High Voltage Cables and Accessories Market by Product Type (Cables (XLPE, EPR, HEPR, MI), Accessories (Joints, Termination, Fittings & Fixtures), Conductor Type (Aluminum, Copper), Installation, Voltage, End User & Region - Global Forecast to 2028

High Voltage Cables and Accessories Market Size, Share, Growth Report & Forecast

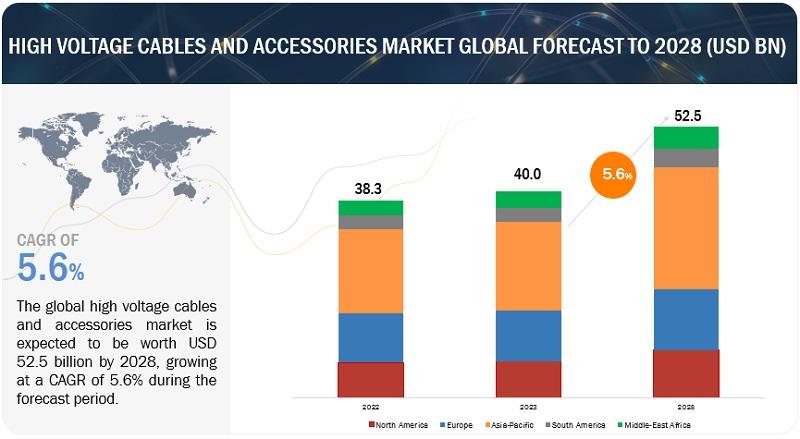

[248 Pages Report] The global high voltage cables and accessories market is estimated to grow from USD 40.0 billion in 2023 to USD 52.5 billion by 2028; it is expected to record a CAGR of 5.6% during the forecast period.

Power utilities is one of the major end user of high voltage cables and accessories. Power utilities utilize high voltage cables to transmit electricity over long distances while minimizing power losses during transmission. This is anticipated to enhance the high voltage cables and accessories market size.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

High Voltage Cables and Accessories Market Growth Dynamics

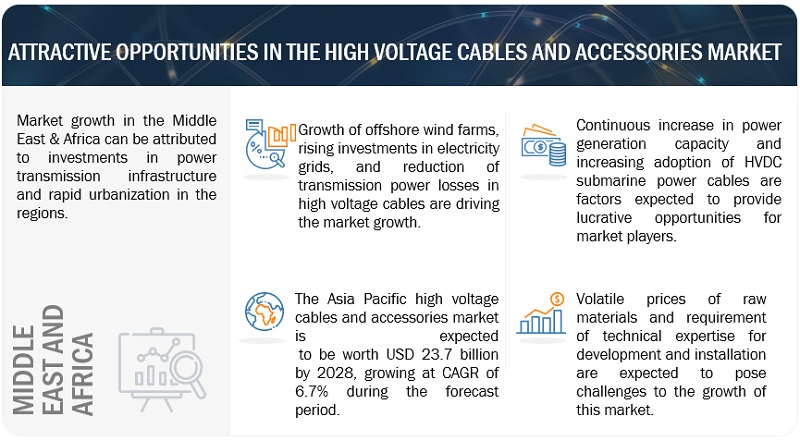

Driver: Rising Investments in Electricity Grids

Investments in electricity grids have been on the rise in recent years as governments and energy companies recognize the need to modernize and upgrade their infrastructure to meet the increasing demand for electricity and support the transition to cleaner energy sources. High voltage cables play a crucial role in the expansion and enhancement of electricity grids. These cables are responsible for transmitting electricity at high voltages over long distances, connecting power generation sources, substations, and distribution networks. They also facilitate the interconnection of regional and national power grids, enabling the exchange of electricity across borders. Interconnections enhance grid stability, support energy trading, and contribute to a more reliable and resilient electricity supply. Moreover, governments are providing fiscal support to bolster spending on electricity networks as part of their response to the economic crisis triggered by the pandemic. This additional support is further contributing to the increased investment in electricity grids.

Restraint: High Cost of Installation and Repair of Underground and Submarine Cables

The installation and repair of underground and submarine cables can be quite costly, posing financial challenges for power transmission projects. This is primarily due to the complex nature of the installation process, the specialized equipment required, and the need for skilled personnel. The installation of underground cables involves excavation, trenching, and cable laying, requiring significant manpower and machinery. Special care must be taken to ensure the cables are properly protected and insulated, which adds to the overall cost. Submarine cable installation is an even more intricate and expensive process. It involves specialized vessels and equipment capable of laying cables on the seabed, often in challenging marine conditions. The cables need to be carefully routed and secured, considering factors such as water depth, seabed conditions, and potential hazards like shipping routes or marine wildlife habitats. The high costs associated with underground and submarine cable installations and repairs are primarily driven by the need for advanced technology, specialized materials, and skilled labor. These factors contribute to the overall project budget and can pose financial constraints for power transmission initiatives, especially for long-distance or large-scale projects.

