Laboratory Information System (LIS) Market by Product (Standalone, Integrated), Component (Services, Software), Delivery Mode (On-premise & Cloud-based), End User (Hospital Laboratories, Independent Laboratories, POLs) and Region - Global Forecast to 2028

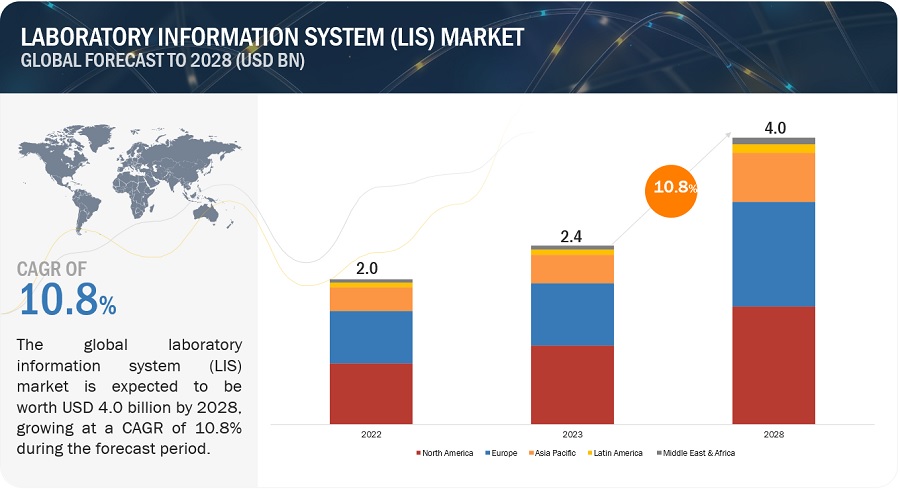

The global laboratory information system market in terms of revenue was estimated to be worth $2.4 billion in 2023 and is poised to reach $4.0 billion by 2028, growing at a CAGR of 10.8% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The expansion of molecular diagnostic techniques, including genomics and personalized medicine, and the need for automation and robotics in laboratories primarily drive the market growth. LIS helps in automating various laboratory processes, such as sample tracking, result management, and data analysis, leading to improved productivity and accuracy. Additionally, the growing need for integrated healthcare systems and the rising adoption of electronic health records (EHRs) are also driving the demand for LIS. Advancements in laboratory practices, including point-of-care testing, remote monitoring, and telemedicine, necessitate adaptable LIS solutions that can support these emerging trends and ensure secure and timely data transmission.

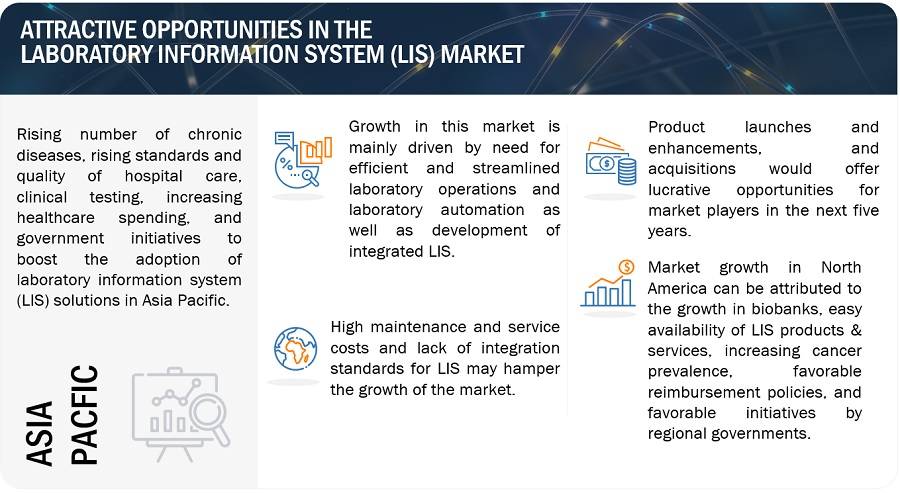

Attractive Opportunities in the Laboratory Information System (LIS) Market

To know about the assumptions considered for the study, Request for Free Sample Report

