Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles

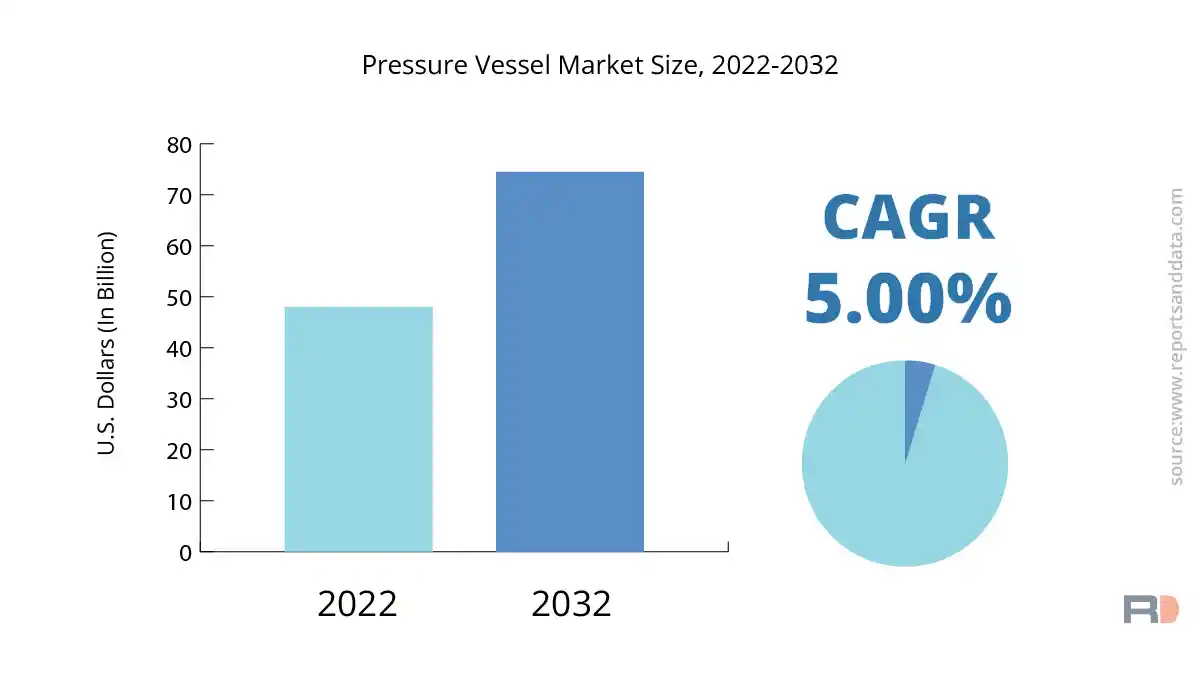

The global pressure vessel market size was USD 48 Billion in 2022 and is expected to reach USD 74.46 Billion in 2032, and register a rapid revenue CAGR of 5% during the forecast period. Rising demand from several end-use industries, including chemical, Oil & Gas (O&G), and energy, among others, is a major factor driving market revenue growth.

Containers called pressure vessels are made to retain gases or liquids under high pressure, which are essential to smooth and secure running of numerous industrial operations. Pressure vessels are becoming more in demand due to rising need for chemicals and rapid growth in the chemical industry. The energy industry is a major user of pressure vessel because of rising demand for power generation.

In addition, adoption of cutting-edge manufacturing processes and materials is another factor driving revenue growth of the market. Creation of strong and lightweight pressure vessels is made possible by development of novel and sophisticated materials such as Composites. The efficiency of manufacturing process is also being increased through developments in welding and fabrication technologies, which lowers the overall cost of production.

Moreover, rising demand for pressure vessels in the nuclear power sector is also expected to drive market revenue growth. Pressure vessels are necessary in the nuclear power sector to safely store and transport radioactive materials and nuclear fuel. Furthermore, rising need for strong and Lightweight Materials for aircraft manufacturing is rising demand for pressure vessels in the aerospace sector.

However, safety worries and regulatory constraints are major factors, which could restrain market revenue growth. In addition, high cost of pressure vessel manufacture , availability of less expensive alternatives, and shortage of experienced workers are other factors, which could restrain market revenue growth.

The global pressure vessel market has been divided into boilers, nuclear reactors, separators, storage tanks, and others based on the kind of product. Among these, the segment for storage tanks contributed a sizably large portion of revenue in 2021.

