Mass Spectrometry Market by Product (Instrument (Triple Quadrupole, Q-TOF, FTMS, Quadrupole, TOF), Services), Sample Preparation (LC-MS, GC-MS), Application (Omics, Clinical, Environmental), End User (Pharma, Academia, F&B) & Region - Forecast to 2028

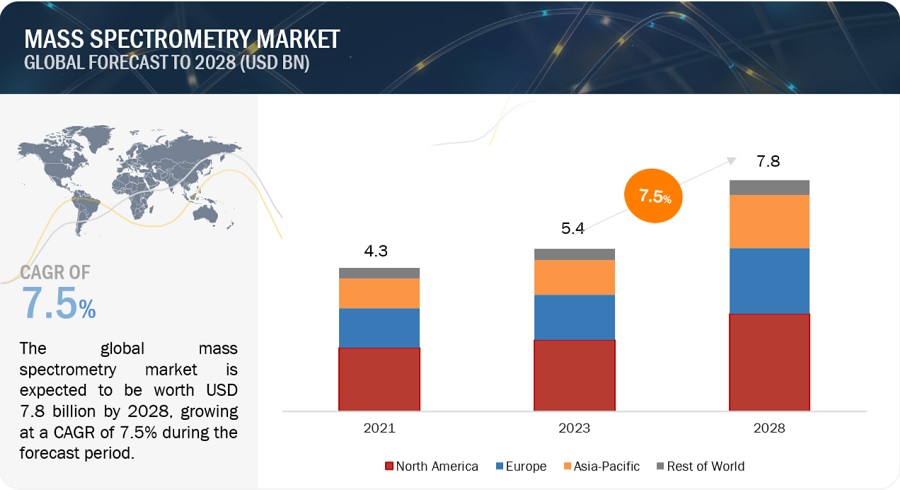

The global mass spectrometry market in terms of revenue was estimated to be worth $5.4 billion in 2023 and is poised to reach $7.8 billion by 2028, growing at a CAGR of 7.5% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth of the clinical mass spectrometry market is attributed to the Increasing spending on pharmaceutical R&D across the globe, government regulations on drug safety, growing focus on the quality of food products, increase in crude and shale gas production, and growing government initiatives for pollution control.

Global Mass Spectrometry Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Mass Spectrometry : Market Dynamics

Driver: Increasing R&D investments in the pharmaceutical and biotechnology industry

The R&D expenditure of pharmaceutical companies has increased significantly over the last two decades. Research activities in the pharmaceutical and biotechnology industries are driven by investments in key areas, such as biopharmaceuticals and personalized medicine. According to the 2022 EU Industrial R&D Investment Scoreboard, the pharmaceutical and biotechnology sector amounts to 21.5% of total global R&D expenditure. Mass spectrometry plays a key role in the pharmaceutical industry, from the early stages of drug discovery to late-stage development and clinical trials. Thus, increasing funding in the pharmaceutical and biotechnology industry is expected to drive the growth of the mass spectrometry market.

Restraint: Premium Product Pricing

Equipped with advanced technologies and features spectrometry instruments are generally premium priced. With addition to that, the cost of compliance of the system to industry standards is also very high. Also, as academic research laboratories have controlled budgets it is difficult for them to afford such systems. However, technological developments and demand have increased system prices. Pharmaceutical companies require many such systems, and hence, the capital cost increases significantly. The price of a spectrometer influences the purchase decision of end users. These are the major factors limiting the adoption of mass spectrometry systems among end users.

Opportunity: Growth opportunities in emerging countries

Developing countries such as China and India present various opportunities for the growth of the mass spectrometry market. Together, China and India generate a huge demand for single mass spectrometers and hybrid spectrometry instruments due to the Greenfield projects being set up in various end-user industries in these countries. The biopharmaceutical industry in these countries is robust and is expected to contribute largely to the growth of the spectrometry and chromatography markets. Key industry players are establishing new facilities, R&D centers, and innovation centers to capitalize on this opportunity and engaging in collaborations with players in the Asian market.

