Healthcare BPO Market by Outsourcing Models, Provider (Patient Care, RCM), Payer (Claims Management, Billing & Accounts), Life Science (R&D, Manufacturing, Sales & Marketing (Analytics, Research)), & Region (Source, Destination) - Global Forecast to 2026

The global healthcare BPO market in terms of revenue was estimated to be worth $296.4 billion in 2021 and is poised to reach $468.5 billion by 2026, growing at a CAGR of 9.6% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Healthcare BPO is a practice in which healthcare organizations outsource their business operations to third-party organizations. The need to reduce rising healthcare costs, the increasing demand for niche services, and the need for structured processes and documentation are compelling payers and providers to outsource their business processes to low-cost countries in order to reduce their operational costs. On the other hand, the fear of losing visibility and control over business processes and data security and privacy concerns are the major factors expected to restrain market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Healthcare BPO Market Dynamics

Driver: pressure to reduce the rising healthcare costs

Cost savings are an important consideration in outsourcing, as by doing so, companies can reduce costs on resource management, labor, and space. There is pressure on the margins of healthcare payers due to the rise of health insurance exchanges (online marketplaces to obtain health insurance from competing providers) in the US. This enables consumers to obtain coverage from competing private healthcare providers and is likely to accelerate the adoption of outsourcing to rationalise costs.

As healthcare continues to take up a larger part of the overall economy, structural changes—such as the push towards paying for value, a greater emphasis on care management, and increased cost-sharing with consumers—are taking a stronger hold, pulling back against the rapid healthcare spending growth. However, medical costs have hovered around the same level—between 6% and 7%—over the last five years, which can be expected to drive healthcare expenditure. Rising healthcare costs are thus expected to considerably boost offshore outsourcing and, in turn, the growth of the global healthcare BPO market.

Restraint: Hidden outsourcing costs

Improper planning and financial allocation for outsourcing activities often lead to negative impacts on cost savings and the business value that can be derived from outsourcing. Companies that plan their finances while outsourcing their business processes fail to take into account unforeseen costs, such as those incurred while evaluating and selecting a vendor, managing offshore contracts, transitioning their processes, and enhancing security and severance pay for employees.

Economic growth in emerging countries has also resulted in rising labor costs, thus raising questions over the value for money that will be offered by these countries. Additionally, customised services and solutions provided by vendors are likely to cost 15–30% more than standard services. In the event that the client exits a contract prematurely, costs increase and expose both the buyer and the provider to litigation, thus increasing legal expenses as well. When cost savings are not as high as expected, clients refrain from outsourcing. This may hinder the growth of the healthcare BPO market.

Opportunity: Growing adoption of artificial intelligence-based tools for drug discovery

Artificial intelligence and machine learning, in particular, make the drug discovery process more efficient and substantially improve success rates at the early stages of drug development. This will help healthcare BPO service providers bring about major breakthroughs, as artificial intelligence also plays an important role in the discovery of drugs for chronic diseases such as cancer. Owing to its capabilities, AI significantly reduces the time taken to bring a cancer-fighting drug to market, which will lead to significant growth in the healthcare BPO market.

Several pharmaceutical companies are increasingly focusing on partnering with established and emerging AI-driven companies to leverage the power of AI-based solutions for boosting their drug discovery programs. The increasing number of drugs developed will impact the CRO services market due to the increasing number of clinical trials and research on them. Such factors have encouraged the adoption of AI for drug discovery by various pharmaceutical and biotechnology companies.

Challenge: Data security concerns

In healthcare, approximately one-third of data breaches result in medical identity theft, mainly due to a lack of internal control over patient information, a lack of top-level management support, outdated policies and procedures or non-adherence to existing ones, and inadequate personnel training. This makes patient confidentiality a major challenge in the healthcare industry. As per the National Center for Biotechnology Information (NCBI), in 2018, the number of data breaches reported was 2,216 from 65 countries. Out of these, the healthcare industry faced 536 breaches (the highest number of breaches among all industries).

The average cost of a data breach in 2019 was USD 3.92 million, while a healthcare data breach typically costs USD 6.45 million. This cost was the highest in the US as compared to other countries (source: IBM). With increasing healthcare data breaches and the cost involved in them, Cybersecurity Ventures predicts that the healthcare industry has spent more than USD 65 billion cumulatively on cybersecurity products and services over the five-year period from 2017 to 2021. As healthcare BPO processes involve data transfer between healthcare organisations and BPO service providers, creating a secure communication platform is a major challenge faced by vendors catering to the healthcare industry. This may hamper the healthcare BPO market until secure solutions are available.

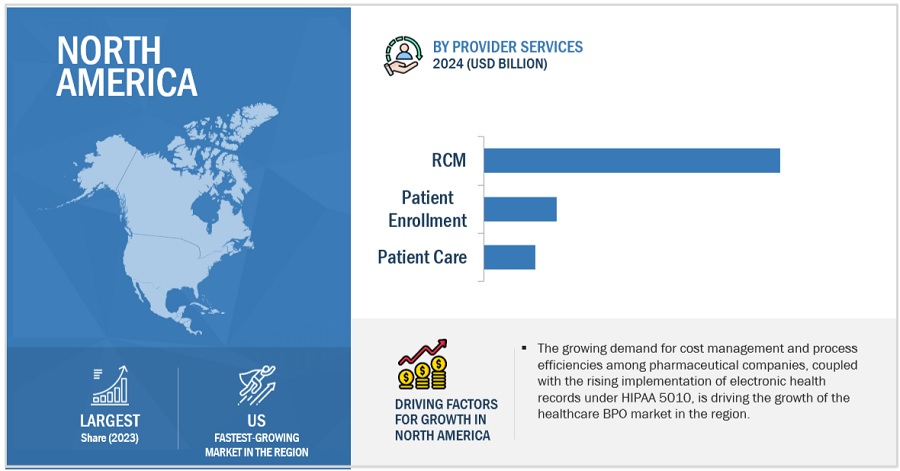

North America, as a source geography, holds the largest share of the healthcare BPO industry.

