Digital Logistics Market Statistics: 2032

The global digital logistics market size was valued at $24.8 billion in 2022, and is projected to reach $155.3 billion by 2032, growing at a CAGR of 20.4% from 2023 to 2032.

Logistics management becomes a finely tuned orchestration of data, automation, and connectivity. These solutions leverage cloud platforms and the Internet of Things (IoT) to provide unparalleled visibility into supply chains. Benefits include enhanced inventory accuracy, reduced order processing times, and lower operational costs. Moreover, the advantages extend to improved customer experiences with accurate delivery estimations and streamlined returns. Digital logistics solutions empower businesses to adapt swiftly to market changes, enabling them to stay ahead of competitors and respond dynamically to customer demands in a fast-paced global marketplace.

The COVID-19 outbreak accelerated the transformation of the logistics industry through technological advancements. As lockdowns and social distancing measures disrupted traditional supply chains, companies turned to digital solutions to adapt and thrive. E-commerce experienced a boom, forcing logistics providers to optimize their operations. Automation, data analytics, and AI-powered systems became essential tools for efficient inventory management, route planning, and last-mile deliveries. The digital logistics market is experiencing a transformative boom, primarily due to the increasing volume of data and its profound impact on service quality. In a data-driven era, companies are amassing vast amounts of information related to their supply chain operations. This data, ranging from real-time tracking to customer preferences, is being harnessed through advanced technologies like IoT sensors, AI, and analytics.

However, the digital logistics market share faces significant challenges due to security and privacy concerns, as well as a lack of robust IT infrastructure. Security breaches and data leaks can have severe consequences in the logistics industry, where sensitive information about shipments, routes, and inventory must be protected from cyberattacks and unauthorized access. On the other hand, as the world becomes more interconnected, the demand for digital logistics solutions will continue to rise, creating a promising market for innovative technologies and services that drive the future of efficient and sustainable supply chain management.

The report focuses on growth prospects, restraints, and trends of the digital logistics market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the digital logistics market.

Segment Review

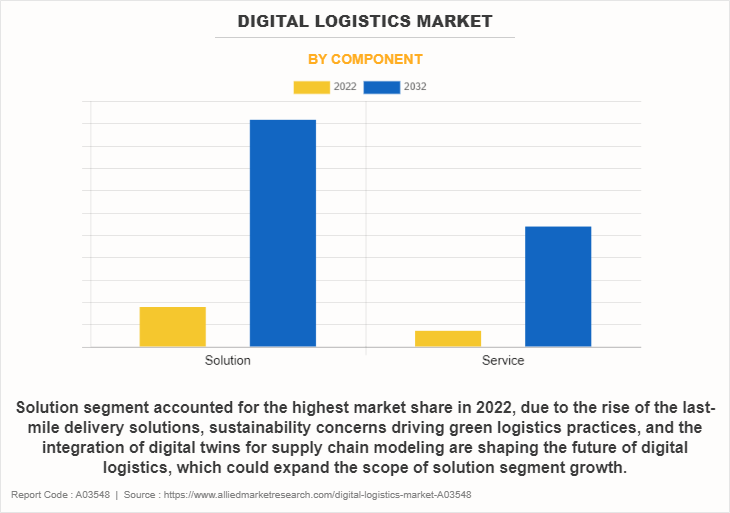

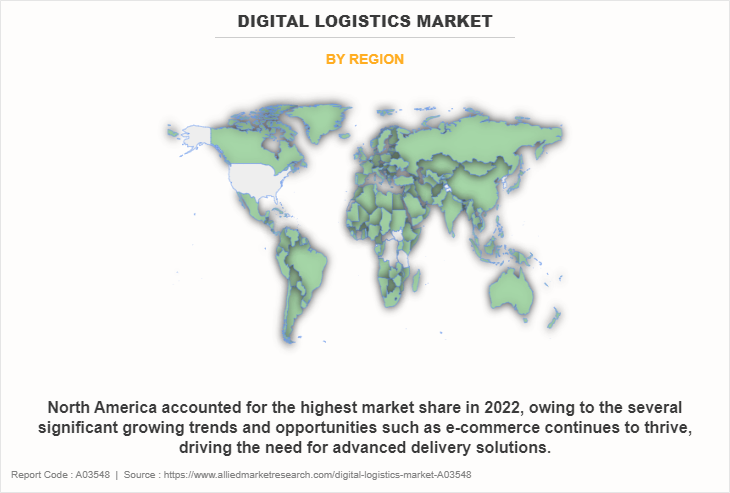

The digital logistics market is segmented on the basis of component, function, organization size, deployment mode, industry verticals, and region. On the basis of the component, the market is bifurcated into solution and services. Based on the function, the market is segmented into warehouse management, transportation management and workforce management. On the basis of the organization size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of the deployment mode, the market is bifurcated into cloud and On-premises. By Industry Vertical, it is bifurcated into retail and e-commerce, manufacturing, pharmaceuticals and healthcare, aerospace, and defense, automotive, energy and utilities, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the solution segment held the highest market. This was attributed to the increase in application across various industries, from retail and manufacturing to healthcare and e-commerce. By leveling costs and analytics, artificial intelligence, and IoT technologies, digital logistics solutions empower organizations to enhance their operational efficiency, reduce costs, and improve customer satisfaction. However, the services segment is forecasted to be the fastest-growing segment. This is attributed to the growing demand for these services due to the increasing complexity of supply chain operations and the need for specialized expertise. Businesses are obtaining guidance from experienced consultants to assess their existing logistics processes and design tailored digital strategies, further fueling growth.