Opportunities: Increasing Adoption of HVDC Submarine Power Cables

The utilization of HVDC (High Voltage Direct Current) submarine power cables is witnessing a notable surge due to their multitude of advantages in transmitting electricity over long distances across bodies of water. HVDC submarine cables offer a dependable and efficient solution for large-scale power transmission, presenting several benefits when compared to traditional HVAC (High Voltage Alternating Current) cables. HVDC systems exhibit lower electrical losses compared to HVAC systems, resulting in improved energy efficiency. By employing HVDC technology, transmission losses are reduced, leading to enhanced efficiency and cost savings. HVDC submarine power cables also boast an augmented power transmission capacity. They have the capability to handle higher power loads compared to HVAC cables, making them well-suited for efficiently transmitting large quantities of electricity over significant distances. Furthermore, HVDC submarine cables contribute to improved grid stability and control. In addition to their technical benefits, HVDC submarine power cables also exhibit a reduced environmental impact compared to HVAC cables. HVDC submarine cables have a smaller physical footprint as they are laid on the seabed. This reduces conflicts related to land use and preserves sensitive ecosystems.

Challenges: Requirement of Technical Expertise for Development and installation

The development of efficient transmission and distribution (T&D) infrastructure is crucial to address energy security concerns and the need to expand power generation capacity in developing nations. The specific types of cables and accessories used in the high voltage cables and accessories market present unique challenges for utilities, wire and cable manufacturers, and material suppliers. The cable industry demands continuous technical innovations to improve system performance, optimize costs, and enhance power delivery. Considering all these factors, the power cable sector aims to ensure long-lasting performance of high voltage cables. This places pressure on supply chain participants to meet the high-quality requirements of high voltage cables and accessories for power and utility applications. Therefore, suppliers must allocate more resources to in-house research and development (R&D) in order to meet customer demands. This presents a challenge for suppliers operating in the high voltage cables and accessories market.

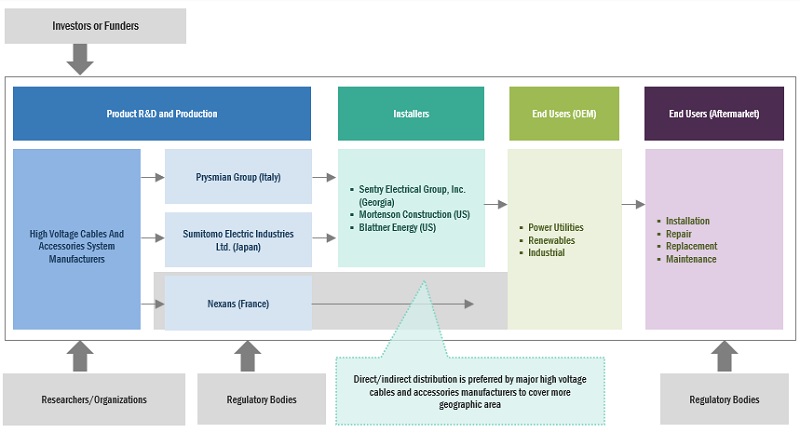

High Voltage Cables And Accessories Market Ecosystem

Leading companies in this market include well-established, financially secure producers of high voltage cables and accessories. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Major companies in this market include Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (South Korea), and NKT A/S (Denmark).

The 400 kV and above segment, is expected to be the fastest market by voltage during the forecast period.

By voltage, the high voltage cables and accessories market is divided into 72.5 kV, 123 kV, 145 kV, 170 kV, 245 kV, 400 kV and above. Bag filter is the fastest segment in the high voltage cables and accessories market. The adoption of 400kV and higher voltage cables is on the rise due to their ability to cater to the demands of major transmission projects and large-scale power generation initiatives. Additionally, the use of these high voltage cables proves cost-effective and allows for future scalability, accommodating expansions and upgrades in power infrastructure.

By industrial end user, the oil & gas segment is expected to be the largest segment during the forecast period

This report segments the high voltage cables and accessories market based on industrial end user into four segments: oil & gas, petrochemicals and chemicals, metals and mining, and others. The oil & gas segment is expected to be the largest segment during the forecast period. The adoption of high voltage cables has witnessed a significant increase in the oil and gas due to the industry's growing power demand requires efficient and reliable transmission of electricity over long distances. Subsea operations have increased the demand for high voltage cables that can withstand harsh underwater environments.

