Simulators Market by Solution (Product, Services), Platform (Air, Land, Maritime), Type, Application (Commercial Training, Military Training), Technique, and Region (North America, Europe, APAC, Middle East, Rest of the World) - Global Forecast to 2028

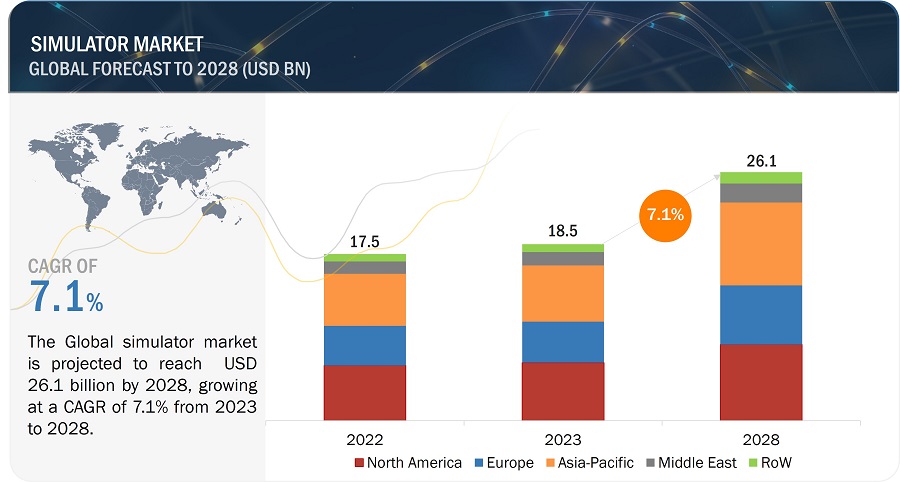

[276 Pages Report] The Simulator Market is estimated to be USD 18.5 Billion in 2023 and is projected to reach USD 26.1 Billion by 2028, at a CAGR of 7.1% from 2023 to 2028. The market is driven by factors such as demand for realistic training solutions driven by a surge in pilot and driver training programs. Technological advancements, such as augmented reality and high-fidelity simulations, are key contributors, to enhancing the efficacy of training modules. Additionally, stringent safety regulations and the need for cost-effective, immersive training experiences further fuel Simulator Industry growth.

Simulators Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Simulator Market Market Dynamics

Driver: Cost-Effectiveness and Safety of Simulator-Based Training

Simulator-based training has become crucial in aviation, driven by safety regulations from bodies like the FAA and the European Aviation Safety Agency. This approach offers effective, real-time training, reducing environmental impact and costs. Full-flight simulators are key for aircraft orientation, ensuring training in low-risk environments and preventing damage to expensive aircraft. Simulators operate over 20 hours daily with low emissions at a cost 22 times less than direct aircraft training. The military, particularly the Air Force, extensively employs flight simulation for equipment-use training, including computer-based battlefield scenarios. This shift to simulator training aligns with safety regulations, providing realistic, cost-effective solutions for the aviation industry.

Simulation training provides a valuable opportunity to train pilots in handling complex situations and emergencies without exposing them to life-threatening risks. Simulators offer trainees a controlled environment where they can make a defined number of errors or lapses without real-world consequences. These training tools are designed to simulate various flight maneuvers and scenarios, including degraded visual environments, vortex rings, dynamic rollover, unpredictable yaw, and auto-correction. This approach enhances the effectiveness of pilot training in a safe and controlled manner, contributing to improved preparedness for real-world aviation challenges. Safety is a paramount consideration in simulator training across various industries. Simulators provide a controlled and risk-free environment, allowing trainees to learn, practice, and enhance their skills without exposing themselves to the potential dangers associated with real-world scenarios. Simulators create a realistic, immersive environment, enhancing trainees' situational awareness and decision-making abilities. Trainees can encounter a diverse range of scenarios, preparing them for a wide array of potential challenges they may face in real-world situations.

