Control Valve Market by Material, Component (Actuators, Valve Body), Size, Type (Rotary and Linear), Industry (Oil & Gas, Water & Wastewater Treatment, Energy & Power, Chemicals), and Region - Global Forecast to 2025

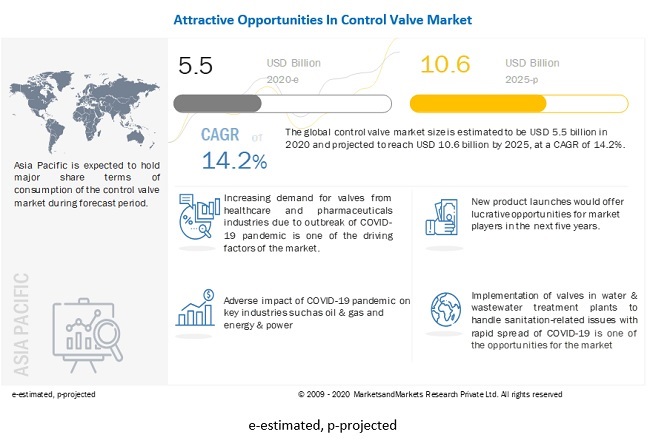

The global control valve market size is projected to reach USD 10.6 billion by 2025. It is expected to grow at a CAGR of 14.2% during the forecast period.

Increasing demand for valves from healthcare and pharmaceuticals industries due to outbreak of COVID-19 pandemic, rising demand for energy in APAC, growing need for connected networks to maintain and monitor industrial equipment, and surging focus on establishing new nuclear power plants and upscaling of existing ones are the key driving factors for the control valve market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Increasing demand for valves from healthcare and pharmaceuticals industries due to COVID-19 pandemic

With the rapid spread of COVID-19, healthcare and pharmaceuticals industries are at the forefront of combating the pandemic. There is a rise in the production of critical medical devices that are required to cure COVID-19 patients. Control valve market play an important role in the manufacturing of different types of medical devices, and several key industry players have grabbed the opportunity to contribute to the fight against the pandemic.

Companies are increasingly investing in the research and development pertaining to automatic components, such as solenoid valves, that are supplied to the pharmaceuticals industry. Likewise, pharmaceuticals companies are looking to develop sophisticated fluid handling systems, such as automatic sanitizer dispensers and liquid soap dispensers, which, in turn, is creating the need for valves. Thus, the growing production of healthcare devices and increasing R&D investments in the pharma field boost the growth of the control valve market.

Restraint: Lack of standardized certifications and government policies

Valve manufacturers need to adhere to certain norms and regulations. Different regions have different certifications and policies with respect to valves. This factor creates diversity in demand due to the wide applicability of valves in various industries, such as oil & gas, food & beverages, pharmaceuticals, energy & power, water & wastewater treatment, building & construction, chemicals, and pulp & paper.

However, such diversity is hindering the growth of the control valve market as industry players have to amend the same product according to the regional policies, which makes it difficult for the valve manufacturers to achieve an ideal cost of installation. To resolve this issue, they have to invest their resources in setting up manufacturing facilities across the world, thus requiring additional capital.

Opportunity: Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19

The COVID-19 pandemic has made people more concerned about sanitation and clean water. Water & wastewater treatment is among the essential services, and hence, the plants are operational for all residential services. Additionally, the aging infrastructure in the water & wastewater treatment industry is the primary concern in several countries. For instance, the US has a wide network of old pipelines that are used for transporting water and wastewater.

Valves used in old infrastructure are also on the verge of replacement as they have surpassed their operational life. Hence, it is important to replace such valves for improved performance and better worker safety. Thus, the rising concern of people for better sanitation and an increasing amount of fresh investments in water supply and sanitation projects create significant opportunities for the providers of valves having applications in the water & wastewater treatment industry.

Challenge: Impact of COVID-19 pandemic on key industries such as oil & gas and energy & power

The COVID-19 pandemic has forced governments worldwide to take drastic measures to protect public health in 2020. This global health crisis has also dented economic growth prospects and upended the oil market. The oil market has been supported by the additional production adjustments put in place by OPEC and non-OPEC countries in the Declaration of Cooperation for the first quarter of 2020. In the last week of March and the entire April, all the indices have deteriorated in terms of economy, stocks, equities, financial instruments, metals, commodities, and oil. Since the beginning of 2020, crude oil prices have decreased dramatically.

Consumer demand has declined following the continued spread of the virus and its negative impact on the economy, which, in turn, has led to the disagreement between 2 of the largest oil producers, Russia and Saudi Arabia, in early March. All these factors are expected to lead to a setback in the control valve market for the oil & gas industry.

Rotary valves to account for a larger share of the control valve market by 2025

Rotary control valves are expected to hold a larger share of the control valve market in 2019. Rotary valves are less prone to clogging in dirty service applications, and through the stem packing, emissions can be controlled effortlessly, without using costly bellows seals. Moreover, lighter weight and smaller size of rotary valves contribute to the constantly increasing demand for these valves. Another advantage offered by rotary valves is the formation of a virtually obstruction-free path for the fluid when the valve is wide open.

Oil & Gas accounted for the largest market share in 2019

The oil & gas industry accounted for the largest share of the control valve market in 2019 owing to the rising energy demand and increasing drilling activities in the Gulf Cooperation Council (GCC) countries. However, at present, the world is facing an economic crisis due to the COVID-19 pandemic. However, at present, the world is facing a financial crisis due to the COVID-19 pandemic. This pandemic has severely affected the oil & gas industry, with oil prices declined to below zero levels.

