Glass Substrate Market by Type (Borosilicate, Silicon, Ceramic, And Fused Silica/Quartz-Based Glass Substrates), End-Use Industry (Electronics, Automotive, Medical, Aerospace & Defense, Solar), and Region - Global Forecast to 2028

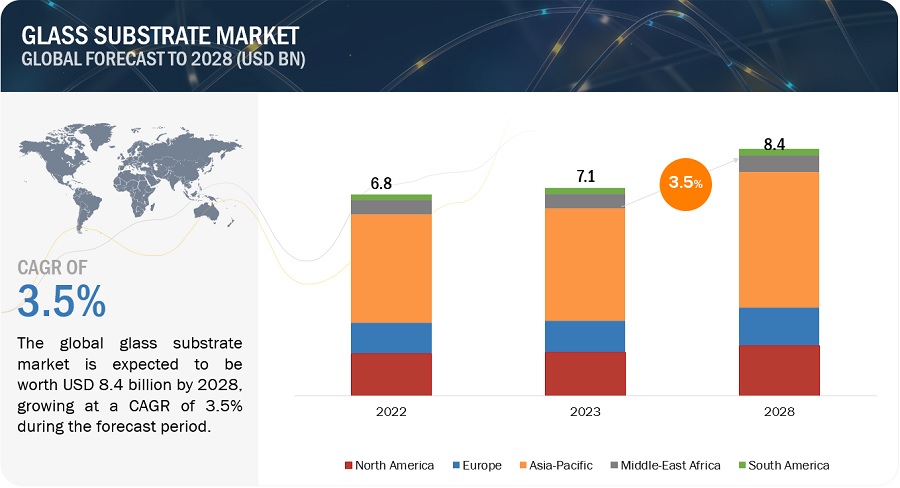

The glass substrate market size is estimated to be USD 7.1 billion in 2023, and it is projected to reach USD 8.4 billion by 2028 at a CAGR of 3.5%. One of the key factors expected to propel the growth of the glass substrate market is the expanding utilization of LCDs in consumer durables, smart handheld devices, and automotive applications. Additionally, the increasing demand for glass substrates is foreseen to be driven by the growth in the semiconductor and electronics industries.

Global Glass Substrate Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Glass substrate Market Dynamics

Driver: Rising usage of LCDs in consumer electronics and automotive application

The surging demand for LCDs in consumer electronics and automotive applications is a pivotal driver behind the growth of the glass substrate market. LCDs, with their sleek designs and high-resolution displays, have become integral components in devices like smartphones, televisions, and laptops, elevating the visual experience for consumers. In the automotive sector, LCDs are increasingly incorporated into digital dashboards, infotainment systems, and heads-up displays, contributing to enhanced driver interfaces and passenger entertainment. As these industries continue to expand and innovate, the need for high-quality glass substrates to support the production of advanced LCDs becomes paramount. The glass substrate market is thus propelled by the growing usage of LCD technology across these dynamic sectors, reflecting the broader trend toward sophisticated and visually immersive electronic displays.

Restraint: High manufacturing and technology costs

The growth of the glass substrate market faces challenges due to the constraints imposed by high technology and manufacturing costs. The intricate processes involved in producing advanced glass substrates for applications such as electronics, displays, and semiconductors often require sophisticated technologies, leading to elevated development costs. Additionally, the manufacturing processes demand precision and specialized equipment, contributing to higher production costs. These elevated costs act as a deterrent for some market players, impacting their ability to invest and innovate. As a result, the glass substrate market encounters obstacles in achieving broader adoption and market expansion, especially as the industry strives to strike a balance between advancing technology and managing the associated economic considerations. Addressing these cost-related challenges becomes imperative for fostering sustainable growth and widespread accessibility within the glass substrate market.

