Managed Security Services Market by Service Type (Managed IAM, MDR, Managed SIEM, Log Management), Type (Fully Managed & Co-managed), Security Type (Network, Cloud, Endpoint, Application), Organization Size, Vertical, & Region - Global Forecast to 2028

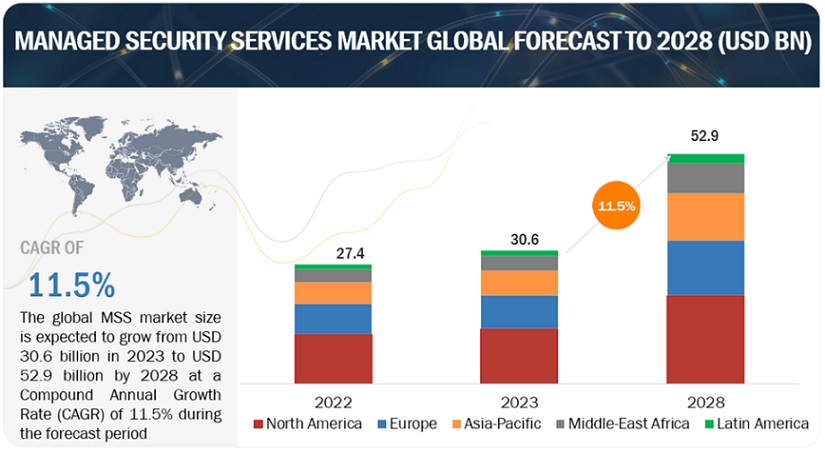

[404 Pages Report] The global MSS market size is expected to grow from USD 30.6 billion in 2023 to USD 52.9 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 11.5% during the forecast period. The escalating frequency and sophistication of cyberattacks are driving organizations to seek Managed Security Services (MSS) to enhance their cyber defense capabilities.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Managed Security Services: Market Dynamics

Driver: Constantly intensifying complexity of cyber threats.

The increasing complexity of cyber threats is a key catalyst driving the growth of the managed security services (MSS) market. In recent years, the cybersecurity landscape has witnessed a surge in sophisticated and multifaceted threats that demand advanced defense mechanisms. Cybercriminals are deploying highly intricate tactics, such as advanced persistent threats (APTs), zero-day exploits, and polymorphic malware, making it challenging for organizations to defend their digital assets adequately.

In response to this evolving threat landscape, organizations recognize the limitations of relying solely on in-house security measures. The shortage of skilled cybersecurity professionals exacerbates this challenge, prompting businesses to turn to MSS providers. These providers offer a comprehensive suite of services, including advanced threat detection, real-time monitoring, incident response, and expertise in handling diverse and complex cyber threats. MSS providers leverage cutting-edge technologies like artificial intelligence and machine learning to analyze patterns, detect anomalies, and respond swiftly to emerging threats.

Restraint:Enterprises reluctant to outsource operations

Enterprises opt for providers, a third-party service provider if they do not have enough in-house security expertise or budgetary constraints. Outsourcing security operations to a third-party service provider involves multiple considerations, such as the security of the third-party’s infrastructure, cybersecurity technology, real-time support, and the overall decision of migrating to security-as-a-service. The service provider’s infrastructure must be secured and advanced to combat the latest threats. Since the service provider’s infrastructure may hold vital data of multiple organizations, it is highly susceptible to repeated and complex attacks; this can be a deterrent for companies to hand over their data to these service providers.

In some instances, the top management of organizations may not be willing to let go of control over vital aspects of their infrastructure. Enterprises suspect managed security service providers when in control of entire system architectures, could be disadvantageous for organizations in case of a breach that limits the market growth. Further, factors such as hidden costs, quality of service provided, and lack of trust in service providers can also limit the growth of this market. However, according to industry experts, if providers can prove themselves to be consistently reliable to upper-level management, enterprises could develop both business motives & profits, thereby extending access to managed security service providers.

Opportunity: Growing adoption of cloud technology and IoT devices

IoT refers to a system of interconnected computing devices and machines that can transfer data over a network without human intervention. However, with the rapid development of IoT, the security concern for these devices has also increased. As more machines get connected to a single network, such connected devices are vulnerable to cyberattacks. For instance, in the automobile sector, companies are focusing on developing independent and self-driving cars. However, due to automation, the dependency of cars on software is set to rise, making the installed systems more susceptible to cyberattacks. IoT has become widespread, but integrating such devices with machines will increase malware attacks, which could compromise hefty amounts of money. Managed security services aim to keep enterprises informed of potential cyberattacks by continuously monitoring cyber threats, enabling enterprises to opt for preventive measures efficiently..