Laboratory Information System Market Dynamics

Driver: Development of integrated LIS

The demand for advanced data management solutions is on the rise with the ever-changing requirements of laboratories. As standalone LIS does not meet all laboratory requirements, modern and agile information systems are increasingly being adopted to run laboratories efficiently. This is particularly evident in the increasing integration of LIS with EHR. LIS within EHR is beneficial in financial and operational capabilities, expected to increase its adoption among healthcare providers. Integrated LIS solutions help ease lab workflow, provide standardized and quality diagnosis, enable simplified solution deployment, and help in reducing the cost associated with installing new and independent LIS systems. Moreover, integrated systems reduce the separate maintenance and service cost incurred on LIS systems.

Integrated solutions greatly assist in compliance with regulatory requirements in the life sciences industry. These solutions provide laboratory and enterprise information at a single point of access and eliminate the gaps in communication between enterprises and stakeholders. Other benefits include better laboratory workflows, reduction of the maintenance cost, easy retrieval of laboratory data, accelerated validation process, quality assurance of products, and regulatory compliance.

Restraint: Lack of integration standards for LIS

Although laboratory information systems have been around for several years, there still are numerous issues related to their integration and implementation. Various attempts are being made by associations such as SiLA (Standardization in Lab Automation) and the IQ Consortium (International Consortium for Innovation and Quality in Pharmaceutical Development) to introduce new interfaces and data management standards to facilitate the integration of these systems. However, as of now, the lack of integration standards is a major concern in the laboratory arena, and there is very little evidence of a universal solution emerging. This acts as a major barrier to the greater adoption of LIS among prospective end users. Currently, with no unified strategy, laboratories are largely continuing to follow conventional procedures, regardless of their efficiency.

Opportunity: Rising demand for personalized medicine

Personalized medicine involves using the uniqueness of each patient’s pathology and physiology to tailor treatment and prevention procedures for gaining optimal results. The need for personalized medicine is on the rise owing to the growth in the aging population and the increasing incidence of chronic diseases such as cancer. For these disease conditions, personalized medicine offers opportunities to provide targeted therapies to destroy tumor cells with less impact on other healthy cells. In personalized medicine, pathology data is required to prescribe the best possible therapy. LIS solutions can be beneficial in this regard as these solutions offer advanced functions, such as digital pathology and companion algorithms, for specimen slide diagnosis to help detect cancer cells and thus enable early diagnosis.

Personalized medicine is gaining importance across the globe and has attracted significant support. The Marcus Program in Precision Medicine Innovation (MPPMI) aims to foster innovation in precision medicine by fostering creative, high-risk, high-impact team science projects supporting the precision medicine continuum. Thus, the growth in demand and rising support for personalized medicine are expected to offer significant growth opportunities to players operating in the LIS market.

Challenge: Requirement of specialized LIS solutions

Most medium and large clinical diagnostic laboratories comprise specialized laboratory units for chemistry, microbiology, and hematology. These laboratories have unique workflow needs and hence require unique LIS solutions to meet these requirements. Furthermore, some laboratories require customizable non-clinical functionalities such as client connectivity and billing. Coming up with solutions that cater to the unique requirements of these specialized laboratory units is a major challenge for LIS vendors.

Laboratory Information System (LIS) Market Ecosystem

The ecosystem of the LIS market comprises data center providers, cloud professional service vendors, software developers, medical institutions, healthcare providers, blood banks, nursing homes, and independent laboratories. Laboratory information system vendors offer different modules and provide access to trained professionals and industry experts at a lower cost. These vendors have large-scale technical teams to develop and support the needs of their customers. These vendors leverage advanced technologies to deliver greater efficiency and offer services to end users to maximize laboratory efficiency and productivity. Product launches and enhancements, and acquisitions are the major strategies these vendors use to provide end-to-end solutions in the laboratory information system (LIS) market.

Based on the component, the software segment of laboratory information system industry is expected to register the highest CAGR during the forecast period.

