Instrument Cluster Market by Application (Speedometer, Odometer, Tachometer, and Others), Vehicle Type (Passenger Car, Commercial, Two-wheeler, Agriculture, Off-highway), Technology (Analog, Hybrid, Digital), and Geography - Global Forecast to 2023

The instrument cluster market was valued at USD 8.67 Billion in 2017 and is expected to reach USD 10.72 Billion by 2023, at a CAGR of 3.5% during the forecast period. The base year considered for the study is 2017, and the forecast period considered is 20182023. The objective of the report is to provide a detailed analysis of the market based on application, vehicle type, technology, and region. The report forecasts the market size, in terms of value, for various segments in four main regions North America, Europe, APAC, and RoW. It strategically profiles the key players and comprehensively analyzes their rankings and core competencies in the instrument cluster market, along with details of the competitive landscape of the market leaders.

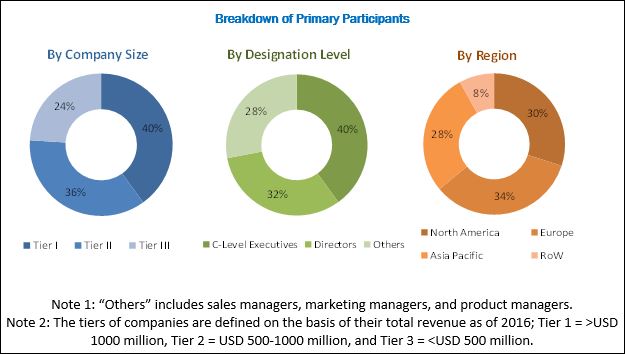

The research methodology used to estimate and forecast the instrument cluster market begins with capturing data on key vendor revenues through secondary research. Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). The bottom-up procedure has been employed to arrive at the market estimates by analyzing revenues of major companies generated from different technologies, combining the revenues obtained to get the market estimates, and validating them based on vehicle shipment data. The bottom-up approach also included analyzing the different types of instrument clusters installed in various types of vehicles such as two-wheelers, passenger cars, agriculture vehicles, commercial vehicles, and off-highway vehicles, among others, considering the shipments of vehicles. It was followed by multiplying the average selling price (ASP) of instrument clusters by the number of units to calculate the market size, in terms of value. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with people holding key positions in the industry such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary respondents has been depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The instrument cluster market comprises a network of the players involved in research and product development, raw material suppliers, manufacturers, investors, and distributors. Players operating in this market include Continental (Germany), DENSO (Japan), Visteon (US), Nippon Seiki (Japan), Magneti Marelli (Italy), Aptiv (UK), Calsonic Kansei (Japan), Pricol (India), Robert Bosch (Germany), and Yazaki (Japan). It also includes profiles of companies such as Alpine Electronics (Japan), Cypress Semiconductor (US), Dongfeng Electronic Technology (China), JP Minda (India), Luxoft (Switzerland), Mini Meters Manufacturing (India), NVIDIA (US), Panasonic Automotive (Germany), Parker Hannifin (US), and Stoneridge (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Base year |

2017 |

|

Forecast period |

20182023 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Continental (Germany), DENSO (Japan), Visteon (US), Nippon Seiki (Japan), Magneti Marelli (Italy), Aptiv (UK), Calsonic Kansei (Japan), Pricol (India), Robert Bosch (Germany), and Yazaki (Japan). It also includes profiles of companies such as Alpine Electronics (Japan), Cypress Semiconductor (US), Dongfeng Electronic Technology (China), JP Minda (India), Luxoft (Switzerland), Mini Meters Manufacturing (India), NVIDIA (US), Panasonic Automotive (Germany), Parker Hannifin (US), and Stoneridge (US) |

Key Target Audience:

- Component and Material Providers

- Automotive Instrument Cluster Manufacturers and Suppliers

- Research Organizations and Consulting Companies

- Associations, Alliances, and Organizations Related to the Instrument Cluster Market

- Analysts and Strategic Business Planners

- OEMs such as Manufacturers of Vehicles including Two-wheelers, Passenger Cars, Commercial Vehicles, Agriculture Vehicles, and Off-highway Vehicles

This study answers several questions for the stakeholders, primarily the market segments to focus on in the next 25 years for prioritizing efforts and investments.

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This research report categorizes the instrument cluster market on the basis of application, vehicle type, technology, and region.

