OTR Tires Market by Application & Equipment (Construction & Mining, Tractors, Industrial Vehicle, ATV), Tractor Tracks by Power Output, Type (Radial, Solid, Bias), Rim Size, Retreading (Application, Process), Aftermarket, Region - Global Forecast to 2027

OTR Tires Market Size, Growth Report & Forecast

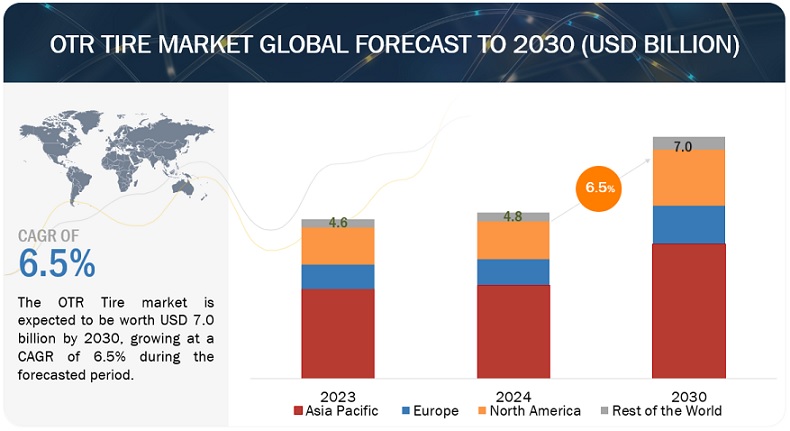

[401 Pages Report] The global OTR Tires Market worldwide size was valued at USD 8.7 billion in 2022 and is expected to reach USD 11.4 billion by 2027 at a CAGR of 5.5 % during the forecast period 2022-2027. Activities in the construction and mining industry have picked up pace post-pandemic, which has caused an increase in demand for equipment used in these sectors. As the demand for this equipment rises, so does the demand for the OTR tires used in these equipment. Another driver for the OTR tires is the high level of mechanization of agricultural activities across the globe that drives the demand for agricultural tractors, which subsequently boosts the agricultural tractor OTR Tires market.

To know about the assumptions considered for the study, Request for Free Sample Report

OTR Tires Market Growth Dynamics

Driver: Growing aftermarket sales

Construction, agriculture, and mining vehicles have demanding working conditions in their respective sector globally, positively influencing the aftermarket sales of tires. An increase in awareness of equipment servicing and maintenance has given a boost to the aftermarket tire industry. As mechanization in the farming sector has increased, the sales of mechanized equipment and parts have increased, which has boosted the sales of aftermarket tires. The life span of tires depends mostly on rolling conditions. The roads and rough terrain exacerbate the wear and tear of industrial and agricultural equipment tires. Hard braking, acceleration, and heavy loads in construction and mining sites affect the life span of tires. Each OTR tire manufacturer defines its tread depth, where the surface plays a key role. Tires with 100% tread depth and traction pattern are used for sand and asphalt surface, and tires with 150% to 250% tread depth are preferred for aggressive/rocky areas. Customers have mixed preferences for OTR tire replacement as many brands from local/domestic players provide cheap tires and big OE brands with a wide range of expensive OTR tires. Hence, the price can be a major factor in the sales numbers aftermarkets witness in the OTR tires market. Thus, increased working hours have increased the need to frequently change OTR tires which has boosted the aftermarket sales of OTR Tires.

Restraint: Recycling of plastic materials used in electric vehicles

Advancement and commercialization of technologies helped in the upgradation and optimal utilization of OTR tires throughout the life cycle. Compact and easy-to-install sensors are usually installed inside the pneumatic tire cavity in OTR tires, which are a part of the tire condition monitoring system (TCMS) or Tire Pressure Monitoring System (TPMS). These electronic devices are used to measure and transmit inflation pressure, cavity air temperature, tire belt stress and strain, normal load, traction force, acceleration, and tire wear to the digital device placed in the driver cabin. These measurements help the driver know the tire's status and take preventive and corrective actions accordingly to avoid downtime due to flat tires. According to MarketsandMarkets' primary research, using sensor-based technology will increase the cost of the OTR tire. However, this technology will increase tire life by sensing and calculating pressure, temperature, tread depth, and other internal damages. This factor will lower the sales growth opportunity for many key players in the OTR tire market. People are more prone to buy competitive and cheaper OTR tires because connected tires will have a very low market share shortly.

Opportunities: Retreading of tires

Retreading can maximize the life of OTR tires. This process replaces the worn-out tire tread with a new one with a proper inspection. The mold cure or pre-cure process is carried out after placing new tread over the buffed old tires with an adhesive layer. These tires are cost-effective, saving 30% to 50% of the money and human effort compared to manufacturing new tires. Retreading is an eco-friendly solution that supports regulations to protect the environment. It helps reduce the use of 740 liters of oil for manufacturing one unit of tire and emissions compared to the production of new tires. Many retread tire manufacturers have connected with fleet owners for tire remolding when their tires are worn out and to increase awareness about the retreading process. Such initiatives by retread of tires will help lower the dumping of old worn-out tires, reducing environmental hazards. The US is a potential market for retreading tires, as the government has improvised many regulations for worn-out tires.

Challenges: Stringent emission regulations

National Emission Standards for Hazardous Air Pollutants (NESHAP) in the US has regulated Hazardous Air Pollutants (HAP) emissions for tire manufacturing companies. The standards talk about the complexity of tire wear particles for the life cycle, the abrasion of Tire tread Wear particles (TWPs), and environmental effects due to raw materials in tires. The rules and regulations are for the raw material used, product manufacturing process, lifetime on the road, and tire disposal with final re-purposing scenarios. Currently, there is no quantified estimation for air emission of PAHs from tire production. However, Directive 2004/107/EC of 15th December 2004 (EC, 2004) is to be considered while releasing the pollutants in the air, which has a predefined limit for the emission of substances in ambient air (including PAHs). This set of rules and regulations will be challenging for protecting the environment from pollutants and saving the health of humans from cancer-causing diseases after inhaling gases.

Hence, tire manufacturers must strictly follow the rules and regulations created by local governments regarding protecting nature from industrial hazards.

Long working hours and rough terrain driving the aftermarket sales of OTR Tires

The life span of tires depends mostly on rolling conditions. The roads and rough terrain exacerbate the wear and tear of industrial and agricultural equipment tires. Hard braking, acceleration, and heavy loads in construction and mining sites affect the life span of tires. The aftermarket share is greater than the OEM share for OTR tires. OTR tires have a short life span compared to normal tires because of the load carried by the vehicle and the rolling resistance of the tires during working hours. According to primary insights, OTR vehicles are used rigorously for several mining and infrastructure projects globally. This tends to wear out their tire treads quickly and require replacement as they consume a lot of fuel once their tire thread depth starts decreasing. There is also an increase in aftermarket sales dealerships of OTR tires. All these factors contribute to the growth of the OTR aftermarket tire segment.

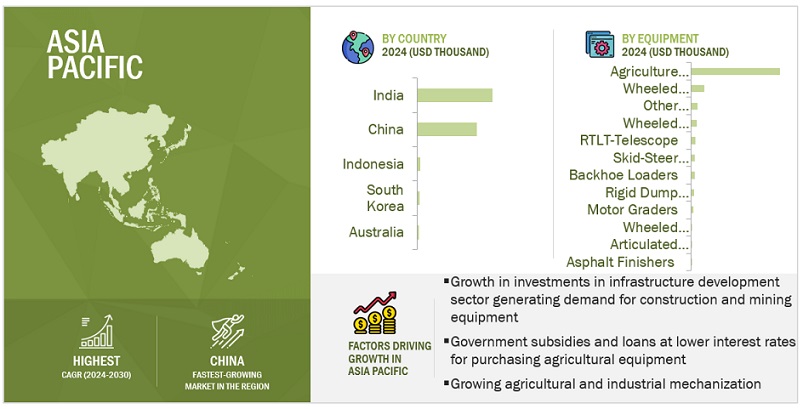

Asia Pacific region to dominate the global OTR Tires market amongst other regions

Asia Pacific’s dominance in the market is primarily driven by its large population that has a large demand for minerals and metals. The region has witnessed rapid economic development in the past decade. It is home to large developing countries such as China, India, and Indonesia, where large construction and mining projects are being sanctioned to fuel the economy. This has driven the construction and mining equipment demand and hence the OTR tires used in these equipment. China ranks 3rd after US and Russia with 173 discovered minerals and 163 proven reserves. China is implementing the Made in China 2025 strategy with the economy transitioning to a higher stage the demand for minerals will continue to increase.

India, according to India Brand Equity Foundation (IBEF), is set to invest USD 1 trillion for developing infrastructure. Construction projects of grand scales will deploy several construction equipment for their execution. Japan’s mining sector is small but has a large construction sector driven by the rebuilding activities following earthquakes and tornados frequenting the nation. Reconstruction activities need more construction equipment, which is likely to drive the OTR tires market in Japan. In South Korea, construction companies generate revenue from local construction projects and overseas projects. The mining sector has a revenue of 1.4 billion USD in South korea for the year 2021. The South Korean mining industry is currently led by industrial minerals, including 78% limestone – which is used for lime and cement clinker production.

Thus, the large construction and mining sector along with rising demand for high agricultural output drives the demand for the equipment used in these sectors which makes Asia Pacific region the leader of the OTR tires market by region.

