Trade Surveillance Systems Market by Component (Solutions (Risk & Compliance, Surveillance & Analytics, Case Management) and Services), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

[268 Pages Report] The Global Trade Surveillance Systems Market size to grow from USD 1.7 billion in 2022 to USD 4.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period. Growing need to monitor trade activities in financial institutions, rising demand to meet trade regulations and compliance requirements across financial institutions, compelling need to control market manipulation and market abuse activities, growing importance of holistic surveillance solutions with integrated markets and communications surveillance, and increasing demand for 360-degree trade surveillance are expected to be the major factors driving the growth of the Trade Surveillance Systems market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing demand for 360-degree trade surveillance

Driven by complex regulatory compliances and increasing trade malpractices, vendors offer holistic trade surveillance system solutions and services with 360-degree surveillance. These trade surveillance solutions monitor & analyze transactions, communications, and behavioral patterns to provide enhanced & comprehensive investigation. The 360-degree approach to trade surveillance systems improves true positives, decreases efforts to process false positives, and better identify patterns for trade surveillance. The demand for robust trade surveillance solutions that gathers data from all different channels, such as trade and order data, social networking sites data, voice communications, and behavioral data, is increasing rapidly.

Restraint: Regulatory uncertainty and cost-versus-benefit objections

New regulatory mandates often undergo major augmentations prior to implementation or are simply delayed for long periods. Although the benefits of installing a surveillance and monitoring system are clear, firm executives will still harbor objections to high spending limits for technology that does not contribute to profit-generating functions, thus making a true ROI calculation impossible.

Opportunity: Growing inclination toward adoption of cloud-based deployments in trade surveillance

Cloud-based trading operations are evolving rapidly because of the convenience of digitalization and quick accessibility. The growing number of cloud-based trading activities increases the requirement for trading surveillance. Cloud-based trade surveillance solutions are gaining more traction than on-premises trade surveillance systems because of their several advantages. Cloud-based platforms or solutions provide highly scalable performance and a stable environment for developing trade surveillance solutions. Additionally, vendors ensure that organizations always have access to the latest version of the solution with regular updates, maintenance, and support services.

Challenge: Non-standardization of compliances, evolving business models, and expanding global regulations

To mitigate financial frauds and cybercrimes, government institutions and concerned authorities from different countries have strived to impose stringent regulations. The advancements in cybercrimes have encouraged authorities to frequently upgrade their regulations. Frequently changing and diverse regulations in different regions have posed certain challenges for trade surveillance management vendors to cope with and upgrade their solutions to comply with the different regulations. Advancement in trading technology and trading across the country boundaries have led the financial institution to keep a close eye on every transaction to reduce the risk of paying heavy fines due to violence of regulations.

By Organization Size, Small and Medium-sized Enterprises segment to have the higher growth during the forecast period

Under Organization Size, the Small and Medium-sized Enterprises segment is expected to have the highest growth rate during the forecast period. Organizations with less than 1,000 employees are categorized as SMEs. The increased number of regulations imposed by the regulatory bodies has prompted SMEs to invest in trade surveillance solutions to better monitor trade transactions across the organization. With these solutions, SMEs are also able to make effective decisions about their business’ growth.

By Solutions, the Reporting & Monitoring segment to have the highest market size during the forecast period

Among Solutions, the Reporting & Monitoring sub-segment to have the highest share. The Reporting & Monitoring solution helps to report suspected and confirmed fraudulent trading activities. Vendors offering this solution also offer a variety of features depending on the type of data and information being reported, the purpose and urgency of relaying the information, and where the data/information is being reported.

By Region, Asia Pacific to record the highest growth during the forecast period

Asia Pacific is one of the fastest-developing regions globally, making the region highly profitable for the trade surveillance systems market. It is expected to be the fastest-growing market owing to the rapid economic developments, globalization, digitalization, and the increased proliferation of smartphones. Japan and China, being two of the most technologically advanced countries in the region, are the undisputed leaders in the market. The regulatory bodies in the region, such as the Australian Securities and Investments Commission (ASIC), Singapore Exchange Limited (SGX), and China Securities Regulatory Commission (CSRC), are tightening the rules for stock trading, surveillance, short-selling, risk management, broker margin financing, and derivatives trading. Furthermore, factors such as good and improving infrastructure, government incentives, and simplification of market trade barriers are expected to be leading to the development of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The report includes the study of key players offering Trade Surveillance Systems and services. It profiles major vendors in the global Trade Surveillance Systems market. The major vendors in the market include NICE (Israel), FIS (US), Nasdaq (US), IPC (US), SIA S.p.A. (Italy), ACA Group (US), Aquis Technologies (UK), Software AG (Germany), b-next (Germany), and BAE Systems (UK). These players have adopted various strategies to grow in the global market.