The major oil-producing companies are running out of space to store the extracted oil, while the demand for oil has declined drastically, which has created a huge demand–supply gap. Oil & gas is one of the key industries for control valves, but the pandemic has adversely affected the control valve market in 2020 to a significant extent.

North America to witness the highest CAGR in control valve market during the forecast period

Many leading players in the control valve market are based in this region. Moreover, increasing R&D activities in the region pertaining to the use of valves in automation and the rising demand for safety applications are the 2 crucial factors driving the growth of this market in North America. R&D at industry levels is broadening the application areas of valves in different industries, such as energy & power and chemicals, especially in the US. Control valves are used in oil & gas, energy & power, and water & wastewater treatment industries to control media flow through a system, as well as to start, stop, or throttle the flow and ensure safe and efficient process automation.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Christian Burkert (Germany), Emerson (US), Flowserve Corporation (US), IMI PLC (UK), and Cameron (Schlumberger Company) (US), are among the major players in the control valve market.

Control Valve Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 5.5 Billion |

| Expected Value | USD 10.6 Billion |

| Growth rate | CAGR of 14.2% |

|

Market Size Availability for Years |

2016–2025 |

|

On Demand Data Available |

2030 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Market Leaders |

Christian Burkert (Germany), IMI PLC (UK), Neles Corporation (Finland), Kitz Corporation (Japan), Neway Valve (China), Ham-Let (Israel), Trillium Flow Technologies (UK), Alfa Laval (Sweden), Spirax Sarco (UK), AVK Holdings A/S (Denmark), Velan, Inc. (Canada) and Avcon Control (India). |

| Top Companies in North America | Emerson (US), Flowserve Corporation (US), Cameron (Schlumberger Company) (US), Crane Co. (US), Samson Controls (US), Apollo Valves (US), Curtiss-Wright Corporation (US), Dwyer Instruments (US), Swagelok (US) |

| Key Market Driver | Increasing demand for valves from healthcare and pharmaceuticals industries due to COVID-19 pandemic |

| Key Market Opportunity | Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19 |

| Largest Growing Region | North America |

| Highest CAGR Segment | Energy & Power Industry |

This research report categorizes the control valve market, by component, material, type, size, industry, and region

Control Valve Market Based on Material:

- Stainless Steel

- Alloy-Based

- Cast Iron

- Cryogenic

- Others

Control Valve Market Based on Component:

- Actuators

- Valve Body

- Others

Control Valve Market Based on Type:

-

Rotary Valves

- Ball Valves

- Butterfly Valves

- Plug Valves

-

Linear Valves

- Globe Valves

- Diaphragm Valves

- Other Valves

Control Valve Market Based on Size:

- Upto 1”

- >1”-6”

- >6”-25”

- >25”-50”

- >50”

Control Valve Market Based on Industry:

- Oil & Gas

- Water & Wastewater Treatment

- Energy & Power

- Pharmaceuticals

- Food & Beverages

- Chemicals

- Building & Construction

- Paper & Pulp

- Metals & Mining

- Others

Control Valve Market Based on the Region

- North America

- Europe

- APAC

- RoW (South America, Middle East & Africa)

Recent Developments

- In Feburary 2020, Emerson introduced the ASC Series 158 Gas Valve and Series 159 Motorized Actuator. Designed specifically for burner-boiler applications, the new products give OEMs, distributors, contractors, and end users a new combustion safety shutoff valve option that increases safety and reliability, and enhances both flow and control.

- In Feburary 2020, Curtiss-Wright Corporation has entered into an agreement to acquire the stock of Dyna-Flo Control Valve Services (Dyna-Flo) for CAD 81 million (USD 62 million) in cash. Dyna-Flo is one of the leading designers and manufacturers of linear and rotary control valves, isolation valves, actuators, and level and pressure control systems for the chemicals, petrochemicals, and oil & gas markets.

- In Feburary 2020, Schlumberger opened a manufacturing center in King Salman Energy Park (SPARK), Saudi Arabia, that supports Saudi Aramco’s In-Kingdom Total Value Add (IKTVA) program to promote economic growth. The center will manufacture various technologies, including liner hangers and packers, and valve technologies such as GROVE valves and ORBIT rising stem ball valves, to help improve the efficiency of oil and gas operations in the kingdom and neighboring countries.

- In Novermber 2019, Bürkert has developed a redundancy block with valves and pressure switches for applications with high safety requirements. For a redundant switch-off option, they are installed pneumatically in a row behind the valves on the valve terminal.

- In August 2019, IMI plc acquired PBM, a manufacturer of ball valves and specialty valves for both sanitary and industrial applications. The acquisition helped IMI expand the operations of its subsidiary IMI Critical into new market segments, including pharmaceuticals and food processing, and allowed PBM to capitalize on IMI’s global reach and support network.

Frequently Asked Questions (FAQ):

Which are the major companies in the control valve market? What are their major strategies to strengthen their market presence?

The major companies in the control valve market are - Christian Burkert (Germany), Emerson (US), Flowserve Corporation (US), Cameron (Schlumberger Company) (US), IMI PLC (UK), Neles Corporation (Finland), and Crane Co. (US). Players in this market have adopted product launches and developments, expansions, acquisitions, and agreements strategies to increase their market share.

Which is the potential market for control valve market in terms of the region?

APAC held the largest share of the control valve market. Rapid population growth and urbanization in developing economies such as China, Japan, and India have led to the growth of the energy & power, water & wastewater treatment, building & construction, chemicals, pharmaceuticals, and oil & gas industries. This, in turn, has increased the demand for control valves until 2019. However, COVID-19 has adversely impacted the control valve market in 2020, due to which it is expected to witness a significant decline. The major industries adopting control valves are oil & gas, energy & power, and water & wastewater treatment.

