Polyvinyl Alcohol Films Market by Grade Type (Fully Hydrolyzed, Partially Hydrolyzed), Application (Detergent Packaging, Medical & Healthcare, Polarizing Plates, Food Packaging, Agrochemical Packaging), & Region - Global Forecast to 2028

Updated on : March 20, 2024

Polyvinyl Alcohol Films Market

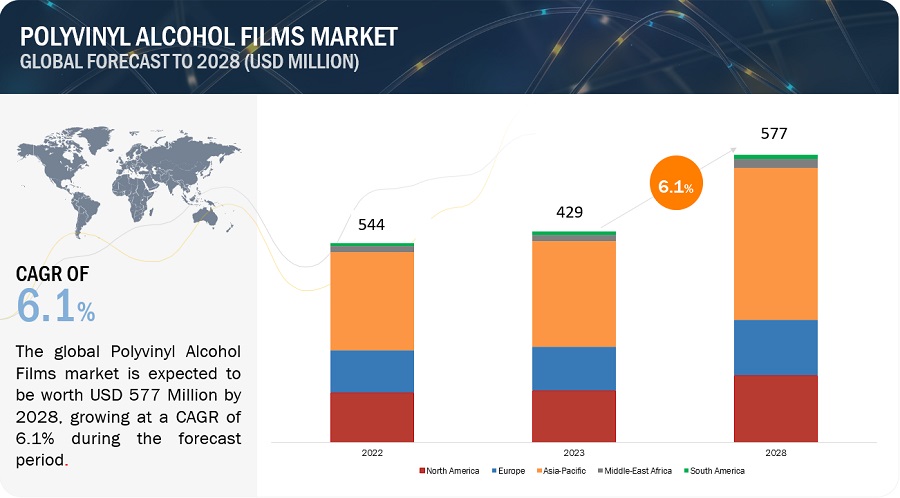

The global polyvinyl alcohol films market was valued at USD 429 million in 2023 and is projected to reach USD 577 million by 2028, growing at 6.1% cagr from 2023 to 2028. PVA films are eco-friendly and biodegradable, aligning with growing environmental concerns. Their excellent barrier properties, moisture resistance, and versatility make them ideal for packaging in various industries. Additionally, their application in industries such as food, pharmaceuticals, and agriculture, where sustainability and protection are paramount, has driven their popularity. With an increasing focus on sustainable packaging solutions and a wide range of applications, the PVA films market continues to experience significant growth.

Attractive Opportunities in the Polyvinyl Alcohol Films Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Films Market Dynamics

Driver: Rising demand from packaging application

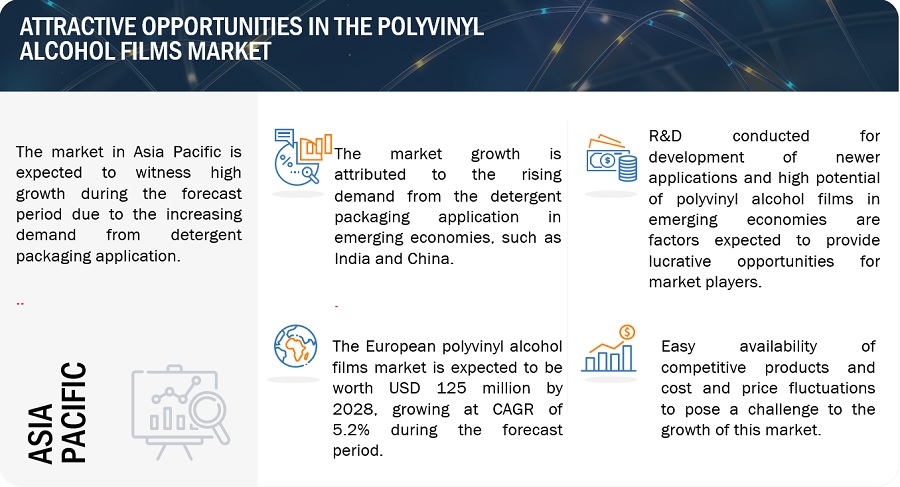

The rising demand for polyvinyl alcohol films from the packaging application is a major driver that significantly influences the growth of the PVA films market. The packaging application is witnessing a continuous evolution in response to changing consumer preferences and global market dynamics. PVA films offer unique advantages in terms of their barrier properties, which protect products from moisture, oxygen, and contaminants. They also provide excellent printability and are compatible with various printing techniques, enhancing their appeal for packaging applications. As consumer packaged goods (CPG) companies strive to differentiate their products and enhance shelf appeal, they are increasingly turning to PVA films to create eye-catching, functional, and eco-friendly packaging solutions.

