The global commercial avionics systems market was valued at $32.9 billion in 2020, and is projected to reach $54.4 billion by 2030, growing at a CAGR of 5.31% from 2021 to 2030.

Commercial avionics system includes various flight sub-systems, including health monitoring systems, flight management, flight control, navigation & surveillance systems, electrical & emergency, communication, and systems electronics. In addition, it includes autonomous computer control components or electronic devices that receives input from engine controls or flight control surfaces and provides output to flight management systems. Flight management systems have multi-purpose performance, navigation, and aircraft operations computer that provide virtual information and operating synergy among closed or open aspects involved with a flight, from pre-engine start or take-off to engine shut-down or landing. There is increase in need for real-time data and navigation systems in commercial avionics systems industry.

Factors, including surge in number of aircraft deliveries, growth in emerging economies, increase in demand for in-flight entertainment (IFE) services, and rise in need for real-time data drive the growth of commercial avionics systems market. However, regulatory framework and vulnerability to cyber-attacks hinder the growth of the market.

On the contrary, development of advanced avionics systems for Nextgen aircraft, growth in adoption of low-cost carriers (LCC) in developing countries, and improvement in commercial aviation networks are factors that are projected to create new growth opportunities for prominent players.

By Aircraft Type

Freighter is expected to witness lucrative growth during the forecast period

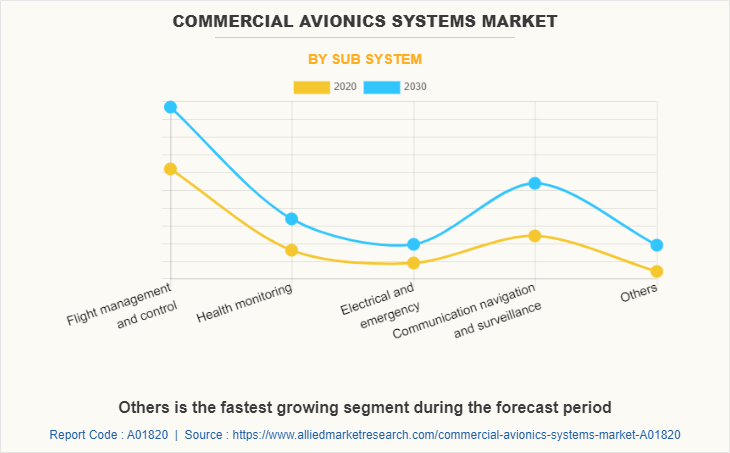

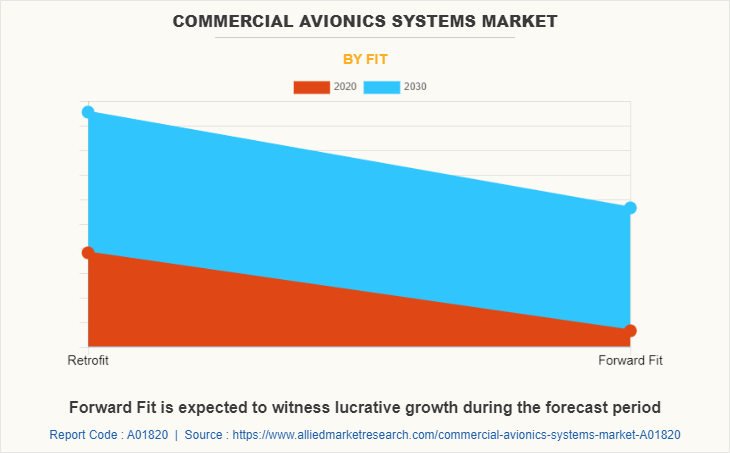

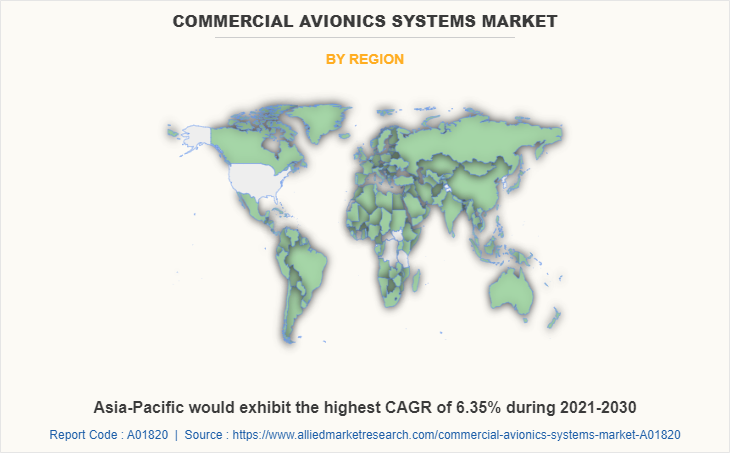

Global commercial avionics systems market is segmented on the basis of aircraft type, sub-system, fit, and region. On the basis aircraft type, the market has been categorized into narrow body, wide body, regional & business jet, and freighter. According to sub-system, it is classified into flight management and control, health monitoring, electrical and emergency, communication navigation and surveillance, and others. Depending on fit, it is categorized into retrofit and forward fit. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in these commercial avionics systems market report include BAE Systems Plc., General Electric, Honeywell International Inc., L-3 Harris Technologies, Meggitt PLC., Panasonic Corporation, Raytheon Technologies Corporation, Teledyne Technologies, Inc., Thales Group, and Universal Avionics Systems Corporation.

Surge in number of aircraft deliveries

