Anti-Money Laundering Software Market Research, 2032

The global anti-money laundering software market was valued at $2.2 billion in 2022, and is projected to reach $8.7 billion by 2032, growing at a CAGR of 15.3% from 2023 to 2032.

Anti-money laundering (AML) software supports the need for compliance with the increasingly stringent regulations set by regulatory authorities and is utilized in the financial sector and other fields that are connected to it. The AML software conserves time, money, and resources through the automation of compliance procedures including the detection and reporting of questionable behavior. In addition, it may prevent or identify abnormal behavior, lessen false positives, and help businesses report suspicious transactions accurately.

The combination of cloud computing and the internet of things (IoT) has the potential to create several benefits for businesses and consumers alike. This AML software combines and deciphers several data points in transaction messages for each client, including the sender and receiver's names, and determines whether either is on any sanction's lists. In addition, the use of advanced technology in conjunction with the IoT can help to improve data management and analytics, as well as provide businesses with a better understanding of their products. Such enhanced factors are expected to provide lucrative opportunities for AML software market growth during the forecast period.

Furthermore, an increase in the use of cutting-edge technologies, increased need for intelligent financial systems, and expanding digitalization are all contributing to the AML software market expansion. In addition, the market is anticipated to expand throughout the projected period due to rising internet service use and developments in AI technology.

Moreover, the rise in online payment modes in bank transactions and the rising adoption of internet solutions are the key factors that positively impact the growth of the AML market in the future. Moreover, an increase in strict regulations and compliance with anti-money laundering propels global market growth. However, high initial cost and expense considerations are expected to hamper AML market growth. In addition, a lack of consumer knowledge and awareness can deter businesses from adopting these technologies. Furthermore, the surge in integration of advanced technologies is one of the major factors creating numerous opportunities for the anti-money laundering software market forecast. Moreover, the growing adoption of analytics solutions is expected to offer remunerative opportunities for the anti-money laundering software market growth during the forecast period.

The anti-money laundering software market is segmented into Component, Deployment, Product Type and Organization Size.

Segment Review

The anti-money laundering software market is segmented into component, product type, deployment, organization size and region. On the basis of component, it is bifurcated into software and service. Based on product, the market is divided into transaction monitoring, currency transaction reporting, customer identity management, and compliance management. Based on deployment, it is segmented into cloud and on-premise. Based on organization size, the market is classified into large enterprises and small & medium-sized enterprises. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

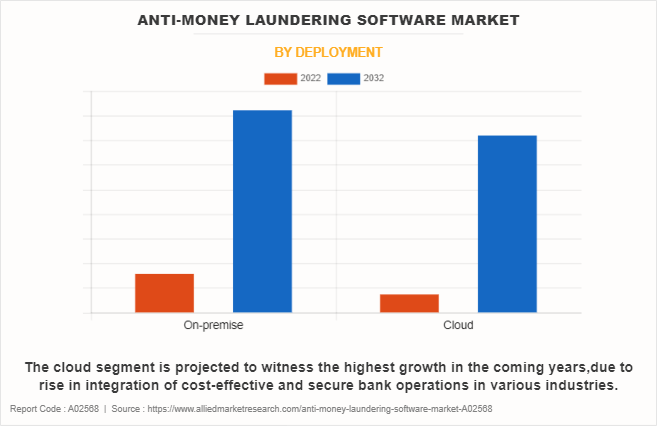

On the basis of deployment, the global anti-money laundering software market share was dominated by the on-premise segment in 2022 and is expected to maintain its dominance in the upcoming years, owing to improving their software, several businesses started to provide more effective anti-money laundering software, from BFSI to manufacturing, and healthcare. However, the cloud segment is expected to witness the highest growth, due to their capacity to provide cost-effective and secure bank operations.

By region, Europe dominated the market share in 2022 for the anti-money laundering software market. The increasing investment of businesses and government bodies in advanced technologies such as cloud-based services, AI, ML, and IoT to improve banking and finance businesses and the customer experience are anticipated to propel the growth of the anti-money laundering software market trends. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increase in penetration of digitalization and higher adoption of advanced technology are expected to provide lucrative growth opportunities for the anti-money laundering aoftware industry in this region.

COVID-19 Impact Analysis

The global COVID-19 pandemic significantly impacted anti-money laundering software market, owing to the spread of novel coronavirus has led to restrictions on various services in different sectors. It further caused a global decline in the demand for traditional bank operations due to lockdown measures and transport restrictions imposed by national authorities, while enabling bank authorities to deliver crucial services. These measures directly impacted on the economy of the banking and finance sector, with the partial or complete shutdown of bank activities, particularly traditional banking services.

On the other hand, some countries have incorporated different technological strategies in their business operations to deal with this pandemic situation. Many consumers are shifting their preference towards online banking operations. According to the Worldbank, in June 2022, the usage of digital payments has expanded as a result of a pandemic. Over 40% of individuals in low- and middle-income countries paid a merchant in-person or online with a card, phone, or the internet. Thus, such trends are expected to boost the online banking operations in the BFSI sector. Consequently, these factors are expected to have less negative impact on the growth of the global anti-money laundering software industry in the forecast period.

