Medical Electronics Market Research, 2032

The Global Medical Electronics Market was valued at $11.8 billion in 2022, and is projected to reach $23.0 billion by 2032, growing at a CAGR of 6.7% from 2023 to 2032.

Medical electronics refers to the specialized branch of electronics dedicated to designing, developing, and manufacturing electronic devices and systems, specifically tailored for use in medical applications. These devices range from diagnostic equipment such as MRI machines and ECG monitors to implantable devices such as pacemakers and insulin pumps. Medical electronics play a pivotal role in modern healthcare, aiding in diagnosis, monitoring, and treatment. They integrate advanced technologies to ensure precision, reliability, and compatibility with medical standards, contributing significantly to the advancement of medical practices and patient care.

Medical electronics play a crucial role in healthcare, offering various benefits. They enhance diagnostic precision, providing timely and accurate information for healthcare professionals. Remote patient monitoring via medical electronics allows for real-time data collection, reducing the need for frequent hospital visits and enabling proactive interventions. Implantable electronic devices such as pacemakers and insulin pumps significantly enhance the quality of life for individuals with chronic conditions. The use of electronic health records (EHRs) streamlines patient information, improving healthcare management and coordination. Furthermore, medical electronics contribute to pioneering treatments and therapies, fostering advancements in medical research and technology. The integration of these technologies leads to improved patient outcomes, personalized medicine, and increased overall efficiency in healthcare delivery.

The rise in demand for efficient healthcare solutions globally acts as a significant driving force for medical electronics. The surge in demand for medical electronics solutions such as biomedical devices, healthcare electronics, and medical sensors across home healthcare patients such as the old age population is one of the prime drivers propelling the growth of the electronics market. Medical electronics offer solutions for accurate diagnosis, continuous monitoring, and effective treatment, addressing the escalating demands on the healthcare system. The shift towards value-based care and patient-centric approaches further propels the adoption of medical electronics, as they contribute to better outcomes, reduced hospitalization, and improved overall healthcare management.

However, a major challenge in medical electronics is dealing with the complex and strict regulatory environment in healthcare. The processes involved in gaining approval and market entry for medical devices, including those incorporating electronic components, are challenging due to diverse standards and compliance criteria across different geographical regions. Navigating these regulations leads to extended timelines and increased financial responsibilities for manufacturers. Obtaining and maintaining regulatory approval proves challenging, particularly for cutting-edge technologies. Moreover, the dynamic nature of regulations, designed to ensure patient safety and device efficacy, necessitates ongoing adaptation, escalating the resource-intensive nature of compliance initiatives. These regulatory challenges impede the prompt introduction of new medical electronics, influencing the rate of innovation and market accessibility for both established industry players and emerging startups in the healthcare technology sector.

Furthermore, a significant future opportunity for medical electronics is the seamless integration of telemedicine technology. As the healthcare landscape changes, there is emphasis on remote patient monitoring and virtual consultations. Medical electronics can help facilitate this transition by enabling the creation of innovative wearable devices and networked health solutions. The integration of medical electronics and telemedicine platforms has the potential to improve real-time data gathering, diagnostics, and personalized and efficient healthcare services, paving the way for enhanced accessibility and convenience for patients globally.

Segment Overview

The medical electronics market report is segmented into Component, Application, End Use, and Region.

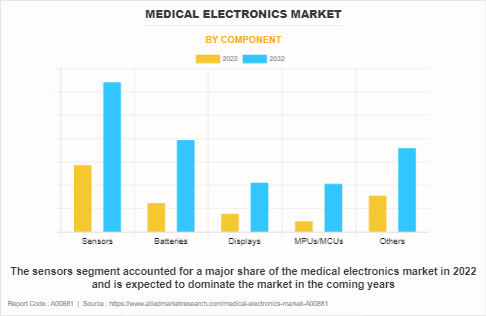

By component, the medical electronics market growth is divided into sensors, batteries, displays, MPUs/MCUs, and others. The sensors segment dominated the segment accounted for the major share of the market in 2022, and is expected to follow the same trends in the coming years.

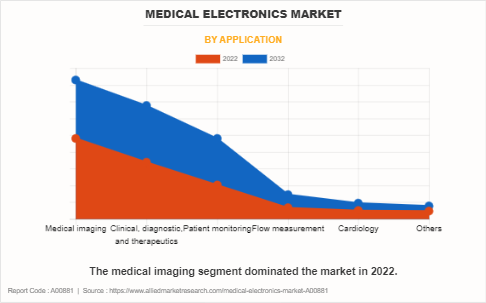

By application, the medical electronics market overview is segmented into medical imaging, clinical, diagnostic, and therapeutics, patient monitoring, flow measurement, cardiology, and others. The medical imaging segment acquired a prime share in the medical electronics industry. However, the patient monitoring segment is expected to grow at a high CAGR during the forecast period.

