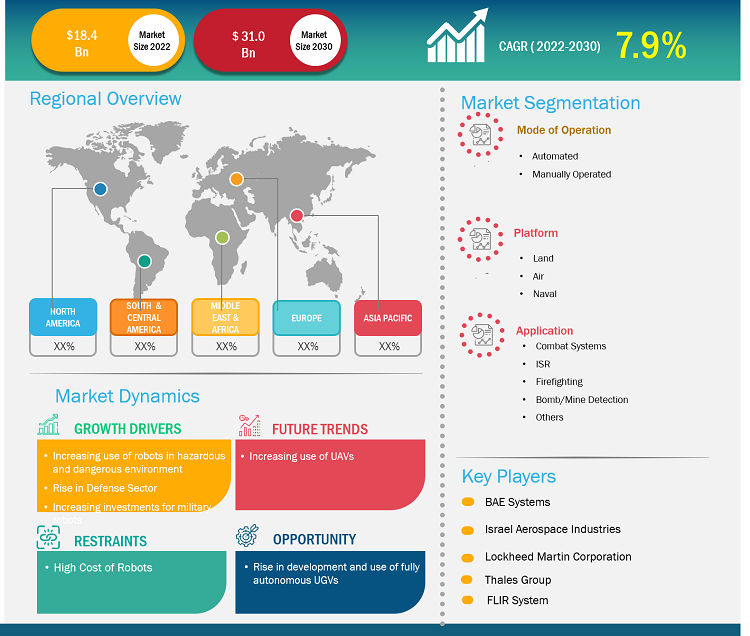

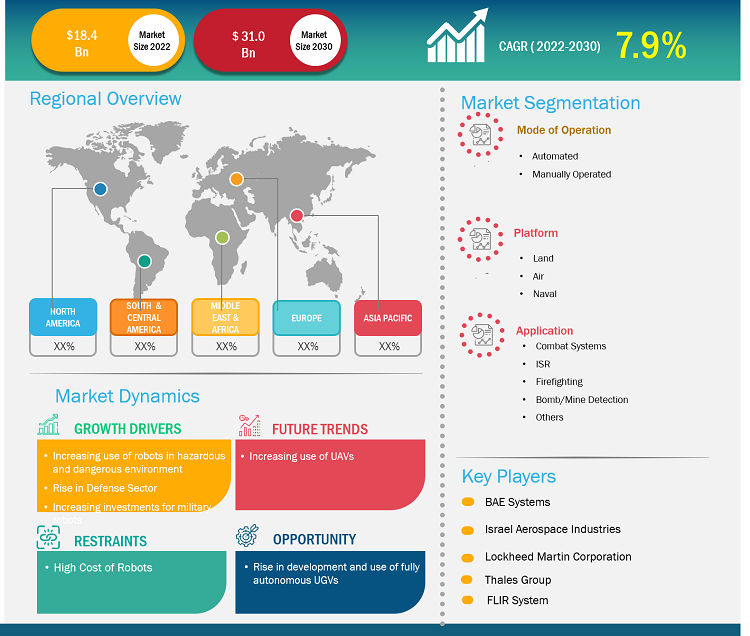

The military robots market is expected to grow from US$ 18.4 billion in 2022 to US$ 31.0 billion by 2030; it is estimated to grow at a CAGR of 7.9% from 2022 to 2030.

Analyst Perspective:

The military robots market has witnessed significant growth in recent years, driven by technological advancements and increasing government spending. The procurement and deployment of technologically advanced military robots play a critical role in boosting the security of any country. A bird’s-eye view provided by flying robots, also known as drones, helps in real-time monitoring and detects unwanted activities across national borders. It also helps detect or destroy the enemy or harmful incomings within the borders. Although these military robots may capture images, recognizing people in crowded spaces becomes challenging. Therefore, researchers and security agencies are engaged in developing an effective technology for the facial recognition of people in crowded places. According to an article published by Mantra Softech (India) Pvt. Ltd. in October 2021, the US military was working on facial recognition solutions through the “Advanced Tactical Facial Recognition at a Distance Technology” project at US Special Operations Command (SOCOM) and the “Intelligence Advanced Research Projects Activity (IARPA) Biometric Recognition and Identification” as a part of the Altitude and Range initiative. In addition, the US is engaged in bringing facial recognition technology into action to boost the efficiency of its military operations. In February 2023, RealNetworks, Inc., a provider of AI and computer vision-based products, signed a US$ 729,056 contract with the US Air Force to deploy its facial recognition technology, SAFR, on small drones for special operations. Thus, the growing trend of using military robots integrated with facial recognition technology will trigger the military robots market growth in the coming years.

