Food Certification Market by Type (Iso 22000, Brc, Sqf, Ifs, Halal, Kosher, Free-Form Certifications), Application(Meat, Poultry, and Seafood, Dairy, Infant Food, Beverages, Bakery & Confectionery), Risk Category and Region - Global Forecast to 2028

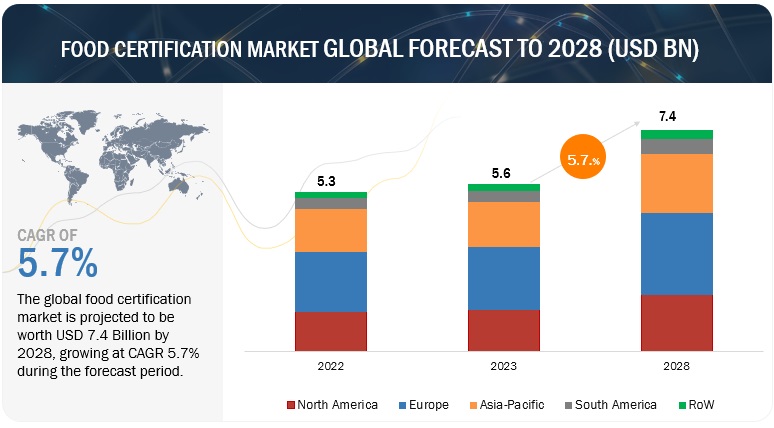

[275 Pages Report] The food certification market is estimated at USD 5.6 billion in 2023 and is projected to reach USD 7.4 billion by 2028, at a CAGR of 5.7% from 2022 to 2028.

The significance and expansion of food certification stem from multiple factors. In an interconnected world where food is sourced and distributed globally, guaranteeing food safety and quality has become a top priority. Food certification acts as a dependable mechanism, verifying compliance with established standards and regulations to mitigate the risks of contamination, foodborne illnesses, and other health hazards. The growing consumer consciousness and demand for healthier, sustainable, and ethically produced food have elevated the role of certification schemes. Certifications such as organic, fair trade, and non-GMO offer assurance that food is produced using environmentally friendly practices, fair labor conditions, and without genetically modified organisms. By providing transparent information, certifications empower consumers to make informed choices aligned with their values, promoting responsible consumption.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Strict food industry standards and certification requirements

The regulatory interventions are projected to affect the food certification industry in the coming years. An increase in government-enforced regulations, extensive industry standards, and certification requirements are projected to drive the growth of the market. The enforcement of stronger penalties against non-compliant parties is projected to encourage the companies to invest in certification compliance. These factors are projected to impact the growth of the market positively.

Food production is strictly regulated by national and international legislation. For instance, recently, extensive governmental laws, such as the Canadian “Multi-Year Regulatory Modernization Plan” or the “US Food Safety Modernization Act” (FSMA), have been introduced or are now in the full deployment phase. Food companies are extensively and voluntarily using industry standards and third-party certifications to comply with the national and international legislations that regulate the food industry to ensure food safety and successfully operate in certain markets.

Restraints: Lack of infrastructure and financial support for food safety and security in developing countries

Developing countries have unique challenges to implementing food safety regulations as presented on a global scale. The food processing industries in the developing countries have some common characteristics, such as they are small scale, limited workplace, and most start in dingy premises. Small-scale businesses are also, at times, managed by non-food technologists in companies that are not focusing on engaging food technologists who they believe could be a more expensive or unnecessary addition to their current requirements. The lack of infrastructure and personnel in developing countries is a key factor inhibiting the growth of the food certification market.

Many developing countries are dependent on their small-scale and regional food businesses, which are incompetent to obtain global food certifications due to poor infrastructure and limited resources. This is a key factor that further impacts the growth of the food certification market.

Food safety systems have poor infrastructure and implementation facilities in developing countries, such as India and countries in East Africa and North Africa. The food certification market is projected to grow at a slower rate in these countries due to the poor basic supporting infrastructure for certification of food products.

Opportunities: Emerging markets in Asian, African, and other developing countries

The increase in food trade across developing countries leads to an increase in growth opportunities for manufacturers in the food certification market. The increase in incidences of foodborne illnesses and improper sanitation and processing conditions in food production factories of few countries, such as Indonesia, increasingly need food certification to gain consumer confidence. China is a potential food-importing and exporting country and is hence, a key market for food certification. The inception of regulations in developing countries has encouraged food trade, authorization of authorities to prohibit the import & supply of contaminated food and enforce food recalls, and nutrition labeling of foods. These factors are projected to drive the demand for certification services in these regions.