Challenge: Dearth of Skilled Professionals

Skilled personnel with relevant experience and knowledge are required for the efficient use of spectrometry equipment. Errors such as misplacing a sample in GC-MS or LC-MS or issues such as fingerprints or bubbles in the solution can impact the quality of the final result. Moreover, in mass spectrometry, sample preparation (including aliquoting, dilution, and extraction) is a key step in isolating the analyte of interest. It eliminates interferences that could affect the precision of the result. The lack of knowledge regarding the right choice of technology also affects results and may incur direct and indirect expenses for end users. There is currently a dearth of skilled personnel for method development, validation, operation, and troubleshooting activities, which is expected to restrain the growth of the mass spectrometry market to a certain extent in the coming years.

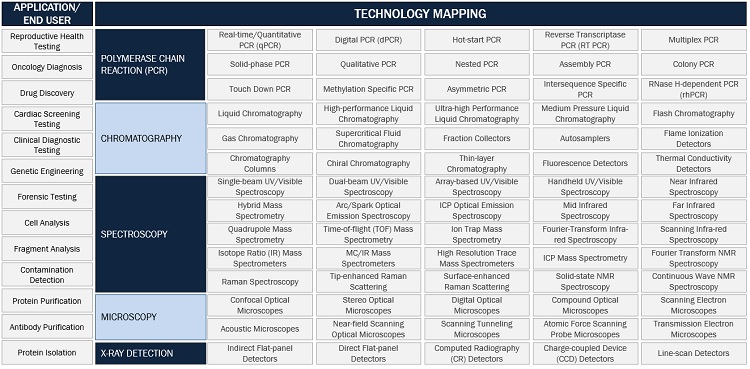

Market Ecosystem

By product, the instrument segment accounted for the largest share of the mass spectrometry industry during the forecast period.

Based on the product, the mass spectrometry market is segmented into instruments and software & services. The hybrid mass spectrometry segment accounts for the largest share of the clinical mass spectrometry market. Hybrid mass spectrometers exhibit, rapid and high-resolution testing abilities with more accurate and precise results.

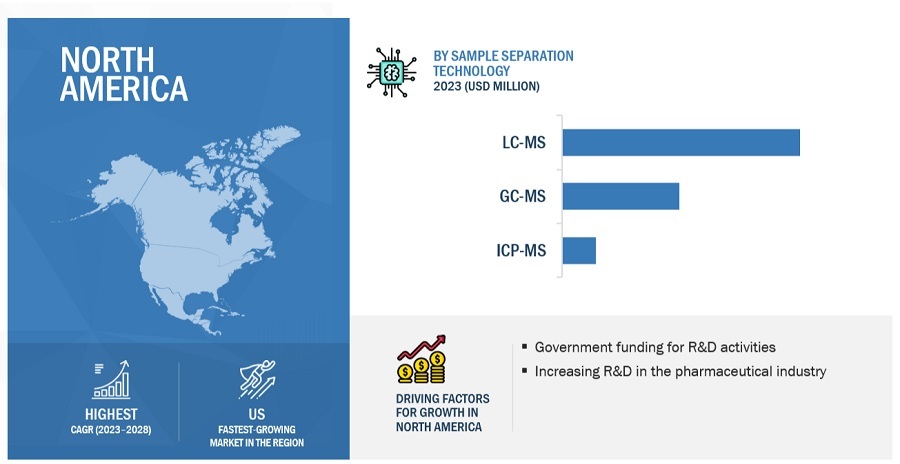

By sample preparation technique, the LC-MS segment accounted for the largest share of the mass spectrometry industry during the forecast period.

Based on sample preparation technique, the mass spectrometry market is segmented into GC-MS, LC-MS, ICP-MS, and others. The LC-MS segment accounts for the largest share of the clinical mass spectrometry market. Due to its high sensitivity, there is a rising need for LC-MS in the pharmaceutical industry. This is because they offer to identify and measure a broader range of compounds with minimal sample preparation, which is expected to propel the growth of this segment during the forecast period.

By application, the OMICS research segment of mass spectrometry industry is expected to witness a significant growth during the forecast period.

Based on application, the mass spectrometry market is segmented into OMICS research, drug discovery, environmental testing, food testing, pharma-biopharma manufacturing, clinical diagnostics, applied industries, and other applications. The OMICS research segment is expected to witness a significant growth during the forecast period. The biopharmaceutical and biotechnology industries have facilitated the advancement of diagnostics & biomarker identification applications in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years.

By End User, pharmaceutical companies’ segment of the mass spectrometry industry to grow at the fastest rate during the forecast period.