The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast year market size |

USD 4.1 Billion |

|

Estimated year market size |

USD 1.7 Billion |

|

Segments covered |

By Component, Deployment Mode, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

NICE (Israel), FIS (US), Nasdaq (US), IPC (US), SIA S.p.A. (Italy), ACA Group (US), Aquis Technologies (UK), Software AG (Germany), b-next (Germany), BAE Systems (UK), OneMarketData (US), Scila (Sweden), CRISIL (India), IBM (US), Trading Technologies (US), Acuity Knowledge Partners (UK), Abel Noser (US), MyComplianceOffice (US), Trillium (US), Trapets (Sweden), Eventus (US), Intellect Design Arena (India), Red Deer (UK), Solidus Labs (US), and SteelEye (UK) |

This research report categorizes the Trade Surveillance Systems market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

-

Solutions

- Risk & Compliance

- Reporting & Monitoring

- Surveillance & Analytics

- Case Management

- Other Solutions

-

Services

- Managed Services

-

Professional Services

- Consulting

- Deployment & Integration

- Support & Maintenance

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

By Vertical:

- Banking

- Capital Markets

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2021, SIA S.p.A. merged with Nexi to consolidate its position as the Italian PayTech leader in Europe, driving the transition toward a cashless and digital economy across Europe.

- In February 2021, Nasdaq acquired Verafin, a provider of anti-financial crime management solutions. The acquisition would significantly strengthen Nasdaq’s existing regulatory and anti-financial crime solutions.

- In August 2020, NICE Actimize launched Xceed, a next-generation AI-powered financial crime risk management cloud platform. It integrates AML and fraud prevention solutions that help financial services organizations of any size to modernize their financial crime risk management solutions.

- In June 2020, IPC partnered with Digital Reasoning to deliver the most advanced voice surveillance for financial services. The partnership would enable financial institutions to analyze all of their voice surveillance data to identify regulatory risks faster to take action sooner.

- In July 2019, FIS acquired Worldpay, a leading global eCommerce and payment technology company. The acquisition would expand FIS’ global footprint and portfolio of solutions for payments, banking, and capital markets.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Trade Surveillance Systems Market?

The Global Trade Surveillance Systems Market size to grow from USD 1.7 billion in 2022 to USD 4.1 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.7% during the forecast period.

Which Region has the largest market share in the Trade Surveillance Systems Market?

Europe is estimated to hold the largest share in the Trade Surveillance Systems Market in 2022. Financial institutions are being put under strict governing rules to ensure fair practices in securities and trading domains. Europe also has the presence of most of the top market vendors, such as SIA S.p.A., Software AG, BAE Systems, Aquis Technologies, and b-next.

Which Solution is expected to have the highest growth during the forecast period?

By Solution, the Surveillance & Analytics sub-segment is expected to have the highest growth during the forecast period as it helps in the systematic collection, analysis, and interpretation of outcomes from specific data for use in planning, implementing, and evaluating compliance policies and practices.

Which Deployment Mode is expected to hold a larger market size during the forecast period?

By Deployment Mode, the On-premises segment is expected to hold a larger market size during the forecast period as it provides enhanced control over data location accessibility across the network.

Who are the major vendors in the Trade Surveillance Systems Market?

Major vendors in the Trade Surveillance Systems Market include NICE (Israel), FIS (US), Nasdaq (US), IPC (US), SIA S.p.A. (Italy), ACA Group (US), Aquis Technologies (UK), Software AG (Germany), b-next (Germany), and BAE Systems (UK). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 6 TRADE SURVEILLANCE SYSTEMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 LIST OF KEY PRIMARY INTERVIEW PARTICIPANTS

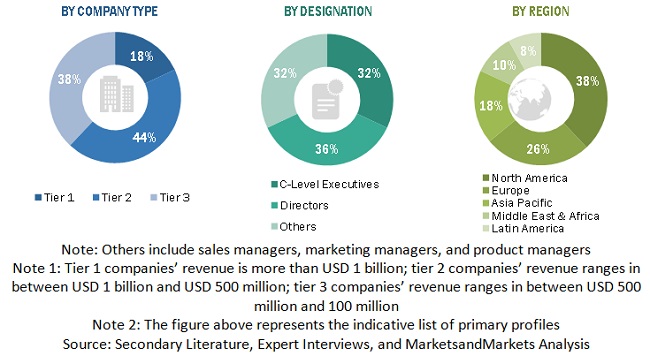

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 TRADE SURVEILLANCE SYSTEMS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE GENERATED BY VENDORS FROM EACH APPLICATION

