Impact Analysis: China Food Safety Testing Market & Regulations

Market Segmentation

| Report Metrics | Details |

|

Market size available for years |

null - null |

|

CAGR % |

null |

Top 10 companies in Impact Analysis: China Food Safety Testing Market

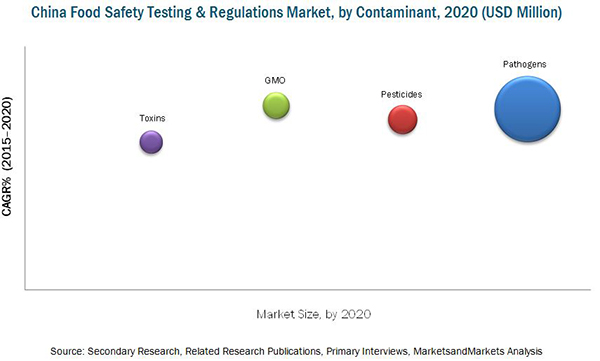

The food safety testing - China market is estimated to be valued at USD 493.3 Million in 2015 and is projected to grow at a CAGR of 9.9% from 2015 to 2020. The market has been segmented on the basis of contaminant, technology, and application. The pathogen food safety testing segment is expected to account for the largest share of the food safety testing - China market through the forecast period due to the increase in the number of outbreaks of diseases caused due to food contamination, and increasing emphasis to meet food safety compliance. These factors have led to the adoption of pathogen testing for various food types such as meat & poultry, dairy, processed foods, fruits & vegetables, and cereals & grains. In addition, the food safety testing – China market is expected to grow due to increasing food safety concerns, the intensity of food safety scandals & frauds, and the increasing level of ill-effects on consumer health and safety. Other factors driving the market growth includes globalization of food trade and the increasing trade between China and the rest of the world. The base year considered for this report is 2014 and the forecast period is from 2015 to 2020.

This research study involves the extensive usage of secondary sources to identify and collect information useful for this technical, market-oriented, and commercial study of the food safety testing – China market.

To know about the assumptions considered for the study, download the pdf brochure

The report is targeted towards existing players in the industry which include:

- Food & beverage manufacturers

- Food safety testing service providers

- Food safety testing equipment & kit providers

- Research institutions/organizations

- Technology standard organizations, forums, alliances, and associations

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

This report categorizes the food safety testing – China market on the basis of contaminant, food type, and technology.

On the basis of Contaminant, the market is segmented as follows:

- Pathogens

- Pesticides

- Genetically Modified Organisms (GMOs)

- Toxins

- Others (heavy metals, food allergens, and other chemical residues)

On the basis of Food Type, the market is segmented as follows:

- Meat & poultry

- Dairy

- Processed food

- Fruits & vegetables

- Cereals & grains

On the basis of Technology, the market is segmented as follows:

- Traditional

-

Rapid

- Convenience-based

- PCR

- Immunoassay

- Other molecular-based tests (HPCL, GC, LC-MS/MS)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Food Scandal Case Analysis

- Deep dive analysis of different food scandals and their impact on China’s food industry & safety testing market

Company Information

- Detailed analysis and profiling of market players in China (up to five)

Customer Interested in this report also can view

European Food Safety Testing Market By Contaminant (Pathogen, GMO, Toxin, Pesticide), Technology (Traditional & Rapid), Food Type (Meat & Poultry Product, Dairy Product, Fruit & Vegetable, Processed Food) & Country - Trends & Forecast To 2018

Food Safety Testing Market by Contaminant (Pathogen, GMO, Toxin, Pesticide), Technology (Traditional & Rapid), Food Type (Meat & Poultry, Dairy, Fruit & Vegetable, Convenience Food) & Region - Global Trends & Forecast to 2020

North American Food Safety Market by Contaminant (Pathogen, GMO, Toxin, Pesticides), Technology (Traditional & Rapid), Food Tested (Meat & Poultry, Dairy, Fruit & Vegetable, Processed Food), & by Country - Trend & Forecast to 2020

The food safety testing market is projected to grow at a CAGR of 9.9% from 2015, to reach USD 791.5 Million by 2020. The market growth is driven by changing consumers’ attitude and concerns of retailers for safe and quality food, positive structural changes in the Chinese food safety regulations, high occurrence of food safety incidents in China, and globalization of food trade and China’s rising food exports.

On the basis of application, the food safety testing market is led by the processed food segment, followed by the meat & poultry segment. The contamination of food products is often observed during several stages in the food supply chain, mainly during the processing, packaging, and storing stages. China Food and Drug Administration (CFDA) have enforced food safety regulations to control the concerns related to the safety of food products, which has driven the food safety testing market in China.

Among the types of food safety testing, testing for pathogens accounted for the largest market share in 2014, owing to their high occurrence in a diverse range of food products, which led to cross contamination incidences leading to a large number of product recalls. The market for GMO testing is projected to grow at the highest CAGR in China in the next five years.