Restraints: High Cost of Gaming, Automobile and Driving Simulators

Driving schools, educational institutions, and training centers often face budget constraints, making it challenging to invest in high-cost simulators. This financial barrier limits access to advanced training tools, potentially impacting the quality of driver education. The anticipated restraint in the growth of the gaming, simulators market is attributed to the high prices associated with these gaming systems. The elevated cost of acquiring gaming simulators may act as a deterrent, potentially limiting their widespread adoption among consumers and businesses. This pricing challenge could pose a barrier for individuals and organizations with budget constraints, hindering their ability to invest in advanced gaming simulator technologies. As the market continues to evolve, addressing affordability concerns and exploring strategies to make gaming simulators more cost-effective may become essential to unlock broader market access and drive sustained growth. Small and medium-sized enterprises (SMEs), including driving schools, may find it economically challenging to incorporate high-cost simulators into their operations. This limitation affects their ability to provide state-of-the-art driver training experiences. Beyond the initial purchase, the maintenance and periodic upgrades of driving simulators incur additional costs. Regular software updates, hardware maintenance, and system enhancements contribute to the total cost of ownership, potentially straining budgets.

Opportunity: Advancements in Technology, Including Improved Graphics and Virtual Reality (VR) Capabilities

Amusement and theme parks, gaming hubs, and various entertainment venues are increasingly embracing gaming simulators to offer cost-effective and immersive experiences to end users. This trend is anticipated to create lucrative opportunities for the market. Notably, attractions such as the Sleep No More show in New York exemplify the integration of immersive theater, where the audience actively participates in the narrative. The incorporation of virtual reality (VR) and other simulator technologies in such experiences has garnered positive responses from end users, showcasing the potential for these technologies to enhance entertainment offerings AI and ML algorithms are being incorporated into simulators to create dynamic and adaptive scenarios. These technologies enable simulations to respond intelligently to user actions, enhancing the realism and effectiveness of training. Advanced haptic feedback systems are bringing a sense of touch to simulators, allowing users to feel and interact with virtual objects. This technology is particularly valuable in medical simulations and equipment operation training. Simulators incorporate 360-degree visual environments, providing a more comprehensive field of view. This is especially beneficial in applications like flight simulation, where a realistic visual panorama is crucial for training. Key players from this market are gaining many contracts in technology. For instance, Maxar Technologies, a provider of comprehensive space solutions and secure, precise geospatial intelligence, announced in February 2023 the availability of SYNTH3D, a high-performance, geotypical 3D representation of the entire planet for gaming, simulation, entertainment, virtual reality (VR), smart cities and metaverse which is a key trend in the simulators market.

Challenges: Stringent Regulatory Approvals

The aviation sector's substantial growth has led to an increased demand for pilots and, consequently, pilot training. However, the process of developing products in the simulator market is time-consuming, particularly in crafting accurate replicas of aircraft. Obtaining approval from Original Equipment Manufacturers (OEMs) is a necessary step for simulator developers, further extending the development timeline and increasing costs. Manufacturers face the additional challenge of creating customer-centric products that are adaptable to evolving customer needs and can address the dynamic landscape of pilot training. Meeting stringent safety and regulatory standards further complicates the timely delivery of required simulators. The industry's commitment to compliance, while commendable, adds complexity to the development process, making it a challenging task to ensure timely and efficient simulator deliveries..