Based on end user, the global mass spectrometry market is segmented pharmaceutical companies, biotechnology companies, research labs & academic institutes, environmental testing labs, F&B industry, forensic labs, petrochemical industry and other end users. The pharmaceutical industry has facilitated the advancement of diagnostics & biomarker identification in the R&D sector, leading to its significant growth and dominance in the industry in the upcoming years. Also, the anticipated revenue growth of this segment during the forecast period is attributed to the rapid expansion of the pharmaceutical industry worldwide and the technological advancements in the pharmaceutical sectors.

To know about the assumptions considered for the study, download the pdf brochure

North America is expected to be the largest market of the mass spectrometry industry during the forecast period.

North America, comprising the US and Canada, held the largest share of the global mass spectrometry market in 2021. This region is witnessing a growth in funding for research and government initiatives in the US, widespread usage of mass spectrometry in the metabolomics and petroleum sector, and CFI funding towards mass spectrometry projects in Canada.

As of 2021, prominent players in the mass spectrometry market are SCIEX AB(US), Thermo Fisher Scientific (US), Agilent Technologies (US), Waters Corporation (US), PerkinElmer Inc. (US), Shimadzu Corporation (Japan), Bruker Corporation (US), Analytik Jena (Germany), JEOL Ltd. (Japan), Hiden Analytical (UK), and MKS Instruments (US), among others.

Scope of the Mass Spectrometry Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$5.4 billion |

|

Projected Revenue by 2028 |

$7.8 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.5% |

|

Market Driver |

Increasing R&D investments in the pharmaceutical and biotechnology industry |

|

Market Opportunity |

Growth opportunities in emerging countries |

This report has segmented the global mass spectrometry market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Instruments

- Hybrid Mass Spectrometry

- Triple Quadrupole

- Quadrupole ToF (Q-ToF)

- Single Mass Spectrometry

- Quadrupole

- Time-Of-Flight (ToF)

- Ion Trap

- Software & Services

By Sample Preparation Technique

- GC-MS

- LC-MS

- ICP-MS

- Others

By Application

- OMICS Research (Genomics, Proteomics and Metabolomics)

- Drug Discovery

- Environmental Testing

- Food Testing

- Pharma-Biopharma Manufacturing

- Clinical Diagnostics

- Applied Industries

- Other Applications

By End User

- Pharmaceutical Companies

- Biotechnology Companies

- Research Labs & Academic Institutes

- Environmental Testing Labs

- F&B Industry

- Forensic Labs

- Petrochemical Industry

- Other endusers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- ASEAN region

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Mass Spectrometry Industry

- In January 2022, Thermo Fisher and Symphogen extended their collaborative partnership with aim to deliver workflows for simplified characterization and quality monitoring of complex therapeutic proteins using the Thermo Scientific Q Exactive Plus Orbitrap LC-MS/MS system.

- In February 2023, SCIEX announced collaboration with HighRes Biosolutions to bring customizable automation solutions powered by Cellario software, which would add automation benefits to the Echo MS system.

- In February 2022, Waters Corporation acquired Charge Detection Mass Spectrometry technology assets and intellectual property rights of Megadalton Solutions, Inc., to broaden its application in Cell and Gene Therapy.

- In September 2022, Agilent Technologies partnered with MOBILion Systems for ion mobility separation technology called Structures for Lossless Ion Manipulation (SLIM) on its Q-TOF mass spectrometers.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global mass spectrometry market?

The global mass spectrometry market boasts a total revenue value of $7.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global mass spectrometry market?

The global mass spectrometry market has an estimated compound annual growth rate (CAGR) of 7.5% and a revenue size in the region of $5.4 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

