Distributed Control System Market by Component (Hardware, Software, Services), Application (Continuous, Batch-Oriented), End-user (Oil & Gas, Power Generation, Chemical, Food & Beverages, Pharmaceutical, Metal & Mining), Region - Global Forecast to 2028

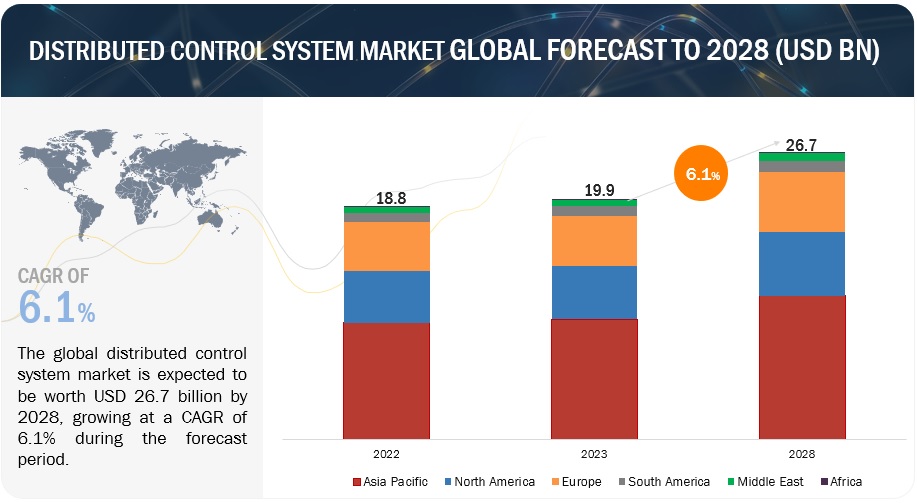

[272 Pages Report] The global Distributed control system market is estimated to grow from USD 19.9 Billion in 2023 to USD 26.7 billion by 2028; it is expected to record a CAGR of 6.1% during the forecast period. The growth in distributed control system demand in recent years is due to the increased investment in automation in process industries to achieve sustainability, enhanced operational performance and improve efficiency. The market for distributed control systems is projected to benefit greatly from the rising usage of distributed control systems in wide range of end-use industries.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Distributed Control System Market Dynamics

Driver: Growing use of renewable energy for power generation

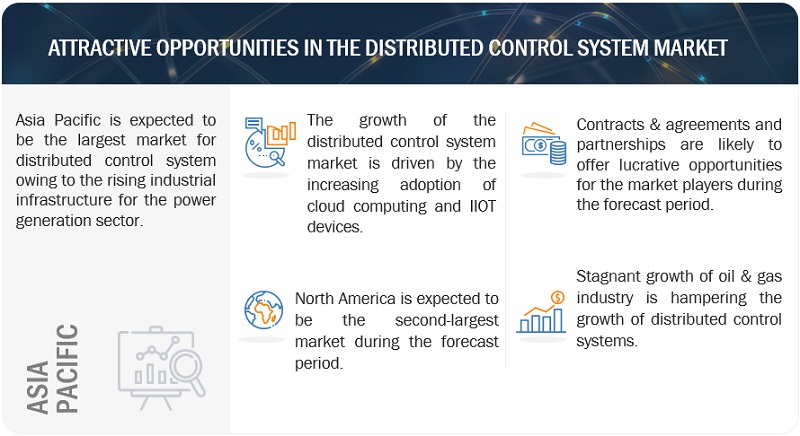

Growing demand for energy and the increasing stringency of environmental regulations have resulted in an increased demand for unconventional sources of energy. Alternative and renewable energy sources are gaining importance, with the use of solar, wind, biomass fuels, and gasification plants expected to rise. Nuclear energy is also likely to go up steadily in the long run. Asia Pacific is estimated to witness the highest growth rate in power generation from renewable sources due to increased investments by China. Consistent governmental efforts in nonconventional energy generation are also expected to fuel the changing trends in the power sector, which is a key market for distributed control systems. Additionally, Utilities in the US have responded to the stringent emissions regulations on coal plants by switching to natural gas-fired power generation. The recent shale gas boom in North America is further driving this phenomenon. The American Council for an Energy-Efficient Economy (ACEE) also provides incentives and tax rebates for the installation of distributed control systems.

