Ceramic Substrates Market by Product Type (Alumina, Aluminum Nitride, Silicon Nitride, Beryllium oxide), End-use Industry (Consumer Electronics, Automotive, Telecom, Industrial, Military & Avionics), and Region - Global Forecast to 2028

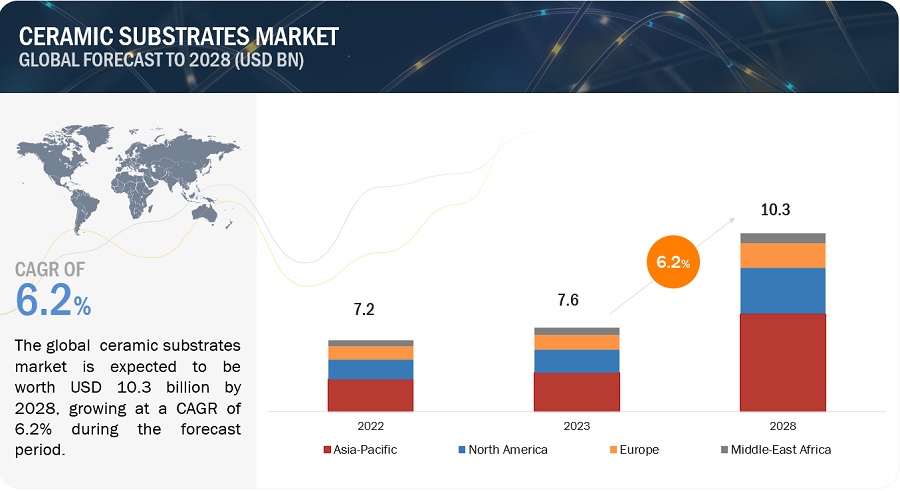

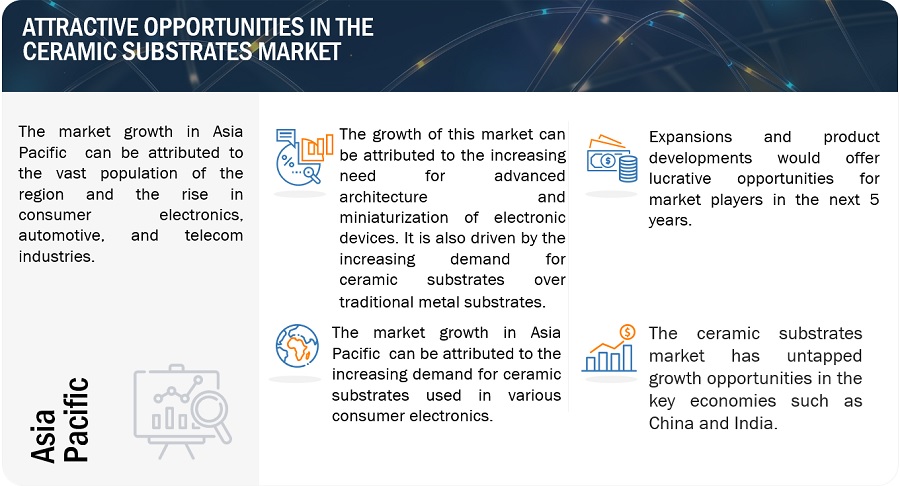

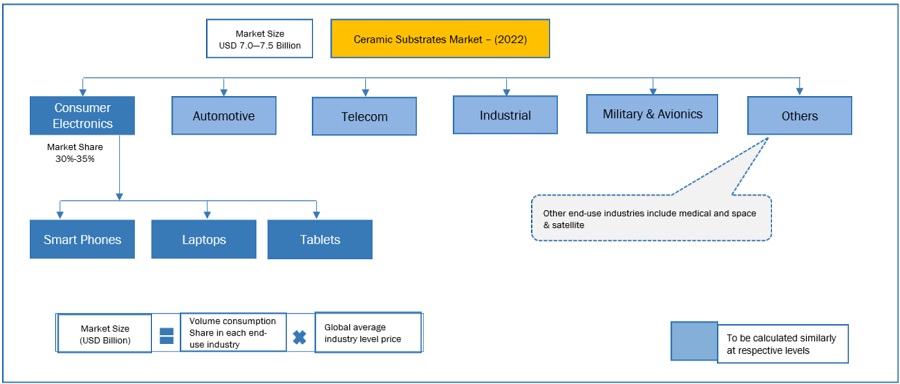

In terms of value, ceramic substrates market size is projected to increase from 7.6 billion in 2023 to USD 10.3 billion by 2028, at a CAGR of 6.2%. The ceramic substrates market derives its primary impetus from the escalating demand across various industries, including consumer electronics, automotive, telecommunications, industrial, military, and avionics, among others. Key drivers include the growing imperative for advanced architectural solutions and the pursuit of miniaturization in electronic devices. This dynamic landscape positions Asia Pacific as the dominant global market for ceramic substrates, surpassing Europe and North America in terms of both volume and value. These trends underscore the significant opportunities and regional variations within the ceramic substrates industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing essential for advanced architecture and miniaturization of electronic devices

Rapid research and development alongside technological advancements have spurred the demand for compact and dependable electronic devices. This surge is primarily driven by the need for miniaturized electronic products. With the evolution of semiconductor technology, many electronic devices have become increasingly sophisticated, necessitating the use of hybrid circuits embedded in ceramic substrates. Ceramic substrates offer three primary advantages, including miniaturization, hermetic sealing, and efficient heat conduction. The integration of thin film ceramic substrates has notably facilitated the miniaturization of various electronic devices, such as smartphones, tablet PCs, e-book readers, and video cameras, all of which comprise a diverse range of hybrid circuits. Initially, glass epoxy resin substrates were the standard for hybrid circuit substrates. However, the adoption of ceramic substrate technology has played a pivotal role in reducing the size of electronic devices through the downsizing of electrical hybrid circuits. The escalating demand for these advanced electronic products is poised to serve as a significant catalyst in propelling the ceramic substrates market forward..

Restraints: Raw material price instability

