ireland), ABB (Switzerland), Siemens (Germany), Mitsubishi Electric (Japan), and Schneider Electric (France).

Gas insulated switchgear indoor segment, by installation, to grow at highest CAGR from 2023 to 2028.

Indoor gas insulated switchgear is expected to be the fastest-growing market from 2021 to 2028, based on installation. A reliable power supply is a major factor driving demand for indoor gas insulated switchgears. The industrial sector also contributes to the growth of the indoor gas insulated switchgear market, with manufacturing and assembly plants incorporating indoor gas insulated switchgear into their power networks.

Hybrid segment, by configuration, to emerge as largest segment of gas insulated switchgear market.

During the forecast period, the hybrid segment has the largest market share based on configuration. The rising demand is due to the configuration's features. The three-position disconnecting and earthing switch on hybrid gas-insulated switchgear makes it safe and compact. In addition to being compact, hybrid gas-insulated switchgear can be installed quickly on-site. The main advantages of hybrid gas-insulated switchgear are its dependability, high level of intelligence, and low maintenance requirements.

Electrical utilities segment, by end-user, to grow at highest CAGR from 2023 to 2028.

By end-user, Electrical utilities are intensifying their investments in grid modernization, aiming to enhance operational efficiency and reliability. This drive includes the integration of cutting-edge technologies like smart grids to optimize energy distribution. Within this modernization landscape, gas-insulated switchgear (GIS) plays a pivotal role by bolstering the performance and dependability of grid infrastructure. Reliability and safety are paramount concerns for utilities, and GIS systems are renowned for their robustness, withstanding challenging environmental conditions. Moreover, they incorporate advanced safety features, effectively mitigating the risk of electrical failures and arc flash incidents, making them the preferred choice for utilities.

Asia Pacific to account for largest market size during forecast period.

The gas insulated switchgear market is projected to be dominated by the Asia Pacific region throughout the forecast period. According to the International Monetary Fund (IMF), the Asia Pacific economy is anticipated to grow by 4.9% in the fiscal year 2022. The region experienced a significant economic slowdown due to the recession, leading to a roughly 1.5% decline in its economy in 2022. Consequently, energy demand saw a notable reduction during this period, but it has rebounded as lockdown measures were lifted, and the industrial and manufacturing sectors fully resumed operations. Additionally, the region's population growth places increased strain on housing infrastructure, prompting economies to prioritize the expansion of public housing infrastructure. With sustained growth in major industrial sectors across Asia Pacific, the demand for gas insulated switchgear is expected to remain strong throughout the forecast period.

Key Market Players

ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Eaton Corporation (Ireland), Mitsubishi Electric (Japan), Hitachi (Japan), Legrand (France), Hyundai Electric (South Korea), Fuji Electric (Japan), and Toshiba (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Installation, By Insulation Type, By Configuration, By Voltage Rating, and By End- User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hitachi (Japan), Hyundai Electric (South Korea), Fuji Electric (Japan), Toshiba energy systems & solutions corporation (Japan), Hyosung Heavy Industries (South Korea), ELEKTROBUDOWA (Poland), Yueqing Liyond Electric Co. Ltd. (China), CG Power and Industrial Solutions (India), Nissin Electric (Japan), Meidensha Corporation (Japan), Powell Industries (US), Lucy Electric (UK), Chint (China), SEL S.P.A. (Italy), and ILJIN Electric (South Korea) |

The market is classified in this research report based on installation, insulation configuration, voltage rating, end-user, and region.

Based on installation, the gas insulated switchgear market has been segmented as follows:

- Indoor

- Outdoor

Based on insulation types, the market has been segmented as follows:

- SF6

- SF6- free

Based on voltage ratings, the market has been segmented as follows:

- Up to 5 kV

- 6 to 15 kV

- 16 to 27 kV

- 28 to 40.5 kV

- 40.6 to 73 kV

- 74 to 220 kV

- Above 220 kV

Based on configurations, the market has been segmented as follows:

- Hybrid

- Isolated Phase

- Integrated Three-phase.