Opportunity: Growing use of glass substrate in solar power application

The burgeoning use of glass substrates in solar applications presents a significant opportunity for the growth of the glass substrate market. As the solar energy sector continues to expand, glass substrates find extensive application in the manufacturing of photovoltaic cells and solar panels. The transparency, durability, and thermal stability of glass make it an ideal substrate for encapsulating and protecting photovoltaic components, ensuring efficient energy conversion and extended lifespan of solar modules. The escalating demand for sustainable energy solutions, coupled with advancements in solar technologies, propels the need for high-performance glass substrates. This trend opens up avenues for innovation and market growth as the solar industry increasingly relies on robust and technologically advanced materials, positioning glass substrates at the forefront of opportunities within the evolving renewable energy landscape.

Challenges: LCD glass to meet strict quality requirements

A formidable challenge faced by the glass substrate market is the imperative to meet stringent quality restrictions in the production of LCD (Liquid Crystal Display) glass. LCDs, ubiquitous in consumer electronics and other industries, demand precise manufacturing processes to ensure flawless displays. Meeting high-quality standards involves minimizing defects, ensuring uniform thickness, and achieving optimal optical clarity in the glass substrate. The intricate nature of these requirements necessitates sophisticated production techniques, which, in turn, can escalate manufacturing costs. Striking a delicate balance between meeting stringent quality standards and managing production expenses poses a significant challenge for industry players. As the demand for impeccable display quality persists, the glass substrate market navigates the complex task of upholding rigorous quality restrictions while maintaining competitiveness in the dynamic landscape of display technologies.

Ecosystem of Glass Substrate Market

“Dominance of electronic industry in the Glass substrate end-use industry segment.”

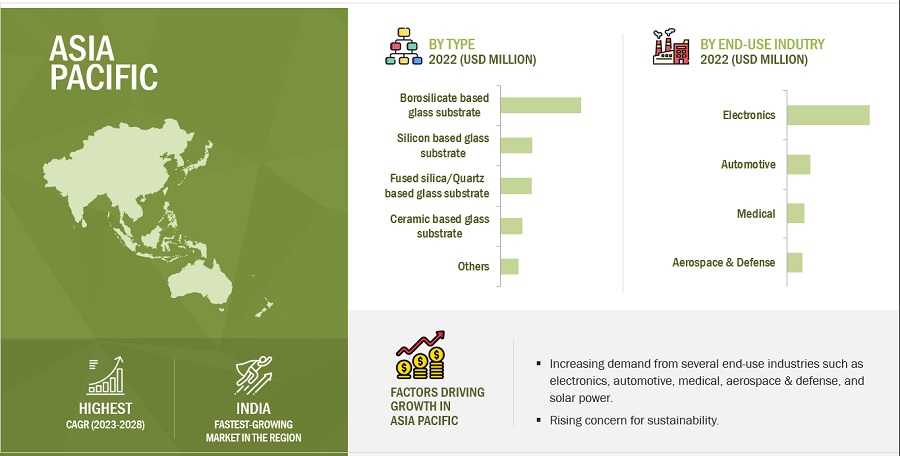

Categorized by end-use industry, the glass substrate market includes segments such as electronics, automotive, medical, aerospace & defense, and solar. Notably, the electronics industry stands out as the largest segment within this market. The significant surge in the production of display devices, electronic components, semiconductors, MEMS devices, and information, computing, and telecommunication devices is anticipated to be a primary driver propelling the growth of the glass substrate market in the electronics sector.

“Borosilicate-based glass substrate is the most usable by type substrate in the glass substrate market.”

Categorized by type, the glass substrate market exhibits segmentation into borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica/quartz-based glass substrates, and other variants. Among these, borosilicate-based glass substrates emerge as the most extensively employed type. This prevalence is attributed to their exceptional attributes, including a low coefficient of thermal expansion, high chemical resistivity, and superior surface strength, making them highly favored for various applications.

“APAC is the speediest-growing market for glass substrate market.”

In terms of value, the Asia Pacific will be the fastest-growing region in the overall glass substrate market.

