Farm Management Software Market by Application (Precision Farming, Livestock, Aquaculture, Forestry, Smart Greenhouses), Offering (On-cloud, On-premise, Data Analytics Services), Farm Size, Farm Production and Region - Global Forecast to 2029

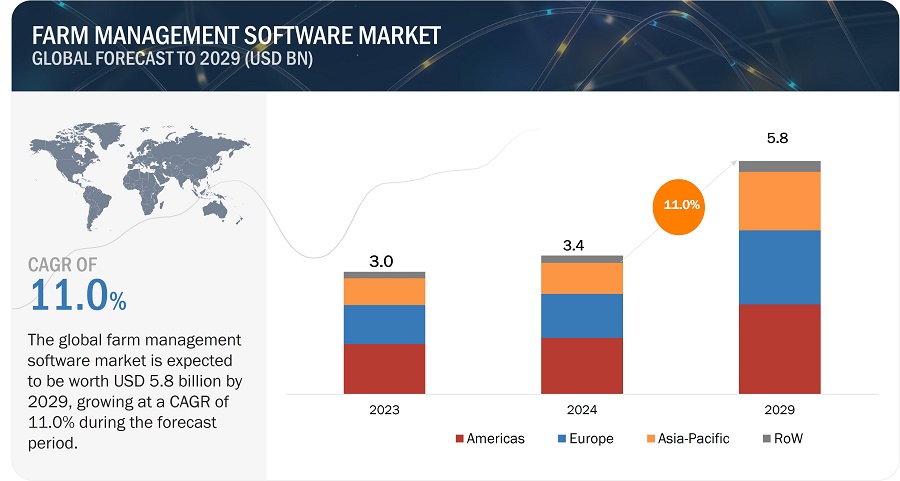

[300 Pages Report] The Farm Management Software Market is projected to reach from USD 3.4 billion in 2024 to USD 5.8 billion by 2029; it is expected to grow at a CAGR of 11.0% from 2024 to 2029. The widespread adoption of farm management software can indeed be attributed to a multitude of factors that collectively enhance farm management practices and agricultural sustainability. One of the key factor is the efficiency and productivity afforded by these software solutions, which streamline tasks such as data collection, analysis, and decision-making.

Farm Management Software Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Farm Management Software Market Dynamics

Driver: Rising integration of advanced technologies for real-time farm management

The expansion of the farm management software market is primarily propelled by the escalating agricultural operations and the increasing demand for instant data for informed decision-making. Artificial intelligence and machine learning are becoming extensive technologies across various farming sectors, including precision farming, livestock monitoring, fish farming, and smart greenhouse practices. These technologies facilitate the seamless exchange of data between farming equipment and stakeholders, streamlining the farm management process. Within the farm management framework, there is a significant emphasis on comprehending the environment by analyzing data generated by diverse farm management tools like GPS, satellite imaging, and in-field sensors. Data management holds immense importance in agriculture, as management decisions rely on real-time data analysis derived from farm activities. The integration of artificial intelligence and machine learning has enabled prompt access to data, simplifying tasks such as planning, procurement, feeding, harvesting, marketing, and inventory control.

Restraint: Limited technical expertise and advanced infrastructure in developing regions

The growth of the farm management software market faces challenges as some farmers encounter difficulties in grasping the process of utilizing such software, handling agricultural data, and leveraging it for decision-making, thereby impeding market expansion. Farm management software solutions are crucial for conducting real-time data analysis of diverse farming activities with the aim of boosting profits and mitigating losses. However, utilizing these solutions in agricultural management necessitates technical expertise.

Opportunity: Rapid adoption of smart farming technologies

Smart farming relies on extensive data collected from sensors, drones, and IoT devices. Farm management software serves as a central platform, consolidating this data with traditional farming operations data like planting schedules and inventory. This integrated perspective enables farmers to base their decisions on data, guiding resource allocation, irrigation plans, and pest management strategies. The embrace of smart farming technologies represents a valuable chance for farm management software to transform into a comprehensive farm management information system. Through data integration, advanced analytics, and automation capabilities, this software empowers farmers to enhance decision-making, resource utilization, and overall efficiency and profitability. Artificial intelligence (AI) emerges as a promising technology to meet the ongoing food demand in agriculture by boosting production. AI solutions enhance the efficiency of agricultural operations by offering valuable insights. By combining IoT with advanced analytics facilitated by AI, farmers can analyze real-time data concerning weather conditions, temperatures, moisture levels, and crop prices in the market.

