Generator Market by Fuel Type (Diesel, Gas, LPG, biofuels), Power Rating (Up to 50 kW, 51–280 kW, 281-500 kW, 501-2000 kW, 2001-3500 kW, Above 3500 kW), Application, End-User Industry, Design, Sales Channel, Region - Global Forecast to 2030

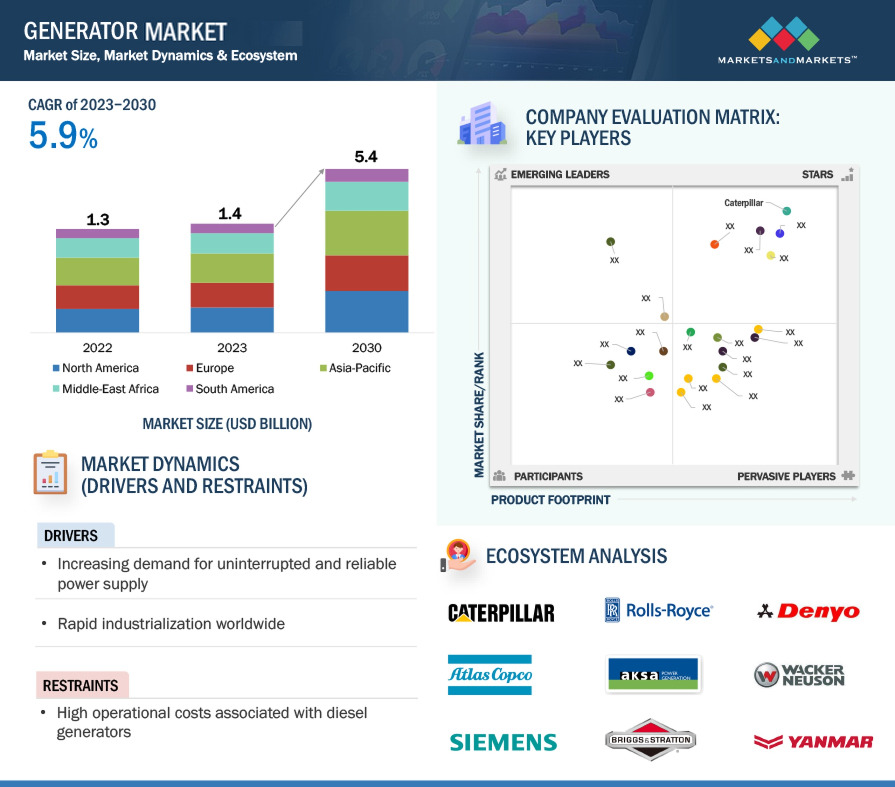

The generator market size was valued at $23.1 billion in 2023 to reach $34.5 billion in 2030, growing at a CAGR of 5.9% from 2023 to 2030. The increasing power demand driven by industrialization, urbanization, and population growth, has led to a significant increase in power generation capacity worldwide. Generators are essential for backup power during outages and to ensure uninterrupted operations, driving the demand for generators. Remote and off-grid locations, such as rural areas, remote construction sites, and mining operations, often lack access to reliable grid power. Generators become the primary source of power in such situations.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Generator Market Dynamics

Driver: Rapid industrialization owing the demand for generator

One of the key drivers of generator is the growing industrial sector. Manufacturing plants, factories, and industrial facilities heavily rely on a consistent power supply to operate their machinery, equipment, and production lines. Any disruption in the grid can result in substantial financial losses, downtime, and compromised productivity. Generators act as a dependable backup power source, ensuring uninterrupted operations during power outages or unstable grid condition

Restraint: High operational costs involved in the diesel generators owing to high fuel price

The generator market has encountered restraints due to the high operational costs associated with diesel generators, primarily caused by the escalating fuel prices. Diesel generators have been widely used as a reliable source of backup power, but the increasing cost of fuel has posed challenges for businesses and industries relying on these generators. The surge in fuel prices has led to concerns over the affordability and sustainability of operating diesel generators, impacting the sales dynamics in the market. Fluctuating global crude oil prices, geopolitical factors, and supply-demand imbalances have resulted in higher fuel costs. Diesel fuel prices can vary significantly across regions and countries, making it a substantial operational expense for businesses that rely on generators for continuous power supply