Asia Pacific: OTR Tires Market

To know about the assumptions considered for the study, download the pdf brochure

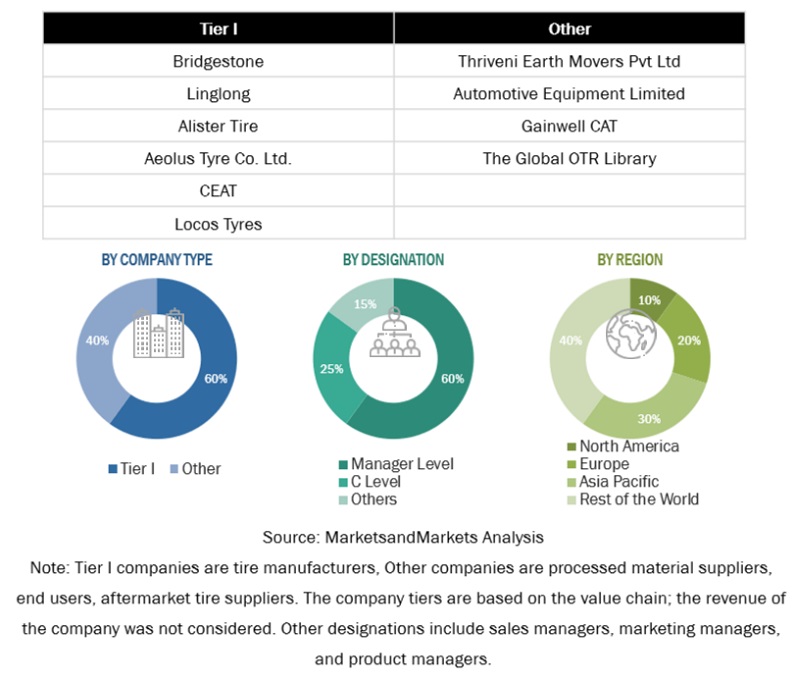

Key Market Players

The OTR Tires market is dominated by global players and comprises several regional players as well. The OTR Tires industry is dominated by global players and comprises several regional players, including Continental AG(Germany), Bridgestone Corporation (Japan), Michelin (France), Goodyear (US), Pirelli (Italy).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 8.7 billion |

|

Estimated Value by 2027 |

USD 11.4 billion |

|

Growth Rate |

Poised to grow at a CAGR of 5.5% |

|

Market Segmentation |

By Equipment Type, by Application, by Region |

|

Market Driver |

Growing aftermarket sales |

|

Market Opportunity |

Retreading of tires |

|

Geographies covered |

Asia Pacific, Europe, North America, and ROW |

Recent Developments

- In September 2022, Bridgestone Corporation invested USD 60 million to expand its Bridgestone Bandag, LLC manufacturing plant in Abilene, Texas. The expansion of the Abilene plant is aimed at the growing demand for the company’s tread rubber products, driven by the rapid growth of its retread business. The expansion includes an immediate increase in operational activity by running on 6- and 7-day production schedules and the construction of new mixing operations at the facility.

- In June 2022, Michelin acquired 51% of Royal Lestari Utama (RLU), a pilot project developing sustainable rubber tree plantations in Indonesia. This deal will provide Michelin with more sustainable rubber raw material for its products, thus improving its sustainability image.

- In March 2022, Titan International, Inc. entered into a three-year agreement with CNH Industrial to supply farm wheels and tires manufactured in Titan’s North American, South American, and European plants to various CNH Industrial manufacturing locations.

- In February 2022, Bridgestone Corporation and ENEOS Corporation announced the launch of a joint research and development project aimed at achieving the social implementation of chemical recycling technologies that enable precise pyrolysis of used tires. Through this project, Bridgestone and ENEOS aim to develop a recycling business that will convert used tires to raw materials, enabling a more sustainable society.

- In March 2021, Continental AG partnered with Fendt to integrate its Continental TractorMaster tires with the Fendt 200 and 300 series tractors. Apart from its brand name, the partnership further enhances the application of Continental tires in various Fendt agriculture equipment.

Frequently Asked Questions (FAQ):

What is the current size of the OTR Tires market?

The global OTR Tires market is expected to grow from USD 8.7 Billion in 2022 and is projected to reach USD 11.4 Billion in 2027, at a CAGR of 5.5% during the forecast period.

Who are the top key players in the OTR Tires market?

The OTR Tires industry is dominated by global players and comprises several regional players, including Continental AG(Germany), Bridgestone Corporation (Japan), Michelin (France), Goodyear (US), and Pirelli (Italy).

What are the trends in the OTR Tires market?

Wheeled loaders to have the largest share by volume in the construction and mining equipment segment.

Industrial equipment OTR Tires to be the fastest growing application segment for the OTR Tires market.

Radial tires to hold majority share of the market by tire type as OEMs move away from bias tires to improve safety.

Which are the most prominent factors driving the OTR Tires market?

Growing infrastructural and mining activities around the world.

Rising level of mechanization of agricultural equipments. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 OTR TIRES MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 OTR TIRES MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources to estimate base number

2.1.1.2 List of key secondary sources to estimate market

2.1.1.3 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.1 List of primary participants

2.2 MARKET SIZE ESTIMATION

FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE: BOTTOM-UP APPROACH (APPLICATION AND REGION)

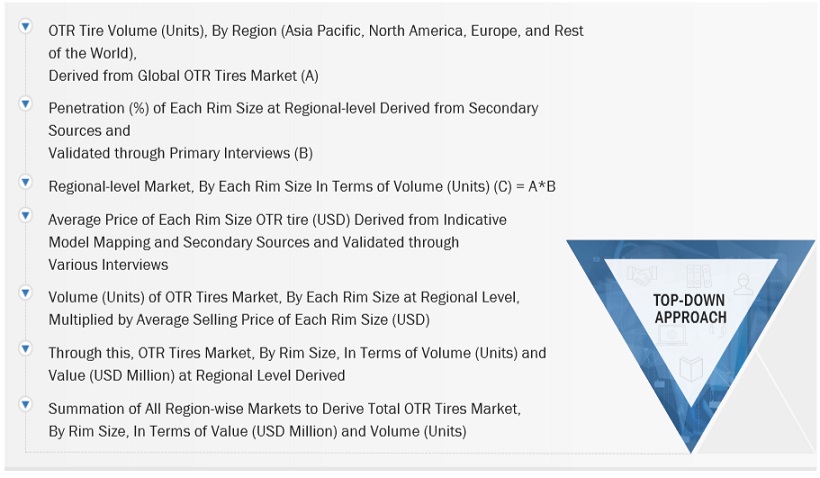

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE: TOP-DOWN APPROACH (RIM SIZE)

FIGURE 8 MARKET: RESEARCH DESIGN AND METHODOLOGY

2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDES

2.3 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

TABLE 1 RESEARCH ASSUMPTIONS, BY SEGMENT

TABLE 2 OTHER ASSUMPTIONS

2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 10 OTR TIRES MARKET OVERVIEW, 2022–2027

FIGURE 11 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OTR TIRES MARKET

FIGURE 12 INCREASED INFRASTRUCTURE DEVELOPMENT AND FARM MECHANIZATION TO DRIVE MARKET

4.2 MARKET, BY EQUIPMENT TYPE

FIGURE 13 AGRICULTURE TRACTORS SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD DUE TO HIGH TRACTOR SALES GLOBALLY

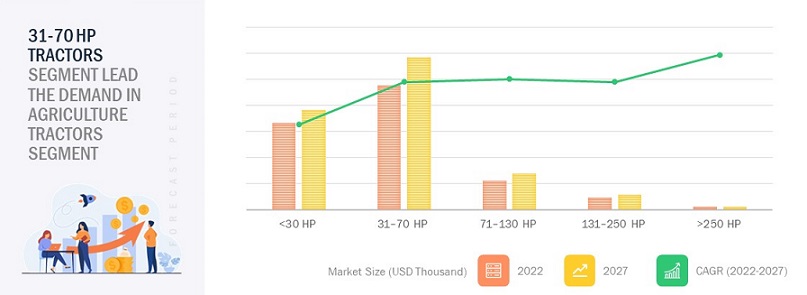

4.3 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT

FIGURE 14 31–70 HP SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD OWING TO INCREASED DEMAND FOR COMPACT CONSTRUCTION EQUIPMENT

4.4 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE

FIGURE 15 TOW TRACTORS SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 AGRICULTURAL TRACTORS TRACKS MARKET, BY POWER OUTPUT

FIGURE 16 131–250 HP SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

4.6 MARKET, BY TIRE TYPE

FIGURE 17 RADIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD OWING TO LONGER LIFESPAN AND BETTER PERFORMANCE

4.7 MARKET, BY RIM SIZE

FIGURE 18 UP TO 30 INCHES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.8 OTR TIRES RETREADING MARKET, BY PROCESS

FIGURE 19 MOLD CURE SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD OWING TO LOWER COSTS COMPARED TO PRE-CURE

4.9 OTR TIRES RETREADING MARKET, BY APPLICATION

FIGURE 20 AGRICULTURE TRACTORS SEGMENT PROJECTED TO REGISTER HIGHER CAGR FROM 2022 TO 2027

4.10 OTR TIRES AFTERMARKET, BY EQUIPMENT

FIGURE 21 WHEELED LOADERS (>80 HP) SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD DUE TO INCREASED SALES OF CONSTRUCTION EQUIPMENT

4.11 MARKET, BY APPLICATION

FIGURE 22 CONSTRUCTION AND MINING EQUIPMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.12 MARKET, BY REGION

FIGURE 23 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 OTR TIRES MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Infrastructure development and growth in construction and mining activities