Throughout the anticipated period, the storage tank segment is anticipated to maintain its dominant position in the pressure vessel market. The expansion of this market is anticipated to be fueled by the rising demand for storage tanks across numerous industries, including water treatment, chemical, and oil and gas. Many liquids and gases, including water, chemicals, refined goods, and crude oil, are kept in storage tanks. The need for storage tanks is growing along with the demand for these commodities on a global scale. The demand for storage tanks to store energy produced by these sources is also being driven by the increasing attention being paid to Renewable Energy sources like wind and solar power. The demand for storage tanks is also anticipated to rise as LNG (liquefied natural gas) is used more frequently as a fuel.

Throughout the projection period, the boilers segment is anticipated to experience considerable revenue growth. Cleaner and more efficient boilers are becoming increasingly popular as a result of rising energy demand and increased focus on lowering carbon emissions. Steam or hot water produced by boilers is then utilised to heat or produce electricity. The demand for electricity and heating is predicted to increase across a number of sectors, including power generating, chemical manufacturing, and food processing.

Throughout the projection period, the nuclear reactors segment is anticipated to have moderate revenue growth. The deployment of nuclear power is being driven by the rising demand for clean energy and the increased focus on lowering carbon emissions. Electricity is produced by nuclear reactions in nuclear reactors. The global demand for power is predicted to rise, which will fuel the nuclear reactors market's expansion.

Throughout the projected period, the separators segment is anticipated to experience consistent revenue growth. In the oil and gas business, separators are frequently used to separate gases and liquids. Separators are predicted to expand in popularity due to rising oil and gas demand as well as increased focus on increasing oil recovery rates.

Throughout the projection period, revenue growth in the others sector, which comprises pressure vessels used in numerous other industries such as pulp and paper, food and beverage, and pharmaceuticals, is anticipated to be moderate. The expansion of the other category is anticipated to be fueled by the rising demand for these industries.

The oil & gas, chemical, power generation, pharmaceutical, and others segments of the global pressure vessel market have been created based on end-use. Among these, the oil and gas segment's revenue share was among the most substantial in 2021.

Throughout the forecast period, the oil & gas sector is anticipated to maintain its dominance of the pressure vessel market. This sector is expanding as a result of the rising demand for oil and gas around the world. The storage, transportation, and processing of oil and gas are only a few of the numerous uses for pressure vessels in the oil and gas sector. The oil & gas segment is anticipated to develop as a result of rising exploration and production operations as well as rising demand for oil and gas.

Throughout the projection period, the chemical segment is anticipated to experience significant revenue growth. In the chemical industry, pressure vessels are frequently used for a variety of tasks include storing, mixing, and reacting with chemicals. The chemical segment is anticipated to increase as a result of the expanding need for chemicals across numerous industries, including pharmaceuticals, polymers, and paints & coatings.

Throughout the projection period, the power generating segment is anticipated to have moderate revenue growth. Boilers, steam turbines, and nuclear reactors are just a few of the many applications for pressure vessels in the power generating sector. The power generation segment is anticipated to develop as a result of the rising global demand for electricity.

Throughout the projection period, the pharmaceutical segment is anticipated to experience consistent revenue growth. For a variety of purposes, including the processing and storage of pharmaceutical goods, pressure vessels are frequently employed in the pharmaceutical business. The pharmaceutical market is anticipated to rise as a result of rising demand for pharmaceutical products and increased focus on quality assurance and legal compliance.

Throughout the projection period, revenue growth in the others category, which comprises pressure vessels used in numerous other industries like food and beverage, pulp and paper, and marine, is anticipated to be moderate. The expansion of the other category is anticipated to be fueled by the rising demand for these industries.

Throughout the forecast period, the regular Gypsum Board segment is anticipated to maintain its commanding revenue share in the worldwide gypsum board market by product type. Gypsum board that resists moisture, fire, and other hazards has been separated from conventional gypsum board in the market. The segment of standard gypsum board had the greatest revenue share in 2021 and is anticipated to keep leading the market during the projected period. The segment's wide range of uses, accessibility, and low cost all contribute to its popularity. Because to its great sound isolation, thermal insulation, and fire resistance, it is often utilised in construction for interior walls, ceilings, and partitions.

