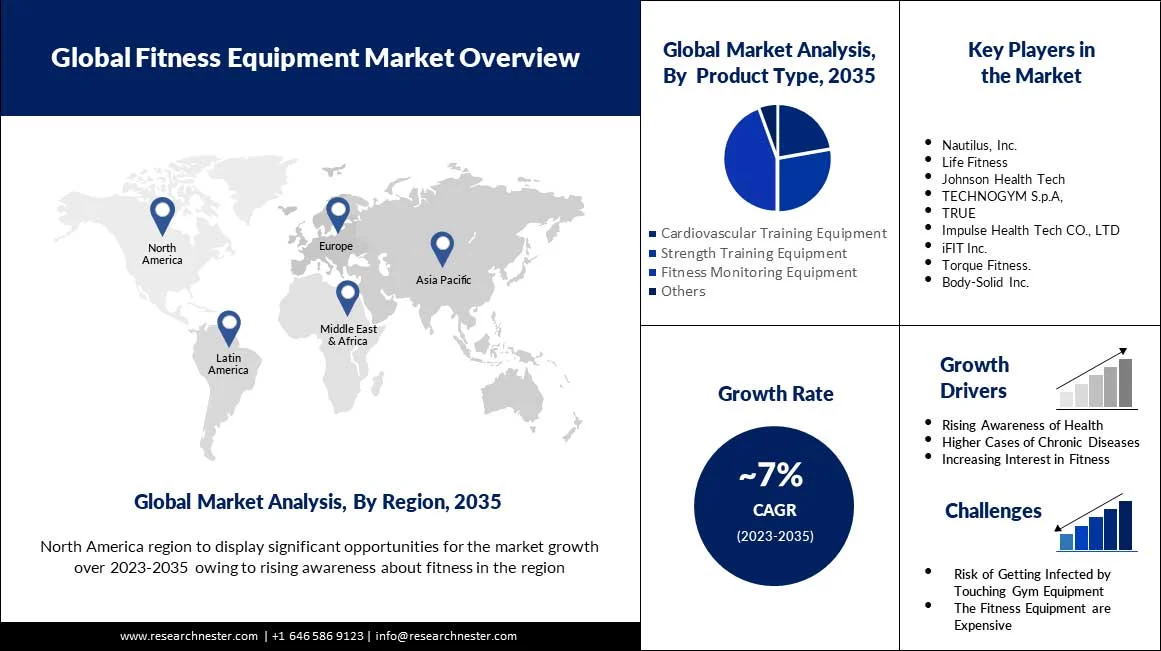

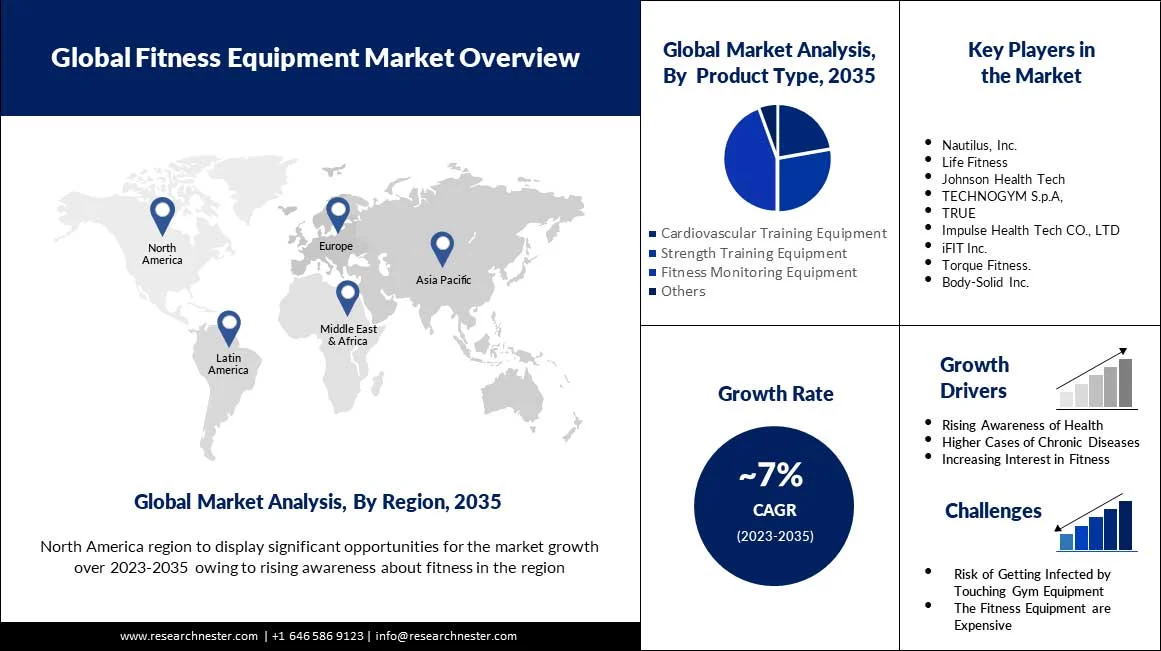

Fitness Equipment Market size is expected to reach USD around 18 Billion by the end of 2035, witnessing around 7% CAGR during the forecast period, i.e., 2023-2035. In the year 2022, the industry size of fitness equipment was USD 14 Billion.The growth of the market can be attributed to the increasing number of people getting more concerned about their health. Moreover, there are a large number of people suffering from diseases that are opting for fitness equipment in order to stay fit. Therefore, it is expected to surge the growth of the market in the upcoming years. Out of nearly 1160 Americans, around 62% consider their health more important after going through the COVID-19 pandemic.

In addition to these, factors that are believed to fuel the market growth of fitness equipment include the rising cases of chronic illness, such as cardiovascular issues, obesity, diabetes, and others. In addition, physical fitness is important to avoid the chronic disease. As the leading chronic disease, it is greatly influenced by health-harming behaviors, including cigarette use, physical inactivity, poor eating habits, and excessive alcohol consumption. Moreover, rising demand for fitness equipment is also expected to boost the market growth, and this need is rising constantly. Hence, it is projected to increase the growth of the global fitness equipment market. The market share for key brands such as MATRIX, Life Fitness, Precor, Star Trac, and Technogym, which together account for roughly 70% of the market of China.

Growth Drivers

Rising Health Awareness Among People– Higher awareness is likely to motivate people to get engage in some kind of physical activity. Around 60% of consumers feel the pandemic has increased their awareness of the importance of maintaining a healthy lifestyle for preventing health problems; this is not a temporary change, but rather a long-term one.

Increasing Inclination Towards Fitness – According to the World Health Organization, adults aged 18 to 64 should engage in at least 150 to 300 minutes of moderate-intensity aerobic physical activity each week. Moreover, those who are inadequately active have a 20% to 30% higher risk of dying than those who are sufficiently active.