Challenge: Management of data for productive decision-making through single digital platform

The integration of various data sources like weather forecasts, soil health assessments, crop growth tracking, and machinery performance data into one platform can present challenges due to variations in data formats and compatibility issues. Managing data from various farm activities poses a significant challenge to the expansion of the farm management software market. Farm management software solutions generate a substantial volume of data regularly, which is crucial for informed decision-making by farmers. This data, collected from agricultural tools used on farms, is essential for tasks such as mapping, variable rate seeding, soil testing, yield monitoring, and historical crop rotation. To utilize this data effectively, it must be appropriately stored and managed in a structured format. After collection, the raw data undergoes processing to provide farmers with context, relevance, and priority, facilitating decision-making. The adoption of farm management software and related technologies is likely to increase if farmers are offered user-friendly data management solutions for their daily operations. Many farmers lack awareness of the potential of data for decision-making purposes. Therefore, it is important to provide farmers and growers with effective data management tools and techniques to acquire, manage, process, and utilize data efficiently.

Farm Management Software Market Ecosystem

The prominent players in the farm management software market are AGRIVI (UK), Trimble Inc. (US), Granular Inc. (US), Raven Industries, Inc. (US), TOPCON CORPORATION (Japan). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

On-cloud offering to account for the largest share of the farm management software market in 2023.

Cloud-based farm management software contributes to sustainable farming practices by optimizing resource utilization, minimizing water and chemical usage through precise irrigation and targeted pest control, and reducing environmental impact. The increasing demand for cloud-based farm management software stems from its capacity to optimize resource allocation, facilitate remote monitoring and automation, streamline inventory and supply chain operations, and promote sustainable farming practices. Consequently, this enhances farm productivity and profitability.

Large farm size segment to dominate farm management software market during the forecast period.

Several factors are propelling the growth of large-scale farms and the adoption of farm management software, including the increasing prominence of precision farming, efficient resource management, technological advancements, government support, rising demand for protein-rich aqua food, labor shortages coupled with an aging population, and a heightened emphasis on sustainable farming practices.

Precision farming application to register the highest share farm management software market in 2023.

The farm management software market is expected to grow at a significant rate, driven by the adoption of new advanced technologies and modern farming systems, including cloud services, mobile applications, data analysis tools, and high-speed imagery services. Precision agriculture is a growing application in farm management software due to its ability to improve crop quality, optimize resource use, and reduce input costs. As the world's population continues to grow, precision agriculture will play an increasingly important role in ensuring food security and sustainability.