However, e-commerce and online retail have experienced exponential growth, further boosting the demand for packaging materials. The COVID-19 pandemic accelerated the shift toward online shopping, increasing the need for durable and efficient packaging materials to protect products during transit. PVA films, with their versatility and water solubility, are well-suited for this purpose, providing both convenience and environmental sustainability. Moreover, PVA films align with the global trend toward sustainable packaging. Consumers are becoming more conscious of environmental issues, and regulatory bodies are imposing stricter requirements on packaging materials. PVA films, being biodegradable and water-soluble, offer an eco-friendly alternative to traditional plastics, making them a preferred choice for companies aiming to reduce their carbon footprint and meet sustainability goals.

Restraint: Limited heat resistance of polyvinyl alcohol films

Limited heat resistance is a significant restraint in the polyvinyl alcohol films market. PVA films, although prized for their eco-friendliness and water-solubility, have inherent vulnerabilities when exposed to elevated temperatures. This constraint hampers their suitability for applications demanding high-temperature resistance, such as packaging for hot-fill food products, heat-sealing processes, or storage in environments with high thermal stress. The primary challenge arises in the food packaging sector, where PVA films may not withstand the high temperatures involved in hot-fill or pasteurization processes. Traditional plastic films, like polyethylene terephthalate (PET) or polypropylene (PP), are better equipped to handle these extreme conditions, making them preferred choices for such applications. Additionally, industries that rely on heat sealing, such as the pharmaceutical sector, may find PVA films less compatible due to their limited heat resistance. This may hinder their adoption in critical packaging processes.

Furthermore, limited heat resistance may also affect the overall durability of PVA films in storage and transportation. In regions with hot climates or during long-term storage, PVA films may experience heat-related degradation, leading to a potential reduction in their performance and shelf life.

Opportunities: Rising demand from medical and healthcare industry

The rising demand for polyvinyl alcohol films from the medical and healthcare industry presents a significant opportunity in the PVA films market. PVA films are valued in medical applications for their biocompatibility, water solubility, and non-toxic nature. They are used in various critical applications, such as dissolvable surgical drapes, wound care products, drug delivery systems, and diagnostic test strips. The global healthcare sector is continually expanding, driven by factors like an aging population, increasing healthcare awareness, and the ongoing development of innovative medical technologies. As a result, the demand for PVA films in medical and healthcare applications is expected to grow substantially. This not only offers a stable and potentially high-growth market segment for PVA film manufacturers but also aligns with the industry's emphasis on patient safety and product reliability. Companies that focus on meeting the stringent quality standards of the medical sector and develop specialized PVA film products tailored to healthcare needs may capitalize on this growing demand and establish strong footholds in a lucrative market.

Challenges: Rising environmental concerns

Rising environmental concerns poses a significant challenge in the polyvinyl alcohol films market. While PVA films are prized for their biodegradability and eco-friendliness, the processes involved in their production may still raise environmental alarms. Manufacturing PVA films often necessitates chemical inputs and energy-intensive procedures, which may have adverse ecological impacts. Additionally, the proper disposal and recycling infrastructure for PVA films are not universally available, potentially undermining their eco-credentials if they end up in conventional landfills. Moreover, the market faces increasing scrutiny from environmentally conscious consumers and regulatory bodies, demanding higher sustainability standards throughout the product life cycle. As a result, PVA film manufacturers are challenged to implement more sustainable and resource-efficient production methods while ensuring that the films remain competitively priced. Balancing the eco-friendly image of PVA films with the environmental realities of their production processes is a complex task, one that requires continuous innovation and commitment to address these concerns effectively.

Polyvinyl Alcohol Films Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of polyvinyl alcohol films. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), and Chang Chun Group (Taiwan).

Based on grade type, partially hydrolyzed grade type is projected to account for the second largest share of the polyvinyl alcohol films market

Partially hydrolyzed grade type holds the second largest share in the polyvinyl alcohol films market's grade type segment due to its unique combination of characteristics. It strikes a balance between water solubility and mechanical strength, making it suitable for various applications, especially in industries like textiles and adhesives. This grade type provides the required flexibility, tensile strength, and adhesion properties, making it a versatile choice. As industries seek adaptable and cost-effective solutions, partially hydrolyzed PVA films emerge as a preferred option, leading to its substantial market share.