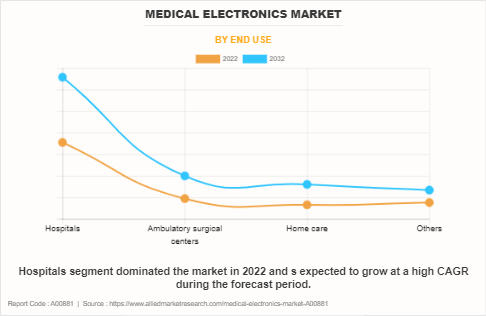

By end use, the medical electronics market opportunity is divided into hospitals, ambulatory surgical centers, home care, and others. In terms of end use, the hospital segment held a significant share and is anticipated to continue this trend throughout the forecast period.

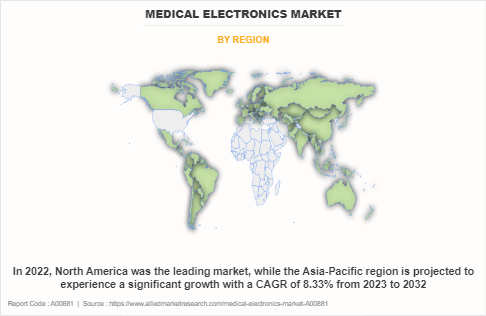

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. North America, particularly the United States, led the medical electronics market in 2022, driven by an increased demand for advanced medical solutions in both hospital and home care sectors.

The key players profiled in the report include Medtronic, Johnson & Johnson (U.S.), Abbott, Koninklijke Philips N.V, Fresenius Medical Care AG & Co. KGaA, GE Healthcare, Becton Dickinson & Company, Siemens Healthineers AG, Stryker, and Cardinal Health. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration

Competition Analysis

Competitive analysis and profiles of the major medical electronics companies profiled in this report include Medtronic, Johnson & Johnson (U.S.), Abbott, Koninklijke Philips N.V, Fresenius Medical Care AG & Co. KGaA, GE Healthcare, Becton Dickinson & Company, Siemens Healthineers AG, Stryker, and Cardinal Health are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

According to medical electronics growth projections in North America, the U.S. acquired a prime share in the medical electronics market and is expected to grow at a CAGR during the forecast period. The U.S. holds a dominant position in the medical electronics market size by country, owing to the rise in demand for advanced medical technologies.

In Europe, the Germany dominated the medical electronics market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, France is expected to emerge as one of the fastest-growing countries in the Europe medical electronics industry with a CAGR of 6.65%, owing to the growing demand for medical devices in various industries such as hospital, and home care across the region.

In Asia-Pacific, China holds a dominant market share and is expected to follow the same trend during the forecast period, owing to significant investments in healthcare infrastructure, and a large population base. However, India is expected to emerge as the highest CAGR in the medical electronics market Asia-Pacific in this region.

In Latin America, Brazil is growing at the faster rate in the medical electronics market owing to its growing economy, increase in disposable income, and ongoing expansion of hospitals. Moreover, Argentina is expected to grow at the highest CAGR from 2023 to 2032.

In Middle East and Africa, the UAE holds a significant share in the medical electronics market and is poised for future dominance due to its robust economic growth, rise in disposable income, and continuous expansion of healthcare infrastructure, including hospitals, indicating a favorable environment for increased adoption of medical electronics. The strategic focus on healthcare development and technological advancements positions the UAE as a key contributor to the growth of the medical electronics market in the Middle East and Africa region.

Top Impacting Factors

The medical electronics market is expected to witness notable growth owing to technological advancements and an increase in healthcare demands. Moreover, growth in the demand for wearable health devices is expected to provide a lucrative opportunity for the growth of the market during the forecast period. On the contrary, high regulatory policies in developing countries limit the growth of the medical electronics market.

Historical Data & Information

The medical electronics market is highly competitive, owing to the strong presence of existing vendors. Vendors of medical electronics with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

In October 2023 - Medtronic: The MiniMed 780G insulin pump system was approved in Canada. This system is a breakthrough for Type 1 diabetics as it offers personalized insulin delivery and improved blood sugar control. The device features an advanced algorithm that adjusts insulin doses based on real-time glucose levels, providing patients with greater freedom and peace of mind.

In December 2023 - Medtronic: Medtronic announced the spin-off of its Patient Monitoring and Respiratory Interventions Businesses. This move is expected to create a new company focused on connected care solutions within 12-18 months. It aims to streamline Medtronic’s operations and unlock the full potential of its patient monitoring and respiratory technologies, ultimately benefiting patients by fostering faster innovation and more specialized care.

In December 2023 - Medtronic: Medtronic has partnered with Verily, a subsidiary of Alphabet, to develop AI-powered solutions for predicting and preventing heart attacks. This groundbreaking collaboration harnesses the power of artificial intelligence to analyze vast amounts of data and identify hidden patterns, enabling early detection and intervention for potentially life-threatening cardiac events.

In August 2023 - Johnson & Johnson: Johnson & Johnson invested heavily in surgical robotics, with plans for a future launch to challenge current market leaders. J&J aims to disrupt the surgical robotics space with its own advanced system, promising increased precision, dexterity, and efficiency for surgeons, ultimately leading to improved patient outcomes and faster recovery times.

