Seed Coating Market Size, Share, Industry Growth, Trends Report and Forecast by Form, Additives (Polymers, Colorants, Minerals/Pumice, Active ingredients, Binders), Process (Film coating, Encrusting, Pelleting), Crops (Cereals & grains, Oilseed & pulses, Vegetables) and Region - Global Forecast to 2028

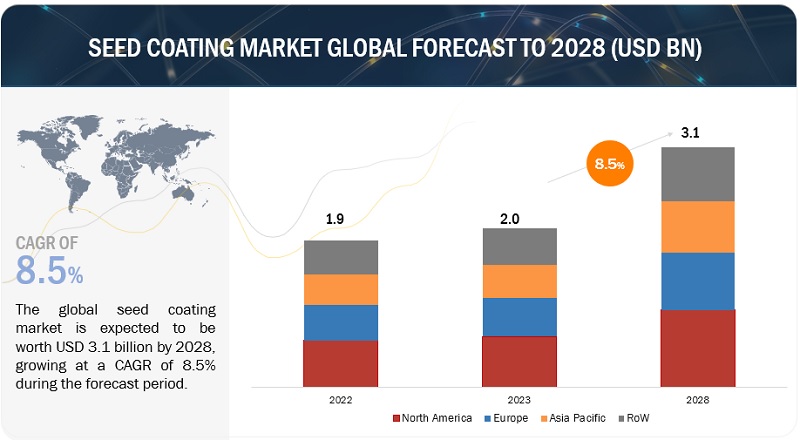

[288 Pages Report] The global seed coating market size is on a trajectory of significant expansion, with an estimated value projected to reach USD 3.1 billion by 2028 from the 2023 valuation of USD 2.0 billion, displaying a promising Compound Annual Growth Rate (CAGR) of 8.5%. This growth surge is primarily attributed to the consistent introduction of innovative seed coating technologies and formulations, aimed at elevating seed quality, enhancing crop performance, and placing a strong emphasis on sustainability within the agricultural sector.

Key technological advancements, notably precision coating technologies, controlled release coatings, bio-polymer-based coatings, and nanocoatings, are driving the market's progression. Precision coating technologies, in particular, enable the precise and uniform application of active ingredients, ensuring seeds receive optimal treatment doses while minimizing adverse environmental impact. They play a pivotal role in efficiently applying fungicides, insecticides, and nutrients to boost efficacy while reducing environmental consequences.In tandem with technological advancements, the development of innovative formulations integrating diverse active ingredients to create synergistic effects is gaining traction. These tailored formulations designed to combat specific pests or diseases cater to the varied needs of the agricultural community, indicating a trend towards more specialized solutions.

The evolving market dynamics are reshaping supply chain mechanisms, necessitating efficient raw material sourcing and processing to meet the burgeoning demand for seed coatings. This surge in demand is driving the development of eco-friendly, biodegradable, and sustainable raw materials, aligning with global sustainability objectives. Global market trends are significantly influenced by varied preferences in seed coating technologies across different regions, impacting international trade dynamics. Regulatory frameworks, trade agreements, and evolving agricultural practices play a vital role in shaping seed coating market trends. Notably, the industry is increasingly focused on aligning these innovations with global sustainability initiatives, aiming to reduce the environmental footprint while concurrently enhancing agricultural productivity. The evolution of the seed coating market growth is propelled by technological advancements and innovative formulations, steering both growth and sustainability. The market's trajectory is heavily influenced by these advancements, underlining the pivotal role of sustainability, tailored formulations, global trade dynamics, and raw material innovation in shaping the future of agriculture.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Global Seed Coating Market Trends & Dynamics

Drivers: Amplifying Agricultural Productivity with Seed Coating on Marginal Lands

Seed coating stands as a pivotal support system for agricultural productivity, especially on marginal lands unsuitable for conventional agriculture due to poor soil quality, salinity, drought, or pest challenges. These coatings play a transformative role by offering seeds the necessary protection and nutrients to germinate and thrive in harsh conditions. Notably, the decreasing availability of land for agriculture due to mounting industrialization and urbanization necessitates innovative solutions such as seed coatings to optimize cultivation areas and enhance yields, directly impacting farmers' income. A significant stride in this domain was the 2019 Massachusetts Institute of Technology (MIT) study, revealing the efficacy of seed coatings featuring silk and nitrogen-fixing bacteria to bolster crop yields in saline soils.