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DIFFERENT VERTICALS

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 15 GLOBAL TRADE SURVEILLANCE SYSTEMS MARKET, 2019–2027 (USD MILLION)

FIGURE 16 FASTEST-GROWING SEGMENTS IN MARKET, 2022–2027

FIGURE 17 REPORTING & MONITORING SOLUTION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 19 ON-PREMISES SEGMENT TO HAVE LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 21 TOP VERTICALS IN MARKET

FIGURE 22 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 OVERVIEW OF TRADE SURVEILLANCE SYSTEMS MARKET

FIGURE 23 NEED FOR REGULATION AND INTERNAL COMPLIANCE TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 24 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY SOLUTION, 2022 VS. 2027

FIGURE 25 REPORTING & MONITORING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY PROFESSIONAL SERVICE, 2022 VS. 2027

FIGURE 26 DEPLOYMENT & INTEGRATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY DEPLOYMENT MODE, 2022 VS. 2027

FIGURE 27 ON-PREMISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 28 LARGE ENTERPRISE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.7 MARKET, BY VERTICAL, 2022–2027

FIGURE 29 CAPITAL MARKETS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.8 TRADE SURVEILLANCE SYSTEMS MARKET: REGIONAL SCENARIO, 2022–2027

FIGURE 30 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 31 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.2.1 DRIVERS

5.2.1.1 Growing need to monitor trade activities in financial institutions

FIGURE 32 GREATEST SURVEILLANCE CHALLENGES TO DRIVE MARKET

5.2.1.2 Rising demand to meet trade regulations and compliance requirements across financial institutions

5.2.1.3 Compelling need to control market manipulation and market abuse activities

FIGURE 33 MAJOR END USERS TO DRIVE MARKET

5.2.1.4 Growing importance of holistic surveillance solutions with integrated markets and communications surveillance

5.2.1.5 Increasing demand for 360-degree trade surveillance

FIGURE 34 KEY FUNCTIONALITY TREND IN TRADE SURVEILLANCE SYSTEMS MARKET

5.2.2 RESTRAINTS

5.2.2.1 Complex analysis of multiple parameters and monitoring of real-time events for fraud detection

5.2.2.2 Regulatory uncertainty and cost-versus-benefit objections

5.2.3 OPPORTUNITIES

5.2.3.1 Growing sophistication of trade surveillance system solutions powered by advanced analytics, AI, ML, and process automation technologies

FIGURE 35 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING TO GENERATE ACCURATE TRADE SURVEILLANCE ANALYTICS

5.2.3.2 Growing inclination toward adoption of cloud-based deployments in trade surveillance

5.2.3.3 Demand for low-latency reporting and time-series databases

5.2.4 CHALLENGES

5.2.4.1 Design and implementation of surveillance systems

5.2.4.2 Non-standardization of compliances, evolving business models, and expanding global regulations

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: GLOBAL BANKING AND FINANCIAL SERVICES CORPORATION IMPLEMENTED NICE ACTIMIZE COMMUNICATIONS SURVEILLANCE FOR PROACTIVE MONITORING AND IMMEDIATE ACCESS TO ALL FX, FICC, AND EQUITIES ASSOCIATES ECOMMUNICATIONS DATA

5.3.2 CASE STUDY 2: IPC DEPLOYED NEXT-GENERATION UNIFIED COMMUNICATIONS SOLUTIONS TO ENABLE HIGH-TOUCH TRADING FOR GERMAN GLOBAL MACRO TRADING FIRM

5.3.3 CASE STUDY 3: ENERGY TRADING FIRM LEVERAGED B-NEXT CMC: ESUITE PLATFORM

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PORTER’S FIVE FORCES ANALYSIS: TRADE SURVEILLANCE SYSTEMS MARKET

FIGURE 36 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 COMPETITIVE RIVALRY WITHIN THE INDUSTRY

5.5 COVID-19-DRIVEN MARKET DYNAMICS

5.5.1 DRIVERS AND OPPORTUNITIES

5.5.2 RESTRAINTS AND CHALLENGES

5.6 TECHNOLOGY ANALYSIS

5.6.1 EVOLUTION OF INVESTIGATIVE, REACTIVE, AND PROACTIVE SURVEILLANCE

FIGURE 37 EVOLUTION AND PROCESS FLOW OF CURRENT AND FUTURE TRADE SURVEILLANCE SYSTEMS

5.7 PRICING ANALYSIS

TABLE 5 TRADE SURVEILLANCE SYSTEMS MARKET: PRICING LEVELS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 38 MARKET: SUPPLY CHAIN

