Automotive IoT Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Hardware, Software, Services), by Connectivity Form Factor (Embedded, Tethered, Integrated), by Communication Type, by Application (Navigation, Telematics, Infotainment) and Global Growth Driver and Industry Forecast to 2028

Updated on : May 09, 2023

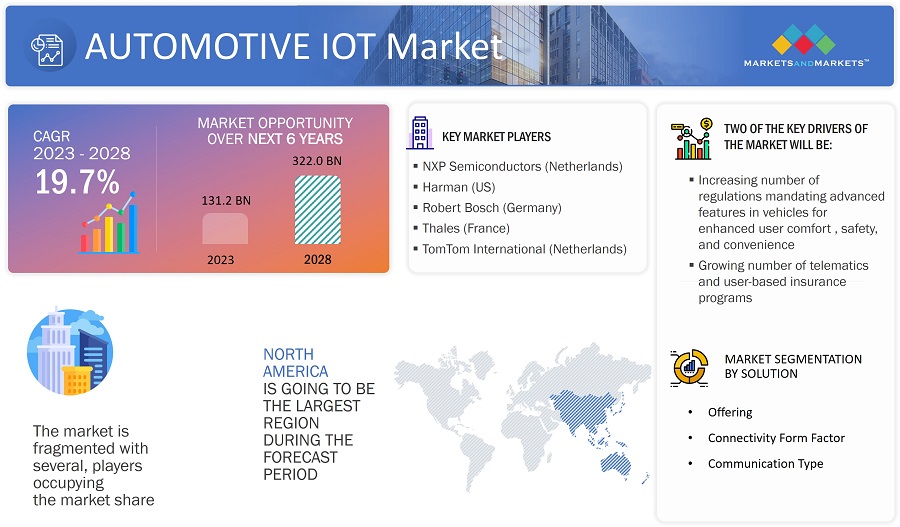

The global Automotive IoT Market in terms of revenue was estimated to be USD 131.2 billion in 2023 and is poised to reach USD 322.0 billion by 2028, growing at a CAGR of 19.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market.

The growth of the automotive IoT industry is governed by the increase in the number of regulations mandating advanced features in vehicles for enhanced user comfort, safety, and convenience along with the growing use of telematics and user-based insurance programs are the major factors driving growth of the automotive IoT market share.

Automotive IoT Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive IoT Market Dynamics

Drivers: Rising adoption of electric and hybrid vehicles to reduce CO2 emissions

Motor vehicles not running on fossil fuels, such as electric vehicles, hybrid electric vehicles, and solar-powered vehicles, are the primary choice for alternate technologies of powering engines that do not involve petroleum. The increasing use of electric and hybrid vehicles will help consumers reduce fuel costs, minimize air pollution due to the reduction in greenhouse gases (GHGs), improve air quality in urban areas, and reduce dependence on fossil fuels.

Environmental problems and the need to conserve energy are powerful factors that have advanced the development of HEVs and EVs. Along with an engine, hybrid vehicles are equipped with a motor and a high-voltage, high-power battery to drive that motor. Hybrid vehicles fulfil the need for high power require The stringency of emission norms across the world has resulted in technological advancements in the automotive sector to reduce the harmful exhaust emissions from vehicles. The advent of EVs is one of the most important steps in the automotive industry for environmental protection. These vehicles do not use any conventional fuel, thereby not producing any harmful gases. All these factors have accelerated the demand for electric cars, especially in developed regions such as North America and Europe. As these vehicles completely rely on an electrical power supply, the use of electronic devices is much more in these vehicles. Power electronics is a key technology for hybrids and represents 20% of the total cost of a vehicle, giving a significant amount of scope for semiconductor technology. These new technologies are in the introduction phase and are poised to impact the automotive semiconductor market in the coming years. The rising adoption of HEVs and EVs drives the requirement for automotive semiconductors. Governments of several countries, such as Germany, the US, Denmark, China, France, Sweden, the UK, and India, offer several incentives to promote the use of electric and hybrid cars within the country. Hence, advanced technologies and new vehicle features have increased the scope for electrification. As a result, original equipment manufacturers (OEMs) are installing a greater number of ICs, microprocessors, and sensors in high-end electric vehicles.ments and environmental benefits whenever necessary.