What are the opportunities for new market entrants?

There are significant opportunities in the control valve market such as implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19, utilization of IIoT and Industry 4.0 in industrial plants, use of 3D printing technology in manufacturing valves, need for replacement of outdated valves and adoption of smart valves, and focus of industry players on offering improved customer services

Which industries are expected to drive the growth of the market in the next five years?

The rising demand for energy and power across the world encourages companies operating in the energy & power industry to adopt solutions that can help them enhance production output with minimum errors and reduced downtime. Also, it is crucial to utilize the available resources efficiently, as most of them are non-renewable. Control valves are key components in power generation plants. Emerging countries are focusing on investing more in the energy & power industry, which is expected to increase the scope for the growth of the control valve market.

Which component is expected to hold the largest share of the market by 2025?

Actuators are expected to account for the largest share of the control valve market, by component, by 2025. This can be attributed to the increasing use of actuators in the oil & gas, energy & power, metals & mining industries; actuators are installed in industrial locations that are not easily accessible by humans, and actuators can provide uninterrupted and reliable services during the operation of the valves. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 CONTROL VALVE MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 CONTROL VALVE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primaries

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 SUPPLY-SIDE ANALYSIS: CONTROL VALVE MARKET (1/2)

FIGURE 4 SUPPLY-SIDE ANALYSIS: MARKET (2/2)

FIGURE 5 DEMAND-SIDE ANALYSIS: MARKET

2.2.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

3.1 CONTROL VALVE MARKET: PRE-COVID-19 AND POST-COVID-19 SCENARIOS

FIGURE 9 MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND PRE-COVID-19 SCENARIO ANALYSIS (2016–2025)

3.1.1 MARKET REALISTIC SCENARIO

3.1.2 MARKET OPTIMISTIC SCENARIO

3.1.3 MARKET: PESSIMISTIC SCENARIO

FIGURE 10 MARKET SIZE, 2016–2025

FIGURE 11 STAINLESS STEEL TO CAPTURE LARGEST SIZE OF MARKET, BY MATERIAL, BY 2025

FIGURE 12 ROTARY VALVES TO CAPTURE LARGEST SIZE OF MARKET, BY TYPE, BY 2025

FIGURE 13 ACTUATORS TO CAPTURE LARGEST SHARE OF MARKET, BY COMPONENT, IN 2020

FIGURE 14 6” TO 25” SIZED VALES TO CAPTURE LARGEST SHARE OF MARKET, BY SIZE, IN 2020

FIGURE 15 ENERGY & POWER TO BE FASTEST-GROWING INDUSTRY DURING FORECAST PERIOD

FIGURE 16 APAC TO HOLD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 17 INCREASING DEMAND FOR VALVES FROM HEALTHCARE AND PHARMACEUTICALS INDUSTRIES DUE TO OUTBREAK OF COVID-19 PANDEMIC PROPELS MARKET GROWTH

4.2 MARKET, BY MATERIAL

FIGURE 18 STAINLESS STEEL CONTROL VALVES TO HOLD LARGEST MARKET SIZE IN 2025

4.3 MARKET, BY COMPONENT

FIGURE 19 ACTUATORS TO HOLD LARGEST SHARE OF MARKET, BY COMPONENT, IN 2025

4.4 MARKET, BY TYPE

FIGURE 20 MARKET FOR ROTARY CONTROL VALVES TO GROW AT HIGHER CAGR THAN THAT OF LINEAR CONTROL VALVES DURING FORECAST PERIOD

4.5 MARKET, BY SIZE

FIGURE 21 CONTROL VALVES SIZED UP TO 1” TO HOLD LARGEST MARKET SIZE IN 2025

4.6 CONTROL VALVE MARKET IN APAC, BY COUNTRY AND INDUSTRY

FIGURE 22 WATER & WASTEWATER TREATMENT INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN APAC IN 2025

4.7 MARKET, BY COUNTRY (2025)

FIGURE 23 US EXPECTED TO HOLD LARGEST SHARE OF MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for valves from healthcare and pharmaceuticals industries due to COVID-19 pandemic

5.2.1.2 Rising demand for energy in APAC

5.2.1.3 Growing need for connected networks to maintain and monitor industrial equipment

5.2.1.4 Surging focus on establishing new nuclear power plants and upscaling of existing ones

5.2.2 RESTRAINTS

5.2.2.1 Lack of standardized certifications and government policies

5.2.3 OPPORTUNITIES

5.2.3.1 Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19

5.2.3.2 Utilization of IIoT and Industry 4.0 in industrial plants

5.2.3.3 Use of 3D printing technology in manufacturing valves

5.2.3.4 Need for replacement of outdated valves and adoption of smart valves

5.2.3.5 Focus of industry players on offering improved customer services

5.2.4 CHALLENGES

5.2.4.1 Impact of COVID-19 pandemic on key industries such as oil & gas and energy & power

5.2.4.2 Rise in collaboration activities among industry players

5.2.4.3 Unplanned downtime due to malfunctioning or failure of valves

6 INDUSTRY TRENDS (Page No. - 69)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 25 RAW MATERIAL AND COMPONENT SUPPLIERS AND ORIGINAL EQUIPMENT MANUFACTURERS COLLECTIVELY ADD MAJOR VALUE TO PRODUCT