5.9 ECOSYSTEM

FIGURE 39 MARKET: ECOSYSTEM

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.2 NORTH AMERICA

5.10.3 EUROPE

5.10.4 ASIA PACIFIC

5.10.5 MIDDLE EAST AND AFRICA

5.10.6 LATIN AMERICA

5.11 PATENT ANALYSIS

TABLE 6 TRADE SURVEILLANCE SYSTEMS MARKET: PATENTS

TABLE 7 TOP 10 PATENT OWNERS (US)

FIGURE 40 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENTS

5.12 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 41 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 42 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ENTERPRISES END USER

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ENTERPRISES END USERS (%)

5.14.2 BUYING CRITERIA

FIGURE 43 KEY BUYING CRITERIA FOR END USERS

TABLE 10 KEY BUYING CRITERIA FOR END USERS

6 TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT (Page No. - 92)

6.1 INTRODUCTION

FIGURE 44 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 13 COMPONENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 14 COMPONENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 45 SURVEILLANCE & ANALYTICS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

TABLE 15 SOLUTIONS: TRADE SURVEILLANCE SYSTEMS SOLUTIONS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 16 SOLUTIONS: TRADE SURVEILLANCE SYSTEMS SOLUTIONS MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 17 SOLUTIONS: TRADE SURVEILLANCE SYSTEMS SOLUTIONS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 18 SOLUTIONS: TRADE SURVEILLANCE SYSTEMS SOLUTIONS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 RISK & COMPLIANCE

6.2.3.1 Growing need to comply with regulations and policies to increase demand for risk & compliance solutions

TABLE 19 RISK & COMPLIANCE: TRADE SURVEILLANCE SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 RISK & COMPLIANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 REPORTING & MONITORING

6.2.4.1 Need to increase efficiency through automation to create high demand for reporting & monitoring solutions

TABLE 21 REPORTING & MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 22 REPORTING & MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 SURVEILLANCE & ANALYTICS

6.2.5.1 Surveillance & analytics solutions to help enterprises gain helpful insights to make informed decisions

TABLE 23 SURVEILLANCE & ANALYTICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 SURVEILLANCE & ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.6 CASE MANAGEMENT

6.2.6.1 Need to effectively resolve issues according to compliance protocols to fuel demand for case management solutions

TABLE 25 CASE MANAGEMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 CASE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.7 OTHER SOLUTIONS

TABLE 27 OTHER SOLUTIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 28 OTHER SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 46 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 29 SERVICES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 31 SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 SERVICES: TRADE SURVEILLANCE SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3 PROFESSIONAL SERVICES

6.3.3.1 Lack of technical expertise with regard to trade surveillance to fuel demand for professional services

FIGURE 47 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 34 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 35 PROFESSIONAL SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3.2 Consulting

TABLE 37 CONSULTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 38 CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3.3 Deployment & Integration

TABLE 39 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 40 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.3.4 Support & Maintenance

TABLE 41 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.4 MANAGED SERVICES

6.3.4.1 Growing need to comply with new regulations to stay competitive to drive demand for managed services

TABLE 43 MANAGED SERVICES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 44 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 TRADE SURVEILLANCE SYSTEMS MARKET, BY DEPLOYMENT MODE (Page No. - 111)

7.1 INTRODUCTION

FIGURE 48 CLOUD DEPLOYMENT MODE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 45 MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 46 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 47 DEPLOYMENT MODE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 48 DEPLOYMENT MODE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 CLOUD: MARKET DRIVERS

7.2.2 CLOUD: COVID-19 IMPACT

TABLE 49 CLOUD: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ON-PREMISES: MARKET DRIVERS

7.3.2 ON-PREMISES: COVID-19 IMPACT

TABLE 51 ON-PREMISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 52 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 TRADE SURVEILLANCE SYSTEMS MARKET, BY ORGANIZATION SIZE (Page No. - 117)

8.1 INTRODUCTION

FIGURE 49 SMALL AND MEDIUM-SIZED ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 53 MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 54 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 55 ORGANIZATION SIZE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 56 ORGANIZATION SIZE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

8.2.2 SMALL AND MEDIUM-SIZED ENTERPRISES: COVID-19 IMPACT

TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

8.3.2 LARGE ENTERPRISES: COVID-19 IMPACT

TABLE 59 LARGE ENTERPRISES: TABLE 60 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 TRADE SURVEILLANCE SYSTEMS MARKET, BY VERTICAL (Page No. - 123)

9.1 INTRODUCTION

FIGURE 50 CAPITAL MARKETS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 61 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 62 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 63 VERTICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 VERTICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 BANKING

9.2.1 BANKING: MARKET DRIVERS

9.2.2 BANKING: COVID-19 IMPACT

TABLE 65 BANKING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 BANKING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CAPITAL MARKETS

