Integrated Passive Devices Market by Material (Silicon, Glass), Passive Devices, Application (ESD/EMI, RF IPD, Digital & Mixed Signals), Wireless Technology (WLAN, Bluetooth, GPS, Cellular), End Use Industry, and Geography - Global Forecast to 2023

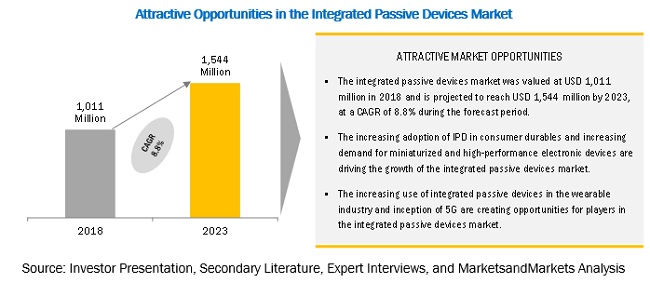

The global integrated passive devices market size was valued at USD 1,011 million in 2018 to USD 1,544 million by 2023, at a Compound Annual Growth Rate (CAGR) of 8.8% during the forecast period.

The growth of the integrated passive devices market is driven by factors such as increasing adoption of IPD in consumer durables, integration of IPDs into RF applications, and increasing demand for miniaturized & high-performance electronic devices. In addition, increasing incorporation of infotainment and navigation features, such as global positioning system (GPS), in automobiles is supporting the market growth.

Integrated Passive Devices Market Segment Overview

By material, the glass segment is expected to grow at the highest growth rate during the forecast period

Among non-silicon-based types, glass base is preferred because of advantages such as high resistivity and low RF coupling to devices. During the manufacturing process, glass wafer does not heat up as much as other materials. Moreover, glass

The consumer electronics segment deals with electronic devices that are used for entertainment, communications, and enterprises purpose. Consumer electronics accounted for the largest share of the IPD market. Consumer electronics include smartphones, notebooks, tablets, and others (wearables, game consoles, and other white goods). Smartphones have been a major driver for the growing market of smart devices. The growth of the smartphones market has proven to be a catalyst for the mainstreaming of the Internet of Things.

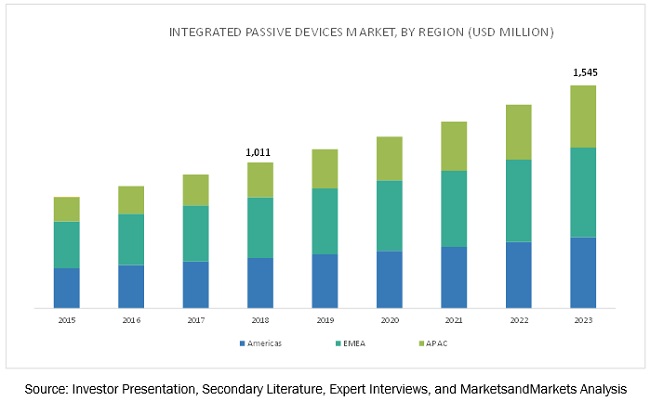

EMEA to account for the largest market size during the forecast period.

EMEA is expected to hold the largest market size in the IPD market during the forecast period, followed by the Americas region. Key regions for the integrated passive devices market in EMEA are Germany, France, Switzerland, and the Rest of Europe (including UK, Sweden, and Norway).

The presence of fabrication and IPD manufacturers, such as Infineon Technologies, STMicroelectronics, and IPDiA, that develop innovative products based on effective research and development drives the IPD market in EMEA. Furthermore, increased technical advancements and high investments by key organizations and surging interest for passive devices are expected to boost the growth of IPD in EMEA.

Integrated Passive Devices Market Dynamics

Driver: Increasing adoption of IPD in consumer durables

White goods are among the biggest applications of the IPD technology. It has been observed that integrated passive devices have a strong penetration in the consumer electronics sector, which consists of smartphones, tablets, portable media players, set-top boxes & digital TVs, and others. Smartphones in recent years have witnessed a strong demand; and the need for numerous features packed in a small form factor has given rise to integrated passive devices.

A smartphone has many features such as Wi-Fi, Bluetooth, global positioning system, near-field communication, and others. For the next-generation communication technology, namely 4G LTE (long term evolution), smartphones need to support higher frequency bands to drive the need for additional miniaturized components. This would increase the adoption of IPDs in consumer electronics as they offer cost-effective solutions for miniaturization.