TABLE 3 MAJOR CONSTRUCTION PROJECTS IN 2022

FIGURE 25 GLOBAL CONSTRUCTION AND MINING EQUIPMENT SALES, 2018–2022 (UNITS)

5.2.1.2 Increased machine-oriented agriculture

FIGURE 26 MECHANIZATION RATE AND CONTRIBUTION OF AGRICULTURE INDUSTRY TO GDP IN MAJOR GEOGRAPHIES, 2020

FIGURE 27 FARM TRACTOR MARKET SIZE, 2018–2022 (‘000 UNITS)

5.2.1.3 Government subsidies on agricultural equipment

TABLE 4 AGRICULTURAL EQUIPMENT SUBSIDIES BY MAJOR REGIONAL GOVERNMENTS

5.2.1.4 Growing aftermarket sales

FIGURE 28 LIFE EXPECTANCY OF EQUIPMENT AND WORK HOURS/YEAR, 2021

TABLE 5 TIRE DEPTH FOR EARTHMOVING EQUIPMENT

5.2.1.5 Growth in off-highway equipment rental market

FIGURE 29 GLOBAL RENTAL CONSTRUCTION EQUIPMENT MARKET (2018–2021)

FIGURE 30 GLOBAL TRACTOR RENTAL MARKET (2018-2021)

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost tires from unorganized market

TABLE 6 CHINESE OTR TIRE MANUFACTURERS

TABLE 7 COMPARISON BETWEEN STANDARD AND CHINESE TIRE PRICES

5.2.2.2 Commercialized use of integrated advanced sensor-based technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Developing alternative, cost-effective, and recyclable raw materials

TABLE 8 TIRE MANUFACTURERS FOCUS ON ECO-FRIENDLY MATERIALS

5.2.3.2 Retreading of tires

5.2.3.3 Increased sales of ATVs and UTVs

FIGURE 31 GLOBAL ATV SALES, 2018–2022 (‘000 UNITS)

5.2.4 CHALLENGES

5.2.4.1 High R&D cost

TABLE 9 INDUSTRY CHARACTERISTICS AND SPECIFICATIONS

5.2.4.2 Stringent emission regulations

TABLE 10 EMISSION RULES SET BY NESHAP FOR HAP (2008-2022)

TABLE 11 REACH POLYMER LEGISLATION, 2022

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TRADE ANALYSIS

5.4.1 IMPORT DATA

5.4.1.1 Australia

TABLE 13 AUSTRALIA: OTR TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

5.4.1.2 US

TABLE 14 US: OTR TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

5.4.1.3 Russia

TABLE 15 RUSSIA: OTR TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

5.4.1.4 Canada

TABLE 16 CANADA: OTR TIRE IMPORT SHARE, BY COUNTRY (VALUE %)

5.4.2 EXPORT DATA

5.4.2.1 Japan

TABLE 17 JAPAN: OTR TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

5.4.2.2 US

TABLE 18 US: OTR TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

5.4.2.3 China

TABLE 19 CHINA: OTR TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

5.4.2.4 India

TABLE 20 INDIA: OTR TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES- MARKET

5.6 CASE STUDIES

5.6.1 INTELLIGENT MANUFACTURING SYSTEMS FOR OTR TIRES USING PROACTIVE CONTROL

5.6.2 NEW DEVELOPMENTS IN OTR TIRES FOR PERFORMANCE AND SUSTAINABILITY

5.6.3 REVERSE LOGISTICS NETWORK OPTIMIZATION MODEL FOR RESIDUAL OTR TIRES FROM MINING INDUSTRY

5.6.4 NEW RETREAD SOLUTIONS FOR OTR TIRES

5.6.5 ADOPTING IOT FOR DIGITAL TRANSFORMATION

5.7 PATENT ANALYSIS

TABLE 21 PATENT ANALYSIS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 34 SUPPLY CHAIN ANALYSIS

5.9 ECOSYSTEM/MARKET MAP

FIGURE 35 MARKET: ECOSYSTEM ANALYSIS

5.10 REGULATORY ANALYSIS: OTR TIRE STANDARDS

5.10.1 TRA CODES AND STAR RATINGS FOR STANDARDIZATION OF OTR TIRES

TABLE 22 OTR TIRES: TRA CODES

TABLE 23 OTR TIRES: STAR RATINGS

5.11 AVERAGE SELLING PRICE (ASP) ANALYSIS

5.11.1 BY REGION

TABLE 24 ASP, BY REGION, 2020–2021 (USD)

5.11.2 BY TYPE

TABLE 25 ASP, BY TYPE, 2020–2021 (USD)

5.11.3 BY APPLICATION

TABLE 26 ASP, BY APPLICATION, 2020–2021 (USD)

5.12 CUSTOMER BUYING BEHAVIOR

5.12.1 BUYING CRITERIA

FIGURE 36 KEY BUYING CRITERIA FOR OTR TIRES

TABLE 27 KEY BUYING CRITERIA FOR OTR TIRES

TABLE 28 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR OTR TIRE APPLICATIONS (%)

5.13 TECHNOLOGICAL TRENDS

5.13.1 INTELLIGENT TIRES

5.13.2 ADVANCEMENTS IN OTR TIRES FOR CONSTRUCTION EQUIPMENT

5.13.3 TECHNOLOGY AND CONNECTIVITY TRENDS AIDING MANAGEMENT OF OTR TIRES

5.13.4 RESEARCH ON TKS DANDELION AS ALTERNATIVE TO NATURAL RUBBER

5.13.5 AIRLESS OTR TIRES FOR AGRICULTURE, MINING, AND INDUSTRIAL SEGMENTS

5.14 KEY CONFERENCES AND EVENTS IN 2023–2024

TABLE 29 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 99)

6.1 ASIA PACIFIC TO DOMINATE OTR TIRES MARKET

6.2 SHIFT IN PREFERENCE TO RADIAL OTR TIRES

6.3 CONCLUSION

7 OTR TIRES MARKET, BY EQUIPMENT TYPE (Page No. - 101)

7.1 INTRODUCTION

FIGURE 37 MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD THOUSAND)

7.1.1 RESEARCH METHODOLOGY

7.1.2 ASSUMPTIONS

7.1.3 INDUSTRY INSIGHTS

TABLE 30 MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 31 MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 32 MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 33 MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

7.2 ARTICULATED DUMP TRUCKS

TABLE 34 MARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2018–2021 (UNITS)

TABLE 35 MARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2022–2027 (UNITS)

TABLE 36 MARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 37 MARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2022–2027 (USD THOUSAND)

7.3 ASPHALT FINISHERS

TABLE 38 MARKET FOR ASPHALT FINISHERS, BY REGION, 2018–2021 (UNITS)

TABLE 39 MARKET FOR ASPHALT FINISHERS, BY REGION, 2022–2027 (UNITS)

TABLE 40 MARKET FOR ASPHALT FINISHERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 41 MARKET FOR ASPHALT FINISHERS, BY REGION, 2022–2027 (USD THOUSAND)

7.4 BACKHOE LOADERS

TABLE 42 MARKET FOR BACKHOE LOADERS, BY REGION, 2018–2021 (UNITS)

TABLE 43 MARKET FOR BACKHOE LOADERS, BY REGION, 2022–2027 (UNITS)

TABLE 44 MARKET FOR BACKHOE LOADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 45 MARKET FOR BACKHOE LOADERS, BY REGION, 2022–2027 (USD THOUSAND)

7.5 MOTOR GRADERS

TABLE 46 MARKET FOR MOTOR GRADERS, BY REGION, 2018–2021 (UNITS)

TABLE 47 MARKET FOR MOTOR GRADERS, BY REGION, 2022–2027 (UNITS)

TABLE 48 MARKET FOR MOTOR GRADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 49 MARKET FOR MOTOR GRADERS, BY REGION, 2022–2027 (USD THOUSAND)

7.6 RIGID DUMP TRUCKS

TABLE 50 MARKET FOR RIGID DUMP TRUCKS, BY REGION, 2018–2021 (UNITS)

TABLE 51 MARKET FOR RIGID DUMP TRUCKS, BY REGION, 2022–2027 (UNITS)

TABLE 52 MARKET FOR RIGID DUMP TRUCKS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 53 MARKET FOR RIGID DUMP TRUCKS, BY REGION, 2022–2027 (USD THOUSAND)

7.7 RTLT-TELESCOPIC

TABLE 54 MARKET FOR RTLT-TELESCOPIC, BY REGION, 2018–2021 (UNITS)

TABLE 55 MARKET FOR RTLT-TELESCOPIC, BY REGION, 2022–2027 (UNITS)

TABLE 56 MARKET FOR RTLT-TELESCOPIC, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 57 MARKET FOR RTLT-TELESCOPIC, BY REGION, 2022–2027 (USD THOUSAND)

7.8 SKID-STEER LOADERS

TABLE 58 MARKET: SKID-STEER LOADERS, BY REGION, 2018–2021 (UNITS)

TABLE 59 MARKET: SKID-STEER LOADERS, BY REGION, 2022–2027 (UNITS)

TABLE 60 MARKET: SKID-STEER LOADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 61 MARKET: SKID-STEER LOADERS, BY REGION, 2022–2027 (USD THOUSAND)

7.9 WHEELED EXCAVATORS

TABLE 62 MARKET: WHEELED EXCAVATORS, BY REGION, 2018–2021 (UNITS)

TABLE 63 MARKET: WHEELED EXCAVATORS, BY REGION, 2022–2027 (UNITS)