6.3 IMPACT OF COVID-19 ON VALVE ECOSYSTEM AND EXTENDED ECOSYSTEM (ADJACENT MARKETS)

6.3.1 RAW MATERIAL AND COMPONENT SUPPLIERS

6.3.2 OEMS

6.3.3 SYSTEM INTEGRATORS

6.3.4 SALES CONSULTANTS AND DISTRIBUTORS

6.4 CONSUMER BUYING PROCESS

6.4.1 ONLINE VALVE PURCHASE TREND IS EXPECTED TO DISRUPT TRADITIONAL CONSUMER BUYING PROCESS OF VALVE INDUSTRY

FIGURE 26 CONSUMER BUYING PROCESS

6.5 INDUSTRY TRENDS

6.5.1 3D PRINTING

6.5.2 DIGITIZATION AND INTEGRATION OF ADVANCED TECHNOLOGIES SUCH AS ARTIFICIAL INTELLIGENCE INTO CONTROL VALVES

6.5.3 IMPACT OF IOT ON MARKET

7 CONTROL VALVE MARKET, BY COMPONENT (Page No. - 75)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY COMPONENT

TABLE 2 MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 3 MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

7.2 ACTUATORS

7.2.1 ACTUATORS TO DOMINATE MARKET BASED ON COMPONENTS DURING 2020–2025

TABLE 4 MARKET FOR ACTUATORS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 5 MARKET FOR ACTUATORS, BY TYPE, 2020–2025 (USD MILLION)

7.3 VALVE BODY

7.3.1 VALVE BODY ACTS AS MAIN CONTROL CENTER

7.4 OTHERS

8 CONTROL VALVE MARKET, BY MATERIAL (Page No. - 79)

8.1 INTRODUCTION

FIGURE 28 MARKET, BY MATERIAL

FIGURE 29 STAINLESS STEEL CONTROL VALVES TO HOLD LARGEST MARKET SIZE BY 2025

TABLE 6 MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 7 MARKET, BY MATERIAL, 2020–2025 (USD MILLION)

8.2 STAINLESS STEEL

8.2.1 DEMAND FOR STAINLESS STEEL CONTROL VALVES IS LIKELY TO UPSURGE DURING FORECAST PERIOD

8.3 CAST IRON

8.3.1 CAST-IRON CONTROL VALVES TO CONTINUE TO ACCOUNT FOR SECOND-LARGEST MARKET SIZE OWING TO ITS WIDE USE IN WATER & WASTEWATER TREATMENT AND HYDROELECTRIC POWER PLANTS

8.4 ALLOY-BASED

8.4.1 MARKET FOR ALLOY-BASED VALVES TO GROW AT A SIGNIFICANT RATE IN COMING YEARS

8.5 CRYOGENIC

8.5.1 CRYOGENIC VALVES ARE EXPECTED TO CONTINUE TO HOLD THIRD-LARGEST MARKET SHARE OWING TO ITS RISING USE IN OIL & GAS INDUSTRY

8.6 OTHERS

8.6.1 BRASS

8.6.2 BRONZE

8.6.3 PLASTIC

9 CONTROL VALVE MARKET, BY TYPE (Page No. - 85)

9.1 INTRODUCTION

FIGURE 30 MARKET, BY TYPE

FIGURE 31 ROTARY VALVES TO DOMINATE MARKET DURING 2020–2025

TABLE 8 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 9 MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.2 ROTARY VALVES

TABLE 10 ROTARY CONTROL VALVE MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 11 ROTARY MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.2.1 BALL VALVES

9.2.1.1 Ball valves to continue to account for largest size of market during forecast period

9.2.2 BUTTERFLY VALVES

9.2.2.1 Butterfly valves account for significant market share owing to their reliable field operations, tight shut-off, and precise control

9.2.3 PLUG VALVES

9.2.3.1 Market for plug valves expected to witness substantial growth in next few years

9.3 LINEAR VALVES

TABLE 12 LINEAR MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 13 LINEAR MARKET, BY TYPE, 2020–2025 (USD MILLION)

9.3.1 GLOBE VALVES

9.3.1.1 Globe valve to hold largest market size owing to their capability to meet demands of a wide range of pressure and temperature conditions

9.3.2 DIAPHRAGM VALVES

9.3.2.1 Diaphragm valves expected to witness highest CAGR in linear control valve market during forecast period

9.3.3 OTHER VALVES

10 CONTROL VALVE MARKET, BY SIZE (Page No. - 91)

10.1 INTRODUCTION

FIGURE 32 CONTROL VALVE MARKET, BY SIZE

FIGURE 33 CONTROL VALVES SIZED >6’’–25” EXPECTED TO HOLD LARGEST MARKET SIZE BY 2025

TABLE 14 MARKET, BY SIZE, 2016–2019 (USD MILLION)

TABLE 15 MARKET, BY SIZE, 2020–2025 (USD MILLION)

10.2 UP TO 1”

10.2.1 CONTROL VALVES SIZED UP TO 1" TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

10.3 >1”–6”

10.3.1 >1"–6" CONTROL VALVES ARE WIDELY USED IN CRITICAL INDUSTRIES SUCH AS OIL & GAS AND CHEMICALS

10.4 >6”–25”

10.4.1 >6"–25" TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

10.5 >25”–50”

10.5.1 CHEMICALS, PHARMACEUTICALS, AND ENERGY & POWER ARE KEY INDUSTRIES THAT USE CONTROL VALVES SIZED >25"–50"

10.6 >50”