The cost of raw materials, particularly aluminum, significantly impacts the pricing of ceramic substrates like aluminum nitride and alumina. Notably, as of January 2023, the London Metal Exchange (LME) recorded the spot price of aluminum at USD 2,014.67 per ton.

The repercussions of the COVID-19 pandemic have had a profound impact on global economic activities, potentially leading to an extended period of economic downturn. This downturn has especially affected the demand for aluminum in industries like automotive and aerospace, with both sectors experiencing substantial declines. In addition to these dynamics, it's important to note that aluminum prices have witnessed notable fluctuations over the past three years. After a severe worldwide recession triggered by the COVID-19 pandemic, the price of aluminum experienced unusual drops during the first three months of 2020. Subsequently, aluminum prices, accounting for inflation, reached their highest levels in ten years in March 2022 and the second-highest levels. However, prices have since undergone a 36% decrease. Furthermore, the volatility in aluminum prices underscores the need for businesses to navigate challenges related to raw material costs effectively, as they can have a substantial impact on manufacturing and pricing strategies. Additionally, it highlights the importance of diversifying supply chain strategies to mitigate risks associated with commodity price fluctuations.

Opportunities: Rising need for nanotechnology and high-end computing system

Ceramic substrates play a vital role in the electrical and electronics sector, offering diverse applications. The growing use of semiconductors, microfabrication, and advancements in surface science has opened up fresh avenues for expansion within the ceramic substrates market. Moreover, the utilization of nanomaterials, including nanopillars, nanoparticles, and nanorods, extends beyond the electrical and electronics sector, encompassing fields like medicine, space exploration, and energy and power. In these domains, ceramic substrates prove indispensable due to their exceptional properties, including high resistance to wear, temperature, and corrosion. Additionally, the unique characteristics of ceramic substrates position them as a key component for applications that demand high durability and performance. This not only ensures the continued growth of the ceramic substrates market but also underscores the broader potential for innovation and integration across various industries. Furthermore, their adoption aligns with the growing emphasis on sustainable and efficient technological solutions..