Instrument Cluster Market, By Application:

- Speedometer

- Odometer

- Tachometer

- Others (Temperature Gauge, Fuel Gauge, Oil Pressure Gauge)

Instrument Cluster Market, By Vehicle Type:

- Passenger Car

- Commercial

- Two-wheeler

- Agriculture

- Off-highway

Instrument Cluster Market, By Technology:

- Analog

- Hybrid

- Digital

Instrument Cluster Market, By Region:

- North America

- Europe

- APAC

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

The instrument cluster market is estimated to be worth USD 9.02 Billion in 2018 and is expected to reach USD 10.72 Billion by 2023, growing at a CAGR of 3.5% between 2018 and 2023. The growth of this market can be attributed to the increasing vehicle production worldwide, stringent government regulations for vehicle and passenger safety across the globe, and increasing demand for instrument clusters from the APAC region due to the increase in sales of two-wheelers.

This report segments the instrument cluster market based on application, vehicle type, technology, and region. The market, based on application, has been segmented into speedometer, odometer, tachometer, and others. The market for speedometer and odometer is expected to grow at the highest CAGR between 2018 and 2023. Speedometer is a standard equipment used in various types of vehicles. The major demand for speedometers and odometers is derived from passenger cars, two-wheelers, and commercial vehicles. The sales of passenger cars is increasing globally, which simultaneously increases the demand for speedometers and odometers.

The instrument cluster market based on vehicle type has been segmented into passenger car, commercial, two-wheeler, agriculture, and off-highway vehicles. The market for two-wheelers is expected to grow at the highest rate during the forecast period. The price of vehicles and income level of consumers are the key factors that influence the buying decision for two-wheelers. The significant demand for two-wheelers from developing countries such as China and India in the APAC region will provide growth opportunities for this market during the forecast period.

The instrument cluster market based on technology has been segmented into analog, hybrid, and digital. The hybrid technology is expected to lead the market. The rising adoption of hybrid instrument clusters for various types of vehicles such as passenger cars, two-wheelers, and commercial vehicles is expected to drive the growth of the hybrid instrument cluster market for during the forecast period.

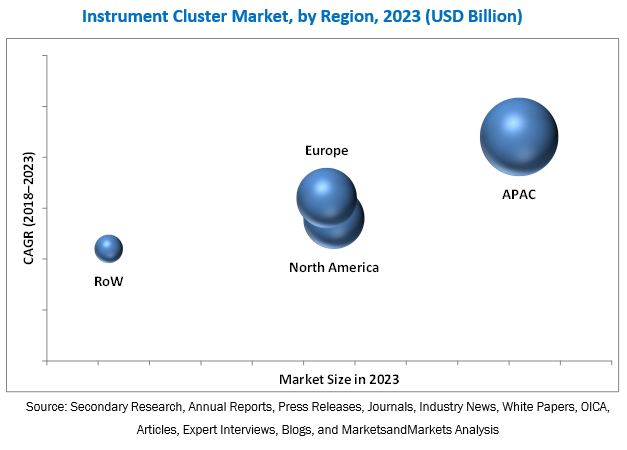

APAC is expected to dominate the instrument cluster market. APAC is the leading region for sales of different types of vehicles, including passenger cars, two-wheelers, agriculture vehicles, and off-highway vehicles. APAC is expected to provide ample of opportunities for this market in the coming years for different types of vehicles. For two-wheelers, the major demand is driven by China and India. China and India are expected to be the major contributors to the growth of the instrument cluster market in APAC between 2018 and 2023.

The rise in price of instrument clusters due to advancements in features may restrains the growth of the market in the coming years.

Key players in the instrument cluster market include Continental (Germany), DENSO (Japan), Visteon (US), Nippon Seiki (Japan), Magneti Marelli (Italy), Aptiv (UK), Calsonic Kansei (Japan), Pricol (India), Robert Bosch (Germany), and Yazaki (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Data From Primary Sources

2.1.2.4 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Instrument Cluster Market

4.2 Market, By Vehicle Type

4.3 Asia Pacific Market, By Vehicle Type and Country (2017)

4.4 Market: Geographical Snapshot (2015-2023)

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Vehicle Production Worldwide