The import of food products not only cater to the safety standards of the country of origin but also pass the inspection and quarantine phases in the country they are exported. It is essential for developing countries to meet international standards of food certification to sustain the food trade supply. According to the 14th ASEAN-Canada Dialogue Meeting held in 2017, ASEAN country members and Canada agreed to enhance the role of SMEs for the region’s economic development through food trade, authorization of authorities to prohibit the import & supply of contaminated food, enforcing food recalls, and nutrition labeling of foods. These factors are projected to drive the demand for certification services in these regions.

The import of food items not only meets the safety standards of the country of origin but also clears the inspection and quarantine phases in the countries they are exported to. It has been essential for emerging countries to meet the international standards of food certification to sustain the food trade supply. According to the 14th ASEAN-Canada Dialogue Meeting held in 2017, ASEAN country members and Canada agreed to enhance the role of SMEs in the region’s economic development.

Countries such as India, China, and South Korea import large quantities of GM food crops from the US. With the increase in awareness among regulatory authorities and consumers, the testing of GM products has further led to a potential increase in demand. In India, the change in food consumption habits and high nutrient requirements, accompanied by the penetration of GM crops, are the key factors that are projected to drive the demand for non-GMO certification services. Thus, the adoption of strong practices for food safety in developing countries leads to high growth opportunities for food certification services.

Challenges: Lack of resources, awareness, and financial support among small-scale manufacturers

A significant number of small-scale food product manufacturers are not aware of the quality standards and certifications, particularly in developing countries. These small-scale producers lack the skills and knowledge and have low investment capability, which is a challenge for the food certification market, specifically in those developing countries where the ratio of small-scale manufacturers is higher. The relevant private and public institutes should take measures to educate these manufacturers about food safety and quality standards.

According to a study published by the International Conference on Trends in Economics, Humanities, and Management in 2014, small-scale food manufacturing companies in the Philippines revealed that HACCP implementation and certification are hindered due to common problems, such as limited financial capability, the lack of prerequisite programs, which include hygiene and sanitation in the factory, limited HACCP knowledge, and technical competence, proper training, the lack of external support from the government and industry associations, management problems comprising low commitment, motivation, and interest in the long-term benefits of HACCP for the company, as well as the lack of government infrastructure and support.

Based on application, meat, poultry, and seafood products is estimated to account for the largest market share of the food certification market.

Meat, poultry, and seafood products play a significant role in the food certification market for several reasons. Food certification is a process that ensures that food products meet specific standards of quality, safety, and sustainability. These certifications provide assurance to consumers and businesses that the products they are purchasing or using meet certain criteria, which can include aspects such as production methods, ingredient sourcing, and environmental impact. Meat, poultry, and seafood products are highly perishable and can be susceptible to contamination and spoilage.

Food certification programs establish rigorous safety and quality standards to prevent foodborne illnesses and maintain product freshness. These certifications verify that the products have been handled, stored, and processed in a manner that minimizes health risks and ensures high quality. Hence, certifications provide trust, credibility, and value to both businesses and consumers in the complex and competitive food industry.

Based on type, The ISO 22000 certification are anticipated to dominate the market.

ISO 22000 covers various aspects of food safety management, including hazard analysis, risk assessment, and control measures. It establishes a systematic approach to identifying potential risks, implementing preventive measures, and monitoring the entire food production and supply chain. With this certification, companies can effectively identify and control food hazards, reducing the likelihood of contamination, product recalls, and foodborne illnesses. Additionally, ISO 22000 certification facilitates access to new markets and trade opportunities. It serves as a passport to global food markets by harmonizing food safety practices and meeting the requirements of international buyers. Many importers and retailers often require their suppliers to have ISO 22000 certification, making it a prerequisite for business partnerships and contracts. As a result, the demand for ISO 22000 certification increases, driving the growth of the food certification market.

High-risk food segment of the food certification market by risk category is projected to witness the highest CAGR during the forecast period.

Certification serves as a safeguard against foodborne illnesses, contamination, and adulteration, which can have severe consequences for consumers. High-risk food products, such as dairy, meat, seafood, and ready-to-eat meals, are particularly susceptible to bacterial growth, pathogenic contamination, and improper handling practices. By implementing rigorous certification standards, the food industry can minimize these risks and enhance consumer confidence in the products they purchase.

Furthermore, certification of high-risk food products is often a prerequisite for accessing international markets. Many countries have established import regulations that require food products to meet specific certification standards. By obtaining certifications that comply with these regulations, food manufacturers can expand their market reach and access lucrative export opportunities. Certification ensures that high-risk food products meet stringent quality standards, build consumer trust, differentiate products, and facilitate access to international markets. Through the continuous improvement and adherence to certification standards, the food industry can provide consumers with safe, high-quality food options, fostering a healthier and more sustainable future

The Europe market is projected to contribute the largest share for the food certification market.