North America held the largest share of healthcare BPO market, accounting for 49.0%, followed by Europe (30.6%) and the rest of the world (20.3%). Pharmaceutical companies in the region, particularly in the United States, are facing significant price pressures as a result of the Medicare Prescription Drug Coverage (Part D), which covers all Medicare beneficiaries for prescription drugs. Additionally, the patent expiration of several blockbuster drugs is expected to affect the revenue of large pharmaceutical companies in the US and Canada. Taking these factors into consideration, a number of pharmaceutical companies are focusing on cost reduction through outsourcing, subsequently driving market growth in North America.

Some of the prominent players operating in the Healthcare BPO market are Accenture (Ireland), Cognizant (US), Tata Consultancy Services (India), Xerox Corporation (US), WNS (Holdings) Limited (India), NTT Data Corporation (Japan), IQVIA (US), Mphasis (India), Genpact (US), Wipro (India), Infosys BPM (India), Firstsource Solutions (India), IBM Corporation (US), HCL Technologies (India), Sutherland Global (US), GeBBS Healthcare Solutions (US), Lonza (Switzerland), Omega Healthcare (India), R1 RCM (US), Invensis Technologies (India), UnitedHealth Group (US), Sykes Enterprises (US), Parexel International (US), Access Healthcare (US), and Akurate Management Solutions (US), among others.

Scope of the Healthcare BPO Industry

|

Report Metric |

Details |

|

Market Revenue in 2021 |

$296.4 billion |

|

Projected Revenue by 2026 |

$468.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 9.6% |

|

Market Driver |

Pressure to reduce the rising healthcare costs |

|

Market Opportunity |

Growing adoption of artificial intelligence-based tools for drug discovery |

This research report categorizes the healthcare BPO market to forecast revenue and analyze trends in each of the following submarkets:

By Provider Service

- Revenue Cycle Management

- Patient Enrollment

-

Patient Care

- Medical Transcription

- Medical Imaging

- Device Monitoring

By Payer Service

-

Claims Management

- Claims Adjudication Services

- Claims Settlement Services

- Information Management Services

- Claims Repricing

- Claims Investigation Services

- Claims Indexing Services

- Fraud Detection & Management

- Product Development & Business Acquisition (PDBA)

- Member Management

- Provider Management

- Care Management

- Integrated Front-End Services and Back-office Operations

- Billing and accounts management services

- HR Services

By Life Science Service

- Manufacturing

- R&D

-

Non-Clinical Services

- Supply Chain Management & Logistics

-

Sales and Marketing Services

- Forecasting

- Performance Reporting

- Analytics

- Research

- Marketing

- Other Non-Clinical Services

By Region

-

Source Geography

- North America

- Europe

- RoW

-

Destination Geography

- India

- China

- Philippines

- US

- Bulgaria & other EU countries

- Brazil

- Kingdom of Saudi Arabia (KSA)

- RoW

Recent Developments

- UnitedHealth Group Inc. has acquired InstaMed, a healthcare payments platform, for an undisclosed sum.

- Cigna Corp. has acquired ScriptDrop, a medication delivery and adherence platform, for an undisclosed sum.

- Optum Inc. has acquired Change Healthcare, a healthcare technology company, for $13 billion.

- Anthem Inc. has acquired Evolent Health, a population health management company, for $4.7 billion.

- Humana Inc. has acquired Genoa Healthcare, a behavioral health pharmacy services provider, for $1 billion.

- Aetna Inc. has acquired Healthagen, a population health management company, for an undisclosed sum.

- Cerner Corp. has acquired NantHealth, a healthcare technology company, for an undisclosed sum.

- Allscripts Healthcare Solutions Inc. has acquired McKesson Corporation’s US Hospital and Health Systems business for an undisclosed sum.

- Cognizant Technology Solutions Corp. has acquired TriZetto, a healthcare information technology provider, for $2.7 billion.

- HCL Technologies Ltd. has acquired Medix, a healthcare BPO provider, for $85 million.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the healthcare BPO market?

The healthcare BPO market boasts a total revenue value of $468.5 billion by 2026.

What is the estimated growth rate (CAGR) of the healthcare BPO market?

The global market for healthcare BPO has an estimated compound annual growth rate (CAGR) of 9.6% and a revenue size in the region of $296.4 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 40)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 45)

2.1 RESEARCH DATA

2.2 RESEARCH METHODOLOGY STEPS

FIGURE 1 RESEARCH METHODOLOGY: HEALTHCARE BPO MARKET

FIGURE 2 RESEARCH DESIGN

2.2.1 SECONDARY DATA

2.2.1.1 Secondary sources

2.2.2 PRIMARY DATA

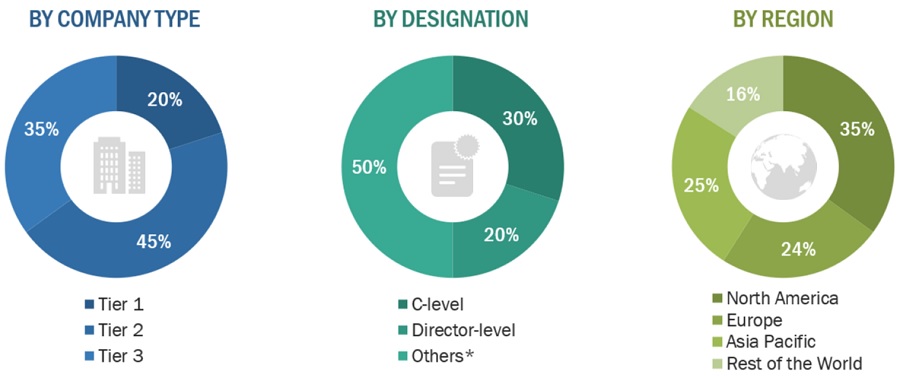

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2.2.1 Primary sources

2.2.2.2 Key insights from primary sources

2.3 MARKET SIZE ESTIMATION

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.4 TOP-DOWN & BOTTOM-UP APPROACHES