The software segment of laboratory information system market is anticipated to register the highest CAGR during the forecast period. This is primarily owing to the increasing demand for user-friendly, comprehensive, and integrated LIS software. A typical LIS software performs operations such as registration of test requests; production of specimen collection sheets and identification labels; confirmation of specimen collection; production of aliquot labels; workload inquiry; production of worksheets; manual as well as automated entry of test results; results inquiry; and generation of preliminary reports, final reports, statistical reports, and daily activities reports, and billing.

Based on delivery mode, the on-premise segment is anticipated to dominate the laboratory information system industry in 2023.

Based on deployment, the laboratory information system market is segmented into on-premise LIS and cloud-based LIS. The on-premises segment is expected to dominate the laboratory information system (LIS) market from 2023 to 2028 due to security concerns among users and higher control over the system. On-premise models offer multivendor architecture, which lowers the risk of data breaches and external attacks. Buyers mainly opt for these delivery models due to the security benefits associated with them. The on-premises segment is expected to dominate the healthcare data monetization market from 2023 to 2028 due to security concerns among users and higher control over the system. On-premise LIS solutions offer benefits such as increased control and security over sensitive data, compliance with regulatory requirements, faster data processing, and the ability to customize and tailor the solution to specific laboratory needs,

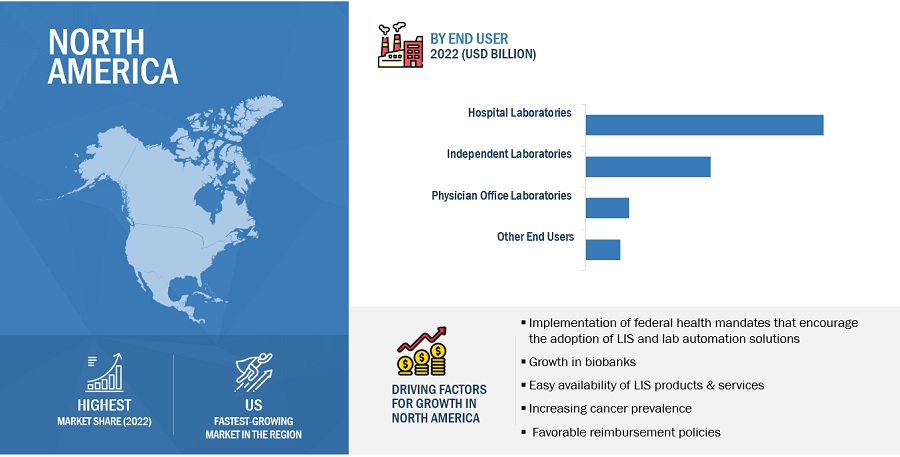

Hospital laboratories are expected to acquire the largest size of laboratory information system industry market by end-user.

Based on the end user, the laboratory information system market is broadly segmented into hospital laboratories, independent laboratories, physician office laboratories (POLs), and other end users (blood banks, retail clinics, public health labs, and nursing homes). The hospital laboratories segment is expected to dominate the market during the forecast period. The use of LIS in hospitals and hospital laboratories can significantly reduce waiting times for patients and improve the quality of diagnostics. Moreover, LIS can facilitate long-distance discussions with experts and make digital slide images of specimens (such as blood smears or frozen sections) available online. Owing to these benefits, hospitals across the world are increasingly adopting LIS.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to account for the largest share in the laboratory information system industry in 2023

The global laboratory information system market has been segmented based on region: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2023, North America is expected to account for the largest market share, followed by Europe. The large share of North America in the global laboratory information system (LIS) market can be attributed to the growth in biobanks, easy availability of LIS products & services, increasing cancer prevalence, favorable reimbursement policies, and favorable initiatives by regional governments. Moreover, most of the leading players in the laboratory information system (LIS) market have their headquarters in North America.

The laboratory information system market is dominated by a few globally established players such as Orchard Software Corporation (US), Clinisys (US), Oracle Corporation (US), Computer Programs and Systems, Inc. (US), and CompuGroup Medical (Germany) among others.