The Europe region is the dominant market for food & beverages and is expected to be the largest for food certification as well. The food industry in Europe is gigantic. Europe has established robust regulatory frameworks for food safety and quality. The European Union (EU) has implemented various regulations and directives, such as the General Food Law, Hygiene Package, and Novel Food Regulation. These regulations require food businesses to comply with strict standards and undergo certification processes to ensure food safety. As a result, the demand for food certification services is high in Europe. The European region's high standards and stringent regulations often influence global food safety and quality standards. International organizations, such as the Codex Alimentarius Commission, take into account European standards when developing global guidelines. This influence extends to certification schemes, where European certification bodies and standards have gained recognition worldwide.

Also, Europe is a significant market for food products, both domestically and internationally. To access European markets, exporters from other regions must comply with European food safety and quality standards. Certification becomes a crucial requirement for exporters to demonstrate compliance and gain market access. For example, the EU has established specific regulations for organic products (EU Organic Certification) and protected geographical indications (PGI) and protected designations of origin (PDO). These certifications assure consumers of the authenticity and quality of specific food products. The region's regulations and consumer demands drive the demand for certification services, making it a critical component of the European food industry.

Key Market Players

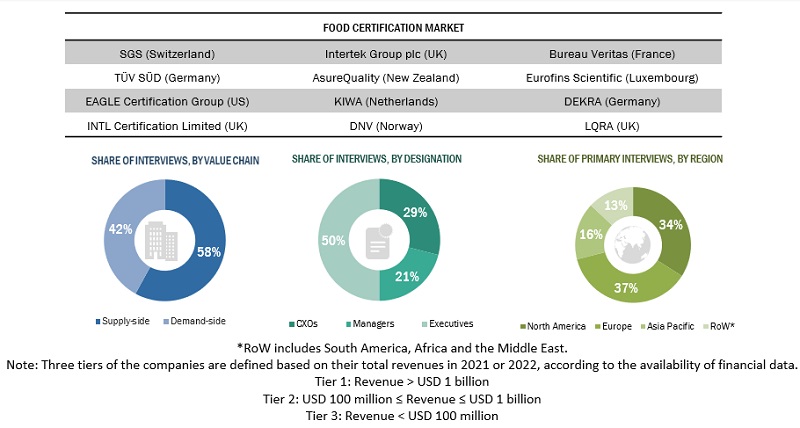

DEKRA (Germany), SGS (Switzerland), Intertek (UK), AsureQuality (New Zealand), and Bureau Veritas (France) are among the key players in the global food certification market. These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, By Application, By Supply Chain (qualitative), By Risk Category, and By Region |

|

Regions covered |

North America, South America, Europe, Asia Pacific, and Rest of the World |

|

Companies studied |

|

Report Scope:

Food Certification Market:

By Type

- ISO 22000

- BRC

- SQF

- IFS

- Halal

- Kosher

- 'Free From' Certifications

- Other Types

By Risk category

- High-risk

- Low-risk

By Application

- Meat, Poultry, and Seafood Products

- Dairy Products

- Infant Food Products

- Bakery & Confectionery Products

- Beverage

- 'Free From' Foods

- Other Applications

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In October 2020, DEKRA (Germany) announced the mergers of its UK process safety, consulting, testing, and advisory business, Chilworth Technology Ltd. (DEKRA Process Safety) with its business DEKRA Organizational Reliability to form DEKRA Organizational and Process Safety (DEKRA UK Ltd.) This extended the company’s offerings and services in the UK. This new organization is also a one-stop-shop for high hazard processes in the pharmaceutical and food industries, offering practical solutions in the process and behavioral safety.

- In August 2020, SGS (France) launched remote FSMA certification audits to offer flexibility for food suppliers during COVID-19 to enable them to opt for a full accredited certification audit for FSMA FSVP while ensuring the safety of food products throughout the supply chain.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the food certification market?

The Europe region accounted for the largest share and fastest growing market, in terms of value, of USD 1.9 Billion, of the global food certification market in 2022 and is expected to grow at a CAGR of 5.3% during the forecast period.

What is the current size of the global food certification market?

The food certification market is estimated at USD 5.6 billion in 2023 and is projected to reach USD 7.4 billion by 2028, at a CAGR of 5.7% from 2022 to 2028.

Which are the major key players in the market?

Key players operating in this market include DEKRA (Germany), SGS (Switzerland), Intertek (UK), AsureQuality (New Zealand), and Bureau Veritas (France).