Another technological advancement in military robots is their capability to refuel manned vehicles in the air. This is considered a major achievement in the era of manned-unmanned teaming operations. This solution can help the military forces to execute their operation for long hours with extra fuel. Refueling from the ground in the middle of a mission is very time-consuming. Hence, this technique helps them to execute the critical mission. For example, in September 2021, Boeing’s MQ-25 Stingray drone refueled an F-35 joint strike fighter as a part of the testing performed by the US Navy. In addition to their popular use in combat systems, ISR, firefighting, bomb/mine detection, and other applications, using military robots for refueling would increase their demand in the coming years.

Thus, facial recognition, mid-air refueling of other aircraft units, and other technological advancements are likely to act as significant trends in the market in the future.

Market Overview:

Military robots are manually controlled, or autonomous machines designed and developed specifically for military applications such as surveillance, search and rescue, transportation, and warfare. Deployment of robots in modern warfare is increasing to support the changing nature of warfare and minimize soldier casualties. The rise in focus of the military department to address the rising concerns of elevated soldier casualties in past wars has led to the adoption of robotics systems. The rise in government investments and initiatives to introduce and boost automated technology in the military is driving the market globally.

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Military Robots Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Customize Research To Suit Your Requirement

We can optimize and tailor the analysis and scope which is unmet through our standard offerings. This flexibility will help you gain the exact information needed for your business planning and decision making.

Military Robots Market: Strategic Insights

Naveen

Have a question?

Naveen will walk you through a 15-minute call to present the report’s content and answer all queries if you have any.

Speak to Analyst

Speak to Analyst

Market Driver:

Increase in Military Budget to Drive Growth of Market

Changes in the modern warfare system have been urging governments across the globe to allocate higher funds for respective military forces. Budget allocation allows military forces to acquire advanced technologies and equipment from domestic or international manufacturers. On the same lines, soldier and military vehicle modernization practices are also on the rise in numerous countries. With the growing need to strengthen military forces with advanced technologies, armaments, artilleries, and vehicles, among others, defense forces across the world are investing substantial amounts in the products mentioned above. A continuous urge to deploy new technologies in combat and non-combat operations by the defense forces is further boosting defense spending worldwide. According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure rose to US$ 2,240 billion in 2022, which represents a 3.7% increase from 2021.

Asymmetric warfare or modern battlefields demand enormous amounts of information to carry out operations successfully. Defense forces in developed and developing countries are utilizing modern technologies to gather information related to the enemy. Fiscal budgets, nowadays, are focused on robotic platforms and related technologies, contributing to the development and procurement of military robots. For instance, in the fiscal year 2021, the US DoD received US$ 7.5 billion for the procurement and deployment of unmanned systems, robotics, and related technologies. Approximately 87% of this amount was funded to 17 military agencies and departments for unmanned vehicles.

Thus, the rise in military expenditure fuels the adoption of military robots and fosters the military robots market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Segmental Analysis:

Based on the platform, the military robots market is segmented into land, air, and naval. The land segment held the largest share of the market in 2022, whereas the air segment is anticipated to register the highest CAGR in the market during the forecast period. The use of unmanned ground vehicles as land-based military robots is gaining traction to transport different supplies like artillery, bombs, and other supplies. They are also used to transport humans, including picking up casualties from the battlefield. In addition, air-based military robots such as drones are used for deep intelligence, detailed surveillance, and real-time reconnaissance activities. Both fixed- and rotary-wing military robots can be used for ISR applications. These robots provide accurate information on cross-border situations and surveillance of complex fields. They also offer quick target discovery, profiling, identification, and accurate location tagging, which helps national defense authorities in strengthening homeland security.

Further, technological developments by companies offering military robots for ISR applications contribute to the military robots market. For instance, in February 2023, Garuda Aerospace, an Indian drone startup, launched a solar-powered military drone named SURAJ, specifically for ISR applications to perform real-time surveillance of the ground. It is a high-altitude drone with a versatile payload capacity of 10 kg and an endurance of 12 hours. Thus, the use and launch of air-based military robots fuels the market.

Regional Analysis:

The European military robots market was valued at US$ XX billion in 2022 and is projected to reach US$ XX billion by 2030; it is expected to grow at a CAGR of XX% during the forecast period. Europe has established itself as a dominant military robots market. Several factors have contributed to Europe's strong position in the military robots market, which includes increased military spending, the need for strong support to the military force, and the rise in the use of unmanned aerial vehicles (UAVs).