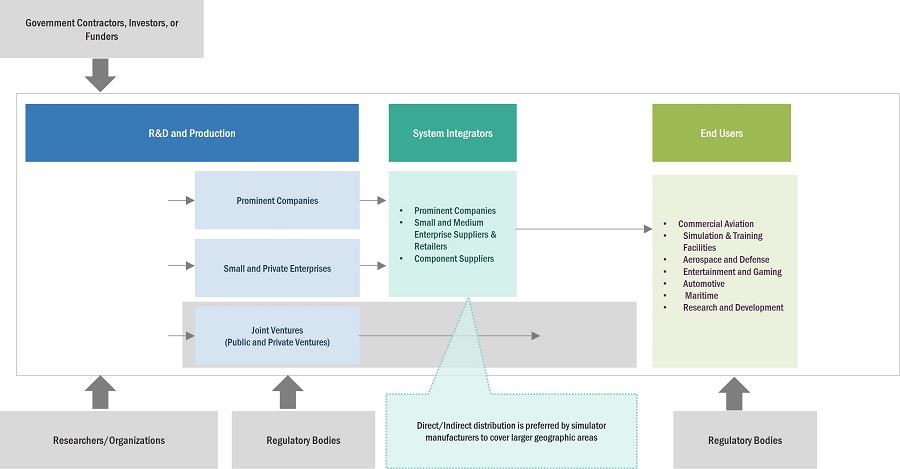

Simulator Market Ecosystem

Prominent companies providing simulators private and small enterprises, distributors/suppliers/retailers, and end customers are key stakeholders in the unmanned surface vehicle market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries serve as major influencers in the market.

The Product Solution Segment of the Simulator Market to Dominate the Market the Solution Segment

By solution segment, the market is segmented into products and services. The product solution segment in the simulator market is primarily propelled by advancements in virtual reality (VR) and augmented reality (AR) technologies. The demand for highly realistic training environments, cost-effective solutions, and the imperative need for skill enhancement in the aerospace and automotive industries are key factors stimulating innovation and adoption in this market segment.

A Maritime Segment of the Platform Segment of the Simulator Market Shows the Highest Growth Rate

The maritime platform segment in the simulator market is driven by the increasing demand for realistic training environments to enhance maritime safety and operational efficiency. Growing emphasis on simulation-based training, technological advancements, and regulatory requirements are key drivers fostering the adoption of maritime simulators, contributing to the segment's robust growth.

Full Mission Bridge Simulator is to Hold the Highest Share of the Simulator Market

The full mission bridge segment in the simulator market is primarily propelled by the escalating demand for advanced training solutions in the maritime and aviation sectors. Stringent safety regulations, coupled with the need for realistic simulation experiences to enhance operational skills and decision-making abilities, drive the adoption of these simulators. Additionally, the rising emphasis on cost-effective and time-efficient training methods, along with the integration of cutting-edge technologies such as virtual reality and artificial intelligence, further stimulates market growth.

The Military Training Segment of the Simulator is to Hold the Largest Market Share for the Estimated Year

The Military training segment simulator market is propelled by escalating global security concerns, necessitating advanced and realistic training solutions. Increased geopolitical tensions and the evolving nature of modern warfare drive the demand for sophisticated simulation technologies. Governments' prioritization of cost-effective and safe training methods, reducing the reliance on live exercises, further fuels market growth. Technological advancements, such as augmented reality (AR) and virtual reality (VR) integration, enhance training realism and effectiveness. Additionally, the imperative to train military personnel in diverse and complex scenarios, including cyber warfare and asymmetric threats, propels the adoption of versatile simulator solutions. These factors collectively contribute to the expansion of the Military training segment simulator market, offering lucrative opportunities for industry players.

The Live, Virtual, and Constructive Simulation Segment of the Simulator Market Holds the Largest Market Share

The Live, Virtual, and Constructive (LVC) segment of the simulator market is propelled by several key technical factors. Advancements in simulation technologies, such as high-fidelity graphics rendering, real-time data integration, and immersive virtual environments, drive demand for realistic training experiences. The integration of augmented reality (AR) and virtual reality (VR) technologies enhances the training precision, allowing for a more immersive and effective simulation. Additionally, the incorporation of artificial intelligence (AI) algorithms contributes to dynamic scenario generation and adaptive learning environments. The growing emphasis on interoperability and networked training scenarios further fuels the adoption of LVC simulations, enabling synchronized training across multiple platforms and domains. These technical innovations collectively stimulate market growth by delivering sophisticated and realistic training solutions for both the flight and automotive industries.