The silk coating acts as a shield, safeguarding seeds from detrimental salt ions, while the nitrogen-fixing bacteria serve as a natural source of nitrogen fertilizer for plants. The study's findings were remarkable, demonstrating that coated seeds exhibited higher germination rates and better overall plant health in highly saline soils compared to their uncoated counterparts. Notably, 88% of coated seeds sprouted in non-salty soil in contrast to 62% of uncoated seeds. In saline soil conditions, 71% of coated seeds sprouted as opposed to 45% of non-coated seeds. Moreover, within a mere two weeks, the coated seeds showcased remarkable growth, boasting longer stems and roots with increased branching, signifying a promising pathway towards sustainable agricultural productivity on challenging marginal lands. which is driving the global seed coating market growth.

These insightful advancements underscore the potential of seed coating technologies to revolutionize agricultural practices, offering a lifeline to farmers struggling with less arable land. The ability of seed coatings to mitigate challenges on marginal lands and significantly enhance crop growth and yield not only marks a pivotal stride in agriculture but also holds the promise of bolstering global food security in the face of shrinking arable areas due to urbanization and industrial expansion.

Restraints: Climate uncertainty poses a significant challenge for the seed coating industry.

The volatility in climate conditions presents a substantial business challenge for the seed coating industry. With erratic weather patterns and shortened growing seasons due to climate change, the industry faces an obstacle in maintaining the consistent performance of seed coatings. This inconsistency directly impacts the efficacy of seed treatments in ensuring optimal germination and robust seedling growth, influencing the market's reliability. The escalating greenhouse gas emissions affecting global temperatures directly disrupt crop cultivation, significantly impacting pollinator activity crucial for seed coating effectiveness, especially in vital crops like rapeseed. This disruption not only affects agricultural productivity but also introduces instability in the market, compelling businesses to adapt and innovate seed coating technologies to remain resilient in the face of unpredictable climate scenarios.

Addressing this challenge requires continuous innovation and adaptation within the seed coating market sector to ensure product reliability and efficacy. Businesses in this industry need to invest in climate-resilient solutions and cutting-edge technologies to mitigate the impact of climate uncertainty on seed coating performance, thereby ensuring consistent agricultural productivity and market stability.

Opportunities: Advancement in Biodegradable Seed Coatings: A Sustainability Catalyst in Agriculture

Biodegradable seed coatings offer a promising resolution to mitigate environmental pollution stemming from traditional non-biodegradable seed coatings. Unlike synthetic polymer-based coatings, which endure for extensive periods, these eco-friendly alternatives, crafted from natural elements like starch, cellulose, or chitosan, can naturally decompose via soil microorganisms. Several entities, including Covestro with its innovative Amulix line, are at the forefront of developing such coatings, made from starch-based waste materials and boasting complete biodegradability. These coatings have demonstrated remarkable enhancements in seed germination and seedling vigor across various crops. The advent of biodegradable seed coatings marks a significant stride toward sustainable agriculture, countering microplastic pollution while fostering soil health, thereby championing environmental protection and sustainable food production.

Challenges: Unorganized new entrants with a low profit-to-cost ratio

The entry of undercapitalized newcomers in the seed coating industry poses a substantial challenge for established players. These entrants, operating with lower overhead costs and less investment in research and development, offer services at reduced prices, pressuring established firms to lower their prices, and impacting profit margins. Increased accessibility to seed coating technology information and the growing demand for these services are driving factors behind the emergence of new competitors. This trend prompts established players to reevaluate pricing strategies while emphasizing quality and innovation to maintain their market position in the face of heightened competition.

Global Seed Coating Market Ecosystem

Film coating is one of the seed coating processes that accounted for the highest market share in 2022 in global seed coating market

The film coating process has emerged as a prominent seed coating technique, capturing a significant market share in 2022. This technique is favored by growers due to its ease of application and cost-effectiveness. Widely embraced for its ability to minimize seed bridging in planters, film coating stands out for its time-efficient application and user-friendly technology, involving the application of polymer on seeds. It finds extensive usage in various crops, notably cereal crops, oilseeds, and pulses on a global scale.