Top Impacting Factors

Rise in online payment modes in bank transactions:

The rising trend of online payment options in the BFSI sector to improve optimization is directly influencing the growth of the global anti-money laundering software market. Radical advancements in the payment environment, enabled through communication technologies, require revising present business models and maintenance strategies. Consequently, online payment systems are gaining significant adoption to increase the use of IT and control systems among banking operators, particularly IoT and other digital technologies. As per Barclays, in February 2023, nearly 91.2 % of all eligible card transactions were initiated using digital payments in 2022. In addition, increased use of IoT and digital solutions helps finance managers improve payment availability, prolong asset lifetime, and empower technical staff to efficiently make maintenance. These factors are likely to contribute to the increased installation of anti-money laundering software market, globally.

Furthermore, the integration of digital payments solutions allows reducing the transaction time and prioritizing of banking maintenance tasks. In addition, the integration of automated systems in payment operations has reduced the rate of errors, such as system errors, as well as improper card detection. Hence, these multiple benefits offered by digital payments used in payment operations and maintenance services will boost the growth of anti-money laundering software market. Moreover, businesses are continuously involved in promoting digitalization in banking operations. For instance, in May 2023, Quantexa partnered with ING, the collaboration aims to strengthen ING’s risk detection and investigative efforts by utilizing Quantexa’s Decision Intelligence Platform. Such strategies pooling in the securing the payment infrastructure will fuel the demand for anti-money laundering software, which in turn, augment the market growth on a global scale.

The rising adoption of internet solutions:

The rising adoption of internet services and devices in banking operations is significantly driving global market growth. The use of internet-based platforms and applications for performing various financial operations and transactions is referred to as internet banking, also known as online banking and digital banking. Accordingly, governments from different geographies recognized the use of IT and communication technologies in bank operations as being like smart banking projects, as they focus on providing improvements to operations, sustainability, experience, and business vitality. Further, customers may access and manage their bank accounts and complete transactions whenever, anywhere that has an internet connection due to the convenience and accessibility which internet banking provides, thus, bank authorities are required to help optimize the growth and integration of the digital systems. These factors are significantly contributing to huge potential for the growth and development of the anti-money laundering software market.

In addition, the emerging trend of internet banking improves payment infrastructure, as well as advance positivity to the urban development and national economy. It also increases the quality of payment gateways of the entire population by responding to comprehensive challenges of flexibility. Thus, the banking and finance sector is increasingly using and implementing internet payment concepts in payment operations. For instance, in June 2022, HDFC Bank launched its products and services including a new payments platform under Digital 2.0. The bank has formed an alliance with an emerging start-up for moving out from its existing core banking platform and creating new core banking modules. The services aim to contribute to the foundation of better digital payment options by applying cutting-edge technologies to bank operators. The launch initiative will further seek to promote technological innovation to make internet payments more reachable to people. Leveraging these smart banking services and systems for payment management help to promote economic development and helps to maintain ecological stability. Therefore, these factors will pave a way for the deployment of anti-money laundering software, which eventually drives market growth.

Key Benefits for Stakeholders

- The study provides an in-depth anti-money laundering software market analysis along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on the anti-money laundering software market size is provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the anti-money laundering software industry.

- The quantitative analysis of the global anti-money laundering software market for the period 2022–2032 is provided to determine the anti-money laundering software market potential.

Anti-Money Laundering Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.7 billion |

| Growth Rate | CAGR of 15.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 275 |

| By Component |

|

| By Deployment |

|

| By Product Type |

|

| By Organization Size |

|

| By Region |

|

| Key Market Players | Verafin Solutions ULC, Ascent Technology Consulting, Moody’s Corporation, Eastnets Holding Ltd., NICE Actimize, LexisNexis Risk Solutions, FICO TONBELLER, ACI Worldwide, Inc., Thomson Reuters Corporation, SAS Institute Inc. |

Analyst Review

As the anti-money laundering software industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. Decision-making is an important aspect of every organization including the BFSI sector. A combination of digital technologies with analytical methods can provide the best result in achieving better decision-making. In addition, IT infrastructure transformation is one of the main advantages of anti-money laundering software. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, anti-money laundering software can enable innovation and collaboration by providing an open and modular architecture that allows developers and partners to build and integrate new applications and services. However, businesses also recognize the challenges associated with anti-money laundering software. One significant restraint is that anti-money laundering software requires a large number of investment in infrastructure, high-speed internet capabilities, and expertise, which can be a limitation to entry for small-scale enterprises.

Furthermore, data privacy and security-related privacy and regulatory problems must be addressed. Businesses must deliver services in accordance with the unique demands and specifications of their organization, considering elements like scalability, dependability, and cutting-edge security. By addressing these challenges, businesses can unlock the full potential of anti-money laundering software market to transform their payment operations, create value, and gain a competitive advantage in their industry. For instance, in June 2023, Google Cloud launched Anti Money Laundering AI (AML AI), an artificial intelligence (AI)-powered product designed to help global financial institutions more effectively and efficiently detect money laundering.

An increase in the use of cutting-edge technologies, increased need for intelligent financial systems, and expanding digitalization are all contributing to the market's expansion.

North America is the largest market for the Anti-Money Laundering Software.

Anti-Money Laundering Software Market is expected to reach $8,710.33 Million, by 2032.

The key growth strategies for Anti-Money Laundering Software include product portfolio expansion, acquisition, partnership, merger, and other.

Some of the top players operating in the market include ACI Worldwide, Inc., Ascent Technology Consulting, Eastnets Holding Ltd., FICO, NICE Actimize, Moody Corporation, LexisNexis Risk Solution, SAS Institute Inc., Thomson Reuters Corporation, and Verafin Inc.

Loading Table Of Content...

Loading Research Methodology...