The endoscopy devices market is estimated to record a stable growth rate across the forecast period of 2016-2024. A considerable number of individuals opting for minimally invasive endoscopic procedures is leading the endoscopy devices market toward growth. The benefits attached to endoscopy devices may prove to be useful for the growth of the endoscopy devices market. Also, the use of endoscopy devices in a variety of applications such as laparoscopy surgeries, neuro/spinal surgeries, ENT surgeries, urology/gynecology surgeries, and others may contribute largely to the growth of endoscopy devices market.

The COVID-19 outbreak has not affected the growth of the endoscopy devices market as healthcare services are open with full force. Therefore, the forecast period may not observe a negative effect on the growth rate of the endoscopy devices market.

Countries in Asia Pacific have witnessed a massive change in their respective healthcare infrastructures and number of resources trained in the use of technologically advanced medical devices in the past few years, leading to the vast rise in the usage of advanced endoscopy devices. The rising geriatric population, rising disposable incomes, increased healthcare infrastructure, and an increased awareness regarding the benefits of minimally invasive devices has also accelerated demand for endoscopy devices in Asia Pacific in the recent past.

Transparency Market Research estimates that the market will tread along a healthy growth path and exhibit a 7.6% CAGR from 2016 through 2024. The market, which had a valuation of US$7.76 bn in 2015, is expected to rise to US$14.8 bn by 2024.

Endoscopy Visualization Systems to Remain Dominant Product Variety

A variety of endoscopes, endoscopic operating devices, and visualization systems required for endoscopy procedures come under the purview of the endoscopy devices market. Of these, the segment of visualization systems presently leads the Asia Pacific endoscopy devices market in terms of revenue, accounting for over 46% of the market’s overall revenues in 2015. Factors such as strengthening economies, rising population of affluent patients, and rising expenditure on health and wellness have enabled the increased adoption of costly and technologically advanced endoscopy visualization products across healthcare settings in the region in the past few years. The segment is expected to expand at an excellent pace over the forecasting horizon as well, retaining its dominant stance across key product varieties.

Of the key types of endoscopy visualization systems available in the Asia Pacific endoscopy devices market, the segment of high definition (HD) visualization systems is the leading product variety. The segment accounted for nearly 73% of the overall endoscopy visualization systems market in Asia Pacific in 2015.

Laparoscopy Surgeries Lead to Highest Demand for Endoscopy Devices

Collectively, gastrointestinal, cardiovascular, and arthroscopy surgeries accounted for the leading share in the Asia Pacific endoscopy devices market in 2015. On an individual level, however, the segment of laparoscopy surgeries leads in terms of revenue in the Asia Pacific endoscopy devices market. The segment accounted for a 33% share in the overall market in 2015.

The vast rise in the number of surgeries such as hernia repairs, antireflux, cholecystectomy, and appendectomy and the emphasis on noninvasive surgical procedures are key to the high contribution of laparoscopy surgeries to the market’s revenues. Expanding at a 9.1% CAGR, the laparoscopy surgeries segment is expected to remain one of the leading individual contributors to the market’s revenues from 2016 through 2024 as well.

Despite Low Population, Japan Emerges as Most Lucrative Market for Endoscopy Devices

Japan was a key revenue contributor to the Asia Pacific endoscopy devices market in 2015, accounting for a more than 35% of revenue. High disposable incomes, rapidly rising geriatric population, and increased adoption of minimally invasive devices were the key forces driving the endoscopy devices market in Japan in the past few years. However, the mature market is expected to witness stagnant growth in the near future and lose its prominence to countries such as India and China.

The market for endoscopy devices is expected to witness expansion at a strong pace in China, at an estimated CAGR of 9.9% over the period between 2016 and 2024, among the most prominent countrywide markets for endoscopy devices in Asia Pacific. The China endoscopy devices market is expected to rise to a valuation of US$5.58 bn by 2024.

Some of the leading vendors in the highly fragmented market are Boston Scientific Corporation, Ethicon Endo-Surgery, Inc., Arthrex, Inc., Fujifilm Holdings Corporation, Intuitive Surgical, Inc., Cook Medical, Inc., KARL STORZ GmbH & Co. KG, HOYA Corporation, Stryker Corporation, Olympus Corporation, Medtronic plc, and Smith & Nephew plc.

1. Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Methodology

1.4. Assumptions

2. Executive Summary

2.1. Asia Pacific Endoscopy Device: Market Snapshot

2.2. Asia Pacific Endoscopy Device Market Revenue, by Country, (US$ Mn), 2015–2024

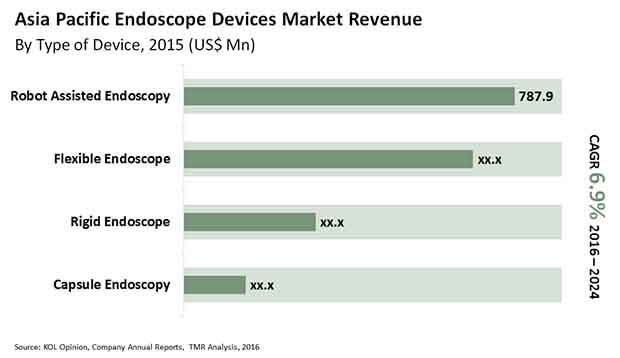

2.3. Asia Pacific Endoscopy Device Market Revenue, by Device Type, (US$ Mn), 2015

2.4. Asia Pacific Endoscopy Device Market Revenue, by Application, (US$ Mn), 2015

3. Asia Pacific Endoscopy Devices Market Industry Analysis

3.1. Overview

3.2. Average Selling Price Analysis: Asia Pacific Endoscopy Devices Market, 2015

3.3. Value Chain Analysis: Asia Pacific Endoscopy Devices Market

3.4. Market Dynamics

3.4.1. Market Drivers

3.4.1.1. Investment Inflow and Mergers & Acquisitions are Increasingly Contributing to Market Growth

3.4.1.2. Rise in Geriatric Population with Increasing Incidences of Diseases that Require Endoscopy Procedures

3.4.1.3. Growing Patient Preference for Minimally Invasive Surgeries

3.4.2. Market Restraints

3.4.2.1. High Cost of Treatment

3.4.2.2. Lack of Trained and Qualified Surgeons

3.4.3. Market Opportunities

3.4.3.1. China is expected to become the Vital Market for Overall Endoscopy Devices in Asia Pacific.

3.5. Porters Five Force Analysis: Asia Pacific Endoscopy Devices Market

3.6. Asia Pacific Endoscopy Devices Market, by Type of Device

3.6.1. Introduction

3.6.2. Asia Pacific Endoscopy Devices Market Revenue, by Device Type (US$ Mn) 2014–2024

3.6.2.1. Asia Pacific Endoscope Devices Market Revenue, by Type of Device, (US$ Mn), 2014–2024

3.6.2.2. Asia Pacific Rigid Endoscope Market Revenue, (US$ Mn), 2014–2024

3.6.2.3. Asia Pacific Flexible Endoscope Market Revenue, (US$ Mn), 2014–2024

3.6.2.4. Asia Pacific Capsule Endoscopy Market Revenue, (US$ Mn), 2014–2024

3.6.3. Asia Pacific Robot Assisted Endoscopy Market Revenue, (US$ Mn), 2014–2024

3.6.3.1. Asia Pacific Endoscopic Operative Devices Market Revenue, by Type of Device, (US$ Mn), 2014–2024

3.6.3.2. Asia Pacific Endoscopic Operative Energy System Market Revenue, (US$ Mn), 2014–2024

3.6.3.3. Asia Pacific Endoscopic Operative Suction/Irrigation systems Market Revenue, (US$ Mn), 2014–2024

3.6.3.4. Asia Pacific Endoscopic Operative Access Devices Market Revenue, (US$ Mn), 2014–2024

3.6.3.5. Asia Pacific Endoscopic Operative Hand Instruments Market Revenue, (US$ Mn), 2014–2024

3.6.3.6. Asia Pacific Other Endoscopic Operative Devices Market Revenue, (US$ Mn), 2014–2024

3.6.4. Asia Pacific Endoscopic Visualization Systems Market Revenue, by Type of Device, (US$ Mn), 2014–2024

3.6.4.1.1. Asia Pacific Endoscopic Ultrasound Devices Market Revenue, (US$ Mn), 2014–2024

3.6.4.1.2. Asia Pacific Endoscopic Standard Definition (SD) Visualization Systems Market Revenue, by Type of Device, (US$ Mn), 2014–2024