Restraint: Lack of infrastructure for proper functioning of connected vehicles

High-speed connectivity, telematics devices, and sensor-equipped fleets are vital for the smooth functioning of connected cars. Applications such as real-time monitoring and geo-fencing gather data using telematics devices, sensors, and software. On highways, information such as lane change, object detection, the distance between vehicles, and traffic statuses, and services such as navigation and connectivity are very important for connected cars. However, vehicles are not connected to each other and the cloud due to limited network connectivity on highways. In developing countries such as Mexico, Brazil, and India, IT infrastructure development on highways is slower than in developed economies. 3G and 4G-LTE communication networks required for connectivity are offered only in urban and semi-urban areas. While several third-party logistics companies operate in semi-urban and rural areas, there are low connectivity issues. Therefore, the lack of IT and communication infrastructure in developing regions can hamper the growth of the connected car market in these countries.

Opportunity: Integration of predictive maintenance platform with vehicles

Predictive maintenance (PdM) is one of the key growth areas for the automotive IoT market. It helps in lowering the operating and capital costs by facilitating proactive servicing and repair of assets while allowing more efficient use of maintenance personnel and replacement components. PdM enables companies to accurately diagnose and prevent failures in real-time, which is vital in critical infrastructure applications.

When technological advancementstechnologies such as the Over the Air (OTA) update are integrated with vehicles, car owners do not have to perform routine car maintenance activities at a service station. They need to visit the service centrescenters only for crucial or emergency servicing activities. Predictive maintenance is highly successful in assuring these comforts to vehicle owners.

Typically, technicians are sent to carry out routine diagnostic inspections and preventive maintenance according to fixed schedules, which can be a costly and labor-intensive process with little assurance that the failure would not occur between inspections. PdM is a more sophisticated technology for remotely monitoring the vehicle’s condition and identifying potential failures.

Challenge: Threats associated with cybersecurity

Despite major developments in connected vehicles technology, cybersecurity remains a major challenge to be tackled. IoT-enabled automobiles comprise hardware, software, mobile apps, and Bluetooth, and each of them is vulnerable to cyberattacks. There are various instances where cybersecurity has created a nuisance. In 2021, luxury brands Volkswagen and Audi were hit by a data breach that exposed the contact details and, in a few cases, personal information such as the driver’s license numbers in the US and Canada.

According to a white paper published by Accenture, data breaches have increased by 67%, with the US being the number one target of cyberattacks. Various stakeholders are working on cybersecurity systems to make connected cars safer by integrating cybersecurity and threat detection systems with data analytics and AI. In collaboration with a leading car manufacturer, Viasat developed the first-ever advanced, in-car connectivity system with military-grade security features.

There is an inherent risk due to the number of companies involved in handling data and the stakeholders present in the IoT value chain, along with observing the flow of data from end to end. From enterprises’ perspective, managing the security of data transferred from various devices at multiple locations is going to be a more complex task. To handle these flows, enterprises must adopt distributed data center management methods. The current model of centralized applications for reducing costs would not be applicable to IoT. Data management companies are expected to aggregate the data in multiple data centers for primary processing and then forward it to a central data center for further processing. In data center networking, the existing network links are not prepared to handle the data generated by IoT devices

Automotive IoT Ecosystem

In-vehicle communication to hold significant market share during the forecast period.

The in-vehicle-communication segment accounted for the largest share of the overall automotive IoT market, in terms of value, in 2022. With the increasing demand for advanced navigation and infotainment applications in both in luxury as well as economy cars, in-vehicle communication is growing rapidly.Global Positioning System ( GPS) and Bluetooth are mandatory systems inside a car that help connecting the vehicle with IoT for navigation and infotainment services.

Microcontrollers to account for the largest share of the automotive IoT market for hardware segment during the forecast period

Microcontrollers are the most commonly used semiconductor devices in almost all automotive electronic systems. On average, every high-end vehicle requires numerous microcontrollers for several applications, from controlling windshield wipers to internal temperature control. The MCU embedded in the automobile monitors and controls large complex electronic systems and is also useful for smaller independent applications, such as head-up displays and instrument clusters. A microcontroller-based engine control unit (ECU) is a critical part of automobile that contains 25 to 35 ECUs per design, while as many as 70 control units can be found on luxury vehicles today. Major companies offering microcontrollers for automotive IoT include Texas Instruments (US), Intel Corporation (US), and NXP Semiconductor (Netherlands), among others. For instance, in August 2022, NXP Semiconductors launched the NCJ37x Secure Element (SE), an automotive-qualified secure microcontroller with advanced cryptographic accelerators and physical built-in electrical attack resistance for various security-critical automotive applications such as smart access key fobs, Qi 1.3 authentication or car-to-cloud communication.