Opportunity: Rising adoption of hybrid generators, bi-fuel generators, and inverter generators

Various alternative fuel sources are being developed to replace traditional fossil fuels, driving innovation in the generator industry. Original Equipment Manufacturers (OEMs) are offering hybrid generators that combine internal combustion engines with batteries. These hybrid gensets optimize power delivery by utilizing the engine during high-load periods and relying on the battery during lower-load times. By reducing running time, fuel consumption, and noise, hybrid generators offer significant advantages over conventional gensets. They are expected to find applications in mobile gensets for remote areas, urban construction sites, and the mining sector

Challenge: Stringent government regulations for the conventional fuel generators

Diesel generators are used for a wide range of residential, commercial, and industrial applications. When diesel is burnt, it emits oxides of nitrogen, carbon monoxide, and particulate matter. These emissions are directly released into the atmosphere, and they deteriorate the environment and inhabitants. Several regulations have been implemented across the world to reduce air pollution by generator sets. With growing environmental concerns, each country has developed its regulations and policies to reduce air pollution.

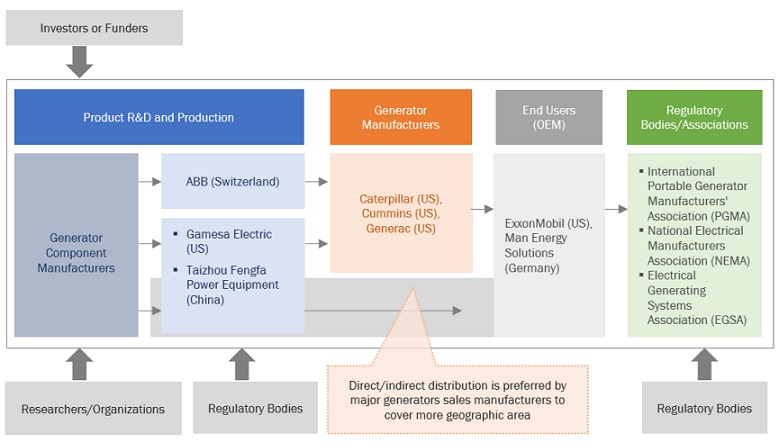

Generator Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of generator market and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Caterpillar (US), Cummins (US), Generac (US), and Rolls-Royce Holdings (UK).

Indirect Sales Channel are expected to dominate the market on based on sales channel

Indirect sales channel such as OEMs, third-party service providers, procure generators and equipment from manufacturers and provide services to different end users. Indirect sales channels typically have a local presence in specific geographic regions. This localized approach allows them to have a better understanding of the local market dynamics, build relationships with customers, and provide prompt after-sales service and support. Indirect sales channels can help generator manufacturers penetrate new markets or reach customer segments that may be challenging to access directly. By leveraging the expertise and networks of distributors or dealers, manufacturers can expand their market reach more efficiently.

Stationary segment, by design, to hold the largest market share during the forecast period during the forecast period

The stationary segment accounted for a larger market share during the forecast Stationary generators are designed for long-term use and can provide continuous power for extended periods. They are built to withstand heavy loads and are commonly used as primary or backup power sources in buildings, factories, data centers, hospitals, and other stationary installations..