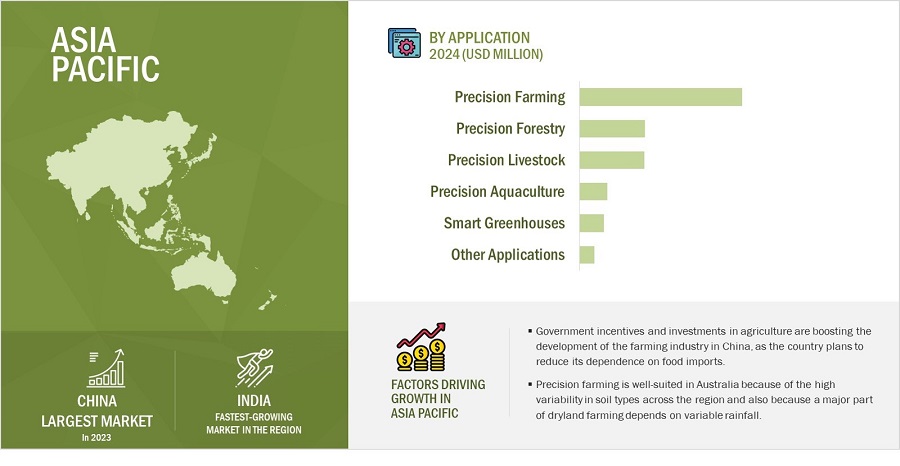

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

The Asia Pacific region is witnessing a notable surge in technological adoption across diverse sectors, agriculture being no exception. This surge is largely facilitated by the growing accessibility and affordability of advanced solutions. As a result, farmers are increasingly inclined to embrace precision farming practices and make investments in cutting-edge software to enhance the efficiency and effectiveness of their operations. Moreover, governments throughout the Asia Pacific region are actively advocating for the adoption of precision farming. They do so by implementing supportive policies, offering subsidies, and launching various initiatives aimed at incentivizing farmers to integrate precision farming practices into their operations. These governmental efforts play a crucial role in driving the adoption of farm management software, encouraging farmers to leverage technology to optimize resource utilization, improve productivity, and foster sustainable agricultural practices.

Farm Management Software Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the farm management software companies include AGRIVI (UK), Trimble Inc. (US), Granular Inc. (US), Raven Industries, Inc. (US), TOPCON CORPORATION (Japan), AgJunction LLC (US), Agworld Pty Ltd (US), Farmers Edge Inc. (Canada), Climate LLC (US). These companies have used organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Offering, By Farm Size, By Farm Production, By Application |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

AGRIVI (UK), Trimble Inc. (US), Granular Inc. (US), Raven Industries, Inc. (US), TOPCON CORPORATION (Japan), AgJunction LLC (US), Agworld Pty Ltd (US), Farmers Edge Inc. (Canada), Climate LLC (US), IBM (US), Afimilk Ltd. (Israel), ABACO S.p.A. (Italy), Deere & Company (US), Microsoft (US), GEA Group Aktiengesellschaft (Germany), SST Software (US), CropX Inc. (Israel), CropIn Technology Solutions Private Limited (India), Conservis (US), Gamaya (Switzerland), Eruvaka Technologies (India), Ag Leader Technology (US), DICKEY-john (US), DeLaval (Sweden), and BouMatic (US) |

Farm Management Software Market Highlights

This research report categorizes the farm management software market based on offering, farm size, farm production, application, and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Farm Size |

|

|

By Farm Production |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In October 2023, AGRIVI joined forces with ReddAgro, a leading Agri-Tech firm known for its expertise in precision farming, greenhouse control and automation, and agricultural supply chain management solutions. Together, they aim to transform farming methods, fostering innovation and sustainability across the agricultural sector in Jordan, Sudan, Saudi Arabia, Egypt, and Iraq. Both ReddAgro and AGRIVI are aligned in their vision of a more sustainable and efficient agricultural future. Through this partnership, they seek to bring this vision to fruition by leveraging their respective strengths, knowledge, and international presence.

- In September 2023, Trimble Inc. disclosed a definitive agreement to establish a joint venture with AGCO, aiming to enhance support for farmers in the mixed fleet precision agriculture market through factory-fitted and aftermarket applications. Together, Trimble and AGCO share the vision of creating a global leader in smart farming and autonomy solutions for mixed fleets.

- In June 2023, TOPCON CORPORATION introduced significant advancements to its cloud-based software platform, TAP FEED management, catering to dairy and beef operations. The platform now offers several options, including the free TAP FEED App and subscription-based choices like TAP FEED Lite and TAP FEED Pro, designed specifically for dairy producers. Additionally, Topcon Agriculture has unveiled the TAP FEED Advisor customer management tool, tailored for feed advisors, consultants, and nutritionists.

- In August 2023, Raven Industries indeed stands out as a frontrunner in the realm of agricultural technology, consistently demonstrating its dedication to advancing farming practices through innovative solutions. By forging strategic partnerships and leveraging its expertise in innovation, Raven not only enhances its own offerings but also contributes to the overall efficiency and productivity of the agricultural sector.

