Blood Collection Devices Market by Product (Tubes (Plasma (EDTA, Heparin), Serum), Needles & Syringes, Blood Bags, Monitors), Method (Manual, Automated), Application (Diagnostic, Therapeutic), End User (Hospitals, Blood Banks) & Region - Global Forecasts to 2027

Updated on : March 15, 2023

The global blood collection devices market worth $8.42 billion by 2027, growing at a CAGR of 6.8% in the upcoming years.

The new edition of the report provides updated financial information until 2022 (depending on availability). This would help to analyze the present status of profiled companies easily in terms of their financial strength, profitability, key revenue-generating region or country, and business segment focus in terms of the highest revenue-generating segment. The expansion of this market is due in large part to surging cases of blood transfusions, donations, and blood disorders. However, a lack of skilled labor is one of the challenges that may inhibit the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Blood Collection Devices Market Dynamics

Drivers: Increasing number of hospitals and surgical centers

The increasing number of hospitals, ambulatory surgical centers, and diagnostic laboratories all over the world is expected to drive the growth of the global blood collection market. The rise in the number of hospitals and other healthcare facilities has increased the demand for blood collection devices. In addition, the growing awareness about the safety and convenience of using advanced blood collection devices is also expected to fuel the growth of this market. Furthermore, increasing government initiatives to promote the use of advanced medical technologies is also contributing to the growth of this market.

Restraints: High cost of automated blood collection devices

The high cost of automated blood collection devices is a major restraint for the global blood collection devices market. Automated blood collection devices are expensive, and the cost of these devices can be a significant burden for hospitals and other medical facilities. Furthermore, the cost of maintaining them can be quite high, as they require periodic maintenance and calibration. This increases the cost of ownership, making them prohibitively expensive for many healthcare facilities. This, in turn, is expected to hamper the growth of the global blood collection market.

Challenges: Increasing complexities of storage and shipping

The increasing complexities involved in the storage and shipping of blood collection devices is a major challenge faced by the global market. In addition, the need to maintain the sterility of these devices is also a major challenge. Furthermore, the rising costs of procuring and maintaining the temperature-controlled storage and shipping systems is a major challenge faced by the manufacturers of these devices. Moreover, the need for stringent regulatory compliances for the distribution of these devices is another challenge faced by the market.

Opportunities: Increasing demand for apheresis

The global blood collection devices market is expected to register a significant growth rate owing to the increasing demand for apheresis for blood component separations. Apheresis is a medical procedure in which the blood of a person is passed through a device that separates out one particular component. This component is then collected and the remaining components are returned to the body. This procedure is increasingly being used to collect plasma, red blood cells, platelets and other components for therapeutic purposes. Furthermore, the increasing prevalence of chronic diseases such as cancer and cardiovascular diseases is further driving the market growth as it enables accurate collection of blood components to treat such diseases. Additionally, increasing public awareness regarding the benefits of blood component separations is also a major factor propelling the growth of the market.

Hospitals, ASCs, and nursing homes accounted for the largest share of the blood collection devices market.

The hospitals, ASCs, and nursing homes segment accounted for the largest share of the market. Growth in this market segment can be attributed to the increasing incidence of infectious diseases and the rise in the number of trauma cases, as well as C-sections and organ transplants, which have ensured the demand for blood collection equipment and devices in hospital facilities.

Clinical laboratories dominated the blood collection devices market.

On the basis of end user, the market is segmented into hospitals, ASCs, & nursing homes, blood banks, diagnostic & pathology laboratories, and other end users. In 2020, the hospitals, ASCs, & nursing homes segment accounted for the largest share of the market.

China is anticipated to account the largest share of APAC Blood Collection Devices Market

Based on the APAC region, the market is divided into China, Japan, India and ROAPAC. China is expected to account the largest share of the market. The increasing demand for blood components (owing to the rising number of surgical procedures and the high prevalence of various diseases, inclusive of blood disorders) requiring diagnostic blood tests, growing awareness about therapeutic apheresis, and rising demand for plasma derivatives are the major factors supporting the growth of the market in China.

Germany is forecasted as the fastest growing country of Blood Collection Devices Market in Europe.

Based on the Europe region, the market is divided into Germany, UK, Italy, Spain, France, and RoE. Germany is forecasted to the fastest growing market of Blood Collection Devices Market in Europe. The increasing cases of blood donations and transfusions, and blood drawn for the diagnosis of Azheimer Diseases.

North America dominates the Blood Collection Devices Market

Based on the region, the market is segmented into North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. North America is expected to dominate the Blood Collection Market. Growth in the North American market is mainly driven by, advanced medical infrastructure and expenditures.