Restraint: Sluggish response time of distributed control system

Distributed control systems have slower response times than the major alternatives such as PLC and hybrid PLC. The response time of PLC is one-tenth of a second. In contrast, a distributed control system takes a longer time to process data, and therefore, is unsuitable for applications where response time is a critical issue. Hence, distributed control systems are not used for safety systems and other critical discrete manufacturing processes. This is hampering the growth of the DCS market in end-use industries such as paper & pulp, automotive, and fine chemicals.

Opportunities: Development of power grid market

Along with opening markets for new entrants, the development of the power grid market is likely to create opportunities for traditional energy infrastructure vendors. New aspirants, such as IT hardware providers, software solution providers, telecommunication and networking companies, semiconductor manufacturers, and system integrators, would pose a challenge to the traditional players/vendors. A service-oriented business model to offer a set of products and services fulfilling the basic requirements of customers could help new entrants strengthen their position in the DCS market. However, participants would need to make their presence felt during the entry into the market to effectively face the competition from traditional vendors.

Challenges: Slowdown in mining industry in Asia Pacific, Americas, and Africa

The mining industry has seen a declining trend in regions such as Australia, the US, Argentina, and major countries in Africa, which has led to a sharp decline in the sector’s output. Problems such as labor strikes, stringent regulations, and rising operational costs are the major concerns for the industry. Several large companies are trying to trim costs, pursue smaller projects, and divest from nonperforming assets to gain profitability. This downturn is expected to continue, which, in turn, would act as a challenge for the DCS market.

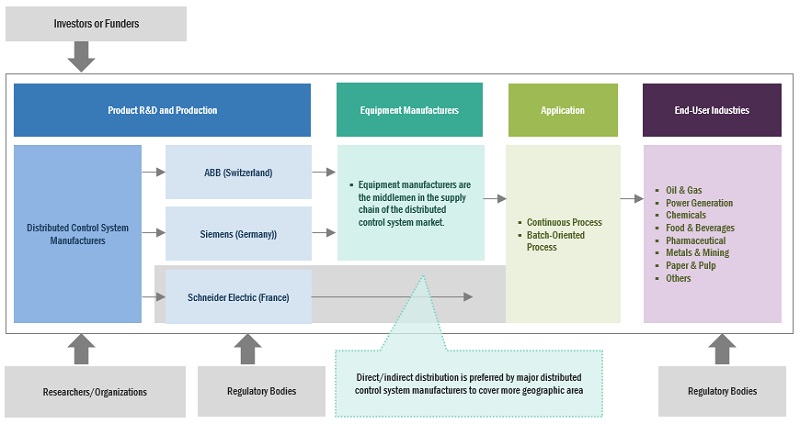

Distributed control system Market Ecosystem

Key companies in this market include well-established, financially stable distributed control system manufacturers. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global sales and marketing networks. Key companies in this market include Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Emerson Electric Co. (US), and Honeywell International Inc. (US).

Services, by component, is expected to be the fastest growing segment during the forecast period.

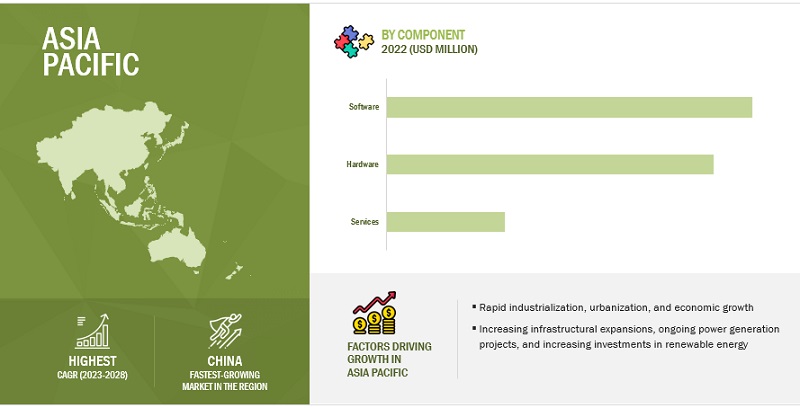

This report segments the distributed control system market based on component into three types: software, hardware, and services. The services segment is expected to be the fastest growing segment during the forecast period. Distributed control system services include maintenance, installation, upgrades, plant asset management, alarm management, lifecycle services, migration services, consulting services, simulation and training services, and technical assistance. The need for plant optimization across industries is one of the key factors driving the services segment of the distributed control system market.