FIGURE 5 RESEARCH METHODOLOGY: REVENUE ANALYSIS APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (BOTTOM-UP APPROACH): COLLECTIVE REVENUE OF ALL SERVICES/SOLUTIONS OF VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY (TOP-DOWN APPROACH): SEGMENTAL ANALYSIS

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.6 ASSUMPTIONS FOR THE STUDY

2.7 COVID-19 SPECIFIC ASSUMPTIONS

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 56)

FIGURE 10 HEALTHCARE BPO MARKET, BY SERVICE TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 11 GLOBAL HEALTHCARE BPO INDUSTRY, BY PROVIDER SERVICE, 2021 VS. 2026 (USD BILLION)

FIGURE 12 GLOBAL HEALTHCARE BPO INDUSTRY, BY PAYER SERVICE, 2021 VS. 2026 (USD BILLION)

FIGURE 13 HEALTHCARE BPO INDUSTRY, BY TYPE, 2021 VS. 2026 (USD BILLION)

FIGURE 14 GLOBAL HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2021 VS. 2026 (USD BILLION)

FIGURE 15 HEALTHCARE BPO MARKET, BY SOURCE GEOGRAPHY

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 HEALTHCARE BPO MARKET OVERVIEW

FIGURE 16 GROWING NEED TO CURTAIL HEALTHCARE COSTS TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: MARKET, BY PROVIDER SERVICE (2020)

FIGURE 17 REVENUE CYCLE MANAGEMENT SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN PROVIDER SERVICES MARKET IN 2020

4.3 GLOBAL MARKET SHARE, BY LIFE SCIENCE SERVICE, 2021 VS. 2026

FIGURE 18 MANUFACTURING SERVICES TO HOLD THE LARGEST SHARE OF THE LIFE SCIENCE SERVICES MARKET IN 2021

4.4 NON-CLINICAL SERVICES MARKET SHARE, BY TYPE, 2021 VS. 2026

FIGURE 19 SALES & MARKETING SERVICES SEGMENT WILL DOMINATE THE NON-CLINICAL SERVICES MARKET IN 2026

4.5 SALES & MARKETING SERVICES MARKET SHARE, BY TYPE, 2021 VS. 2026

FIGURE 20 ANALYTICS SERVICES SEGMENT WILL DOMINATE THE SALES & MARKETING SERVICES MARKET IN THE FORECAST PERIOD

4.6 HEALTHCARE BPO MARKET, BY DESTINATION GEOGRAPHY

FIGURE 21 INDIA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 HEALTHCARE BPO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Shift to ICD-10 coding standards and upcoming ICD-11 standards

5.2.1.2 Pressure to reduce the rising healthcare costs

5.2.1.3 Loss of revenue due to billing errors

5.2.1.4 Demand for niche services

5.2.1.5 Need for structured processes and documentation

5.2.1.6 Lack of in-house expertise in end-use industries

5.2.1.7 Growing outsourcing in the pharma and biopharma industries

5.2.2 RESTRAINTS

5.2.2.1 Hidden outsourcing costs

5.2.2.2 Concerns related to losing visibility and control over the business process

5.2.3 CHALLENGES

5.2.3.1 Limitations in the data capturing process in Medicaid services

5.2.3.2 Data security concerns

5.2.4 OPPORTUNITIES

5.2.4.1 Advanced data analytics

5.2.4.2 Growing adoption of artificial intelligence-based tools for drug discovery

5.3 OUTSOURCING APPROACHES

5.3.1 BUNDLED SERVICES

5.3.2 FEE FOR SERVICE

5.3.3 FLEXIBLE CONTRACTS

5.3.4 BEST-SHORE

5.4 OUTSOURCING MODELS

5.4.1 MULTI-SOURCING

5.4.2 CAPTIVE CENTER

5.4.3 HYBRID DELIVERY MODEL

5.4.4 PREFERRED PROVIDER

5.4.5 STRATEGIC PARTNERSHIP

5.4.6 GLOBAL DELIVERY MODEL

5.5 IMPACT OF COVID-19 ON THE HEALTHCARE BPO MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 23 COMPETITIVE INTENSITY IS HIGH IN THE GLOBAL MARKET

TABLE 1 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7 PRICING ANALYSIS

TABLE 2 HEALTHCARE BPO SERVICES: AVERAGE SELLING PRICE

5.8 TECHNOLOGY ANALYSIS

5.8.1 MACHINE LEARNING

5.8.2 ARTIFICIAL INTELLIGENCE

5.8.3 INTERNET OF THINGS

5.8.4 BLOCKCHAIN

5.8.5 AUGMENTED REALITY

5.9 REGULATORY ANALYSIS

5.9.1 NORTH AMERICA

5.9.2 EUROPE

5.9.3 ASIA PACIFIC

5.9.4 MIDDLE EAST AND AFRICA

5.9.5 LATIN AMERICA

5.10 ECOSYSTEM

TABLE 3 ECOSYSTEM: GLOBAL MARKET

5.11 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN: HEALTHCARE BPO MARKET