3.6.4.1.2.1. Asia Pacific Endoscopic Standard definition (SD) Two Dimensional (2D) Visualization Systems Market

3.6.4.1.2.2. Asia Pacific Endoscopic Standard definition (SD) Three Dimensional (3D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

3.6.4.1.3. Asia Pacific High Definition (HD) Visualization System Market Revenue, by Type of Device, (US$ Mn), 2014–2024

3.6.4.1.3.1. Asia Pacific Endoscopy High Definition (HD) Two Dimensional (2D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

3.6.4.1.3.2. Asia Pacific Endoscopy High Definition (HD) Three Dimensional (3D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

3.7. Endoscopy Devices Market - By Application

3.7.1. Asia Pacific Market Revenue, by Application, (US$ Mn), 2014–2024

3.7.1.1. Asia Pacific Urology/Gynecology Market Revenue, (US$ Mn), 2014–2024

3.7.1.2. Asia Pacific ENT Surgeries Market Revenue, (US$ Mn), 2014–2024

3.7.1.3. Asia Pacific Neuro/Spinal Surgeries Market Revenue, (US$ Mn), 2014–2024

3.7.1.4. Asia Pacific Laparoscopy Surgeries Market Revenue, (US$ Mn), 2014–2024

3.7.1.5. Asia Pacific Other Applications Market Revenue, (US$ Mn), 2014–2024

3.8. Competitive Landscape

3.8.1. Asia Pacific Endoscopy Devices Market Share, by Key Players, 2015 (%)

4. Asia Pacific Endoscopy Devices Market - Country Snippets

4.1. Overview

4.1.1. Japan Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.2. China Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.3. Australia Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.4. South Korea Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.5. India Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.6. Singapore Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

