Smart Glass and Smart Window Market Statistics - 2030

The global smart glass and smart window market was valued at $5.1 billion in 2020, and is projected to reach $19.6 billion by 2030, registering a CAGR of 15.0% from 2021 to 2030.

The applications of smart glass and smart windows span across diverse industries and continue to grow. In architecture, they are utilized for innovative building facades, privacy partitions, and curtain walls. Smart glass and smart window market opportunity is increasingly integrated into smart homes and eco-friendly buildings to enhance energy efficiency and comfort for residents. In the automotive sector, smart glass technologies are integrated into sunroofs, side windows, and rear windows, enhancing user experience and vehicle energy efficiency. In the aerospace field, smart windows provide glare reduction and thermal control for a more enjoyable flying experience for passengers. In addition, smart glass finds applications in the marine industry, improving visibility and energy efficiency in ships and yachts. As research and development efforts persist, smart glass and smart windows are likely to discover novel and ingenious applications across various sectors, revolutionizing our interactions with glass surfaces in everyday life.

Smart glass, also referred to as switchable or dynamic glass, is a technologically advanced material that can alter its optical properties based on external triggers or user input. It has the unique capability to switch between transparent, translucent, and opaque states, making it a versatile solution for various applications such as a electrochromic smart windows. Different technologies, such as electrochromic, thermochromic, photochromic, and suspended particle device (SPD) technology, can be used to manufacture smart glass. When activated, these technologies modify the light transmission of the glass, allowing for privacy control, glare reduction, heat insulation, and improved energy efficiency.

Smart windows, a specific type of smart glass designed for windows and glass surfaces, share similar functionalities with smart glass but are tailored for window installations. They can adapt to changing light conditions and user preferences, providing on-demand tint control and creating a comfortable and customizable environment for occupants. In the construction industry, smart windows optimize natural light usage, leading to reduced reliance on artificial lighting and enhanced energy efficiency. In vehicles, smart windows enhance visibility, reduce glare, and protect against UV radiation, contributing to improved driving experiences and energy conservation.

Segment Overview

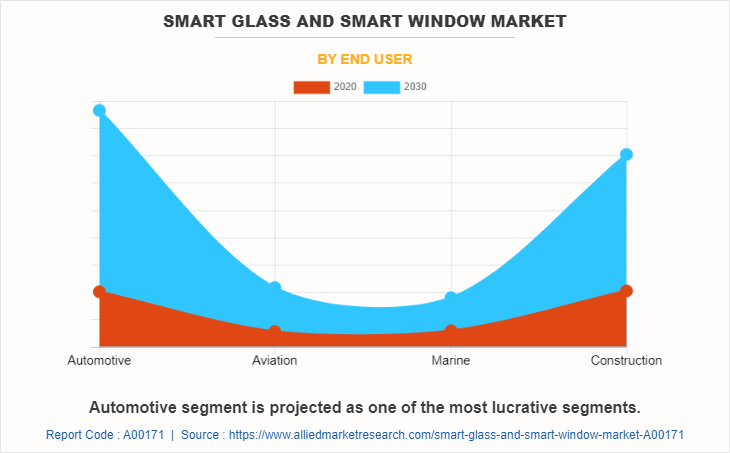

The smart glass and smart window market forecast is segmented on the basis of end user, technology, and region. On the basis of end user, the market is segregated into automotive, aviation, marine and construction. The automotive segment acquired the largest share in 2022 and is expected to grow at a significant CAGR from 2021 to 2030.