9.3.1 CAPITAL MARKETS: MARKET DRIVERS

9.3.2 CAPITAL MARKETS: COVID-19 IMPACT

TABLE 67 CAPITAL MARKETS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 CAPITAL MARKETS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 OTHER VERTICALS

9.4.1 OTHER VERTICALS: MARKET DRIVERS

9.4.2 OTHER VERTICALS: COVID-19 IMPACT

TABLE 69 OTHER VERTICALS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 TRADE SURVEILLANCE SYSTEMS MARKET, BY REGION (Page No. - 130)

10.1 INTRODUCTION

FIGURE 51 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 52 EUROPE TO HAVE HIGHEST MARKET SHARE DURING FORECAST PERIOD

TABLE 71 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 53 NORTH AMERICA: MARKET SNAPSHOT

TABLE 73 NORTH AMERICA: TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 UNITED STATES

10.2.3.1 Strong economy and investment to drive trade surveillance systems market growth

TABLE 89 UNITED STATES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 90 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 91 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 92 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 93 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 94 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Advancement in IT infrastructure and technical expertise to fuel demand for trade surveillance systems

TABLE 95 CANADA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 96 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 97 CANADA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 98 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 99 CANADA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 100 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: TRADE SURVEILLANCE SYSTEMS MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 101 EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 105 EUROPE: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 107 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 109 EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 110 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 111 EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 112 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 113 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 115 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UNITED KINGDOM

10.3.3.1 Technical literacy and growing economy to boost trade surveillance systems market growth

TABLE 117 UNITED KINGDOM: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 118 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 119 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 120 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 121 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 122 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.4 GERMANY

10.3.4.1 Booming FinTech industry and government support to drive trade surveillance systems adoption

TABLE 123 GERMANY: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 124 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 125 GERMANY: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 126 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 127 GERMANY: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 128 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 FRANCE

10.3.5.1 Digital advancement and internet penetration to fuel trade surveillance systems solutions

TABLE 129 FRANCE: TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 130 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 131 FRANCE: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 132 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 133 FRANCE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 134 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 135 REST OF EUROPE: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 136 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 139 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 140 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: TRADE SURVEILLANCE SYSTEMS MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Technological developments and growing economy to boost trade surveillance systems market growth

TABLE 157 CHINA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 158 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 159 CHINA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 160 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 161 CHINA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 162 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Investment in new technologies and strong work ethics to drive demand for trade surveillance systems solutions

TABLE 163 JAPAN: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 166 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 167 JAPAN: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 168 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 INDIA

10.4.5.1 Government initiatives and improving online infrastructure to fuel trade surveillance market growth

TABLE 169 INDIA: TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 170 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 171 INDIA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 172 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 173 INDIA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 174 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 175 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 176 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 177 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 178 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 179 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: TRADE SURVEILLANCE SYSTEMS MARKET

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 181 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 184 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.3 MIDDLE EAST

10.5.3.1 Foreign investments for buying local shares to boost demand for trade surveillance systems solutions

TABLE 197 MIDDLE EAST: TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 198 MIDDLE EAST: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 199 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 200 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 201 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 202 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 AFRICA

10.5.4.1 Mobile economy and adoption of cloud solutions to drive market growth

TABLE 203 AFRICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 204 AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 205 AFRICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 206 AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 207 AFRICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 208 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: TRADE SURVEILLANCE SYSTEMS MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 209 LATIN AMERICA: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY SERVICE, 2018–2021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2018–2021 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Digital transformation initiatives and high foreign investments to drive trade surveillance systems market growth

TABLE 225 BRAZIL: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 226 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 227 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 228 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 229 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 230 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Growing risk and crime instances to drive market growth

TABLE 231 MEXICO: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 232 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 233 MEXICO: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 234 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 235 MEXICO: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 236 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 237 REST OF LATIN AMERICA: TRADE SURVEILLANCE SYSTEMS MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 238 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 239 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2018–2021 (USD MILLION)

TABLE 240 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 241 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2018–2021 (USD MILLION)

TABLE 242 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 191)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 55 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 243 OVERVIEW OF STRATEGIES ADOPTED BY KEY TRADE SURVEILLANCE SYSTEMS VENDORS

11.4 REVENUE ANALYSIS

FIGURE 56 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD BILLION)

11.5 MARKET SHARE ANALYSIS

FIGURE 57 TRADE SURVEILLANCE SYSTEMS MARKET: MARKET SHARE ANALYSIS, 2022

TABLE 244 MARKET: DEGREE OF COMPETITION

11.6 COMPANY EVALUATION QUADRANT

TABLE 245 COMPANY EVALUATION QUADRANT: CRITERIA

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 58 MARKET, KEY COMPANY EVALUATION MATRIX, 2021