To know about the assumptions considered for the study, download the pdf brochure

Some of the key players in the blood collection devices market include Becton, Dickinson and Company (US), Terumo BCT (US), Fresenius Kabi AG (Germany), Grifols S.A.(Spain), Haematonics (US), Nipro Medical Corporation (Japan), Greiner Holding (Austria), Quest Diagnostics (US), SARSTEDT AG & Co. (Germany), Macopharma (France), Smiths Medical (US), Cardinal Health (US), and Retractable Technologies (US)

Blood Collection Devices Market Report Scope:

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$6.06 billion |

|

Estimated Value by 2027 |

$8.42 billion |

|

Growth Rate |

Poised to grow at a CAGR of 6.8% |

|

Market Driver |

Increasing number of hospitals and surgical centers |

|

Market Opportunity |

Increasing demand for apheresis |

|

Segments Covered |

Method, Product, Application, End User, and Region |

|

Geographies Covered |

North America (US and Canada), Europe (Germany, France, UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, and RoAPAC), Latin America, and the Middle East & Africa |

This research report categorizes the blood collection devices market into the following segments and sub-segments:

By Product

-

Blood Collection tubes

-

Plasma/whole-blood tubes

- EDTA Tubes

- Heparin Tubes

- Coagulation Tubes

- Glucose Tubes

- ESR Tubes

- Serum Tubes

-

Plasma/whole-blood tubes

-

System Type

- Vacuum Tubes

- Non-vacuum Tubes

- Needles & Syringes

- Blood Bags

- Blood Collection Systems/Monitors

- Lancets

By Application

- Diagnostics

- Therapeutics

By Method

- Manual Blood Collection

- Automated Blood Collection

By End User

- Hospitals, Ambulatory Surgical Centers, & Nursing Homes

- Diagnostic & Pathology Laboratories

- Blood Banks

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In 2021, Greiner Bio-One introduced MiniCollect PIXIE Heel Incision Safety Lancet for expanding its portfolio with a new safety lancet specially designed for heel incision and now has three different lancet types on offer to cover individual needs

- In 2021, Terumo Blood and Cell Technologies and CSL Plasma announce collaboration to deliver a new plasma collection platform

- In 2021, Quest Diagnostics Incorporated has acquired Boca Raton-based Nationwide Laboratory Services. With the acquisition, Quest will broaden access to diagnostic innovation and insights empowering better health for more communities in South Florida.

Frequently Asked Questions (FAQ):

What is the projected market value of the global blood collection devices market?

The global market of blood collection devices is projected to reach USD 8.42 billion.

What is the estimated growth rate (CAGR) of the global blood collection devices market for the next five years?

The global blood collection devices market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2022 to 2027.

What are the major revenue pockets in the blood collection devices market currently?

Based on the region, the market is segmented into North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. North America is expected to dominate the Blood Collection Devices Market. Growth in the North American market is mainly driven by, advanced medical infrastructure and expenditures.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 44)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

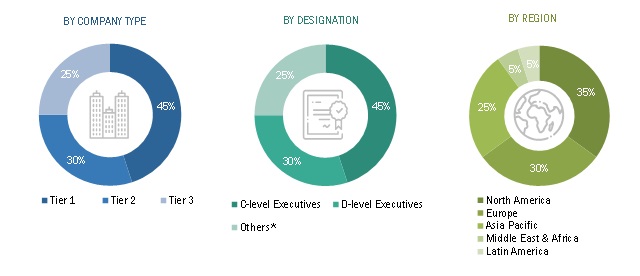

2.1.2.3 Breakdown of primary interviews: By company type, designation, and region

2.2 MARKET SIZE ESTIMATION

FIGURE 3 REVENUE SHARE ANALYSIS ILLUSTRATION: BECTON, DICKINSON AND COMPANY

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF BLOOD COLLECTION PRODUCTS AND METHODS

FIGURE 5 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: BLOOD COLLECTION DEVICES MARKET

2.8 COVID-19 HEALTH ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 10 BLOOD COLLECTION DEVICES MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY METHOD, 2021 VS. 2026 (USD BILLION)

FIGURE 12 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GLOBAL BLOOD COLLECTION MARKET, BY REGION, 2021 VS. 2026 (USD BILLION)

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 BLOOD COLLECTION DEVICES MARKET OVERVIEW

FIGURE 15 INCREASING DISEASE INCIDENCE AND DEMAND FOR BLOOD COMPONENTS TO DRIVE MARKET GROWTH

4.2 GLOBAL MARKET BY BLOOD COLLECTION TUBES, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 PLASMA WHOLE /BLOOD TUBES SEGMENT TO REGISTER THE HIGHEST CAGR

4.3 NORTH AMERICA: MARKET, BY METHOD AND COUNTRY (2020)

FIGURE 17 MANUAL BLOOD COLLECTION TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET

4.4 GLOBAL MARKET, BY END USER, 2021–2026

FIGURE 18 HOSPITALS, AMBULATORY SURGICAL CENTERS, & NURSING HOMES SEGMENT TO WITNESS THE HIGHEST GROWTH

4.5 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH IN THE BLOOD COLLECTION DEVICES MARKET