- In November 2023, Kubota and Chouette have collaborated aimed at creating solutions that minimize the use of chemical pesticides while also reducing the labor needed for growth monitoring. This partnership integrates Chouette's AI-driven technology, which detects diseases and assesses growth issues through vineyard imagery, with Kubota's tractors and sprayers. The result is the generation of maps highlighting optimal locations and volumes for chemical application, enhancing efficiency and sustainability in agricultural practices.

Frequently Asked Questions (FAQs):

What is the current size of the Global Farm Management Software Market?

The farm management software market is projected to reach from USD 3.4 billion in 2024 to USD 5.8 billion by 2029; it is expected to grow at a CAGR of 11.0% from 2024 to 2029.

Who are the winners in the Global Farm Management Software Market?

Companies such as AGRIVI (UK), Trimble Inc. (US), Granular Inc. (US), Raven Industries, Inc. (US), TOPCON CORPORATION (Japan).

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the farm management software market during the forecast period. Governments across the Asia Pacific region actively promote the adoption of precision farming through supportive policies, subsidies, and initiatives.

What are the major drivers and opportunities related to the farm management software market?

Rising integration of advanced technologies for real-time farm management, Increasing climate change and food security concerns, and Rapid adoption of smart farming technologies are some of the major drivers and opportunities related to the farm management software market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their farm management software market position.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

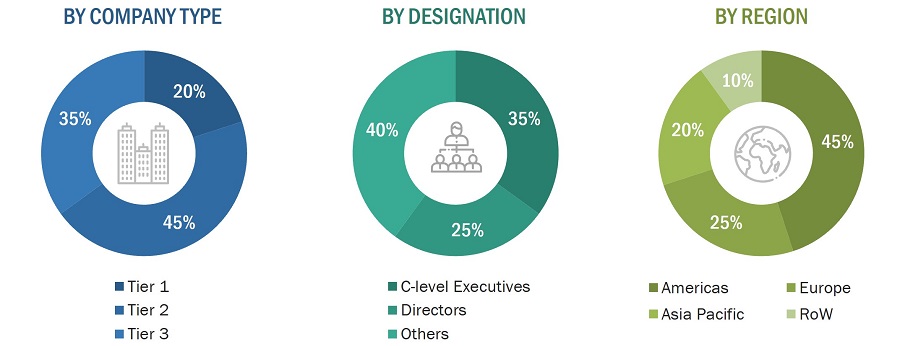

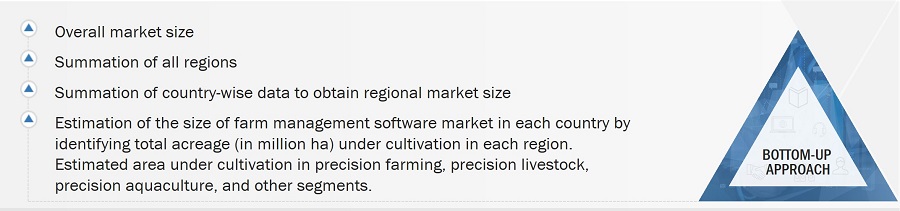

The study involved four major activities in estimating the size of the farm management software market. Exhaustive secondary research has been conducted to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering farm management software have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been conducted mainly to obtain critical information about the market’s value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both demand- and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the farm management software market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: Americas, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the farm management software market.

- Analyzing the agriculture technology ecosystem in each country and identifying the major companies in the market

- Analyzing the market for farm management software for each country

- Identifying major farm management software applications, including precision farming, precision livestock, precision aquaculture, smart greenhouses, and precision forestry, along with the types of software and services required for various applications and sub-applications.

- Estimating the market size in each region by summation of country-wise market size

- Tracking the ongoing and upcoming implementation projects of farm management software by various companies in each region and forecasting the farm management software market size based on these developments and other critical parameters, including ongoing recession scenario and its impact on the farm management software market

- Arriving at the global farm management software market size through the summation of all the regions

The top-down approach has been used to estimate and validate the total size of the farm management software market.