Throughout the projection period, the moisture-resistant gypsum board segment is anticipated to expand significantly. This section is utilised in high-humidity locations including bathrooms, kitchens, and laundry rooms to prevent moisture buildup. The demand for moisture-resistant gypsum board is anticipated to rise in response to the growing emphasis on green and energy-efficient buildings. In addition, it is anticipated that the increasing number of commercial building projects, including those for hotels and hospitals, will aid in the segment's expansion.

Over the projection period, the fire-resistant gypsum board segment is also anticipated to have considerable expansion. In places where fire protection is essential, such as stairwells, corridors, and fire-rated dividers, this component is utilised to stop the spread of fire. The need for fire-resistant gypsum board is anticipated to rise as building standards and fire safety laws proliferate in different nations. The segment is also anticipated to grow as a result of the rising demand for high-performance building materials and the expanding use of gypsum board in green buildings.

Products including soundproof gypsum board, impact-resistant gypsum board, and mold-resistant gypsum board are included in the others sector. Certain advantages like noise reduction, impact resistance, and mold avoidance are provided by these goods. Throughout the forecast period, the demand for these goods is anticipated to be driven by the rising demand for high-quality building materials and the expanding trend of smart homes and buildings.

Residential is predicted to continue to have a disproportionate share of the global gypsum board market by application during the projected period. Residential, commercial, and industrial applications make up the market segments. The residential market had the largest revenue share in 2021, and it is anticipated that it would continue to rule the market throughout the projection period. The rising housing demand and the escalating appeal of interior design in homes are to blame for the segment's success. Due to its great sound isolation, thermal insulation, and fire resistance, gypsum board is frequently used in residential construction for walls, ceilings, and partitions.

During the forecast period, the commercial segment is anticipated to experience significant expansion. Applications in this area include those for workplaces, shops, and public structures. Gypsum board demand in commercial applications is anticipated to be driven by an increase in commercial development projects and the push towards green buildings. Because to its toughness, fire resistance, and simplicity of installation, gypsum board is employed in commercial construction.

Throughout the projection period, the industrial segment is also anticipated to have considerable expansion. Applications including factories, warehouses, and manufacturing facilities are included in this sector. Due to its qualities of fire resistance, thermal insulation, and noise reduction, gypsum board is employed in industrial building. Gypsum board demand in industrial applications is anticipated to be driven by the rising trend of green manufacturing and the rising need for industrial development in emerging nations.