10.6.1 CONTROL VALVES SIZED >50" TO ACCELERATE THE MARKET FOR OIL & GAS, POWER, AND PETROCHEMICALS INDUSTRIES

11 CONTROL VALVE MARKET, BY INDUSTRY (Page No. - 95)

11.1 INTRODUCTION

FIGURE 34 MARKET, BY INDUSTRY

FIGURE 35 OIL & GAS TO CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 16 MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 17 MARKET, BY INDUSTRY, 2020–2025 (USD MILLION)

11.2 OIL & GAS

11.2.1 OIL & GAS COMPANIES TO WITNESS MAJOR SETBACK IN 2020 DUE TO OUTBREAK OF COVID-19 AND OIL PRICE CRISIS

FIGURE 36 APPLICATIONS OF DIFFERENT TYPES OF CONTROL VALVE IN OIL & GAS INDUSTRY

FIGURE 37 OIL & GAS END-USER INDUSTRY: PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 18 PRE- AND POST-COVID-19 SCENARIO: MARKET FOR OIL & GAS INDUSTRY, 2016–2025 (USD MILLION)

11.2.2 IMPACT OF COVID-19 & OIL PRICE CRISIS: MNM VIEWPOINT

FIGURE 38 COVID-19 IMPACT ANALYSIS

TABLE 19 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 23 MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 24 CONTROL VALVE MARKET FOR OIL & GAS INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 25 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 27 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 28 MARKET FOR OIL & GAS INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 29 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 30 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 31 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 32 MARKET FOR OIL & GAS INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 33 MARKET FOR OIL & GAS INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 MARKET FOR OIL & GAS INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.3 WATER & WASTEWATER TREATMENT

11.3.1 RISE IN DEMAND FOR CLEANER WATER AND MODIFICATION IN OLDER WATER INFRASTRUCTURE TO AUGMENT DEMAND FOR CONTROL VALVES

FIGURE 39 CONTROL VALVE APPLICATIONS IN WATER & WASTEWATER TREATMENT PLANTS

FIGURE 40 WATER & WASTEWATER TREATMENT INDUSTRY: PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 35 PRE- AND POST-COVID-19 SCENARIO: CONTROL VALVE MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, 2016–2025 (USD MILLION)

11.3.2 IMPACT OF COVID-19: MNM VIEWPOINT

FIGURE 41 COVID-19 IMPACT ANALYSIS

TABLE 36 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 38 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 39 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 40 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 41 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 42 CONTROL VALVE MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 44 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 45 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 46 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 48 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 49 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 50 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 MARKET FOR WATER & WASTEWATER TREATMENT INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.4 ENERGY & POWER

11.4.1 INCREASING NEED FOR ENERGY IN DEVELOPING COUNTRIES IS EXPECTED TO ACCELERATE DEMAND FOR CONTROL VALVES

FIGURE 42 CONTROL VALVE APPLICATIONS IN ENERGY & POWER PLANTS: COMBINED CYCLE POWER PLANT

FIGURE 43 ENERGY & POWER INDUSTRY: PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 52 PRE- AND POST-COVID-19 SCENARIO: CONTROL VALVE MARKET FOR ENERGY & POWER INDUSTRY, 2016–2025 (USD MILLION)

11.4.2 IMPACT OF COVID-19: MNM VIEWPOINT

FIGURE 44 COVID-19 IMPACT ANALYSIS

TABLE 53 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 54 MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 55 MARKET FOR ENERGY & POWER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 56 MARKET FOR ENERGY & POWER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 57 MARKET FOR ENERGY & POWER INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 58 CONTROL VALVE MARKET FOR ENERGY & POWER INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 59 MARKET FOR ENERGY & POWER INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 60 MARKET FOR ENERGY & POWER INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 61 MARKET FOR ENERGY & POWER INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 62 CONTROL VALVE MARKET FOR ENERGY & POWER INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 63 MARKET FOR ENERGY & POWER INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 MARKET FOR ENERGY & POWER INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 65 MARKET FOR ENERGY & POWER INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 66 MARKET FOR ENERGY & POWER INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 67 MARKET FOR ENERGY & POWER INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 68 MARKET FOR ENERGY & POWER INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.5 PHARMACEUTICALS

11.5.1 NORTH AMERICA TO LEAD CONTROL VALVE MARKET FOR PHARMACEUTICALS INDUSTRY

FIGURE 45 PHARMACEUTICALS INDUSTRY: PRE- AND POST-COVID-19 SCENARIO ANALYSIS

TABLE 69 PRE- AND POST-COVID-19 SCENARIO: MARKET FOR PHARMACEUTICALS INDUSTRY, 2016–2025 (USD MILLION)

11.5.2 IMPACT OF COVID-19: MNM VIEWPOINT

FIGURE 46 COVID-19 IMPACT ANALYSIS

TABLE 70 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 MARKET FOR PHARMACEUTICALS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 72 MARKET FOR PHARMACEUTICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 73 MARKET FOR PHARMACEUTICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 74 MARKET FOR PHARMACEUTICALS INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 75 MARKET FOR PHARMACEUTICALS INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 76 MARKET FOR PHARMACEUTICALS INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 77 MARKET FOR PHARMACEUTICALS INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 78 MARKET FOR PHARMACEUTICALS INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR PHARMACEUTICALS INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 80 MARKET FOR PHARMACEUTICALS INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 81 CONTROL VALVE MARKET FOR PHARMACEUTICALS INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 82 MARKET FOR PHARMACEUTICALS INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 83 MARKET FOR PHARMACEUTICALS INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 84 MARKET FOR PHARMACEUTICALS INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 MARKET FOR PHARMACEUTICALS INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.6 FOOD & BEVERAGES