Moreover, the surging demand for film coating is primarily propelled by the continuous development of advanced materials used in this process. The innovation in film-coating materials focuses on enhancing biodegradability and expanding the spectrum of active ingredients deliverable to seeds. This drive towards creating more biodegradable materials aligns with the industry's sustainable goals and presents opportunities for wider applications in diverse agricultural settings.

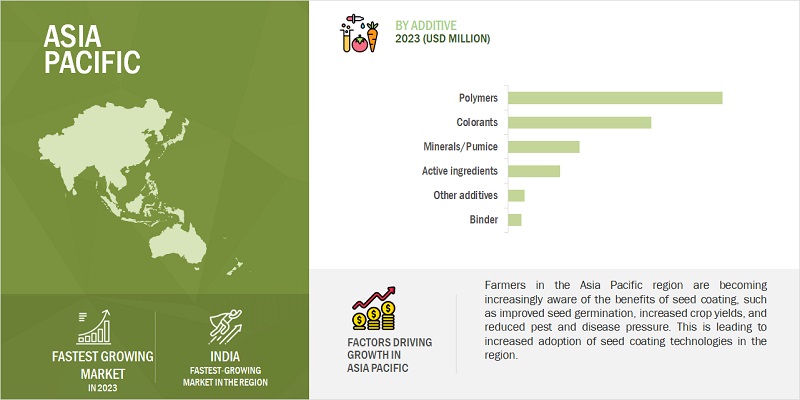

China Is One Of The Largest Growing Region For Seed Coating Market Growth In Asia Pacific

China stands as the dominant force in seed coating within the Asia Pacific region, propelled by an increasing adoption of this technology among its farmers. This trend is attributed to Chinese farmers increasingly embracing seed coating technology to elevate crop quality, boost yields, and diminish reliance on pesticides. This innovative technique acts as a shield, safeguarding seeds against pests, diseases, and weeds while amplifying germination rates and seedling robustness.

Crucially, the Chinese government is actively championing seed coating technology to enhance agricultural productivity and curtail pesticide usage. In a strategic move, the Ministry of Agriculture and Rural Affairs (MARA) unveiled a policy document in 2021, outlining robust support for the seed coating industry. This encompassed substantial plans to escalate investment in research and development, expand subsidies for seed coating products, and encourage widespread adoption of this technology among farmers, signifying a pivotal governmental endorsement of this transformative agricultural practice.

Key Market Players

The key players in this market include BASF SE (Germany), Solvay (Belgium), Croda International Plc (UK), CLARIANT (Switzerland), DSM (Netherlands), Sensient Colors LLC (US), BrettYoung (Canada), Milliken (US), Precision Laboratories, LLC (US), and Germains Seed Technology (UK).

Seed Coating Market Report Scope:

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Form, Process, Additive, Crop Type, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Target Audience

- Seed manufacturers, formulators, and blenders

- Pesticide traders, suppliers, distributors, importers, and exporters

- Government Agricultural Authorities

- Chemical Intermediate and Technology Providers

- Seed coating manufacturers

- Commercial research & development (R&D) organizations and financial institutions

- Government agricultural departments and regulatory bodies such as the US Environmental Protection Agency (EPA), US Department of Agriculture (USDA), European Food Safety Authority (EFSA), National Seed Administration of China (NSAC), Central Seed Certification Board (CSCB), and Australian Pesticides and Veterinary Medicines Authority (APVMA)

Seed Coating Market Report Segmentation:

This research report categorizes the global seed coating market based on form, process, additive, crop type, and region.

By Form

- Liquid

- Powder

By Additive

-

Polymers

- Polymer gels

- Superabsorbent polymer gels

- Colorants

- Binders

- Minerals/Pumice

-

Active Ingredients

- Protectants

- Phytoactive promoters

- Other active ingredients

- Other additives

By Process

- Film coating

- Encrusting

- Pelleting

By Crop Type

- Cereals & Grains

- vegetables

- Oilseed & Pulses

- Flowers & ornamentals

- Other crop types

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments in the global Seed Coating Market

- In June 2023, Precision Laboratories, LLC is expanding strategically by providing specialized chemistries for the agricultural industry in the merger of Seed Tech and Direct Enterprises (DEI) to distribute value-added products for seed producers and conditioners. Precision Laboratories, LLC’s proprietary seed enhancement and seed treatment technologies include water management chemistries, nano-particle nutrient products, seed coating polymers, and seed colorants, many of which are formulated in combinations for ease of customer use. The collaboration enables Precision Laboratories, LLC to introduce its seed product portfolio swiftly and effectively to the market through DEI's distribution network.