Challenges: Problems associated to recyclability and reparability

Addressing damages in components constructed from ceramic substrates, such as internal cracks or wear and tear, presents a significant challenge due to the complexity of repair processes. The limited availability of skilled labor and proper repair techniques exacerbates this issue. However, as awareness regarding ceramic substrate repair techniques grows, and as the pool of skilled labor expands, the impact of these challenges is likely to diminish in the near future. While ceramic substrates are renowned for their durability, they pose specific challenges concerning recyclability and reparability. Unlike materials that can be easily recycled and reused in similar applications, ceramic substrates often find use in conjunction with composites across various end-use industries. This reliance on composites, coupled with the inherent durability and resistance to temperature and corrosion, raises concerns regarding the feasibility of recycling and repairing end-products. Furthermore, it's important to note that addressing the challenges associated with recyclability and reparability is paramount, as it aligns with the broader industry trend towards sustainability and circular economy principles. Successfully overcoming these challenges can lead to a more environmentally responsible and resource-efficient use of ceramic substrates, providing a competitive edge for businesses that can navigate these complexities effectively.

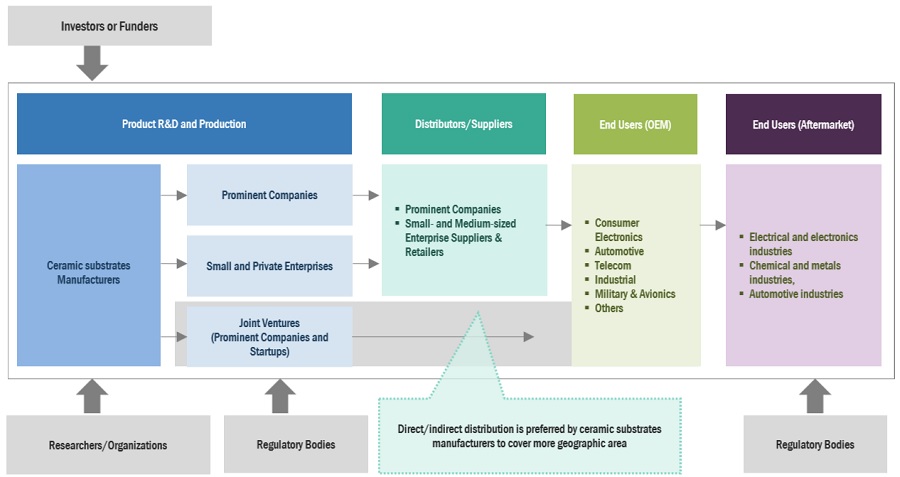

Ceramic Substrates Market Ecosystem

Prominent companies in this market include well-established, financially stable ceramic substrates manufacturers. These businesses have been in business for a while and have a extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include KYOCERA Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), CoorsTek Inc. (US), CeramTec GmbH (Germany), MARUWA Co., Ltd. (Japan), KOA Corporation (Japan), Yokowo Co., Ltd. (Japan), TONG HSING ELECTRONIC Industries,LTD. (Taiwan), LEATEC Fine Ceramics Co,.Ltd. (Taiwan), and NIKKO COMPANY (Japan).

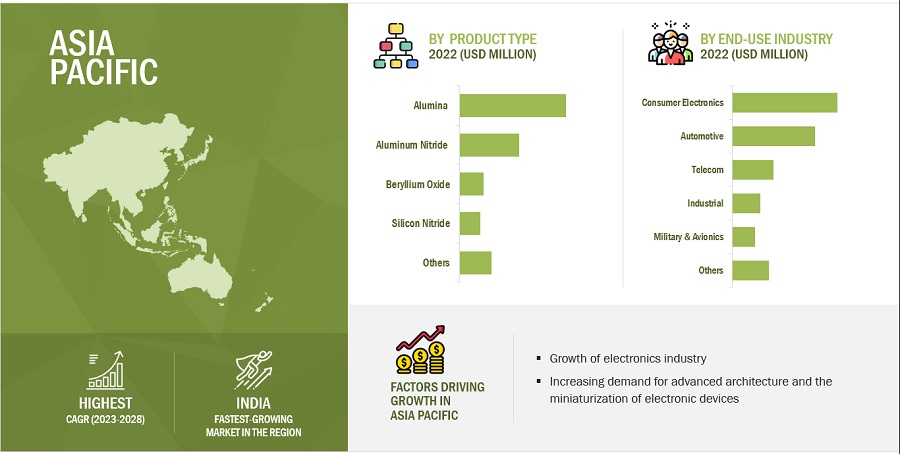

“Based on product type, Alumina Substrates is estimated to be the largest product type, in terms of value, during the forecast period”

Alumina stands out as the most extensively employed advanced oxide ceramic material, boasting a wide array of applications. The production of components for alumina substrates involves various manufacturing techniques, including uniaxial (die) pressing, isostatic pressing, injection molding, extrusion, and slip casting. Notably, alumina showcases remarkable attributes such as high strength and hardness, exceptional resistance to wear and corrosion, and temperature stability. Alumina substrates fulfill all the requisites for insulating materials in electrical and electronics engineering applications, exemplifying their reliability and suitability. These substrates are prevalent in both thick and thin film applications, serving as a cost-effective alternative when compared to other ceramic substrate options. This makes them an attractive choice for various industries seeking dependable solutions for electronic components and insulating materials.