Restraint: Higher cost of IPDs compared with discrete components

High price of IPDs compared to discrete components is restraining the growth of the integrated passive device market. The impact is expected to be low in the long term as key players operating in this market are putting their efforts to reduce the cost of IPDs.

Furthermore, low-cost fabrication is essential to maximize profits. However, traditional printed circuit boards are standardized for individual discrete components and not for IPDs. Traditional PCBs incur extra cost when used with IPDs. The cost ratio of single discrete component to IPD (1.5 X 1.5) is 1:31. This is mainly due to the commoditization of discrete components and their mass usage.

Opportunity: Inception of 5G

5G is expected to be commercialized by the end of 2018. To develop products such as baluns, filters, and diplexers compatible with 5G, it would be essential to integrate IPDs in these products. The integration of IPDs would help in reducing the size and power consumption of telecom infrastructure products, which would boost the IPD market in the coming years, especially in the telecom industry. The 5G market is expected to have 89 million subscriptions by 2022, which would provide an opportunity for the IPD market to grow. 3D Glass Solutions has developed high-efficiency 5G IPD RF filters.

Furthermore, by 2021, the US, Japan, South Korea, UK, Germany, and China are expected to deploy the 5G technology, which would further contribute to the growth of the integrated passive devices market in the coming years.

Challenge: RF tuning of IPD demands longer product design cycle

Manufacturers require a long product design cycle for RF tuning of IPDs; this acts as a major restraining factor for the IPD market. Tuning of discrete components is much easier. In IPD, it is difficult to replace them or change them during the RF tuning which resulting in increasing the product design cycle. Therefore, the integration of IPD improves the design cycle of the final product, which hinders the growth of the IPD market.

Integrated Passive Devices Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2015–2023 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2023 |

|

Forecast Units |

Million (USD) |

|

Segments Covered |

Material, Application, Passive Devices, Wireless Technology, End Use Industry and Region |

|

Geographies Covered |

Americas, Europe, Middle East and Africa (EMEA), APAC |

|

Companies Covered |

STATS ChipPAC Pte. Ltd. (Stats ChipPac) (Singapore), ON Semiconductor Corporation (ON Semiconductor) (US), Infineon Technologies AG (Infineon) (Germany), STMicroelectronics N.V. (STMicroelectronics) (Switzerland), Murata Manufacturing Co., Ltd. (Murata) (Japan), Johanson Technology, Inc. (Johanson) (US), OnChip Devices, Inc. (OnChip Devices) (US), Global Communication Semiconductors, LLC (GCS) (US), 3DiS Technologies (3Dis) (France), and Advanced Furnace Systems Corp. (AFSC) (Taiwan). |

The research report categorizes the IPD to forecast the revenues and analyze the trends in each of the following sub-segments:

IPD Market, by Material

- Silicon

- Glass

- Others

IPD Market, by Passive Devices

- Baluns

- Filter

- Couplers

- Diplexers

- Customized IPDs

- Others

IPD Market, by Application

- ESD/EMI

- RF IPD

- Digital & Mixed Signals

- Others

IPD Market, by Wireless Technology

- WLAN

- Bluetooth

- Cellular

- GPS

- Others

IPD Market, by End Use Industry

- Consumer Electronics

- Automotive

- Communication

- Aerospace & Defense

- Healthcare & Lifesciences

IPD Market, by Geography

- Americas

- Europe, Middle East, & Africa

- Asia Pacific (APAC)

Key Market Players in Integrated Passive Devices Industry

STATS ChipPAC Pte. Ltd. (Stats ChipPac) (Singapore), ON Semiconductor Corporation (ON Semiconductor) (US), Infineon Technologies AG (Infineon) (Germany), STMicroelectronics N.V. (STMicroelectronics) (Switzerland), Murata Manufacturing Co., Ltd. (Murata) (Japan), Johanson Technology, Inc. (Johanson) (US), OnChip Devices, Inc. (OnChip Devices) (US), Global Communication Semiconductors, LLC (GCS) (US), 3DiS Technologies (3Dis) (France), and Advanced Furnace Systems Corp. (AFSC) (Taiwan).