In December 2023 - Johnson & Johnson: Johnson & Johnson acquired Abiomed for $16.6 billion, significantly expanding its presence in the cardiovascular market. This strategic acquisition positions J&J as a major player in the heart pump market, providing patients with wider access to life-saving technologies and accelerating innovation in the field.

In December 2023 - Johnson & Johnson: Johnson & Johnson collaborated with the University of California, San Diego to research AI-driven personalized medicine based on genomic data. This partnership combines J&J’s vast healthcare expertise with UCSD’s cutting-edge genomic research, paving the way for personalized treatment plans tailored to individual patients’ unique genetic profiles.

In November 2023 - Abbott: Abbott launched the FreeStyle Libre 3 Sensor, the first continuous glucose monitoring (CGM) system integrated with an insulin dosing app for Android phones. This revolutionary device simplifies diabetes management for Android users by seamlessly combining real-time glucose data with automated insulin dosing recommendations, offering greater convenience and improved glycemic control.

In January 2024 - Abbott: Abbott expanded into neuromodulation with the acquisition of St. Jude Medical for $16 billion, gaining valuable deep brain stimulation (DBS) technology. This strategic move allows Abbott to tap into the rapidly growing neuromodulation market, offering hope for patients with neurological disorders like Parkinson’s disease and essential tremor.

In December 2023 - Abbott: Abbott partnered with Microsoft to integrate the Azure cloud platform for enhanced data analytics and remote patient monitoring in their medical devices. This collaboration leverages Microsoft’s advanced cloud computing and AI capabilities to empower Abbott with deeper insights into patient data, enabling proactive care and improved clinical decision-making.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical electronics market analysis from 2022 to 2032 to identify the prevailing medical electronics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities along with the medical electronics market share by company.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical electronics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical electronics market trends, key players, market segments, application areas, and market growth strategies.

Medical Electronics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 120 |

| By Component |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Medtronic, Becton Dickinson & Company, Johnson & Johnson (U.S.), Siemens Healthineers AG, GE Healthcare, Fresenius Medical Care AG & Co. KGaA, Cardinal Health, Stryker, Koninklijke Philips N.V, Abbott |

Analyst Review

The expansion in the medical electronics market is primarily fueled by the growing occurrence of chronic and infectious diseases, the integration of cutting-edge technologies in medical devices, a rising inclination towards minimally invasive surgical procedures, and the trend of leasing high-cost equipment.

However, the market faces challenges such as stringent regulatory scenarios and lack of skilled healthcare professionals. Despite these challenges, companies in the industry are innovating to provide advanced product offerings. Technological improvements in wearable health monitors and medical imaging equipment have propelled the growth of the medical electronics sector. The digitization of healthcare data has improved communication between healthcare professionals and boosted research and analytics. Telemedicine and remote patient monitoring solutions have become prevalent, especially during the COVID-19 pandemic.

The focus will be on sustainability of medical electronics, with an emphasis on eco-friendly materials, recycling, and ethical production techniques. The integration of AI and IoT technology is expected to transform medical electronics, enhancing diagnosis and treatment. In application, medical electronics are pervasive in consumer electronics, permeating smartphones, tablets, and home entertainment systems. Their role extends to the automotive sector, enhancing in-car audio experiences.

The global medical electronics market is highly competitive, owing to the strong presence of existing vendors. Medical electronics vendors, who have access to extensive technical and financial resources, are anticipated to gain a competitive edge over their rivals, as they have the capacity to cater to the market requirements. The competitive environment in this market is expected to further intensify with an increase in technological innovations, product extensions, and different strategies adopted by key vendors.

Rise in demand for portable devices across consumer electronics, automotive, and commercial sector globally is driving the need for next generation to enhance medical electronics solutions. Moreover, prime economics, such as the U.S., China, Germany, and Japan, are planning to develop and deploy next generation AR/VR solutions across various consumer electronics applications, which is anticipated to provide lucrative opportunities for the market growth.

Region-wise, Asia-Pacific exhibits the highest adoption of medical electronics and has been experiencing massive expansion of the market. However, Europe is expected to grow at a faster pace, is expected to grow due to emerging countries such as UK and Germany investing in these technologies. Regions such as the Middle East and Africa are expected to offer new opportunities for the growth of the medical electronics market in the future.

The key players profiled in the report include Medtronic, Johnson & Johnson (U.S.), Abbott, Koninklijke Philips N.V, Fresenius Medical Care AG & Co. KGaA, GE Healthcare, Becton Dickinson & Company, Siemens Healthineers AG, Stryker, and Cardinal Health are provided in this report.

North America is the largest region of Medical Electronics Market in 2022.

Medical imaging is the leading application of the Medical Electronics Market.

The global Medical Electronics market was valued at $11,837.5 million in 2022 and is estimated to reach $23,034.2 million by 2032, exhibiting a CAGR of 6.73% from 2023 to 2032..

Medtronic, Johnson & Johnson (U.S.), Abbott, Koninklijke Philips N.V, Fresenius Medical Care AG & Co. KGaA, GE Healthcare are the top companies to hold the market share in Medical Electronics.

The medical electronics market is expected to witness notable growth owing to technological advancements and an increase in healthcare demands.

Loading Table Of Content...

Loading Research Methodology...