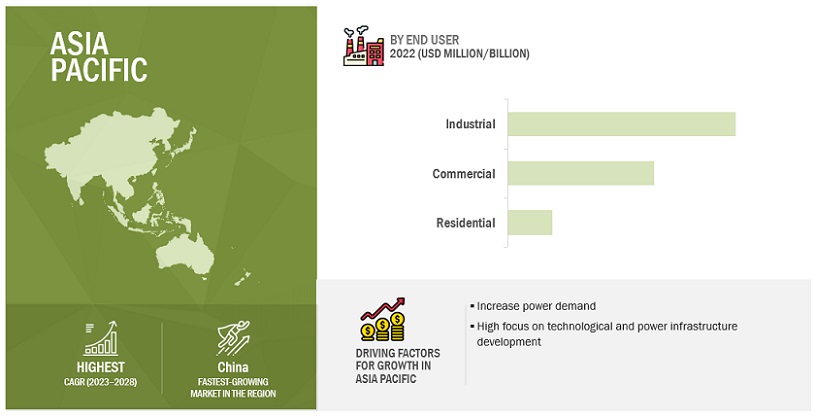

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is expected to be the largest and fastest-growing market due to the high demand for power products in China and India. The generator market in Asia Pacific is witnessing rapidly growing population, which drives the need for infrastructure development, industrial expansion, and increased power demand. Generators are essential for meeting the rising electricity needs in residential, commercial, and industrial sectors. Governments across the Asia Pacific region are investing heavily in infrastructure development, including energy, transportation, and telecommunications. These projects require reliable power sources, and generators are often used as temporary or backup power solutions during the construction phase and as standby power for critical infrastructure.

Key Market Players

Some of the major players in the generator market are Caterpillar Inc. (US), Cummins Inc. (US), Rolls-Royce Holdings plc (UK), Generac Holdings Inc. (US), Mitsubishi Heavy Industries, Ltd. (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2024–2030 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Fuel Type, End User, Power Rating, Application, Design, Sales Channel, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

Caterpillar (US), Cummins (US), Rolls-Royce Holdings (UK), Weichai Group (China), Kohler Co. (US), Atlas Copco (Sweden), Denyo (Japan), Wacker Neuson (Germany), Generac (US), Doosan (South Korea), Greaves Cotton Limited (India), Kirloskar Oil Engines Ltd. (India), Siemens (Germany), Aksa Energy (Turkey), Wärtsilä (Finland), Honda (Japan), Briggs & Stratton (US), ABB (Germany), Yanmar (Japan), Cooper Corp (India), Jubaili Bros (UAE), Southwest Products (US), Sterling & Wilson (India), and Siam Telemach (Thailand). |

This research report categorizes the generator market by fuel type, end user, power rating, application, design, sales channel, and region

On the basis of fuel type:

- Diesel

- Gas

- LPG

- Biofuel

- Coal Gas

- Producer Gas

- Fuel Cell

On the basis of application:

- Standby

- Prime & Continuous

- Peak Shaving

On the basis of end- user industry:

-

Industrial

- Utilities/Power Generation

- Oil & Gas

- Chemicals & Petrochemicals

- Mining & Metals

- Manufacturing

- Marine

- Construction

- Others (Agriculture, Transportation, and Aerospace & Defense)

-

Commercial

- IT & Telecom

- Healthcare

- Data Centers

- Others (Hotels, Shopping Complexes, Malls, and Public Infrastructure)

- Residential

On the basis of by power rating:

-

Up To 50 KW

- Up To 10 KW

- 11–20 KW

- 21–30 KW

- 31–40 KW

- 41–50 KW

- 51–280 KW

- 281–500 KW

- 501–2,000 KW

- 2,001–3,500 KW

- Above 3,500 KW

On the basis of by sales channel:

- Direct

- Indirect

On the basis of by sales channel:

- Stationary

- Portable

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In January 2022, Caterpillar launched Cat G3516 natural gas-fueled Fast Response generator set with US EPA Certification for use in emergency and non-emergency applications.

- In January 2022, Rolls-Royce, along with its distributor partner Knopf & Wallisch (K&W), supplied three mtu customized and containerized combined cooling, heat and power plant (CCHP) trigeneration units to Romanian cloud service provider ClusterPower.

- In October 2021, Generac announced the introduction of two new large diesel units – the MDE330 and MDE570 diesel mobile generators, which are aimed at providing ease of operation and maintenance. The rental-ready machines feature wide-opening removable doors to maximize serviceability.

- In August 2021, Toho Gas and MHIET Successfully Conduct Test Operation of City Gas and Hydrogen Mixed-fuel Combustion in a Commercial Gas Engine for a Cogeneration System.

- In March 2021, Cummins Power Systems introduced the C2750D5BE. The new model complements the successful QSK60 series, extending its standby power range from 2500kVA to 2750kVA for 50Hz markets

Frequently Asked Questions (FAQ):

What is the current size of the generator market?

The current market size of global generator market is USD 23.1 billion in 2023.

What is the major drivers for generator market?