11.6.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 246 COMPANY PRODUCT FOOTPRINT

TABLE 247 COMPANY COMPONENT FOOTPRINT

TABLE 248 COMPANY VERTICAL FOOTPRINT

TABLE 249 COMPANY REGION FOOTPRINT

11.7 RANKING OF KEY PLAYERS

FIGURE 59 RANKING OF KEY PLAYERS IN TRADE SURVEILLANCE SYSTEMS MARKET, 2022

11.8 STARTUP/SME EVALUATION MATRIX

FIGURE 60 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 61 MARKET (GLOBAL) STARTUP/SME COMPANY EVALUATION MATRIX, 2021

11.8.5 COMPETITIVE BENCHMARKING

TABLE 250 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 251 TRADE SURVEILLANCE SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

11.9 KEY MARKET DEVELOPMENTS

11.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

TABLE 252 NEW PRODUCT LAUNCHES & ENHANCEMENTS, 2020–2021

11.9.2 DEALS

TABLE 253 DEALS, 2019–2022

11.9.3 OTHERS

TABLE 254 OTHERS, 2019–2021

12 COMPANY PROFILES (Page No. - 212)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Solutions, Products & Services, Response to COVID-19, Recent Developments, MnM View)*

12.2.1 NICE

TABLE 255 NICE: BUSINESS OVERVIEW

FIGURE 62 NICE: COMPANY SNAPSHOT

TABLE 256 NICE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 257 NICE: NEW SOLUTION/SERVICE LAUNCHES

TABLE 258 NICE: DEALS

TABLE 259 NICE: OTHERS

12.2.2 FIS

TABLE 260 FIS: BUSINESS OVERVIEW

FIGURE 63 FIS: COMPANY SNAPSHOT

TABLE 261 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 262 FIS: DEALS

12.2.3 NASDAQ

TABLE 263 NASDAQ: BUSINESS OVERVIEW

FIGURE 64 NASDAQ: COMPANY SNAPSHOT

TABLE 264 NASDAQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 265 NASDAQ: NEW SOLUTION/SERVICE LAUNCHES

TABLE 266 NASDAQ: DEALS

TABLE 267 NASDAQ: OTHERS

12.2.4 IPC

TABLE 268 IPC: BUSINESS OVERVIEW

TABLE 269 IPC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 270 IPC: DEALS

12.2.5 SIA SPA.

TABLE 271 SIA SPA: BUSINESS OVERVIEW

TABLE 272 SIA S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 273 SIA SPA: DEALS

TABLE 274 SIA SPA: OTHERS

12.2.6 ACA GROUP

TABLE 275 ACA GROUP: BUSINESS OVERVIEW

TABLE 276 ACA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 277 ACA GROUP: NEW SOLUTION/SERVICE LAUNCHES

TABLE 278 ACA GROUP: DEALS

TABLE 279 ACA GROUP: OTHERS

12.2.7 AQUIS TECHNOLOGIES

TABLE 280 AQUIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 65 AQUIS TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 281 AQUIS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 282 AQUIS TECHNOLOGIES: DEALS

12.2.8 SOFTWARE AG

TABLE 283 SOFTWARE AG: BUSINESS OVERVIEW

FIGURE 66 SOFTWARE AG: COMPANY SNAPSHOT

TABLE 284 SOFTWARE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.9 B-NEXT

TABLE 285 B-NEXT: BUSINESS OVERVIEW

TABLE 286 B-NEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.10 BAE SYSTEMS

TABLE 287 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 67 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 288 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.11 ONEMARKETDATA

12.2.12 SCILA

12.2.13 CRISIL

12.2.14 IBM

12.2.15 TRADING TECHNOLOGIES

12.2.16 ACUITY KNOWLEDGE PARTNERS

12.2.17 ABEL NOSER

12.2.18 MYCOMPLIANCEOFFICE

12.2.19 TRILLIUM

12.2.20 TRAPETS

*Details on Business Overview, Solutions, Products & Services, Recent Developments, Response to COVID-19, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 EVENTUS

12.3.2 INTELLECT DESIGN ARENA

12.3.3 RED DEER

12.3.4 SOLIDUS LABS

12.3.5 STEELEYE

13 ADJACENT MARKETS (Page No. - 252)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 289 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 TRADE SURVEILLANCE SYSTEMS MARKET ECOSYSTEM AND ADJACENT MARKETS

13.4 ANTI-MONEY LAUNDERING MARKET

13.4.1 ANTI-MONEY LAUNDERING MARKET, BY COMPONENT

TABLE 290 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 291 POST COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