“Based on end use industry, the consumer electronics industry is projected to account for the largest share, in terms of volume and value, of the overall ceramic substrate market in 2022

he consumer electronics sector encompasses a wide array of electronic devices designed for daily use, primarily within the realms of entertainment and communication equipment. This sector extensively incorporates various ceramic systems for packaging applications, with ceramic substrates emerging as the most versatile and cost-effective thick film technology utilized in consumer electronics. These ceramic substrates come in the form of printed thick film ceramic substrates, serving in applications like circuitry games, membrane touch switches, digital product lighting, and signage. Additionally, multilayer LTCC ceramic substrates find prominent use in digital cameras, facilitating a reduction in the printed wiring board's volume, resulting in significant size and cost reduction. Crucially, the miniaturization capability of ceramic substrates renders them vital for compact packaging requirements, notably in hearing aids and earphones. Moreover, the surge in high-volume manufacturing for a broad range of mobile consumer products, including smartphones, tablets, laptops, desktop PCs, set-top boxes, portable game consoles, video cameras, speakers, and earphones, is poised to exert a substantial impact on the ceramic substrates market.

“Asia Pacific is expected to be the largest ceramic substrate market during the forecast period, in terms of value and volume.”

The demand for ceramic substrates is intricately linked to the economic prosperity of a region, with regions experiencing rapid economic growth driving heightened demand. Notably, China and India have emerged as two of the world's fastest-growing economies, according to the International Monetary Fund (IMF). Moreover, India is anticipated to surpass China in terms of growth rate, exerting a significant influence on the global economy. These robust economic developments in both nations are poised to fuel growth within the manufacturing sector. Additionally, the region benefits from rapidly expanding end-use industries, competitive manufacturing costs, and an impressive economic growth trajectory. These favorable conditions collectively contribute to the expansion of the ceramic substrates market in the Asia Pacific region. As a result, market players are increasingly drawn to invest and expand their operations in this thriving economic landscape.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players profiled in the report include KYOCERA Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), CoorsTek Inc. (US), CeramTec GmbH (Germany), MARUWA Co., Ltd. (Japan), KOA Corporation (Japan), Yokowo Co., Ltd. (Japan), TONG HSING ELECTRONIC Industries,LTD. (Taiwan), LEATEC Fine Ceramics Co,.Ltd. (Taiwan), and NIKKO COMPANY (Japan) among others, are the key manufacturers that holds major market share in the last few years. Major focus was given to the collaborations, partnerships and new product development due to the changing requirements of users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Ton) and Value (USD Million/Billion) |

|

Segments covered |

Product Type, End-Use Industry, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

KYOCERA Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), CoorsTek Inc. (US), CeramTec GmbH (Germany), MARUWA Co., Ltd. (Japan), KOA Corporation (Japan), Yokowo Co., Ltd. (Japan), TONG HSING ELECTRONIC Industries,LTD. (Taiwan), LEATEC Fine Ceramics Co,.Ltd. (Taiwan), and NIKKO COMPANY (Japan) |

This report categorizes the global ceramic substrates market based on product type, end use industry, and region.

On the basis of Product Type, the ceramic substrates market has been segmented as follows:

- Alumina Substrates

- Aluminum Nitride Substrates

- Beryllium Oxide Substrates

- Silicon Nitride Substrates

- Other Ceramic Substrates

On the basis of End-Use Industry, the ceramic substrates market has been segmented as follows:

- Consumer Electronics

- Automotive

- Telecom

- Military & Avionics

- Industrial

- Others

On the basis of region, the ceramic substrates market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Arica

- South America

Recent Developments

- In 2023, Murata Electronics (Thailand), Ltd., a manufacturing subsidiary of Murata Manufacturing Co., Ltd., has been constructing a new production building since July 2021. It has now completed the building and held a ceremony to mark its completion in March 2023. The production system is ready to meet medium- to long-term growth in demand for multilayer ceramic capacitors.