By application, the continuous process is expected to be the largest segment during the forecast period

This report segments the distributed control system market based on application into two segments: continuous process and batch-oriented process. The continuous production process is used in oil & gas, chemicals, power generation, and water & wastewater treatment industries. It is one of the more efficient and profitable methods of production. The use of distributed control systems in nuclear and renewable sectors in the power generation industry and upstream and downstream activities in the oil & gas industry are the major factors driving the continuous process segment. The increasing production of chemicals and the growing demand for distributed control systems in the refining industry also contribute to the segment’s growth.

"Asia Pacific": The largest in the distributed control system market"

Asia Pacific is expected to have the largest market share in the distributed control system market between 2023–2028, followed by North America and Europe. Urbanization and population growth have resulted in the need for vast infrastructure development, which has propelled the power demand across the region. As per the Indian Electrical and Electronics Manufacturers’ Association (IEEMA), the electricity generation capacity in India is expected to increase from 200 GW in 2010 to over 800 GW by 2032 to fulfill the increasing demand for power. Thus, there is a need for a huge investment of approximately USD 300 billion in the next 3–4 years in power generation industry, which will increase the demand for distributed control systems in this region. Moreover, the automation is increasing in APAC across various industries because of the rising need for high-quality products and increasing production rates.

Key Market Players

The distributed control system market is dominated by a few major players that have a wide regional presence. The major players in the distributed control system market include Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Emerson Electric Co. (US), and Honeywell International Inc. (US). Between 2018 and 2022, these companies followed strategies such as contracts, agreements, partnerships, mergers, acquisitions, and expansions to capture a larger share of the distributed control system market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

Distributed control system market by Shipment Scale, Component, Application, End-Use industry, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, Middle East, and Africa. |

|

Companies covered |

ABB (Switzerland), Schneider Electric (France), Emerson Electric Co. (US), Siemens (Germany), Honeywell International Inc. (US), Yokogawa Electric Corporation (Japan), HollySys Group (Singapore), Concept Systems Inc (US), ZAT a.s. (Czech Republic), Ingeteam (Spain), Rockwell Automation (US), Hitachi, Ltd. (Japan), General Electric (US), Valmet (Finland), TOSHIBA CORPORATION (Japan), Azbil Corporation (Japan), Mitsubishi Electric Corporation (Japan), NovaTech, LLC. (US), ANDRITZ (Austria), and OMRON Corporation (Japan) |

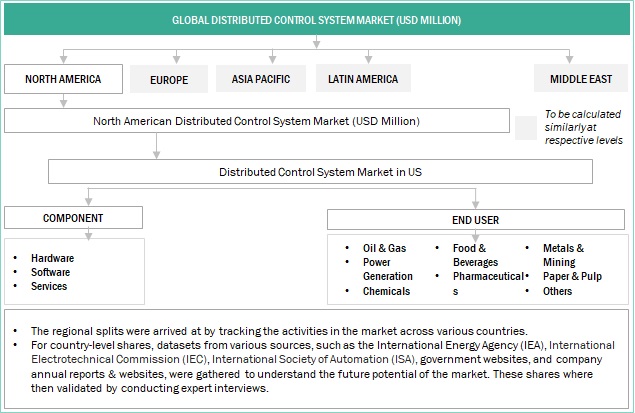

This research report categorizes the distributed control system market based on shipment scale, component, application, end-use industry, and region.

On the basis of shipment scale, the distributed control system market has been segmented as follows:

- Large

- Medium

- Small

On the basis of component, the distributed control system market has been segmented as follows:

- Hardware

- Software

- Services

On the basis of application, the distributed control system market has been segmented as follows:

- Continuous process

- Batch-oriented process

On the basis of end-use industry, the distributed control system market has been segmented as follows:

- Oil & Gas

- Power Generation

- Chemicals

- Food & Beverages

- Pharmaceutical

- Metals & Mining

- Paper & Pulp

- Others

On the basis of region, the distributed control system market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Middle East

- Africa

Recent Developments

- In February 2023, ABB has recently launched the ABB Ability Symphony Plus distributed control system (DCS) in order to support digital transformation in the power generation and water industries. The latest Symphony Plus version will further enhance customers digital journey, through a simpler and secure OPC UA1 connection.

- In October 2022, Emerson have signed a five-year agreement with LANXESS, a specialty chemicals company. Emerson will help drive the adoption of advanced automation technologies and enable more efficient project implementation that will allow LANXESS to achieve shorter time-to-market for new products.

- In October 2022, Emerson has introduced a new version of its DeltaV distributed control system (DCS). DeltaV DCS Version 15 assists facilities in digitally transforming operations through increased production optimization and improved operator performance.