13.4.2 ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT TYPE

TABLE 292 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 293 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

13.4.3 ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE

TABLE 294 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 295 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

13.4.4 ANTI-MONEY LAUNDERING MARKET, BY END USER

TABLE 296 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

TABLE 297 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

13.4.5 ANTI-MONEY LAUNDERING MARKET, BY REGION

TABLE 298 ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 299 POST-COVID-19: ANTI-MONEY LAUNDERING SOLUTION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.5 VIDEO SURVEILLANCE MARKET

13.5.1 VIDEO SURVEILLANCE MARKET, BY OFFERING

TABLE 300 GLOBAL VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 301 GLOBAL VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021–2026 (USD MILLION)

13.5.2 VIDEO SURVEILLANCE MARKET, BY SYSTEM

TABLE 302 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2017–2020 (USD MILLION)

TABLE 303 VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2021–2026 (USD MILLION)

13.5.3 VIDEO SURVEILLANCE MARKET, BY VERTICAL

TABLE 304 VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 305 VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

13.5.4 VIDEO SURVEILLANCE MARKET, BY REGION

TABLE 306 VIDEO SURVEILLANCE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 307 VIDEO SURVEILLANCE MARKET, BY REGION, 2021–2026 (USD MILLION)

14 APPENDIX (Page No. - 261)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the Trade Surveillance Systems market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Trade Surveillance Systems market.

Secondary Research

The market size of the companies offering trade surveillance system solutions and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports; press releases and investor presentations of companies; product data sheets, white papers, journals, and certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from trade surveillance system vendors, managed trade surveillance system providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews have been conducted to gather insights, such as market statistics, latest trends disrupting the market, new use cases implemented, data of revenue collected from the products and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped understand various trends related to the technology, application, deployment model, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams, of governments/end users using trade surveillance system solutions, project teams were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of solutions, which would affect the overall trade surveillance systems market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the trade surveillance systems market and various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the top-down approach, an exhaustive list of all vendors offering solutions and services in the trade surveillance systems market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Both types of vendors that offer trade surveillance systems as a standalone solution, as well as an integrated solution in trade surveillance systems offerings, were considered for the evaluation of the market size. Each vendor was evaluated based on its product/solution offerings, services, functions, deployment modes, organization sizes, and verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption trend trade surveillance system solutions and services among different verticals in key countries with respect to the regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of solutions, along with different use cases, with respect to their business segments, has been identified and extrapolated. Weightage has been given to use cases identified in the different application areas for the calculation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global trade surveillance systems market based on components (solutions and services), verticals, deployment modes, organization sizes, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the impact of COVID-19 on components, verticals, organization sizes, deployment modes, and regions across the globe

- To analyze the opportunities in the market for stakeholders and provide details of their competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Trade Surveillance Market & its impact on Trade Surveillance Systems Market

The Trade Surveillance Market and Trade Surveillance Systems Market are closely related as they both refer to the same domain of financial technology aimed at detecting and preventing market abuse, insider trading, and other forms of illicit trading activities in financial markets.

The Trade Surveillance Market is a broader market that encompasses not only the software solutions but also the services, consulting, and support offered by vendors and service providers in this field. This market includes a wide range of stakeholders, including software vendors, managed service providers, consultants, and regulatory bodies.

Here are some of the ways in which the Trade Surveillance Market is likely to impact the Trade Surveillance Systems Market:

- Increased demand: The Trade Surveillance Market is expected to drive the demand for trade surveillance systems as financial institutions and regulators look for ways to monitor and analyze trading activities in real-time. This is likely to result in an increase in the adoption of trade surveillance systems, which will drive the growth of the Trade Surveillance Systems Market.

- Technological advancements: The Trade Surveillance Market is driving technological advancements in the field of trade surveillance systems.

- Increasing competition: The Trade Surveillance Market is leading to an increase in the number of vendors and service providers offering trade surveillance systems. This is likely to result in intense competition among vendors, leading to innovation and the development of new and more advanced solutions. This will benefit customers by providing them with a wide range of options to choose from, driving the growth of the Trade Surveillance Systems Market.

- Demand for managed services: The Trade Surveillance Market is also driving the demand for managed services and consulting services in the field of trade surveillance systems. As financial institutions and regulators look for expert support to implement and maintain these systems, there is likely to be an increase in the demand for managed services and consulting services, driving the growth of this segment of the Trade Surveillance Systems Market.

Futuristic Growth Use-Cases of Trade Surveillance Market

Here are some potential growth use-cases for trade surveillance:

- Artificial Intelligence (AI) and Machine Learning (ML): Trade surveillance technology will increasingly incorporate AI and ML to analyze and identify patterns in large volumes of trading data, improving detection of suspicious activity and reducing false positives.