Murata is one of the leading players in the integrated passive devices market. Murata engages in the manufacturing and sale of electronic components across the globe. The company has achieved rapid growth from the flagship models of Samsung and Apple, as Apple upgraded its Iphone X by using 1,000 MLCCs (multilayer ceramic capacitor), and Murata is the sole producer of MLCC. The acquisition of IPDiA has enhanced Murata's position as a provider of high-reliability capacitors. It is a part of Murata's strategy to strengthen its core business within the communication (mobile) market and to expand its reach for new applications in automotive and medical markets.

Recent Developments in Integrated Passive Devices Industry

- In February 2018, Murata launched NFZ03SG_SN series of audio line noise filters for smart phones to efficiently eliminate noise while maintaining high sound quality.

- In February 2017, STMicroelectronics extended the flexibility of STM32 Ecosystem by launching STM32F722 Nucleo board and STM32F723 Discovery Kit. With rich on-board features such as MEMS microphones and sensors, an audio codec, and a display for user-interface development, these kits can support creative demonstrations.

- In January 2017, STMicroelectronics partnered with Mobile-Payment Partners such as Giesecke & Devrient (Germany) and FitPay (US) to create turnkey, certification-ready solutions for wearable devices.

- In August 2016, Onchip Devices has expanded its service offerings through its new fab offering Semiconductor Wafer Fabrication Services.

Critical Questions the Report Answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the IPD market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of Study

1.2 Definition

1.3 Scope of the Study

1.3.1 Years Considered for Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insight (Page No. - 28)

4.1 Attractive Opportunities in the Integrated Passive Devices Market

4.2 Market for ESD/EMI Application, By Material Type

4.3 Market in APAC, By Application

4.4 Market, By Wireless Technology

4.5 Market, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of IPD in Consumer Durables

5.2.1.2 Integration of IPDs in RF Applications

5.2.1.3 Increasing Demand for Miniaturized and High-Performance Electronic Devices

5.2.1.4 Proliferation of Automotive Infotainment

5.2.2 Restraints

5.2.2.1 Higher Cost of IPDs Compared With Discrete Components

5.2.3 Opportunities

5.2.3.1 Rise in the Use of Integrated Passive Devices in the Wearable Industry

5.2.3.2 Inception of 5g

5.2.4 Challenges

5.2.4.1 RF Tuning of IPD Demands Longer Product Design Cycle

5.3 Value Chain

6 Integrated Passive Devices Market, By Material (Page No. - 35)

6.1 Introduction

6.2 Silicon

6.3 Glass

6.4 Others

7 Integrated Passive Devices Market, By Application (Page No. - 40)

7.1 Introduction

7.2 ESD/EMI

7.3 RF IPD

7.4 Digital and Mixed Signals

7.5 Others

8 Integrated Passive Devices Market, By Passive Devices (Page No. - 46)

8.1 Introduction

8.2 Baluns

8.3 Filter

8.4 Couplers

8.5 Diplexers

8.6 Customized IPDs

8.7 Others

9 Integrated Passive Devices Market, By Wireless Technology (Page No. - 51)

9.1 Introduction

9.2 WLAN

9.3 Cellular

9.4 Bluetooth

9.5 GPS

9.6 Others

10 Integrated Passive Devices Market, By End Use Industry (Page No. - 54)

10.1 Introduction

10.2 Consumer Electronics

10.3 Communication

10.4 Automotive

10.5 Aerospace & Defense

10.6 Healthcare & Lifesciences

11 Geographic Analysis (Page No. - 58)

11.1 Introduction

11.2 Americas

11.2.1 US

11.2.2 Canada

11.2.3 Rest of Americas

11.3 Europe, Middle East, and Africa

11.3.1 Germany

11.3.2 Switzerland

11.3.3 France

11.3.4 Rest of Europe, Middle East, & Africa

11.4 Asia Pacific (APAC)

11.4.1 China

11.4.2 Japan

11.4.3 South Korea

11.4.4 Rest of APAC

12 Competitive Landscape (Page No. - 81)

12.1 Introduction

12.2 Market Ranking Analysis, 2017

12.3 Competitive Situations & Trends

12.3.1 Product Launches and Developments

12.3.2 Partnerships, Agreements, and Collaborations

12.3.3 Expansions

12.3.4 Merger and Acquisitions

13 Company Profile (Page No. - 86)

13.1 Introduction

13.2 Key Players

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

13.2.1 Stats Chippac

13.2.2 On Semiconductor

13.2.3 Infineon

13.2.4 Stmicroelectronics

13.2.5 Murata IPDIA

13.2.6 Johanson Technology

13.2.7 Onchip Devices

13.2.8 Global Communication Semiconductor

13.2.9 3DIS Technology

13.2.10 AFSC

*Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13.3 Other Important Players