5 MARKET OVERVIEW (Page No. - 70)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 MARKET DRIVERS

5.2.1.1 Rising prevalence of infectious diseases with the emergence of newer pathogens and chronic & lifestyle diseases

5.2.1.2 Increasing number of hospitals and surgical centers

5.2.1.3 Rising number of accidents and trauma cases

5.2.1.4 Growing emergence of liquid biopsy tests

5.2.1.5 Rising demand and awareness for blood donations and blood components

TABLE 3 GLOBAL CANCER PREVALENCE, 2018 VS. 2025

5.2.2 RESTRAINTS

5.2.2.1 Rising costs of automated blood collection devices

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for apheresis

5.2.3.2 Growing number of emerging economies offer lucrative opportunities

5.2.3.3 Rising advancements in blood collection—microsampling and dried blood sampling

5.2.4 CHALLENGES

5.2.4.1 Increasing complexities of storage and shipping

5.2.4.2 Increasing incidences in the lack of skilled professionals

5.3 IMPACT OF COVID-19 ON THE BLOOD COLLECTION DEVICES MARKET

5.4 RANGES/SCENARIOS

5.4.1 GLOBAL MARKET

FIGURE 21 PESSIMISTIC SCENARIO

FIGURE 22 OPTIMISTIC SCENARIO

FIGURE 23 REALISTIC SCENARIO

5.5 REGULATORY ANALYSIS

TABLE 4 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING MEDICAL DEVICES

5.5.1 NORTH AMERICA

5.5.1.1 US

5.5.1.2 Canada

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.3.1 Japan

5.5.3.2 India

5.5.4 LATIN AMERICA

5.5.4.1 Brazil

5.5.5 MIDDLE EAST

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 BLOOD COLLECTION DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF BUYERS

5.6.4 BARGAINING POWER OF SUPPLIERS

5.6.5 DEGREE OF COMPETITION

5.7 TECHNOLOGY ANALYSIS

5.8 VALUE CHAIN ANALYSIS

FIGURE 24 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 25 BLOOD COLLECTION DEVICES MARKET: SUPPLY CHAIN ANALYSIS

5.10 ECOSYSTEM ANALYSIS

FIGURE 26 GLOBAL MARKET: ECOSYSTEM ANALYSIS

5.10.1 ROLE IN THE ECOSYSTEM

FIGURE 27 KEY PLAYERS IN THE GLOBAL MARKET

5.11 PATENT ANALYSIS

5.11.1 PATENT GRANTED TRENDS FOR BLOOD COLLECTION

FIGURE 28 PATENT GRANTED TRENDS OF BLOOD COLLECTION TUBES, JANUARY 2011–JULY 2021

FIGURE 29 PATENT GRANTED TRENDS OF BLOOD COLLECTION SYSTEMS/MONITORS, JANUARY 2011– DECEMBER 2021

5.11.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 30 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR BLOOD COLLECTION TUBES PATENTS, JANUARY 2011—NOVEMBER 2021

FIGURE 31 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR BLOOD COLLECTION SYSTEMS/MONITORS PATENTS, JANUARY 2011— DECEMBER 2021

5.12 TRADE ANALYSIS

TABLE 6 IMPORT DATA FOR HS CODE 901890 - INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SCIENCES, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 7 EXPORT DATA FOR HS CODE 901890 - INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, OR VETERINARY SCIENCES, BY COUNTRY, 2016–2020 (USD MILLION)

5.13 PRICING ANALYSIS

TABLE 8 PRICE RANGE FOR BLOOD COLLECTION DEVICES, BY COUNTRY

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.14.1 REVENUE SOURCES ARE SHIFTING TOWARD TECHNOLOGY-BASED SOLUTIONS DUE TO THE COVID-19 PANDEMIC

FIGURE 32 REVENUE SHIFT FOR THE BLOOD COLLECTION DEVICES MARKET

6 BLOOD COLLECTION DEVICES MARKET, BY PRODUCT (Page No. - 98)

6.1 INTRODUCTION

TABLE 9 GLOBAL MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 10 GLOBAL MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

6.2 BLOOD COLLECTION TUBES

6.2.1 IMPACT OF COVID-19 ON THE BLOOD COLLECTION TUBES MARKET

6.2.2 BLOOD COLLECTION TUBES MARKET, BY TYPE

TABLE 11 BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 12 BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 13 BLOOD COLLECTION TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 BLOOD COLLECTION MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1 Plasma/whole-blood tubes

TABLE 15 PLASMA/WHOLE-BLOOD TUBES AVAILABLE IN THE MARKET

TABLE 16 PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 17 PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 18 PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1.1 EDTA tubes