5.2.1.2 Stringent Government Regulations for Vehicle and Passenger Safety Across the Globe

5.2.1.3 Increasing Demand for Instrument Clusters From the APAC Region Due to the Increase in Two-Wheeler Sales

5.2.2 Restraints

5.2.2.1 Rise in Price of Instrument Clusters as Features Become Advanced

5.2.3 Opportunities

5.2.3.1 Rising Demand for Digital Instrument Clusters Across the World

5.2.3.2 Increasing Demand for Luxury Vehicles

5.2.4 Challenges

5.2.4.1 Software Integration Challenges for Digital Instrument Clusters

6 Instrument Cluster Market, By Application (Page No. - 40)

6.1 Introduction

6.2 Speedometer

6.3 Odometer

6.4 Tachometer

6.5 Others

7 Instrument Cluster Market, By Vehicle Type (Page No. - 44)

7.1 Introduction

7.2 Passenger Car

7.3 Commercial

7.4 Two-Wheeler

7.5 Agriculture

7.6 Off-Highway

8 Instrument Cluster Market, By Technology (Page No. - 68)

8.1 Introduction

8.2 Analog

8.3 Hybrid

8.4 Digital

9 Geographic Analysis (Page No. - 74)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Italy

9.3.5 Russia

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 South Korea

9.4.5 Rest of APAC

9.5 RoW

9.5.1 South & Central America

9.5.2 Middle East & Africa

10 Competitive Landscape (Page No. - 102)

10.1 Introduction

10.2 Market Ranking Analysis, 2017

10.2.1 Product Launches/Developments

10.2.2 Joint Ventures/Partnerships/Collaborations/Agreements

10.2.3 Acquisitions

10.2.4 Expansions

11 Company Profiles (Page No. - 107)

11.1 Introduction

11.2 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.2.1 Continental

11.2.2 Denso

11.2.3 Visteon

11.2.4 Nippon Seiki

11.2.5 Magneti Marelli

11.2.6 Aptiv

11.2.7 Calsonic Kansei

11.2.8 Pricol

11.2.9 Robert Bosch

11.2.10 Yazaki

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

11.3 Other Key Companies

11.3.1 Alpine Electronics

11.3.2 Cypress Semiconductor

11.3.3 Dongfeng Electronic Technology

11.3.4 JP Minda

11.3.5 Luxoft

11.3.6 Mini Meters Manufacturing

11.3.7 Nvidia

11.3.8 Panasonic Automotive

11.3.9 Parker Hannifin

11.3.10 Stoneridge

12 Appendix (Page No. - 136)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customization

12.6 Related Reports

12.7 Author Details

List of Tables (67 Tables)

Table 1 Instrument Cluster Market, By Application, 20152023 (USD Million)

Table 2 Market, By Vehicle Type, 20152023 (USD Million)

Table 3 Market, 2015-2023 (Million Units)

Table 4 Market for Passenger Car, By Technology, 20152023 (USD Million)

Table 5 Market for Passenger Car, By Region, 20152023 (USD Million)

Table 6 Market for Passenger Car in APAC, By Country, 20152023 (USD Million)

Table 7 Market for Passenger Car in Europe, By Country, 20152023 (USD Million)

Table 8 Market for Passenger Car in North America, By Country, 20152023 (USD Million)

Table 9 Market for Passenger Car in RoW, By Region, 20152023 (USD Million)

Table 10 Market for Commercial Vehicle, By Technology, 20152023 (USD Million)

Table 11 Market for Commercial Vehicle, By Region, 20152023 (USD Million)

Table 12 Market for Commercial Vehicle in North America, By Country, 20152023 (USD Million)

Table 13 Market for Commercial Vehicle in APAC, By Country, 20152023 (USD Million)

Table 14 Market for Commercial Vehicle in Europe, By Country, 20152023 (USD Million)

Table 15 Market for Commercial Vehicle in RoW, By Region, 20152023 (USD Million)

Table 16 Market for Two-Wheeler, By Technology, 20152023 (USD Million)

Table 17 Market for Two-Wheeler, By Region, 20152023 (USD Million)

Table 18 Market for Two-Wheeler in APAC, By Country, 20152023 (USD Million)

Table 19 Market for Two-Wheeler in Europe, By Country 2015-2023 (USD Million)

Table 20 Market for Two-Wheeler in North America, By Country, 20152023 (USD Million)

Table 21 Market for Two-Wheeler in RoW, By Region, 20152023 (USD Million)