- In December 2022, Valmet will deliver the Valmet DNA Automation System (DCS) and the Valmet IQ Quality Control System (QCS) to Schumacher Packaging's Myszków facility in Poland for the repair of the board machine 2. The aim is to increase the plant's output efficiency and product quality. The installation is set to begin in May 2023.

- In November 2022, Rockwell Automation launched the FLEXHA 5000TM I/O family, which provides high availability and continues the advancement of the PlantPAx Distributed Control System (DCS). It provides easily integrated design, allowing clients to observe more efficient engineering time, consistent operations, and optimized footprints.

Frequently Asked Questions (FAQ):

What is the current size of the distributed control system market?

The current market size of the distributed control system market is USD 18.8 billion in 2022.

What are the major drivers for the distributed control system market?

Rising demand of Industrial Internet of Things (IIOT) and 5G technology in industrial environments will be major drivers for the distributed control system market.

Which is the largest region during the forecasted period in the distributed control system market?

Asia Pacific is expected to dominate the distributed control system market between 2023–2028, followed by North America. The increase in demand of advanced automation in power generation sector in recent years is driving the region's market.

Which is the fastest growing segment, by component, during the forecasted period in the distributed control system market?

The services segment is expected to be the largest market during the forecast period. Installing a distributed control system is often a large-scale project and needs a variety of equipment and in-depth knowledge of the process/plant for which it is being installed. Once the installation is done, maintenance services need to be carried out at regular intervals to avoid any unplanned shutdown and vulnerability to cyberattacks.

Which is the largest application segment during the forecasted period in the distributed control system market?

The continuous process segment is expected to be the fastest market during the forecast period. The use of distributed control systems in nuclear and renewable sectors in the power generation industry and upstream and downstream activities in the oil & gas industry are the major factors driving the continuous process segment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

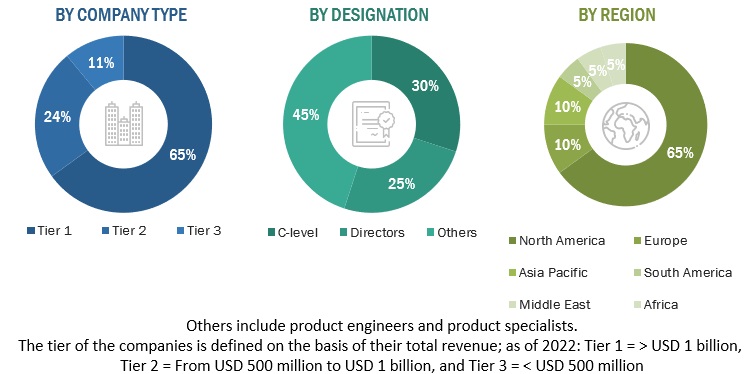

The study involved major activities in estimating the current size of the distributed control system market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the distributed control system market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal to collect and identify information useful for a technical, market-oriented, and commercial study of the distributed control system market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The distributed control system market comprises several stakeholders, such as distributed control system manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for distributed control system in Oil & Gas, Power Generation, Chemicals, Food & Beverages, Pharmaceutical, Metals & Mining, Paper & Pulp, and Other end user industries. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the distributed control system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Distributed control system Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Distributed control system Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A distributed control system (DCS) is an industrial automation solution primarily deployed in process industries to facilitate plant control through a distributed network of supervisory and control elements. It is typically used to control manufacturing processes in industries such as food & beverages, pharmaceuticals, and petrochemicals that use either continuous or complex batch-oriented processes for production

The market for distributed control system is defined as the sum of revenues generated by the global companies through the sales of their distributed control systems. The scope of the current study includes the bifurcation of the distributed control system market by components, application, end-use industry, shipment scale and region.

Key Stakeholders

- Manufacturers and suppliers of DCS

- Solution vendors

- Original equipment manufacturers (OEMs)

- Government agencies

- Managed service providers (MSPs)

- System integrators

- Consultancy firms/advisory firms

- Investors and venture capitalists

- Independent software vendors

- Existing and prospective end-user industries

- Government and research organizations

Objectives of the Study

- To describe, segment, and forecast the distributed control system market based on component, application, end-use industry, and region, in terms of value.

- To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, South America, the Middle East and Africa, along with their country-level market sizes, in terms of value.

- To provide information on shipment scale of distributed control system

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the distributed control system market.

- To analyze opportunities for stakeholders in the distributed control system market and draw a competitive landscape of the market.

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study.

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

- To compare key market players with respect to the product specifications and applications.

- To strategically profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the distributed control system market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Distributed Control System Market