TABLE 64 MARKET: WHEELED EXCAVATORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 65 MARKET: WHEELED EXCAVATORS, BY REGION, 2022–2027 (USD THOUSAND)

7.10 WHEELED LOADERS <80 HP

TABLE 66 MARKET: WHEELED LOADERS <80 HP, BY REGION, 2018–2021 (UNITS)

TABLE 67 MARKET: WHEELED LOADERS <80 HP, BY REGION, 2022–2027 (UNITS)

TABLE 68 MARKET: WHEELED LOADERS <80 HP, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 69 MARKET: WHEELED LOADERS <80 HP, BY REGION, 2022–2027 (USD THOUSAND)

7.11 WHEELED LOADERS >80 HP

TABLE 70 MARKET: WHEELED LOADERS >80 HP, BY REGION, 2018–2021 (UNITS)

TABLE 71 MARKET: WHEELED LOADERS >80 HP, BY REGION, 2022–2027 (UNITS)

TABLE 72 MARKET: WHEELED LOADERS >80 HP, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 73 MARKET: WHEELED LOADERS >80 HP, BY REGION, 2022–2027 (USD THOUSAND)

7.12 AGRICULTURE TRACTORS

TABLE 74 MARKET: AGRICULTURE TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 75 MARKET: AGRICULTURE TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 76 MARKET: AGRICULTURE TRACTORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 77 MARKET: AGRICULTURE TRACTORS, BY REGION, 2022–2027 (USD THOUSAND)

7.13 OTHERS

TABLE 78 MARKET: OTHER EQUIPMENT, BY REGION, 2018–2021 (UNITS)

TABLE 79 MARKET: OTHER EQUIPMENT, BY REGION, 2022–2027 (UNITS)

TABLE 80 MARKET: OTHER EQUIPMENT, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 81 MARKET: OTHER EQUIPMENT, BY REGION, 2022–2027 (USD THOUSAND)

8 OTR TIRES MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT (Page No. - 125)

8.1 INTRODUCTION

FIGURE 38 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022 VS. 2027 (USD THOUSAND)

8.1.1 RESEARCH METHODOLOGY

8.1.2 ASSUMPTIONS

TABLE 82 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2018–2021 (UNITS)

TABLE 83 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022–2027 (UNITS)

TABLE 84 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2018–2021 (USD THOUSAND)

TABLE 85 MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022–2027 (USD THOUSAND)

8.2 <30 HP

8.2.1 COMPACT UTILITY WITH ADEQUATE TORQUE FOR SMALL FARMS

TABLE 86 <30 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 87 <30 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 88 <30 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 89 <30 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.3 31–70 HP

8.3.1 CONSTITUTE HIGHEST SHARE IN ASIA PACIFIC WITH GOOD RENTAL MARKET

TABLE 90 31–70 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 91 31–70 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 92 31–70 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 93 31–70 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.4 71–130 HP

8.4.1 EXPECTED TO HOLD LARGEST MARKET SHARE IN ASIA PACIFIC

TABLE 94 71–130 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 95 71–130 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 96 71–130 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 97 71–130 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.5 131–250 HP

8.5.1 HIGHEST DEMAND FROM EUROPEAN COUNTRIES

TABLE 98 131–250 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 99 131–250 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 100 131–250 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 101 131–250 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (USD THOUSAND)

8.6 >250 HP

8.6.1 LARGE FARMLANDS IN NORTH AMERICA TO DRIVE SEGMENT

TABLE 102 >250 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 103 >250 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 104 >250 HP TRACTORS TIRES MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 105 >250 HP TRACTORS TIRES MARKET, BY REGION, 2022–2027 (USD THOUSAND)

9 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT (Page No. - 137)

9.1 INTRODUCTION

FIGURE 39 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022 VS. 2027 (USD THOUSAND)

9.1.1 RESEARCH METHODOLOGY

9.1.2 ASSUMPTIONS

TABLE 106 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2018–2021 (UNITS)

TABLE 107 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022–2027 (UNITS)

TABLE 108 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2018–2021 (USD THOUSAND)

TABLE 109 OTR TRACKS MARKET FOR AGRICULTURE TRACTORS, BY POWER OUTPUT, 2022–2027 (USD THOUSAND)

9.2 131–250 HP

9.2.1 HIGHEST DEMAND IN EUROPE

TABLE 110 OTR TRACKS MARKET FOR 131–250 HP TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 111 OTR TRACKS MARKET FOR 131–250 HP TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 112 OTR TRACKS MARKET: 131–250 HP TRACTORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 113 OTR TRACKS MARKET: 131–250 HP TRACTORS, BY REGION, 2022–2027 (USD THOUSAND)

9.3 >250 HP

9.3.1 LARGE FARMLANDS IN NORTH REGION TO DRIVE MARKET

TABLE 114 OTR TRACKS MARKET: >250 HP TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 115 OTR TRACKS MARKET: >250 HP TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 116 OTR TRACKS MARKET: >250 HP TRACTORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 117 OTR TRACKS MARKET: >250 HP TRACTORS, BY REGION, 2022–2027 (USD THOUSAND)

10 OTR TIRES MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE (Page No. - 144)

10.1 INTRODUCTION

FIGURE 40 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE, 2022 VS. 2027 (USD THOUSAND)

10.1.1 RESEARCH METHODOLOGY

10.1.2 ASSUMPTIONS

10.1.3 INDUSTRY INSIGHTS

TABLE 118 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE, 2018–2021 (UNITS)

TABLE 119 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE, 2022–2027 (UNITS)

TABLE 120 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 121 MARKET FOR INDUSTRIAL EQUIPMENT, BY TYPE, 2022–2027 (USD THOUSAND)

10.2 FORKLIFTS

10.2.1 HIGHEST MARKET SHARE IN ASIA PACIFIC IN 2022

TABLE 122 MARKET FOR FORKLIFTS, BY REGION, 2018–2021 (UNITS)

TABLE 123 MARKET FOR FORKLIFTS, BY REGION, 2022–2027 (UNITS)

TABLE 124 MARKET FOR FORKLIFTS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 125 MARKET FOR FORKLIFTS, BY REGION, 2022–2027 (USD THOUSAND)

10.3 AISLE TRUCKS

10.3.1 USED IN LARGE ARABLE LANDS AND WAREHOUSE SETUPS

TABLE 126 MARKET FOR AISLE TRUCKS, BY REGION, 2018–2021 (UNITS)

TABLE 127 MARKET FOR AISLE TRUCKS, BY REGION, 2022–2027 (UNITS)

TABLE 128 MARKET FOR AISLE TRUCKS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 129 MARKET FOR AISLE TRUCKS, BY REGION, 2022–2027 (USD THOUSAND)

10.4 TOW TRACTORS

10.4.1 INCREASED USE OF BATTERY-OPERATED OR EMISSION-FREE TOW TRACTORS TO DRIVE SEGMENT

TABLE 130 MARKET FOR TOW TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 131 MARKET FOR TOW TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 132 MARKET FOR TOW TRACTORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 133 MARKET FOR TOW TRACTORS, BY REGION, 2022–2027 (USD THOUSAND)

10.5 CONTAINER HANDLERS

10.5.1 INCREASED IMPORT AND EXPORT ACTIVITIES AT PORTS TO DRIVE DEMAND

TABLE 134 MARKET FOR CONTAINER HANDLERS, BY REGION, 2018–2021 (UNITS)

TABLE 135 MARKET FOR CONTAINER HANDLERS, BY REGION, 2022–2027 (UNITS)

TABLE 136 MARKET FOR CONTAINER HANDLERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 137 MARKET FOR CONTAINER HANDLERS, BY REGION, 2022–2027 (USD THOUSAND)

11 OTR TIRES MARKET, BY TYPE (Page No. - 155)

11.1 INTRODUCTION

FIGURE 41 MARKET, BY TYPE, 2022 VS. 2027 (USD THOUSAND)

11.1.1 RESEARCH METHODOLOGY

11.1.2 ASSUMPTIONS

11.1.3 INDUSTRY INSIGHTS

TABLE 138 MARKET, BY TYPE, 2018–2021 (UNITS)

TABLE 139 MARKET, BY TYPE, 2022–2027 (UNITS)

TABLE 140 MARKET, BY TYPE, 2018–2021 (USD THOUSAND)

TABLE 141 MARKET, BY TYPE, 2022–2027 (USD THOUSAND)

11.2 RADIAL TIRES

11.2.1 HIGHEST MARKET SHARE IN ASIA PACIFIC IN 2022

TABLE 142 RADIAL OTR TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 143 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 144 MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 145 MARKET, BY REGION, 2022–2027 (USD THOUSAND)

11.3 BIAS TIRES

11.3.1 LOWER FLEXIBILITY AND OVERHEATING

TABLE 146 BIAS OTR TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 147 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 148 MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 149 MARKET, BY REGION, 2022–2027 (USD THOUSAND)

11.4 SOLID TIRES

11.4.1 INCREASED APPLICATION OF INDUSTRIAL EQUIPMENT TO DRIVE DEMAND FOR SOLID TIRES

TABLE 150 SOLID OTR TIRES MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 151 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 152 MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 153 MARKET, BY REGION, 2022–2027 (USD THOUSAND)

12 OTR TIRES MARKET, BY RIM SIZE (Page No. - 164)

12.1 INTRODUCTION

FIGURE 42 MARKET, BY RIM SIZE, 2022—2027 (USD THOUSAND)