Table 22 Market for Agriculture Vehicle, By Technology, 20152023 (USD Million)

Table 23 Market for Agriculture Vehicle, By Region, 20152023 (USD Million)

Table 24 Market for Agriculture Vehicle in APAC, By Country, 20152023 (USD Million)

Table 25 Market for Agriculture Vehicle in North America, By Country, 20152023 (USD Million)

Table 26 Market for Agriculture Vehicle in Europe, By Country, 20152023 (USD Million)

Table 27 Market for Agriculture Vehicle in RoW, By Region, 20152023 (USD Million)

Table 28 Market for Off-Highway Vehicle, By Technology, 20152023 (USD Million)

Table 29 Market for Off-Highway Vehicle, By Region, 20152023 (USD Million)

Table 30 Market for Off-Highway Vehicle in APAC, By Country, 20152023 (USD Million)

Table 31 Market for Off-Highway Vehicle in North America, By Country, 20152023 (USD Million)

Table 32 Market for Off-Highway Vehicle in Europe, By Country, 20152023 (USD Million)

Table 33 Market for Off-Highway Vehicle in RoW, By Region, 20152023 (USD Million)

Table 34 Market, By Technology, 20152023 (USD Million)

Table 35 Analog Market, By Vehicle Type, 20152023 (USD Million)

Table 36 Hybrid IMarket, By Vehicle Type, 20152023 (USD Million)

Table 37 Digital Market, By Vehicle Type, 20152023 (USD Million)

Table 38 Market, By Region, 20152023 (USD Million)

Table 39 North America: Market, By Country, 2015-2023 (USD Million)

Table 40 Market in North America, By Vehicle Type, 2015-2023 (USD Million)

Table 41 Market in US, By Vehicle Type, 2015-2023 (USD Million)

Table 42 Market in Canada, By Vehicle Type, 2015-2023 (USD Million)

Table 43 Market in Mexico, By Vehicle Type, 2015-2023 (USD Million)

Table 44 Market in Europe, By Country, 2015-2023 (USD Million)

Table 45 Market in Europe, By Vehicle Type, 2015-2023 (USD Million)

Table 46 Market in Germany, By Vehicle Type, 2015-2023 (USD Million)

Table 47 Market in UK, By Vehicle Type, 2015-2023 (USD Million)

Table 48 Market in France, By Vehicle Type, 2015-2023 (USD Million)

Table 49 Market in Italy, By Vehicle Type, 2015-2023 (USD Million)

Table 50 Market in Russia, By Vehicle Type, 2015-2023 (USD Million)

Table 51 Market in Rest of Europe, By Vehicle Type, 2015-2023 (USD Million)

Table 52 Market in APAC, By Country, 20152023 (USD Million)

Table 53 Market in APAC, By Vehicle Type, 2015-2023 (USD Million)

Table 54 Market in China, By Vehicle Type, 2015-2023 (USD Million)

Table 55 Market in Japan, By Vehicle Type, 2015-2023 (USD Million)

Table 56 Market in India, By Vehicle Type, 2015-2023 (USD Million)

Table 57 Market in South Korea, By Vehicle Type, 2015-2023 (USD Million)

Table 58 Market in Rest of APAC, By Vehicle Type, 2015-2023 (USD Million)

Table 59 Market in RoW, By Region, 20152023 (USD Million)

Table 60 Market in RoW, By Vehicle Type, 20152023 (USD Million)

Table 61 Market in South & Central America, By Vehicle Type, 2015-2023 (USD Million)

Table 62 Market in Middle East & Africa, By Vehicle Type, 2015-2023 (USD Million)

Table 63 Ranking of Players, 2017

Table 64 Product Launches, 20162017

Table 65 Joint Ventures/Partnerships/ Collaborations/Agreements, 20152017

Table 66 Acquisitions, 20162017

Table 67 Expansions, 20142017

List of Figures (57 Figures)

Figure 1 Instrument Cluster Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Bottom-Up Approach to Arrive at Market Size

Figure 5 Top-Down Approach to Arrive at Market Size

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Speedometer & Odometer Application Segment Expected to Lead the Instrument Cluster Market During Forecast Period

Figure 9 Hybrid Technology Expected to Lead the Market During the Forecast Period

Figure 10 Passenger Car Segment Expected to Lead the Market Between 2018 and 2023