The global generator market is driven by infrastructure development projects, including the construction of new buildings, roads, bridges, airports, and hospitals, often require reliable power sources. Generators are used to provide temporary or permanent power solutions during the construction phase and as backup power sources for critical infrastructure.

Which is the largest growing region during the forecasted period in generator market?

Asia Pacific is the largest growing region during the forecasted period due to certain regions in the Asia Pacific face challenges in accessing reliable grid electricity, especially in rural or remote areas. Generators play a vital role in providing off-grid power solutions to meet the electricity needs of these underserved regions.

Which is the fastest-growing segment, by end - use industry during the forecasted period in generator market?

The industrial end – use industry segment is witnessing a high demand for diesel & gas generators, particularly in developing countries. The growth of this segment is attributed to many industrial applications require a continuous and reliable power supply. Industrial generators provide backup power during grid outages or fluctuations, ensuring uninterrupted operations and minimizing production losses.

Which is the largest-growing segment, by fuel type during the forecasted period in generator market?

The industrial end user segment is witnessing a high demand for diesel & gas generators, particularly in developing countries. The growth of this segment is attributed to global industrial sector is experiencing significant growth, with increased manufacturing activities, infrastructure development, and expansion of industrial facilities. This growth drives the demand for industrial generators to ensure reliable and uninterrupted power supply for these operations .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

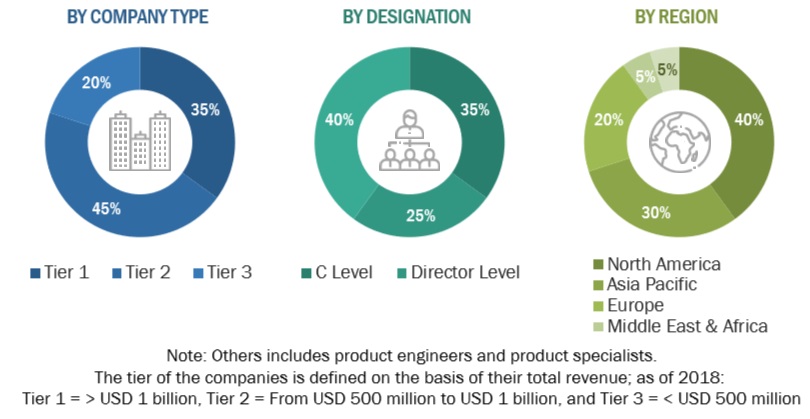

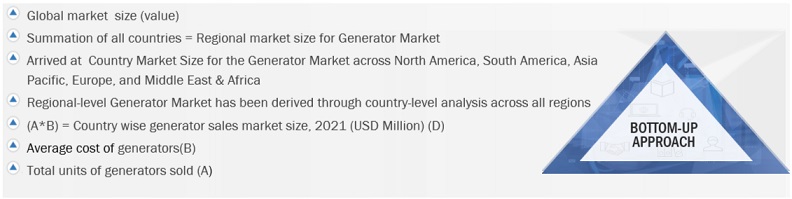

The study involved major activities in estimating the current size of the generator market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the generator market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the global generator market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The generator market comprises several stakeholders such as generator manufacturers, engine manufacturers, manufacturers of subcomponents of generators, manufacturing technology providers, and technology support providers in the supply chain. The demand side of this market is characterized by the rising demand for uninterrupted power supply from end users. Moreover, the demand is also driven by the rising demand from data centers & IT facilities. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the generator market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Generator Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

A generator is a converting device that uses diesel, gas, and many other fuels to transform mechanical energy into electrical energy. Internal combustion engines produce mechanical energy, which can be converted into electrical energy through generators. The generators considered in this study are compact packages that consist of an internal combustion engine, alternators, and other accessories, such as transfer switches, integrated power systems, paralleling systems, and remote monitoring systems.

Key Stakeholders

- Government & research organizations

- Institutional investors and investment banks

- Investors/shareholders

- Environmental research institutes

Objectives of the Study

- To define, describe, segment, and forecast the Generator market, in terms of value and volume, on the basis of fuel type, end user, power rating, application, design, sales channel, and region

- To forecast the market size for five key regions: North America, South America, Europe, Asia Pacific, and Middle East & Africa, along with their key countries

- To provide detailed information about the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Generator Market

What factors are estimated to drive and restrain the generator sales market growth?