- Compact GIS

Based on end-users, the market has been segmented as follows:

- Industrial

- Commercial & Institutional

- Electrical Utilities

- Data Centers

- Aftermarket

Based on regions, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In April 2022, ABB and Samsung Electronics joined forces to collaboratively develop technologies focused on energy conservation, energy management, and the intelligent integration of the Internet of Things (IoT) in residential and commercial buildings.

- In August 2020, Schneider Electric finalized a transaction that merged its Low Voltage and Industrial Automation business in India with Larsen & Toubro's Electrical and automation business.

- In December 2021, ABB entered into a four-year framework agreement with Italy's Transmission System Operator (TSO), Terna, responsible for managing and distributing energy throughout the country. The contract entails the supply of ABB's Gas-Insulated Switchgear (GIS), a technology that significantly reduces the physical footprint of equipment in comparison to traditional air-insulated switchgear substations, often by a factor of one-tenth.

Frequently Asked Questions (FAQ):

What is the current size of the global gas insulated switchgear market?

The global gas insulated switchgear market is estimated to be USD 31.6 billion in 2028.

What are the major drivers for gas insulated switchgear market?

Due to aging power distribution infrastructure, increased renewable energy capacity addition, and increased investment in industrial production, the gas insulated switchgear market is expected to grow significantly during the forecast period. A well-designed GIS is trouble-free to use and requires little maintenance. Arc-resistant GIS designs that have been tested to IEC standards can also be used for increased reliability and safety without increasing the equipment footprint. As a result, when compared to metal-clad designs, GIS has the significant advantage of being inherently arc resistant by design.

Which End-user has the largest market share in the gas insulated switchgear market?

Electrical utilities hold the largest market share in the Gas Insulated Switchgear (GIS) market due to their critical role in the distribution and transmission of electricity. GIS systems are preferred by utilities because they offer compact, reliable, and efficient solutions for managing high-voltage electrical networks. Their ability to minimize space requirements, reduce maintenance costs, and enhance system reliability makes GIS a favored choice for utilities aiming to ensure a stable power supply to meet the increasing demand for electricity in a space-constrained and environmentally sensitive manner.

Which is the largest-growing region during the forecast period in the gas insulated switchgear market?

During the forecast period, Asia Pacific is expected to have the largest market size. China, India, Japan, South Korea, Australia, and the rest of Asia Pacific are included in the region. Industrial, commercial & institutional, electrical utilities, data centers and aftermarket are the region's major end users for gas insulated switchgear. Due to rising energy demand and the replacement of aging coal-fired power plants and distribution infrastructure with new and smart infrastructure, the region has lucrative opportunities for gas insulated switchgear.

Which is the fastest-growing segment in the gas insulated switchgear market during the forecast period?

The rapid growth of the SF6-free segment is primarily propelled by the escalating global apprehension regarding the environmental ramifications of sulfur hexafluoride (SF6) gas. SF6 serves as an insulating and arc-quenching medium in conventional gas-insulated switchgear (GIS), but it is a potent greenhouse gas with a high global warming potential (GWP), contributing to climate change. Consequently, regulatory bodies and governments worldwide are enacting stringent regulations aimed at curbing SF6 emissions, compelling the industry to explore and adopt more environmentally friendly alternatives. Numerous countries and regions are implementing stricter regulatory frameworks and guidelines, often accompanied by penalties and compliance mandates, to curb SF6 usage and emissions. This regulatory environment is fostering the adoption of SF6-free alternatives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

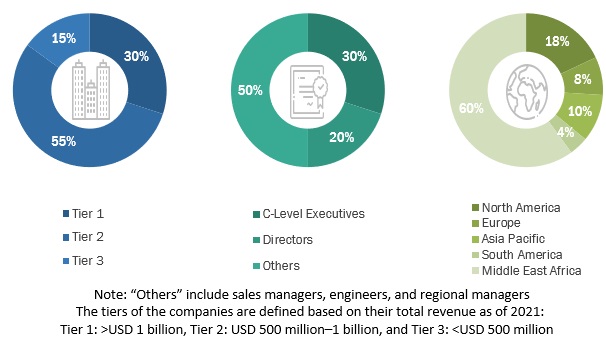

This study encompassed significant efforts in determining the present size of the gas insulated switchgear market. It commenced with a thorough secondary research process to gather data related to the market, similar markets, and the overarching industry. Subsequently, these findings, assumptions, and market size calculations were rigorously validated by consulting industry experts across the entire value chain through primary research. The total market size was assessed by conducting an analysis specific to each country. Following that, the market was further dissected, and the data was cross-referenced to estimate the size of various segments and sub-segments within the market.