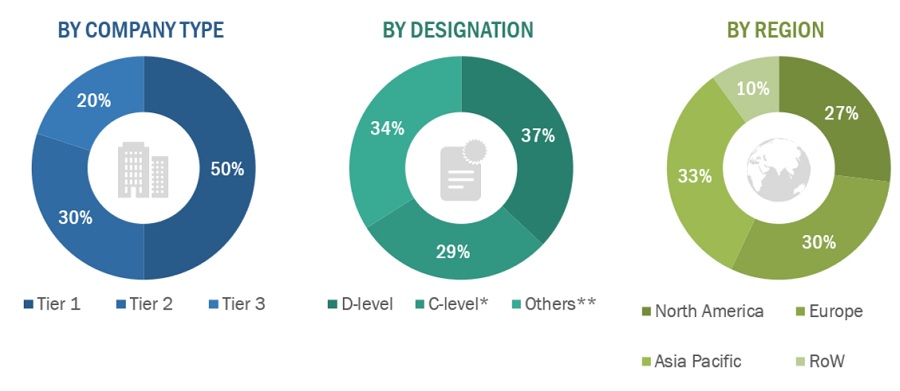

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the mass spectrometry market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the clinical mass spectrometry market. The primary sources from the demand side include medical OEMs, Analytical instrument OEMs, CDMOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2022, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

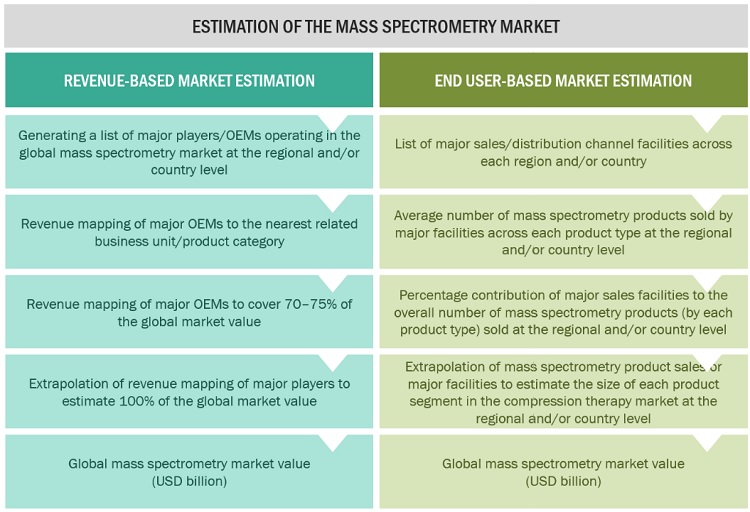

Market Estimation Methodology

In this report, the global mass spectrometry market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the mass spectrometry business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the clinical mass spectrometry market

- Mapping annual revenues generated by major global players from the mass spectrometry segment (or nearest reported business unit/product category)

- Revenue mapping of key players to cover major share of the global market, as of 2022

- Extrapolating the global value of the mass spectrometry industry

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global mass spectrometry market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the clinical mass spectrometry market was validated using both top-down and bottom-up approaches.

Market Definition

Mass spectrometry is an analytical technique used to measure specific compounds and evaluate molecular structure & chemical properties. This technique ionizes chemical species and sorts the ions based on the mass-to-charge ratio. Mass spectroscopy has become a powerful analytical tool for testing in various industries due to its high sensitivity.

Key Market Stakeholders

- Mass spectrometry and related device manufacturing companies

- Product suppliers, direct distributors, and third-party sales channels

- Research laboratories and academic institutes

- Pharmaceutical and biopharmaceutical companies

- Biotechnology companies

- Environment protection agencies and institutes

- Food, beverage, and agricultural analysis companies

- Cosmetic companies

- Market research and business consulting firms

- Government, national, and international regulatory authorities

- Non-government and independent associations/organizations

- Venture capitalists and other public-private funding agencies

Objectives of the Study

- To define, describe, and forecast the mass spectrometry market on the basis of product, sample preparation technique, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global clinical mass spectrometry market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global mass spectrometry market.

- To analyze key growth opportunities in the global mass spectrometry market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, ASEAN region and the RoAPAC), and rest of the world.

- To profile the key players in the global mass spectrometry market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global clinical mass spectrometry market, such as product launches, agreements, expansions, and & acquisitions.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global mass spectrometry market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top fifteen companies

Company Information

- Detailed analysis and profiling of additional market players (up to 15)

Geographic Analysis

- Further breakdown of the Rest of Europe mass spectrometry market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific mass spectrometry market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the Latin America mass spectrometry market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mass Spectrometry Market

Thanks You For the good information sharing with us.

Which geography will have the largest share of the global Mass Spectrometry Market?

Thank you. This is, as usual, an authoritative survey of the field. A perspective for science historians would be tracing the evolution as backwards as your collected data and forecasts go. This is a totally virgin field that is worth investigation. I am looking for contact, since I am in your mailing list. Best regards