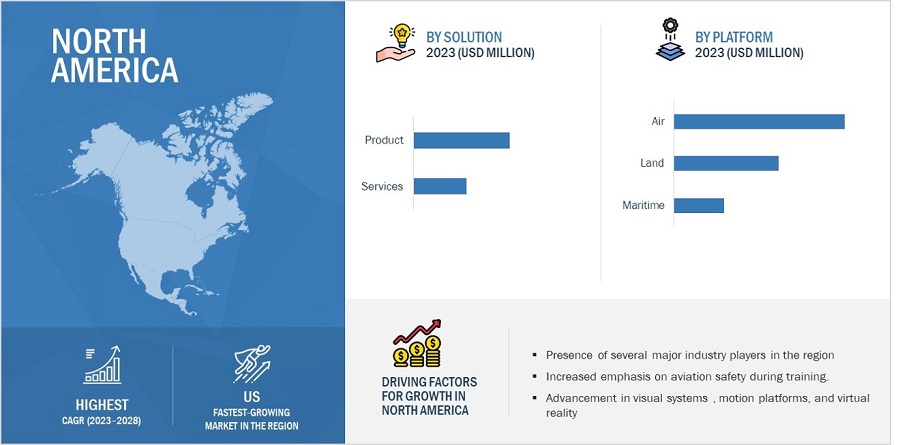

The North American Market is Projected to Contribute the Largest Share From 2023 to 2028

Simulators Market by Region

To know about the assumptions considered for the study, download the pdf brochure

North America's dominance in the simulator market, boasting over 33% market share, can be traced to a multitude of factors. The North American simulator market is propelled by escalating demand for advanced training solutions in sectors such as aviation, defense, and healthcare. The growing emphasis on enhancing operational efficiency and reducing training costs has driven the adoption of cutting-edge simulation technologies. Technological advancements in virtual reality (VR) and augmented reality (AR) contribute significantly providing realistic and immersive training experiences. Furthermore, the increasing complexity of modern systems and the need for hands-on training without real-world risks fuel the demand for sophisticated simulators. The market is characterized by a surge in investments in research and development, fostering the evolution of state-of-the-art simulators tailored to meet the specific technical training requirements of diverse industries.

Emerging Industry Trends

Standalone Bridge Simulation Consoles (Flexicon)

Flexicon is a stand-alone console equipped with real ship controls and navigation equipment capable of offering a 200° field of view. It is fitted with an integrated electronic chart display and information system (ECDIS), vessel traffic service (VTS), radar, and automatic identification system (AIS). This console allows the creation of various simulated environments that resemble a ship's bridge, a tug, or an offshore supply vessel.

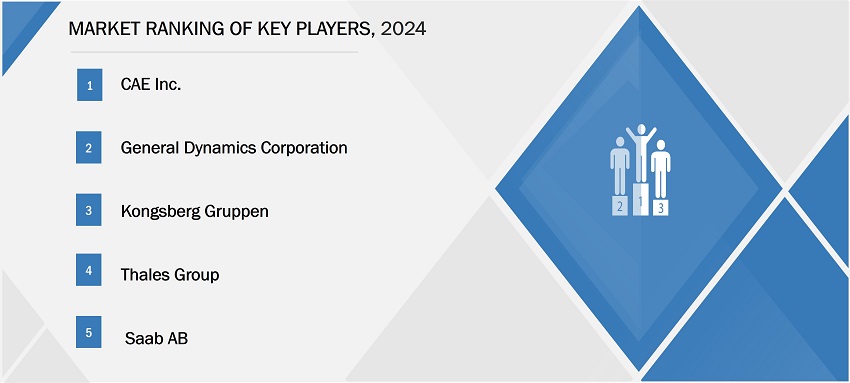

Simulators Industry Companies - Top Key Market Players

Major players in the Simulator Companies include CAE, Inc. (Canada), L3Harris Technologies, Inc. (US), Saab AB (Sweden), Thales (France), and Indra Seistemas S. A. (Spain) to enhance their presence in the market. The report covers various industry trends and new technological innovations in the simulator market for the period, 2019-2028.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Estimated Market Size |