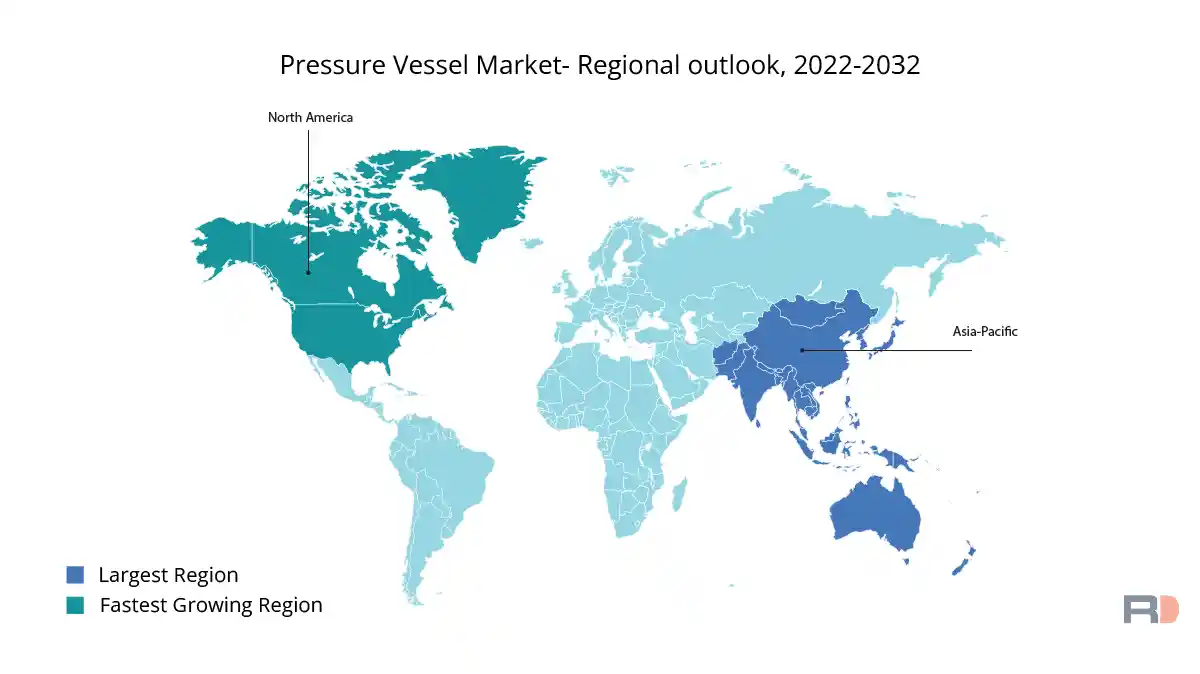

Over the projected period, the Asia Pacific region is anticipated to lead the worldwide pressure vessel market. The rising demand from the chemical, oil and gas, and energy sectors is what's fueling the region's expansion. Due to the increase in population, urbanization, and industrialization in the area, the demand for pressure vessels is anticipated to increase. Pressure vessel demand will also increase significantly as a result of the expansion of the building and infrastructure sectors in the region, notably in developing nations like China and India.

The Asia Pacific region's biggest pressure vessel market is China. The pressure vessel market is expanding as a result of the nation's robust manufacturing sector and low production costs. Additionally, it is anticipated that the region's need for pressure vessels will increase as a result of the Chinese government's commitment to invest extensively in infrastructure development. The development of the nation's chemical, energy, and oil and gas industries is another factor boosting the demand for pressure vessels.

Another significant pressure vessel market in the Asia Pacific region is India. Pressure vessels are in high demand as a result of the nation's expanding population and urbanization, which are also pushing up demand for power and energy. The region's need for pressure vessels is also being fueled by the Indian government's emphasis on the growth of the industrial sector in the nation.

Throughout the forecast period, North America's share of the pressure vessel market is anticipated to expand significantly. The rising demand from the oil and gas, chemical, and power generation industries is what's fueling the region's expansion. The growing need for sustainable energy sources is also having a big impact on the region's energy sector. The need for pressure vessels for natural gas storage and transit is being driven by this.

Pressure vessels have a sizable market in Europe as well, particularly in nations like Germany, France, and the UK. The rising demand from the chemical, food & beverage, and pharmaceutical industries is what fuels the region's growth. The region's pressure vessel industry is expanding as a result of the strict rules the European Union has placed on the usage of pressure vessels in these industries.

The global pressure vessel market is highly competitive, with several large and medium-sized players dominating the market. Major players in the pressure vessel market are adopting various strategies, such as mergers & acquisitions, strategic agreements & contracts, and introducing advanced technologies to gain a competitive advantage. Some of the major companies included in the global pressure vessel market report are:

This report offers historical data and forecasts revenue growth at a global, regional, and country level, and provides analysis of market trends in each of segments and sub-segments from 2019 to 2032. For the purpose of this report, Reports and Data has segmented the global pressure vessel market based on product type, end-use, and region:

| PARAMETERS | DETAILS |

| The market size value in 2022 | USD 48 Billion |

| CAGR (2022 - 2032) | 5% |

| The Revenue forecast in 2032 |

USD 74.46 Billion |

| Base year for estimation | 2022 |

| Historical data | 2020-2021 |

| Forecast period | 2022-2032 |

| Quantitative units |

|

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Product Type Outlook, End-use Outlook, Regional Outlook |

| By Product Type Outlook |

|

| By End-use Outlook |

|

| Regional scope | North America; Europe; Asia Pacific; Latin America ; Middle East & Africa |

| Country scope | U.S.; Canada; U.K.; Germany; France; BENELUX; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE; Turkey |

| Key companies profiled | ABB Group, Alfa Laval AB, Doosan Heavy Industries & Construction Co. Ltd, Hitachi Zosen Corporation, Mitsubishi Heavy Industries Ltd, Babcock & Wilcox Enterprises Inc, General Electric Company, Larsen & Toubro Limited, Suzhou THVOW Technology Co. Ltd, Zhangjiagang Furui Special Equipment Co. Ltd, Pressure Vessel Technologies LLC |

| Customization scope | 10 hrs of free customization and expert consultation |

Facing issues finding the exact research to meet your business needs? Let us help you! One of our Research Executives will help you locate the research study that will answer your concerns. Speak to Analyst Request for Customization

Request a FREE Sample here to understand what more we have to offer over competition…

upto20% OFF

upto20% OFF

Want to curate the report according to your business needs

Report Description + Table of Content + Company Profiles