- In February 2022, Croda International Plc collaborated with Xampla, a company backed by Cambridge University, to collaborate on the development of next-generation, biodegradable seed coatings that are free from microplastics. This collaboration is supported by the UK government and the National Institute of Agricultural Botany and involves a £640,000 project trial focused on Xampla's plastic-free seed coatings. These coatings aim to provide sustainable and biodegradable alternatives to the petroleum-derived polymers traditionally used for seed coatings in agriculture.

- In January 2022, GreenLight Biosciences and Germains Seed Technology have joined forces to form a research partnership agreement. This collaboration introduces the world's first commercial use of RNA (Ribonucleic Acid) as a seed treatment, with the primary goal of controlling crop diseases and offering innovative solutions to farmers. The collaboration will involve an exploration of the synergistic potential between Germains Seed Technology expertise in seed priming and coating technologies and GreenLight Biosciences proficiency in dsRNA technology.

- In December 2021, Precision Laboratories, LLC expanded its PRISM line with the introduction of PRISM SCP2020, a seed coating polymer designed to offer a range of benefits to the agriculture industry. PRISM SCP2020 delivers optimized coverage, minimum dust-off, maximum retention of active ingredients, improved seed flow, and enhanced plantability.

- In December 2021, BASF launched a seed coating polymer, Flo Rite Pro 2805 to enhance seed treatment value for growers and promote environmental safety. It facilitates more uniform coverage and application of seed-applied insecticides, nematicides, and fungicides, thereby enhancing the overall treatment efficiency.

- In September 2021, Croda International plc opened a new crop product validation center in Holambra. It prepares the plant growth mediums based on the climatic conditions of the region. The state-of-the-art center is dedicated to serving the agrochemical industry.

- In September 2021, Milliken do Brasil officially opened a factory dedicated to the production of polymers designed to preserve the active ingredients within seeds. This venture represents a significant step forward in the field of seed technology, particularly for companies involved in the production of seeds for major crops like corn, soy, wheat, cotton, and barley, among others.

- In July 2021, Solvay acquired Bayer AG’s global seed coatings business to provide reinvestment opportunities in its Crop Science division. This strengthens Solvay’s existing seed care portfolio in bio-based, and seed-applied solutions.

Frequently Asked Questions (FAQ):

What is the current size of the seed coating market?

The seed coating market is estimated at USD 2.0 Billion in 2023 and is projected to reach USD 3.1 Billion by 2028, at a CAGR of 8.5% from 2023 to 2028.

Which are the key players in the market, and how intense is the competition?

The key players in this market include BASF SE (Germany), Solvay (Belgium), Croda International Plc (UK), CLARIANT (Switzerland), DSM (Netherlands), Sensient Colors LLC (US), BrettYoung (Canada), Milliken (US), Precision Laboratories, LLC (US), and Germains Seed Technology (UK).

The seed coating market witnesses increased scope for growth. The market is seeing an increase in the number of mergers and acquisitions and new product launches. Moreover, the companies involved in the production of seed coating are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the seed coating market?

The market is expected to grow in North America and is expected to dominate during the forecast period. The North American region is home to some of the world's most populous countries, including the US and Canada. This large and diverse consumer base creates significance for seed coating to meet the increasing food demand.

What kind of information is provided in the competitive landscape section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