Based on application, medical & healthcare application is projected to account for the second largest share of the polyvinyl alcohol films market

The medical & healthcare application sector secures the second largest share in the polyvinyl alcohol (PVA) films market due to its unique combination of properties catering to the stringent requirements of healthcare products. PVA films are highly valued for their exceptional biocompatibility, ensuring that medical devices and implants interact safely with the human body, a paramount criterion in this sector. Additionally, their biodegradability aligns with the industry's growing emphasis on sustainable solutions. PVA films water solubility proves advantageous in various applications, from wound dressings to drug delivery systems. Their mechanical strength, transparency, and heat-sealability are pivotal for creating reliable and sterile medical products. As the healthcare field continues to evolve, PVA films remain a versatile and indispensable material, contributing to their significant presence in the medical application segment of the market.

Asia Pacific is expected to be the fastest growing market during the forecast period.

Asia Pacific is poised to be the fastest-growing market for polyvinyl alcohol (PVA) films during the forecast period due to a convergence of factors. The region's burgeoning middle class is driving increased consumer demand for packaged goods, ranging from food to pharmaceuticals, necessitating innovative and sustainable packaging solutions. Furthermore, the regulatory environment is increasingly favouring eco-friendly packaging, and PVA films align well with these requirements as they are biodegradable and eco-conscious. The region's robust manufacturing and industrial base, particularly in countries like China and India, is propelling the adoption of PVA films for diverse applications, including textiles, electronics, and agriculture. This, coupled with a growing awareness of PVA film benefits in reducing plastic waste, positions the Asia Pacific as a hotbed for market expansion in the coming years. Companies investing in this region may tap into the burgeoning demand and capitalize on the sustainability trend.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The polyvinyl alcohol films market is dominated by a few major players that have a wide regional presence. The key players in the polyvinyl alcohol films market are Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), and Chang Chun Group (Taiwan), Japan VAM & POVAL Co., Ltd. (Japan), Polysciences, Inc. (US), Arrow GreenTech Limited (India), Aicello Corporation (Japan), Ecomavi (Italy). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the polyvinyl alcohol films market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion), Volume(Ton) |

|

Segments |

Grade Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), Chang Chun Group (Taiwan), Japan VAM & POVAL Co., Ltd. (JAPAN), Polysciences, Inc. (US), Arrow GreenTech Limited (India), Aicello Corporation (Japan) Ecomavi (Italy) |

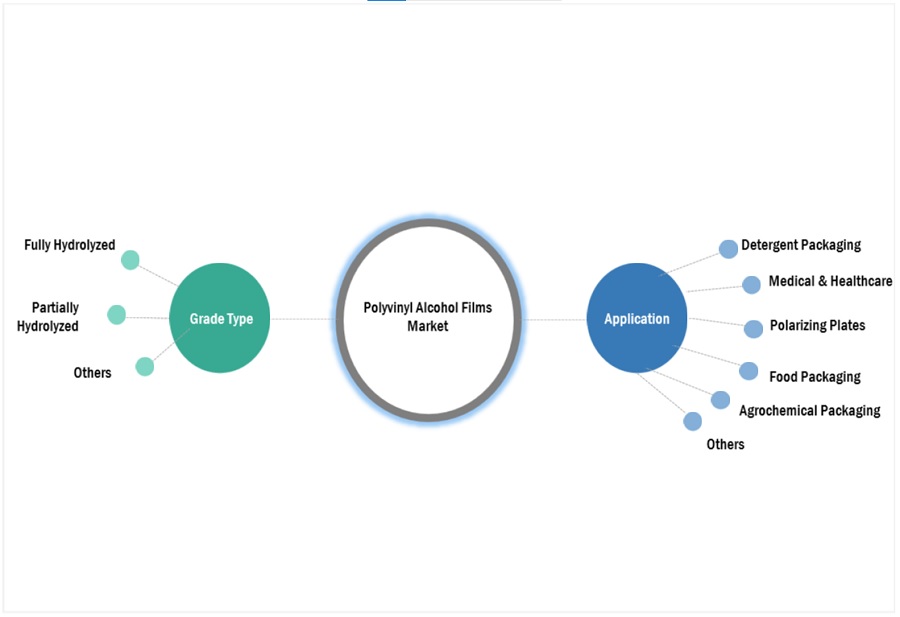

This report categorizes the global polyvinyl alcohol films market based on grade type, application, and region.

On the basis of grade type, the polyvinyl alcohol films market has been segmented as follows:

- Fully Hydrolyzed

- Partially Hydrolyzed

- Others

On the basis of application, the polyvinyl alcohol films market has been segmented as follows:

- Detergent Packaging

- Medical & Healthcare

- Polarizing Plates

- Food Packaging

- Agrochemical Packaging

- Others

On the basis of region, the polyvinyl alcohol films market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2022, Sekisui Chemical Co., Ltd. has announced to expand the PVOH manufacturing capacity to meet the growing needs of its downstream customers. With this expansion Sekisui Chemical Co., Ltd. remains committed to meeting customers’ needs with high quality products. This expansion will increase Sekisui’s PVOH capacity by as much as 25%.