This growth is attributed to rapid urbanization, increasing disposable income, and improving living standards, which drive the demands from several end-use industries such as electronics, automotive, medical, aerospace & defense, and solar power. Apart from this, the growing adoption of electronics gadgets such as consumer wearbales, smart watches, etc. This fuelled the market of glass substrates in the region during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Key stakeholders steering the trajectory of the glass substrate market include AGC Inc. (Japan), Schott (Germany), Corning, Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), Plan Optik AG (Germany), HOYA Corporation (Japan), Ohara Inc. (Japan), IRICO Group New Energy Company Limited (China), Toppan Inc. (Japan), Tunghsu Group Co. Ltd. (China). To solidify their positions in this competitive market, these industry frontrunners have judiciously employed a range of growth strategies. This encompasses acquisitions, diversifying their product lineup, geographical expansions, and forging productive partnerships, collaborations, and agreements. Through these strategic maneuvers, they aim to cater to the escalating demand for glass substrates, particularly from dynamic emerging markets.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2019–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies |

The major players are AGC Inc. (Japan), Schott (Germany), Corning Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), HOYA Corporation (Japan) and others are covered in the Glass substrate market. |

This research report categorizes the global Glass substrate market on the basis of Type, End-use Industries, and Region.

Glass substrate Market, By Type

- Borosilicate-based glass substrates

- Silicon-based glass substrates

- Ceramic-based glass substrates

- Fused silica-/quartz-based glass substrates

- Other Types

Glass substrate Market, By End-Use Industries

- Automotive

- Electronics

- Medical

- Aerospace & Defense

- Solar Power

Glass substrate Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- South America

- Middle East & Africa

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In December 2023, Schott (Germany) has invested in expanding the research and development site, in Landshut.

- In November 2023, Nippon Sheet Glass Co., Ltd. (Japan) has announced its plans to invest in additional TCO (transparent conductive oxide) glass production capacity in the United States. to support the growing solar market.

- In November 2023, Nippon Sheet Glass Co., Ltd. (Japan) has announced the opening of new production plant of solar glass in Malaysia

- In September 2023, Schott (Germany) has announced a three-point action plan to address the chip industry's needs for glass-substrate-based advanced chip packaging.

- In May 2023, Corning Incorporated (US) has announced a 20% increment in the prices of display glass substrate

- In February 2023, AGC Inc. (Japan) has partnered with Saint-Gobain, to design a pilot breakthrough flat glass line that is expected to reduce very significantly direct CO2 emissions.

- In January 2023, AGC Inc. (Japan) has developed a CADTANK Online Computation and Optimization Assistant (a digital twin technology), used for the glass melting process.

- In January 2022, Schott (Germany) has introduced, FLEXINITY connect, an ultra-fine structured glass that brings a game-changing element to semiconductor manufacturing, which has traditionally used printed circuit boards (PCB) and silicon interposers for advanced chip packaging solutions.

- In June 2022, Schott (Germany) has inaugurated a new flat glass, state-of-the-art production plant in Bolu, Turkey

- In December 2022, Nippon Sheet Glass Co., Ltd. (Japan) has announced the establishment of the Second Research Building, in its Technical Research Laboratory of Japan.

Frequently Asked Questions (FAQ):

What growth prospects does the glass substrate market present?

Rising urbanization, improving living standards, and increasing disposable income, led to the adoption of electronic products, which drives the market of glass substrate. Apart from this, increasing demands from several end-use industries such as automotive, medical, aerospace & defense, and solar power also drive the glass substrate market.

How do product type choices influence the glass substrate market dynamics?

The market is categorized based on by type segments like borosilicate-based glass substrates, silicon-based glass substrates, ceramic-based glass substrates, fused silica-/quartz-based glass substrates, and others. Borosilicate glass substrates are widely used for various applications due to their unique properties and advantages such as low coefficient of thermal expansion, good chemical resistance, excellent optical clarity, good mechanical strength, good resistance to water and moisture, and others. These benefits help to influence the market of the glass substrate.

Which application predominantly utilizes glass substrate?

On the basis of end-use industry, the market is segmented into the following end-use industries such as electronics, automotive, medical, aerospace & defense, and solar power. The electronics industry holds the largest market share, where glass substrates are used in making LCDs, OLEDs, touchscreens, sensors, semiconductor manufacturing, etc.

Which companies are at the forefront of the glass substrate market?