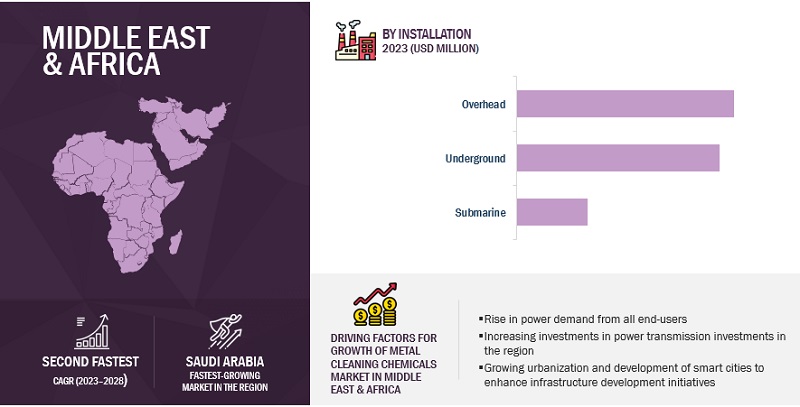

“Middle East & Africa”: The second-fastest in the high voltage cables and accessories market”

Middle East & Africa is expected to be the second-fastest high voltage cables and accessories market during the forecast period. As nations in this region are undergoing massive urbanization, there is a greater demand for reliable power transmission, which is enhancing the investment in development of high voltage transmission grids, further driving the high voltage cables and accessories market in Middle East & Africa.

Key Market Players

The high voltage cables and accessories market is dominated by a few major players that have a wide regional presence. The major players in the high voltage cables and accessories market are Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (South Korea), and NKT A/S (Denmark). Between 2019 and 2023, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the high voltage cables and accessories market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

High voltage cables and accessories market by product type, voltage, conductor type, installation, and end user |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and Middle East & Africa. |

|

Companies covered |

Prysmian Group (Italy), Sumitomo Electric Industries Ltd. (Japan), Nexans (France), LS Cable & System Ltd. (Korea), NKT A/S (Denmark), Furukawa Electric (Japan), Taihan Cable & Solution Co., Ltd. (South Korea), ZTT (China), Elsewedy Electric Company (Egypt), Wuxi Jiangnan Cable (China), Riyadh Cables (Saudi Arabia), PFISTERER Holding AG (Germany), DUCAB (UAE), TE Connectivity (Switzerland), Brugg Kabel AG (Switzerland), KEI Industries Ltd. (India), Tratos (Italy), Southwire Company, LLC (US), Tele-Fonika Kable SA (Poland), and Synergy Cables (US). |

This research report categorizes the high voltage cables and accessories market by component, power source, application, and region.

On the basis of by product type:

-

Cables

- XLPE Cables (Cross-linked Polyethylene)

- EPR Cables (Ethylene-Propylene Rubber)

- HEPR Cables (High Modulus Ethylene-Propylene)

- MI Cables (Mass Impregnated)

-

Accessories

- Cable Joints

- Cable Terminations

- Fittings & Fixtures

- Others

On the basis of voltage:

- 72.5 kV

- 123 kV

- 145 kV

- 170 kV

- 245 kV

- 400 kV and above

On the basis of installation:

- Overhead

- Underground

- Submarine

On the basis of conductor type:

- Copper

- Aluminum

On the basis of end user:

- Power Utilities

- Renewables

-

Industrial

- Oil & Gas

- Chemicals & Petrochemicals

- Metals & Mining

- Others

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In May 2023, Prysmian Group made an announcement regarding the successful acquisition of a contract valued at over USD 864.9 million. This contract pertains to the development of a new power interconnection project between France and Spain, which will be executed for INELFE. INELFE is a joint venture equally owned by Red Electrica, the Spanish grid operator, and Réseau de Transport d’Électricité (RTE), the French grid operator.

- In April 2023, Nexans finalized the purchase of Reka Kaapeli Oy, for a total of USD 57.29 million. The integration of Reka Cables into Nexans' Distribution & Usage business group was included in the acquisition. Being a part of Nexans presents Reka Cables with the chance to enhance its growth and development, while also enabling increased investments in renewable energy solutions.

- In April 2023, Sumitomo Electric Industries, Ltd. revealed its plans to construct a fresh Power Cable facility in the Scottish Highlands, UK. This initiative aims to make a substantial impact on fostering local supply chains and advancing technologies in the UK within the renewable energy sector.

- In March 2023, Prysmian Group made an announcement regarding the acquisition of contracts from the Dutch transmission system operator TenneT. These contracts, with a total value of around USD 1.94 billion, are for two grid connection projects that aim to connect two upcoming offshore wind farms situated in the Dutch North Sea to the province of Zeeland in the Netherlands. The scope of the project includes various tasks such as design, engineering, manufacturing, installation, testing, and commissioning of two 525 kV HVDC submarine and land cable systems, along with all associated accessories.

Frequently Asked Questions (FAQ):

What is the current size of the high voltage cables and accessories market?