13.3.1 KOA Speer Electronics

13.3.2 Wavenics

13.3.3 Macom

13.3.4 Viking Tech

13.3.5 Qorvo

13.3.6 Skyworks Solution

13.3.7 Xpeedic Technology

13.3.8 TDK

13.3.9 Jacket Micro Devices

13.3.10 3D Glass Solution

14 Appendix (Page No. - 114)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (67 Tables)

Table 1 Integrated Passive Devices Market, By Material, 2015–2023 (USD Million)

Table 2 Key Companies and Substrate Mapping

Table 3 Market for Silicon, By Application, 2015–2023 (USD Million)

Table 4 Market for Silicon, By Passive Devices, 2015–2023 (USD Million)

Table 5 Devices Market for Glass, By Application, 2015–2023 (USD Million)

Table 6 Market for Glass, By Passive Devices, 2015–2023 (USD Million)

Table 7 Integrated Passive Devices Market for Others, By Passive Devices, 2015–2023 (USD Million)

Table 8 Market for Others, By Application, 2015–2023 (USD Million)

Table 9 Market, By Application, 2015–2023 (USD Million)

Table 10 Market for ESD/EMI, By Passive Devices, 2015–2023 (USD Million)

Table 11 Market for ESD/EMI, By Material, 2015–2023 (USD Million)

Table 12 Market for RF IPD, By Passive Devices, 2015–2023 (USD Million)

Table 13 Market for RF IPD, By Material, 2015–2023 (USD Million)

Table 14 Integrated Passive Devices Market for Digital and Mixed Signals, By Passive Devices, 2015–2023 (USD Million)

Table 15 Market for Digital and Mixed Signals, By Material, 2015–2023 (USD Million)

Table 16 Market for Others, By Passive Devices, 2015–2023 (USD Million)

Table 17 Market for Others, By Material, 2015–2023 (USD Million)

Table 18 Market, By Passive Devices, 2015–2023 (USD Million)

Table 19 Market, By Passive Devices, 2015–2023 (Billion Units)

Table 20 Integrated Passive Devices Market for Baluns, By Material, 2015–2023 (USD Million)

Table 21 Market for Filter, By Material, 2015–2023 (USD Million)

Table 22 Market for Couplers, By Material, 2015–2023 (USD Million)

Table 23 Market for Diplexers, By Material, 2015–2023 (USD Million)

Table 24 Market for Customized IPDs, By Material, 2015–2023 (USD Million)

Table 25 Market for Others, By Material, 2015–2023 (USD Million)

Table 26 Market, By Wireless Technology, 2015–2023 (USD Million)

Table 27 Market, By End Use Industry, 2015–2023 (USD Million)

Table 28 Market, By Region, 2015–2023 (USD Million)

Table 29 Market in the Americas, By Country, 2015–2023 (USD Million)

Table 30 Market in Americas, By Passive Devices, 2015–2023 (USD Million)

Table 31 Market in Americas, By Material, 2015–2023 (USD Million)

Table 32 Market in Americas, By End Use Industry, 2015–2023 (USD Million)

Table 33 Market in US, By Passive Devices, 2015–2023 (USD Million)

Table 34 Market in US, By Material, 2015–2023 (USD Million)

Table 35 Market in Canada, By Passive Devices, 2015–2023 (USD Million)

Table 36 Market in Canada, By Material, 2015–2023 (USD Million)

Table 37 Integrated Passive Devices Market in Rest of Americas, By Passive Devices, 2015–2023 (USD Million)

Table 38 Market in Rest of Americas, By Material, 2015–2023 (USD Million)

Table 39 Market in Emea, By Country, 2015–2023 (USD Million)

Table 40 Market in Emea, By Passive Devices, 2015–2023 (USD Million)

Table 41 Market in Emea, By Material, 2015–2023 (USD Million)

Table 42 Market in Emea, By End Use Industry, 2015–2023 (USD Million)

Table 43 Market in Germany, By Passive Devices, 2015–2023 (USD Million)

Table 44 Market in Germany, By Material, 2015–2023 (USD Million)