11.6.1 FOOD & BEVERAGES INDUSTRY TO WITNESS SIGNIFICANT GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 47 CONTROL VALVE APPLICATIONS IN FOOD & BEVERAGES INDUSTRY

11.6.2 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 86 CONTROL VALVE MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 87 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 88 MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 90 MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 91 MARKET FOR FOOD & BEVERAGES INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 92 MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 93 MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 94 MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 MARKET FOR FOOD & BEVERAGES INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 96 MARKET FOR FOOD & BEVERAGES INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 97 CONTROL VALVE MARKET FOR FOOD & BEVERAGES INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 98 MARKET FOR FOOD & BEVERAGES INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 MARKET FOR FOOD & BEVERAGES INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 100 MARKET FOR FOOD & BEVERAGES INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 101 MARKET FOR FOOD & BEVERAGES INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.7 CHEMICALS

11.7.1 CONTROL VALVES ARE ADOPTED IN CHEMICALS INDUSTRY AS THEY MEET MOST STRINGENT PROTECTION REQUIREMENTS AND STANDARDS

FIGURE 48 CONTROL VALVE APPLICATIONS IN CHEMICAL PLANTS

11.7.2 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 102 CONTROL VALVE MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 103 MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 104 MARKET FOR CHEMICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 105 MARKET FOR CHEMICALS INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 106 MARKET FOR CHEMICALS INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 107 MARKET FOR CHEMICALS INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 108 MARKET FOR CHEMICALS INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 109 MARKET FOR CHEMICALS INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 110 MARKET FOR CHEMICALS INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 111 MARKET FOR CHEMICALS INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 112 MARKET FOR CHEMICALS INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 113 MARKET FOR CHEMICALS INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 114 MARKET FOR CHEMICALS INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 115 CONTROL VALVE MARKET FOR CHEMICALS INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 116 MARKET FOR CHEMICALS INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 117 MARKET FOR CHEMICALS INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.8 BUILDING & CONSTRUCTION

11.8.1 SIGNIFICANT DECREASE IN DEMAND FOR CONTROL VALVES OWING TO CANCELLED OR POSTPONED SMART INFRASTRUCTURE PROJECTS IN BUILDING & CONSTRUCTION INDUSTRY

11.8.2 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 118 CONTROL VALVE MARKET FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 119 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 120 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 121 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 122 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 124 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 125 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 126 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 127 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 128 CONTROL VALVE MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 129 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 130 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 132 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 133 MARKET FOR BUILDING & CONSTRUCTION INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.9 PULP & PAPER

11.9.1 CONTROL VALVES HELP IN PREDICTIVE MAINTENANCE OF EQUIPMENT USED IN PULP AND PAPER MANUFACTURING

11.9.2 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 134 CONTROL VALVE MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 135 MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 136 MARKET FOR PULP & PAPER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 137 MARKET FOR PULP & PAPER INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 138 MARKET FOR PULP & PAPER INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 MARKET FOR PULP & PAPER INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 140 MARKET FOR PULP & PAPER INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 141 MARKET FOR PULP & PAPER INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 142 MARKET FOR PULP & PAPER INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 143 MARKET FOR PULP & PAPER INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 144 CONTROL VALVE MARKET FOR PULP & PAPER INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 145 MARKET FOR PULP & PAPER INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 146 MARKET FOR PULP & PAPER INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 147 MARKET FOR PULP & PAPER INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 148 MARKET FOR PULP & PAPER INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 149 MARKET FOR PULP & PAPER INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.10 METALS & MINING

11.10.1 GROWING DEMAND FOR PREDICTIVE MAINTENANCE ENCOURAGING USE OF CONTROL VALVES

11.10.2 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 150 CONTROL VALVE MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2016–2019 (USD MILLION)

TABLE 151 MARKET FOR METALS & MINING INDUSTRY, BY REGION, 2020–2025 (USD MILLION)

TABLE 152 MARKET FOR METALS & MINING INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 153 MARKET FOR METALS & MINING INDUSTRY IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 154 MARKET FOR METALS & MINING INDUSTRY IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 155 MARKET FOR METALS & MINING INDUSTRY IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 156 MARKET FOR METALS & MINING INDUSTRY IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 157 MARKET FOR METALS & MINING INDUSTRY IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 158 MARKET FOR METALS & MINING INDUSTRY IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 159 MARKET FOR METALS & MINING INDUSTRY IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 160 MARKET FOR METALS & MINING INDUSTRY IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 161 MARKET FOR METALS & MINING INDUSTRY IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 162 MARKET FOR METALS & MINING INDUSTRY IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 163 MARKET FOR METALS & MINING INDUSTRY IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 164 MARKET FOR METALS & MINING INDUSTRY IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 165 MARKET FOR METALS & MINING INDUSTRY IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.11 OTHERS

TABLE 166 CONTROL VALVE MARKET FOR OTHER INDUSTRIES, BY REGION, 2016–2019 (USD MILLION)

TABLE 167 MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 168 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 169 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 170 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 171 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 172 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 173 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 174 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 175 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 176 MARKET FOR OTHER INDUSTRIES IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 177 MARKET FOR OTHER INDUSTRIES IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 178 MARKET FOR OTHER INDUSTRIES IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 179 MARKET FOR OTHER INDUSTRIES IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 180 MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 181 MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2020–2025 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 164)