12.1.1 RESEARCH METHODOLOGY

12.1.2 ASSUMPTIONS

12.1.3 INDUSTRY INSIGHTS

TABLE 154 MARKET, BY RIM SIZE, 2018–2021 (UNITS)

TABLE 155 MARKET, BY RIM SIZE, 2022–2027 (UNITS)

TABLE 156 MARKET, BY RIM SIZE, 2018–2021 (USD THOUSAND)

TABLE 157 MARKET, BY RIM SIZE, 2022–2027 (USD THOUSAND)

12.2 UP TO 30 INCHES

12.2.1 ADVANCED MECHANIZATION TO INCREASE DEMAND IN ASIA PACIFIC

TABLE 158 MARKET: UP TO 30 INCHES, BY REGION, 2018–2021 (UNITS)

TABLE 159 MARKET: UP TO 30 INCHES, BY REGION, 2022–2027 (UNITS)

TABLE 160 MARKET: UP TO 30 INCHES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 161 MARKET: UP TO 30 INCHES, BY REGION, 2022–2027 (USD THOUSAND)

12.3 30–50 INCHES

12.3.1 PRESENT IN MAJORITY OF WHEELED LOADERS

TABLE 162 MARKET: 30–50 INCHES, BY REGION, 2018–2021 (UNITS)

TABLE 163 MARKET: 30–50 INCHES, BY REGION, 2022–2027 (UNITS)

TABLE 164 MARKET: 30–50 INCHES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 165 MARKET: 30–50 INCHES, BY REGION, 2022–2027 (USD THOUSAND)

12.4 ABOVE 50 INCHES

12.4.1 MOSTLY USED IN RIGID DUMP TRUCKS FOR MINING PROJECTS IN ASIA PACIFIC

TABLE 166 MARKET: ABOVE 50 INCHES, BY REGION, 2018–2021 (UNITS)

TABLE 167 MARKET: ABOVE 50 INCHES, BY REGION, 2022–2027 (UNITS)

TABLE 168 MARKET: ABOVE 50 INCHES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 169 MARKET: ABOVE 50 INCHES, BY REGION, 2022–2027 (USD THOUSAND)

13 OTR TIRES RETREADING MARKET, BY PROCESS (Page No. - 173)

13.1 INTRODUCTION

TABLE 170 PRE-CURE VS. MOLD CURE TIRES

FIGURE 43 OTR TIRES RETREADING MARKET, BY PROCESS, 2022 VS. 2027 (USD MILLION)

13.1.1 RESEARCH METHODOLOGY

13.1.2 ASSUMPTIONS

13.1.3 INDUSTRY INSIGHTS

TABLE 171 OTR TIRES RETREADING MARKET, BY PROCESS, 2018–2021 (UNITS)

TABLE 172 OTR TIRES RETREADING MARKET, BY PROCESS, 2022–2027 (UNITS)

TABLE 173 OTR TIRES RETREADING MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 174 OTR TIRES RETREADING MARKET, BY PROCESS, 2022–2027 (USD MILLION)

FIGURE 44 PRE-CURE VS. MOLD CURE OTR RETREADING PROCESS

13.2 PRE-CURE

13.2.1 LOW DEMAND DUE TO HIGHER REJECTION OF TIRES

TABLE 175 PRE-CURE OTR TIRES RETREADING MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 176 PRE-CURE OTR TIRES RETREADING MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 177 PRE-CURE OTR TIRES RETREADING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 178 PRE-CURE OTR TIRES RETREADING MARKET, BY REGION, 2022–2027 (USD MILLION)

13.3 MOLD CURE

13.3.1 HIGHER MILEAGE AND LONGER SHELF LIFE

TABLE 179 MOLD CURE OTR TIRES RETREADING MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 180 MOLD CURE OTR TIRES RETREADING MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 181 MOLD CURE OTR TIRES RETREADING MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 182 MOLD CURE OTR TIRES RETREADING MARKET, BY REGION, 2022–2027 (USD MILLION)

14 OTR TIRES RETREADING MARKET, BY APPLICATION (Page No. - 181)

14.1 INTRODUCTION

FIGURE 45 OTR TIRES RETREADING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

14.1.1 RESEARCH METHODOLOGY

14.1.2 ASSUMPTIONS

14.1.3 INDUSTRY INSIGHTS

TABLE 183 OTR TIRES RETREADING MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 184 OTR TIRES RETREADING MARKET, BY APPLICATION, 2022–2027 (UNITS)

TABLE 185 OTR TIRES RETREADING MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 186 OTR TIRES RETREADING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

14.2 CONSTRUCTION AND MINING EQUIPMENT

14.2.1 STEADY GROWTH IN EQUIPMENT PARC AND WORK HOURS TO DRIVE DEMAND

TABLE 187 OTR TIRES RETREADING MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2018–2021 (UNITS)

TABLE 188 OTR TIRES RETREADING MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2022–2027 (UNITS)

TABLE 189 OTR TIRES RETREADING MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 190 OTR TIRES RETREADING MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2022–2027 (USD MILLION)

14.3 AGRICULTURE TRACTORS

14.3.1 GROWTH IN TRACTOR FLEET TO FUEL DEMAND

TABLE 191 OTR TIRES RETREADING MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 192 OTR TIRES RETREADING MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 193 OTR TIRES RETREADING MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 194 OTR TIRES RETREADING MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2022–2027 (USD MILLION)

15 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE (Page No. - 188)

15.1 INTRODUCTION

FIGURE 46 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD THOUSAND)

15.1.1 RESEARCH METHODOLOGY

15.1.2 ASSUMPTIONS

15.1.3 INDUSTRY INSIGHTS

TABLE 195 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 196 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 197 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 198 OTR TIRES AFTERMARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

15.2 ARTICULATED DUMP TRUCKS

TABLE 199 OTR TIRES AFTERMARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2018–2021 (UNITS)

TABLE 200 OTR TIRES AFTERMARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2022–2027 (UNITS)

TABLE 201 OTR TIRES AFTERMARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 202 OTR TIRES AFTERMARKET FOR ARTICULATED DUMP TRUCKS, BY REGION, 2022–2027 (USD THOUSAND)

15.3 ASPHALT FINISHERS

TABLE 203 OTR TIRES AFTERMARKET FOR ASPHALT FINISHERS, BY REGION, 2018–2021 (UNITS)

TABLE 204 OTR TIRES AFTERMARKET FOR ASPHALT FINISHERS, BY REGION, 2022–2027 (UNITS)

TABLE 205 OTR TIRES AFTERMARKET FOR ASPHALT FINISHERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 206 OTR TIRES AFTERMARKET FOR ASPHALT FINISHERS, BY REGION, 2022–2027 (USD THOUSAND)

15.4 BACKHOE LOADERS

TABLE 207 OTR TIRES AFTERMARKET FOR BACKHOE LOADERS, BY REGION, 2018–2021 (UNITS)

TABLE 208 OTR TIRES AFTERMARKET FOR BACKHOE LOADERS, BY REGION, 2022–2027 (UNITS)

TABLE 209 OTR TIRES AFTERMARKET FOR BACKHOE LOADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 210 OTR TIRES AFTERMARKET FOR BACKHOE LOADERS, BY REGION, 2022–2027 (USD THOUSAND)

15.5 MOTOR GRADERS

TABLE 211 OTR TIRES AFTERMARKET FOR MOTOR GRADERS, BY REGION, 2018–2021 (UNITS)

TABLE 212 OTR TIRES AFTERMARKET FOR MOTOR GRADERS, BY REGION, 2022–2027 (UNITS)

TABLE 213 OTR TIRES AFTERMARKET FOR MOTOR GRADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 214 OTR TIRES AFTERMARKET FOR MOTOR GRADERS, BY REGION, 2022–2027 (USD THOUSAND)

15.6 MOTOR SCRAPERS

TABLE 215 OTR TIRES AFTERMARKET FOR MOTOR SCRAPERS, BY REGION, 2018–2021 (UNITS)

TABLE 216 OTR TIRES AFTERMARKET FOR MOTOR SCRAPERS, BY REGION, 2022–2027 (UNITS)

TABLE 217 OTR TIRES AFTERMARKET FOR MOTOR SCRAPERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 218 OTR TIRES AFTERMARKET FOR MOTOR SCRAPERS, BY REGION, 2022–2027 (USD THOUSAND)

15.7 RIGID DUMP TRUCKS

TABLE 219 OTR TIRES AFTERMARKET FOR RIGID DUMP TRUCKS, BY REGION, 2018–2021 (UNITS)

TABLE 220 OTR TIRES AFTERMARKET FOR RIGID DUMP TRUCKS, BY REGION, 2022–2027 (UNITS)

TABLE 221 OTR TIRES AFTERMARKET FOR RIGID DUMP TRUCKS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 222 OTR TIRES AFTERMARKET FOR RIGID DUMP TRUCKS, BY REGION, 2022–2027 (USD THOUSAND)

15.8 RTLT-TELESCOPIC

TABLE 223 OTR TIRES AFTERMARKET FOR RTLT-TELESCOPE, BY REGION, 2018–2021 (UNITS)

TABLE 224 OTR TIRES AFTERMARKET FOR RTLT-TELESCOPE, BY REGION, 2022–2027 (UNITS)

TABLE 225 OTR TIRES AFTERMARKET FOR RTLT-TELESCOPE, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 226 OTR TIRES AFTERMARKET FOR RTLT-TELESCOPE, BY REGION, 2022–2027 (USD THOUSAND)