- In May 2021, Mitsubishi Chemical Corporation has completed the acquisition of major shares of Nakai Industrial Co., Ltd., a film coating manufacturer. This acquisition enables Mitsubishi Chemical Corporation to quickly respond to the sophisticated demands of a wide range of customers for polyester films and polyvinyl alcohol films.

- In February 2020, Mitsubishi Chemical Corporation has completed the acquisition of European Engineering Plastics, a recycling company. This acquisition will allow MCC to establish an integrated business model for engineering plastics, and polyvinyl alcohol films, from manufacturing to sales, machining, collection, and reuse.

- In February 2023, Mitsubishi Chemical Corporation announces that it has decided to establish a new facility at the Okayama Plant to enhance the production capacity of GOHSENX and Nichigo G-Polymer, specialty brands of polyvinyl alcohol resin (PVOH resin). The facility is scheduled to start operation in October 2024.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the polyvinyl alcohol films market?

The growth of this market can be attributed to the growing demand for sustainable packaging, versatile applications in various industries, and growing awareness of their biodegradability and protective qualities.

Which are the key applications driving the polyvinyl alcohol films market?

The key applications driving the demand for polyvinyl alcohol films are food packaging, detergent packaging, medical, agrochemical packaging, and others.

Who are the major manufacturers?

Major manufacturers include Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Arrow GreenTech Limited (India), Mitsubishi Chemical Corporation (Japan), Ecomavi (Italy) among others.

What will be the growth prospects of the polyvinyl alcohol films market?

Rise in technological advancements, and rising demand from packaging application are some of the driving factors.

What will be the growth prospects of the polyvinyl alcohol films market in terms of CAGR in next five years?

The CAGR of the market will be in between 5-6% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the polyvinyl alcohol films market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key polyvinyl alcohol films, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The polyvinyl alcohol films market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the polyvinyl alcohol films market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the polyvinyl alcohol films industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of polyvinyl alcohol films and future outlook of their business which will affect the overall market.

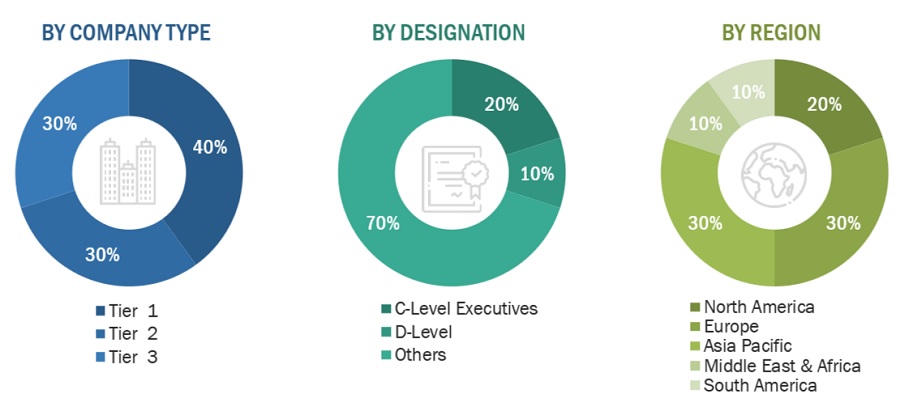

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for polyvinyl alcohol films for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on grade type, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Polyvinyl Alcohol Films Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Films Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process polyvinyl alcohol films above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Polyvinyl alcohol films are a class of versatile polymer-based materials widely used in various industries such as textiles and packaging. These films are derived from the hydrolysis of polyvinyl acetate, resulting in a water-soluble and biodegradable product. PVA films possess remarkable barrier properties against moisture and oxygen, making them ideal for packaging applications in the food, pharmaceutical, and agrochemical industries. They are known for their capacity to create a highly hydrated environment that fosters cell attachment and proliferation, making them invaluable in tissue engineering. Their adaptability to 3D bioprinting and electrospinning technologies further enhances their applicability. PVA films align with the growing global emphasis on sustainability, serving as a preferred eco-friendly choice for product preservation and a broad range of other applications across diverse sectors.

Key Stakeholders

- Polyvinyl alcohol films Manufacturers

- Polyvinyl alcohol films Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the polyvinyl alcohol films market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on grade type, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on polyvinyl alcohol films market

Growth opportunities and latent adjacency in Polyvinyl Alcohol Films Market