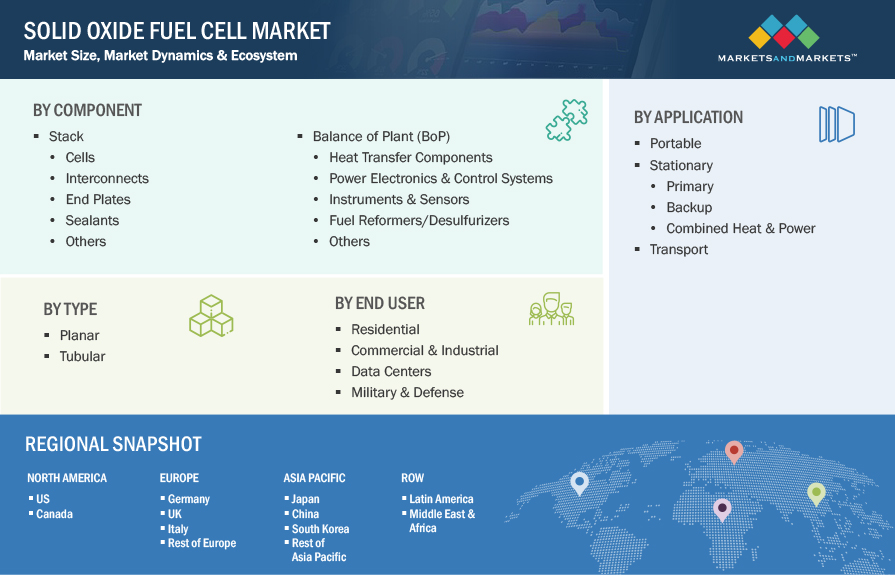

Solid Oxide Fuel Cell Market by Type (Planar, Tubular), Component (Stack, BOP), Application (Stationary, Portable, Transport), End User (Commercial & Industrial, Data Centers, Military & Defense, Residential) & Region - Global Trends & Forecasts to 2028

Solid Oxide Fuel Cell Market Size, Share, Growth Report & Forecast

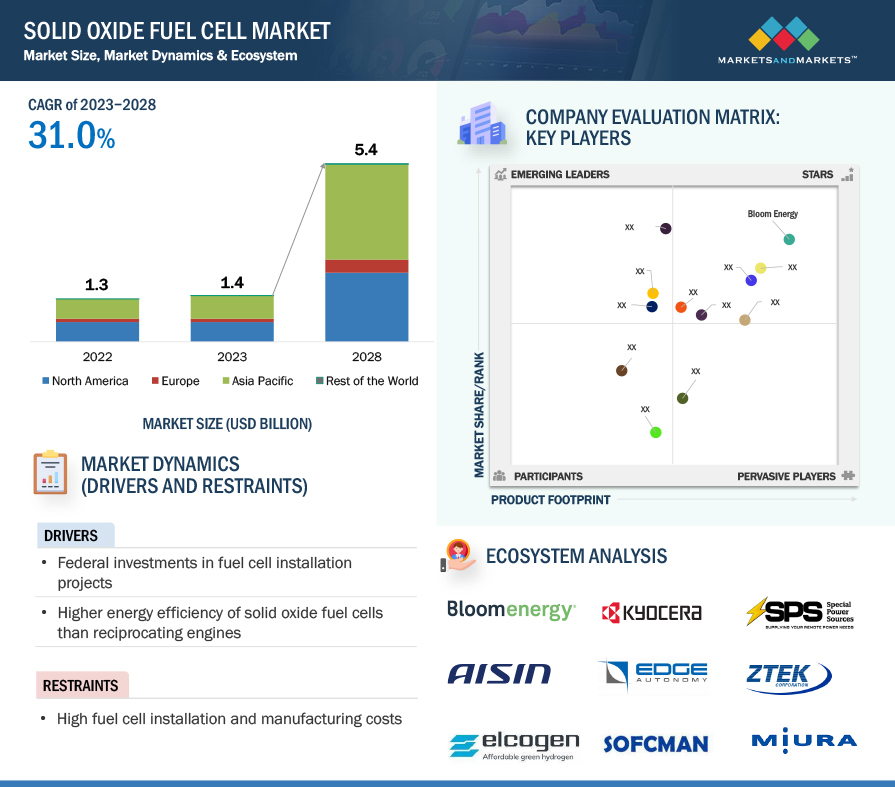

[239 Pages Report] The global Solid oxide fuel cell market is estimated to grow from USD 1.4 billion in 2023 to USD 5.4 billion by 2028; it is expected to record a CAGR of 31.0% during the forecast period. The supportive government policies and subsidies for R&D and applications such as power generation play a vital role in the growth of solid oxide fuel cell market. Furthermore, Japan and South Korea are the prime country-level markets in Asia Pacific owing to the large commercialization of SOFC in the regions.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Solid Oxide Fuel Cell Market Growth Dynamics