5.12 CASE STUDY ANALYSIS

5.12.1 CASE STUDY 1

5.12.2 CASE STUDY 2

5.12.3 CASE STUDY 3

6 HEALTHCARE BPO MARKET, BY PROVIDER SERVICE (Page No. - 86)

6.1 INTRODUCTION

TABLE 4 HEALTHCARE BPO INDUSTRY, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 5 MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 6 HEALTHCARE PROVIDER SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 7 HEALTHCARE PROVIDER SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 8 HEALTHCARE PROVIDER SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 9 HEALTHCARE PROVIDER SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

6.2 REVENUE CYCLE MANAGEMENT

6.2.1 REVENUE CYCLE MANAGEMENT SEGMENT HELD THE LARGEST SHARE OF THE HEALTHCARE BPO PROVIDER SERVICES MARKET

TABLE 10 REVENUE CYCLE MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 11 REVENUE CYCLE MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 12 REVENUE CYCLE MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 13 REVENUE CYCLE MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

6.3 PATIENT ENROLMENT

6.3.1 OUTSOURCING PATIENT ENROLMENT SERVICES HELP PREVENT CLAIM DENIALS AND PAYMENT DELAYS

TABLE 14 PATIENT ENROLLMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 15 PATIENT ENROLLMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 16 PATIENT ENROLLMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 17 PATIENT ENROLLMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

6.4 PATIENT CARE

TABLE 18 PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 19 PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 20 PATIENT CARE SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 21 PATIENT CARE SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 22 PATIENT CARE SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 23 PATIENT CARE SERVICES MARKET, BY DESTINATION GEOGRAPHY,2021–2026 (USD MILLION)

6.4.1 MEDICAL TRANSCRIPTION

6.4.1.1 Medical transcription outsourcing offers a quicker, efficient, and streamlined medical transcription process

TABLE 24 MEDICAL TRANSCRIPTION SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 25 MEDICAL TRANSCRIPTION SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 26 MEDICAL TRANSCRIPTION SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 27 MEDICAL TRANSCRIPTION SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

6.4.2 DEVICE MONITORING

6.4.2.1 Device monitoring centers facilitate health systems to cater to unique patient needs

TABLE 28 DEVICE MONITORING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 29 DEVICE MONITORING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 30 DEVICE MONITORING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 31 DEVICE MONITORING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

6.4.3 MEDICAL IMAGING

6.4.3.1 Medical imaging outsourcing services provide a multidisciplinary approach to obtain accurate imaging results

TABLE 32 MEDICAL IMAGING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 33 MEDICAL IMAGING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 34 MEDICAL IMAGING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 35 MEDICAL IMAGING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7 HEALTHCARE BPO MARKET, BY PAYER SERVICE (Page No. - 103)

7.1 INTRODUCTION

TABLE 36 HEALTHCARE BPO INDUSTRY, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 37 MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 38 HEALTHCARE PAYER SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 39 HEALTHCARE PAYER SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 40 HEALTHCARE PAYER SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 41 HEALTHCARE PAYER SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2 CLAIMS MANAGEMENT SERVICES

TABLE 42 CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 43 CLAIMS MANAGEMENT SERVICE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 44 CLAIMS MANAGEMENT SERVICE MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 45 CLAIMS MANAGEMENT SERVICE MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 46 CLAIMS MANAGEMENT SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 47 CLAIMS MANAGEMENT SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.1 CLAIMS ADJUDICATION SERVICES

7.2.1.1 The claims adjudication services segment accounted for the largest share of the claims management outsourcing services market in 2020

TABLE 48 CLAIMS ADJUDICATION SERVICE MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 49 CLAIMS ADJUDICATION SERVICE MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 50 CLAIMS ADJUDICATION SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 51 CLAIMS ADJUDICATION SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.2 CLAIMS SETTLEMENT SERVICES

7.2.2.1 Streamlined settlement processes offered by outsourcing companies to drive the segment growth

TABLE 52 CLAIMS SETTLEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY,2018–2020 (USD MILLION)

TABLE 53 CLAIMS SETTLEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 54 CLAIMS SETTLEMENT SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 55 CLAIMS SETTLEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.3 INFORMATION MANAGEMENT SERVICES

7.2.3.1 Information management services enable the handling of a large amount of data generated during the claims management process

TABLE 56 INFORMATION MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 57 INFORMATION MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 58 INFORMATION MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 59 INFORMATION MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.4 CLAIMS REPRICING

7.2.4.1 Outsourcing claims repricing services to healthcare BPOs reduces the administrative burden on payer firms

TABLE 60 CLAIMS REPRICING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 61 CLAIMS REPRICING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 62 CLAIMS REPRICING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 63 CLAIMS REPRICING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.5 CLAIMS INVESTIGATION SERVICES

7.2.5.1 Outsourcing claims investigation services help improve fraud detection & recovery

TABLE 64 CLAIMS INVESTIGATION SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 65 CLAIMS INVESTIGATION SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 66 CLAIMS INVESTIGATION SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 67 CLAIMS INVESTIGATION SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.6 CLAIMS INDEXING SERVICES

7.2.6.1 Outsourcing is preferred for the indexing of medical records as it is time-consuming and requires expertise

TABLE 68 CLAIMS INDEXING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 69 CLAIMS INDEXING SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 70 CLAIMS INDEXING SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 71 CLAIMS INDEXING SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.2.7 FRAUD DETECTION & MANAGEMENT

7.2.7.1 Third-party vendors use advanced analytics, technologies, and tools to identify fraudulent activities accurately

TABLE 72 FRAUD DETECTION & MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 73 FRAUD DETECTION & MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 74 FRAUD DETECTION & MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 75 FRAUD DETECTION & MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.3 INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS

7.3.1 REDUCTION IN OVERHEAD EXPENSES AND IMPROVED EFFICIENCY OFFERED BY OUTSOURCING COMPANIES TO SUPPORT SEGMENT GROWTH

TABLE 76 INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 77 INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 78 INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 79 INTEGRATED FRONT-END SERVICES AND BACK-OFFICE OPERATIONS MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.4 MEMBER MANAGEMENT SERVICES

7.4.1 THIRD-PARTY VENDORS HELP MANAGE MEMBER-RELATED ELIGIBILITY DATA MORE STRATEGICALLY ACROSS THE ENTERPRISE

TABLE 80 MEMBER MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 81 MEMBER MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 82 MEMBER MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 83 MEMBER MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.5 PRODUCT DEVELOPMENT & BUSINESS ACQUISITION SERVICES (PDBA)

7.5.1 INCREASING FOCUS ON CUSTOMER ENGAGEMENT AND RETENTION TO SUPPORT THE SEGMENT GROWTH

TABLE 84 PDBA SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 85 PDBA SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 86 PDBA SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 87 PDBA SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.6 PROVIDER MANAGEMENT SERVICES

7.6.1 INCREASING COMPLEXITIES AND VARIATIONS IN PROVIDER NETWORKS AND HEALTH PLANS HAS INCREASED THE DEPENDENCY ON THIRD-PARTY VENDORS

TABLE 88 PROVIDER MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 89 PROVIDER MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 90 PROVIDER MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 91 PROVIDER MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.7 CARE MANAGEMENT SERVICES

7.7.1 CARE MANAGEMENT SERVICES PLAY A MAJOR ROLE IN CLINICAL COVERAGE DECISIONS AND REVIEW SYSTEMS

TABLE 92 CARE MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 93 CARE MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 94 CARE MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 95 CARE MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.8 BILLING AND ACCOUNTS MANAGEMENT SERVICES

7.8.1 OUTSOURCING OF THESE SERVICES HELP CHECK FRAUDS, REDUCE PROCESS TIME, AND MINIMIZE THE BURDEN ON PAYER STAFF

TABLE 96 BILLING AND ACCOUNTS MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 97 BILLING AND ACCOUNTS MANAGEMENT SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 98 BILLING AND ACCOUNTS MANAGEMENT SERVICES MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 99 BILLING AND ACCOUNTS MANAGEMENT SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

7.9 HR SERVICES

7.9.1 OUTSOURCING HR SERVICES ENSURES REDUCED COSTS AND ATTRITION RATES WHILE ENSURING STEADY BUSINESS GROWTH

TABLE 100 HR SERVICES MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 101 HR SERVICES MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 102 HR SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 103 HR SERVICE MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8 HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE (Page No. - 139)

8.1 INTRODUCTION

TABLE 104 HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2018–2020 (USD BILLION)

TABLE 105 MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD BILLION)

TABLE 106 HEALTHCARE LIFE SCIENCE SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 107 HEALTHCARE LIFE SCIENCE SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD BILLION)

TABLE 108 HEALTHCARE LIFE SCIENCE SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 109 HEALTHCARE LIFE SCIENCE SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD BILLION)

8.2 MANUFACTURING

8.2.1 BENEFITS OF OUTSOURCING SUCH AS LONG-TERM COST SAVINGS AND AVAILABILITY OF EXPERT PERSONNEL TO PROPEL MARKET GROWTH

TABLE 110 MANUFACTURING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 111 MANUFACTURING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD BILLION)

TABLE 112 MANUFACTURING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 113 MANUFACTURING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD BILLION)

8.3 RESEARCH & DEVELOPMENT (R&D)

8.3.1 INCREASING DEMAND FOR SPECIALIZED RESEARCH AND DEVELOPMENT SERVICE PROVIDERS TO DRIVE MARKET GROWTH

TABLE 114 RESEARCH & DEVELOPMENT SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 115 RESEARCH & DEVELOPMENT SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD BILLION)

TABLE 116 RESEARCH & DEVELOPMENT SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 117 RESEARCH & DEVELOPMENT SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD BILLION)

8.4 NON-CLINICAL SERVICES

TABLE 118 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY TYPE, 2018–2020 (USD BILLION)

TABLE 119 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY TYPE, 2021–2026 (USD BILLION)

TABLE 120 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 121 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD BILLION)

TABLE 122 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 123 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD BILLION)

8.4.1 SALES & MARKETING SERVICES

TABLE 124 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 125 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 126 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 127 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 128 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 129 SALES & MARKETING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.1.1 Analytics

8.4.1.1.1 Use of analytics to improve customer-facing functions and minimize risks have increased the outsourcing of analytical services

TABLE 130 ANALYTICS SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 131 ANALYTICS SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 132 ANALYTICS SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 133 ANALYTICS SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.1.2 Marketing

8.4.1.2.1 Outsourcing marketing services to third parties helps organizations to focus on their core functionalities

TABLE 134 MARKETING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 135 MARKETING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 136 MARKETING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 137 MARKETING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.1.3 Research

8.4.1.3.1 Increasing focus on outsourcing research activities for strategic decision-making to drive market growth

TABLE 138 RESEARCH SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 139 RESEARCH SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 140 RESEARCH SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 141 RESEARCH SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.1.4 Forecasting

8.4.1.4.1 Sales, revenue, and demand are the most commonly outsourced forecasting services by the life science industry

TABLE 142 FORECASTING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 143 FORECASTING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 144 FORECASTING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 145 FORECASTING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.1.5 Performance reporting

8.4.1.5.1 Commonly outsourced performance reporting services include brand performance tracking, sales force performance tracking, and sales tracking

TABLE 146 PERFORMANCE REPORTING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 147 PERFORMANCE REPORTING SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 148 PERFORMANCE REPORTING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 149 PERFORMANCE REPORTING SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.2 SUPPLY CHAIN MANAGEMENT & LOGISTICS