USD 18.5 Billion in 2023 |

|

Projected Market Size |

USD 26.1 Billion by 2028 |

|

Growth Rate |

7.1% |

|

Market Size Available for Years |

2020-2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Solution, Platform, Type, Application, and Technique |

|

Geographies Covered |

North America, Europe, Asia Pacific, the Middle East & ROW (Africa, and Latin America) |

|

Companies Covered |

CAE, Inc. (Canada), L3Harris Technologies (US), FlightSafety International (US), Boeing (US), Thales (France), FAAC (Italy), ECA (France), RUAG (Switzerland), Lockheed Martin (US), and Elbit Systems (Israel), among others. |

Simulators Market Highlights

This research report categorizes the Simulator markets based on Solution, Platform, Type, Application, and Technique.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Platform |

|

|

By Type |

|

|

By Application |

|

|

By Technique |

|

|

By Region |

|

Recent Developments

- North America: In May 2023, IncCAE Inc. secured a contract from General Dynamics Information Technology (GDIT) to support Flight School Training Support Services (FSTSS) at Fort Novosel (formerly Fort Rucker), Alabama. The contract is part of the USD 1.7 billion award to GDIT by the US Army Program Executive Office for Simulation, Training, and Instrumentation (PEO STRI) for simulation capabilities and training support services to prepare initial entry-level and graduate-level rotary wing flight training at Fort Novosel.

- Europe: In May 2022, Atlantic Airways and Thales entered into an agreement for the acquisition of a fully equipped AW139 Reality H Level D Full Flight Simulator. Positioned in the Faroe Islands, strategically located in the North Atlantic, this simulator will serve as a central hub for advanced AW139 training, contributing to enhanced safety in global helicopter operations. The Atlantic Airways Aviation Academy will leverage this cutting-edge simulator to provide comprehensive training services, covering initial type rating, recurrent training, and proficiency checks for both Visual Flight Rules (VFR) and Instrument Flight Rules (IFR). This facility will play a crucial role in assisting pilots in obtaining the necessary certification to operate the AW139 under EASA approval.

Frequently Asked Questions (FAQs) Addressed by the Report:

What are your views on the growth prospect of the Simulator market?

Response: The simulator market is experiencing robust growth, fueled by the integration of advanced technologies such as virtual reality (VR) and augmented reality (AR). These technological advancements enhance realism and effectiveness, driving demand across diverse industries. Sectors like aviation, healthcare, and defense are increasingly seeking cost-effective and risk-free training solutions, contributing to market expansion. The growing emphasis on safety, efficiency, and skill development further supports this trend. Ongoing innovations in simulator technologies, aligned with a heightened focus on digital transformation, position the market for continuous evolution and increased adoption, making it poised for sustained growth.

What are the key sustainability strategies adopted by leading players operating in the Simulator market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the simulator market. Major players, including CAE , Inc. (Canada), L3Harris Technologies, Inc. (US) Saab AB (Sweden), Thales (France), Indra Sistemas S.A. (Spain) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Simulator market?

Response: Some of the major emerging technologies are extended reality and 5G connectivity that will disrupt the simulator market.

Who are the key players and innovators in the ecosystem of the Simulator market?

Response: Major players in the Simulator market include CAE,Inc. (Canada), L3Harris Technologies, Inc. (US) Saab AB (Sweden), Thales (France), Indra Sistemas S.A. (Spain).

Which region is expected to hold the highest market share in the simulator market?

Response: Simualtor market in The North America region is estimated to account for the largest share of 33.0% of the market in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

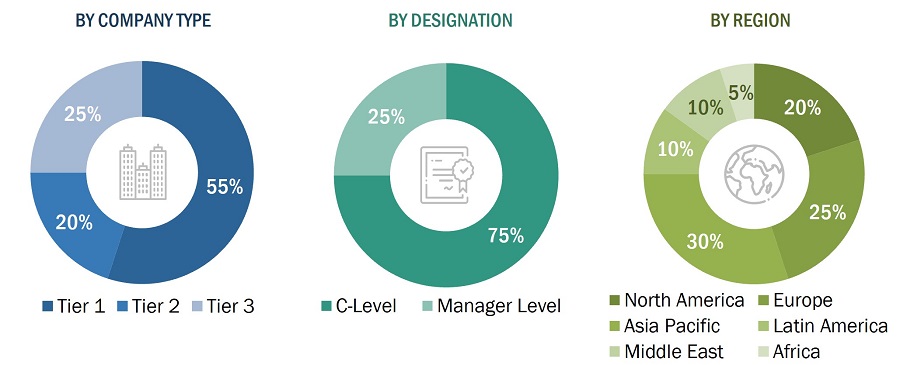

This research study on the simulator market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the simulator's market and assess the market's growth prospects.