Figure 11 Instrument Cluster Market, By Region

Figure 12 Digital Instrument Cluster Segment Expected to Provide Significant Growth Opportunities During the Forecast Period

Figure 13 Two-Wheelers Segment Expected to Grow at the Highest Rate During the Forecast Period

Figure 14 Passenger Cars Segment Held the Major Share of the Asia Pacific Market in 2017

Figure 15 The US Accounted for the Largest Share of the Market in 2017

Figure 16 Increase in Vehicle Production Worldwide is Driving the Market

Figure 17 Global Vehicle Production Data, 2010-2016

Figure 18 Speedometer and Odometer Application Expected to Dominate Instrument Cluster Market During Forecast Period

Figure 19 Two-Wheeler Segment Expected to Provide Significant Growth Opportunities for Market During the Forecast Period

Figure 20 Hybrid Technology Expected to Lead the Market for Passenger Car During the Forecast Period

Figure 21 APAC Expected to Dominate the Market for Passenger Car During the Forecast Period

Figure 22 China Expected to Lead the APAC Market for Passenger Car During the Forecast Period

Figure 23 The US Expected to Hold the Largest Share of the North American Market for Passenger Car During the Forecast Period

Figure 24 North America Expected to Lead the Market for Commercial Vehicle During the Forecast Period

Figure 25 The US Expected to Dominate the North American Market for Commercial Vehicle During the Forecast Period

Figure 26 China Expected to Dominate the APAC Market for Commercial Vehicle During the Forecast Period

Figure 27 APAC Expected to Hold the Largest Share of the Market for Two-Wheeler Between 2018 and 2023

Figure 28 China and India Expected to Lead the Market for Two-Wheeler Between 2018 and 2023

Figure 29 APAC Expected to Dominate the Market for Agriculture Vehicle During the Forecast Period

Figure 30 The APAC Market for Off-Highway Vehicle Expected to Grow at the Highest Rate During the Forecast Period

Figure 31 Digital Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Two Wheelers Segment Expected to Grow at the Highest CAGR for Analog Market During the Forecast Period

Figure 33 Passenger Car Vehicle Segment Expected to Lead the Hybrid Market During the Forecast Period

Figure 34 Digital Market for Two-Wheelers Expected to Grow at the Highest CAGR During the Forecast Period

Figure 35 The Market in India Expected to Grow at the Highest CAGR During the Forecast Period

Figure 36 The APAC Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 37 North America Instrument Cluster Market Snapshot

Figure 38 The US Expected to Dominate the North American Market During the Forecast Period

Figure 39 Passenger Car Expected to Dominate the US Market During the Forecast Period

Figure 40 Europe Instrument Cluster Market Snapshot

Figure 41 Germany Expected to Dominate the European Market During the Forecast Period

Figure 42 Passenger Car Vehicle Type Segment Expected to Lead the Germany Market During the Forecast Period

Figure 43 The Passenger Car Vehicle Segment of the UK Market Expected to Grow at the Highest CAGR During the Forecast Period

Figure 44 APAC Instrument Cluster Market: Snapshot

Figure 45 China Expected to Dominate the Market in APAC During the Forecast Period

Figure 46 Passenger Car Vehicle Segment Expected to Dominate the Chinese Market During the Forecast Period

Figure 47 Two-Wheeler Vehicle Segment Expected to Dominate the Indian Market During the Forecast Period

Figure 48 South & Central America Expected to Hold the Largest Share of the in RoW During the Forecast Period

Figure 49 Organic and Inorganic Strategies Adopted By Companies Operating in the Market (20142017)

Figure 50 Continental: Company Snapshot

Figure 51 Denso: Company Snapshot

Figure 52 Visteon: Company Snapshot

Figure 53 Nippon Seiki: Company Snapshot

Figure 54 Calsonic Kansei: Company Snapshot

Figure 55 Pricol: Company Snapshot

Figure 56 Robert Bosch: Company Snapshot

Figure 57 Yazaki: Company Snapshot

Growth opportunities and latent adjacency in Instrument Cluster Market

I was looking for some data related to IVI and Cluster market. Is there any common relevance that can be drawn by comparing this data? I need this data for preparing a presentation for my board meeting.

Does the report split the vehicle type market by technology? For instance, instrument cluster market for commercial vehicle by analog, hybrid, and digital.