8.4.2.1 Outsourcing helps manage complex supply chain operations with more efficiency and flexibility as compared to in-house units

TABLE 150 SCM & LOGISTICS SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 151 SCM & LOGISTICS SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 152 SCM & LOGISTICS SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 153 SCM & LOGISTICS SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

8.4.3 OTHER NON-CLINICAL SERVICES

TABLE 154 OTHER NON-CLINICAL SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 155 OTHER NON-CLINICAL SERVICE OUTSOURCING MARKET, BY SOURCE GEOGRAPHY, 2021–2026 (USD MILLION)

TABLE 156 NON-CLINICAL SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD MILLION)

TABLE 157 OTHER NON-CLINICAL SERVICE OUTSOURCING MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD MILLION)

9 HEALTCHARE BPO MARKET, BY REGION (Page No. - 166)

9.1 SOURCE GEOGRAPHY

TABLE 158 HEALTHCARE BPO MARKET, BY SOURCE GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 159 GLOBAL HEALTHCARE BPO INDUSTRY, BY SOURCE GEOGRAPHY, 2021–2026 (USD BILLION)

9.1.1 NORTH AMERICA

9.1.1.1 The US is the largest source geography for healthcare BPO services in North America

FIGURE 25 NORTH AMERICA: HEALTHCARE BPO MARKET SNAPSHOT

TABLE 160 NORTH AMERICA: MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 161 NORTH AMERICA: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 162 NORTH AMERICA: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 163 NORTH AMERICA: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 164 NORTH AMERICA: MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 165 NORTH AMERICA: HEALTHCARE BPO INDUSTRY, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 166 NORTH AMERICA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 167 NORTH AMERICA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 168 NORTH AMERICA: MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 169 NORTH AMERICA: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 170 NORTH AMERICA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 171 NORTH AMERICA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 172 NORTH AMERICA: SALES & MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: SALES & MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.1.2 EUROPE

9.1.2.1 Need to minimize the incidence of healthcare fraud in Europe to drive the market growth

TABLE 174 EUROPE: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 175 EUROPE: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 176 EUROPE: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 177 EUROPE: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 178 EUROPE: MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 179 EUROPE: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 180 EUROPE: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 181 EUROPE: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 182 EUROPE: MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 183 EUROPE: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 184 EUROPE: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 185 EUROPE: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 186 EUROPE: SALES & MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 187 EUROPE: SALES & MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.1.3 ROW

9.1.3.1 Lack of centralized healthcare systems and low healthcare expenditure in certain countries to create market opportunities

TABLE 188 ROW: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 189 ROW: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 190 ROW: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 191 ROW: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 192 ROW: MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 193 ROW: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 194 ROW: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 195 ROW: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 196 ROW: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 197 ROW: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 198 ROW: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 199 ROW: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 200 ROW: SALES & MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 201 ROW: SALES & MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2 DESTINATION GEOGRAPHY

TABLE 202 HEALTHCARE BPO MARKET, BY DESTINATION GEOGRAPHY, 2018–2020 (USD BILLION)

TABLE 203 MARKET, BY DESTINATION GEOGRAPHY, 2021–2026 (USD BILLION)

9.2.1 INDIA

9.2.1.1 India to soon become the destination of choice for outsourcing healthcare services

FIGURE 26 INDIA: HEALTHCARE BPO MARKET SNAPSHOT

TABLE 204 INDIA: MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 205 INDIA: MARKET, BY PROVIDER SERVICE,2021–2026 (USD MILLION)

TABLE 206 INDIA: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 207 INDIA: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 208 INDIA: MARKET, BY PAYER SERVICE,2018–2020 (USD MILLION)

TABLE 209 INDIA: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 210 INDIA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 211 INDIA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 212 INDIA: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 213 INDIA: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 214 INDIA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 215 INDIA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 216 INDIA: SALES & MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 217 INDIA: SALES & MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.2 US

9.2.2.1 Adoption of computer-assisted RCM coding systems is increasing in the country

TABLE 218 US: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 219 US: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 220 US: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 221 US: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 222 US: MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 223 US: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 224 US: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 225 US: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 226 US: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 227 US: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 228 US: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 229 US: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 230 US: SALES & MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 231 US: SALES & MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.3 BULGARIA & OTHER EU COUNTRIES

9.2.3.1 Bulgaria is one of the leading outsourcing destinations in Southeastern Europe

TABLE 232 BULGARIA & OTHER EU COUNTRIES: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 233 BULGARIA & OTHER EU COUNTRIES: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 234 BULGARIA & OTHER EU COUNTRIES: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 235 BULGARIA & OTHER EU COUNTRIES: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 236 BULGARIA & OTHER EU COUNTRIES: HEALTHCARE BPO MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 237 BULGARIA & OTHER EU COUNTRIES: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 238 BULGARIA & OTHER EU COUNTRIES: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 239 BULGARIA & OTHER EU COUNTRIES: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 240 BULGARIA & OTHER EU COUNTRIES: HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 241 BULGARIA & OTHER EU COUNTRIES: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 242 BULGARIA & OTHER EU COUNTRIES: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 243 BULGARIA & OTHER EU COUNTRIES: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 244 BULGARIA & OTHER EU COUNTRIES: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 245 BULGARIA & OTHER EU COUNTRIES: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.4 PHILIPPINES

9.2.4.1 The Philippines offers a pool of ideal factors for outsourcing businesses

TABLE 246 PHILIPPINES: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 247 PHILIPPINES: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 248 PHILIPPINES: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 249 PHILIPPINES: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 250 PHILIPPINES: HEALTHCARE BPO MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 251 PHILIPPINES: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 252 PHILIPPINES: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 253 PHILIPPINES: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 254 PHILIPPINES: HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE,2018–2020 (USD MILLION)