6.2.2.1.1.1 EDTA tubes to hold the largest share of the plasma/whole blood collection tubes segment

TABLE 20 EDTA TUBES AVAILABLE IN THE MARKET

TABLE 21 EDTA TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 EDTA TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1.2 Heparin tubes

6.2.2.1.2.1 Heparin tubes to eliminate the need to wait for clots to form

TABLE 23 HEPARIN TUBES AVAILABLE IN THE MARKET

TABLE 24 HEPARIN TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 HEPARIN TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1.3 Coagulation tubes

6.2.2.1.3.1 Coagulation tubes to show high demand for specific tubes

TABLE 26 COAGULATION TUBES AVAILABLE IN THE MARKET

TABLE 27 COAGULATION TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 COAGULATION TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1.4 Glucose tubes

6.2.2.1.4.1 Increasing incidence of diabetes to drive the growth of the glucose tubes market

TABLE 29 GLUCOSE TUBES AVAILABLE IN THE MARKET

TABLE 30 GLUCOSE TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 GLUCOSE TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.1.5 ESR tubes

6.2.2.1.5.1 Increasing prevalence of prominent diseases to support market growth

TABLE 32 ESR TUBES AVAILABLE IN THE MARKET

TABLE 33 ESR TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 ESR TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2.2 Serum tubes

6.2.2.2.1 Accuracy and stability are important advantages of using serum tubes

TABLE 35 SERUM TUBES AVAILABLE IN THE MARKET

TABLE 36 SERUM TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 SERUM TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3 BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE

6.2.3.1 Impact of COVID-19 on the blood collection tubes market, by system type

TABLE 38 BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 39 BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

6.2.3.2 Vacuum tubes

6.2.3.2.1 Advantages of vacuum tubes to account for the larger market share

TABLE 40 VACUUM TUBES AVAILABLE IN THE MARKET

TABLE 41 VACUUM TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 VACUUM TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3.3 Non-vacuum tubes

6.2.3.3.1 Cost constraints to drive consumer preference towards non-vacuum tubes

TABLE 43 NON-VACUUM TUBES AVAILABLE IN THE MARKET

TABLE 44 NON-VACUUM TUBES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 NON-VACUUM TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 NEEDLES & SYRINGES

6.3.1 INCREASING NUMBER OF BLOOD COLLECTION PROCEDURES TO DRIVE MARKET GROWTH

TABLE 46 NEEDLES & SYRINGES AVAILABLE IN THE MARKET

TABLE 47 BLOOD COLLECTION NEEDLES & SYRINGES MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 BLOOD COLLECTION NEEDLES & SYRINGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.4 BLOOD BAGS

6.4.1 INCREASE IN BLOOD DONATIONS TO SUSTAIN PURCHASE AND USE OF BLOOD BAGS

TABLE 49 BLOOD BAGS AVAILABLE IN THE MARKET

6.4.2 IMPACT OF COVID-19 ON THE BLOOD BAGS MARKET

6.4.2.1 Standard blood bags

6.4.2.2 Inline systems

6.4.2.3 Filters

TABLE 50 BLOOD BAGS MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 51 BLOOD BAGS MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 52 BLOOD COLLECTION BAGS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 BLOOD COLLECTION BAGS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.5 BLOOD COLLECTION SYSTEMS/MONITORS

6.5.1 RISING PREVALENCE OF BLOOD DISORDERS AND DEMAND FOR BLOOD TO ENSURE THE USE OF COLLECTION SYSTEMS

TABLE 54 BLOOD COLLECTION SYSTEMS/MONITORS AVAILABLE IN THE MARKET

6.5.2 IMPACT OF COVID-19 ON BLOOD COLLECTION SYSTEMS/MONITORS MARKET

TABLE 55 BLOOD COLLECTION SYSTEMS/MONITORS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 BLOOD COLLECTION SYSTEMS/MONITORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.6 LANCETS

6.6.1 RISING GOVERNMENT SUPPORT FOR LANCET TO INCREASE THEIR ADOPTION

TABLE 57 LANCETS AVAILABLE IN THE MARKET

TABLE 58 BLOOD COLLECTION LANCETS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 BLOOD COLLECTION LANCETS MARKET, BY REGION, 2021–2026 (USD MILLION)

7 BLOOD COLLECTION DEVICES MARKET, BY METHOD (Page No. - 126)

7.1 INTRODUCTION

TABLE 60 BLOOD COLLECTION DEVICES MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 61 GLOBAL MARKET, BY METHOD, 2021–2026 (USD MILLION)

7.2 MANUAL BLOOD COLLECTION

7.2.1 MANUAL BLOOD COLLECTION TO HOLD THE LARGEST MARKET SHARE

7.2.2 IMPACT OF COVID-19 ON THE MANUAL BLOOD COLLECTION DEVICES MARKET

TABLE 62 MANUAL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MANUAL MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 AUTOMATED BLOOD COLLECTION