- In 2022, CoorsTek Inc., celebrated the groundbreaking of the Advanced Materials Processing (AMP) expansion at its Benton, Arkansas facility. The materials produced in this new facility will enable the world’s most sophisticated semiconductor manufacturing processes.

- In 2021, KYOCERA developed a silicon nitride (SN) hot-surface igniter with brilliant endurance and very stable ignition performance for 230-volt industrial or residential gas furnaces, water heaters, and boilers.

Frequently Asked Questions (FAQ):

What are the major developments impacting the market?

The chances for use ceramic substrates in automotive and electronics industry for the need of miniaturization are expected to shift market trends.

Who are major players in ceramic substrates market?

KYOCERA Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), CoorsTek Inc. (US), CeramTec GmbH (Germany), MARUWA Co., Ltd. (Japan), KOA Corporation (Japan), Yokowo Co., Ltd. (Japan), TONG HSING ELECTRONIC Industries,LTD. (Taiwan), LEATEC Fine Ceramics Co,.Ltd. (Taiwan), and NIKKO COMPANY (Japan).

What are the factors Influencing the growth of Ceramic substrate?

Increasing need for advanced architecture and miniaturization of electronics devices

What are Alumina and Aluminum Nitride Substrate?

Alumina substrates contain at least 80% of aluminum oxide (AL2O3). Lesser amounts of silica (SiO2), magnesia (MgO), and zirconia (ZrO2) can also be added to these ceramic substrates. Aluminum nitride (AlN) substrate has very good thermal conductivity and excellent thermal shock and corrosion resistance.

What is the biggest Restraint for ceramic substrate?

High volatility in raw material prices

How many types of ceramic substrate are available in the market?

Alumina, aluminum nitride, silicon nitride, beryllium oxide, and others. Alumina is amongst the most widely used ceramic substrate. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

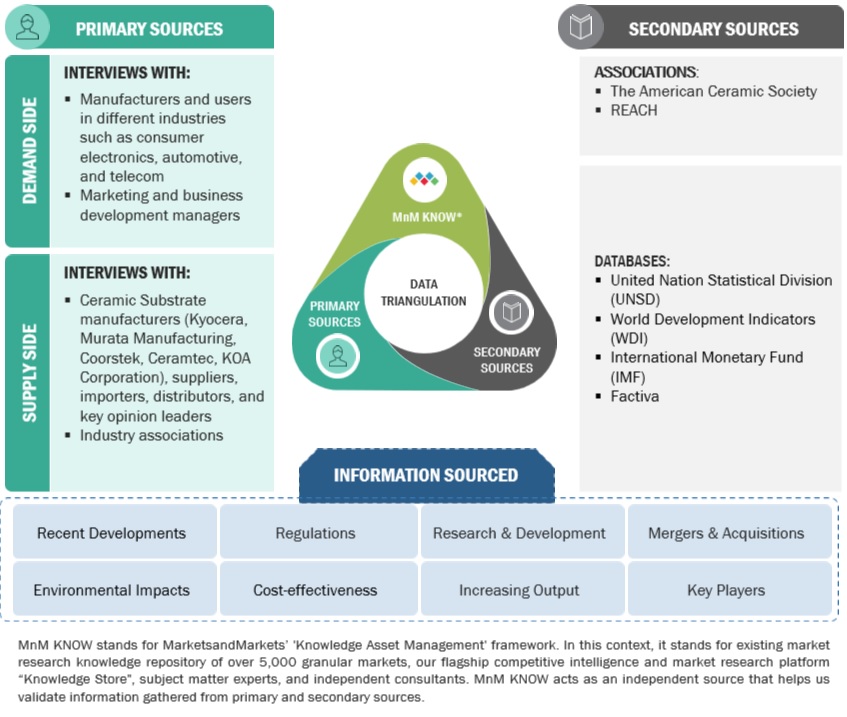

The study involved four major activities in estimating the market size for ceramic substrates market. Intensive secondary research was done to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