According to the International Civil Aviation Organization (ICAO), by 2035, passenger traffic and freight volume will be double. Increase in number of airline passengers is observed, owing to factors, including growth in disposal income of middle-class population and rise in adoption of low-cost airlines. Thus, increase in passengers tends to increase number of commercial aircraft deliveries. In addition, significant increase in demand for avionics systems & services, owing to rise in number of commercial aircraft deliveries. Major countries such as Canada, the U.S., Brazil, Indonesia, Philippines, China, Saudi Arabia, and India witness rise in number of air passengers and aircraft deliveries. For instance, according to the Bureau of transportation, in October 2021, the U.S. Airlines passengers increased 119% from October 2020. According to the International Air Transport Association (IATA), passenger numbers will be double to 8.2 billion in 2037 at 3.5% compound annual growth rate (CAGR).

Increase in demand for real-time data

Technological improvements significantly impacted the commercial avionics systems market. Furthermore, developments in health monitoring systems, glass cockpits, and in-flight entertainment aided the growth of market Increase in demand for data analytics in aviation industry primarily drives the growth of market, particularly in North America and Europe, where the industry is sufficiently advanced to include such advancements. Real-time data analytics allows for faster data processing speed, which aids in industry decision-making. This element is expected to have a significant impact in future.

Moreover, inappropriate business decisions, due to unavailability of data management systems, maintenance scheduling, business/operation trend analysis, and aircraft on ground (loss of revenue) hinder the growth of advanced aviation industry. These problems are efficiently solved with use of advanced real-time data monitoring systems & software for various flight operations. Companies focus on developing new support systems for aircraft health monitoring, preventive maintenance, and avoiding system failure to facilitate real-time, post-flight recorded data management, fault notification, and diagnostic reporting. These new developments drive the growth of commercial avionics systems market.

High costs involved

Commercial avionics systems involve high costs in implementation and maintenance. In addition, complexities involved in managing value chain, owing to low profits associated with installation of such expensive systems and rise in prices of fuel hinder the growth of the market. In addition, high initial cost associated with installation of networking technologies and connectivity hardware hamper the growth of the market. For instance, air-to-ground technology costs around $80,000 per aircraft however, cost associated with deployment of satellite technology is around $400,000. This hinders the adoption rate of connectivity hardware and services by airlines, particularly in the developing regions, including Asia Pacific and Latin America to a considerable extent. Moreover, commercial avionics systems are highly dependent on network planning & designing and complex electronic integrations. These services, if related to deployment of satellite networking technology or equipment, are estimated to cost over $100,000.