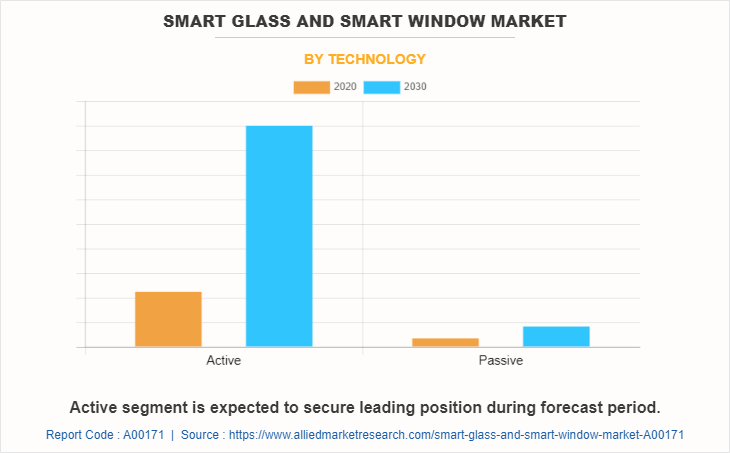

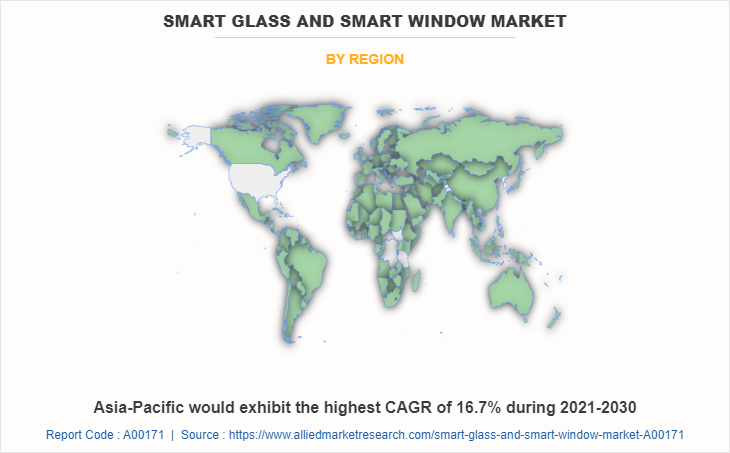

On the basis of technology, the market is bifurcated into active and passive. In 2020, the active segment dominated the market, in terms of revenue, and it is expected to acquire major market share till 2030. Region-wise, the smart glass and smart window market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

Competitive analysis and profiles of the major global Smart glass and smart window Market players that have been provided in the report include Pleotint LLC, Asahi Glass Co Ltd, Hitachi Ltd (Hitachi Chemical Co Ltd), Ravenbrick LLC (Ravenwindow), Gentex Corporation, Ppg Industries Inc, View Inc, Saint Gobain, Corning Incorporated, and Research Frontiers Incorporated. The key strategies adopted by the major players of the smart glass and smart window market outlook are product launch, and collaboration.

Country Analysis

Country-wise, the U.S. acquired a prime share in the smart glass and smart window market growth in the North American region and Mexico is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Germany, dominated the smart glass and smart window market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. Moreover, the Germany is expected to emerge as the fastest-growing country in Europe's smart glass and smart window equipment and accessories with a CAGR of 16.3%.

In Asia-Pacific, China, Japan, and India are expected to emerge as a significant market for the smart glass and smart window market industry, owing to a significant rise in investment by prime players due to rise in investment in infrastructure in rural and urban in the region.

By LAMEA region, the Middle East held significant market share in 2022. The LAMEA smart glass and smart window market analysis has been witnessing improvement, owing to the growing inclination of companies towards connecting the region with developed companies to provide the better infrastructure across this region. Moreover, the Middle East region is expected to grow at a high CAGR of 17.2% from 2023 to 2032.

Historical Data & Information

The global smart glass and smart window market size is highly competitive, owing to the strong presence of existing vendors. Vendors of the smart glass and smart window market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in the market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Pleotint LLC, Asahi Glass Co Ltd, Hitachi Ltd (Hitachi Chemical Co Ltd), Ravenbrick LLC (Ravenwindow), Gentex Corporation, Ppg Industries Inc, View Inc, Saint Gobain, Corning Incorporated, and Research Frontiers Incorporated are the top companies holding a prime share in the submarine cables industry. Top market players have adopted various strategies, such as product launch, and collaboration to expand their foothold in the smart glass and smart window market opportunity.

- In June 2023, View, Inc. a leader in smart building technologies, has been selected to enclose the 14-story, Class-A office building, 1050 Brickworks, located at 1050 Marietta Street NW in Atlanta's West Midtown area. Developed by Sterling Bay and Asana Partners, the 225,000 square-foot creative office building will feature View's Smart Windows, providing a premium amenity for tenants. This partnership marks View's first project with Sterling Bay, a national real estate development company with over $20 billion in assets.

- In May 2023, Hydro Building Systems and Saint-Gobain Glass collaborate to cut building facades' carbon footprint by 50%. They utilize Hydro CIRCAL with high recycled content and low-carbon glass from Saint-Gobain to achieve low embodied carbon products. The partnership also involves urban mining for recycling end-of-life aluminium and glass, promoting circularity in the building industry. This collaboration aims to create greener buildings and align with sustainable development goals, considering buildings currently contribute 39% of global greenhouse gas emissions.