Based on region, North America attained the highest market share in the digital logistics market owing to several significant growing trends and opportunities. As e-commerce continues to thrive, driving the need for advanced last-mile delivery solutions. Delivery drones, autonomous vehicles, and robotics are being explored to expedite the delivery process and reduce costs. The market for digital logistics is expected to develop at the quickest rate in the Asia-Pacific region. This growth can be attributed as the adoption of emerging technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and blockchain is revolutionizing logistics operations. IoT-enabled sensors and devices are enhancing real-time tracking and monitoring of shipments, ensuring greater transparency and security.

Some of the key players profiled in the report include AT&T Intellectual Property, HCL Technologies Limited, Honeywell International Inc., IBM Corporation, Infosys Limited, Intel Corporation, Oracle, SAP SE, Tech Mahindra Limited, and Webxpress. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital logistics market.

Top Impacting Factors

Expansion of the E-Commerce Industry

The expansion of e-commerce has been a game-changer for the digital logistics market. As more people turn to online shopping, the demand for efficient and streamlined logistics solutions has surged. E-commerce businesses are constantly striving to deliver products faster, cheaper, and with greater accuracy to meet customer expectations. This has led to the adoption of advanced technologies like automated warehouses, route optimization, and real-time tracking systems, all of which are integral to digital logistics. Digital logistics enables businesses to manage their supply chains more effectively, reducing lead times and inventory costs. It also allows for better demand forecasting, which minimizes stockouts and overstock situations. Furthermore, the rise of multi-channel retailing, including mobile shopping and social commerce, has made logistics even more complex, requiring real-time data sharing and synchronization across various platforms. Thus, the expansion of e-commerce has propelled the digital logistics market forward by necessitating innovative solutions to meet the growing demand for fast and efficient product delivery in today's digital age. This trend is likely to continue as online shopping becomes increasingly integrated into our daily lives.

Technological Advancements & Covid-19 Outbreak Leading to Lockdown

The COVID-19 outbreak accelerated the transformation of the logistics industry through technological advancements. As lockdowns and social distancing measures disrupted traditional supply chains, companies turned to digital solutions to adapt and thrive. E-commerce experienced a boom, forcing logistics providers to optimize their operations. Automation, data analytics, and AI-powered systems became essential tools for efficient inventory management, route planning, and last-mile deliveries. Contactless delivery options and real-time tracking gained prominence to ensure safety. Furthermore, remote work and virtual collaboration tools enabled logistics teams to coordinate seamlessly. These changes pushed the digital logistics market to new heights. Companies invested heavily in cloud-based platforms, IoT sensors, and blockchain for enhanced visibility and transparency. The pandemic underscored the importance of agility and resilience in supply chain management, driving businesses to embrace digitalization to future-proof their operations. The market is now a dynamic ecosystem where technology and innovation play a pivotal role in meeting evolving customer demands and navigating unpredictable disruptions.

High Capital Investment

High capital investment can act as a significant hurdle for the growth of the digital logistics market. In this context, digital logistics refers to the use of technology and data-driven solutions to streamline and optimize the movement of goods. Implementing digital logistics systems often requires substantial investments in software, hardware, and skilled personnel. Small and medium-sized businesses, in particular, may struggle to afford these upfront costs, limiting their ability to compete effectively in the market. Additionally, the market forecast is constantly evolving, necessitating ongoing investments to stay competitive.

Large corporations with deeper pockets have an advantage here, as they can more easily absorb these capital expenses and keep pace with the latest technological advancements. This disparity can lead to market consolidation, where a few major players dominate, potentially reducing competition and innovation. To overcome this barrier, it's crucial for governments and industry stakeholders to promote initiatives that support smaller businesses in adopting digital logistics solutions, leveling the playing field, and fostering a more dynamic and inclusive digital logistics industry.

Growing Adoption of Cloud Technology, and Globalization

The growing adoption of cloud technology and globalization has paved the way for significant opportunities in the digital logistics industry. Cloud technology enables companies to store and access vast amounts of data and applications remotely, making it easier to manage and optimize complex supply chains. This has led to increased efficiency, reduced costs, and improved visibility throughout the logistics process. Moreover, globalization has expanded the reach of businesses, requiring them to manage supply chains that span the globe. Digital logistics solutions leverage cloud-based platforms to provide real-time tracking, predictive analytics, and seamless communication between all stakeholders, including suppliers, manufacturers, and consumers. This not only ensures smoother operations but also enables companies to adapt to changing market conditions quickly. As the world becomes more interconnected, the demand for digital logistics solutions will continue to rise, creating a promising market for innovative technologies and services that drive the future of efficient and sustainable supply chain management.