- Blockchain: As blockchain technology becomes more widespread, trade surveillance solutions will be needed to monitor and detect illegal activities on these platforms, such as market manipulation, insider trading, and money laundering.

- Cloud-based solutions: Trade surveillance solutions will increasingly be delivered through cloud-based platforms, allowing for greater scalability and flexibility, as well as easier integration with other financial systems.

- Regulatory compliance: The regulatory environment for financial institutions is becoming more complex, and trade surveillance solutions will play an increasingly important role in helping firms stay compliant with regulations such as MiFID II, Dodd-Frank, and others.

- Cybersecurity: As cyber threats to financial institutions continue to evolve, trade surveillance solutions will be needed to monitor for potential cyber-attacks and protect against data breaches.

- Alternative data sources: Trade surveillance solutions will increasingly incorporate alternative data sources, such as social media and news feeds, to provide more comprehensive monitoring of market activity and identify emerging risks.

The trade surveillance market is anticipated to expand significantly over the next few years as financial institutions look to increase compliance, identify and stop illegal activity, and guard against new risks.

Some of the Top players in Trade Surveillance market are Nasdaq Inc., FIS Global, FISERV Inc., IPC Systems, Smarsh, Refinitiv, Trading Technologies, NICE Actimize, Eventus Systems and Aquis Technologies.

New Business Opportunities in Trade Surveillance Market

Here are some of the new business opportunities that could emerge in the trade surveillance market:

- Developing and marketing advanced AI and ML algorithms: There is a huge opportunity for businesses to create and market cutting-edge algorithms that can scan massive amounts of data and spot patterns suggestive of suspicious trading activity. AI and ML technologies offer a lot of potential for trade surveillance.

- Providing cloud-based solutions: With the move towards cloud-based solutions, there is an opportunity for companies to provide secure, scalable, and flexible trade surveillance solutions that can be easily integrated with other financial systems.

- Offering consulting and advisory services: Many financial institutions lack the expertise and resources to develop and implement effective trade surveillance programs. As a result, there is an opportunity for companies to provide consulting and advisory services to help firms develop and implement robust surveillance programs.

- Developing blockchain-based surveillance solutions: As blockchain technology becomes more prevalent in financial markets, there is an opportunity for companies to develop and market blockchain-based surveillance solutions that can detect and prevent illegal activity on blockchain platforms.

- Providing cybersecurity solutions: With the increasing threat of cyber-attacks in the financial industry, there is a growing need for companies to provide cybersecurity solutions that can protect trade surveillance systems from unauthorized access and data breaches.

- Offering training and education programs: There is a need for training and education programs to help financial professionals understand the complexities of trade surveillance and how to effectively use surveillance tools to detect and prevent illegal activity.

Growth Drivers for Trade Surveillance Business from Macro to Micro

There are several growth drivers for the trade surveillance business, both on a macro and micro level:

Macro-level Growth Drivers:

- Increased regulatory scrutiny: Financial regulators around the world are placing greater emphasis on trade surveillance to detect and prevent financial fraud, insider trading, and market manipulation. This has created a growing demand for advanced surveillance solutions that can help financial institutions comply with regulatory requirements.

- Advancements in technology: Advances in artificial intelligence, machine learning, cloud computing, and big data analytics are making it easier for financial firms to monitor and analyze large volumes of trading data in real-time, enabling them to detect and prevent illegal activity more effectively.

- Globalization of financial markets: The globalization of financial markets has increased the complexity and interconnectedness of financial systems, making it more difficult for financial institutions to monitor and detect illegal activity.

- Increasing cyber threats: The rise of cyber threats in the financial industry has created a growing need for trade surveillance solutions that can protect against cyber-attacks and data breaches.

Micro-level Growth Drivers:

- Increasing demand for real-time monitoring: Financial firms are increasingly seeking real-time monitoring solutions that can detect and prevent illegal activity as it occurs, rather than relying on after-the-fact analysis.

- Growing adoption of cloud-based solutions: Financial firms are increasingly adopting cloud-based trade surveillance solutions, which offer greater scalability, flexibility, and cost-effectiveness compared to traditional on-premises solutions.

- Need for customization: Financial institutions have unique requirements for trade surveillance, and there is a growing demand for customizable solutions that can be tailored to meet the specific needs of each firm.

- Focus on data privacy and security: There is an increasing need for trade surveillance systems that can offer reliable security measures to guard against unwanted access and data breaches as financial businesses place more focus on data privacy and security.

Overall, the trade surveillance market is expected to continue growing in the coming years due to these macro and micro-level growth drivers.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Trade Surveillance Systems Market