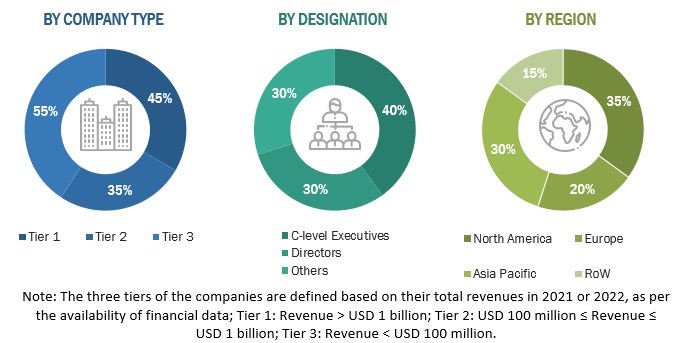

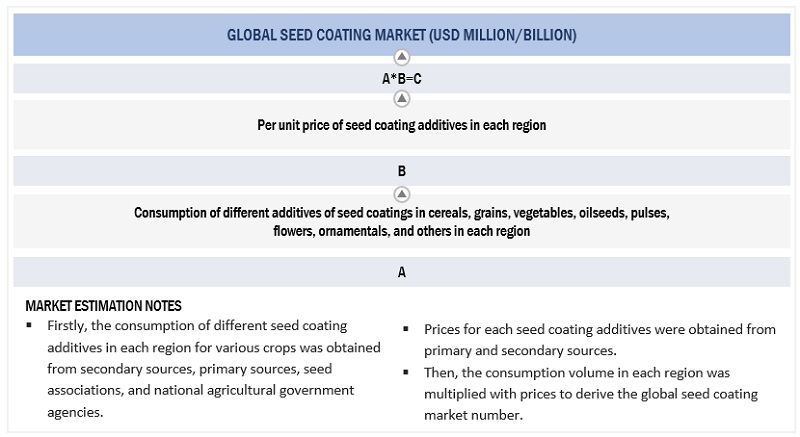

The study involved four major activities in estimating the current seed coating market size. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the global seed coating market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the seed coating market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to additives of seed coating, form, type, process, crop type, and region. Stakeholders from the demand side, such as seed companies who are using seed coating were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of seed coating and the outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

Croda International Plc (UK) |

General Manager |

|

DSM (Netherlands) |

Sales Manager |

|

Solvay (Belgium) |

Manager |

|

BASF SE (Germany) |

Head of seed solutions |

|

Clariant (Switzerland) |

Marketing Manager |

|

Sensient Colors LLC (US) |

Sales Executive |

|

Little’s Agrivet Private Limited (India) |

Head - Research & Development |

|

Bayer AG (Germany) |

Senior Engineering Manager |

|

Pivot Bio (US) |

Manager |

|

Vriksha Agro Sciences Private Limited (India) |

R&D, QC and production Expert |

Seed Coating Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Seed Coating Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Seed Coating Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to estimate the seed coating market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying numerous factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Seed Coating Industry Definition

According to the International Seed Testing Association (ISTA), is the application of materials to the surface of seeds to improve their appearance, and handling characteristics, and/or to deliver active compounds that can improve seed quality, protect the seed from biotic and abiotic stress, and enhance plant growth.

Seed coating can be used to deliver a wide range of materials to seeds, including:

- Fungicides and insecticides: To protect seeds from pests and diseases

- Plant growth regulators: To promote germination and seedling growth

- Micronutrients: To improve seed nutrition

- Inoculants: To deliver beneficial microorganisms to the seed

Key Stakeholders in the Global Seed Coating Market

- Seed Coating Raw Material Suppliers and Manufacturers

- Seed Coating Material Importers and Exporters

- Seed Coating Material Traders and Distributors

- Government and Research Organizations

- Seed Manufacturing Companies

- Specialty Chemical Manufacturers

- Associations and Industrial Bodies

- Agricultural Institutes and Universities

- Manufacturers and suppliers related to seed treatment and the seeds industry.

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies.

-

Regulatory bodies such as

- US Food and Drug Administration (FDA)

- European Commission (EC)

- United States Department of Agriculture (USDA)

- United States Environmental Protection Agency (USEPA)

- Government agencies and NGOs

- Commercial research & development (R&D) institutions and financial institutions

- Food and Agriculture Organization (FAO)

- World Health Organization (WHO)

- Intermediary suppliers such as wholesalers and dealers

Seed Coating Market Report Objectives

- To determine and project the size of the market with respect to the form, process, additive, crop type, and region in terms of value and volume over five years, ranging from 2023 to 2028.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

- To provide insights on key product innovations and investments in the seed coating market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe’s seed coating market into Sweden, Netherlands, and Greece.

- Further breakdown of the Rest of Asia Pacific market for seed coating into Indonesia, Vietnam, and South Korea.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Seed Coating Market