FPGAs to exhibit highest growth in terms of automotive IoT market for the hardware segment during the forecast period

FPGAs is expected to witness highest market growth for the automotive IoT market for semiconductor components hardware segment. In the case of autonomous vehicles, FPGAs can be used to handle data input from multiple sensors, such as cameras, LIDAR, and audio sensors. With the reconfigure and reprogrammed architecture, FPGA becomes ideal for AI and deep learning workload, where algorithms can be changed as per needs while using less space and low power consumption. These factors has led to the increase in their adoption for automotive applications.

Connectivity ICs to witness higher growth compared to semiconductor components for automotive IoT hardware market during the forecast period

Connectivity enables vehicles to interact with each other and with the infrastructure- for safer, greener, and more efficient roads. Car manufacturers are integrating wireless communication in both luxury and economy vehicles and need reliable wireless connectivity technology that reduces the total cost of a vehicle, from production to after-sales services. The demand for wireless technologies such as Wi-Fi, Bluetooth, and cellular networks (LTE, 3G, and HSPA+) is accelerating in the automotive industry, this in turn is expected to lead to increase in demand for connectivity ICs.

Automotive IoT market in Asia Pacific estimated to grow at the fastest rate during the forecast period

The automotive IoT market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. China, Japan, South Korea, and India are the major contributors to the market in the Asia Pacific region. China is the largest automobile market, making it attractive for automotive IoT. The market growth in Asia Pacific can be attributed to the changing government norms regarding the adoption of ADAS and connected services systems. Factors such as the high adoption rate of IoT in automotives due to their smart features, such as fleet management, better monitoring of fuel consumption and travel time, among others, coupled with the rising production of IoT-enabled automotive in the Asia Pacific region, have been instrumental in market growth. Moreover, government initiatives for collecting traffic data for proper monitoring of vehicles have also been beneficial for the adoption of automotive IoT technology in the Asia Pacific region.

Automotive IoT Market by Region

To know about the assumptions considered for the study, download the pdf brochure

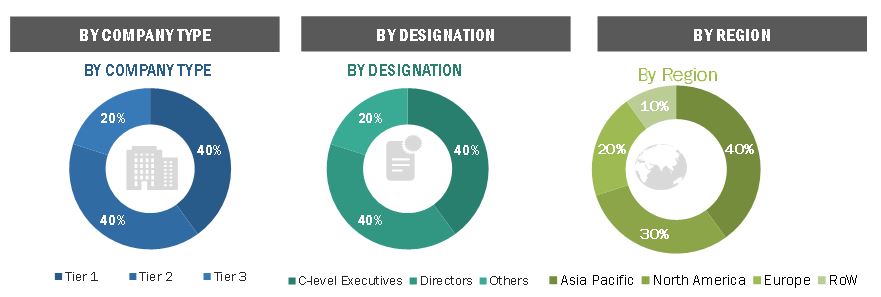

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the automotive IoT market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 – 40%, Tier 2 – 40%, and Tier 3 – 20%

- By Designation: C-level Executives – 40%, Directors –40%, and Others – 20%

- By Region: North America –30%, Asia Pacific– 40%, Europe – 20%, and RoW – 10%

Top Automotive IoT Companies - Key Market Players

Major vendors in the automotive IoT Companies include NXP Semiconductors (Netherlands), Harman (US), Robert Bosch (Germany), Thales (France), TomTom International (Netherlands), IBM (US), Geotab Inc. (Canada), Texas Instruments (US), Intel Corp. (US), Eurotech (Italy), STMicroelectronics (Switzerland), Renesas (Japan), Infineon Technologies (Germany). Apart from this, Airbiquity (US), Qualcomm (US), Visteon (US), Vodafone Group (UK), Microsoft Corporation (US), Alphabet Inc. (US), AT&T (US), Cloudmade (UK), Sierra Wireless (Canada) are among a few emerging companies in the automotive IoT market.