The current market size of the high voltage cables and accessories market is USD 40.0 billion in 2023.

Rising investments in electricity grids and renewable energy adoption are the major driving factors for the high voltage cables and accessories market.

Rising investments in electricity grids and renewable energy adoption are the major driving factors for the high voltage cables and accessories market.

Which is the largest region during the forecasted period in the high voltage cables and accessories market?

Asia Pacific is expected to dominate the high voltage cables and accessories market between 2023–2028, followed by Europe and North America. Rising energy demand with increased power transmission infrastructure investments are driving the market for this region.

Which is the largest segment, by conductor type during the forecasted period in the high voltage cables and accessories market?

The copper segment is expected to be the largest market during the forecast period owing to their superior electrical conductivity, that allows for efficient and low-resistance transmission of electricity.

Which is the fastest segment, by the voltage during the forecasted period in the high voltage cables and accessories market?

The 400 kV and above segment is expected to be the fastest growing market during the forecast period due to the convenience of future scalability and cost-effectiveness of the voltage range.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

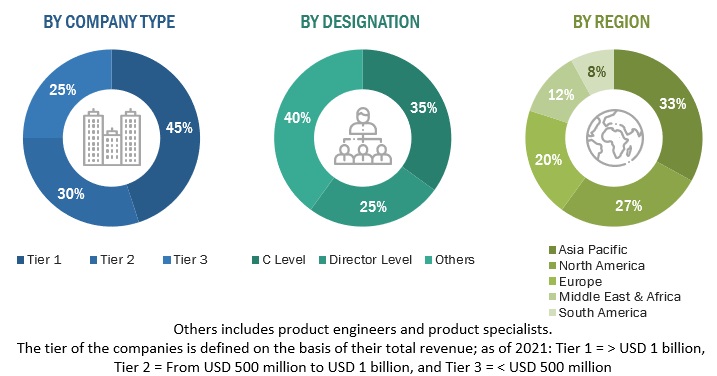

The study involved major activities in estimating the current size of the high voltage cables and accessories market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the high voltage cables and accessories market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the high voltage cables and accessories market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The high voltage cables and accessories market comprises several stakeholders such as high voltage cables and accessories manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for high voltage cables and accessories in power utilities, renewable and industrial end-user. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

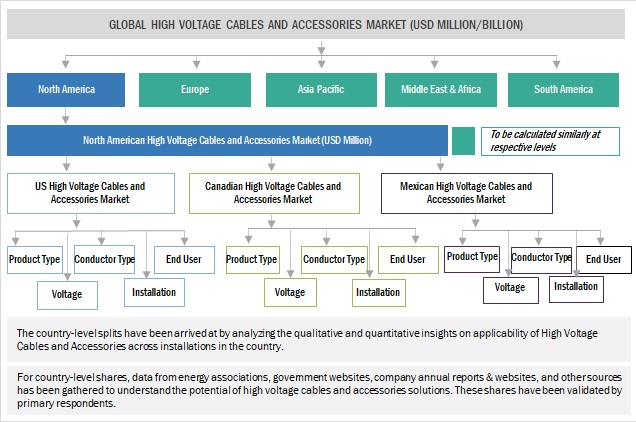

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the high voltage cables and accessories market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

High Voltage Cables and Accessories Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

High voltage cables and accessories are electrical components designed for transmitting electricity at high voltages. These components are used in various applications that require efficient and reliable power delivery over long distances. High voltage cables are specially constructed with multiple layers of insulation and shielding to handle increased electrical stress and insulation requirements. They have copper or aluminum conductors at their core, while insulation layers provide electrical insulation and protection against environmental factors. Accessories such as cable joints, terminations, insulators, surge arresters, and cable markers enhance performance and ensure safe operation of high voltage cable systems.

The growth of the high voltage cables and accessories market can be attributed to the transmission and distribution investments across major countries in North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Key Stakeholders

- Associations, forums, and alliances related to high voltage cables and accessories.

- High voltage cables and accessories manufacturing companies.

- Consulting companies in the energy sector

- Government and research organizations

- Power utilities

- State and national regulatory authorities

- Energy Management Companies

- Investment banks

- Original Equipment Manufacturers (OEMs)

Objectives of the Study

- To define, describe, and forecast the high voltage cables and accessories market based on product type, voltage, conductor type, installation, end user, and region, in terms of value and volume.

- To describe and forecast the high voltage cables and accessories market for various segments with respect to five main regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the high voltage cables and accessories value chain, along with industry trends, use cases, security standards, and Porter’s five forces analysis

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments in the high voltage cables and accessories market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape of the market.

- To analyze growth strategies adopted by market players such as partnerships, mergers and acquisitions, agreements, and product launches in the high voltage cables and accessories market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in High Voltage Cables and Accessories Market