The lack of awareness about food safety regulations, food safety practices perceived as additional costs by food manufacturers, and non-compliance to food safety standards are the factors restraining the growth of food safety testing market in China. Food safety testing is regulated by the China Food and Drug Administration (CFDA). Stringent regulations imposed by the regulatory bodies in order to curb the food adulteration, frauds, and scandals have caused closure of substantial number of food manufacturing and processing plants in China, which mainly includes infant formula and dairy manufacturers.

Key market players such as Silliker (U.S.), Neogen (U.S.), Intertek Group Plc (U.K.), Chemical Inspection and Regulation Service (CIRS), and other state owned and private players are focusing on joint ventures and expansions through business establishments in key market regions. Mergers & acquisitions are also a part of strategic moves adopted by key players to gain a significant share and increase their foothold in the Chinese food safety testing market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Currency Considered

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 23)

4.1 Overview: Food Safety Testing Market in China

4.2 Food Safety Testing Market in China, By Contaminant, 2015 vs 2020

4.3 Food Safety Testing Market in China, By Technology, 2015–2020

4.4 Food Safety Testing Market in China, By Food Tested, 2015–2020

5 Market Overview (Page No. - 26)

5.1 Global Food Safety Testing Market

5.1.1 By Top Countries

5.1.2 By Contaminants

5.1.3 By Food Type

5.1.4 By Technology

5.2 Food Safety Testing Market in Asia-Pacific

5.2.1 By Country

5.2.2 By Contaminants

5.3 Food Safety Testing Market in China

5.3.1 By Contaminants

5.3.2 By Technology

5.3.3 By Food Type

6 Need for Food Safety Regulations in China (Page No. - 31)

6.1 Introduction

6.2 Factors Affecting Food Safety in China

6.2.1 Food Manufacturing Practices

6.2.2 Consumer Awareness

6.2.3 Complexities in Food Supply Chain

6.2.3.1 Agricultural Production

6.2.3.2 Transportation & Storage

6.2.3.3 Food Manufacturing & Processing

6.2.3.4 Trade & Retailing

6.2.3.4.1 Trade

6.2.3.4.2 Retailing

6.2.3.5 End Consumption

6.3 Case Studies

6.3.1 The Case Of: Tainted Milk & Baby Formula

7 Regulatory Framework (Page No. - 43)

7.1 List of Regulatory Associations for Food Safety in China

7.2 Regulations for Food Safety Testing in China

7.2.1 Old Laws vs Revised Laws

7.2.1.1 Food Safety Standard

7.2.1.2 Food Production and Trade(Labeling Laws)

7.2.1.3 Food Inspection and Testing

7.2.1.4 Food Import and Export

7.2.1.5 Prevention of and Response to Food Safety Incidents

7.2.1.6 Supervision and Administration

7.2.1.7 Special Areas for Amendments

7.2.1.7.1 Health Foods

7.2.2 Approval and Licensing Process

7.2.2.1 Health Foods

8 Opportunity Analysis (Page No. - 61)

8.1 Economic Indicators

8.1.1 China’s Food Industry

8.1.2 China’s Upsurge in Food Trade

8.1.3 Changing Consumer Diets Influence Food Demand

8.1.4 Other Macroeconomic Factors

8.2 Market Analysis

8.2.1 Drivers

8.2.1.1 Positive Structural Changes in Chinese Food Safety Regulations

8.2.1.2 High Occurrence of Food Contamination Incidents in China

8.2.1.3 Globalization of Food Trade and China’s Rising Food Exports

8.2.2 Restraints

8.2.2.1 Lack of Knowledge & Awareness About Food Safety Regulations Among Food Manufacturers

8.2.3 Opportunities

8.2.3.1 New Food Safety Regulations

8.2.3.2 Growing Level of Consumer Awareness About Food Safety

8.2.4 Market Challenges

8.2.4.1 Inefficiencies in Food Supply Chain

8.2.4.2 Consumer Perception Towards Safety of Food in China

8.3 Customer Analysis

8.3.1 Food Manufacturers & Processors

8.4 Opportunity Analysis in China’s Food Industry

8.4.1 Meat

8.4.2 Dairy

8.4.3 Fruits & Vegetables

8.4.4 Cereals & Grains

8.5 Market Development Analysis

9 Impact Analysis (Page No. - 78)

9.1 Introduction

9.2 Establishment of Food Safety Laws

9.2.1 Health Food Filing

9.2.2 Imported Food Management System

9.2.3 New Food Material Safety Assessment for Imported Foods

9.2.4 Domestic Infant Formula Manufacturer Credit Rating System

9.2.5 Food Recall System

9.3 Food Poisoning Cases

9.4 China’s Food Safety Testing Market

9.5 Market Players

List of Tables (16 Tables)

Table 1 Global Food Safety Testing Market Size, By Top Countries, 2013–2020 (USD Million)

Table 2 Global Food Safety Testing Market Size, By Contaminants, 2013–2020 (USD Million)

Table 3 Global Food Safety Testing Market Size, By Food Type, 2013–2020 (USD Million)

Table 4 Global Food Safety Testing Market Size, By Technology, 2013–2020 (USD Million)

Table 5 Asia-Pacific Food Safety Testing Market Size, By Country, 2013–2020 (USD Million)