Major market players include AGC Inc. (Japan), Schott (Germany), Corning, Incorporated (US), Nippon Sheet Glass Co., Ltd. (Japan), Plan Optik AG (Germany), HOYA Corporation (Japan), Ohara Inc. (Japan), IRICO Group New Energy Company Limited (China), Toppan Inc. (Japan), Tunghsu Group Co. Ltd. (China), and others.

What are the prime factors that are poised to influence the market in the forecast period?

Burgeoning demand for advanced electronic devices, including smartphones, tablets, and high-resolution displays, a continuous evolution of display technologies, such as OLED and flexible displays, increasing use of glass in solar panels, etc. propels the market of glass substrate. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

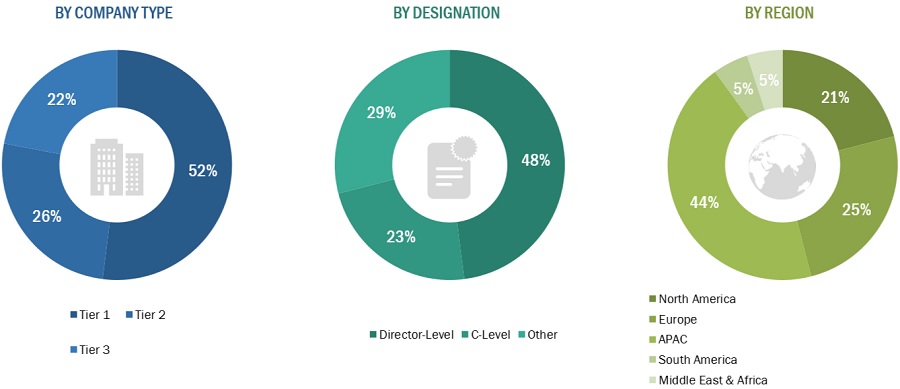

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the Glass substrate market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The Glass substrate market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product users. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, managers, directors, and CEOs of companies in the Glass substrate market. Primary sources from the supply side include associations and institutions involved in the Glass substrate industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

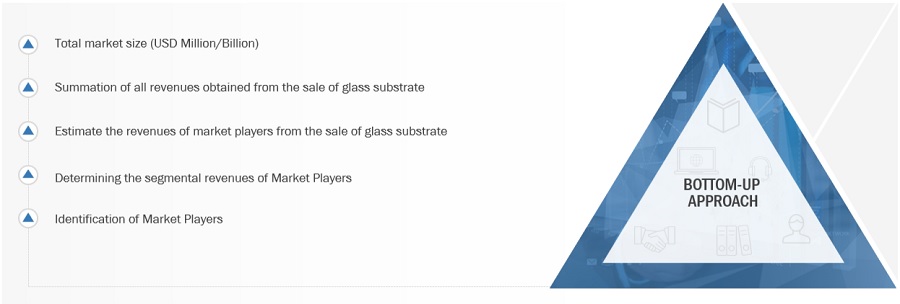

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Glass substrate market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

Glass substrates serve as thin, flat boards onto which a precise thin circuit is deposited. These substrates are crafted from various raw materials, including borosilicate, silicon, ceramic, fused silica/quartz, soda-lime, and aluminosilicate. They come in the form of disks and panels. Disk-shaped glass substrates, referred to as wafers, find primary applications in semiconductor manufacturing, while panel-shaped glass substrates are predominantly used in LCD manufacturing. The characteristics of glass substrates, such as shape, size, thickness, sharpness, and flexibility, are tailored to meet the specific requirements of their end-use industries, dictating their manufacturing processes accordingly.

Key Stakeholders

- Material Suppliers and Producers

- Regulatory Bodies

- End User

- Research and Development Organizations

- Industrial Associations

- Glass substrate manufacturers, dealers, traders, and suppliers.

Report Objectives

- To define, describe, and forecast the global Glass substrate market in terms of value.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, end-use industries, and region

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, Asia Pacific, South America, and Middle East & Africa.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Glass substrate market

- Further breakdown of the Rest of Europe’s Glass substrate market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Glass Substrate Market