7.3.1 HIGHER SAFETY AND EFFICIENCY TO DRIVE DEMAND FOR AUTOMATED COLLECTION

7.3.2 MARKET TRENDS

7.3.3 IMPACT OF COVID-19 ON THE AUTOMATED BLOOD COLLECTION DEVICES MARKET

TABLE 64 AUTOMATED MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 65 AUTOMATED MARKET, BY REGION, 2021–2026 (USD MILLION)

8 BLOOD COLLECTION DEVICES MARKET, BY APPLICATION (Page No. - 132)

8.1 INTRODUCTION

TABLE 66 GLOBAL MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 67 GLOBAL BLOOD COLLECTION MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 DIAGNOSTICS

8.2.1 RISING DISEASE INCIDENCE AND ADOPTION OF POINT-OF-CARE TESTING TO DRIVE MARKET GROWTH

8.2.2 IMPACT OF COVID-19 ON THE DIAGNOSTIC BLOOD COLLECTION DEVICES MARKET

TABLE 68 DIAGNOSTIC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 DIAGNOSTIC MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 THERAPEUTICS

8.3.1 NORTH AMERICA TO DOMINATE THE THERAPEUTIC BLOOD COLLECTION DEVICES MARKET

8.3.2 IMPACT OF COVID-19 ON THE THERAPEUTIC MARKET

TABLE 70 THERAPEUTIC MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 71 THERAPEUTIC MARKET, BY REGION, 2021–2026 (USD MILLION)

9 BLOOD COLLECTION DEVICES MARKET, BY END USER (Page No. - 138)

9.1 INTRODUCTION

TABLE 72 GLOBAL MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 73 GLOBAL BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

9.2 HOSPITALS, ASC, & NURSING HOMES

9.2.1 INCREASING DISEASE AND TRAUMA INCIDENCE TO DRIVE MARKET GROWTH

TABLE 74 NUMBER OF SURGICAL PROCEDURES, 2015 VS. 2020 (MILLION)

TABLE 75 GLOBAL MARKET FOR HOSPITALS, AMBULATORY SURGICAL CENTERS, & NURSING HOMES, BY REGION, 2017–2020 (USD MILLION)

TABLE 76 GLOBAL MARKET FOR HOSPITALS, AMBULATORY SURGICAL CENTERS, & NURSING HOMES, BY REGION, 2021–2026 (USD MILLION)

9.3 DIAGNOSTIC & PATHOLOGY LABORATORIES

9.3.1 MARKET GROWTH TO WITNESS RISING DISEASE INCIDENCE AND INCREASING TESTING VOLUMES

TABLE 77 BLOOD COLLECTION DEVICES - MARKET FOR DIAGNOSTIC & PATHOLOGY LABORATORIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 GLOBAL MARKET FOR DIAGNOSTIC & PATHOLOGY LABORATORIES, BY REGION, 2021–2026 (USD MILLION)

9.4 BLOOD BANKS

9.4.1 RISE IN BLOOD DONATION VOLUMES TO DRIVE THE MARKET FOR BLOOD BANKS

TABLE 79 GLOBAL MARKET FOR BLOOD BANKS, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 GLOBAL MARKET FOR BLOOD BANKS, BY REGION, 2021–2026 (USD MILLION)

9.5 OTHER END USERS

TABLE 81 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2021–2026 (USD MILLION)

10 BLOOD COLLECTION DEVICES MARKET, BY REGION (Page No. - 146)

10.1 INTRODUCTION

TABLE 83 GLOBAL MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 GLOBAL MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: BLOOD COLLECTION DEVICES - MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 US to be the largest market for blood collection devices both globally and in North America

TABLE 101 INCIDENCE OF VARIOUS CANCERS IN THE US, 2018 VS. 2025

TABLE 102 US: KEY MACROINDICATORS

10.2.1.2 Impact of COVID-19 on the market in the US

TABLE 103 US: BLOOD COLLECTION DEVICES MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 104 US: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 105 US: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 US: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 107 US: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 US: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 109 US: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 110 US: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 111 US: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 112 US: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 113 US: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 115 US: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 116 US: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Growing volume of surgical procedures and the rising burden of cancer to support market growth

TABLE 117 SURGICAL PROCEDURES PERFORMED IN CANADA, 2019

TABLE 118 CANADA: KEY MACROINDICATORS

10.2.2.2 Impact of COVID-19 on the market in Canada

TABLE 119 CANADA: BLOOD COLLECTION DEVICES MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 120 CANADA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 121 CANADA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 122 CANADA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 123 CANADA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 124 CANADA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 125 CANADA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 126 CANADA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 127 CANADA: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 128 CANADA: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 129 CANADA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 130 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 131 CANADA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 132 CANADA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3 EUROPE