Secondary Research

In this research study, a wide range of secondary sources were utilized, including directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data for a comprehensive analysis of the global gas insulated switchgear market covering technical, market-oriented, and commercial aspects. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources.

Primary Research

The gas insulated switchgears market involves a range of stakeholders, including component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-users within the supply chain. The demand for this market is primarily driven by industrial end-users. Additionally, the increasing demand from transmission and distribution utilities contributes to market growth. On the supply side, there is a notable trend of heightened demand for contracts from the industrial sector and a significant presence of mergers and acquisitions among major players.

To gather qualitative and quantitative insights, various primary sources from both the supply and demand sides of the market were interviewed. The following breakdown presents the primary respondents involved in the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

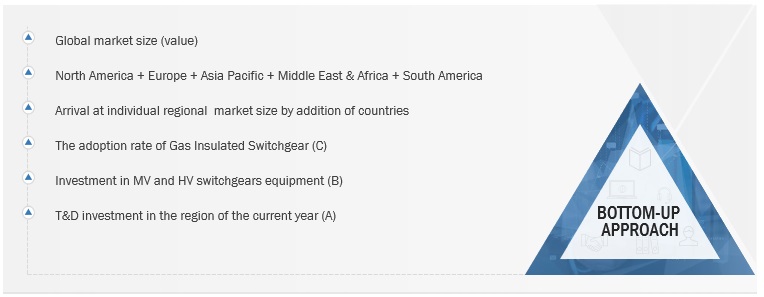

The estimation and validation of the gas insulated switchgear market size have been conducted using a bottom-up approach. This approach was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process comprises the following key stages.

In this method, the production statistics for each type of gas insulated switchgear have been examined at both the country and regional levels.

Thorough secondary and primary research has been conducted to gain a comprehensive understanding of the global market landscape for various categories of switchgears.

Numerous primary interviews have been undertaken with key experts in the field of switchgear system development, encompassing important OEMs and Tier I suppliers.

When calculating and forecasting the market size, qualitative factors such as market drivers, limitations, opportunities, and challenges have been taken into account.

Global Gas Insulated Switchgear Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of determining the overall market size involved the methodologies described earlier, followed by segmenting the market into multiple segments and subsegments. To finalize the comprehensive market analysis and obtain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were applied, as appropriate. Data triangulation was accomplished by examining various factors and trends from both the demand and supply perspectives within the ecosystem of the gas insulated switchgears market.

Market Definition

The gas-insulated switchgear (GIS) market pertains to a specialized sector of the electrical equipment industry. It involves the production and distribution of switchgear systems designed for the efficient management and protection of high-voltage components using a gaseous insulating material, typically sulphur hexafluoride (SF6). These GIS systems are deployed in various applications, including power plants, substations, industrial facilities, and other settings where reliable electricity distribution and safety are paramount. The market encompasses a wide range of stakeholders, from component manufacturers and product assemblers to service providers and end-users and is influenced by factors such as increasing energy demands, renewable energy integration, and the need for compact and reliable power distribution solutions.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Switchgear manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Switchgear manufacturers, distributors, and suppliers

- Switchgear and circuit breaker original equipment manufacturers (OEMs)

Objectives of the Study

- The gas insulated switchgear market will be defined, described, segmented, and forecasted based on installation, insulation type, voltage rating, configuration, and end-user.

- To forecast market size for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East and Africa, as well as the key countries within each region.

- To provide comprehensive information about market growth drivers, restraints, opportunities, and industry-specific challenges.

- To strategically analyze the subsegments in terms of individual growth trends, prospects, and contributions to overall market size.

- To examine market opportunities for stakeholders and the competitive landscape for market leaders.

- To profile the key players strategically and thoroughly analyze their market shares and core competencies.

- To monitor and analyze competitive developments in the gas insulated switchgears market, such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments.

- This report examines the value of the gas insulated switchgears market.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gas Insulated Switchgear Market

How to purchase this report? for view and company development only