12.1 INTRODUCTION

FIGURE 49 CONTROL VALVE MARKET: GEOGRAPHIC SNAPSHOT

TABLE 182 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 183 MARKET, BY REGION, 2020–2025 (USD MILLION)

FIGURE 50 APAC TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

12.2 NORTH AMERICA

FIGURE 51 SNAPSHOT OF MARKET IN NORTH AMERICA

FIGURE 52 NORTH AMERICA: PRE- AND POST-COVID-19 SCENARIOS

TABLE 184 PRE- AND POST-COVID-19 SCENARIO: MARKET IN NORTH AMERICA, 2016–2025 (USD MILLION)

12.2.1 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 185 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 186 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 187 MARKET IN NORTH AMERICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 188 MARKET IN NORTH AMERICA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.2.2 US

12.2.2.1 Aging water & wastewater infrastructure in US generates demand for hybrid valves

TABLE 189 CONTROL VALVE MARKET IN US, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 190 MARKET IN US, BY INDUSTRY, 2020–2025 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Rising energy demand to augment market growth in coming years

TABLE 191 MARKET IN CANADA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 192 MARKET IN CANADA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.2.4 MEXICO

12.2.4.1 Uptrend in the water & wastewater treatment industry expected to drive the market in Mexico during the forecast period

TABLE 193 MARKET IN MEXICO, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 194 MARKET IN MEXICO, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3 EUROPE

FIGURE 53 SNAPSHOT OF MARKET IN EUROPE

FIGURE 54 EUROPE: PRE- AND POST-COVID-19 SCENARIOS

TABLE 195 PRE- AND POST-COVID-19 SCENARIO: MARKET IN EUROPE, 2016–2025 (USD MILLION)

12.3.1 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 196 CONTROL VALVE MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 197 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 198 MARKET IN EUROPE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 199 MARKET IN EUROPE, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.2 UK

12.3.2.1 Prominence of water industry in UK will propel demand for control valves

TABLE 200 ARKET IN UK, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 201 MARKET IN UK, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 Growth prospects of process industries to propel the growth of control valve market in Germany

TABLE 202 MARKET IN GERMANY, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 203 MARKET IN GERMANY, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Energy & power sector expected to drive the market in France

TABLE 204 MARKET IN FRANCE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 205 MARKET IN FRANCE, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.5 ITALY

12.3.5.1 Italian market will be driven by upcoming investments in water & wastewater treatment industry

TABLE 206 MARKET IN ITALY, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 207 MARKET IN ITALY, BY INDUSTRY, 2020–2025 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 208 CONTROL VALVE MARKET IN REST OF EUROPE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 209 MARKET IN REST OF EUROPE, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4 ASIA PACIFIC (APAC)

FIGURE 55 SNAPSHOT OF MARKET IN APAC

FIGURE 56 APAC: PRE- AND POST-COVID-19 SCENARIOS

TABLE 210 PRE- AND POST-COVID-19 SCENARIO: MARKET IN APAC, 2016–2025 (USD MILLION)

12.4.1 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 211 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 212 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 213 MARKET IN APAC, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 214 MARKET IN APAC, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4.2 CHINA

12.4.2.1 market in China will be driven by growing demand from energy & power and oil & gas sectors

TABLE 215 MARKET IN CHINA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 216 MARKET IN CHINA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Investment in renewable energy sources and power generation in Japan will increase demand for control valves

TABLE 217 MARKET IN JAPAN, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 218 MARKET IN JAPAN, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 Chemicals industry to witness high demand for control valves to ensure highest level of hygienic processing

TABLE 219 MARKET IN SOUTH KOREA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 220 MARKET IN SOUTH KOREA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4.5 INDIA

12.4.5.1 India would be fastest-growing country in control valve market in APAC

TABLE 221 MARKET IN INDIA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 222 MARKET IN INDIA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.4.6 REST OF APAC

TABLE 223 MARKET IN REST OF APAC, BY INDUSTRY, 2016–2019(USD MILLION)

TABLE 224 MARKET IN REST OF APAC, BY INDUSTRY, 2020–2025 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

FIGURE 57 ROW: PRE- AND POST-COVID-19 SCENARIOS

TABLE 225 PRE- AND POST-COVID-19 SCENARIO: MARKET IN ROW, 2016–2025 (USD MILLION)

12.5.1 IMPACT OF COVID-19: MNM VIEWPOINT

TABLE 226 CONTROL VALVE MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 227 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 228 MARKET IN ROW, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 229 MARKET IN ROW, BY INDUSTRY, 2020–2025 (USD MILLION)

12.5.2 MIDDLE EAST

12.5.2.1 Middle East to hold largest share of market in RoW during forecast period

TABLE 230 MARKET IN MIDDLE EAST, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 231 MARKET IN MIDDLE EAST, BY INDUSTRY, 2020–2025 (USD MILLION)

12.5.3 SOUTH AMERICA

12.5.3.1 Growing oil & gas industry will drive market growth in South American countries

TABLE 232 MARKET IN SOUTH AMERICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 233 MARKET IN SOUTH AMERICA, BY INDUSTRY, 2020–2025 (USD MILLION)

12.5.4 AFRICA

12.5.4.1 Investments in water & power industries drive the market in Africa

TABLE 234 MARKET IN AFRICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 235 MARKET IN AFRICA, BY INDUSTRY, 2020–2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 204)

13.1 OVERVIEW

13.2 COMPETITIVE SCENARIO

13.2.1 PRODUCT DEVELOPMENTS/LAUNCHES

TABLE 236 KEY PRODUCT DEVELOPMENTS/LAUNCHES (2017–2020)

