Air compressor Market size is expected to reach USD 57 Billion by the end of 2036, growing at a CAGR of 5.5% during the forecast period, i.e., 2024-2036. In the year 2023, the industry size of the air compressor was USD 30 Billion. The industry growth is impelled by the increase in the construction and industrialization worldwide, as several industries are expected to expand along with may construction projects, and this can lead to high demand for air compressors as for several applications such as powering tools and equipment. As the construction sector holds the largest in the world economy, with about USD 10 trillion spent on construction-related goods and services every year, the growth averaged 1 percent a year over the past two decades as compared with 2.8 percent for the total world economy and 3.6 percent for manufacturing.

Furthermore, oil, mining, and gas industries have frequently demanded the air compressors for heavy tasks such as flushing mediums, aerating mud during underbalanced drilling, and air-pigging pipelines, which generally require high-pressure air to power such instruments and equipment in industries such as automotive, construction, and manufacturing.

Growth Drivers

challanges

|

Base Year |

2023 |

|

Forecast Year |

2024-2036 |

|

CAGR |

~5.5% |

|

Base Year Market Size (2023) |

~ USD 30 Billion |

|

Forecast Year Market Size (2036) |

~ USD 57 Billion |

|

Regional Scope |

|

Technology (Rotary, Reciprocating, Centrifugal)

The rotatory technology is estimated to gain a robust revenue share of 61% in the coming years owing to high-pressure ratios, high efficiency, and better control of flow and pressure. Moreover, rotary compressors used in the process industry use electric motor drivers. Compressors used in portable service use internal combustion engines. The use of rotary positive displacement compressors provides various advantages such as longer running time, lower maintenance and service costs, and lower energy consumption. This will allow for greater efficiency in the use of the available energy resources, leading to lower greenhouse gas emissions, as well as lower costs and improved competitiveness. Moreover, this allows for the production and availability of compressors with a wide range of configurations, sizes, and specifications, offering a greater choice for consumers. This can enable the selection of compressors as per the specific application and requirements, leading to more effective and efficient use of the system.

Lubrication (Oil free, Oil filled)

The oil-free segment is set to garner a notable share shortly and is likely to remain the second largest segment in the lubrication of the as the absence of oil and the use of dry powder lubrication can improve overall efficiency, reducing energy consumption and running costs. The use of dry powder lubricant does not require regular servicing and maintenance, reducing the downtime and costs associated with maintenance. Moreover, the oil-free design is a more eco-friendly and sustainable approach, as it reduces the use of oils or lubricants and decreases the risk of oil leakage or spills that can impact the environment.

End-users (Manufacturing industry, Home appliances, Food & beverage industry, Oil & gas industry, Energy industry, Semiconductors & electronics industry, Healthcare industry)

The manufacturing industry segment is estimated to hold a noteworthy share in the process of fabricating and assembling vehicles and their various parts to produce cars, trucks, buses, and other vehicles. Furthermore, in the electronics and appliance sector include assembly and welding operations, cleaning and drying components, and cooling process operations. The growing demand for electronic devices and appliances, such as mobile phones, refrigerators, and washing machines, contributes to the growth of air compressor market in this sector.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Lubrication |

|

|

End-users |

|

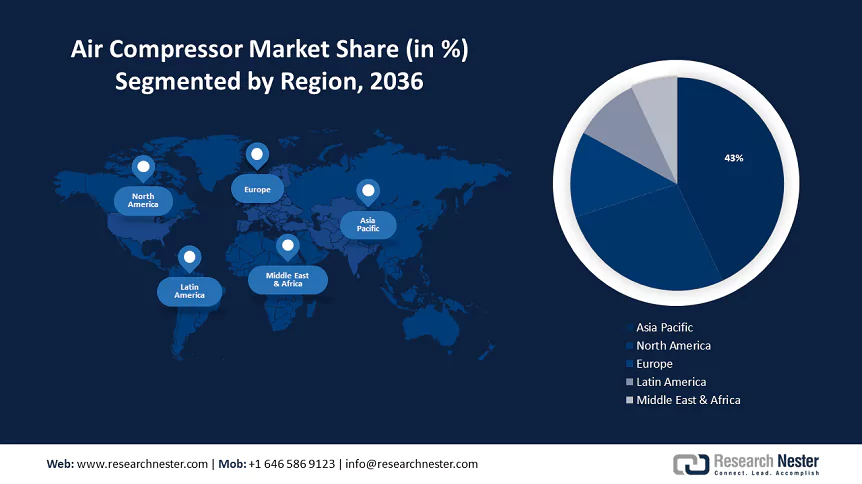

APAC Market Forecast

The air compressor market in Asia Pacific is estimated to have the largest share of approximately 43% in 2023, impelled by increasing demand for compressors from refineries and steel manufacturing plants, particularly in countries like China, India, and Japan. Countries like China are undergoing rapid industrialization, leading to a surge in energy demand and industrial activities, thereby boosting the demand for compressors in the manufacturing sector. Moreover, the region's growing investments in LNG, chemical, mining projects, and infrastructure development are fueling the demand for air compressors in various industries such as automotive, construction, electronics, and more. China is one of the world's most important nations in 2021, which contributed to the rise in LNG consumption. Natural gas LNG imports were approximately 94 billion cubic meters in 2020 and 109.5 billion cubic meters in 2021. This surge in demand caused China to overtake Japan as the world's largest importer of LNG. Demand has increased as a result of Chinese LNG buyers signing long-term contracts for more than 20 million tons per year.

North American Market Statistics

The North American air compressor market is estimated to be the second largest, during the forecast timeframe led by the demand for energy-efficient solutions in various industries like manufacturing, energy, and automotive. Furthermore, environmental regulations and a growing focus on sustainability are pushing industries to adopt energy-efficient air compressors to comply with regulations and reduce emissions, thus driving market demand. Along with the expansion of end-use industries like automotive production and food processing is creating a higher demand for air compressors in North America.

Author Credits: Rushikesh, Richa Gupta

FREE Sample Copy includes market overview, growth trends, statistical charts & tables, forecast estimates, and much more.

Have questions before ordering this report?