Many small and medium-sized enterprises (SMEs) and large corporations are choosing cloud computing due to its many benefits, including cost-effectiveness, dynamic access to data, and faster business processes. Cloud services offer unique features like security policy enforcement, various compliances, encryption, IAM, SIEM, and malware detection and prevention. This makes cloud computing an attractive option for businesses that want to have greater control over their data and infrastructure. These benefits have led to the increased adoption of cloud technology by SMEs and large enterprises, making it a cost-effective and efficient solution for these organizations. Additionally, managed security service providers can offer custom-based security solutions to enterprises who are looking to move their businesses to the cloud. Hence, the rising adoption of cloud technology and IoT devices among enterprises is expected to be a favorable opportunity in the coming years.

Challenge: Shortage of security professionals

The managed security infrastructure is becoming more complex as technology advances. There are several entry points for threats to surface in a virtual enterprise. Despite the surge in critical issues, limited trained professionals can understand and respond to sophisticated attacks. Due to an extreme shortage of qualified security talent, organizations are exposed to severe risks. Cyber threats target network vulnerabilities and use them to enter the enterprise network. With cyber-attacks rising, many new zero-day threats have emerged. The methods and techniques attackers use to penetrate an organization’s enterprise network remain undetected.

Due to low awareness of advanced cyber threats, organizations do not spend enough on their security infrastructure, which results in massive losses. Furthermore, companies with pressing security needs have observed a major shortage of qualified professionals, making them further vulnerable to cyberattacks and threats.

Market Ecosystem

Managed SIEM and Log Management hold the highest market share during the forecast period.

Managed SIEM and log management services offer a strategic solution, allowing organizations to leverage specialized expertise and advanced technologies effectively to defend against sophisticated cyber threats. Many industries have stringent regulatory requirements regarding the protection of sensitive data. Managed SIEM and log management services to help organizations meet these compliance requirements. The need for compliance with regulations such as GDPR, HIPAA, and others drives managed SIEM and Log management segment.

BFSI segment to hold the highest market share during the forecast period.

BFSI institutions are subject to stringent data privacy and security regulations, creating immense pressure to implement comprehensive security measures. MSS providers ensure continuous compliance monitoring and reporting, easing the burden for BFSI organizations. BFSI organizations often engage with third-party vendors for various services. Managed security services extend their oversight to assess and manage the security risks associated with third-party relationships.

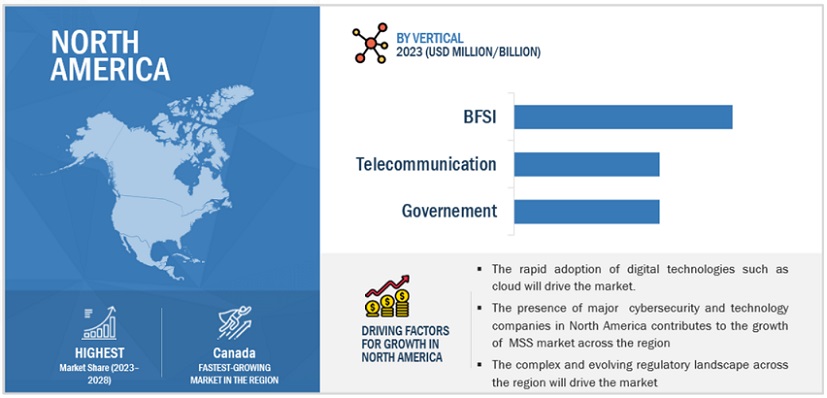

North America accounts for the largest market share during the forecast period.

By region, North America is estimated to hold the highest market share during the forecast period. North America is a hotbed for cyber security innovation, with major players like Cisco, Palo Alto Networks, and CrowdStrike driving new technologies and approaches. The cybersecurity landscape in North America is constantly threatened by sophisticated cyberattacks and data breaches. Also, rising adoption of cloud technologies is further driving the demand for specialized cloud security within managed security services offerings.