Driver: Introduction of stringent carbon emission norms

SOFC is a clean technology incorporating conventional fuels, such as natural gas. They have a negligible level of carbon emissions than other types of natural gas-fired technologies used typically for power generation. This is due to the direct conversion of chemical energy into electrical energy without a combustion process. One of the key drivers for the demand for low-emission technologies, such as SOFC, is stringent carbon emission norms prevalent across multiple regions. North America, Europe, and Asia Pacific have formulated several strict regulations to limit carbon emissions from power generation operations. Such regulations also specify the permissible diesel generator noise levels to reduce noise pollution caused by diesel genset operations. Different countries/regions have their own set of regulations and policies.

For instance, the European Union has set a target of reducing carbon emissions and related pollution by 20% by 2030. In the US, stringent norms for carbon emissions have been a driver for the growth of SOFCs. In addition, the growing awareness regarding the impact of carbon emissions on climate change has influenced end users to incorporate clean energy sources into their energy mix. Electricity and heat generation accounted for the absolute rise in emissions in 2022. Emissions from the combined heat and power (CHP) sectors increased by 1.8% (or 261 Mt), hitting an all-time high of 14.6 Gt. Gas-to-coal conversion was the primary driver of this expansion in many regions: CO2 emissions from coal-fired power generation increased by 2.1%, especially in emerging and developing nations. Natural gas emissions in the power sector stayed close to 2021 levels. The rapid deployment of renewables across all regions resulted in a continued drop in carbon intensity, with renewables meeting 90% of worldwide growth in energy demand. Solar PV and wind generation grew by about 275 TWh, resulting in an estimated 465 Mt reduction in power sector emissions. Thus, stringent norms for carbon emissions have been a driver for the growth of SOFCs.

Restraint: Availability of alternatives

SOFCs have a smaller market share in the overall fuel cell market due to the limited number of end-use applications they can cater to. The market is dominated by proton exchange membrane fuel cells (PEMFC), which have at least 65% of the global market share because of their versatile usage in various end-use segments. PEMFC and direct methanol fuel cells (DMFC) are better suited for military applications, especially in portable and unmanned systems, as they operate at lower temperatures. Other technologies, such as molten carbonate fuel cells (MCFC) and phosphoric acid fuel cells (PAFC), compete with SOFC technology in the US, Japan, and South Korea. MCFC technology is in stiff competition with SOFC regarding installation cost per kilowatt and applications, such as combined heat and power (CHP) and power.

Opportunities: Increasing electricity consumption in data centers

Data centers and commercial & industrial sectors are among the fastest-growing end users of power generation solutions in the US. Data centers are highly power-consuming and power-intensive. Additionally, data centers require uninterrupted power to minimize the loss of valuable data.

According to the International Energy Agency (IEA), electricity consumption from data centers in 2022 was estimated to be approximately 240–340 TWh, or almost 1–1.3% of the demand for electricity worldwide. Due to the high power consumption, data centers opt for cost reductions by adopting distributed power generation, particularly fuel cells. Fuel cells, including SOFCs, have previously seen tremendous growth in the US. Its adoption for data centers by Google (US), IBM (US), and Equinix (US) has stimulated growth at the fastest rate. Currently, the overall SOFC adoption by data centers is still minuscule with respect to the total data centers in the US, making it one of the most lucrative businesses. In the military sector, stationary and portable power generation by SOFCs is on the rise. Additionally, the need for noiseless and efficient power generation for military applications creates an opportunity for SOFCs in this segment. Military & defense end users are increasingly adopting SOFC-powered devices for portable applications.