Automotive IoT Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 131.2 Billion |

| Projected Market Size | USD 322.0 Billion |

| Growth Rate | CAGR of 19.7% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Offering, Connectivity Form Factor, Communication Type, Application and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

NXP Semiconductors (Netherlands), Harman (US), Robert Bosch (Germany), Thales (France), TomTom International (Netherlands), IBM (US), Geotab Inc. (Canada), Texas Instruments (US), Intel Corp. (US), Eurotech (Italy), STMicroelectronics (Switzerland), Renesas (Japan), Infineon Technologies (Germany). Apart from this, Airbiquity (US), Qualcomm (US), Visteon (US), Vodafone Group (UK), Microsoft Corporation (US), Alphabet Inc. (US), AT&T (US), Cloudmade (UK), Sierra Wireless (Canada), Verizon Communications, Inc. (US), Telefonica SA (Spain), Mitsubishi Electric Corp. (Japan), Tech Mahindra Ltd. (India), Desay SV HV Automotive (China), Valeo (France), Aptiv Plc (Ireland), Intellias (Ukraine) |

Automotive IoT Market Highlights

This research report categorizes the automotive IoT market based on offering, connectivity form factor, communication type, application, and Region.

|

Segment |

Subsegment |

|

Automotive IoT Market, Offering : |

|

|

Automotive IoT Market, by Connectivity Form Factor: |

|

|

Automotive IoT Market, by Communication Type: |

|

|

Automotive IoT Market, by Application: |

|

|

Automotive IoT Market, By Region: |

|

Recent Developments in Automotive IoT Industry

- In January 2023 , VinFast and NXP Semiconductors announced their collaboration on VinFast’s next generation of automotive applications. The collaboration supports VinFast’s goal of developing smarter, cleaner, connected electric vehicles. Under the collaboration, VinFast seeks to leverage NXP’s processors, semiconductors, and sensors. VinFast and NXP will engage in the early development phases of new VinFast automotive projects, leveraging NXP’s rich portfolio of system solutions for innovative applications.

- In January 2023, HARMAN unveiled HARMAN Ready on Demand, a software platform for delivering branded audio value, feature enhancement, upgrades, and monetization opportunities in an easy to-use app. An industry-first product, Ready on Demand is the foundation for providing expanded experiences and future upgrades that can be unlocked by the consumer at any time via in-app purchases throughout the life of the vehicle.

- In November 2022, TomTom International, announced it will power PTV Truck Navigator G2, the next generation of PTV Group’s professional truck navigation app. In a move that expands the firms’ partnership, PTV Group will be using TomTom’s recently launched Navigation SDK (Mobile Software Development Kit) to power up-to-date maps, custom truck routing, and more in their app, now available globally for the first time.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of automotive IoT market based on type?

The software segment is expected to hold the largest share of the automotive IoT market during the the forecast period. The software market includes platforms and solutions which are vital to the functioning of IoT in an automobile. Software solutions are designed to meet interoperability challenges that arise due to varied heterogeneous devices and to manage large volumes of data and its security and privacy. Factors such as the increasing adoption of connected cars and the evolution of high-speed networking technologies have led to the adoption of IoT software solutions.

Which connectivity form factor will contribute more to the overall market share by 2028?

The embedded segment will contribute the most to the automotive IoT market. The market for embedded segment is expected to account for largest share of the automotive IoT market during the forecast period. Increase in demand for the best consumer experience is met by upgrade of infotainment systems in vehicles connected to the Internet and with cloud facility. For automotive IoT applications like infotainment, embedded connectivity results in avoidance of incompatibility, interoperability, or tethering issues, resulting in good communication performance.

How will technological developments such as Artificial Intelligence (AI) technology, machine learning (ML) technology change the automotive IoT landscape in the future?

5G will be a key enabler for connected cars and autonomous vehicles ? it will enable them to communicate with each other, buildings, and infrastructure almost instantaneously. 5G will also offer digital services from within the car, thereby enhancing the passenger experience and increasing mobility revenue potential. OEMs are increasingly investing in adopting 5G technology for enhanced functions, connectivity, and safety. This is expected to further drive the connected car market. The generation of humongous data while dealing with connected cars has led to the explosion of AI in the automotive industry. AI is used in connected cars for different purposes, such as speech and gesture recognition, eye tracking, enhanced HMI, driver monitoring, virtual assistance, radar-based detection, and engine control (fused with sensors). Deep learning used to implement AI is estimated to be growing at a faster rate than other technologies in the automotive sector.

Which region is expected to adopt automotive IoT systems at a fast rate?

Asia Pacific region is expected to adopt automotive IoT systems at the fastest rate. Developing countries such as India and China are expected to have a high potential for the future growth of the market.

What are the key market dynamics influencing market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Predictive maintenance (PdM) is one of the key growth areas for the automotive IoT market. It helps in lowering the operating and capital costs by facilitating proactive servicing and repair of assets while allowing more efficient use of maintenance personnel and replacement components. PdM enables companies to accurately diagnose and prevent failures in real-time, which is vital in critical infrastructure applications.