Key Market Players

The MSS market vendors have adopted various organic and inorganic growth strategies, such as new product launches, services upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global IBM (US), NTT (Japan), Accenture (Ireland), DXC Technology (US), Secureworks (US), Trustwave (US), Atos (France), Orange Cyberdefense (France), Fujitsu (Japan), AT&T (US), Verizon (US), Capgemini (France), HPE (US), Cisco (US), TCS (India), Kudelski Security (Switzerland), F5(US), Infosys (India), Lumen Technologies (US), Crowdstrike (US), Kroll (US), Nokia Networks (Finland), Trend Micro (Japan), Cipher Security (US), RSI Security (US), SecurityHQ (UAE), TrustNet (US), LightEdge (US), Nettitude (US), Teceze (US), CyFlare (US), Ascend Technologies (US), Avertium (US), DigitalXRAID (UK). The study includes an in-depth competitive analysis of these key players in the MSS market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments Covered |

By service type, type, security type, organization size, vertical and region |

|

Regions covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies covered |

IBM (US), NTT (Japan), Accenture (Ireland), DXC Technology (US), Secureworks (US), Trustwave (US), Atos (France), Orange Cyberdefense (France), Fujitsu (Japan), AT&T (US), Verizon (US), Capgemini (France), HPE (US), Cisco (US), TCS (India), Kudelski Security (Switzerland), F5(US), Infosys (India), Lumen Technologies (US), Crowdstrike (US), Kroll (US), Nokia Networks (Finland), Trend Micro (Japan), Cipher Security (US), RSI Security (US), SecurityHQ (UAE), TrustNet (US), LightEdge (US), Nettitude (US), Teceze (US), CyFlare (US), Ascend Technologies (US), Avertium (US), DigitalXRAID (UK) |

This research report categorizes the MSS market to forecast revenues and analyze trends in each of the following subsegments:

By Service Type:

- Managed IAM

- Managed Vulnerability Management

- Managed Risk and compliance

- Managed detection and response

- Managed Firewall

- Managed SIEM and Log Management

- Other service type

By Type

- Fully Managed

- Co-Managed

By Organization size

- Large Enterprises

- SMEs

By Security Type

- Network Security

- Cloud Security

- Endpoint Security

- Application Security

By Vertical

- BFSI

- Government

- Healthcare & Life Sciences

- Telecommunications

- IT and ITeS

- Retail and eCommerce

- Energy and Utilities

- Manufacturing

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- Saudia Arabia

- Rest of GCC Countries

- South Africa

- Kenya

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In November 2023, Rapid7 chose TruVisor as its exclusive distributor for cybersecurity solutions in the ASEAN and India regions. This partnership aims to enhance their joint customers' cybersecurity capabilities through Rapid7’s security platforms. This strategic collaboration is significant in the growing cybersecurity market in these regions.

- In November 2023, Accenture acquired Innotec Security, a privately held company specializing in cybersecurity-as-a-service, cyber resilience, and cyber risk management, expanding its capabilities and footprint in Spain. Innotec Security was previously owned by parent company Entelgy Group. The acquisition of Innotec Security—which also has a presence in Barcelona, Seville, and the Basque Country—will add 500 cybersecurity professionals to Accenture Security’s workforce of 20,000 professionals globally, making Accenture Security one of the top managed security services (MSS) players in Spain.

- In August 2023, DXC Technology signed an IT Infrastructure Services Agreement with AT&T; under the agreement, DXC will manage AT&T’s midrange IT infrastructure, which spans AT&T’s enterprise compute, storage, backup, and recovery environments. DXC will also provide system, database, storage administration, hardware architecture, and maintenance across these environments.

- In June 2023, Secureworks unveiled the Taegis XDR (Extended detection and response), and Taegis Managed XDR for OT (operational technology) offerings to help industrial organizations protect against cyber threats. Taegis XDR combines IT security telemetry with OT intelligence and uses analytics and machine learning to help organizations identify threats and prioritize the most serious ones.

Frequently Asked Questions (FAQ):

What is MSS?

Managed security services manage an organization’s security infrastructure from an outside or third-party location. Outsourced security services, third-party security services, and as-a-service are the terms associated with managed security services.

Which countries are considered to be in the Asia Pacific region?

The report includes an analysis of China, Japan, India, Australia & New Zealand, and the Rest of Asia Pacific in the Asia Pacific region.

Which are the key drivers supporting the growth of the MSS market?

The key drivers supporting the growth of the MSS market are driven by escalating cybercrime and the shortage of skilled cybersecurity experts.

Who are the key vendors in the MSS market?