What are the factors driving the food certification market?

- Increasing consumer demand for safe and high-quality food products.

- Growing awareness and concern regarding food safety and health.

- Regulatory requirements and government initiatives to ensure food safety standards.

- Globalization of the food supply chain, necessitating standardized certification for international trade.

- Rise in food fraud incidents, leading to the need for rigorous certification processes.

Which segment by risk category accounted for the largest food certification market share?

The high-risk foods segment dominated the market for food certification market and was valued the largest at USD 3.9 Billion in 2022. High-risk food products dominate the food certification market due to the significant risks they pose to consumer health and safety. The stringent certification requirements imposed on these products are justified by the need to prevent foodborne illnesses, contamination, and adulteration. Certification ensures that high-risk food products meet stringent quality standards, build consumer trust, differentiate products, and facilitate access to international markets.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

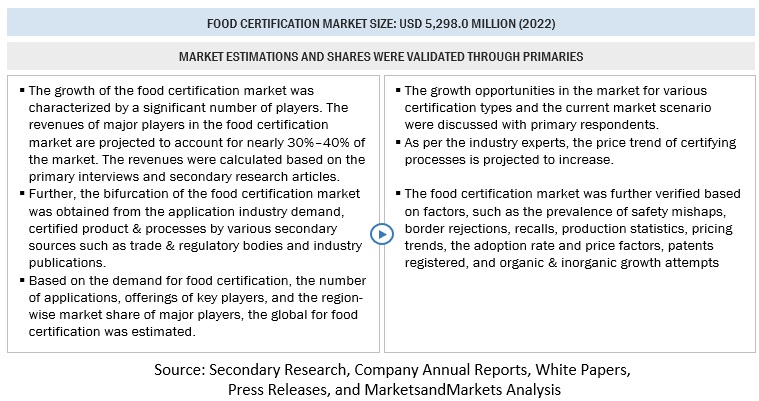

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the food certification market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), China Food and Drug Administration (CFDA), United States Department of Agriculture (USDA), European Food and Fermentation Cultures Association (EFFCA), U.S Department of Agriculture (USDA), Organization for Economic Co-operation and Development (OECD) and others were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The food certification market comprises several stakeholders, including manufacturers and suppliers of food certification, processors, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, for food certifications, and technology providers. Primary sources from the demand side include key opinion leaders, executives, vice presidents, and CEOs of food certification companies catering food certification in developing companies through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The food certification market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food certification market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market size estimation: Top-Down approach

- Calculations for the market size have been based on the revenues of key companies identified in the market, which dominated the overall market size. This overall market size has been used in the top-down procedure to estimate the size of other individual markets (mentioned in the market segmentation) via percentage splits derived using secondary and primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the food certification were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- For the calculation of market shares of each market segment, the size of the most appropriate and immediate parent market has been considered for implementing the top-down procedure. The bottom-up procedure has also been implemented for data extracted from secondary research to validate the market size obtained for each segment.

Food Certification Market: Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Bottom-up approach

- The bottom-up approach was implemented for the data extracted from secondary research to validate the share of the market segments obtained.

- With the bottom-up approach, food certification for each source and form for each country were added up to arrive at the global and regional market size and CAGR.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the food certification market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each individual market have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size from the above estimation process using both top-down and bottom-up approaches, the total market was split into several segments and subsegments. To complete the overall food certification market estimation and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to the Food and Agriculture Organization (FAO), “Food certification is the procedure, by which official certification bodies and officially recognized bodies provide written or equivalent assurance that foods or food control systems conform to requirements. Certification of food may be, as appropriate, based on a range of inspection activities, which may include continuous on-line inspection, auditing of quality assurance systems, and examination of finished products.”

Key Stakeholders

- Food certification service providers

- Food technologists

- Food product manufacturers

- Raw material suppliers

Report Objectives

Market Intelligence

- Determining and projecting the size of the food certification market based on type, application, risk category, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the food certification market.

Competitive Intelligence

- Identifying and profiling the key market players in the food certification market.

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players.

- Providing insights into the key investments and product innovations and technology in the food certification market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European food certification market, by key country

- Further breakdown of the Rest of South American food certification market, by key country

- Further breakdown of the Rest of Asia Pacific food certification market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Food Certification Market

We need analysis for Europe and South America for each free-from certifications by country . Also wondering if we can get opportunity size by value chain for free-from certification such as Gluten-Free, Allergen-Free, Vegan, Organic certification.

Does this report contain a detailed analysis into high-risk foods on the meat industry? Do you provide additional insights into the impact of high-risk foods on the meat, poultry, and seafood segment?