15.9 SKID-STEER LOADERS

TABLE 227 OTR TIRES AFTERMARKET FOR SKID-STEER LOADERS, BY REGION, 2018–2021 (UNITS)

TABLE 228 OTR TIRES AFTERMARKET FOR SKID-STEER LOADERS, BY REGION, 2022–2027 (UNITS)

TABLE 229 OTR TIRES AFTERMARKET FOR SKID-STEER LOADERS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 230 OTR TIRES AFTERMARKET FOR SKID-STEER LOADERS, BY REGION, 2022–2027 (USD THOUSAND)

15.10 WHEELED EXCAVATORS

TABLE 231 OTR TIRES AFTERMARKET FOR WHEELED EXCAVATORS, BY REGION, 2018–2021 UNITS)

TABLE 232 OTR TIRES AFTERMARKET FOR WHEELED EXCAVATORS, BY REGION, 2022–2027 (UNITS)

TABLE 233 OTR TIRES AFTERMARKET FOR WHEELED EXCAVATORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 234 OTR TIRES AFTERMARKET FOR WHEELED EXCAVATORS, BY REGION, 2022–2027 (USD THOUSAND)

15.11 WHEELED LOADERS (<80 HP)

TABLE 235 OTR TIRES AFTERMARKET FOR WHEELED LOADERS <80 HP, BY REGION, 2018–2021 (UNITS)

TABLE 236 OTR TIRES AFTERMARKET FOR WHEELED LOADERS <80 HP, BY REGION, 2022–2027 (UNITS)

TABLE 237 OTR TIRES AFTERMARKET FOR WHEELED LOADERS <80 HP, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 238 OTR TIRES AFTERMARKET FOR WHEELED LOADERS <80 HP, BY REGION, 2022–2027 (USD THOUSAND)

15.12 WHEELED LOADERS (>80 HP)

TABLE 239 OTR TIRES AFTERMARKET FOR WHEELED LOADERS >80 HP, BY REGION, 2018–2021 (UNITS)

TABLE 240 OTR TIRES AFTERMARKET FOR WHEELED LOADERS >80 HP, BY REGION, 2022–2027 (UNITS)

TABLE 241 OTR TIRES AFTERMARKET FOR WHEELED LOADERS >80 HP, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 242 OTR TIRES AFTERMARKET FOR WHEELED LOADERS >80 HP, BY REGION, 2022–2027 (USD THOUSAND)

16 OTR TIRES MARKET, BY APPLICATION (Page No. - 209)

16.1 INTRODUCTION

FIGURE 47 MARKET, BY APPLICATION, 2022—2027 (USD THOUSAND)

16.1.1 RESEARCH METHODOLOGY

16.1.2 ASSUMPTIONS

16.1.3 INDUSTRY INSIGHTS

TABLE 243 MARKET, BY APPLICATION, 2018–2021 (UNITS)

TABLE 244 MARKET, BY APPLICATION, 2022–2027 (UNITS)

TABLE 245 MARKET, BY APPLICATION, 2018–2021 (USD THOUSAND)

TABLE 246 MARKET, BY APPLICATION, 2022–2027 (USD THOUSAND)

16.2 CONSTRUCTION AND MINING EQUIPMENT

16.2.1 GROWTH IN INFRASTRUCTURAL DEVELOPMENT AND MINING ACTIVITIES TO DRIVE DEMAND

TABLE 247 MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2018–2021 (UNITS)

TABLE 248 MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2022–2027(UNITS)

TABLE 249 MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 250 MARKET FOR CONSTRUCTION AND MINING EQUIPMENT, BY REGION, 2022–2027 (USD THOUSAND)

16.3 AGRICULTURE TRACTORS

16.3.1 GROWING DEMAND FOR MECHANIZATION DUE TO IMPROVED PRODUCTIVITY

TABLE 251 MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2018–2021 (UNITS)

TABLE 252 MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2022–2027 (UNITS)

TABLE 253 MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 254 MARKET FOR AGRICULTURE TRACTORS, BY REGION, 2022–2027 (USD THOUSAND)

16.4 INDUSTRIAL EQUIPMENT

16.4.1 INCREASED LABOR COSTS AND IMPROVED EFFICIENCY OF MACHINES TO DRIVE SEGMENT

TABLE 255 MARKET FOR INDUSTRIAL EQUIPMENT, BY REGION, 2018–2021 (UNITS)

TABLE 256 MARKET FOR INDUSTRIAL EQUIPMENT, BY REGION, 2022–2027 (UNITS)

TABLE 257 MARKET FOR INDUSTRIAL EQUIPMENT, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 258 MARKET FOR INDUSTRIAL EQUIPMENT, BY REGION, 2022–2027 (USD THOUSAND)

16.5 ALL-TERRAIN VEHICLES

16.5.1 INCREASED DEMAND FOR RECREATIONAL ACTIVITIES TO DRIVE MARKET

TABLE 259 MARKET FOR ALL-TERRAIN VEHICLES, BY REGION, 2018–2021 (UNITS)

TABLE 260 MARKET FOR ALL-TERRAIN VEHICLES, BY REGION, 2022–2027 (UNITS)

TABLE 261 MARKET FOR ALL-TERRAIN VEHICLES, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 262 MARKET FOR ALL-TERRAIN VEHICLES, BY REGION, 2022–2027 (USD THOUSAND)

17 OTR TIRES MARKET, BY REGION (Page No. - 220)

17.1 INTRODUCTION

FIGURE 48 MARKET, BY REGION, 2022 VS. 2027 (USD THOUSAND)

17.1.1 RESEARCH METHODOLOGY

TABLE 263 MARKET, BY REGION, 2018–2021 (UNITS)

TABLE 264 MARKET, BY REGION, 2022–2027 (UNITS)

TABLE 265 MARKET, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 266 MARKET, BY REGION, 2022–2027 (USD THOUSAND)

17.2 ASIA PACIFIC

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 267 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 268 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (UNITS)

TABLE 269 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 270 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

17.2.1 AUSTRALIA

17.2.1.1 Demand from construction and mining sectors

TABLE 271 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 272 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 273 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 274 AUSTRALIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.2 CHINA

17.2.2.1 Increased mining activities and government policies for agricultural mechanization

TABLE 275 CHINA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 276 CHINA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 277 CHINA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 278 CHINA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.3 JAPAN

17.2.3.1 Rebuilding construction activities

TABLE 279 JAPAN: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 280 JAPAN: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 281 JAPAN: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 282 JAPAN: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.4 INDIA

17.2.4.1 Agricultural tractors to hold largest market share

TABLE 283 INDIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 284 INDIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 285 INDIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 286 INDIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.5 INDONESIA

17.2.5.1 Driven by large-scale mining activities

TABLE 287 INDONESIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 288 INDONESIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 289 INDONESIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 290 INDONESIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.6 SOUTH KOREA

17.2.6.1 Mechanized agricultural sector and local construction projects to use OTR tires

TABLE 291 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 292 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 293 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 294 SOUTH KOREA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.2.7 REST OF ASIA PACIFIC

17.2.7.1 Dominated by mining sector

TABLE 295 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 296 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 297 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 298 REST OF ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3 EUROPE

FIGURE 50 EUROPE: MARKET, BY COUNTRY, 2022 VS. 2027 (USD THOUSAND)

TABLE 299 EUROPE: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 300 EUROPE: MARKET, BY COUNTRY, 2022–2027 (UNITS)

TABLE 301 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 302 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

17.3.1 GERMANY

17.3.1.1 Expected to be largest market in Europe

TABLE 303 GERMANY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 304 GERMANY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 305 GERMANY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 306 GERMANY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.2 UK

17.3.2.1 Construction and mining applications to drive market

TABLE 307 UK: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 308 UK: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 309 UK: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 310 UK: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.3 FRANCE

17.3.3.1 Construction equipment and newly approved mining projects to boost market

TABLE 311 FRANCE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 312 FRANCE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 313 FRANCE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 314 FRANCE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.4 SPAIN

17.3.4.1 Urban construction and earthmoving equipment to use OTR tires

TABLE 315 SPAIN: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 316 SPAIN: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 317 SPAIN: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 318 SPAIN: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.5 POLAND

17.3.5.1 Large-scale coal mining investments to drive demand for mining OTR tires

TABLE 319 POLAND: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 320 POLAND: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 321 POLAND: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 322 POLAND: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.6 TURKEY

17.3.6.1 Agricultural tractors to drive demand

TABLE 323 TURKEY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 324 TURKEY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 325 TURKEY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 326 TURKEY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.7 ITALY

17.3.7.1 Agriculture 4.0 policy

TABLE 327 ITALY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 328 ITALY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 329 ITALY: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 330 ITALY: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.8 RUSSIA

17.3.8.1 Coal mining and growing mechanized agricultural practices to fuel market

TABLE 331 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 332 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 333 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 334 RUSSIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.3.9 REST OF EUROPE

17.3.9.1 Mid-size construction equipment and autonomous agricultural tractors to fuel demand for OTR tires

TABLE 335 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 336 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 337 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 338 REST OF EUROPE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.4 NORTH AMERICA

FIGURE 51 NORTH AMERICA: MARKET SNAPSHOT

TABLE 339 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 340 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (UNITS)

TABLE 341 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 342 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

17.4.1 US

17.4.1.1 OTR tires for construction equipment to witness higher demand

TABLE 343 US: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 344 US: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 345 US: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 346 US: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.4.2 CANADA

17.4.2.1 Increased infrastructural development and mining activities

TABLE 347 CANADA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 348 CANADA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 349 CANADA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 350 CANADA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.4.3 MEXICO