13.2.2 PARTNERSHIPS, MERGERS & ACQUISITIONS, AND EXPANSIONS

TABLE 237 KEY PARTNERSHIPS, MERGERS & ACQUISITIONS, AND EXPANSIONS (2017–2020)

13.3 COMPETITIVE LEADERSHIP MAPPING

13.3.1 VISIONARY LEADERS

13.3.2 INNOVATORS

13.3.3 DYNAMIC DIFFERENTIATORS

13.3.4 EMERGING COMPANIES

FIGURE 58 CONTROL VALVE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

14 COMPANY PROFILES (Page No. - 209)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

14.2.1 CHRISTIAN BÜRKERT

14.2.2 EMERSON

FIGURE 59 EMERSON: COMPANY SNAPSHOT

14.2.3 FLOWSERVE CORPORATION

FIGURE 60 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

14.2.4 IMI PLC.

FIGURE 61 IMI PLC. CORPORATION: COMPANY SNAPSHOT

14.2.5 CURTISS-WRIGHT CORPORATION

FIGURE 62 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

14.2.6 TRILLIUM FLOW TECHNOLOGIES (WEIR FLOW CONTROL)

14.2.7 CAMERON – (SCHLUMBERGER COMPANY)

FIGURE 63 CAMERON (SCHLUMBERGER COMPANY): COMPANY SNAPSHOT

14.2.8 SPIRAX SARCO

FIGURE 64 SPIRAX SARCO: COMPANY SNAPSHOT

14.2.9 CRANE CO.

FIGURE 65 CRANE CO.: COMPANY SNAPSHOT

14.2.10 KITZ CORPORATION

FIGURE 66 KITZ CORPORATION: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14.3 OTHER IMPORTANT PLAYERS

14.3.1 SAMSON CONTROLS

14.3.2 NELES CORPORATION (METSO CORPORATION)

14.3.3 NEWAY VALVE CO.

14.3.4 ALFA LAVAL

14.3.5 VELAN INC.

14.3.6 AVK HOLDING A/S

14.3.7 AVCON CONTROLS

14.3.8 HAM–LET

14.3.9 DWYER INSTRUMENTS

14.3.10 APOLLO VALVES

14.3.11 SWAGELOK

15 APPENDIX (Page No. - 249)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

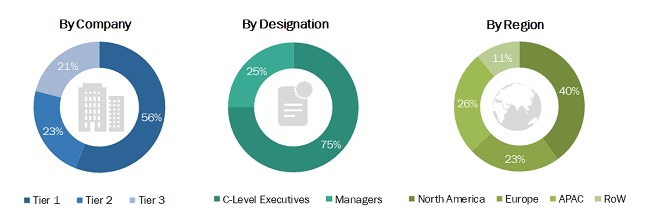

The study has involved four major activities in estimating the size of the control valve market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the control valve market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the control valve market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various control valves manufacturers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the control valve market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the control valve market, by material, component, type, size, industry, and geography, in terms of value

- To define and forecast the control valve market for various segments with regard to 4 main regions—North America, Asia Pacific (APAC), Europe, Rest of the World (RoW), in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the control valve market

- To study a complete control valve value chain and analyze current and future market trends

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall control valve market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the control valve market

- To strategically profile key players, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, mergers, collaborations, contracts, expansions, and partnerships in the control valve market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Control Valve Market

We would like to know market size, industry trends, and industry players information operating into 6" to 60" Control Flow Valves business used for liquids, cryogenics, gasses, and steam applications.

Dose this report contains shipments for different valve sizes, specially for liquid applications?

As I am focusing on solenoid valves, angle seat valves, media separated valves. I want to know weather it is part of the market mentioned in this report and what all details I would able to extract from your report.

I am interesting to get complete report of Control Valve Market, but I want more specific data on actuators and European countries.

I am interested for market sizing of solenoid valves, angle seat valves, media separated valves for North America region. Specifically US and Canada

Dose this report covers middle east countries market size in detail? We would like to understand oil & gas market of control valve for all middle east countries.

Do you provide excel version of the underlying data used in the report? We would like to understand methodology of the report and scope of control valves?

I would like to see a summary of the control valves report. We are into global market, we want to understand futuristic market and impact of IIOT on control valve business.

We intend to invest in production of control valves for oil & gas industries. Need to collect some information about control valve markets locally and internationally. What all you can provide us?

Could you please mention what is included in this category. We are more intrested into pressure relief valves, hydronic heating valves and respective global market size?

We would like to have a better understanding of the valves sold around the US and specifically in Texas. What information you can provide for the same.

dose this report includes shipments for rotary and linear control valves? We need to understand technological shift happening into this market.

I am really looking for Marketing research on the the usage of Rotary Valves in the NAFTA region, market size, competitors, products offerings. Is it covered in your report?

I am looking for information on global USD market volume of Butterfly Valves and tripple eccentric valves. Do you have any seprate report for the same.

Mostly interested in Actuators, Valve Body and Diaphragm Valves (Sanitary/Hygienic Valves) specifically US, Europe and Asia Pacific region. What granularity is covered into the report?

we are planning to enter into APAC market for control valve business, we want to understand APAC market trend, industry players strategies, and rules & regulation into this region. Dose report include all these?

I am working in industrial and control valves business, I need to understand the scope difference between industrial valve and control valve reports. I would like to see sample and research methodology behind both the reports.

I am more intrested in actuators used along with control valves. I would like to know market size of various actuators types by industries.

we are more keen to know European valve market particularly for Power and Steam Conditioning applications. In addition, looking for brief about valve business with deep dive on Control Valves.