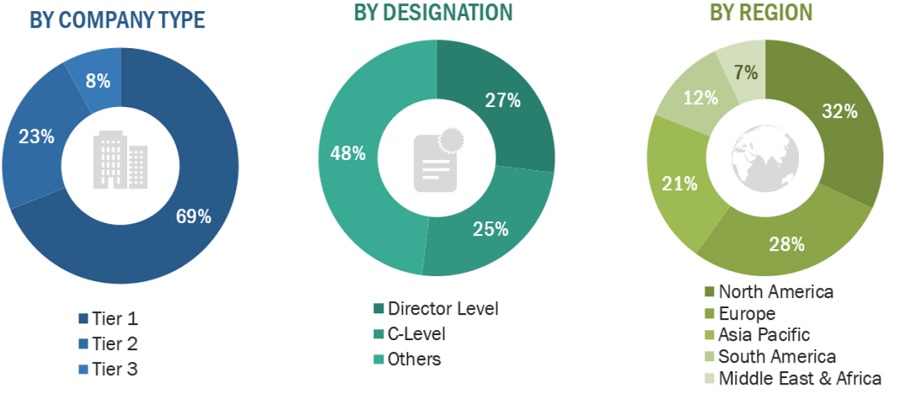

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The ceramic substrates market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized from key opinion leaders in various applications for the ceramic substrates market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

KYOCERA Corporation |

Global Strategy & Innovation Manager |

|

Murata Manufacturing Co., Ltd. |

Technical Sales Manager |

|

CoorsTek Inc. |

Senior Supervisor |

|

CeramTec GmbH |

Production Supervisor |

|

MARUWA Co., Ltd. |

Production Manager |

Market Size Estimation

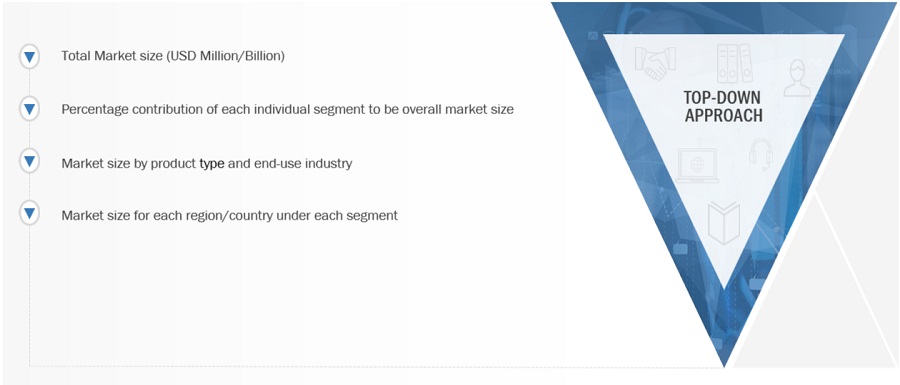

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ceramic substrates market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Ceramic substrates Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Ceramic substrates Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into respective segments and subsegments. To realize the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the ceramic substrates industry.

Market Definition

Ceramic substrates are hard, nonmetallic, and frequently thin materials that serve as the foundation or base for electronic components and circuits. A thick coating of ceramic paste is applied to a substrate to generate a ceramic substrate. Ceramic pastes are employed in ceramic tableware decoration as well as the formation of capacitors and dielectric layers on stiff substrates for microelectronics. Ceramic slurry formation is performed by slip casting, gel casting, or tape casting.

Tape casting is the process of applying a thin coating of ceramic slurry on a support surface with a knife edge. Tape casting is commonly used to create thin ceramic sheets or tapes that may be sliced and layered to create multilayer ceramics for capacitors and dielectric insulator substrates. They are often made of ceramics, such as alumina (aluminum oxide) or aluminum nitride, which have special electrical, thermal, and mechanical qualities that make them perfect for a variety of applications in electronics, telecommunications, automotive, and other fields. Ceramic substrates provide structural support and an insulating layer for various electronic components such as integrated circuits (ICs), resistors, capacitors, and semiconductor devices, allowing them to be densely packed and connected within electronic devices while maintaining thermal stability and electrical isolation. These substrates are essential components of contemporary electronic and electrical systems, providing benefits like as high thermal conductivity, superior electrical insulation, and resilience to environmental influences.

Key Stake Holders

- Ceramic Substrates manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the ceramic substrates market in terms of volume and value

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the ceramic substrates market based on product type, and end use industry

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Ceramic Substrates Market