Challenges: Fuel cell degradation and carbon dusting

Many challenges are associated with solid oxide fuel cells as they operate at high temperatures of around 1,000°C. Maintaining the temperature is directly related to performance, and the possibility of material degradation poses a significant challenge. The difference in oxygen partial pressures creates the need for different materials for the anode and cathode, making material stability crucial. Maintaining the stability of solid electrolytes in low-oxygen partial pressures and minimizing the chances of electrolytes reacting with other components are also areas of concern. The possibility of degradation, caused by changes in the size and shape of nickel particles due to sintering and morphological changes in the anode, creates stress and leads to fuel impurities and cracking during redox cycling.

Also, maintaining stability in interconnects in oxidizing and reducing environments, as they are exposed to anode and cathode, is challenging. Ceramic interconnects provide higher stability than metallic interconnects but at a higher cost. One of the concerns while using ceramic interconnects is carbon dusting. Finally, ensuring the matching of the coefficient of thermal expansion of sealant with other SOFC components is also crucial. These material challenges associated with solid oxide fuel cells will likely pose a significant challenge for the SOFC market.

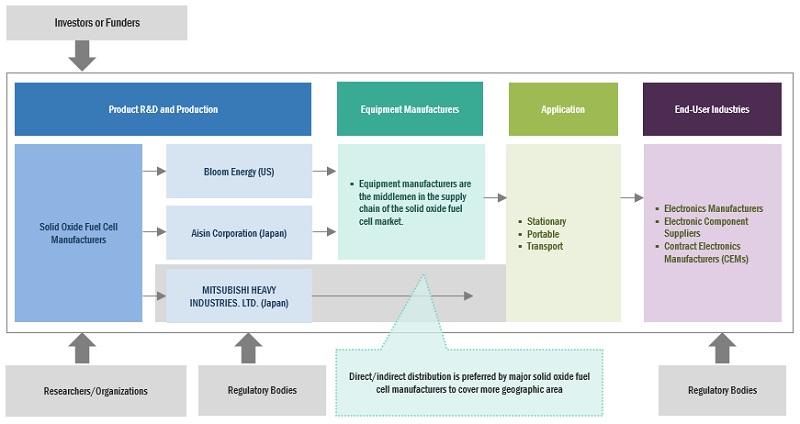

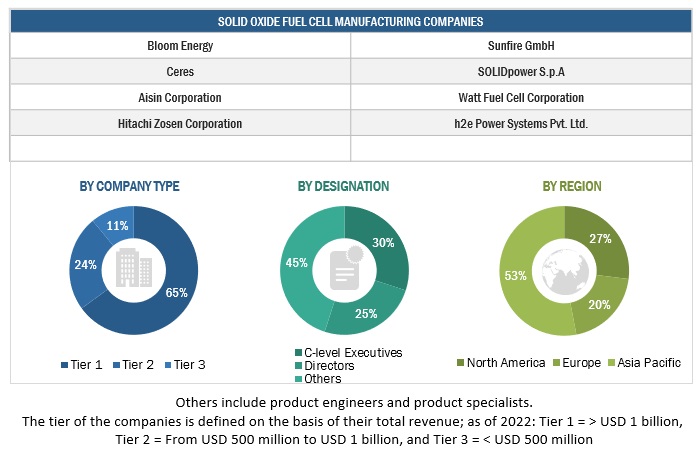

Solid oxide fuel cell Market Ecosystem

Prominent companies in this market include well-established, financially stable solid oxide fuel cell manufacturers. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Bloom Energy (US), AISIN CORPORATION (Japan), KYOCERA Corporation (Japan), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), and MIURA CO., LTD. (Japan).

The planar, by type, is expected to be the largest segment during the forecast period.

This report segments the solid oxide fuel cell market based on type into two types: planar and tubular. The planar segment is expected to be the largest segment during the forecast period. Because of its compact structure, the planar solid oxide fuel cell demand is likely to be significant. As its construction is relatively simple, it is the most commonly used solid oxide fuel cell type. Planar SOFCs are extensively used in stationary power applications due to superior power densities and heavy system designs. The key players that manufacture SOFCs with planar geometry include Bloom Energy (US), Sunfire GmbH (US), SOLIDpower S.p.A. (Italy), and Convion Ltd. (Finland).