TABLE 255 PHILIPPINES: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 256 PHILIPPINES: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 257 PHILIPPINES: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 258 PHILIPPINES: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 259 PHILIPPINES: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.5 CHINA

9.2.5.1 China is expected to be a promising destination for outsourcing of healthcare services in the coming years

TABLE 260 CHINA: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 261 CHINA: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 262 CHINA: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 263 CHINA: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 264 CHINA: HEALTHCARE BPO MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 265 CHINA: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 266 CHINA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 267 CHINA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 268 CHINA: HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 269 CHINA: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 270 CHINA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 271 CHINA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 272 CHINA: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 273 CHINA: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.6 BRAZIL

9.2.6.1 Brazil has emerged as a global manufacturing hub for life science industries

TABLE 274 BRAZIL: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 275 BRAZIL: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 276 BRAZIL: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 277 BRAZIL: PATIENT CARE SERVICES MARKET, BY TYPE,2021–2026 (USD MILLION)

TABLE 278 BRAZIL: HEALTHCARE BPO MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 279 BRAZIL: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 280 BRAZIL: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 281 BRAZIL: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 282 BRAZIL: HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 283 BRAZIL: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 284 BRAZIL: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 285 BRAZIL: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 286 BRAZIL: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 287 BRAZIL: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.7 KINGDOM OF SAUDI ARABIA

9.2.7.1 Organized clinical research services to support market growth

TABLE 288 KSA: HEALTHCARE BPO MARKET, BY PROVIDER SERVICE, 2018–2020 (USD MILLION)

TABLE 289 KSA: MARKET, BY PROVIDER SERVICE, 2021–2026 (USD MILLION)

TABLE 290 KSA: PATIENT CARE SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 291 KSA: PATIENT CARE SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 292 KSA: HEALTHCARE BPO MARKET, BY PAYER SERVICE, 2018–2020 (USD MILLION)

TABLE 293 KSA: MARKET, BY PAYER SERVICE, 2021–2026 (USD MILLION)

TABLE 294 KSA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 295 KSA: CLAIMS MANAGEMENT SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 296 KSA: HEALTHCARE BPO MARKET, BY LIFE SCIENCE SERVICE, 2018–2020 (USD MILLION)

TABLE 297 KSA: MARKET, BY LIFE SCIENCE SERVICE, 2021–2026 (USD MILLION)

TABLE 298 KSA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 299 KSA: NON-CLINICAL SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 300 KSA: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2018–2020 (USD MILLION)

TABLE 301 KSA: SALES AND MARKETING SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2.8 ROW

9.2.8.1 Increasing investments in modernizing healthcare systems to support the market growth in this region

TABLE 302 ROW: HEALTHCARE BPO MARKET, BY PROVIDER-SERVICE, 2018–2020 (USD MILLION)

TABLE 303 ROW: MARKET, BY PROVIDER-SERVICE, 2021–2026 (USD MILLION)

TABLE 304 ROW: PATIENT CARE SERVICES MARKET-, BY TYPE, 2018–2020 (USD MILLION)

TABLE 305 ROW: PATIENT CARE SERVICES MARKET-, BY TYPE, 2021–2026 (USD MILLION)

TABLE 306 ROW: HEALTHCARE BPO MARKET, BY PAYER-SERVICE, 2018–2020 (USD MILLION)

TABLE 307 ROW: MARKET, BY PAYER-SERVICE, 2021–2026 (USD MILLION)

TABLE 308 ROW: CLAIMS MANAGEMENT SERVICES MARKET-, BY TYPE, 2018–2020 (USD MILLION)

TABLE 309 ROW: CLAIMS MANAGEMENT SERVICES MARKET-, BY TYPE, 2021–2026 (USD MILLION)

TABLE 310 ROW: HEALTHCARE BPO MARKET, BY LIFE SCIENCE -SERVICE, 2018–2020 (USD MILLION)

TABLE 311 ROW: HEALTHCARE BPO INDUSTRY, BY LIFE SCIENCE-SERVICE, 2021–2026 (USD MILLION)

TABLE 312 ROW: NON-CLINICAL SERVICES MARKET-, BY TYPE, 2018–2020 (USD MILLION)

TABLE 313 ROW: NON-CLINICAL SERVICES MARKET-, BY TYPE, 2021–2026 (USD MILLION)

TABLE 314 ROW: SALES AND MARKETING SERVICES MARKET-, BY TYPE, 2018–2020 (USD MILLION)

TABLE 315 ROW: SALES AND MARKETING SERVICES MARKET-, BY TYPE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 230)

10.1 OVERVIEW

FIGURE 27 KEY DEVELOPMENTS OF PROMINENT PLAYERS OPERATING IN THE HEALTHCARE BPO MARKET (2018–2021)

10.2 MARKET RANKING

FIGURE 28 MARKET RANKING OF COMPANIES OPERATING IN GLOBAL HEALTHCARE BPO INDUSTRY (2020)

10.3 MARKET SHARE ANALYSIS

TABLE 316 HEALTHCARE BPO MARKET: DEGREE OF COMPETITION

FIGURE 29 MARKET SHARE ANALYSIS: GLOBAL HEALTHCARE BPO INDUSTRY

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PARTICIPANTS

10.4.4 PERVASIVE PLAYERS

FIGURE 30 HEALTHCARE BPO MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

10.5 COMPANY EVALUATION QUADRANT FOR EMERGING PLAYERS

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 DYNAMIC COMPANIES

FIGURE 31 HEALTHCARE BPO MARKET: COMPANY EVALUATION QUADRANT, 2020 (EMERGING PLAYERS)