The government authorities in Europe are introducing new rules for military UAVs. According to a news article by the European Commission in January 2023, new European Union (EU) rules focused on establishing a dedicated airspace for drones—U-space—were enforced, allowing operators to provide a broader range of services. This space creates a condition for drones to operate in a safe environment and further allows for the scaling up of the drone industry and services. These rules will help improve military drones' performance by carrying out complex, long-distance operations. These rules are also focused on the technological development of drones under Drone Strategy 2.0 and support the full implementation of the U-space by 2030.

European countries are investing in military robots to strengthen national security. For instance, according to Italy's budgetary plan for 2021, the Ministry of Defense is scheduled to invest ~US$ 63 million over seven years to arm Italy's Reaper UAVs. In addition, under the Eurodrone project, European countries such as Italy, Germany, Spain, and France got the green light to develop 20 Medium-Altitude and Long-Endurance (MALE) drones to compete against Israel and US-made UAVs. All these factors are fueling the growth of the military robots market.

Saab AB and Thales Group are the market players in Europe. These companies produce military robots and supply them to military forces for various activities such as ISR and warfare, which helps them generate revenue, thereby catalyzing the growth of the European military robots market.

- Sample PDF showcases the content structure and the nature of the information with qualitative and quantitative analysis.

Key Player Analysis:

The military robots market analysis consists of players such as BAE Systems, Israel Aerospace Industries Ltd, Lockheed Martin Corporation, Northrop Grumman Corporation, Rheinmetall AG, SAAB AB, Thales Group, FLIR System, AeroVironment, and General Dynamics.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the military robots market. A few recent key market developments are listed below:

- In May 2022, the Australian government announced the funds of US$ 317 million (A$ 454 million) to procure seven MQ-28A Ghost Bat drones for the Royal Australian Air Force (RAAF), which will be delivered in the next two to three years.

- In September 2021, MSI-Defence Systems Limited, in partnership with robotics and autonomous system developer Milrem Robotics, unveiled the highly mobile, unmanned kinetic C-UAV at DSEI 2021.

- In January 2021, SAAB AB received a contract from the Anglo-French Program to deliver underwater vehicles to destroy underwater sea mines. The deal was worth US$ 37 million.

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

The List of Companies

1. Aerovironment, Inc.

2. Boston Dynamics

3. Cobham plc

4. Elbit Systems Ltd.

5. FLIR Systems, Inc.

6. Israel Aerospace Industries

7. Lockheed Martin Corporation

8. Northrop Grumman Corporation

9. QinetiQ Group plc

10. Rheinmetall AG

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published many reports and advised several clients across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organizations are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in the last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/Sales Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- 3.1 Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- 3.2 Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- 3.3 Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- 3.4 Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

Trends and growth analysis reports related to Military Robots Market

Apr 2024

Apr 2024

Advanced Air Mobility Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Component (Hardware, Software), Operation Mode (Piloted, Autonomous), Propulsion Type (Fully Electric, Hybrid), End Use (Passenger, Cargo)

Apr 2024

Airport Fueling Equipment Market

Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Tanker Capacity (Below 5,000 Liters; 5,000–20,000 Liters; and Above 20,000 Liters), Aircraft Type (Civil Aircraft and Military Aircraft), and Power Source (Electric and Non-Electric)

Apr 2024

Satellite Optical Ground Station Market

Forecast to 2028 - Global Analysis by Operation (Laser Satcom and Optical Operations), Equipment (Consumer Equipment and Network Equipment), Application (Laser Operations, Debris Identification, Earth Observation, and Space Situational Awareness), and End User (Government and Military and Commercial Enterprises)

Apr 2024

Electro-Optics in Naval Market

Forecast to 2028 - COVID-19 Impact and Global Analysis By Technology (Camera, Sensor, and Laser Range Finder), Application (Target Detection, Identification, and Tracking; Surveillance; Fire Control; and Others), and End Use (Defense and Commercial)

Apr 2024

Commercial Air Traffic Management Market

Forecast to 2030 - COVID-19 Impact and Global Analysis By Type (Air Traffic Services, Air Traffic Flow Management, and Airspace Management), Component (Hardware and Software), Application (Communication, Navigation, Surveillance, Traffic Control, and Others), and Airport Class (Class I, Class II, Class III, and Class IV)