Growing Efforts for Boosting the Physical Activity– A rising initiative by regulatory organizations is likely to boost the demand for physical fitness. The World Health Organization launched a Global Action Plan on Physical Activity (GAPPA) for the year 2018-2030, its plan is to increase the physical activity worldwide and decrease the inactivity prevalence by 15% by 2030.

Rapidly Surging Urbanization– Growing urbanization is expected to boost the demand for more gym facilities and better equipment. As per the data of the World Bank, today, more than 50% of the world's population resides in cities. The number of people living in urban areas will more than double to 6 billion by 2045.

Growing Prevalence of Chronic Disease– Insufficient physical activity is the prime factor in catching a chronic illness. Using light fitness equipment is best for chronic disease management. In practically every country, chronic diseases and non-communicable diseases are currently the leading cause of adult mortality, and over the next 10 years, this number is expected to rise by almost 17%. Almost one third of persons worldwide have numerous chronic diseases.

Challenges

|

Base Year |

2022 |

|

Forecast Year |

2023-2035 |

|

CAGR |

~7% |

|

Base Year Market Size (2022) |

~ USD 14 Billion |

|

Forecast Year Market Size (2035) |

~ USD 18 Billion |

|

Regional Scope |

|

Application (Weight Loss, Physical Fitness, Mental Fitness, Body Building)

The global fitness equipment market is segmented and analyzed for demand and supply by application into weight loss, physical fitness, mental fitness, body building, and others. Out of the five applications of fitness equipment, the weight loss segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing prevalence of obesity and high levels of cholesterol. For the past three decades, obesity rates have been steadily rising around the globe. By 2025, the number of adults who are obese could reach 1 billion, or 12% of the world's population. Moreover, by 2030, 1 billion people worldwide, including one in five women and one in seven men, will be obese, as per the statistics of the Global Obesity Atlas 2022, issued by the International Obesity Federation.