By end user, the data centers is expected to be the fastest growing during the forecast period

This report segments the solid oxide fuel cell market based on end user into three segments: residential, commercial & industrial, data centers and military & defense. The data centers is expected to grow at the fastest rate during the forecast period. The market for solid oxide fuel cell the data centers sector is primarily driven by growing demand of reliable, and high efficiency power. Owing to the emerging need to decrease carbon emissions, various manufacturers are continuously investing in the solid oxide fuel cell market

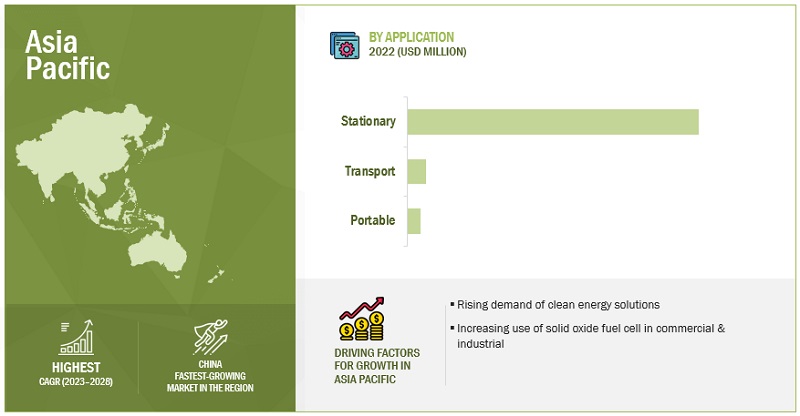

"Asia Pacific": The largest in the solid oxide fuel cell market"

Asia Pacific is expected to have the largest market share in the solid oxide fuel cell market between 2023–2028, followed by North America and Europe. Urbanization and population growth have resulted in the need for vast infrastructure development, which has propelled the electricity demand across the region. As per the Indian Electrical and Electronics Manufacturers’ Association (IEEMA), the electricity generation capacity in India is expected to increase from 200 GW in 2010 to over 800 GW by 2032 to fulfill the increasing demand for power. Thus, there is a need for a huge investment of approximately USD 300 billion in the next 3–4 years in power equipment manufacturing, which will increase the demand for solid oxide fuel cell.

Key Market Players

The solid oxide fuel cell market is dominated by a few major players that have a wide regional presence. The major players in the solid oxide fuel cell market include Bloom Energy (US), AISIN CORPORATION (Japan), KYOCERA Corporation (Japan), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), and MIURA CO., LTD. (Japan). Between 2018 and 2023, these companies followed strategies such as contracts, agreements, partnerships, mergers, acquisitions, and expansions to capture a larger share of the solid oxide fuel cell market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Thousand) |

|

Segments covered |

Solid oxide fuel cell market by type, component, application, end user and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies covered |

Bloom Energy (US), Mitsubishi Power (Japan), AISIN CORPORATION (Japan), Hitachi Zosen Corporation (Japan), Ceres (US), MIURA CO., LTD. (Japan), KYOCERA Corporation (Japan), Convion Ltd. (Finland), Elcogen AS (Estonia), SolydEra SpA (Italy), Watt Fuel Cell Corporation (US), h2e Power (India), Upstart Power, Inc. (US), FuelCell Energy, Inc. (US), Ningbo Suofuren Energy Technology Co., Ltd. (SOFCMAN) (China), WEICHAI POWER CO., LTD (China), Sunfire GmbH (Germany), ZTEK Corporation, Inc. (US), Special Power Sources (US), ADELAN (UK), Edge Autonomy (US), Robert Bosch GmbH (Germany), Doosan Fuel Cell Co., Ltd. (South Korea), POSCO ENERGY (South Korea), Cummins Inc. (US), Clara Venture Labs (Norway) |

This research report categorizes the solid oxide fuel cell market by type, component, application, end user and region.

On the basis of type:

- Planar

- Tubular

On the basis of component:

- Stack

- Balance of plant

On the basis of application:

- Commercial & Industrial

- Residential

- Military & Defense

- Data Centers

On the basis of region:

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In June 2023, Bloom Energy signed an agreement with Perenco, an independent oil & gas company, to deploy 2.5 megawatts (MW) of Bloom’s solid oxide fuel cell technology in England.

- In February 2023, WEICHAI POWER CO., LTD., a leading company of SOFC systems based in China, launched a stationary power SOFC system using Ceres technology. The newly launched SOFC system passed the EU CE certification.

- In January 2023, Elcogen AS signed an MOU with Korea Shipbuilding and Offshore Engineering (KSOE) and Fraunhofer Institute for Ceramic Technologies and Systems (IKTS) for developing green hydrogen production and emission-free power generation systems. As per the partnership, Elcogen AS will supply its solid oxide fuel cell (SOFC) and solid oxide electrolyzer cell (SOEC) technology.