TABLE 133 EUROPE: BLOOD COLLECTION DEVICES - MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 137 EUROPE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 138 EUROPE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 139 EUROPE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 140 EUROPE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 141 EUROPE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 142 EUROPE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 143 EUROPE: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 144 EUROPE: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 148 EUROPE: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany to hold the largest share of the market in Europe

TABLE 149 SURGICAL PROCEDURES PERFORMED IN GERMANY, 2019

TABLE 150 GERMANY: KEY MACROINDICATORS

10.3.1.2 Impact of COVID-19 on the market in Germany

TABLE 151 GERMANY: BLOOD COLLECTION DEVICES - MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 152 GERMANY: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 153 GERMANY: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 154 GERMANY: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 155 GERMANY: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 156 GERMANY: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 157 GERMANY: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 158 GERMANY: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 159 GERMANY: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 160 GERMANY: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 161 GERMANY: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 162 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 163 GERMANY: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 164 GERMANY: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Favorable initiatives and the development of diagnostic tests to showcase growth trajectory in France

TABLE 165 SURGICAL PROCEDURES PERFORMED IN FRANCE, 2019

TABLE 166 FRANCE: KEY INDICATORS

10.3.2.2 Impact of COVID-19 on the market in France

TABLE 167 FRANCE: BLOOD COLLECTION DEVICES - MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 168 FRANCE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 169 FRANCE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 170 FRANCE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 171 FRANCE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 FRANCE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 FRANCE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 174 FRANCE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 175 FRANCE: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 176 FRANCE: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 177 FRANCE: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 178 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 179 FRANCE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 180 FRANCE: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Government support to prevent transmission of HIV, chronic diseases, and other infections to drive market growth

TABLE 181 SURGICAL PROCEDURES PERFORMED IN THE UK, 2019

TABLE 182 UK: KEY MACROINDICATORS

10.3.3.2 Impact of COVID-19 on the market in the UK

TABLE 183 UK: BLOOD COLLECTION DEVICES - MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 184 UK: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 185 UK: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 186 UK: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 187 UK: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 188 UK: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 UK: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 190 UK: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 191 UK: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 192 UK: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 193 UK: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 194 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 195 UK: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 196 UK: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Low healthcare expenditure and slow growth in the healthcare sector to affect the market growth

TABLE 197 DIFFERENT SURGICAL PROCEDURES PERFORMED IN ITALY IN 2019

TABLE 198 ITALY: KEY INDICATORS

10.3.4.2 Impact of COVID-19 on the market in Italy

TABLE 199 ITALY: BLOOD COLLECTION DEVICES - MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 200 ITALY: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 201 ITALY: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 202 ITALY: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 203 ITALY: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 204 ITALY: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 205 ITALY: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 206 ITALY: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 207 ITALY: BLOOD COLLECTION DEVICES - MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 208 ITALY: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 209 ITALY: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 210 ITALY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 211 ITALY: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 212 ITALY: BLOOD COLLECTION DEVICES - MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increasing adoption of NAT technology to support market growth

TABLE 213 DIFFERENT SURGICAL PROCEDURES PERFORMED IN SPAIN IN 2019

TABLE 214 SPAIN: KEY INDICATORS

10.3.5.2 Impact of COVID-19 on the market in Spain

TABLE 215 SPAIN: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 216 SPAIN: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 217 SPAIN: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 218 SPAIN: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 219 SPAIN: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 220 SPAIN: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 221 SPAIN: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 222 SPAIN: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 223 SPAIN: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 224 SPAIN: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 225 SPAIN: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 226 SPAIN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 227 SPAIN: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 228 SPAIN: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 229 ROE: HEALTHCARE EXPENDITURE, BY COUNTRY, 2010 VS. 2020 (% OF GDP)

TABLE 230 PERCENTAGE OF POPULATION AGED 60 YEARS OR OVER, 2017 VS. 2050

TABLE 231 SURGICAL PROCEDURES PERFORMED IN SWITZERLAND, 2019

TABLE 232 SURGICAL PROCEDURES PERFORMED IN BELGIUM, 2019

TABLE 233 ROE: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 234 ROE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 235 ROE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 ROE: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 237 ROE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 238 ROE: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 239 ROE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 240 ROE: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 241 ROE: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 242 ROE: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 243 ROE: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 244 ROE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 245 ROE: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 246 ROE: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 247 APAC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 248 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 249 APAC: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 250 APAC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 251 APAC: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 252 APAC: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 253 APAC: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 254 APAC: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 255 APAC: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 256 APAC: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 257 APAC: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 258 APAC: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 259 APAC: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 260 APAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 261 APAC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 262 APAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China to dominate the market in the Asia Pacific region