17.4.3.1 Mining sector to drive OTR tires market

TABLE 351 MEXICO: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 352 MEXICO: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 353 MEXICO: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 354 MEXICO: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5 REST OF THE WORLD (ROW)

FIGURE 52 REST OF THE WORLD: MARKET, BY COUNTRY, 2022 VS. 2027 (USD THOUSAND)

TABLE 355 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (UNITS)

TABLE 356 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (UNITS)

TABLE 357 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2021 (USD THOUSAND)

TABLE 358 REST OF THE WORLD: MARKET, BY COUNTRY, 2022–2027 (USD THOUSAND)

17.5.1 BRAZIL

17.5.1.1 Agricultural tractors to drive OTR tires market

TABLE 359 BRAZIL: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 360 BRAZIL: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 361 BRAZIL: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 362 BRAZIL: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.2 ARGENTINA

17.5.2.1 Large arable land ratio and new mining projects

TABLE 363 ARGENTINA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 364 ARGENTINA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 365 ARGENTINA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 366 ARGENTINA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.3 SOUTH AFRICA

17.5.3.1 High demand for agriculture tractors and wheeled loaders

TABLE 367 SOUTH AFRICA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 368 SOUTH AFRICA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 369 SOUTH AFRICA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 370 SOUTH AFRICA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.4 SAUDI ARABIA

17.5.4.1 Large-scale infrastructure projects

TABLE 371 SAUDI ARABIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 372 SAUDI ARABIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 373 SAUDI ARABIA: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 374 SAUDI ARABIA: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.5 CHILE

17.5.5.1 Demand for critical mineral mining

TABLE 375 CHILE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 376 CHILE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 377 CHILE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 378 CHILE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.6 PERU

17.5.6.1 Agricultural tractors to lead demand

TABLE 379 PERU: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 380 PERU: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 381 PERU: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 382 PERU: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

17.5.7 UAE

17.5.7.1 High investment in infrastructure development

TABLE 383 UAE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (UNITS)

TABLE 384 UAE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (UNITS)

TABLE 385 UAE: MARKET, BY EQUIPMENT TYPE, 2018–2021 (USD THOUSAND)

TABLE 386 UAE: MARKET, BY EQUIPMENT TYPE, 2022–2027 (USD THOUSAND)

18 COMPETITIVE LANDSCAPE (Page No. - 302)

18.1 OVERVIEW

18.2 OTR TIRES MARKET SHARE ANALYSIS, 2021

FIGURE 53 MARKET SHARE ANALYSIS, 2021

18.2.1 MARKET SHARE ANALYSIS FOR SELECT COUNTRIES, 2021

18.2.1.1 US

FIGURE 54 US: MARKET SHARE ANALYSIS, 2021

18.2.1.2 Brazil

FIGURE 55 BRAZIL: MARKET SHARE ANALYSIS, 2021

18.2.1.3 Germany

FIGURE 56 GERMANY: MARKET SHARE ANALYSIS, 2021

18.2.1.4 India

FIGURE 57 INDIA: MARKET SHARE ANALYSIS, 2021

18.2.1.5 Japan

FIGURE 58 JAPAN: MARKET SHARE ANALYSIS, 2021

18.2.1.6 UK

FIGURE 59 UK: MARKET SHARE ANALYSIS, 2021

18.2.1.7 France

FIGURE 60 FRANCE: MARKET SHARE ANALYSIS, 2021

18.2.1.8 Mexico

FIGURE 61 MEXICO: MARKET SHARE ANALYSIS, 2021

18.2.1.9 Canada

FIGURE 62 CANADA: MARKET SHARE ANALYSIS, 2021

18.2.2 MARKET RANKING ANALYSIS FOR SELECT COUNTRIES, 2021

18.2.2.1 Indonesia

TABLE 387 INDONESIA: MARKET RANKING ANALYSIS, 2021

18.2.2.2 Spain

TABLE 388 SPAIN: MARKET RANKING ANALYSIS, 2021

18.2.2.3 Italy

TABLE 389 ITALY: MARKET RANKING ANALYSIS, 2021

18.2.2.4 Russia

TABLE 390 RUSSIA: MARKET RANKING ANALYSIS, 2021

18.2.2.5 Chile

TABLE 391 CHILE: MARKET RANKING ANALYSIS, 2021

18.2.2.6 Peru

TABLE 392 PERU: MARKET RANKING ANALYSIS, 2021

18.2.2.7 Argentina

TABLE 393 ARGENTINA: MARKET RANKING ANALYSIS, 2021

18.2.2.8 South Korea

TABLE 394 SOUTH KOREA: MARKET RANKING ANALYSIS, 2021

18.2.2.9 Poland

TABLE 395 POLAND: MARKET RANKING ANALYSIS, 2021

18.2.2.10 UAE

TABLE 396 UAE: MARKET RANKING ANALYSIS, 2021

18.2.3 LIST OF KEY PLAYERS FOR SELECT COUNTRIES, 2021

18.2.3.1 South Africa

TABLE 397 SOUTH AFRICA: LIST OF KEY PLAYERS, 2021

18.2.3.2 Saudi Arabia

TABLE 398 SAUDI ARABIA: LIST OF KEY PLAYERS, 2021

18.2.3.3 Australia

TABLE 399 AUSTRALIA: LIST OF KEY PLAYERS, 2021

18.2.3.4 Thailand

TABLE 400 THAILAND: LIST OF KEY PLAYERS, 2021

18.2.3.5 Austria

TABLE 401 AUSTRIA: LIST OF KEY PLAYERS, 2021

18.2.3.6 Netherlands

TABLE 402 NETHERLANDS: LIST OF KEY PLAYERS, 2021

18.2.3.7 Ireland

TABLE 403 IRELAND: LIST OF KEY PLAYERS, 2021

18.2.3.8 Sweden

TABLE 404 SWEDEN: LIST OF KEY PLAYERS, 2021

18.2.3.9 Turkey

TABLE 405 TURKEY: LIST OF KEY PLAYERS, 2021

18.3 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS IN 2021

FIGURE 63 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS IN 2021

18.4 COMPANY EVALUATION QUADRANT

18.4.1 STARS

18.4.2 EMERGING LEADERS

18.4.3 PERVASIVE PLAYERS

18.4.4 PARTICIPANTS

18.4.5 COMPETITIVE EVALUATION MATRIX - CONSTRUCTION AND MINING TIRE MANUFACTURERS, 2021

FIGURE 64 COMPETITIVE EVALUATION MATRIX (CONSTRUCTION AND MINING TIRE MANUFACTURERS), 2021

18.4.6 COMPETITIVE EVALUATION MATRIX - AGRICULTURAL TRACTOR TIRE MANUFACTURERS, 2021

FIGURE 65 COMPETITIVE EVALUATION MATRIX (AGRICULTURAL TRACTOR TIRE MANUFACTURERS), 2021

TABLE 406 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019–2022

18.5 COMPETITIVE SCENARIO

18.5.1 PRODUCT LAUNCHES

TABLE 407 PRODUCT LAUNCHES, 2019–2022

18.5.2 DEALS

TABLE 408 DEALS, 2018–2022

18.5.3 OTHER DEVELOPMENTS

TABLE 409 OTHER DEVELOPMENTS, 2019–2022

18.6 RIGHT TO WIN

TABLE 410 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019–2022

18.7 COMPETITIVE BENCHMARKING

TABLE 411 OTR TIRES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 412 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

19 COMPANY PROFILES (Page No. - 336)

(Business overview, Products offered, Recent developments & MnM View)*

19.1 KEY PLAYERS

19.1.1 CONTINENTAL AG

TABLE 413 CONTINENTAL AG: BUSINESS OVERVIEW

FIGURE 66 CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 414 CONTINENTAL AG: PRODUCTS OFFERED