Table 45 Market in Switzerland, By Passive Devices, 2015–2023 (USD Million)

Table 46 Market in Switzerland, By Material, 2015–2023 (USD Million)

Table 47 Market in France, By Passive Devices, 2015–2023 (USD Million)

Table 48 Market in France, By Material, 2015–2023 (USD Million)

Table 49 Market in Rest of Emea, By Passive Devices, 2015–2023 (USD Million)

Table 50 Market in Rest of Europe, By Material, 2015–2023 (USD Million)

Table 51 Integrated Passive Devices Market in APAC, By Country, 2015–2023 (USD Million)

Table 52 Market in APAC, By Passive Devices, 2015–2023 (USD Million)

Table 53 Market in APAC, By Material, 2015–2023 (USD Million)

Table 54 Market in APAC, By End Use Industry, 2015–2023 (USD Million)

Table 55 Market in China, By Passive Devices, 2015–2023 (USD Million)

Table 56 Market in China, By Material, 2015–2023 (USD Million)

Table 57 Market in Japan, By Passive Devices, 2015–2023 (USD Million)

Table 58 Market in Japan, By Material, 2015–2023 (USD Million)

Table 59 Market in South Korea, By Passive Devices, 2015–2023 (USD Million)

Table 60 Market in South Korea, By Material, 2015–2023 (USD Million)

Table 61 Market in Rest of APAC, By Passive Devices, 2015–2023 (USD Million)

Table 62 Market in Rest of APAC, By Material, 2015–2023 (USD Million)

Table 63 Market Ranking Analysis of Key Players in Market, 2017

Table 64 Product Launches and Developments, 2017–2018

Table 65 Partnerships, Agreements, and Collaborations, 2016–2017

Table 66 Expansions, 2016

Table 67 Merger and Acquisitions, 2016

List of Figures (28 Figures)

Figure 1 Segmentation of the Integrated Passive Devices Market

Figure 2 Market: Research Design

Figure 3 Process Flow for Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of Research Study

Figure 8 Customized IPDs to Hold Largest Size of Market During Forecast Period

Figure 9 Silicon to Hold Larger Size of Market By 2023

Figure 10 Integrated Passive Devices Market for Communication End Use Industry to Grow at Highest CAGR During Forecast Period

Figure 11 Market in Japan to Grow at Highest CAGR During Forecast Period

Figure 12 Increasing Use of Integrated Passive Devices in the Wearable Industry

Figure 13 Silicon to Lead the Market for ESD/EMI Application During the Forecast Period

Figure 14 Customized IPDs to Held the Largest Share of the Market in APAC in 2017

Figure 15 Integrated Passive Devices Market for WLAN Technology to Grow at the Highest CAGR Between 2018 and 2023

Figure 16 Market in APAC to Grow at the Highest CAGR Between 2018 and 2023

Figure 17 Increasing Adoption of IPD in Consumer Durables Driving the IPD Market

Figure 18 Value Chain Analysis (2018)

Figure 19 Key IPD Manufacturers Product Mapping By Wireless Application

Figure 20 Global Smartphone Shipments, 2013–2018 (Million Units)

Figure 21 Market: Geographic Snapshot

Figure 22 Snapshot of Integrated Passive Devices Market in Americas

Figure 23 Snapshot of Market in EMEA

Figure 24 Snapshot of Market in APAC

Figure 25 Companies Adopted Product Launches as the Key Growth Strategies Between 2015 and 2018

Figure 26 Geographic Revenue Mix of Major Companies

Figure 27 Stmicroelectronics: Company Snapshot

Figure 28 Global Communication Semiconductor: Company Snapshot

Growth opportunities and latent adjacency in Integrated Passive Devices Market

Integrated passive devices have diverse applications in consumer electronics, communication, autotmotive, healhcare among others. We need to understand the Integrated passive devices market specific to each industry. Does you report cover these industries?

What are the growth opportunities for the Integrated passive devices market? What are the market dynamics? Who are the key players in this market? We are looking for market share analysis and the top players, along with their product offerings and business growth opportunities in the IPD market.

Different types of passive devices are used for different applications to meet the requisite specifications. These devices are made up of different materials such as silicon, glass. What is the market for these devices and their material?

We are looking for price and quantity of passive devices. Does your report including such data?

We are looking to expand our business in UK. Does your report provide us the relative information?