Scope of the Laboratory Information System Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$2.4 billion |

|

Projected Revenue by 2028 |

$4.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.8% |

|

Market Driver |

Development of integrated LIS |

|

Market Opportunity |

Rising demand for personalized medicine |

This research report categorizes the global laboratory information system market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Standalone LIS

- Integrated LIS

By Component

- Software

- Services

By Delivery Mode

- On-premise LIS

- Cloud-based LIS

By End User

- Hospital Laboratories

- Independent Laboratories

- Physician Office Laboratories

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Laboratory Information System Industry

- In May 2023, Clinisys acquired Promium, a provider of laboratory information management systems for environmental and analytical testing laboratories. This acquisition strengthens Clinisys' position in public health and toxicology diagnostics and supports its global expansion.

- In January 2023, Orchard Software Corporation announced the release of its new Enterprise Toxicology solution, which aimed to enhance patient care in toxicology laboratories by providing information system tools. The solution offers features such as an integrated workflow engine, plate mapping tools for patient safety, medication consistency interpretation, and customizable report formats.

- In November 2022, Oracle Cerner and LabCorp formed a new collaboration to streamline lab operations for a leading nonprofit Catholic health system. Labcorp would manage hospital-based laboratories in 10 states using Cerner's laboratory information system (LIS), aiming to enhance patient care and improve lab efficiency.

- In November 2022, CompuGroup Medical (CGM) announced two add-on acquisitions in the areas of data solutions and US laboratory information systems. The acquisition of Medicus LIS strengthens CGM's position as a software leader in the independent US laboratory segment, while the acquisition of GHG business operations complements CGM's portfolio of data-based solutions for the healthcare sector.

- In August 2022, Sparta Community Hospital, a critical access hospital in Sparta, Illinois, provided healthcare services to previously underserved areas through their Mobile Health Clinic. The hospital partnered with the Grand American World Trapshooting Championships to offer healthcare services. They leveraged the Evident EHR solution offered by Computer Programs and Systems, Inc. to provide primary care during the event. Sparta Community Hospital runs the full Evident EHR in its inpatient and clinic care settings.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global laboratory information system market?

The global laboratory information system market boasts a total revenue value of $4.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global laboratory information system market?

The global laboratory information system market has an estimated compound annual growth rate (CAGR) of 10.8% and a revenue size in the region of $2.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

3 EXECUTIVE SUMMARY (Page No. - 55)

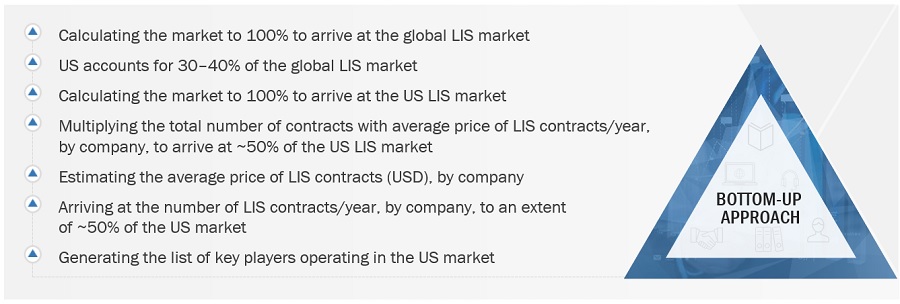

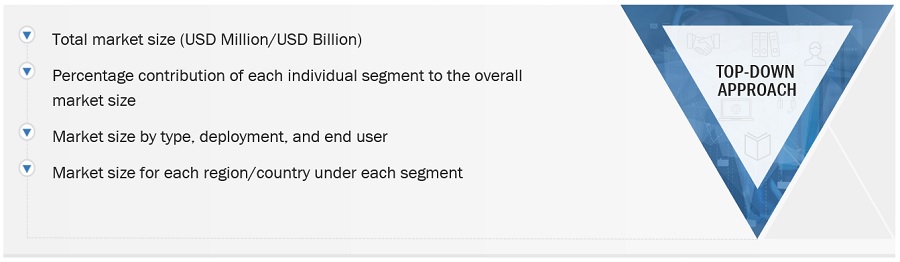

The study involved major activities in estimating the current size of the global Laboratory information systems market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Laboratory information systems market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