Table 6 Asia-Pacific Food Safety Testing Market Size, By Contaminants, 2013–2020 (USD Million)

Table 7 China Food Safety Testing Market Size, By Contaminants, 2013–2020 (USD Million)

Table 8 China Food Safety Testing Market Size, By Technology, 2013–2020 (USD Million)

Table 9 China Food Safety Testing Market Size, By Food Type, 2013–2020 (USD Million)

Table 10 WH Group Limited: List of Food Contamination Instances in China

Table 11 Key Development Strategies Adopted By Food Safety Testing Companies in China, 2012–2015

Table 12 Regulatory Impact of New Laws on Health Food

Table 13 Regulatory Impact of New Laws on Food Imports to China

Table 14 Regulatory Impact of New Laws on New Food Materials in Imported Products

Table 15 Regulatory Impact of New Laws on Domestic Infant Formula Industry

Table 16 Regulatory Impact of New Laws on Food Recalls

List of Figures (51 Figures)

Figure 1 Food Safety Testing Market in China: Market Segmentation

Figure 2 Research Design: Food Safety Testing Market in China

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Chinese: Food Safety Testing Market Snapshot, By Contaminant (2015 vs 2020)

Figure 7 Stringent Regulations, High Occurrence of Severe Food Saefty Incidents and Increasing Food Trade to Drive China’s Food Safety Testing Market

Figure 8 Pathogen Testing Poised to Maintain Dominant Market Share Till 2020

Figure 9 Quick Results and Increasing Level of Technology Adoption to Boost Market Growth of Rapid Technology

Figure 10 Processed Foods and Meat & Poultry Together Account for Majority of Safety Testing in 2015

Figure 11 Key Pointers: Food Safety Concerns in China

Figure 12 China: Food Poisoning Cases, 2000–2013

Figure 13 Primary Causes of Food Safety Incidents in China, 2001–2014

Figure 14 China: Food Safety Incidents Breakdown, By Human Factor, 2001–2014

Figure 15 Stages in Food Supply Chain With High Susceptibility to Contamination

Figure 16 Number of Food Manufacturers & Processing Companies in China, 2009–2013

Figure 17 China’s Food Trade, USD Billion, 2001–2013

Figure 18 China’s Food Import Supply Chain

Figure 19 Unqualified Food Imports to China, 2010–2014

Figure 20 Unqualified Food Imports to China, January 2015–June 2015

Figure 21 Stringent Food Safety Regulations Led to Decline in Infant Formula Manufacturers

Figure 22 Decreasing Number of Dairy Manufacturers Due to Regulatory Coimpliances, 2008- 2014

Figure 23 Food Recalls By Major International Food Companies in China

Figure 24 Acceptance and Approval Process for Health Foods in China

Figure 25 Impact of Economic Indicators on China’s Food Safety Testing Market

Figure 26 China’s Food Industry Scenario, 2006–2014

Figure 27 China’s Growth in Food Trade, 2008–2013 (USD Million)

Figure 28 Shifting Consumer Preference From Rice Diet to Meat Diet

Figure 29 China’s Population, 2000–2030 (Billion)

Figure 30 China’s Population (%) Shift From Rural to Urban

Figure 31 China’s GDP, 2000–2014 (USD Trillion)

Figure 32 Market Dynamics: Food Safety Testing Market in China

Figure 33 New Food Safety Laws to Address Drawbacks of Previous Food Safety Laws

Figure 34 China Meat Market, By Volume, 2008–2013 (Million Metric Tons)

Figure 35 China’s Meat Consumption, By Livestock, 2013 vs 2020 (MMT)

Figure 36 China’s Food Safety Testing Market for Meat & Poultry, 2012–2020 (USD Million)

Figure 37 China Dairy Market, By Volume, 2003–2011 (Million Metric Tons)

Figure 38 China’s Dairy Market, By Product Category, 2014 (USD Million)

Figure 39 China’s Food Safety Testing Market for Dairy & Dairy Products, 2012–2020 (USD Million)

Figure 40 China: Fruits & Vegetables Market, By Volume, 2003-2011 (Million Metric Tons)

Figure 41 China: Food Safety Testing Market for Fruits & Vegetables, 2012–2020 (USD Million)

Figure 42 China: Cereals & Grains Market, By Volume, 2003–2011 (Million Metric Tons)

Figure 43 China: Food Safety Testing for Cereals & Grains, 2012–2020 (Million Metric Tons)

Figure 44 Authorized Testing Laboratories in China, 2012–2020

Figure 45 Market Share Analysis: Food Safety Testing Market in China, 2012

Figure 46 Impact Analysis: Food Safety Regulations in China

Figure 47 Effect of Food Safety Laws on China’s Food Industry, 2008–2018

Figure 48 Differential Effect of Food Safety Regulations

Figure 49 Impact of Food Safety Regulations on Food Poisoning Cases in China, 2007–2013

Figure 50 Safety Laws to Boost Food Safety Testing Market in China, 2013–2020

Figure 51 Impact on Market Share of Food Safety Testing Companies in China

Growth opportunities and latent adjacency in Impact Analysis: China Food Safety Testing Market