The key vendors operating in the MSS market include IBM (US), NTT (Japan), Accenture (Ireland), DXC Technology (US), Secureworks (US), Trustwave (US), Atos (France), Orange Cyberdefense (France), Fujitsu (Japan), AT&T (US), Verizon (US), Capgemini (France), HPE (US), Cisco (US), TCS (India), Kudelski Security (Switzerland), F5(US), Infosys (India), Lumen Technologies (US), Crowdstrike (US), Kroll (US), Nokia Networks (Finland), Trend Micro (Japan), Cipher Security (US), RSI Security (US), SecurityHQ (UAE), TrustNet (US), LightEdge (US), Nettitude (US), Teceze (US), CyFlare (US), Ascend Technologies (US), Avertium (US), DigitalXRAID (UK)

Which region is expected to hold the highest market share In the MSS market?

North America is expected to hold the highest market share in the MSS market. The presence of key players across the region will drive the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information for a technical, market-oriented, and commercial study of the global managed security services market. A few other market-related reports and analyses published by various industry associations and consortiums were also considered while conducting the extensive secondary research.

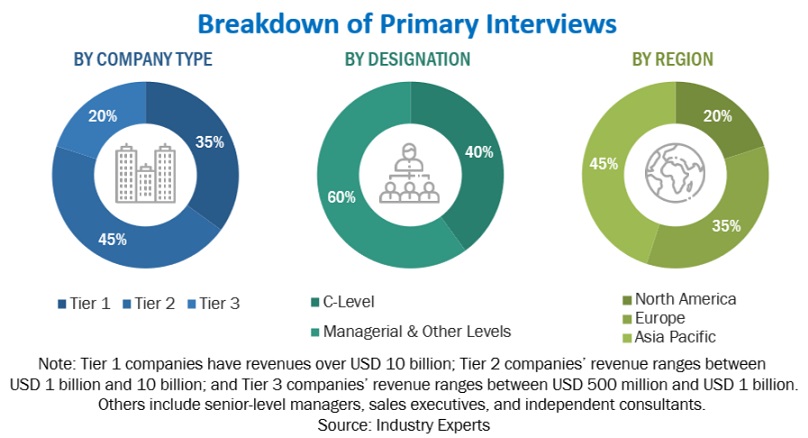

The primary sources were mainly industry experts from core and related industries, service providers, technology developers, and technologists from companies and organizations related to all segments of the managed security services industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of managed security service vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain key information related to the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

Various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the managed security services market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, the top-down and bottom-up approaches were used along with multiple data triangulation methods to estimate and validate the size of the managed security services market and other dependent submarkets. Key market players were identified through secondary research, and their market share in the targeted regions was determined with the help of primary and secondary research. This entire research methodology included the study of annual and financial presentations of the top market players and interviews with experts for key insights (quantitative and qualitative).

The percentage shares, and breakdowns were determined using secondary sources and verified through primary research. All the possible parameters that affect the managed security services market were verified in detail with the help of primary sources and analyzed to obtain quantitative and qualitative data. This data was supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Managed Security Services Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Managed Security Services market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the managed security services market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Managed security services are the management of an organization’s security infrastructure from an outside or third-party location. Outsourced security services, third-party security services, and as-a-service are the terms associated with managed security services.

Key Stakeholders

- Chief technology and data officers

- Consulting service providers

- Managed security services professionals

- Business analysts

- Information Technology (IT) professionals

- Government agencies

- Investors and venture capitalists

- SMEs and large enterprises

- Third-party providers

- Consultants/consultancies/advisory firms

- Managed and professional service providers

Report Objectives

- To describe and forecast the global managed security services market by service type, type, security type, organization size, vertical, and region

- To forecast the market size of five main regions: North America, Europe, the Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the managed security services market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions (M&A), new product developments, partnerships, and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Security Services Market

Need to know specifics on demographics covered i.e. how are organization types defined, which verticals are covered and specifically which countries

Interested in a percentage breakdown of the total managed security service market by type (Managed IAM, Managed Firewall, etc).

Information on Brazilian cybersecurity market overview specially regarding cyber services (consultancy).

Valuation of Managed Security Services company

Market trend Search for Managed security Services, OEM comparisons, Service Providers Competitive Analysis , Service Analysis .

Need country specific data points and list of major players in Managed Security segment across Middle East, Africa and Central Asia countries.

Information on the M&A activity (summary level data) for the managed security services industry