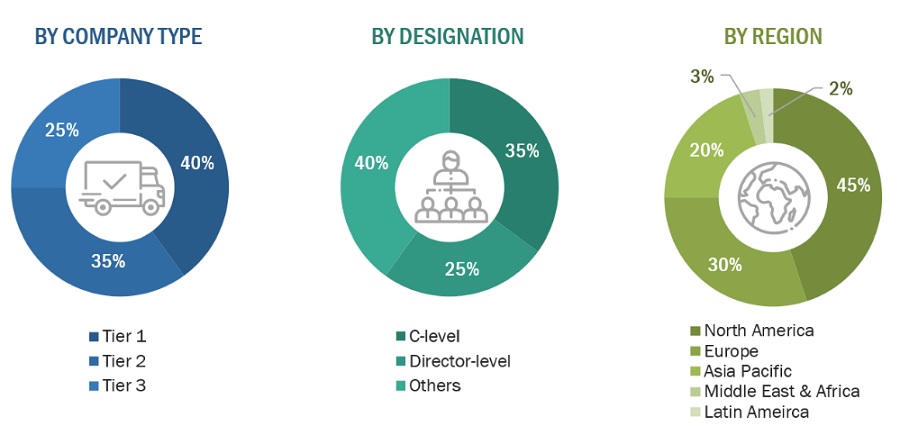

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Laboratory information systems market. The primary sources from the demand side include key executives from hospital laboratories, independent laboratories, physician office laboratories, blood banks, nursing homes, public health labs, and retail clinics. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, deployment, end user, and region.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends by product, component, delivery mode, end-user, and region) were used to estimate and validate the total size of the Laboratory information systems market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Laboratory information systems Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A laboratory information systems is a software system specifically designed to manage and streamline the operations of a laboratory. It serves as a comprehensive information management tool that automates and integrates various laboratory processes, including test ordering, sample tracking, result entry, quality control, inventory management, reporting, and storing specimen data.

LIS systems typically include features such as test catalog management, sample tracking, instrument interface connectivity, result validation, data analysis, report generation, and billing integration. LIS has traditionally been adept at sending laboratory test orders to lab instruments, tracking those orders, and recording the results, typically to a searchable database for future reference. Laboratories with a dedicated LIS can strengthen the country public health by sharing data between laboratories, clinicians, and public health networks. Physicians and lab technicians use LIS to coordinate a variety of inpatient and outpatient medical testing, including hematology, chemistry, immunology, and microbiology.

Key Stakeholders

- Laboratory information systems solution providers

- Platform providers

- Technology providers

- Healthcare providers

- Hospitals

- Clinics

- System Integrators

- Physician groups and organizations

- Clinical laboratories, medical laboratories, research laboratories, and other healthcare facilities

- Forums, alliances, and associations

- Distributors

- Venture capitalists

- Government organizations

- Institutional investors and investment banks

- Investors/Shareholders

- Consulting companies in the LIS sector

- Raw material and component manufacturers

Objectives of the Study

- To define, describe, and forecast the laboratory information systems market, by product, component, delivery mode, end-user, and region

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall laboratory information systems market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the laboratory information systems market in five main regions (along with their respective key countries): North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

- To provide key industry insights such as supply chain analysis, regulatory analysis, patent analysis, and recession impact analysis

- To profile the key players in the laboratory information systems market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches & enhancements, partnerships, acquisitions, sales contracts, agreements, collaborations, expansions, and R&D activities of the leading players in the laboratory information systems market

- To benchmark players within the laboratory information systems market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Latin American laboratory information systems market into Brazil, Mexico, and the rest of Latin America.

- Further breakdown of the Middle East & Africa laboratory information systems market into the UAE, Saudi Arabia, South Africa, and the rest of MEA countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laboratory Information System (LIS) Market