Competition Analysis

Recent Partnerships in the Market

In April 2021, Celonis, IBM Corporation and Red Hat entered into a global strategic partnership to help accelerate the adoption of the Celonis Execution Management System (EMS) and help deliver more flexibility and choice in how customers deploy the technology. The collaboration seeks to accelerate how customers apply process mining, intelligence and automation to the core enterprise system functions and processes that drive business.

Recent Product Launches in the Market

In June 2023, Honeywell introduced its new Honeywell Digital Prime solution, a cloud-based digital twin for tracking, managing, and testing process control changes and system modifications. Digital Prime is a cost-effective solution that allows users to test frequently for more accurate results while resulting in an overall reduction in reactive maintenance.

Recent Innovation in the Market

In June 2022, NTT DATA and SAP SE Asia Pacific and Japan (APJ) announced a new co-innovation solution to improve supply chain insurance management. The solution, Connected Product, is a packaged offering jointly developed by global digital business and IT services leader, NTT DATA, and SAP SE, furthering the strategic alliance formed in 2020 between parent company NTT, and SAP SE.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital logistics market analysis from 2022 to 2032 to identify the prevailing digital logistics market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital logistics market segmentation assists to determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global digital logistics market growth.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global digital logistics market trends, key players, market segments, application areas, and market growth strategies.

Digital Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 155.3 billion |

| Growth Rate | CAGR of 20.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 324 |

| By Deployment Mode |

|

| By Industry Verticals |

|

| By Component |

|

| By Function |

|

| By Organisation Size |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., WebXpress, Tech Mahindra Limited, Intel Corporation, Infosys Limited, SAP SE, HCL Technologies Limited, Oracle, IBM Corporation, AT&T Intellectual Property |

Analyst Review

The digital logistics market represents a transformative opportunity to enhance supply chain efficiency, visibility, and customer satisfaction. Embracing advanced technologies which include IoT, blockchain, and AI-driven analytics further helps to streamline operations, reduce costs, and mitigate risks. By integrating these digital tools, market players can optimize inventory management, track shipments in real-time, and respond swiftly to changing market demands. This digital transformation allows for sustainable practices and customer-centric service. As a result, CXOs are poised to achieve growth, sustainability, and resilience in an increasingly complex global market.

Furthermore, due to the increased demand for end-to-end visibility and data-driven supply chain decision-making, this market is witnessing a significant development. This industry is propelled by the growth of e-commerce, the proliferation of IoT devices, and the need to minimize environmental impacts. In addition, industry participants are investing in cutting-edge technologies to automate warehouses, improve last-mile delivery, and optimize routing. While AI-driven analytics enable predictive maintenance and route optimization, the incorporation of blockchain assures secure and transparent transactions. There is significant room for expansion in this sector, and emerging economies offer bright prospects. However, issues like interoperability and data security must be resolved. Overall, the digital logistics sector offers organizations chances to increase productivity, save costs, and improve customer satisfaction.

Moreover, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in September 2023, Infosys, a global leader in next-generation digital services and consulting, and Economist Impact announced the launch of the Value Chain Navigator (VCN) to help businesses understand and address their scope 3 emissions. Scope 3 includes all indirect emissions that occur in the upstream and downstream activities of an organization’s value chain. These can include emissions from purchased goods and services, business travel, employee commuting, waste disposal, use of sold products, transportation, distribution, investments, and leased assets and franchises. Further, in August 2023, ElAraby Group, a leading manufacturer and supplier of electronics and home appliances in the Middle East and North Africa region, announced it will enter the next phase of its digital transformation journey with global technology company SAP SE. The family-owned Egyptian enterprise has signed an agreement to adopt RISE with SAP to enable a full cloud migration, including flagship cloud solutions such as Customer Experience (CX), SAP Signavio, Business Technology Platform (BTP), and Digital Supply Chain that will support its customer-first approach and ensure a far more resilient supply chain.

Some of the key players profiled in the report include AT&T Intellectual Property, HCL Technologies Limited, Honeywell International Inc., IBM Corporation, Infosys Limited, Intel Corporation, Oracle, SAP SE, Tech Mahindra Limited, and Webxpress. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital logistics market.

The COVID-19 outbreak accelerated the transformation of the logistics industry through technological advancements. As lockdowns and social distancing measures disrupted traditional supply chains, companies turned to digital solutions to adapt and thrive.

It provides the last-mile delivery solutions, sustainability concerns driving green logistics practices, and the integration of digital twins for supply chain modeling are shaping the future of digital logistics, which could expand the scope of solution segment growth.

The digital logistics market is projected to reach $155.31 billion by 2032.

The key players profiled in the report include AT&T Intellectual Property, HCL Technologies Limited, Honeywell International Inc., IBM Corporation, Infosys Limited, Intel Corporation, Oracle, SAP SE, Tech Mahindra Limited, and Webxpress.

North America is the largest regional market for Digital Logistics.

Loading Table Of Content...

Loading Research Methodology...