Microserver Market Research, 2032

The global microserver market was valued at $28.8 billion in 2022, and is projected to reach $122.4 billion by 2032, growing at a CAGR of 15.8% from 2023 to 2032.

Micro servers are miniature, standalone computing nodes designed to perform specific functions or services, often as part of a distributed infrastructure. They feature compact hardware configurations, including low-power processors, minimal RAM, and storage. Micro servers are particularly suitable for scenarios where scalability and redundancy are crucial, offering a balance between performance and efficiency. End-users can benefit from micro servers in several ways. Their compact size and power efficiency contribute to reduced energy costs and physical space requirements. Micro servers also facilitate easy scalability, allowing organizations to add or remove nodes as needed, which is especially valuable for businesses experiencing fluctuating workloads. The distributed nature of microserver architecture enhances system reliability, ensuring that services remain available even if one node fails. For end-users, this translates into robust and cost-effective solutions that adapt to their evolving needs, ultimately delivering a more reliable and efficient computing experience.

The emergence of hyperscale data center architecture has significantly propelled the growth of the microserver market. Hyperscale data centers, which are massive facilities designed to deal with the steadily expanding interest for computerized administrations and distributed computing, require a more proficient and adaptable way to deal with waiter organization. Traditional, monolithic servers are often too bulky and power-hungry for hyperscale operations, prompting greater expenses and failures. In addition, low power utilization and low space use of micro servers are key driving factors for the microserver market which opens up a new avenue for growth. However, the absence of standard determinations in the microserver market is a huge component that restrains its growth. Micro servers are compact, energy-efficient computing devices designed for specific tasks, and they have gained popularity due to their scalability and cost-effectiveness.

Moreover, the cost-effectiveness of microservers can assist associations in emerging nations reduce their capital and operational expenses while still satisfying the developing need for data processing. As a result, the microserver market is expected to witness substantial growth, driven by the need for data center solutions that can efficiently support the digital transformation and economic development of developing countries. This pattern benefits innovation suppliers as well as adds to connecting the advanced gap and working with financial advancement in these regions.

The report focuses on growth prospects, restraints, and trends of the microserver market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the microserver market.

The microserver market is segmented into Component, Function, Organization and Application.

Segment Review

The microserver market is segmented on the basis of component, function, organization size, application, and region. On the basis of the component, the market is segmented into hardware and software. By function, it is segmented into intel, AMD, and others. On the basis of the organization size, the market is segmented into large enterprises and small and medium-sized enterprises. By application, it is bifurcated into data center, data analytics, cloud computing, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

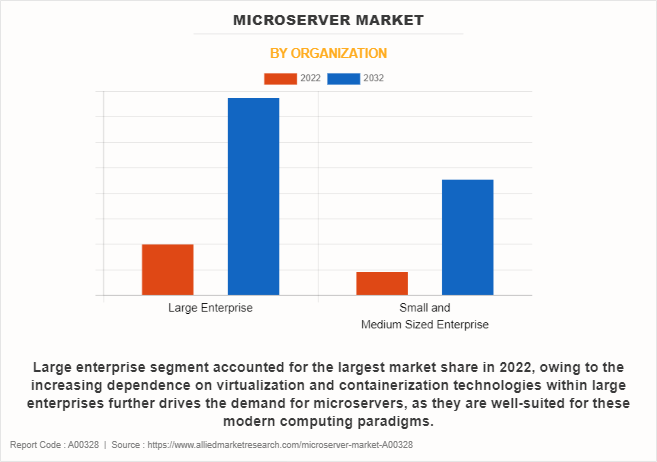

By organization size, the large enterprises segment held the highest market share in 2022, owing to the increasing reliance on virtualization and containerization technologies within large enterprises further drives the demand for microservers, as they are well-suited for these modern computing standards. However, the small and medium-sized enterprises segment is projected to manifest the highest CAGR from 2023 to 2032, owing to the increasing adoption of microservers for hosting websites, running small-scale databases, and managing network services. This trend is driven by the need for budget-friendly and energy-efficient computing solutions that can help drive its adoption, further fueling growth.