TABLE 415 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

TABLE 416 CONTINENTAL AG: DEALS

TABLE 417 CONTINENTAL AG: OTHER DEVELOPMENT

19.1.2 BRIDGESTONE CORPORATION

TABLE 418 BRIDGESTONE CORPORATION: BUSINESS OVERVIEW

FIGURE 67 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

TABLE 419 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

TABLE 420 BRIDGESTONE CORPORATION: NEW PRODUCT DEVELOPMENTS

TABLE 421 BRIDGESTONE CORPORATION: DEALS

TABLE 422 BRIDGESTONE CORPORATION: OTHER DEVELOPMENTS

19.1.3 MICHELIN

TABLE 423 MICHELIN: BUSINESS OVERVIEW

FIGURE 68 MICHELIN: COMPANY SNAPSHOT

TABLE 424 MICHELIN: PRODUCTS OFFERED

TABLE 425 MICHELIN: NEW PRODUCT DEVELOPMENTS

TABLE 426 MICHELIN: DEALS

19.1.4 GOODYEAR

TABLE 427 GOODYEAR: BUSINESS OVERVIEW

FIGURE 69 GOODYEAR: COMPANY SNAPSHOT

TABLE 428 GOODYEAR: PRODUCTS OFFERED

TABLE 429 GOODYEAR: NEW PRODUCT DEVELOPMENTS

TABLE 430 GOODYEAR: DEALS

19.1.5 PIRELLI

TABLE 431 PIRELLI: BUSINESS OVERVIEW

FIGURE 70 PIRELLI: COMPANY SNAPSHOT

TABLE 432 PIRELLI: PRODUCTS OFFERED

19.1.6 YOKOHAMA

TABLE 433 YOKOHAMA: BUSINESS OVERVIEW

FIGURE 71 YOKOHAMA: COMPANY SNAPSHOT

TABLE 434 YOKOHAMA: PRODUCTS OFFERED

TABLE 435 YOKOHAMA: NEW PRODUCT DEVELOPMENTS

TABLE 436 YOKOHAMA: OTHER DEVELOPMENTS

19.1.7 TRELLEBORG AB

TABLE 437 TRELLEBORG AB: BUSINESS OVERVIEW

FIGURE 72 TRELLEBORG AB: COMPANY SNAPSHOT

TABLE 438 TRELLEBORG AB: PRODUCTS OFFERED

TABLE 439 TRELLEBORG AB: NEW PRODUCT DEVELOPMENTS

TABLE 440 TRELLEBORG AB: OTHER DEVELOPMENTS

19.1.8 TITAN INTERNATIONAL, INC.

TABLE 441 TITAN INTERNATIONAL, INC.: BUSINESS OVERVIEW

FIGURE 73 TITAN INTERNATIONAL, INC.: COMPANY SNAPSHOT

TABLE 442 TITAN INTERNATIONAL, INC.: PRODUCTS OFFERED

TABLE 443 TITAN INTERNATIONAL, INC.: NEW PRODUCT DEVELOPMENTS

TABLE 444 TITAN INTERNATIONAL, INC.: DEALS

19.1.9 NOKIAN

TABLE 445 NOKIAN: BUSINESS OVERVIEW

FIGURE 74 NOKIAN: COMPANY SNAPSHOT

TABLE 446 NOKIAN: PRODUCTS OFFERED

TABLE 447 NOKIAN: NEW PRODUCT DEVELOPMENTS

TABLE 448 NOKIAN: OTHER DEVELOPMENTS

19.1.10 CEAT

TABLE 449 CEAT: BUSINESS OVERVIEW

FIGURE 75 CEAT: COMPANY SNAPSHOT

TABLE 450 CEAT: PRODUCTS OFFERED

TABLE 451 CEAT: NEW PRODUCT DEVELOPMENTS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

19.2 OTHER PLAYERS

19.2.1 DOUBLE COIN TIRE GROUP LTD.

TABLE 452 DOUBLE COIN TIRE GROUP LTD.: COMPANY OVERVIEW

19.2.2 EUROTIRE

TABLE 453 EUROTIRE: COMPANY OVERVIEW

19.2.3 MAGNA TYRES GROUP

TABLE 454 MAGNA TYRES GROUP: COMPANY OVERVIEW

19.2.4 CARLISLE

TABLE 455 CARLISLE: COMPANY OVERVIEW

19.2.5 FIRESTONE

TABLE 456 FIRESTONE: COMPANY OVERVIEW

19.2.6 TECHKING TIRES LTD.

TABLE 457 TECHKING TIRES LTD.: COMPANY OVERVIEW

19.2.7 TRIANGLE TIRE

TABLE 458 TRIANGLE TIRE: COMPANY OVERVIEW

19.2.8 MRF

TABLE 459 MRF: COMPANY OVERVIEW

19.2.9 JK TIRE & INDUSTRIES LTD.

TABLE 460 JK TIRE & INDUSTRIES LTD.: COMPANY OVERVIEW

19.2.10 APOLLO TYRES LTD.

TABLE 461 APOLLO TYRES LTD.: COMPANY OVERVIEW

19.2.11 BALKRISHNA INDUSTRIES LTD.

TABLE 462 BALKRISHNA INDUSTRIES LTD.: COMPANY OVERVIEW

19.2.12 MAXXIS INTERNATIONAL

TABLE 463 MAXXIS INTERNATIONAL: COMPANY OVERVIEW

19.2.13 LINGLONG TIRE

TABLE 464 LINGLONG TIRE: COMPANY OVERVIEW

19.2.14 QINGDAO RHINO TIRE CO., LTD.

TABLE 465 QINGDAO RHINO TIRE CO., LTD.: COMPANY OVERVIEW

19.2.15 OTANI TIRE CO. LTD.

TABLE 466 OTANI TIRE CO. LTD.: COMPANY OVERVIEW

19.2.16 BELSHINA

TABLE 467 BELSHINA: COMPANY OVERVIEW

20 APPENDIX (Page No. - 393)

20.1 KEY INDUSTRY INSIGHTS

20.2 DISCUSSION GUIDE

20.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

20.4 CUSTOMIZATION OPTIONS

20.4.1 OTR TIRES MARKET, BY ASPECT RATIO

20.4.1.1 28

20.4.1.2 30

20.4.1.3 34

20.4.1.4 38

20.4.1.5 42

20.4.1.6 46

20.4.1.7 50

20.4.2 OTR TIRES MARKET, BY SUPPLY SIDE

20.4.2.1 OEM

20.4.2.2 Aftermarket

20.4.3 DETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 3)

20.5 RELATED REPORTS

20.6 AUTHOR DETAILS

The study involves four main activities to estimate the current size of the OTR Tires Market. Exhaustive secondary research was done to collect information on the market, such as tire types and their applications in multiple industries. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered under this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to in this research study include Organisation Internationale des Constructeurs d'Automobiles (OICA); Consumer Specialty Products Association; SAE International; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. The secondary data was collected and analyzed to arrive at the overall market size, which is further validated by primary research. Trade websites and technical articles have been used to identify and collect information useful for an extensive commercial study of the OTR Tires Market.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the OTR Tires Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand- (vehicle manufacturers) and supply-side (OTR Tire manufacturers) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 70% and 30% of the primary interviews were conducted from the supply and demand sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administration strived to provide a holistic viewpoint in reports while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, has led to the findings delineated in the rest of this report:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value and volume of the OTR tires market and other dependent submarkets, as mentioned below:

- The Bottom-Up Approach Was Used To Estimate And Validate The Size Of The OTR Tires Market. The Market Size By Application, In Terms Of Volume, Was Derived By Estimating The Annual Sales (Units) Of Construction And Mining Equipment, Agriculture Tractors, Industrial Equipment, And Atvs At The Country Level. This Was Further Multiplied By The Regional-Level Penetration Of OTR Tires/Tracks In Each Application (Construction And Mining Equipment, Agriculture Tractors, Industrial Equipment, And Atvs).

- The Country-Level Market By Application (Volume) Was Multiplied With The Country-Level Average Selling Price (ASP) For Each Application To Derive The Market For Each Application By Value.

- The Summation Of The Country-Level Market Would Help Derive The Regional Level, And Then Further Addition Provided The Global Market By Application (Construction And Mining, Agriculture Tractors, Industrial Equipment, And Atvs). The Total Value Of Each Country Was Then Summed Up To Derive The Total Value Of The OTR Tires Market By Application.

- All Key Macro Indicators Affecting The Revenue Growth Of The Market Segments And Subsegments Were Accounted For, Viewed In Extensive Detail, Verified Through Primary Research, And Analyzed To Get The Validated And Verified Quantitative And Qualitative Data.

- The Gathered Market Data Was Consolidated And Added With Detailed Inputs, Analyzed, And Presented In This Report.

OTR Tires Market Size: Bottom-Up Approach (Application and Region)

To know about the assumptions considered for the study, Request for Free Sample Report

OTR Tires Market Size: Top-Down Approach (RIM Size)

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact data for the market by value for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the off-the-road (OTR) tires market with respect to individual growth trends and prospects and determine the contribution of each segment to the total market.

- To forecast the OTR tires market size by volume and value based on

- Equipment Type (Articulated Dump Trucks, Asphalt Finishers, Backhoe Loaders, Motor Graders, Rigid Dump Trucks, RTLT-Telescopic, Skid-steer Loaders, Wheeled Excavators, Wheeled Loaders <80 HP, Wheeled Loaders >80 HP, Agriculture Tractors, and Others)

- Agriculture Tractors Tires, By Power Output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, and >250 HP)

- Agriculture Tractors Tracks, By Power Output (131–250 HP, and >250 HP)

- Industrial Equipment, By Type (Forklifts, Aisle Trucks, Tow Tractors, and Container Handlers)

- Tire Type (Radial, Bias, and Solid)

- Rim Size (Up to 30 Inches, 30–50 Inches, and Above 50 Inches)

- Retreading, By Process (Pre-cure and Mold Cure)

- Retreading, By Application (Construction and Mining Equipment and Agriculture tractors)

- By Application (Construction and Mining Equipment, Agriculture Tractors, Industrial Equipment, and All Terrain Vehicles)

- Aftermarket, By Application (Construction)

- By Region - Asia Pacific (China, India, Japan, Australia, South Korea, Indonesia, and Rest of Asia Pacific), Europe (Germany, UK, France, Spain, Italy, Poland, Turkey, Russia, and Rest of Europe), North America (US, Canada, and Mexico), and Rest of the World (Brazil, Chile, Peru, Argentina, South Africa, UAE, Saudi Arabia)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with Porter’s Five Forces analysis, trade analysis, trends/disruptions impacting buyers, case studies, patent analysis, supply chain analysis, market ecosystem, regulatory analysis, and technology trend

- To analyze the market share of leading players in the market and evaluate the competitive leadership mapping

- To strategically analyze the key player strategies/right to win and company revenue

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the OTR tires market

Customization Option

OTR Tires Market, By Aspect Ratio

- 28

- 30

- 34

- 38

- 42

- 46

- 50

OTR Tires Market, By Supply-Side

- OEMs

- Aftermarkets

Detailed Analysis and Profiling of Additional Market Players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in OTR Tires Market