When technologies such as the Over the Air (OTA) update are integrated with vehicles, car owners do not have to perform routine car maintenance activities at a service station. They need to visit the service centers only for crucial or emergency servicing activities. Predictive maintenance is highly successful in assuring these comforts to vehicle owners.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

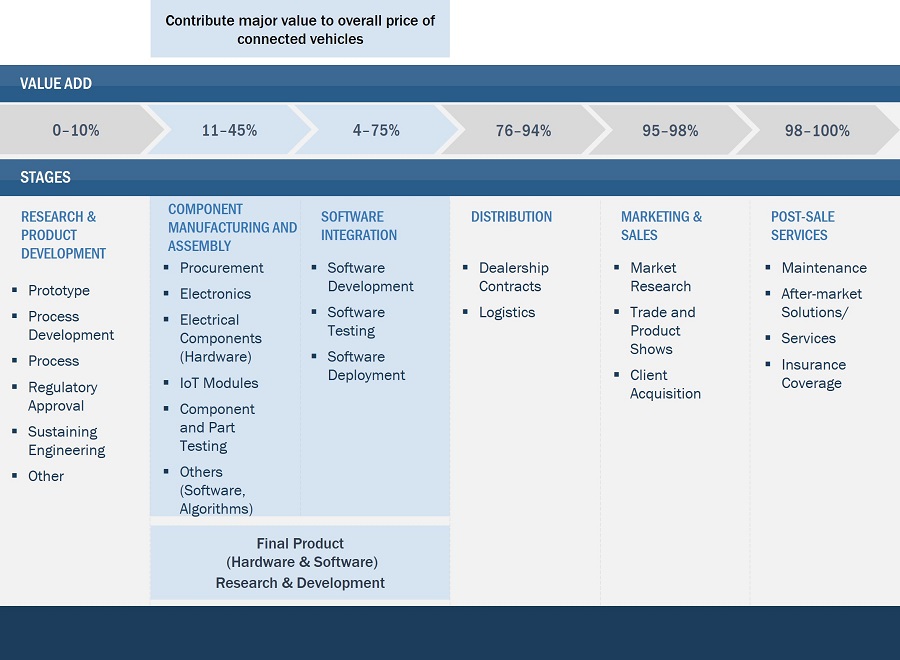

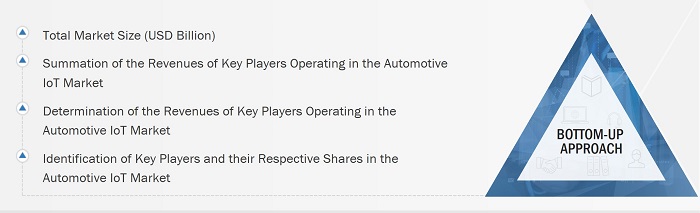

The study involved four major activities in estimating the size for automotive IoT market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, and certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the supply chain of the industry, the total pool of market players, classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the automotive IoT market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the automotive IoT market scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end users) and supply side (automotive IoT offering providers) across 4 major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews have been conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the automotive IoT market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Automotive IoT Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Definition

The automotive industry is witnessing a technological revolution, with the Internet of Things (IoT) being at the core of it since connectivity is becoming an integral part of an automobile’s value. Bluetooth, cellular, and Wi-Fi are the major technologies used for the purpose of connectivity. Connected vehicles and intelligent transportation are the key verticals wherein IoT is being implemented for applications such as navigation, telematics, and infotainment. Increase in embedded connectivity in cars is leading to the development and uptake of connected cars solutions. Safety & security are some of the major factors driving the growth of automotive IoT. Early warning systems, blind spot detection, and automated or assisted braking are some of the major safety features that can be enabled through connectivity.

Key Stakeholders

- Senior Management

- Application

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and estimate the automotive IoT market based on offerings, connectivity technologies, connectivity form factors, communication types, applications and region.

- To forecast the size of the market, by region—North America, Europe, Asia Pacific, and the Rest of the World (RoW)—in terms of value

- To forecast the automotive IoT market size, in terms of volume, by hardware offerings

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the automotive IoT market

- To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and their contribution to the automotive IoT market

- To map the competitive landscape based on company profiles, key player strategies, and key developments.

- To provide a detailed overview of the automotive IoT value chain and ecosystem

- To provide information about the key technology trends and patents related to the automotive IoT market.

- To provide information regarding trade data related to the automotive IoT market.

- To identify the key players operating in the automotive IoT market and comprehensively analyze their market shares and core competencies2.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the automotive IoT market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio.

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, partnerships, and research and development (R&D) in the automotive IoT market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive IoT Market