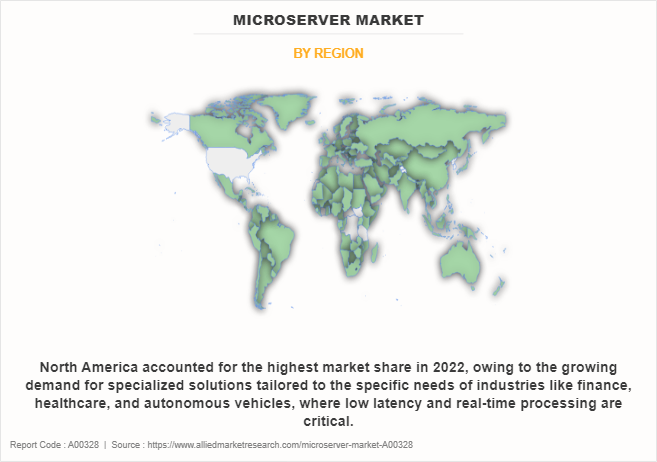

Based on region, North America attained the highest market share in the microserver market owing to the rising adoption of edge computing and Internet of Things (IoT) technologies in North America is creating a need for decentralized computing resources. However, the market for microserver is expected to develop at the fastest rate in the Asia-Pacific region. The growing demand for data centers and cloud computing services has been on the rise, driven by increased internet penetration and digitalization across the region. This surge in data processing needs is creating a growing market for microservers, which are energy-efficient and space-saving solutions.

Some of the key players profiled in the report include Advanced Micro Devices, Inc., Dell Inc., Fujitsu Ltd., Hewlett Packard Enterprise, Hitachi, Ltd., IBM Corporation, MiTAC Holdings Corp., NVIDIA Corporation, Penguin Computing, and Super Micro Computer, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the microserver market.

Competition Analysis

Recent Product development in the Microserver Industry

In September 2021, IBM unveiled generated IBM Power servers for frictionless, scalable hybrid cloud. The New IBM Power E1080 server offers 2.5x greater per core performance vs x86-based servers and sets a new world record SAP benchmark for 8-socket systems. Industry-first metering of Red Hat OpenShift and Red Hat Enterprise Linux for on-premises server planned to improve software licensing costs.

Recent partnership in the Microserver Market

In April 2022, FS.COM, a high-speed network solution provider for data centers, enterprises, and telecom networks, partnered with Super Micro Computer, Inc., a global leader in enterprise computing, storage, networking solutions, and green computing technology. This helps to deliver rack servers with powerful performance and high reliability to help customers deploy, manage and scale their infrastructure applied for virtualization, big data, and cloud computing in the digital economy.

In November 2022, Hewlett Packard Enterprise partnered with VMware, Inc. to deliver a fully integrated solution with a simple pay-as-you-go hybrid cloud consumption model.

Recent Collaboration in the Microserver Market

In February 2023, Supermicro, Inc. a Total IT Solution Provider for Cloud, AI/ML, Storage, and 5G/Edge, collaborated with Rakuten Symphony to deliver the next generation of servers and storage systems, for a wide range of workloads. As a major collaborator with Rakuten Symphony, the two companies are providing blueprints to operators for cloud-based mobile services that utilize the most advanced servers and networking architecture, delivering an easy-to-implement solution for operators worldwide. In addition, Rakuten Symphony can quickly offer Open RAN solutions with timely technical support and consultancy.

In May 2022, HPE and NVIDIA collaborated to help businesses unlock the power of AI by delivering an end-to-end enterprise platform optimized for AI workloads on a consumption-based model using HPE GreenLake for NVIDIA AI Enterprise. The platform is deployed on industry-leading HPE servers that are NVIDIA-Certified to accelerate the speed at which developers can build AI and high-performance data analytics.