Growth of low-cost carriers (LCCs) in emerging economies

Emergence of low-cost airlines revolutionized travel industry, especially in developing countries, across the globe. Low-cost carriers (LCCs)) are favored by cost-conscious travelers in developing countries. This is expected to drive the demand for aircraft deliveries. Furthermore, growth in network capacities and adoption of low-cost carriers in many developing countries provide lucrative growth opportunities for the market. This led to increase in number of aircraft deliveries, which boost the market growth of commercial avionics systems

Moreover, emerging markets in the developing regions such as Asia-Pacific, the Middle East, and Latin America are projected to create new growth opportunities for prominent players. Commercial aviation market players, including Honeywell International Inc. and General Electric supplement the growth of the market during the forecast period. For instance, in November 2021, Collins Aerospace (a subsidiary of Raytheon Technologies Corporation) signed an agreement with Emirates Airline to upgrade its fleet of 101 B777 and 107 A380 aircraft with the company's latest GLU-2100 multi-mode receiver (MMR) and provide a full suite of avionics and satellite communication (SATCOM) capabilities to Emirates’ 777X aircraft.

Furthermore, in May 2021, Honeywell International Inc. signed a five-year maintenance agreement with SR Technics Malaysia, as an authorized channel partner for both mechanical and avionics components. In addition, in April 2021, Honeywell International Inc. signed a five-year distribution agreement with the Abu Dhabi Aviation (ADA) to supply multifunction control display units (MCDU) products.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global commercial avionics systems market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall commercial avionics systems market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the commercial avionics systems market with a detailed impact analysis.

- The current commercial avionics systems market is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers in the industry.

Commercial Avionics Systems Market Report Highlights

| Aspects | Details |

| By Aircraft Type |

|

| By Sub System |

|

| By Fit |

|

| By Region |

|

| Key Market Players | Honeywell International Inc, Teledyne Technologies Inc, Thales Group, L3 Harris Technologies, Raytheon Technologies Corporation, Meggitt PLC, Universal Avionics Systems Corporation, BAE Systems PLC, General Electric, Panasonic Corporation |

Analyst Review

Commercial avionics systems include all of the smaller systems found in an aircraft cockpit, including surveillance, communication, control, and navigation. These systems pushed both government and business entities to engage in development of efficient and innovative avionics subsystems. Moreover, implementation of cutting-edge technologies, including NextGen Avionics and increase in system expenditure drive the growth of the global commercial avionics systems market.

Moreover, numerous developments have been carried out by key players operating in the industry, which are expected to create remunerative opportunities for growth of the commercial avionics market during the forecast period. For instance, in January 2022, GE Aviation (a subsidiary of General Electric) entered collaborated with SmartSky Networks and Mosaic ATM to improve flight management systems (FMS) and air traffic management (ATM) for advanced air mobility (AAM). In addition, in November 2021, Collins Aerospace (a subsidiary of Raytheon Technologies Corporation) signed an agreement with Emirates Airline to upgrade its fleet of 101 B777 and 107 A380 aircraft with company's latest GLU-2100 multi-mode receiver (MMR) and provide a full suite of avionics and satellite communication (SATCOM) capabilities to Emirates’ 777X aircraft.

Global commercial avionics systems market is segmented on the basis of aircraft type, sub-system, fit, and region. On the basis aircraft type, the market has been categorized into narrow body, wide body, regional & business jet, and freighter. According to sub-system, it is classified into flight management and control, health monitoring, electrical and emergency, communication navigation and surveillance, and others. Depending on fit, it is categorized into retrofit and forward fit. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA

The global commercial avionics systems market valued at $32.94 billion in 2020, and is projected to reach $54.42 billion by 2030, registering a CAGR of 5.31% between 2021 and 2030

The leading companies operating in the commercial avionics systems market are BAE Systems Plc, Honeywell International Inc., L-3 Harris Technologies, and Universal Avionics Systems Corporation

The report sample for global commercial avionics systems market report can be obtained on demand from the website

The key segments covered in the report are the aircraft type, sub system, and fit

In terms of sub system, we have categorized commercial avionics systems into flight management and control, health monitoring, electrical and emergency, communication navigation and surveillance, and others

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated

Growth of low-cost carriers (LCCs) in emerging economies, and increased safety of aircraft

Loading Table Of Content...