- Initially, MarketsandMarkets focused on the top-line investment and expenditure in the ecosystems of agriculture technology, which also includes farm management software. software upgrades, and major developments in the key market area.

- Further information was derived from the market revenue the key farm management software and service providers generated.

- Multiple on-field discussions were conducted with key opinion leaders from each major company involved in the development of farm management software and services.

- The geographic splits were estimated using secondary sources based on various factors, such as the number of players in a specific country and region, the level of services offered, and the type of software implemented.

Data Triangulation

After arriving at the overall size of the farm management software market through the process explained, the total market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides. The market has also been validated using the top-down and bottom-up approaches.

Market Definition

Farm management is a technique to optimize and manage farm operations by automating farm activities such as record keeping, data management, crop health analysis, livestock monitoring, and aquaculture farm optimization. The software is customized to meet specific farm requirements since each farm carries out different activities. Farm management software is used for planning, implementation, assessment, and optimization of tasks performed on farms. It helps farmers improve better plan and track, save on input and labor costs, and improve yield.

The software helps enhance farm productivity and reduce input wastage. The software is integrated with hardware equipment and devices to enhance the productivity of the farmland with the help of the Global Positioning System (GPS), sensing, and communication technologies.

Key Stakeholders

- Satellite service providers, UAVs/drone service providers, and data collection and analysis service providers

- Electronic components (sensors, GPSs, yield monitoring systems) and device manufacturers

- Agriculture original equipment manufacturers (OEMs)

- Component and device suppliers, system integrators, and distributors

- Software providers, including Software as a Service (SaaS) and Platform as a Service (SaaS) providers

- Data analytics service providers, agricultural IoT infrastructure providers, and technology providers

- Standardization and testing firms

- Government bodies such as regulatory authorities, policymakers, and agricultural ministry

- Associations, organizations, forums, and alliances related to agriculture technology

- Research institutes and organizations

- Market research and consulting firms

- Agri-food companies, contract farming companies, farm-input providers, agronomists, and independent agriculture consultants

Report Objectives

- To define, describe, segment, and forecast the size of the farm management software market, by offering, farm size, application, and farm production planning, in terms of value

- To forecast the market size for various segments with respect to four main regions, namely, the Americas, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the farm management software market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the farm management software market landscape

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, pricing data, patents and innovations, and trade data (export and import data) in the farm management software market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

- To strategically profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To analyze competitive developments such as contracts, product launches/developments, expansions, and research & development (R&D) activities carried out by players in the farm management software market.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Farm Management Software Market

I would like to get a copy of this report for an article I am working on for our midNovember Tech issue. Laurie Bedord Advanced Technology Editor

We'd like to get informatin on global market forecast for farm management and decision making support system.

Manufacturing companies that produces agricultural equipment is rapidly updating their products by integrating IoT devices and autonomous technology . May need to integrate with these providers in future. Looking for data for different OEM/ODM in major countries.

Since 2010, numerous companies have enetered this space as there is huge potential in leveraging agriculture prodcution with technology. Can you provide data for different hardware devices like IoT, sensors, GPS, smart cameras, and drones; used in agriculture industry.

I would like to know the size and the format of this report, and the degree of detail of the geographic analysis (world region, country...). Would be also interested in knowing penetration rate for different technologies. Thanks

I am from an digital agtech company. Looking for data related to some competitor analysis (top 10 players). Can you provide up-to-date information on competitor software products, particularly indications of consumer perceptions data.

I am making a research proposal about the farm management system markets. Would be keen on understanding more about the global trends shaping the agriculture technology industry.

Hi, I am interested in this report but also would like to understand what a corporate user license will include. Thanks, Ethy

Mackensie Agribusiness is a brasilian company thats Works with sugar,coton, soy and corn. I would like to recieve this report to know current market trends and technological development happening in this market.. Best Regards Carlos Araujo

Dear Sirs, I need this report for my thesis in academic research. The subject of my research is optimization model in horticulture supply chain.

I am looking to understand the Global smart farming and Farm management market in terms of key players and their offerings + technology future and challenges. What level of discount you can provide for a bulk deal/multiple copies ?