Recent Product Launches in the Microserver Market

In July 2022, IBM launched its new IBM z16 mainframe. Based on its IBM Telum Processor, the new system has been based on over 1,100 hours of co-creation with more than 70 of its mainframe customers and partners. The new server extends the technical leadership IBM already has for providing ‘systems of record’ to the largest enterprise organizations in the world.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of microserver market trends from 2022 to 2032 to identify the prevailing microserver industry opportunities.

- The report provides a comprehensive analysis of the current market estimations through 2022-2032, which would enable the stakeholders to capitalize on prevailing market opportunities.

- In-depth analysis of microserver market growth assists to determine the prevailing market opportunities.

- The report includes an analysis of the regional as well as microserver market share, key players, market segments, application areas, and market growth strategies.

- Major countries are mapped according to their revenue contribution to microserver market size.

- Identify key players and their strategic moves in microserver market forecast.

- Assess and rank the top factors that are expected to affect the growth of microserver market outlook.

Microserver Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 122.4 billion |

| Growth Rate | CAGR of 15.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 364 |

| By Component |

|

| By Function |

|

| By Organization |

|

| By Application |

|

| By Region |

|

| Key Market Players | Penguin Computing (US), Hitachi, Ltd., Fujitsu, IBM Corporation, Advanced Micro Devices, Inc., Dell, Hewlett Packard Enterprise, NVIDIA Corporation, MiTAC Holdings Corp., Super Micro Computer, Inc. |

Analyst Review

With the advancement in the capabilities of ARM-based processors, there are a number of ARM technology licensees targeting server solutions, and in particular the micro-server-based markets. Although ARM is European IP, none of the other ARM-based server chips are being built by European companies. Overall, the hardware and software segments of the global microserver market are integral components of the microserver ecosystem. While hardware provides the physical foundation, software plays a crucial role in optimizing and managing microserver resources. Both segments are witnessing continuous evolution and growth, driven by the demands of cloud computing, edge computing, and emerging technologies. Furthermore, the segments including cloud computing and media storage, play integral roles in the digital age. While cloud computing revolutionizes how computing resources are accessed and utilized, media storage and related applications ensure the preservation, accessibility, and efficient management of multimedia content.

Moreover, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in February 2022, AMD completed the acquisition of Xilinx in an all-stock transaction. This acquisition creates the industry’s high-performance and adaptive computing leader with significantly expanded scale and the strongest portfolio of leadership computing, graphics and adaptive SoC products. AMD expects the acquisition to be accretive to non-GAAP margins, non-GAAP EPS and free cash flow generation in the first year. Further, in May 2022, HPE and NVIDIA collaborated to help businesses unlock the power of AI by delivering an end-to-end enterprise platform optimized for AI workloads on a consumption-based model using HPE GreenLake for NVIDIA AI Enterprise. The platform is deployed on industry-leading HPE servers that are NVIDIA-Certified to accelerate the speed at which developers can build AI and high-performance data analytics.

Some of the key players profiled in the report include Advanced Micro Devices, Inc., Dell Inc., Fujitsu Ltd., Hewlett Packard Enterprise, Hitachi, Ltd., IBM Corporation, MiTAC Holdings Corp., NVIDIA Corporation, Penguin Computing, and Super Micro Computer, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the microserver market.

The growing trend toward specialized microservers tailored for specific workloads, such as AI inference, IoT applications, or data analytics. This trend aimed at maximizing efficiency for particular tasks rather than offering a one-size-fits-all solution.

Cloud Computing is the leading application of Microserver Market

North America region holds the largest regional market for Microserver.

The estimated industry size of Microserver is $122,441.3 million.

The key players profiled in the report include Advanced Micro Devices, Inc., Dell Inc., Fujitsu Ltd., Hewlett Packard Enterprise, Hitachi, Ltd., IBM Corporation, MiTAC Holdings Corp., NVIDIA Corporation, Penguin Computing, and Super Micro Computer, Inc.

Loading Table Of Content...

Loading Research Methodology...