TABLE 263 CHINA: KEY INDICATORS

10.4.1.2 Impact of COVID-19 on the market in China

TABLE 264 CHINA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 265 CHINA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 266 CHINA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 267 CHINA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 268 CHINA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 269 CHINA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 270 CHINA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 271 CHINA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 272 CHINA: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 273 CHINA: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 274 CHINA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 275 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 276 CHINA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 277 CHINA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Japan is the second-largest healthcare market in the world

TABLE 278 JAPAN: KEY INDICATORS

10.4.2.2 Impact of COVID-19 on the market in Japan

TABLE 279 JAPAN: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 280 JAPAN: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 281 JAPAN: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 282 JAPAN: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 283 JAPAN: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 284 JAPAN: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 285 JAPAN: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 286 JAPAN: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 287 JAPAN: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 288 JAPAN: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 289 JAPAN: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 290 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 291 JAPAN: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 292 JAPAN: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 High blood donation and collection volumes indicate a strong growth potential

TABLE 293 INDIA: KEY INDICATORS

TABLE 294 INDIA: KEY INDICATORS

10.4.3.2 Impact of COVID-19 on the market in India

TABLE 295 INDIA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 296 INDIA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 297 INDIA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 298 INDIA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 299 INDIA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 300 INDIA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 301 INDIA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 302 INDIA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 303 INDIA: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 304 INDIA: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 305 INDIA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 306 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 307 INDIA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 308 INDIA: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 309 SURGICAL PROCEDURES IN SOUTH KOREA, 2019

TABLE 310 ROAPAC: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 311 ROAPAC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 312 ROAPAC: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 313 ROAPAC: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 314 ROAPAC: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 315 ROAPAC: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 316 ROAPAC: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 317 ROAPAC: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 318 ROAPAC: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 319 ROAPAC: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 320 ROAPAC: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 321 ROAPAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 322 ROAPAC: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 323 ROAPAC: MARKET, BY END USER, 2021–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 REDUCTIONS IN BLOOD DONATION RATE TO AFFECT MARKET GROWTH IN LATIN AMERICA

TABLE 324 LATAM: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 325 LATAM: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 326 LATAM: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 327 LATAM: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 328 LATAM: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 329 LATAM: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 330 LATAM: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 331 LATAM: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 332 LATAM: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 333 LATAM: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 334 LATAM: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 335 LATAM: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 336 LATAM: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 337 LATAM: BLOOD COLLECTION MARKET, BY END USER, 2021–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 RISING PREVALENCE OF INFECTIOUS DISEASES AND GROWING HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

TABLE 338 MEA: MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 339 MEA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 340 MEA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 341 MEA: BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 342 MEA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 343 MEA: PLASMA/WHOLE-BLOOD COLLECTION TUBES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 344 MEA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2017–2020 (USD MILLION)

TABLE 345 MEA: BLOOD COLLECTION TUBES MARKET, BY SYSTEM TYPE, 2021–2026 (USD MILLION)

TABLE 346 MEA: MARKET, BY METHOD, 2017–2020 (USD MILLION)

TABLE 347 MEA: MARKET, BY METHOD, 2021–2026 (USD MILLION)

TABLE 348 MEA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 349 MEA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 350 MEA: MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 351 MEA: MARKET, BY END USER, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 250)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 352 OVERVIEW OF THE STRATEGIES ADOPTED BY KEY PLAYERS IN THE BLOOD COLLECTION DEVICES MARKET

11.3 REVENUE SHARE ANALYSIS

FIGURE 35 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN THE BLOOD COLLECTION DEVICES MARKET

11.4 MARKET SHARE ANALYSIS

FIGURE 36 MARKET SHARE ANALYSIS, BY KEY PLAYER, 2020

TABLE 353 BLOOD COLLECTION DEVICES MARKET: DEGREE OF COMPETITION

11.5 BLOOD BAGS MARKET SHARE ANALYSIS

FIGURE 37 BLOOD BAGS MARKET SHARE ANALYSIS, BY PLAYER, 2019

11.6 COMPETITIVE LEADERSHIP MAPPING

FIGURE 38 BLOOD COLLECTION MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

11.7 COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS

FIGURE 39 BLOOD COLLECTION MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES & START-UPS (2020)

11.8 COMPANY FOOTPRINT

TABLE 354 COMPANY FOOTPRINT

TABLE 355 COMPANY PRODUCT FOOTPRINT

TABLE 356 COMPANY REGIONAL FOOTPRINT

11.9 COMPETITIVE SCENARIO

TABLE 357 KEY PRODUCT LAUNCHES & APPROVALS, JANUARY 2018– DECEMBER 2021

TABLE 358 KEY DEALS, JANUARY 2018– DECEMBER 2021

TABLE 359 OTHER KEY DEVELOPMENTS, JANUARY 2018–DECEMBER 2021

12 COMPANY PROFILES (Page No. - 268)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

12.1.1 BECTON, DICKINSON AND COMPANY

TABLE 360 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 40 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2020)