4.1.7. New Zealand Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

5. Company Profiles

5.1. Arthrex, Inc.

5.1.1. Company Details

5.1.2. Business Overview

5.1.3. Product Portfolio

5.1.4. Financial Details

5.1.5. Recent Development

5.1.6. Business Strategy

5.2. Boston Scientific Corporation

5.2.1. Company Details

5.2.2. Business Overview

5.2.3. Product Portfolio

5.2.4. Financial Details

5.2.5. Recent Development

5.2.6. Business Strategy

5.3. Cook Medical, Inc.

5.3.1. Company Details

5.3.2. Business Overview

5.3.3. Product Portfolio

5.3.4. Financial Details

5.3.5. Recent Development

5.3.6. Business Strategy

5.4. Ethicon Endo-Surgery, Inc.

5.4.1. Company Details

5.4.2. Business Overview

5.4.3. Product Portfolio

5.4.4. Financial Details

5.4.5. Recent Development

5.4.6. Business Strategy

5.5. Fujifilm Holdings Corporation

5.5.1. Company Details

5.5.2. Business Overview

5.5.3. Product Portfolio

5.5.4. Financial Details

5.5.5. Recent Development

5.5.6. Business Strategy

5.6. HOYA Corporation

5.6.1. Company Details

5.6.2. Business Overview

5.6.3. Product Portfolio

5.6.4. Financial Details

5.6.5. Recent Development

5.6.6. Business Strategy

5.7. Intuitive Surgical, Inc.

5.7.1. Company Details

5.7.2. Business Overview

5.7.3. Product Portfolio

5.7.4. Financial Details

5.7.5. Recent Development

5.7.6. Business Strategy

5.8. Medtronic plc

5.8.1. Company Details

5.8.2. Business Overview

5.8.3. Product Portfolio

5.8.4. Financial Details

5.8.5. Recent Development

5.8.6. Business Strategy

5.9. Stryker Corporation

5.9.1. Company Details

5.9.2. Business Overview

5.9.3. Product Portfolio

5.9.4. Financial Details

5.9.5. Recent Development

5.9.6. Business Strategy

5.10. KARL STORZ GmbH & Co. KG

5.10.1. Company Details

5.10.2. Business Overview

5.10.3. Product Portfolio

5.10.4. Financial Details

5.10.5. Recent Development

5.10.6. Business Strategy

5.11. Olympus Corporation

5.11.1. Company Details

5.11.2. Business Overview

5.11.3. Product Portfolio

5.11.4. Financial Details

5.11.5. Recent Development

5.11.6. Business Strategy

5.12. Smith & Nephew plc

5.12.1. Company Details

5.12.2. Business Overview

5.12.3. Product Portfolio

5.12.4. Financial Details

5.12.5. Recent Development

5.12.6. Business Strategy

List of Tables

TABLE 1 Asia Pacific Endoscopy Devices Market, 2015–2023: Market Snapshot

TABLE 2 Asia Pacific Endoscopy Devices Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 3 Asia Pacific Endoscope Devices Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 4 Asia Pacific Endoscopic Operative Devices Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 5 Asia Pacific Endoscopic Visualization Systems Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 6 Asia Pacific Endoscopic Standard Definition (SD)Visualization Systems Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 7 Asia Pacific High Definition (HD) Visualization System Market Revenue, by Type of Device, (US$ Mn), 2014–2024

TABLE 8 Asia Pacific Market Revenue, by Application, (US$ Mn), 2014–2024

TABLE 9 Asia Pacific Endoscopy Devices Market Revenue, by Country, (US$ Mn), 2014–2024

List of Figures

FIG. 1 Market Segmentation

FIG. 2 Asia Pacific Endoscopy Devices Market Share, by Country, 2015

FIG. 3 Asia Pacific Endoscopy Devices Market Share, by Country, 2024

FIG. 4 Asia Pacific Market Revenue, by Type of Devices, 2015 (US$ Mn)

FIG. 5 Asia Pacific Market Revenue, by Type of Application, 2015 (US$ Mn)

FIG. 6 Asia Pacific Rigid Endoscope Market Revenue, (US$ Mn), 2014–2024

FIG. 7 Asia Pacific Flexible Endoscope Market Revenue, (US$ Mn), 2014–2024

FIG. 8 Asia Pacific Capsule Endoscopy Market Revenue, (US$ Mn), 2014–2024

FIG. 9 Asia Pacific Robot Assisted Endoscopy Market Revenue, (US$ Mn), 2014–2024

FIG. 10 Asia Pacific Endoscopic Operative Energy System Market Revenue, (US$ Mn), 2014–2024

FIG. 11 Asia Pacific Endoscopic Operative Suction/Irrigation systems Market Revenue, (US$ Mn), 2014–2024

FIG. 12 Asia Pacific Endoscopic Operative Access Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 13 Asia Pacific Endoscopic Operative Hand Instruments Market Revenue, (US$ Mn), 2014–2024

FIG. 14 Asia Pacific Other Endoscopic Operative Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 15 Asia Pacific Endoscopic Ultrasound Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 16 Asia Pacific Endoscopic Standard definition (SD) Two Dimensional (2D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

FIG. 17 Asia Pacific Endoscopic Standard definition (SD) Three Dimensional (3D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

FIG. 18 Asia Pacific Endoscopy High Definition (HD) Two Dimensional (2D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

FIG. 19 Asia Pacific Endoscopy High Definition (HD) Three Dimensional (3D) Visualization Systems Market Revenue, (US$ Mn), 2014–2024

FIG. 20 Asia Pacific Urology/Gynecology Market Revenue, (US$ Mn), 2014–2024

FIG. 21 Asia Pacific ENT Surgeries Market Revenue, (US$ Mn), 2014–2024

FIG. 22 Asia Pacific Neuro/Spinal Surgeries Market Revenue, (US$ Mn), 2014–2024

FIG. 23 Asia Pacific Laparoscopy Surgeries Market Revenue, (US$ Mn), 2014–2024

FIG. 24 Asia Pacific Other Applications Market Revenue, (US$ Mn), 2014–2024

FIG. 25 Asia Pacific Endoscopy Devices Market Share, by Key Players, 2015 (%)

FIG. 26 Japan Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 27 China Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 28 Australia Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 29 South Korea Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 30 India Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 31 Singapore Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024

FIG. 32 New Zealand Endoscopy Devices Market Revenue, (US$ Mn), 2014–2024