10.6 COMPETITIVE BENCHMARKING

10.6.1 COMPANY PRODUCT FOOTPRINT

TABLE 317 COMPANY PRODUCT FOOTPRINT

10.6.2 COMPANY APPLICATION FOOTPRINT

TABLE 318 COMPANY APPLICATION FOOTPRINT

10.6.3 COMPANY REGION FOOTPRINT

TABLE 319 COMPANY REGION FOOTPRINT

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

TABLE 320 HEALTHCARE BPO MARKET: KEY PRODUCT LAUNCHES & APPROVALS

10.7.2 DEALS

TABLE 321 GLOBAL HEALTHCARE BPO INDUSTRY: KEY DEALS

10.7.3 OTHER DEVELOPMENTS

TABLE 322 HEALTHCARE BPO MARKET: OTHER KEY DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 245)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 KEY PLAYERS

11.1.1 ACCENTURE

TABLE 323 ACCENTURE: BUSINESS OVERVIEW

FIGURE 32 ACCENTURE: COMPANY SNAPSHOT (2020)

11.1.2 COGNIZANT

TABLE 324 COGNIZANT: BUSINESS OVERVIEW

FIGURE 33 COGNIZANT: COMPANY SNAPSHOT (2020)

11.1.3 TATA CONSULTANCY SERVICES

TABLE 325 TATA CONSULTANCY SERVICES: BUSINESS OVERVIEW

FIGURE 34 TATA CONSULTANCY SERVICES: COMPANY SNAPSHOT (2020)

11.1.4 XEROX CORPORATION

TABLE 326 XEROX CORPORATION: BUSINESS OVERVIEW

FIGURE 35 XEROX CORPORATION: COMPANY SNAPSHOT (2020)

11.1.5 WNS (HOLDINGS) LIMITED

TABLE 327 WNS (HOLDINGS) LIMITED: BUSINESS OVERVIEW

FIGURE 36 WNS (HOLDINGS) LIMITED: COMPANY SNAPSHOT (2020)

11.1.6 NTT DATA CORPORATION

TABLE 328 NTT DATA CORPORATION: BUSINESS OVERVIEW

FIGURE 37 NTT DATA CORPORATION: COMPANY SNAPSHOT (2020)

11.1.7 IQVIA

TABLE 329 IQVIA: BUSINESS OVERVIEW

FIGURE 38 IQVIA: COMPANY SNAPSHOT (2020)

11.1.8 MPHASIS

TABLE 330 MPHASIS: BUSINESS OVERVIEW

FIGURE 39 MPHASIS: COMPANY SNAPSHOT (2020)

11.1.9 GENPACT

TABLE 331 GENPACT: BUSINESS OVERVIEW

FIGURE 40 GENPACT: COMPANY SNAPSHOT (2020)

11.1.10 WIPRO

TABLE 332 WIPRO: BUSINESS OVERVIEW

FIGURE 41 WIPRO: COMPANY SNAPSHOT (2020)

11.1.11 INFOSYS BPM

TABLE 333 INFOSYS BPM: BUSINESS OVERVIEW

FIGURE 42 INFOSYS BPM: COMPANY SNAPSHOT (2020)

11.1.12 FIRSTSOURCE SOLUTIONS

TABLE 334 FIRSTSOURCE SOLUTIONS: BUSINESS OVERVIEW

FIGURE 43 FIRSTSOURCE SOLUTIONS: COMPANY SNAPSHOT (2020)

11.2 OTHER PLAYERS

11.2.1 IBM CORPORATION

11.2.2 GEBBS HEALTHCARE SOLUTIONS

11.2.3 LONZA

11.2.4 OMEGA HEALTHCARE

11.2.5 R1 RCM

11.2.6 INVENSIS TECHNOLOGIES

11.2.7 UNITEDHEALTH GROUP

11.2.8 HCL TECHNOLOGIES

11.2.9 SYKES ENTERPRISES

11.2.10 PAREXEL INTERNATIONAL

11.2.11 ACCESS HEALTHCARE

11.2.12 SUTHERLAND GLOBAL

11.2.13 AKURATE MANAGEMENT SOLUTIONS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 301)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This study involved four major activities in estimating the size of the healthcare BPO market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), Centers for Disease Control and Prevention (CDC), Organisation for Economic Co-operation and Development (OECD), Association of Clinical Research Organizations (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICRO), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Eurostat, Food and Drug Administration (FDA), Pharmaceutical Research and Manufacturers of America (PhRMA), Japan CRO Association, Indian Society for Clinical Research, Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare BPO market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, business development managers, product/service managers, and related key executives from various key companies and organizations operating in the healthcare BPO market. The primary sources from the demand side included industry experts, consultants, healthcare organizations, providers, payers, as well as personnel from pharmaceutical, biopharmaceutical and medical device industries. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare BPO market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the healthcare BPO industries.

Report Objectives

- To define, describe, and forecast the healthcare BPO market based on provider service, payer service, life science service, and geography.

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges).

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall healthcare BPO market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to source geographies, namely, North America, Europe, and the Rest of the World (RoW); as well as destination geographies, namely, India, the US, China, the Philippines, Bulgaria and other EU countries, Brazil, the Kingdom of Saudi Arabia (KSA), and RoW.

- To profile the key players and analyze their market shares and core competencies.

- To track and analyze competitive developments such as product/service launches & approvals, partnerships, agreements, collaborations, joint ventures, expansions, and acquisitions in the overall healthcare BPO market.

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product/service strategy.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of healthcare BPO market

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare BPO Market

Looking forward to gain more insights on the global Healthcare BPO Industry

What are the growth opportunities in Healthcare BPO Market?

Can you enlighten us on the end users in Healthcare BPO Market?