Secondary Research

The market share of companies in the simulators market was determined using the secondary data acquired through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the simulators market included government sources, such as GAMA (General Aviation Manufacturer Association), FlightGlobal Commercial Simulator Consensus (2021), FlightGlobal Military Simulator Consensus (2021), International Air Transport Association (IATA), Boeing Outlook 2023, Airbus Outlook 2023, and federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the simulator market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the simulator market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and ROW, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

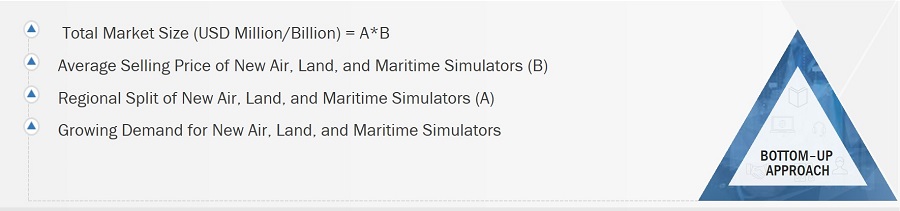

- Both top-down and bottom-up approaches were used to estimate and validate the size of the simulator market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-down Approach

Data triangulation

After arriving at the overall size of the simulator market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

A simulator is a system that combines software and hardware to simulate training.

Simulators constitute a dynamic market encompassing specialized devices designed to replicate real-world environments for training, skill development, and entertainment purposes. These devices leverage advanced technologies, including virtual reality (VR), augmented reality (AR), and haptic feedback, to provide users with highly realistic and immersive experiences. Simulators find extensive applications across diverse industries, notably in aviation for pilot training, automotive for driver education, healthcare for medical procedures, and the gaming sector for recreational purposes. Training through simulators can be provided via three techniques: live, virtual & constructive Simulator, synthetic environment Simulator, and gaming Simulator.

Key trends driving the simulator market include ongoing technological advancements, resulting in enhanced graphics and Simulator capabilities. The demand for simulators is notably rising in response to the need for risk-free training environments, especially in high-stakes professions where safety and precision are paramount. Additionally, the entertainment sector is experiencing a surge in demand for immersive simulators, contributing to the market's expansion.

The global simulator market caters to a wide range of clients, including commercial enterprises, government agencies, and individual consumers. Despite challenges such as initial costs and the necessity for regular updates, the market presents substantial opportunities for manufacturers and developers to create cost-effective solutions and establish lasting partnerships. As industries prioritize safety, efficiency, and skill development, the simulators market is poised for sustained growth, fostering a competitive landscape driven by innovation and evolving user requirements.

Stakeholders

Various stakeholders of the market are listed below:

- Simulator Manufactures

- Air, Land, and Naval Platform Manufacturers

- Technology Providers

- System Integrators

- Transport Industry Players

- Simulator Service Providers

- Pilot Training Institutes

- Regulatory Bodies

- Simulator Suppliers and Distributors

- Software Providers

- End Users

Report Objectives

- To define, describe, and forecast the size of the simulators market based on platform, solution, application, type, technique, and region from 2023 to 2028

- To forecast the size of market segments with respect to five major regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the world

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, agreements, joint ventures and partnerships, product developments, and research and development (R&D) activities in the market

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players

- To strategically profile key market players and comprehensively analyze their core competencies2

1Micromarkets are referred to as the segments and subsegments of the Simulator markets considered in the scope of the report.

2Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Simulators Market

Working on a report for Cornell analyzing the market for satellite simulators. (market size/share, potential ROI, etc...)