12.1.2 TERUMO BCT

TABLE 361 TERUMO BCT: BUSINESS OVERVIEW

FIGURE 41 TERUMO BCT: COMPANY SNAPSHOT (2020)

12.1.3 FRESENIUS KABI AG

TABLE 362 FRESENIUS KABI AG: BUSINESS OVERVIEW

FIGURE 42 FRESENIUS KABI AG: COMPANY SNAPSHOT (2020)

12.1.4 GRIFOLS, S.A.

TABLE 363 GRIFOLS, S.A.: BUSINESS OVERVIEW

FIGURE 43 GRIFOLS, S.A.: COMPANY SNAPSHOT (2020)

12.1.5 NIPRO MEDICAL CORPORATION

TABLE 364 NIPRO MEDICAL CORPORATION: BUSINESS OVERVIEW

FIGURE 44 NIPRO MEDICAL CORPORATION: COMPANY SNAPSHOT (2020)

12.1.6 GREINER HOLDING AG

TABLE 365 GREINER HOLDING AG: BUSINESS OVERVIEW

FIGURE 45 GREINER HOLDING AG: COMPANY SNAPSHOT (2020)

12.1.7 QUEST DIAGNOSTICS INCORPORATED

TABLE 366 QUEST DIAGNOSTICS INCORPORATED: BUSINESS OVERVIEW

FIGURE 46 QUEST DIAGNOSTICS INCORPORATED: COMPANY SNAPSHOT (2020)

12.1.8 SARSTEDT AG & CO. KG

TABLE 367 SARSTEDT AG & CO. KG: BUSINESS OVERVIEW

12.1.9 MACOPHARMA

TABLE 368 MACOPHARMA: BUSINESS OVERVIEW

12.1.10 HAEMONETICS CORPORATION

TABLE 369 HAEMONETICS CORPORATION: BUSINESS OVERVIEW

FIGURE 47 HAEMONETICS CORPORATION: COMPANY SNAPSHOT (2020)

12.1.11 SMITHS MEDICAL

TABLE 370 SMITHS MEDICAL: BUSINESS OVERVIEW

FIGURE 48 SMITHS MEDICAL: COMPANY SNAPSHOT (2020)

12.1.12 CARDINAL HEALTH

TABLE 371 CARDINAL HEALTH: BUSINESS OVERVIEW

FIGURE 49 CARDINAL HEALTH: COMPANY SNAPSHOT (2021)

12.1.13 RETRACTABLE TECHNOLOGIES, INC.

TABLE 372 RETRACTABLE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 50 RETRACTABLE TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2020)

12.2 OTHER PLAYERS

12.2.1 LIUYANG SANLI MEDICAL TECHNOLOGY DEVELOPMENT CO., LTD.

TABLE 373 LIUYANG SANLI MEDICAL TECHNOLOGY DEVELOPMENT CO., LTD.: BUSINESS OVERVIEW

12.2.2 FL MEDICAL S.R.L.

TABLE 374 FL MEDICAL S.R.L: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12.2.3 AB MEDICAL CO., LTD.

12.2.4 APTACA SPA

12.2.5 JIANGSU MICSAFE MEDICAL TECHNOLOGY CO., LTD.

12.2.6 DISERA TIBBI MALZEME LOJISTIK SANAYI VE TICARET A.S

12.2.7 AJOSHA BIO TEKNIK PVT. LTD.

12.2.8 PREQ SYSTEMS

12.2.9 CML BIOTECH (P) LTD.

12.2.10 LMB TECHNOLOGIE GMBH

12.2.11 MITRA INDUSTRIES PRIVATE LIMITED

12.2.12 NEOMEDIC LIMITED

13 APPENDIX (Page No. - 327)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the global blood collection devices market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the blood collection devices market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, OECD, FDA, CDC, and World Bank. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global blood collection devices market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global blood collection devices market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as personnel from the hospitals, ASCs, Nursing homes, Blood Banks and pathology laboratories) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The global size of the blood collection devices market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the global blood collection devices market and other adjucent submarkets. The research methodology and the market numbers were then validated from primaries.

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the blood collection devices market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the blood collection devices market

Report Objectives

- To define, describe, segment, and forecast the blood collection devices market based on product, application, end user, method and region

- To provide detailed information about the factors influencing market growth, such as drivers, opportunities, restraints and challenges

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall in blood collection devices market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific (APAC), Middle East and Africa

- To profile the key players in the global blood collection devices market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as product launches, expansions, and partnerships in the blood collection devices market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographical Analysis

- Further for LATAM and MEA countries market into countries.

- Product Analysis by product Matrix, which gives a detailed comparison of the product portfolios of top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Collection Devices Market

Who is the targeted audience for this Study?

What will be the market value for Blood Collection Devices Market in 2028?

Which factors are responsible for restraining the growth of Blood Collection Devices Market?