Product Type (Cardiovascular Training Equipment, Strength Training Equipment, Fitness Monitoring Equipment)

The global fitness equipment market is also segmented and analyzed for demand and supply by product type into cardiovascular training equipment, strength training equipment, fitness monitoring equipment, and others. Amongst these four segments, the fitness monitoring equipment segment is expected to garner a significant share. The growth of the segment is attributed to the rising use of smart watches and fitness bands that monitor physical activity. The popularity of monitoring devices is increasing, as they help keep track of progress, boosts our fitness plans, and monitor our health status. Therefore, it is projected to surge the growth of the segment in the market. In 2020, around 21% of U.S. adults report wearing a smart watch or wearable fitness tracker on a regular basis. Additionally, nearly 31% of Americans who live in families with annual incomes of over USD 75,000 or more claim to regularly wear a smart watch or fitness tracker.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

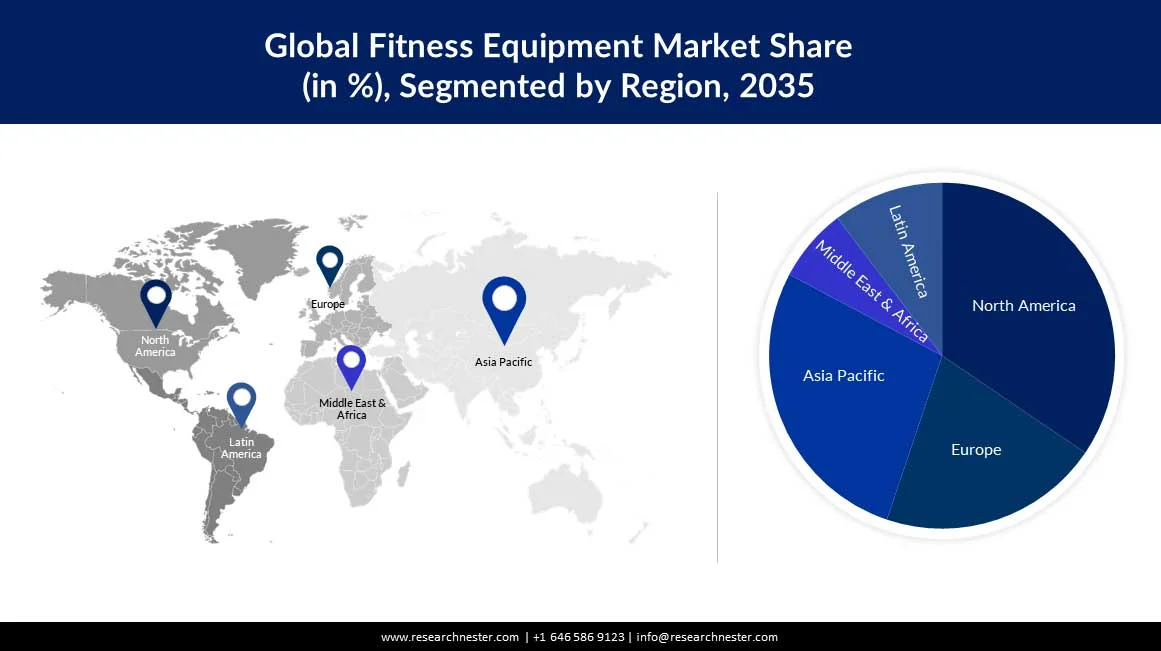

North American Market Forecast

The North American fitness equipment market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the increasing number of people indulged in physical activities, followed by a rise in the number of gym membership. Men were found to engage in sports, exercise, and leisure activities on a daily basis in the year 2021 at a rate of around 23% compared to women's rate of nearly 20% in the United States. Furthermore, almost 64 million Americans were discovered to be members of health clubs and fitness centers in 2019. Besides this, the rising count of obese people is also expected to augment the market growth in the region. Around 27% of Canadians aged 18 and older, or around 7.3 million persons reported having obesity-related height and weight in 2018. An additional about 10 million adults were categorized as overweight in 2018.

APAC Market Statistics

The Asia Pacific fitness equipment market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The market growth in the region is expected on the account of rising interest of people in fitness activities. According to the survey of the Health, Wellness Fitness Expo, the pandemic has heightened people's excitement for exercise and sports. It found that in China, the number of individuals participating in fitness activities climbed from 68.12 million in 2019 to 70.29 million in 2020, with a 5.02 percent fitness population penetration rate. Furthermore, rising cases of people suffering from chronic issues and higher government efforts to create awareness about physical fitness.

Johnson Health Tech acquired its former distributor, Cravatex Brands Ltd. With this acquisition, Johnson Health has become the first wholly owned fintness equipment manufacturer in India. It is likely to expand the business and also enable the upgrading process of fitness equipment.

Nautilius, Inc. released a press release announcing the launch of the Bowflex BXT8J treadmill with JRNY adaptive fitness app compatibility. It offers users a full range of fitness options at a reasonable price.

Author Credits: Anil Kumar, Ipsheeta Dash

FREE Sample Copy includes market overview, growth trends, statistical charts & tables, forecast estimates, and much more.

Have questions before ordering this report?