- In July 2022, Aisin Corporation declared to acquire SBT Certification, an organization that sets Science Based Targets (SBTs). SBTs embody greenhouse gas emission-reduction goals that align with the scientifically established target outlined in the Paris Agreement.

- In June 2022, Bloom Energy installed a new 1 MW solid oxide fuel cell plant at the Maranello facilities of Ferrari, a sports car manufacturer. This plant provides 5% of the energy required for Ferrari’s production activities. This contributed to Ferrari’s aim of achieving carbon neutrality by 2030.

- In June 2022, Mitsubishi Power signed a contract with the gas- und Wärme-Institut Essen e.V. (GWI), a research institute working on heat and energy technology, under which it received an order to provide the first SOFC in Europe. The company laid the foundation of the SOFC system in 2021 and commenced its commercialization in June 2022.

Frequently Asked Questions (FAQ):

What is the current size of the solid oxide fuel cell market?

The current market size of the solid oxide fuel cell market is USD 1.3 billion in 2022.

What are the major drivers for the solid oxide fuel cell market?

Rising demand of backup power and primary power sources will be major drivers for the solid oxide fuel cell market.

Which is the largest region during the forecasted period in the solid oxide fuel cell market?

Asia Pacific is expected to dominate the solid oxide fuel cell market between 2023–2028, followed by Europe and North America. The increase in demand of consumer electronics in recent years is driving the region's market.

Which is the largest segment, by type, during the forecasted period in the solid oxide fuel cell market?

The planar segment is expected to be the largest market during the forecast period. Increased demand for solid oxide due to the increasing investments in renewable energy sources and the simple structure of planar SOFC are expected to drive the market for the type solid oxide fuel cell segment.

Which is the fastest application segment during the forecasted period in the solid oxide fuel cell market?

The transport segment is expected to be the fastest market during the forecast period. The increasing investment in advancing solid oxide fuel cell methods to meet the power unit demand would drive the demand for solid oxide fuel cells used in automotive industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved major activities in estimating the current size of the solid oxide fuel cell market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the solid oxide fuel cell market involved the use of extensive secondary sources, directories, and databases, such as Bloomberg, Factiva, IRENA, International Energy Agency, Statista Industry Journal, and The Fuel Cell Energy Review, E4Tech, to collect and identify information useful for a technical, market-oriented, and commercial study of the solid oxide fuel cell market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The solid oxide fuel cell market comprises several stakeholders, such as solid oxide fuel cell manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for solid oxide fuel cell in automotive, aerospace, defense & government services, wireless communication & infrastructure, consumer electronics, medical equipment manufacturing and energy sector applications. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the solid oxide fuel cell market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Solid Oxide Fuel Cell Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A solid oxide fuel cell (SOFC) is an electrochemical energy conversion device that generates power directly from fuel oxidation. During the electrochemical conversion, a solid or ceramic electrolyte material is inserted between the anode and cathode electrodes. This conversion technique directly generates power by oxidizing a fuel. SOFCs can also be considered as a form of flow battery as they continue to produce energy if the fuel is available and does not need to be recharged. In the market estimation, we have considered the system and the balance of plant costs.

The growth of the solid oxide fuel cell market during the forecast period can be attributed to the rising demand for backup power solutions in the commercial & industrial sector.

Key Stakeholders

- Ceramic and electrolyte manufacturers

- Environmental research institutes

- Fuel cell and stack manufacturers

- Government and research organizations

- Institutional investors/shareholders

- Power and energy associations

- Repair and maintenance service providers

- SOFC technology manufacturing companies

- Organizations, forums, alliances, and associations

- Research and consulting companies

- State and national regulatory authorities

Objectives of the Study

- To describe, segment, and forecast the solid oxide fuel cell market, by type, component, application, and end user, in terms of value

- To forecast the solid oxide fuel cell market, by type, in terms of volume

- To forecast the market across four key regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with country-level analysis

- To provide detailed information about key drivers, restraints, opportunities, and challenges influencing the solid oxide fuel cell market

- To strategically analyze the solid oxide fuel cell market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze the supply chain, trends/disruptions impacting customer business, market/ecosystem, pricing trends, and regulatory landscape pertaining to solid oxide fuel cells

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Solid Oxide Fuel Cell Market

What are the key technological and market trends shaping the global solid oxide fuel cell market?