- In December 2022, Corning Incorporated introduced its latest glass innovation, CorningR. GorillaR. Glass VictusR. 2. This new glass composition expands the Gorilla Glass portfolio, offering improved drop performance on rough surfaces like concrete while maintaining the scratch resistance of Gorilla Glass Victus.

- In September 2021, Gentex Corporation announced the acquisition of Guardian Optical Technologies, an Israeli startup that pioneered a unique, multi-modal sensor technology designed to provide a comprehensive suite of driver- and cabin-monitoring solutions for the automotive glass industry.

- In June 2021, Corning Incorporated joined the newly formed Laser Scanning for Augmented Reality (LaSAR) Alliance, which aims to foster the development and standardization of augmented reality wearable devices, including smart glasses and head-mounted displays. Through collaboration with the alliance, Corning seeks to contribute to the growth of laser beam scanning-based solutions in the augmented reality wearables market.

- In January 2020, Corning Inc. announced the industrialization of its patented Corning ColdForm Technology for curved automotive display systems. Driven by consumer demand for more in-car infotainment and connectivity, ColdForm Technology enables larger, curved, and more integrated displays designs.

- In November 2019, Pleotint LLC unveiled an innovative product called Suntuitive MonoLite, which introduces the world's first single-pane dynamic glass. This cutting-edge dynamic glazing addresses a crucial demand in various regions across the globe. By incorporating all the advantages of Suntuitive Dynamic Glass into a single laminate, Suntuitive MonoLite presents a distinctive and unparalleled solution in the market.

Key Market Benefits

- This report defines, describes, segments, and forecasts the smart glass and smart window industry along with the current trends and future estimations influencing the market growth from 2020-2030.

- The report provides detailed market information considering historic year 2019, base year 2021, and estimate and forecast years from 2021-2030.

- The smart glass and smart window industry size and estimations are based on a comprehensive analysis of key developments in the Latin America smart glass and smart window market industry.

- This report provides comprehensive analysis of top market players.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the market.

Smart Glass and Smart Window Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 19.6 billion |

| Growth Rate | CAGR of 15% |

| Forecast period | 2020 - 2030 |

| Report Pages | 216 |

| By End User |

|

| By Technology |

|

| By Region |

|

| Key Market Players | Gentex Corporation, Research Frontiers Incorporated, PLEOTINT LLC, Saint Gobain, Hitachi Ltd (Hitachi Chemical Co Ltd), Asahi Glass Co Ltd, PPG Industries Inc, Ravenbrick LLC (Ravenwindow), View Inc., Corning Incorporated |

| Other players in the value chain include | Active Glass Technologies, PPG Industries |

Analyst Review

The global smart glass and smart window market is flourishing at a rapid pace. However, high initial cost of smart glass and smart window products is still a concern for new entrants. Market players are generously investing in R&D activities to develop improved solutions to reduce the overall cost of smart glass and smart window products. In addition, according to industry experts, it is essential to optimize affordable prices for smart glass and smart window products for long-term growth.

In January 2022, View Inc. Partners with Bjarke Ingels which will provide sustainable materials and will be carbon neutral in operations. The partnership will feature View Smart Windows, which adjusts automatically to provide continuous access to natural light and outdoor views while minimizing heat and glare.

Key players of the market focus on introducing technologically advanced products to remain competitive in the market. Partnership, acquisition, and product launches are expected to be the prominent strategies adopted by the market players. North America accounted for a major share of the market in 2020, owing to the presence of major players in the region. However, Asia-Pacific is expected to grow at the highest CAGR, owing to rise in adoption of smart glass and smart window market in a variety of fields.

The global smart glass and smart window market size was valued at $5.14 billion in 2020.

North America dominated the smart glass and smart window market in 2020

It is widely used in automotive, aerospace, marine, commercial & residential buildings, and other industries.

The use of electrochromic smart windows is the latest trend which reduces energy costs and provides architects with more design freedom.

Corning Incorporated, Ppg Industries Inc., and Saint Gobain

15.0%.

Growth of the global smart glass and smart window market is anticipated to be driven by factors, such as growing demand for smart glass-based products in automotive & aviation sector, reducing expenditure on air-conditioning, heating & lighting, and stringent regulations by government.

Loading Table Of Content...

Loading Research Methodology...